U.S. Long Term Care Market Size and Growth 2025 to 2034

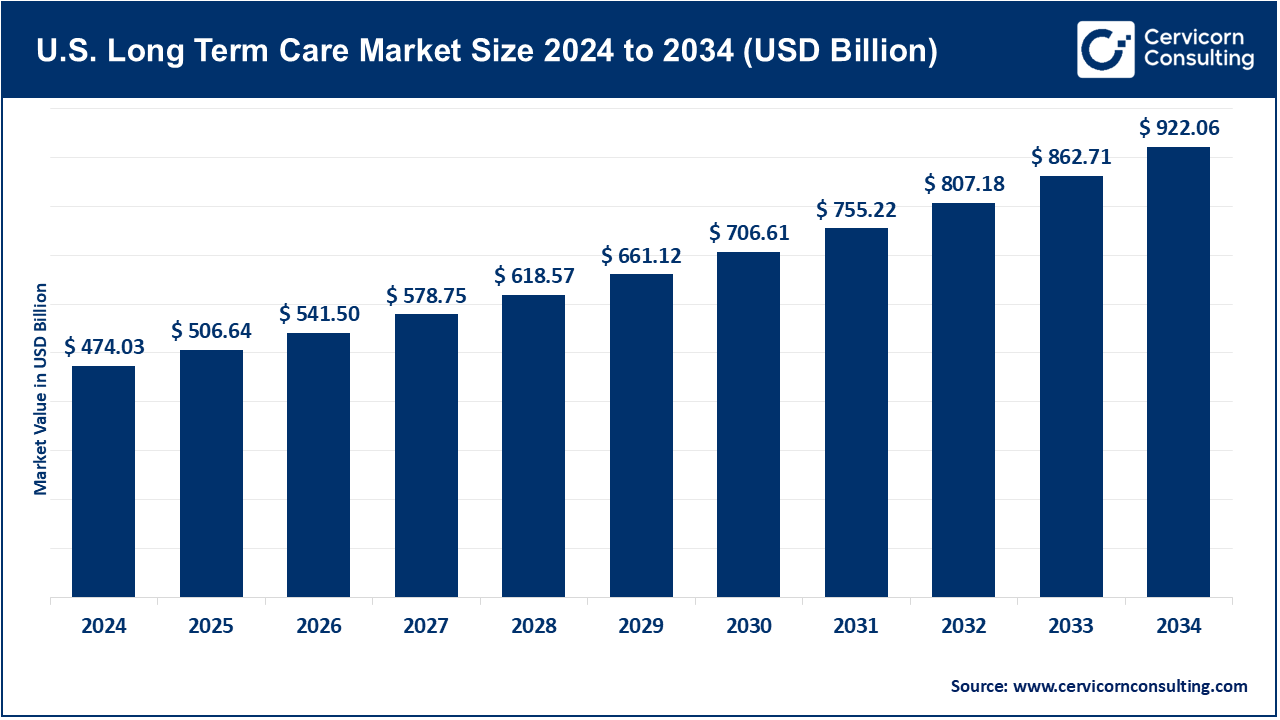

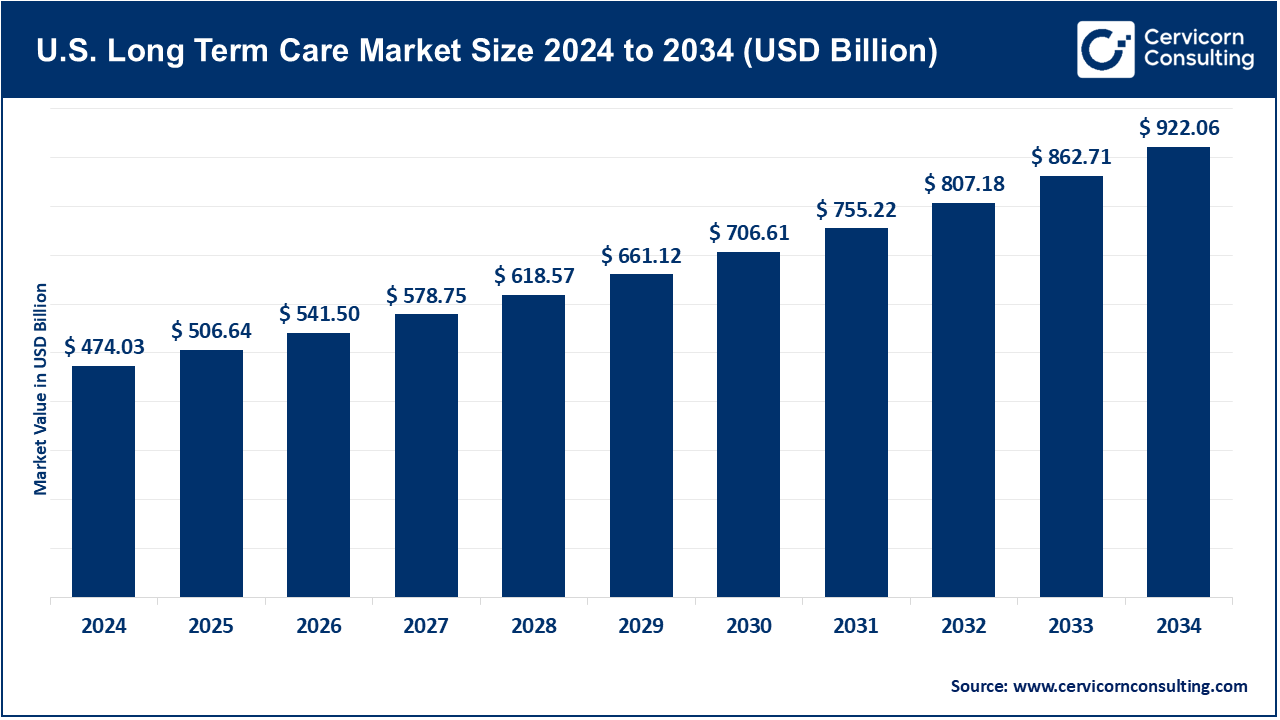

The global U.S. long term care market size was valued at USD 474.03 billion in 2024 and is expected to hit around USD 922.06 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.86% over the forecast period from 2025 to 2034.

The growing dispersion of home-based and community-centered care in the LTC market is another noteworthy trend driving growth in the U.S. long-term care industry. Advancements in healthcare technology, policies, patient preferences, and cost efficiency are all driving this change. In the past, long-term care was mainly provided through nursing homes and assisted living facilities, which primarily housed older adults. There has also been a significant increase in the number of elderly individuals who want to “age in place”. According to AARP surveys, nearly 77% of older Americans would prefer to stay in their homes as they age. As a result, there is increased need for home health care, adult day care, and home-based hospice services. Within these, the most impactful is the aging US population, which serves as the primary factor for the long-term care (LTC) market.

Long-Term Care (LTC) involves a myriad of services aimed at helping individuals with chronic illnesses, persistent disabilities, or age-related limitations who become incapable of self-care over prolonged durations. Such services provide help in daily tasks of ADLs like bathing, dressing, eating, taking prescribed medications, and moving. These services are rendered at various levels of institutional care (nursing homes, assisted living) to home- and community-based services (HCBS). The sector incorporates a variety of different services such as nursing care facilities, home healthcare, hospice and palliative care, adult day care services, and assisted living facilities. Nursing care facilities have the greatest market share because of the high dependence on full-time medical support caregiving for aging patients. However, the home healthcare and hospice segments are growing at a faster pace owing to the demand for aging in place and innovations in digital health care services.

U.S. Long Term Care Market Report Highlights

- By Payer, the public segment accounted for a revenue share of 65% in 2024.

- By Age Group, the 85+ Years segment has garnered 46% of the total revenue share in 2024.

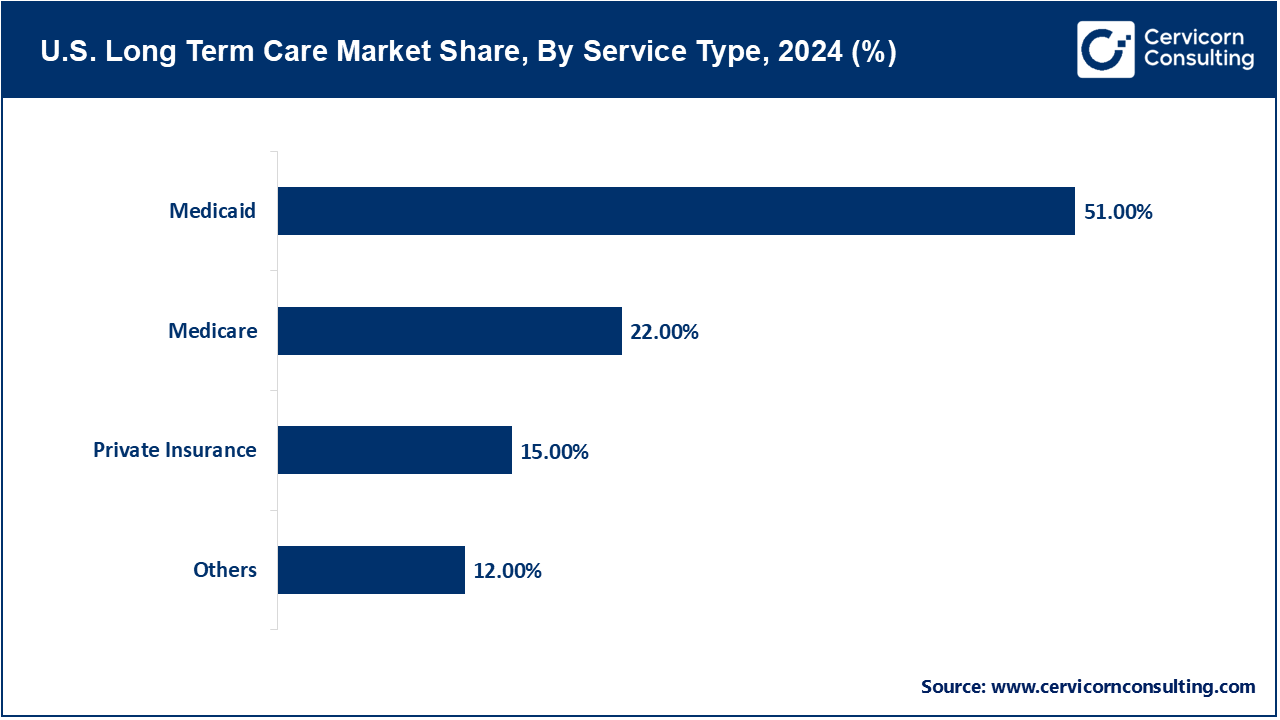

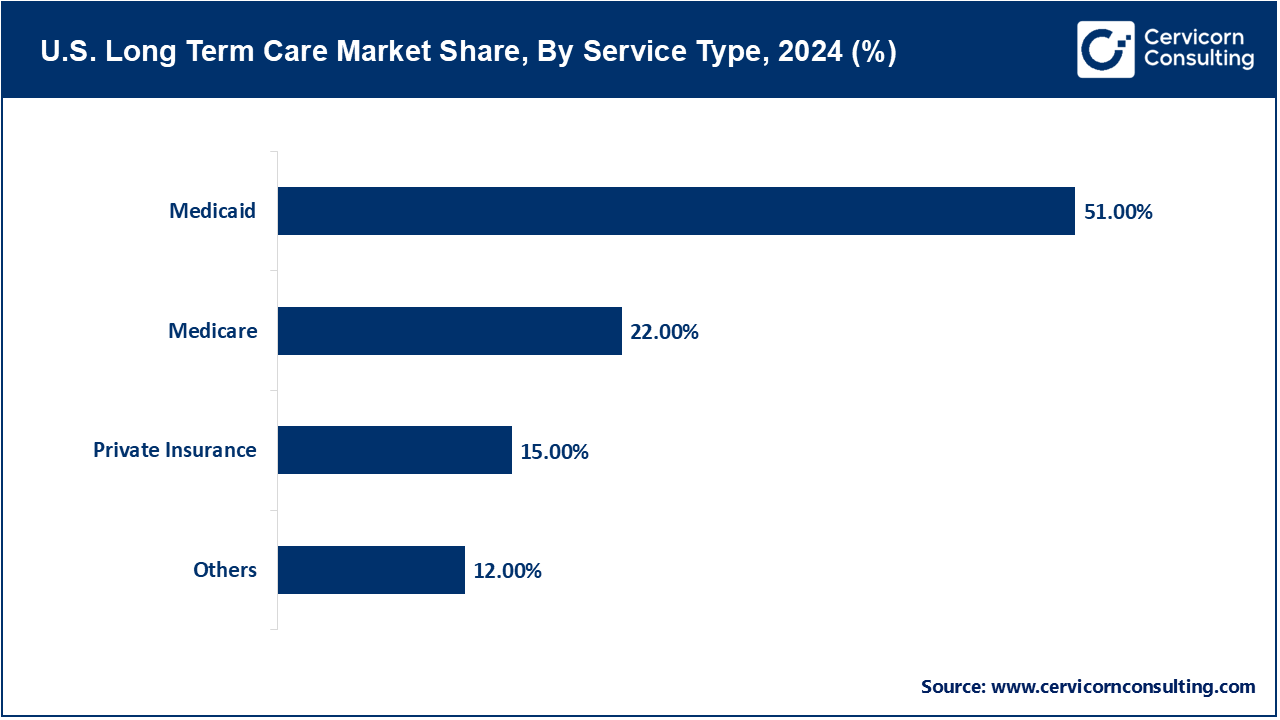

- By Service Type, the medicaid segment has captured revenue share of 51% in 2024.

- The largest share within this market segment was attributed to home healthcare in 2024 due to an increase in aging-in-place as well as technology-driven care at home.

- Increasing demand for chronic care and palliative care is projected to grow at the fastest CAGR of 7.2%.

- The gradual increase in the popularity of Assisted Living Facilities stems from their combination of independence with 24/7 support.

- The segment aged 65 years and older remains the most prominent in the market, and is likely to retain dominance due to the increasing elderly demographic, which is projected to reach 80 million individuals by 2040.

- Demand for memory care services for Alzheimer’s and dementia within this demographic is escalating.

- The memory care market within this age group is driven by the increasing prevalence of Alzheimer’s and dementia.

U.S. Long Term Care Market Trends

- Rise of Technology-Driven Long-Term Care: The use of remote care technologies in the U.S. long-term care market to improve service delivery, efficiency, and outcomes is one of the most revolutionary shifts. With an aging population, the need for long-term care (LTC) is increasing and so are the challenges for providers. They must oversee large and dispersed patient populations while controlling costs and improving care coordination. In this regard, technology is proving to be a powerful ally. Telehealth and remote patient monitoring (RPM) are already core to this transformation. The adoption of virtual care platforms was hastened due to lax restrictions and flexible reimbursement models during the COVID-19 pandemic.

- Shift Toward Home and Community: Based Long-Term Care Services (HCBS) - Perhaps the most important trend changing the long-term care landscape in the U.S. is the movement away from institutional care facilities toward home and community-based services (HCBS). This movement also reflects consumer demand as well as efforts aimed at cost containment of institutional care. Surveys conducted by the AARP and the U.S. Department of Health and Human Services showed that about 77% of Americans aged 50 and older prefer to receive care in their homes as opposed to nursing homes or assisted living facilities. This change of expectation is driving a shift in available funding and care models toward increasing customization and integration into the community. Home-based care integrates skilled nursing, home health aides, physical, speech and occupational therapy, along with assistance with daily activities. This model aids patients with chronic conditions, post-operative care, or provides end-of-life support. Furthermore, adult day care centers alongside respite services are vital for family caregivers and help patients stay engaged with their communities. For e.g. A 2021 AARP “Home & Community Preferences” survey found that 77% of adults aged 50 and older prefer to remain in their homes as they age, underscoring strong consumer demand for more personalized, home-focused care.

Report Scope

| Area of Focus |

Details |

| Market Size in 2025 |

USD 506.64 Billion |

| Expected Market Size in 2034 |

USD 922.06 Billion |

| Projected CAGR 2025 to 2034 |

6.88% |

| Key Segments |

Payer, Age Group, Service Type |

| Key Companies |

Brookdale Senior Living Inc., Genesis HealthCare, LHC Group, Inc., Amedisys Inc., Enhabit Inc. (formerly part of Encompass Health), ProMedica Senior Care (formerly HCR ManorCare), Sunrise Senior Living, National HealthCare Corporation (NHC), Kindred Healthcare (now part of Gentiva/LifePoint), Senior Lifestyle Corporation, Home Instead, Inc. (part of Honor Technology) |

U.S. Long Term Care Market Dynamics

Market Drivers

- Growing Burden of Chronic Diseases Among the Aging Population: The rampant prevalence of chronic diseases especially among the elderly demographic is a formidable driver of the U.S. Long-Term Care market. With rising lifespans, there is a greater likelihood of a person suffering from multiple chronic health conditions requiring continuous medication and long-term care support. The presence of chronic diseases also reduces autonomy and gives rise to complicated care requirements resulting in the need for specialized long-term care placed in diverse locations like skilled nursing facilities, assisted living facilities, as well as through home health care services. The Centers for Disease Control and Prevention (CDC) reports that 6 out of 10 Americans suffer from at least one chronic condition including heart disease, cancer, diabetes, or arthritis, with 40% of them having two or more. Adults aged 65 and older show an even higher prevalence of these conditions. Taking Alzheimer's disease as an example: a disability of choice for elderly individuals, it currently impacts over 7.2 million Americans above the age of 65 with estimates suggesting a near doubling by the year 2050. Such diseases not only impact memory, but also mobility and critical thinking capabilities which eventually leads to the need of specialized continuous care. For example, In 2021, 86.2% of participants using Medicaid long-term services and supports (LTSS) received Home and Community Based Services (HCBS) and these services constituted 63.2% of total LTSS spending. This illustrates a significant, policy-driven movement away from institutional care.

- Expansion of Public Payer Support: Medicare and Medicaid are other strong drivers of supporting the U.S. LTC market. This is the continued expansion and support of public payer programs, especially Medicare and Medicaid. These publicly funded programs bear the burden of long-term care services for millions of Americans while also being key industry specific for the economic viability of LTC providers. Medicaid is the largest payer for long term care servicing in the United States, specifically for Nursing home, home and community-based services (HCBS). After getting older, many people tend to spend the majority of their personal savings and become eligible for Medicaid for nursing home care or home care. For instance, Medicaid continues to dominate the funding spending for long-term care, covering 44% of institutional LTC spending and a remarkable 69% of home care expenses in 2023, reinforcing the primary burden of financing on LTC services.

Market Restraints

- Workforce Shortages and High Staff Turnover: Workforce Gaps and Elevated Employee Turnover Rates - One of the most acute issues in the U.S. LTC sector remains the persistent lack of skilled workers—especially nurses, family nursing aides (FHNAs), personal care aides (PCAs), and other elderly care specialists. This shortage of skilled workers not only constrains the capacity of LTC providers to meet the increasing demand, but also negatively impacts the quality, continuity, and safety of patient care across the continuum. The LTC sector is projected to create over 7.4 million direct care jobs from 2020 to 2029, which includes replacements and additional positions due to rising demand, as noted by the U.S. Bureau of Labor Statistics. In spite of this growth potential, LTC clinics and home care agencies are unable to attract and retain qualified personnel. Nursing home staff turnover has been reported to exceed 50% annually, with CNAs and home health aides in some states even more acute.

- High Cost of Long-Term Care and Limited Private Insurance Penetration: Long-term care (LTC) services, whether provided in the home setting, assisted living facilities, or nursing homes, remains financially out of reach for most people. By the Genworth Cost of Care Survey 2023, the average annual cost for a private room in a U.S. nursing home is over $108,000; assisted living facilities charge between $50,000 to $65,000 annually, and home healthcare services average over $60,000 per year depending on the number of hours provided. For most individuals not qualifying for Medicaid, these expenses are largely out-of-pocket as long as custodial care is not covered by Medicare’s limited post-acute nursing home care coverage. For middle-income seniors, and families who struggle with navigating the Medicaid thresholds, these costs can quickly deplete available savings and assets, rendering them financially vulnerable. According to Genworth’s 2023 Cost of Care Survey, the annual median cost for a private nursing home room was $116,800, assisted living averaged $64,200 per year, and in-home care via a home health aide cost a median of $75,500 annually, underscoring how these expenses can quickly erode personal savings for middle-income seniors who don’t qualify for Medicaid.

Market Opportunities

- Expansion of Home-Based and Community-Based Services (HCBS): One of the most exciting opportunities in the US LTC market is the expansion of home and community-based services (HCBS). There is a growing preference among the aged population for 'aging in place' instead of in institutional settings like nursing homes and assisted living facilities; as a result, the supply of in-home care, adult day care, and community support programs is rapidly increasing. As outlined by the U.S. Department of Health and Human Services, about 70% of older adults will require some form of Long-Term Care (LTC) during their lifetimes, with a majority preferring to receive this care in the comfort of their homes. This pattern has become more pronounced due to the COVID-19 pandemic, which left many traditional care institutions exposed and vulnerable, driving families and policy makers on a quest for safer alternatives. For instance, in 2022, 86.6% of Medicaid LTSS beneficiaries received HCBS and HCBS claimed 64.6% of Medicaid LTSS spending, indicating the continued movement funding away from institutional long-term services and supports.

- Integration of Technology and AI in Long-Term Care Delivery: Another key opportunity in the LTC market in the U.S. is the use of advanced technologies including Artificial Intelligence (AI), remote monitoring, and digital health platforms to improve operations and healthcare delivery, as well as patient outcomes. Wearable technology and IoT devices allow for real-time health monitoring and tracking of potential health issues such as falls, heart rate irregularities, and aberrant sleeping patterns. These technologies are useful for home-based healthcare services, as real-time manual monitoring is exceedingly expensive.

Market Challenges

- Acute Workforce Shortage and High Turnover Rates: Acute Workforce Shortage and High Employee Turnover - Another challenge is the acute workforce shortage and high employee turnover that contributes to the strain in the quality of care being provided. As the the U.S LTC market is grappling with, there is an existing gap in the skilled healthcare professionals sustaining the services being provided. Healthcare workers tend to burnout quickly due to the emotionally taxing role they hold, and because of the consistently underpaid nature of these jobs, the industry relies heavily on RNs, LPNs, CNAs, and home health aides. According to the U.S. Bureau of Labor Statistics (BLS), over 7 million direct care workers will be needed in the next decade to meet demand, yet current projections indicate a substantial shortfall. Turnover rates can exceed 50% in less than 12 months for certain position due to low pay, minimal employee perks, understaffing, and the psychological impacts of caring for patients with dementia or terminal illnesses. e.g. HCBS waivers have been in place since 1981 and have started to shift the long-term care funding structure. 60% of all LTSS spending is allocated towards HCBS which is a significant increase from decades ago.

- Regulatory Complexity and Reimbursement Pressure: Another important issue facing the U.S. long term care (LTC) market is the grappling with the increasingly intricate regulatory framework and growing reimbursement constraints, especially from government entities like Medicare and Medicaid. The LTC sector is characterized by some of the most stringent regulations in all of healthcare, facing federal, state, and local oversight. Providers face a myriad of compliance obligations for licensing, staffing ratios, infection control, billing, facility maintenance, resident rights, and quality reporting. As burdensome as these regulations are, they are made in the best interest of the patients to protect them from harm and guarantee that services provided to them are of high quality. These rules, unfortunately, create a greater burden in the form of inefficiency and cost to the healthcare system. Smaller providers, and especially those serving rural communities, are often unable to comply with such requirements due to limited financial resources, placing them at risk of incurring fines, losing licensure, or closure of the facility. e.g. the closure of nursing homes in rural counties resulted in a sustained 7%–9% decline in local health sector jobs which shows a significant loss of economic services as smaller providers become unable to regulatory-driven requirements.

U.S. Long Term Care Market Segmental Analysis

Service Type Analysis

Medicaid: Nursing facilities represent the largest public payer for long-term care, covering roughly 60% of residents. Eligibility requirements are asset tested, necessitating individuals to deplete their assets prior to eligibility. While Medicaid primarily finances nursing home care, newer policy initiatives have been expanding the Home and Community-Based Services (HCBS) programs, enabling a greater number of individuals to age in place. The dominance of Medicaid has both positive and negative effects—it guarantees access, but often comes with restrictions on provider selection, payment, and reimbursement rates.

Medicare: Although utilized extensively by the elderly population, Medicare only covers limited LTC services, which is short-term skilled nursing or rehabilitation care post hospitalization.

Private Insurance: Private Insurance, including long-term care insurance, is utilized by a smaller population, constituting less than 10% of older adults. Adoption has been hampered by High premiums, limited coverage terms, and a complex claims process.

Payer Analysis

Public: The primary public payers include Medicaid and Medicare, who together form the backbone of long-term care financing in the United States. Medicaid alone finances over 60 percent of all long-term care expenditures, especially for institutionalized low-income elderly individuals and those needing home and community-based services (HCBS). Medicaid's long-term care (LTC) benefits differ across state lines, but the majority provide coverage for nursing home care, some in-home services, as well as community-based programs such as adult daycare and respite care. A growing number of states have adopted Medicaid waiver programs designed to fund alternatives to institutionalization which aids aging-in-place and reduces pressure on overcrowded nursing homes. For instance, Medicaid waiver programs like Section 1915(c) and Money Follows the Person programs allow states to care for people at home and in the community—over 34,000 people moved from institutions to home care, and 30 states including D.C. shifted their care models.

U.S. Long Term Care Market Revenue Share, By Payer, 2024 (%)

| Payer |

Revenue Share, 2024 (%) |

| Public |

65% |

| Private |

20% |

| Out-of-pocket |

15% |

Private: The private payer category covers privately held insurance policies, out of pocket payments, and long-term care insurance (LTCI) provided by employers or taken out individually. Private payers facilitate specialized LTC facilities and services not covered by public programs. Out-of-pocket spending remains considerable; individuals often spend thousands of dollars a month on nursing homes or assisted living facilities according to the Department of Health and Human Services. Private payment options enable greater consumer choice in the standard of facilities and services offered, contributing to a growing trend toward bespoke and luxury LTC. Nevertheless, expensive private pay options restrict access for many middle-income families and there remains low uptake of long term care insurance (LTCI). Currently, fewer than 7 million Americans own LTCI policies. Coverage is often expensive, limited, and complicated by stringent underwriting rules and benefit caps, making it difficult for most to acquire.

Out-of-pocket: Family contributions and personal assets account for a significant share of funding for long-term care services not covered by Medicare and Medicaid, including assisted living and some in-home care services. In urban areas with especially high care costs, families often face financial exhaustion until they rely on Medicaid. Regardless, out-of-pocket spending is often the dominant payer for bespoke services, especially at private care facilities.

Age Group Analysis

65–74 Years: This ‘young-old’ group is characterized by well-retired people who still maintain a considerable degree of independence in function and mobility. Even though most individuals are not seeking full-time long-term cared-for services with wellness services geared towards preventive care and part-time in-home support services becoming increasingly common. The primary focus during these years shifts to preparation for potential care needs while maximally preserving technological aids and freedom. A sizable proportion within this category are the early adopters of aging-in-place innovations like remote patient monitoring, advanced medical alert systems, and smart home technology. e.g. in comparison, 37% of seniors 65 and older in internet-using households were ready to spend money on “solutions that help them live in the home independently,” while only 35% were willing to relocate to senior living communities. This shows that smart home technologies have the potential to enhance elderly living arrangements.

U.S. Long Term Care Market Share, By Age Group, 2024 (%)

| Age Group |

Revenue Share, 2024 (%) |

| 65–74 Years |

20% |

| 75–84 Years |

34% |

| 85+ Years |

46% |

75-84 Years: This age category has been classified as the middle-old. Like every previous cohort, “middle-old” groups are experiencing a pronounced rise in chronic illnesses and functional limitations along with increased demand for assistance. This group shows an increased need for long-term care and assisted living facilities, skilled nursing services, and adult daycare programs. This subgroup is marked by an increasing necessity to assist with activities of daily living (ADLs) such as washing, dressing, administering medications, and preparing meals. It is usual for individuals to rely on Medicare for temporary assistance during the initial stages, but most will require a transition to Medicaid for long-term custodial assistance later on. Adult Day Care: In programs like these based in New York, older middle-aged patients greatly benefitted—a 22% drop-in emergency room visits for patients attending three or more days a week was noted, thanks to medication adherence and chronic illness management.

85+ Years: This segment of the population has a greater prevalence of dementia, immobility, frailty, and social isolation, necessitating the most intensive long-term care. They frequently experience multiple chronic illnesses, cognitive decline, and significant polypharmacy. Within skilled nursing facilities, this segment incurs the highest need for care costing over $100,000 annually.

U.S. Long Term Care Market Top Companies

Recent Developments

- July 2025: A New Nationwide Retirement Institute survey claims that a staggering 58% of Americans falsely believe Medicare covers long term care services such as assisted living or home care services. This highlights a phenomenal discrepancy when it comes to the financial planning of eldercare services. The study also reveals that most LTC costs remain out of pocket, with the private nursing room cost outpacing more than 127,000 dollars yearly.

- May 2025: Massachusetts Assisted Living Fire Sparks Policy Review: The tragic incident at Gabriel House in Fall River, where 9 residents lost their lives, has reignited concerns about safety regulations for assisted living facilities in the state. These facilities continue to function with limited safety regulations when compared to nursing homes, where the federal government mandates stringent requirements. This raises significant worries regarding supervision, fire safety measures, and personnel education.

- April 2025: Staffing Shortages May Lead to Dangerous Sedation Practices: Researchers from Penn Wharton recently published their findings on the potential impact of not implementing federal minimum staffing levels. The study predicts a stark increase of approximately 24,000 residents who will be more likely to receive sedatives and antipsychotic drugs in nursing homes due to inadequate trained staff. There is now growing concern about the moral and physical health concerns of elderly patients within chronic understaffing in long-term care centers.

Market Segmentation

By Service Type

- Medicaid

- Medicare

- Private Insurance

- Others

By Payer

- Public

- Private

- Out-of-pocket

By Age Group

- 65–74 Years

- 75–84 Years

- 85+ Years

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Long-Term Care

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Service Type Overview

2.2.2 By Payer Overview

2.2.3 By Age Group Overview

2.3 Competitive Overview

Chapter 3. U.S. Impact Analysis

3.1 Russia-Ukraine Conflict: U.S. Market Implications

3.2 Regulatory and Policy Changes Impacting U.S. Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Growing Burden of Chronic Diseases Among the Aging Population

4.1.1.2 Expansion of Public Payer Support

4.1.2 Market Restraints

4.1.2.1 Workforce Shortages and High Staff Turnover

4.1.2.2 High Cost of Long-Term Care and Limited Private Insurance Penetration

4.1.3 Market Challenges

4.1.3.1 Acute Workforce Shortage and High Turnover Rates

4.1.3.2 Regulatory Complexity and Reimbursement Pressure

4.1.4 Market Opportunities

4.1.4.1 Expansion of Home-Based and Community-Based Services (HCBS)

4.1.4.2 Integration of Technology and AI in Long-Term Care Delivery

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 U.S. Long Term Care Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Long Term Care Market, By Service Type

6.1 U.S. Long Term Care Market Snapshot, By Service Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Medicaid

6.1.1.2 Medicare

6.1.1.3 Private Insurance

6.1.1.4 Others

Chapter 7. Long Term Care Market, By Payer

7.1 U.S. Long Term Care Market Snapshot, By Payer

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Public

7.1.1.2 Private

7.1.1.3 Out-of-pocket

Chapter 8. Long Term Care Market, By Age Group

8.1 U.S. Long Term Care Market Snapshot, By Age Group

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 65–74 Years

8.1.1.2 75–84 Years

8.1.1.3 85+ Years

Chapter 9. Long Term Care Market, By Region

9.1 Overview

9.2 U.S.

9.3 U.S. Long Term Care Market Revenue, 2022-2034 ($Billion)

9.4 Market Size and Forecast

9.5 U.S. Market Segmental Analysis

Chapter 10. Competitive Landscape

10.1 Competitor Strategic Analysis

10.1.1 Top Player Positioning/Market Share Analysis

10.1.2 Top Winning Strategies, By Company, 2022-2024

10.1.3 Competitive Analysis By Revenue, 2022-2024

10.2 Recent Developments by the Market Contributors (2024)

Chapter 11. Company Profiles

11.1 Brookdale Senior Living Inc.

11.1.1 Company Snapshot

11.1.2 Company and Business Overview

11.1.3 Financial KPIs

11.1.4 Product/Service Portfolio

11.1.5 Strategic Growth

11.1.6 U.S. Footprints

11.1.7 Recent Development

11.1.8 SWOT Analysis

11.2 Genesis HealthCare

11.3 LHC Group, Inc.

11.4 Amedisys Inc.

11.5 Enhabit Inc. (formerly part of Encompass Health)

11.6 ProMedica Senior Care (formerly HCR ManorCare)

11.7 Sunrise Senior Living

11.8 National HealthCare Corporation (NHC)

11.9 Kindred Healthcare (now part of Gentiva/LifePoint)

11.10 Senior Lifestyle Corporation

11.11 Home Instead, Inc. (part of Honor Technology)

...