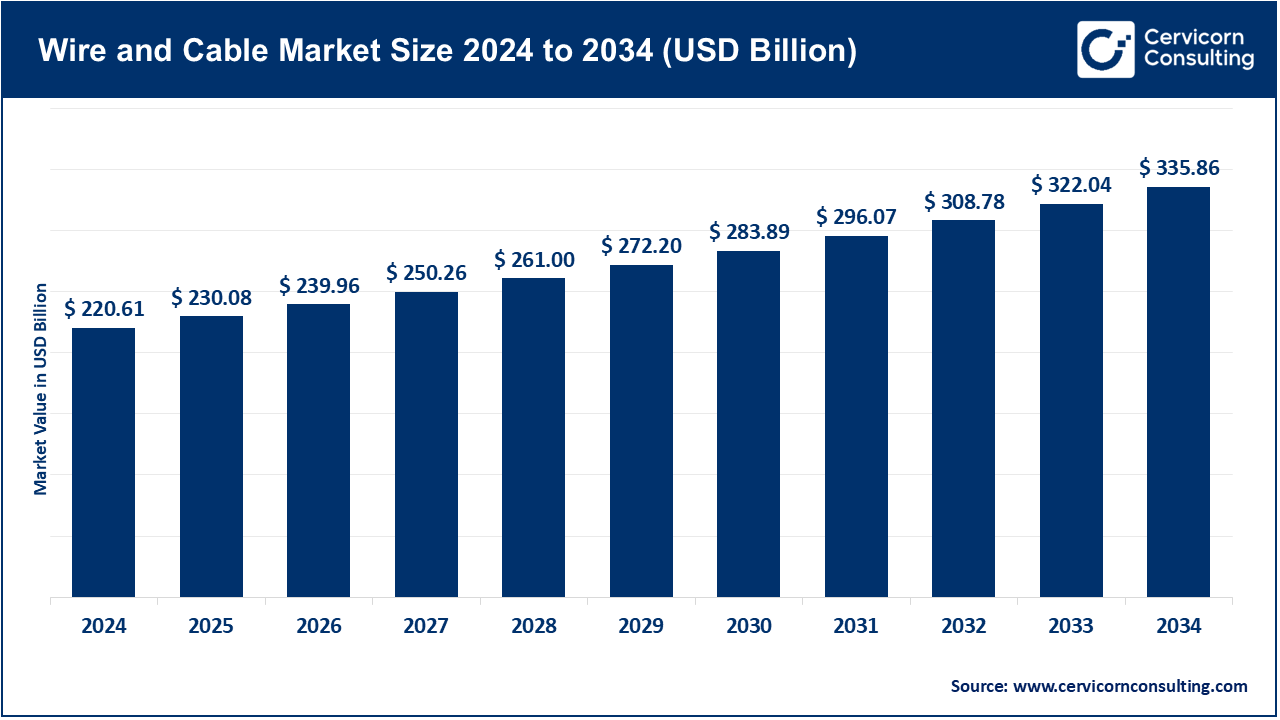

The global wire and cable market size was valued at USD 220.61 billion in 2024 and is expected to be worth around USD 335.86 billion by 2034, growing at a compound annual growth rate (CAGR) of 4.29% over the forecast period from 2025 to 2034. The wire and cable market is picking up the pace regarding the challenges of the construction industry turned towards eco-friendly growth, green certifications, and net-zero commitment. The requirements of modern infrastructure go beyond high electrical performance and require materials to have a lower embodied carbon emission, utilize fewer resources and allow more circularity in climate conscious projects. The emergence of more exacting environmental regulation, market-leading corporate responsibilities on ESG and the necessity to respond to the uncontrollable effects of climate caused by warming planet are fuelling this transformation.

Why wire and cable?

One of the main supports of sustainable building are Wire and Cables-They provide greater efficiency in energy use, increased life durability and reduced CO2 emissions in the lifecycle of the building. Electrical systems are becoming greener because of innovations in recyclable conductors; low-smoke zero-halogen (LSZH) insulation; bio-based polymers; and enhanced conductor designs, but without sacrificing performance. The solutions cut across the different sectors of operation namely, the Residential, Commercial, Industrial, and Infrastructure sectors, aimed at achieving global decarbonization targets and providing improved resource efficiency in projects. Employing sustainable wire and cable technologies can help make the built environment safer, stronger, and more ready to transit to green.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 230.08 Billion |

| Expected Market Size in 2034 | USD 335.86 Billion |

| Projected CAGR 2025 to 2034 | 4.29% |

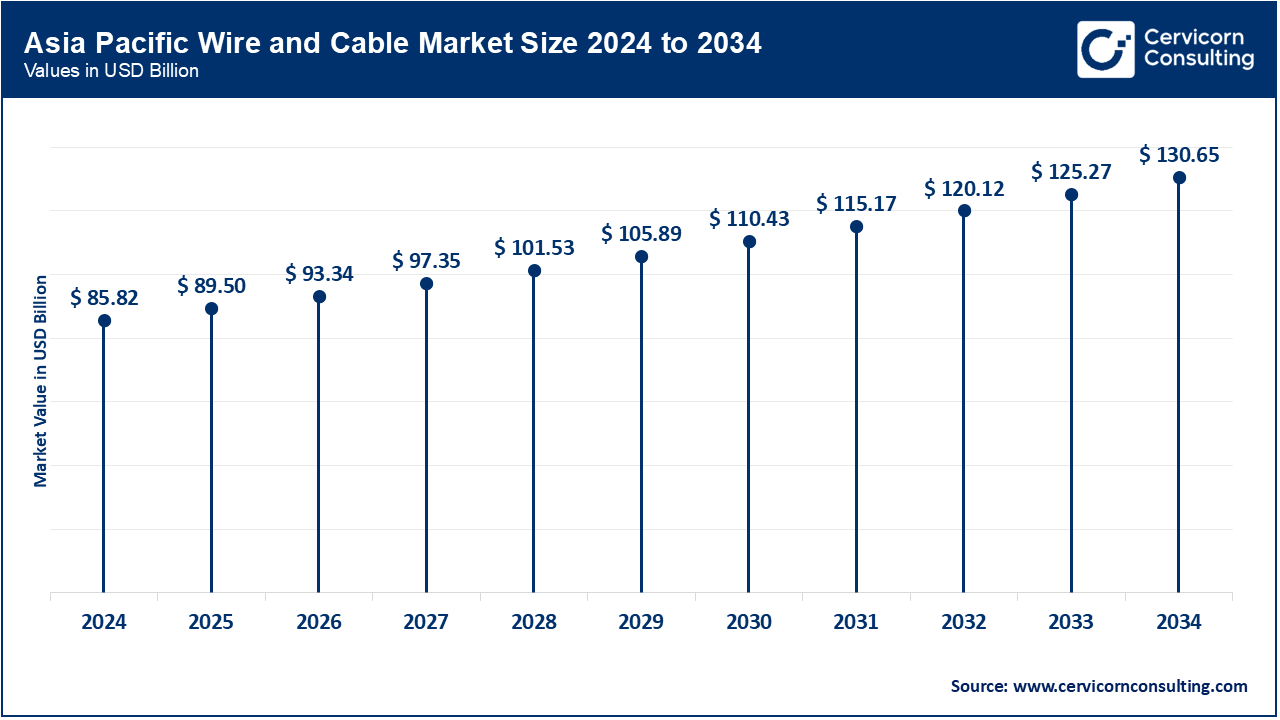

| Leading Region | Asia-Pacific |

| Key Segments | Material Type, Product Type, Installation, Voltage, End-user, Region |

| Key Companies | Hengtong Optic-Electric Co Ltd., Prysmian Group, Sumitomo Electric Industries, Ltd., Furukawa Electric Co., Ltd., Leoni AG, Jiagnan Group, General Cable Corporation, LS Cable & System Ltd, TPC Wire & Cable Corp, Southwire Company, LLC, Polycab Wires Private Limited, Nexans S.A., Hitachi Metals Ltd, Far East Cable Co., Ltd. |

Metal: Copper and aluminium based metal cables are treasured as they have high conductive, durable, and load carrying characteristics in communication and electric networks. They excel on power transmission and heavy-industrial purposes. Southwire In June 2024, Southwire increased its capacity in its American copper cable plant as utility projects put pressure on manufacturing capacity. The thermal resistance of copper makes this metal favorable in the urban electrification grids. Overhead long-distance transmission is normally carried on lighter aluminium cables.

Wire and Cable Market Share, By Material Type, 2024 (%)

| Material Type | Revenue Share, 2024 (%) |

| Metal | 61.20% |

| Polymer | 38.80% |

Polymer: Polymer cables are made of flexible insulation and sheathing, both of plastic materials, which make them weatherproof and safe in insulation with both power cables and communications. They find extensive application in consumer electronics and wiring building, marine wiring. In March 2024, Nexans launched a bio-based polymer insulation on its data cables in a bid to lower environmental impact. The materials also promote low-smoke zero-halogen requirements in delicate building. Polymer cables are flexible and can be applicable in various climatic conditions.

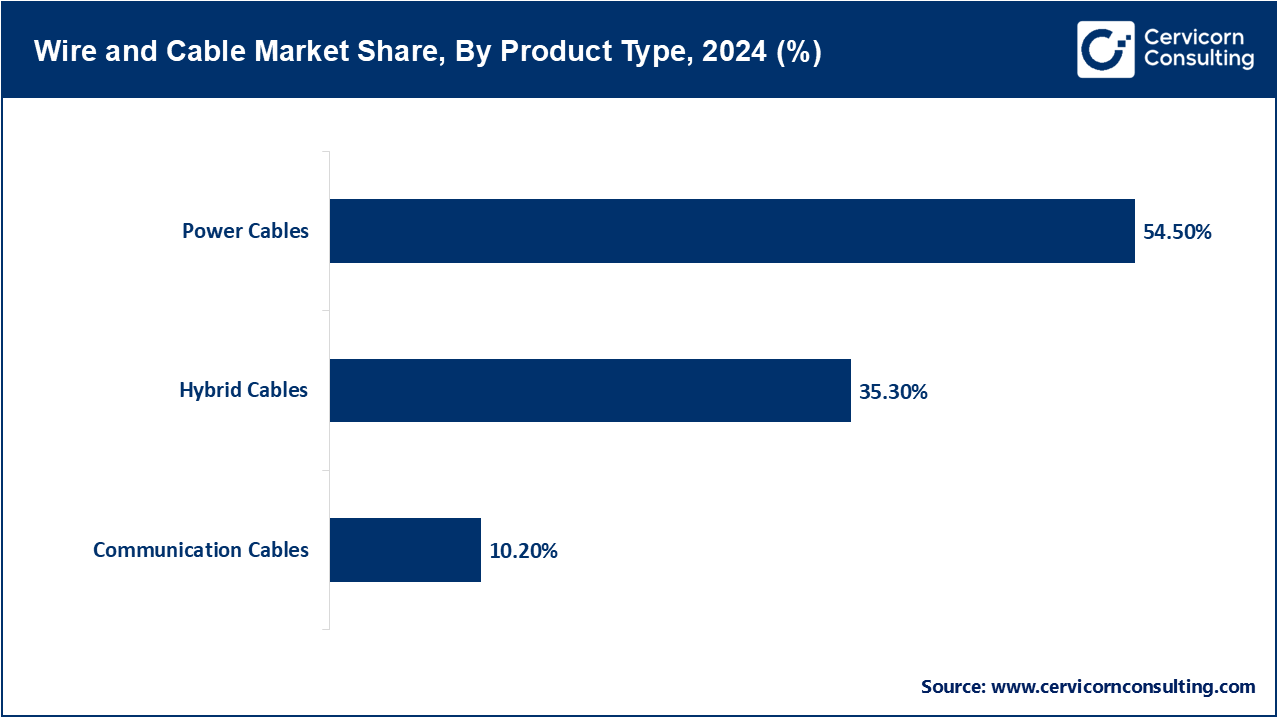

Power Cables: The power cables segment has registered highest revenue share. Power cables are made to convey the electrical energy in relation to the generation, distribution, and transmission points. They comprise low to extra-high voltages with respect to application requirements. In July 2023, LS Cable & System provided 500 kV high-voltage cable in a South Korean grid upgrade. These types of cables play a crucial role in the management of load of urban areas as well as integration of renewable energy. They make sure that there is reliable supply of electricity whether in an overhead or underground system.

Hybrid Cables: Hybrid cables put different types of transmission transmissions (e.g. power and data) together in a single sheath to conserve space and installation cost. They are typical within telecom towers, offshore wind farms, and smart buildings. In February 2024, Prysmian supplied hybrid cables to the 5G rollout project in Germany which will allow the supply of power and fiber-optic connectivity through a single cable. This incorporation reduces infrastructure congestion and generates system efficiency.

Communication Cables: The types of communication cables that transfer both voice and data as well as video include fiber-optic and coaxial. IT, telecom and broadcasting networks cannot be without them. In October 2023, Corning said it would expand its optical fiber plant in North Carolina to meet the rising demand of broadband. A smart city is built around high-speed communication cables as part of a digital infrastructure. They also help anchor defense- or healthcare-missions.

Overhead: Overhead cables run on poles or towers to get them above the ground and are both affordable and simple to maintain. They are popular because of their use in long distance electricity transmission. Maharashtra In August 2023, overhead lines were upgraded in India to 132kV and should help cut losses in rural power supply. There is a rapid installation of these systems where the use of underground cable is not feasible. Nevertheless, they are more susceptible to weather related destruction.

Underground: The cable installation is buried under the ground to avoid the effects of weather conditions and direct physical destruction and at the same time improving the overall city aesthetics. They are more desirable in crowded and / or risky locations. In May 2024, London Power Networks finished an underground replacement of cable to enhance more capacity of the grid. These systems need sophisticated insulation materials that can take care of the different soil conditions. There are increased costs of installation but there is increased reliability.

Wire and Cable Market Share, By Installation, 2024 (%)

| Installation | Revenue Share, 2024 (%) |

| Overhead | 51.30% |

| Underground | 39.80% |

| Submarine | 8.90% |

Submarine: Submarine cables are laid on the seadeep at the bottom linking power grids/communication systems across the bodies of water. They call on maximum durability to resistant pressure and corrosion. Nexans supplied 320 kV submarine cables to this interconnector between the UK and Denmark, in September 2023. On shore wind farms and the internet on a global scale depend on these cables. They are high tech ships and engineering to get them installed.

Low Voltage: Residential, commercial and small industrial applications use low-voltage cables (up to 1 kV). They energize lighting, appliances and control systems. In January 2024, Polycab India introduced a range of cables with low-voltage use that can be energy-efficient in smart households. Such cables are flexible and they are more convenient to fit within small areas. Flame-retardant insulation on low-voltage systems is a common requirement of safety standards.

Medium Voltage: The medium-voltage cables (1,000 to 69,000V) are used in distribution networks which link substation and end-users. They are efficient and insulation can be accommodated. In November 2023 Sumitomo Electric provided medium-voltage cables to an industrial park expansion in Vietnam. They are cables that deal with greater loads without the added complication of extra-high-voltage systems. They are key to the stability of the regional grid and the local industrial development.

Wire and Cable Market Share, By Voltage, 2024 (%)

| Voltage | Revenue Share, 2024 (%) |

| Low Voltage | 43.20% |

| Medium Voltage | 30.30% |

| High Voltage | 16.70% |

| Extra-High Voltage | 9.80% |

High Voltage: Long distance transmission of electricity in high-voltage cables (69 kV to 230 kV) is a necessity to ensure low losses. They are incorporated in underground as well as overhead systems. In April 2024, NKT finished an underground high-voltage project in Sweden as a connection between renewable energy sources and the national grid. More sophisticated insulation and jointing methods are needed in such cables. They are important in incorporating renewable energy projects.

Extra-High Voltage: Special bulk power XLPE cables supplying large grid hubs (above 230 kV) are referred to as extra-high voltage (above 230 kV). They require high insulation levels, excellent thermal control and careful fitting. In February 2023, LS Cable & System supplied 500 kV EHV cables to one of the world largest mega interconnection projects in the Middle East. Such cables are needed to facilitate cross-border trading and big-scale integrations of renewables. They are very expensive due to their complex engineering requirement.

Aerospace & Defense: Aerospace and defence cables are subjected to extreme environments, such as high temperature, vibration and electromagnetic shielding. They are indispensable to aircrafts, satellites and military systems. In May 2023 Carlisle Interconnect Technologies have provided wiring in an aircraft upgrade program of the U.S Air Force. These cables have to go through stringent safety and performance certification. They provide reliability to missions whether made on the civilian and military side.

Construction: The numerous types of cables utilized in this industry include power distribution, lighting, HVAC and communications cables in buildings. The major factors of selection are fire safety, durability, and sustainability. In October 2023 LSZH building wires were installed in a LEED-Certified skyscraper in Dubai in accordance with the green certification requirements. It is common in construction sites to have a temporary wiring as well as permanent ones in place.

IT & Telecommunication: This industry depends on the fiber-optic and copper cables in data-centers, broadband networks, and mobile infrastructure. Unlimited system throughput and fast response time are of primary importance. In March 2024, China Mobile filed a large fiber-optic backbone upgrade by utilizing the ultra low loss optical cables. The sector is guided by 5G implementation and cloud computing needs. The world is transforming digitally on solid cabling.

Power Distribution & Transmission: These utilities rely on cables to transport electricity to the producer of electricity and the consumers. This comes with all the voltage levels, and the types of installations. In July 2023, ABB provided the connection grid cables to a hydroelectric plant in Canada which was needed to deliver power efficiently. T&D networks are concerned with reliability and capacity. The industry is turning more to the green technology of insulation materials.

Others: The industries found in this category are railways, oil and gas, marine as well as mining; these are industries which have hostile operating conditions and thus need special cables to best suit the environment. These are cables that tend to offer increased mechanical protection and chemical resistance. In 2023 August, Tsubaki KabelSchlepp provided drag chain cables on an automated mining project in Australia. Every sub-sector requires customizable designs of cables to face its course of action.

The wire and cable market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region.

The Asia-Pacific is currently going through high growth due to the rise in infrastructure upgrades and digitalization in this region. Increases are seen in power-data cable systems along with investment to expand high-voltage transmission and rural electrification. Climate-resilient design and energy efficiency have also been given priority in projects by governments. In May 2025, Japan has laid down high voltage underground cabling work on new bullet train route to maximize land. These projects are also creating a demand in the area as far as advanced manufacturing items as well as installation skills are concerned.

North America is gaining momentum because of electrification projects and increasing stringent environment standard and growth of smart infrastructure. Manufacturers are working on such solutions as environment friendly insulation and hybrid cables, which cater to all the energy requirements as well as connectivity requirements. The aim is grid resiliency and efficiency which is being invested in by the government and privately. In January 2025, a U.S. utility installed an underground medium-voltage cable line in New York, to achieve better transmission reliability. The development is boosting the sustainability of the region in urban and industrial development.

Wire and Cable Market Share, By Region, 2024 (%)

| Region | Revenue Share, 2024 (%) |

| North America | 26.20% |

| Europe | 22.40% |

| Asia-Pacific | 38.90% |

| LAMEA | 12.50% |

In Europe, wire and cable industry is a policy in the context of green policies, integration of renewables, and circular economy programs. The center of attention is on recyclable conductor materials, designs that are fire-safe, and high-quality monitoring systems. The governments are modernizing the grids to consume more renewable power and to enhance aesthetics in an urban environment. In February 2025, Germany had placed submarine power cables that linked the North Sea wind farms to the national grid. This trend is also resulting in the need to have high-performance, long-life cable solutions in numerous industries.

The LAMEA market is growing with the increased use in renewable energy, smart city and updated distributors. Nations are embracing cables that are used in harsh weather conditions, ocean, and high energy transfer products. Domestic and international investment are helping to upgrade the infrastructure. In April 2025, UAE linked up a huge solar farm over extra-high voltage cables designed to operate in desert environments. Such developments are making the region an emerging sustainable power connectivity hub.

Market Segmentation

By Material Type

By Product Type

By Installation

By Voltage

By End-user

By Region

Chapter 1 Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Wire and Cable

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2 Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Material Type Overview

2.2.2 By Product Type Overview

2.2.3 By Installation Overview

2.2.4 By End-user Overview

2.2.5 By End-user Overview

2.3 Competitive Overview

Chapter 3 Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4 Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 The requirements of Green Building certifications

4.1.1.2 Electrification and Modernization of Infrastructure in the City Uprights

4.1.2 Market Restraints

4.1.2.1 Prices of Raw Material Volatility

4.1.2.2 Delays in Procedures of Product Approvals

4.1.3 Market Challenges

4.1.3.1 Spread of Counterfeit Cable

4.1.3.2 Installation Skill Gaps in New Markets

4.1.4 Market Opportunities

4.1.4.1 Recycling and Circular economy initiatives

4.1.4.2 Bulking up on Renewable Energy Grid Connections

4.2 Market Trends

Chapter 5 Premium Insights and Analysis

5.1 Global Wire and Cable Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6 Wire and Cable Market, By Material Type

6.1 Global Wire and Cable Market Snapshot, By Material Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Metal

6.1.1.2 Polymer

Chapter 7 Wire and Cable Market, By Product Type

7.1 Global Wire and Cable Market Snapshot, By Product Type

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Power Cables

7.1.1.2 Hybrid Cables

7.1.1.3 Communication Cables

Chapter 8 Wire and Cable Market, By Installation

8.1 Global Wire and Cable Market Snapshot, By Installation

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Overhead

8.1.1.2 Underground

8.1.1.3 Submarine

Chapter 9 Wire and Cable Market, By Voltage

9.1 Global Wire and Cable Market Snapshot, By Voltage

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Low Voltage

9.1.1.2 Medium Voltage

9.1.1.3 High Voltage

9.1.1.4 Extra-High Voltage

Chapter 10 Wire and Cable Market, By End-user

10.1 Global Wire and Cable Market Snapshot, By End-user

10.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

10.1.1.1 Aerospace & Defense

10.1.1.2 Construction

10.1.1.3 IT & Telecommunication

10.1.1.4 Power Transmission & Distribution

10.1.1.5 Oil & Gas

10.1.1.6 Energy & Power

10.1.1.7 Automotive

10.1.1.8 Others

Chapter 11 Wire and Cable Market, By Region

11.1 Overview

11.2 Wire and Cable Market Revenue Share, By Region 2024 (%)

11.3 Global Wire and Cable Market, By Region

11.3.1 Market Size and Forecast

11.4 North America

11.4.1 North America Wire and Cable Market Revenue, 2022-2034 ($Billion)

11.4.2 Market Size and Forecast

11.4.3 North America Wire and Cable Market, By Country

11.4.4 U.S.

11.4.4.1 U.S. Wire and Cable Market Revenue, 2022-2034 ($Billion)

11.4.4.2 Market Size and Forecast

11.4.4.3 U.S. Market Segmental Analysis

11.4.5 Canada

11.4.5.1 Canada Wire and Cable Market Revenue, 2022-2034 ($Billion)

11.4.5.2 Market Size and Forecast

11.4.5.3 Canada Market Segmental Analysis

11.4.6 Mexico

11.4.6.1 Mexico Wire and Cable Market Revenue, 2022-2034 ($Billion)

11.4.6.2 Market Size and Forecast

11.4.6.3 Mexico Market Segmental Analysis

11.5 Europe

11.5.1 Europe Wire and Cable Market Revenue, 2022-2034 ($Billion)

11.5.2 Market Size and Forecast

11.5.3 Europe Wire and Cable Market, By Country

11.5.4 UK

11.5.4.1 UK Wire and Cable Market Revenue, 2022-2034 ($Billion)

11.5.4.2 Market Size and Forecast

11.5.4.3 UK Market Segmental Analysis

11.5.5 France

11.5.5.1 France Wire and Cable Market Revenue, 2022-2034 ($Billion)

11.5.5.2 Market Size and Forecast

11.5.5.3 France Market Segmental Analysis

11.5.6 Germany

11.5.6.1 Germany Wire and Cable Market Revenue, 2022-2034 ($Billion)

11.5.6.2 Market Size and Forecast

11.5.6.3 Germany Market Segmental Analysis

11.5.7 Rest of Europe

11.5.7.1 Rest of Europe Wire and Cable Market Revenue, 2022-2034 ($Billion)

11.5.7.2 Market Size and Forecast

11.5.7.3 Rest of Europe Market Segmental Analysis

11.6 Asia Pacific

11.6.1 Asia Pacific Wire and Cable Market Revenue, 2022-2034 ($Billion)

11.6.2 Market Size and Forecast

11.6.3 Asia Pacific Wire and Cable Market, By Country

11.6.4 China

11.6.4.1 China Wire and Cable Market Revenue, 2022-2034 ($Billion)

11.6.4.2 Market Size and Forecast

11.6.4.3 China Market Segmental Analysis

11.6.5 Japan

11.6.5.1 Japan Wire and Cable Market Revenue, 2022-2034 ($Billion)

11.6.5.2 Market Size and Forecast

11.6.5.3 Japan Market Segmental Analysis

11.6.6 India

11.6.6.1 India Wire and Cable Market Revenue, 2022-2034 ($Billion)

11.6.6.2 Market Size and Forecast

11.6.6.3 India Market Segmental Analysis

11.6.7 Australia

11.6.7.1 Australia Wire and Cable Market Revenue, 2022-2034 ($Billion)

11.6.7.2 Market Size and Forecast

11.6.7.3 Australia Market Segmental Analysis

11.6.8 Rest of Asia Pacific

11.6.8.1 Rest of Asia Pacific Wire and Cable Market Revenue, 2022-2034 ($Billion)

11.6.8.2 Market Size and Forecast

11.6.8.3 Rest of Asia Pacific Market Segmental Analysis

11.7 LAMEA

11.7.1 LAMEA Wire and Cable Market Revenue, 2022-2034 ($Billion)

11.7.2 Market Size and Forecast

11.7.3 LAMEA Wire and Cable Market, By Country

11.7.4 GCC

11.7.4.1 GCC Wire and Cable Market Revenue, 2022-2034 ($Billion)

11.7.4.2 Market Size and Forecast

11.7.4.3 GCC Market Segmental Analysis

11.7.5 Africa

11.7.5.1 Africa Wire and Cable Market Revenue, 2022-2034 ($Billion)

11.7.5.2 Market Size and Forecast

11.7.5.3 Africa Market Segmental Analysis

11.7.6 Brazil

11.7.6.1 Brazil Wire and Cable Market Revenue, 2022-2034 ($Billion)

11.7.6.2 Market Size and Forecast

11.7.6.3 Brazil Market Segmental Analysis

11.7.7 Rest of LAMEA

11.7.7.1 Rest of LAMEA Wire and Cable Market Revenue, 2022-2034 ($Billion)

11.7.7.2 Market Size and Forecast

11.7.7.3 Rest of LAMEA Market Segmental Analysis

Chapter 12 Competitive Landscape

12.1 Competitor Strategic Analysis

12.1.1 Top Player Positioning/Market Share Analysis

12.1.2 Top Winning Strategies, By Company, 2022-2024

12.1.3 Competitive Analysis By Revenue, 2022-2024

12.2 Recent Developments by the Market Contributors (2024)

Chapter 13 Company Profiles

13.1 Hengtong Optic-Electric Co Ltd.

13.1.1 Company Snapshot

13.1.2 Company and Business Overview

13.1.3 Financial KPIs

13.1.4 Product/Service Portfolio

13.1.5 Strategic Growth

13.1.6 Global Footprints

13.1.7 Recent Development

13.1.8 SWOT Analysis

13.2 Prysmian Group

13.3 Sumitomo Electric Industries, Ltd.

13.4 Furukawa Electric Co., Ltd.

13.5 Leoni AG

13.6 Jiagnan Group

13.7 General Cable Corporation

13.8 LS Cable & System Ltd

13.9 TPC Wire & Cable Corp

13.10 Southwire Company, LLC