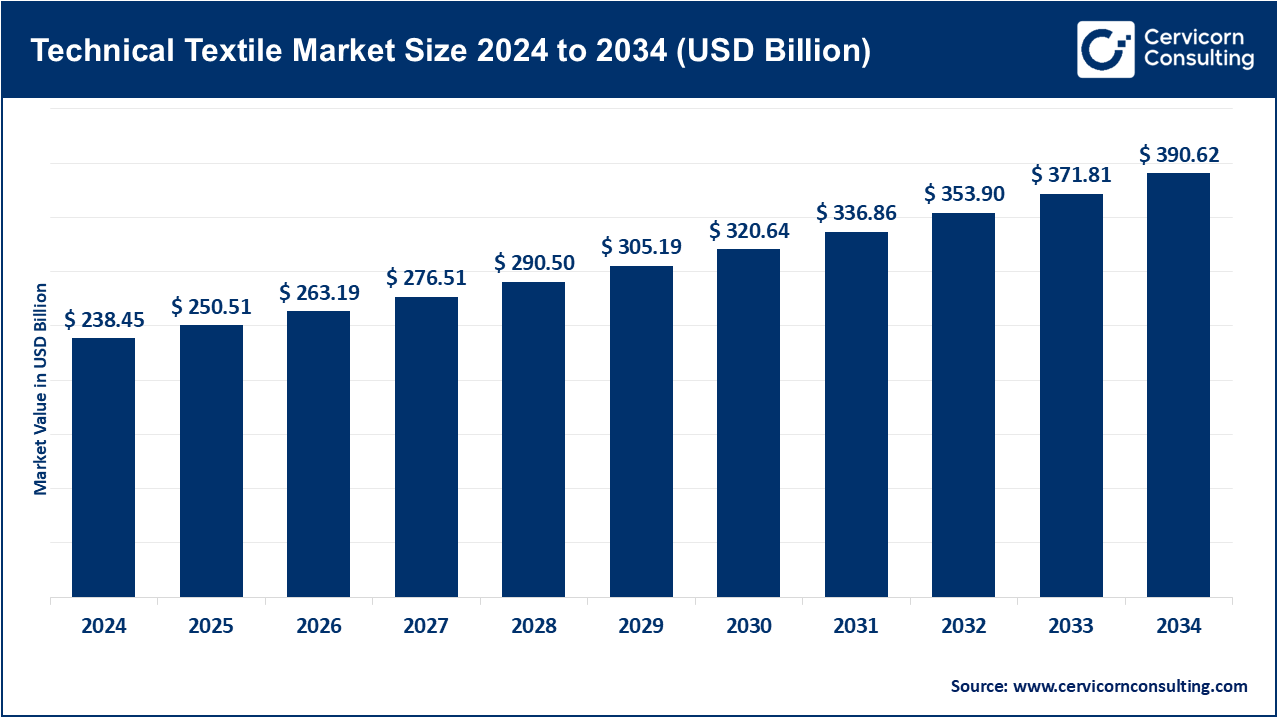

The global technical textile market size was reached at USD 238.45 billion in 2024 and is expected to exceed around USD 390.62 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.20% over the forecast period from 2025 to 2034.

The technical textile market is expected to grow significantly owing to its expanding application across industries such as automotive, construction, healthcare, and agriculture. Rising demand for durable, high-performance materials that offer enhanced strength, thermal resistance, and moisture control is a major driver. Additionally, government initiatives promoting the use of geotextiles in infrastructure projects and increasing adoption in PPE, medical textiles, and smart fabrics contribute to market acceleration.

The technical textile market includes textiles designed for specific high performance in automotive, healthcare, construction, and defense industries. Growth is propelled by demand within those industries concerning fire resistance, durability as well as antimicrobial active properties of textiles. Innovations are spurred with government and corporate funding through eco-friendly sustainable R&D alongside smart fibers and nanotechnology which furthers production technology as well as fabrics themselves. Product development is aided greatly through collaboration across different domains enabling the fusion of sensors and electronics into textiles leading them towards real-time data exchange capabilities thus revolutionizing industrial safety standards while improving efficiency and sustainability simultaneously.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 250.51 Billion |

| Expected Market Size in 2034 | USD 390.62 Billion |

| Projected CAGR 2025 to 2034 | 5.20% |

| Dominant Area | North America |

| High-growth Region | Asia-Pacific |

| Key Segments | Product Type, Application, Technology, End-User, Manufacturing Process, Material, Region |

| Key Companies | Asahi Kasei, Baltex, Du Pont, Filspec, Freudenberg Performance Materials, Heathcoat Fabrics, Huntsman International, Khosla Profil, Milliken & Company, Mitsui Chemicals, Nikol Advance Materials, Nobletex, Srf, Toray Industries, Toyobo |

Woven Technical Textiles: Woven technical textiles are made by interlacing yarns perpendicular to one another. This form of weaving possesses high dimensional stability and load-bearing capacity. As such, they are utilized in critical strength or durability applications. There is a global oversight on VOC emission regulations on weaving facilities from 2022 until 2025. BIS set standards on product quality for woven composite fabrics used in automotive seat covers in 2023. The U.S. EPA added air toxics monitoring for large woven textile plants in 2024. Germany’s Clean Mobility initiative funded lighter woven composite panels for EV interiors in 2024.

Nonwoven Technical Textiles: The Nonwoven segment has dominated the market in 2024. Nonwoven textiles are created through the bonding or felting of fibers into webs or mats and offer filtration, hygiene, and insulation at low cost. These fabrics are significant in medical, filtration, and disposable uses. Nonwovens N95 and surgical masks mandated quality-control orders from India’s NTTM since 2022. Recognition of wound dressings containing nanofiber layers was given by U.S. FDA with cross horizon application in 2023. In 2024, NIST included nonwoven blends to its sorting protocol to promote recycling. Woven hygiene products gained legal status under EPR regulations enforcement by the EU in 2025.

Composites and Laminated Textiles: The Fiber Reinforced Polymer (FRP) composites are hybrid materials composed of high-performance filaments infused with resins, while laminate fabrics add supplementary functions such as waterproof or fire resistance. These textiles are designed for aerospace, construction and defense applications. Between 2022-2025 the U.S. EPA increased VOC emission limits for resin-coated structural panels used in construction. In 2023 India’s NTTM sponsored the creation of prototype carbon-fiber composite laminates for healthcare shielding. In 2024 the EU's Horizon program funded antimicrobial laminate development intended for hospital use. Germany sponsored eco-friendly composite laminates to help achieve green building certification in 2025.

Coated Technical Textiles: Coated rainwear includes technical textiles with functional finishes like PU, PVC or PTFE which offer water resistance, UV protection or chemical shielding on woven substrates and applied to fabrics at lower temperatures than their melting point Fused Layers Superlattice, giving it ultra-high temperature resistant properties. This coat is widely worn in industrial, protective, and recreational settings. Standards for coated rainwear were issued by BIS in 2023 under its certification scheme. Emissions from production lines of coated textiles were included into revised NESHAP rule by United States Environmental Protection Agency (EPA) in 2024. Development of bio-based polyurethanes (PU) films targeted to agriculture was financed by India in year 2024. Restrictions on PFAS substances used in coating textile fabrics came into force within the European Union in late 2023.

Medtech (Healthcare & Hygiene): Medtech textiles include surgical drapes, gowns, wound dressings, and sanitary products, engineered for absorbency, biocompatibility, and safety. They're essential in infection control and patient care. From 2022–2025, the U.S. FDA authorized smart wound dressings with embedded sensors in 2023. India’s BIS upgraded surgical gown standards in 2023 under pandemic preparedness guidelines. EU medical textile PPE regulations were updated in 2024, requiring CE marking and traceability. Japan funded smart diaper R&D with fluid-sensing tech in 2025.

Mobiltech (Transportation): The Mobiltech segment leading the market in 2024. Mobiltech covers textiles used in vehicles—seat fabrics, airbags, filters, and insulation—that enhance safety, comfort, and weight efficiency. They meet stringent regulatory and emissions norms. Between 2022–2025, India funded high-strength seatbelt nav-composites for EVs. The U.S. EPA tightened VOC regulations for cabin air filters in vehicles in 2024. Germany subsidized anti-noise reinforcement fabrics in EV chassis in 2023. EU emissions law amendments in 2024 drove lightweight textile insulation projects for trains.

Buildtech (Construction): Buildtech comprises textiles like geotextiles, roofing membranes, scaffolding nets, and insulation used in civil infrastructure for reinforcement and protection. They improve durability and sustainability in construction. From 2022 to 2025, India mandated geotextile use in highway expansion under NTTM frameworks. EU funded eco-friendly roofing textile membranes via Horizon in 2024. The U.S. EPA revised emissions standards for applicators of coated scaffolding nets in 2023. Germany adopted noise-reduction wall coverings in urban renewal projects in 2025.

Agrotech (Agriculture): Agrotech encompasses shading and crop covers, protective nets, and fabrics aimed at improving agricultural productivity while conserving water. In the agriculture sector, these textiles provide low-cost solutions. In 2023, India’s NTTM subsidized biodegradable crop nets tailored for resource-poor farmers. The U.S. EPA added mandates for irrigation systems to include textile filters capable of removing pesticides in 2024. EU regulations put a stop on non-degradable multi-layered mulch films in 2022, which sparked innovation around textiles. Japan sponsored solar-reflective shade fabrics in 2025 to mitigate heat-related losses during cropping seasons.

Indutech (Industrial Filtration & Cleaning): Indutech covers filtration textiles as well as those used in conveyor belts, industrial wipes, drill pipes insulation tubes for heavy industries are also included indutech products. These face harsh environments and require high-temperature resistance. The US textile filter limit set by chemical plants between 2022-2025 faced Oregon setting more stringent regulation back in 2023 that was stricter than previous ones. Industrial standards regarding cleaning wipes specific to manufacturing were released by India’s BIS in 2024. The EU with its circular initiatives regarding filtration dipers fabricated into use the same year.

3D Weaving/Knitting: The 3D Weaving/Knitting segment has captured leading position in 2024. 3D knitting and weaving create multi-layered, seamless textile structures for which the strength-to-weight ratio is high. Aerospace, automotive, and medical devices capture complex multi-dimensional shapes. NIST and ASTM published 2024 standards from 2022-2025 covering 3D structures, textiles considering circularity and repair. In India, the NTNM sponsored pilots in ‘23 for knitted orthopedic braces that were 3D modeled. In 2024, the US EPA started regulating VOC emissions on composites infused with resin and 3D woven filaments while the focus was on additives in the EU Horizon program for electric vehicles PPE legroom capusen in ’25 EU. The horizon was sponsorship of cab parts with textile composites for EVs.

Thermal Bonding & Needle Punching (nonwovens): Thermal bonding joins fibres using heat while needle punching uses mechanical entanglement to join fibres nonwovens ensuring porous and durable fabric used for filtration, insulation as well as hygiene products. These methods are essential within disposable and industrial textiles manufacturing. This was applied by BIS adding quality criteria to thermally bonded nonwoven filters PPE’s from ‘22-‘25 in India. The US responded to an oil spill problem with funding hydrophobic materials designed geo nonwovens needed for flood control spent in green energy projects like needle punched german funds working ever since 2024 while over here applying ecofriendly adhesive designs tor (tea)spouts created mulch counters featuring banned single use items since 2022.

Technical Textile Market Revenue Share, By Technology, 2024 (%)

| Technology | Revenue Share, 2024 (%) |

| 3D Weaving / Knitting | 36.40% |

| Thermal Bonding & Needle Punching (for nonwovens) | 23.10% |

| Coating & Lamination | 20.30% |

| Electrospinning (for nanofibers) | 11.50% |

| Digital Printing / Conductive Printing | 8.70% |

Coating & Lamination: Coating and lamination serve to apply functional materials such as PU, PVC, or PTFE to textiles fo waterproofing and flame, chemical, and wear resistance which make the materials protective implementing coating enhances the functionality of textile. For the period 2022-25 the U.S. EPA’s revised NESHAP rules for 2024 included VOC and PFAS monitoring in coated Texas. In 2023 India’s NTTM granted funds for bio based PU coatings in agromembranes. In 2026 BIS introduced certification hospital grade laminated fabrics issued in 2024. EU REACH restrictions on PFAS-based coatings came into force in late 2023.

Electrospinning (nanofibers): The process of electrospinning utilizes an electric field to produce nano fibrous mats with a large surface area which also have porosity making them useful for filtration, sensors and even medical dressings. Subsequently these nanofibres will enable propulsive functional textiles of the future. From 22-25 NIST added identification of electrospun nanofibers to textile sorting standards in 2024. Electrospun nanofiber wound dressings were approved by the US FDA in 2023. In agronomy NTNTM funded prototype construction of masks via electrospinning in 2023. Supported by EU research programs, restoration of filters using biodegradable plastics which would prevent npnoplastic pollution was aimed at metered out micro plastic pollutants until nano fiber water filtration system is fully competent.

Digital Printing / Conductive Printing: Similar to other forms of digital printing, conductive printing applies functional inks (conductive, antimicrobial, or UV-blocking) to textile substrates with precision. These actions support the efficient creation and personalization of smart garments. Between 2022-2025 NIST’s 2024 Guidelines defined criterion for standard compliance on Digital Textile Printing. The EPA's 2025 VOC regulations also apply to aerosol digital coatings. In 2023 India’s BIS approved digitally printed PPE Fabrics. EU funded research projects in 2024 for garments embedded with health monitors designed for printed circuitry using conductive ink.

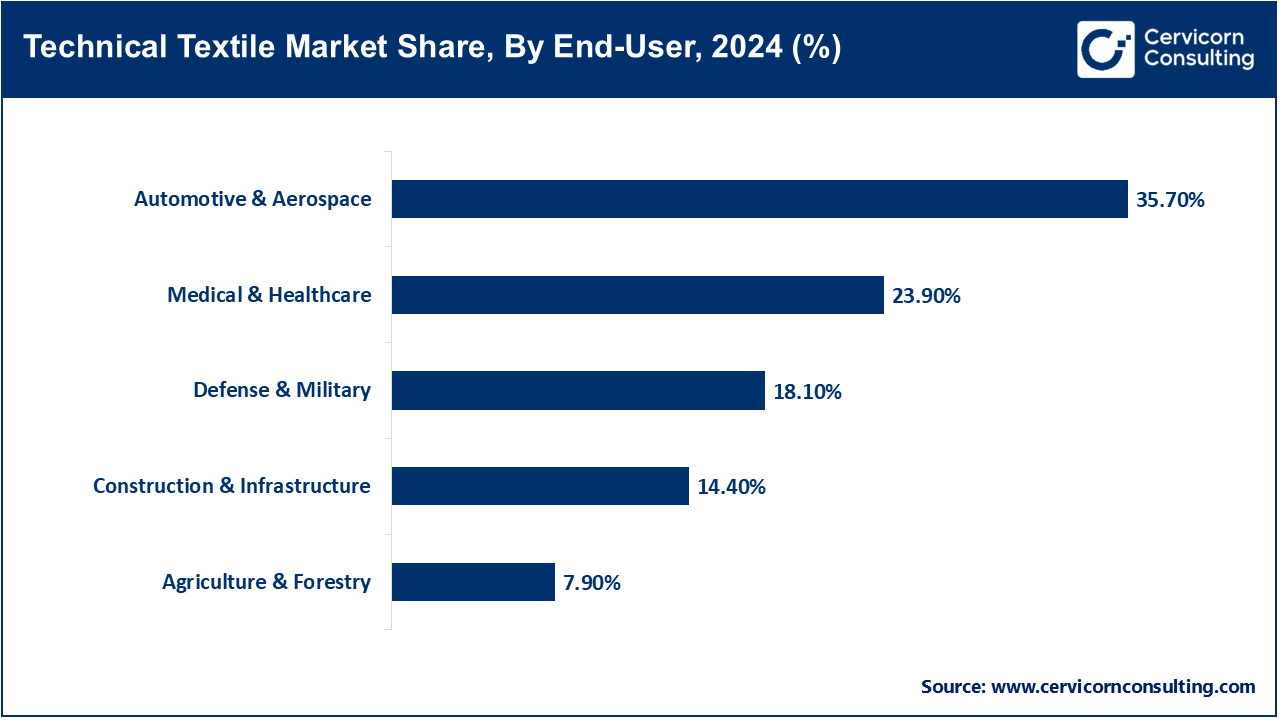

Automotive & Aerospace: The Automotive & Aerospace segment leading the market in 2024. Technical textiles improve safety and protection for occupants in vehicles and airplanes while enhancing durability, reducing weight, and improving aerodynamics. They are also used in airbags, seatbelt insulation, structural reinforcements, trims, and seat interiors. These materials must meet stringent mechanical and fire-retardant requirements. Under NTTM in 2023, India’s Ministry of Textiles sponsored research on nonwoven composites for the interiors of electric vehicles (EVs). Boeing widened their collaboration with Toray in 2024 to use carbon fibre reinforced textiles on commercial airplanes to increase fuel efficiency and range. BASF collaborated with Audi on the e-mobility batteries regarding insulation using technical textiles. Teijin, a Japanese supplier, introduced flame resistant battery housing fabrics for EVs in 2025. The above innovations showcase the increasing cross-sectoral integration of mobility industries with advanced technical textiles driven by rigorous sustainability objectives enhancing safety performance standards.

Medical & Healthcare: Out of all surgical gowns, wearable health monitoring devices, and biocompatible implants. surgical dressings must be bio-compatible. They are paramount to infection control and management of the patient. After the post-COVID changes in 2022, India’s Bureau of Indian Standards (BIS) revised the national quality regulations for disposable gowns and drapes. MediPrint’s smart wound dressings containing embedded sensors received US FDA approval in 2023. METI further developed long-term biodegradable nonwovens for use as implants in Japan in 2024. Freudenberg Medical designed an antimicrobial textile catheter sheath intended to surgically reduce infection risk during surgery in 2025. These advances confirm that dedicated innovative efforts and further advancement within this field of medical textiles remain essential in regard to public healthcare concerns.

Defense & Military: For Defense grade textiles, ballistic protection, flame resistance, chemical shielding, stealth signature reduction, and many more are all achievable under extreme conditions. The prerequisites for these functionalities include rigorous durability and safety benchmarks. There have been notable advancements such as the purchase order approved by India’s Ministry of Defense for domestically manufactured bullet resistant fabrics in 2023 as part of the Make-II initiative. In 2024, the MIT Entrepreneurship Ecosystem together with DIU launched smart biosensor uniforms and in 2025 NATO published finalized testing guidelines for chemically-protective suits constructed from membrane coated textiles. Alongside these Israel’s defense ministry investing into lightweight bulletproof aramid fiber vests showcase noteworthy international military multifunctional intelligent apparel prioritized funding trends globally.

Construction & Infrastructure: In the building industry, technical textiles are used as geotextiles, tarpaulins, insulation layers, roofing membranes and fire barriers. They help with soil reinforcement, moisture control, and the protection of building silos. In India’s infrastructure initiatives, the use of geotextiles for slope stabilization on highways became compulsory in 2022 under BIS norms. Sioen Industries received approval from DIBt Fire Protection Office in Germany for high-rise façade fire retarding building textile in 2023. Advanced geo-sythethics for flood control were introduced by US Federal Highway Administration (FHWA) in 2024. Then in 2025 China Construction Tech Group launched a line of site-used modular fabrics specially coated to be UV resistant. Alongside various other policies these products bolstered the contribution of technical textiles towards constructing climate-resilient durable infrastructure.

Agriculture & Forestry: Agrotech bolsters crop protection and irrigation alongside soil amelioration using shade nets, mulch mats root bags, and anti-insect net barriers. These materials enhance yield while reducing chemical usage. The Indian Council of Agricultural Research (ICAR) has implemented jute-based agrotech mats for organic farming in tribal areas in 2022. Later that year, Spain’s IRTA introduced UV-stable shade cloths for extreme temperature regions which also increases tomato yield. EMBRAPA of Brazil invested in biodegradable drip irrigation textiles for small-scale farmers in 2024. In 2025 FAO worked with Kenyan cooperatives to test hail resistant netting fabrics. Initiatives such as these demonstrate that technical textiles are critical to achievement of global sustainable climate-smart agriculture.

Spinning & Weaving: The processes of spinning and weaving are essential for manufacturing technical textiles with complex strength, elasticity, and durability. They are crucial in industrial applications like industrial belts, conveyor fabrics, and ballistic textiles. In 2023, the NTTM in India assisted in the modernization of legacy mills to incorporate high tenacity yarn spinning located in Tamil Nadu. In 2024, The Itema Group from Italy adopted an air-jet weaving machine specialized for technical fabric production that is energy efficient. USA-based Milliken invested in aramid weaving looms incorporated into firefighting suits which Toyota Industries plans to complete by 2025 along with real-time defect monitoring sensors developed during the weaving process in Japan. These innovations reflect continued upgrades to traditional textile techniques for specialized industrial use.

Knitting (Warp & Weft): Warp and weft knitting methods are favored for applications requiring elasticity, comfort, and seamless construction, such as compression wear, medical textiles, and sports gear. Knitting offers great flexibility and efficiency for complex shapes. In 2022, KARL MAYER of Germany introduced an industrial flat-knitting machine designed specifically for the technical composite reinforcements industry. In 2023, India's Apparel Export Promotion Council sponsored warp-knit R&D projects aimed at orthotics and sportswear design. Nike increased production of its 3D-knitted Flyknit series in 2024 with automated weft knit machinery. In Nottingham University UK, work commenced on warp-knit scaffolds for tissue engineering design, completing them by 2025. These innovations mark knitting's transformation from clothing into biomedicine and structural fields.

Nonwoven Fabrication (Meltblown, Spunbond): The Nonwoven Fabrication has held dominant position in 2024. The categories meltblown and spunbond are examples of nonwoven processes that make fabrics from a polymer without weaving or knitting as is common with filtration and hygiene protective textiles. Translated as ‘not woven’ these fabrics are light weight and provide a superior barrier to flow. The first indigenous meltblown unit based out of Gujarat was launched by India in 2022. Berry Global USA expanded its mask – diaper spun bond line to meet sustainability goals in 2023. PLA-based nonwovens became funded projects intended for medical drape fabrics within Europe in 2024 while Asahi Kasei scaled up his hybrid spun bond air filter systems for use in electric vehicle cabins set for completion by 2025. International investment continues to be drawn to nonwoven materials due to their unique characteristics and versatility as well as diverse applications.

Technical Textile Market Revenue Share, By Manufacturing Process, 2024 (%)

| Manufacturing Process | Revenue Share, 2024 (%) |

| Spinning & Weaving | 24.20% |

| Knitting (Warp & Weft) | 16.40% |

| Nonwoven Fabrication (Meltblown, Spunbond) | 36.10% |

| Lamination & Coating | 14.70% |

| Finishing (Chemical & Mechanical) | 8.60% |

Lamination & Coating: These processes increase a textile’s protective quality by incorporating a polymer, rubber or resin layer which serves as waterproof, fireproof or bonding protective layer. Laminated textiles form an important part of the military fabrics as well as in geotextile and upholstery engineering. The Textiles Ministry of India sponsored a coating facility under NTTM in 2022 to produce flame retardant coatings. In 2023, SIKA Switzerland launched construction membranes with textile-lamination for UV and chemical resistance. The U.S. EPA guidance issued in 2024 on low-VOC emissions coatings prompted manufacturers to switch to water-based solutions for fabrics used in upholstery furniture goods. In 2025, ARAMCO Saudi Arabia formed a joint venture to manufactor PTFE coated fabrics designed to protect from desert climate extremes. Enhancement of customization tailored sophisticated advanced requirements and the durability of textiles still dominate this segment.

Finishing (Chemical & Mechanical): Finishing encompasses several calendaring, surface enhancement, and flame resistance treatments. For technical textiles, these processes are essential from an end-use performance perspective. In 2023, Freudenberg invested in antimicrobial finishing lines for medical and HVAC textiles. SASMIRA developed an enzymatic method for finishing biodegradable textiles in 2022. The U.S. Department of Energy sponsored low-energy plasma-based finishings on aramid fabrics in 2024. Odour-resistant finishing on sports and defense gear employing silver-free technology was introduced by Polygiene of Sweden in 2025. Finishing plays a crucial role in preparing fabrics for defense, healthcare, sportswear industries, or any other industrial applications.

Natural Fibers (Cotton, Wool, Jute): Each natural fiber has a distinct role to play in natural technical textiles. Agro-geo-home insulation textiles require breathability combined with biodegradability and cost efficiency. In 2022 the National Jute Board of India sponsored pilot projects on jute geotextiles in Bihar’s flood area. Netherlands promoted the use of flax and hemp fibers in building composites under its Green Building Directive in 2023. In 2024 eco-friendly agro-mats for sustainable agriculture manufactured from coir were introduced by Bangladesh aided with FAO grants. Then, a Finnish startup launched thermally treated wool felt used as acoustic insulation for architecture textiles in 2025. These examples showcase interdisciplinary movements around the world embracing the use of natural fibers in technical applications.

Synthetic Fibers (Polyester, Polyamide, Polypropylene): The Synthetic Fibers segment has recorded highest revenue share in 2024. These are widely accepted and put to use on professional sites like construction due to their strength alongside water resistance coupled with particular thermal properties of automotive as well as filtration industry. Reliance Industries increased the production scale of specialty polyester yarns for safety gear causing an eruption in demand in India back in 2022. Moving onto Turkey where Korteks also had recent breakthroughs by producing anti UV polypropylene fibers aimed at outdoor textile products serving their intended purpose since 2023. New advancements don’t stop there: BASF created flame-retardant polyamide yarns marketed for cable textiles slated for release next year. In 2024 Sinopec will be introducing new lines targeted towards used polyester industrial nonwovens recyclables avenue offer yet another glimpse into the future across borders. It is clear that these strategies of synthesis are undisputed dominantly due to their flexibility and, in addition, providing novel methods while seeking approaches for GoGreen options—after all, the above catchphrases can come from any angle.

Technical Textile Market Revenue Share, By Material, 2024 (%)

| Material | Revenue Share, 2024 (%) |

| Natural Fibers | 15.20% |

| Synthetic Fibers | 45.60% |

| High-Performance Fibers | 28.70% |

| Biodegradable & Bio-based Fibers | 10.50% |

High-Performance Fibers (Aramid, Carbon, Glass Fibers): Military and aerospace industries utilize these specialized fibers for thermal insulation owing to their lightweight composition coupled with a remarkable tensile strength. Meeting global ballistic textile requirements in 2023 prompted Teijin to scale up aramid fiber production in the Netherlands. The “Atmanirbhar” initiative led to sanctioning by India’s DRDO for carbon fiber fabrics on UAV frames in 2024. The following year Owens Corning launched low-density glass-fiber mats earmarked EV battery insulators. Toray partnered with NASA developing space-grade aramid layers for deep-space missions which illustrates the critical safety and structural integrity need advanced technology strives toward, underlining why these fibers are crucial to evolution.

Biodegradable & Bio based Fibers (PLA, PHA ): These materials pose an alternative to synthetic substitutes as they are targeted at hygiene and farming biodegrading without harmful remnants suited for medical uses. The EU’s Bio-Based Industries Joint Undertaking funded a trial of PLA diaper fabric which occurred in Spain during 2022. In 2023, Daicel from Japan commercialized PHA nonwoven fabrics for use in single-use wound dressings. A bio-tech firm backed by Reliance created PLA mats intended for tea estates with hopes of mitigating plastic pollution in 2024. Unilever together with Lenzing tested bio-fiber hygiene wipes conducted trials across Asia intending to roll out biodegradable alternatives in 2025. As tighter regulations on plastics come into effect, there is rapid advancement of technical textiles designed to biodegrade.

The technical textile market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region.

The region continues to lead in the technical textile industry, driven by innovations in high-performance apparels and compliance with legal and social environmental obligations. USA maintains a leading position in defense textiles, smart fabrics as well as medical nonwovens. During the period of 2023-2025, the US EPA (Environmental Protection Agency) Emissions Standards for Textile Finishing Processes stipulated more stringent emission norms resulting in VOC-compliant coating technologies for VOC-upholding coatings. Canada implemented circular economy policies at the national level through which he advanced its textile recycling policies and introduced EPRs concerning textiles. Mexico set protective tariffs on texiles while under “Program for the Promotion of Exports of the Maquila Industry” (IMMEX), enhanced assistance to domestic clusters of technical textiles. All these developments continue reshaping supply chains for technical textiles within th region focused on green construction and automation. Innovation is being accelerated on smart wearables and protective fabrics due to sustainability policies coupled with government grants.

The UK, Germany, and France are the leaders in innovative sustainable and functional technical textiles spanning all of Europe. These nations are adopting biosourced fibers, PFAS-free coatings, and composites that can be recycled. Germany financed the research and development of advanced composites from recovered aramid fibers for use in electric vehicles (EVs) as well as public infrastructure in 2023. Post Brexit, the UK incorporated EU and U.S. standards into its regulatory framework which included antimicrobial performance mandates on technical fabrics. In 2024 France initiated policies that required the textile industry to repair and reuse garments along with supporting domestic circular economy clusters via its Green Industry Plan. There is now an emerging response among European manufacturers for advanced textiles to stricter regulations set by REACH and ECHA regarding laminates and coatings which is spurring innovation towards sustainability. We can now observe a growing presence of eco-certifications alongside automation that will redefine European competitiveness.

Technical Textile Market Revenue Share, By Region, 2024 (%)

| Region | Revenue Share, 2024 (%) |

| North America | 44.30% |

| Europe | 25.70% |

| Asia-Pacific | 21.80% |

| LAMEA | 8.20% |

The region remains the primary manufacturing hub for industrial textiles, gaining strong government support and cheap labor, along with an established demand in the automotive, healthcare, and agriculture industries. China has dominated by increasing exports of coated and laminated textiles while also fostering domestic smart textile initiatives. India’s NTTM sponsored over 70 pilot projects in agritech, meditech, and defense funded tech by 2025. Japan expanded grant schemes for nonwovens with antimicrobial and biodegradable properties applied to surgical and disaster relief uses. South Korea introduced PM2.5 air filtration programs using electrospun nanofibers for use in national health priorities in early 2025. Australia added bio-insulation geotextiles that are fire resistant to housing retrofit programs. Regional governments have spearheaded creating innovation hubs for industrial textiles in Asia-Pacific.

LAMEA is an emerging region, with growing demand in infrastructure, defense, filtration, and climate-resilient applications. Brazil has focused on agrotech by supporting biodegradable nonwoven fabrics for soil conditioning and water retention. The UAE launched government-backed initiatives to incorporate smart geotextiles in coastal and desert infrastructure projects under its 2030 Vision. Saudi Arabia funded high-performance coatings and thermal protection materials as part of its construction mega-projects like NEOM. South Africa passed new textile waste management frameworks in 2024, encouraging reuse and localized circular textile hubs. Government interest in domestic manufacturing and protective textiles is leading to investments in both education and industrial modernization. LAMEA is poised to grow as a niche producer of functional and climate-adaptive textiles supported by policy momentum.

Recent partnerships in the technical textile industry emphasize innovation, sustainability, and advanced material integration across sectors. Freudenberg Performance Materials partnered with Rheinmetall in 2023 to co-develop high-resistance textiles for defense and mobility applications. DuPont teamed up with Apollo Hospitals in India to explore medical-grade textile solutions for infection control. Asahi Kasei collaborated with Toyobo to enhance smart wearables using sensor-integrated fibers for health monitoring. In 2024, Lenzing Group joined hands with Archroma to advance biodegradable and non-toxic coating solutions for agri-textiles. Meanwhile, Baltex and Nottingham Trent University continued joint research on 3D warp-knitted fabrics for aerospace interiors. These partnerships are driving the integration of performance, safety, and sustainability, positioning technical textiles as a core enabler in next-gen industrial and consumer applications.

Market Segmentation

By Product Type

By Application

By Technology

By End-User

By Manufacturing Process

By Material

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Technical Textile

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Product Type Overview

2.2.2 By Technology Overview

2.2.3 By Manufacturing Process Overview

2.2.4 By Material Overview

2.2.5 By Application Overview

2.2.6 By End User Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Consumer Demand for Functional Apparel

4.1.1.2 Technological Advances Related to Fibers & Yarns

4.1.1.3 Need for Lightweight Materials in Aerospace & Transport

4.1.2 Market Restraints

4.1.2.1 High Regulatory Compliance Costs in Healthcare & Defense

4.1.2.2 Slow Adoption in Developing Countries

4.1.2.3 Low Recycling Rates and Infrastructure Gaps

4.1.3 Market Challenges

4.1.3.1 Reconciling Competing International Regulations

4.1.3.2 Intellectual Property Concerns in Fiber Innovation

4.1.3.3 Scaling Production While Maintaining Quality

4.1.4 Market Opportunities

4.1.4.1 Partnerships Between Tech Firms and Textile Manufacturers

4.1.4.2 Online B2B Textile Marketplaces

4.1.4.3 Geotextile Market Stimulated by Government Infrastructure Projects

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Technical Textile Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Technical Textile Market, By Product Type

6.1 Global Technical Textile Market Snapshot, By Product Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Woven Technical Textiles

6.1.1.2 Nonwoven Technical Textiles

6.1.1.3 Composites and Laminated Textiles

6.1.1.4 Coated Technical Textiles

Chapter 7. Technical Textile Market, By Technology

7.1 Global Technical Textile Market Snapshot, By Technology

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 3D Weaving / Knitting

7.1.1.2 Thermal Bonding & Needle Punching (for nonwovens)

7.1.1.3 Coating & Lamination

7.1.1.4 Electrospinning (for nanofibers)

7.1.1.5 Digital Printing / Conductive Printing

Chapter 8. Technical Textile Market, By Manufacturing Process

8.1 Global Technical Textile Market Snapshot, By Manufacturing Process

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Spinning & Weaving

8.1.1.2 Knitting (Warp & Weft)

8.1.1.3 Nonwoven Fabrication (Meltblown, Spunbond)

8.1.1.4 Lamination & Coating

8.1.1.5 Finishing (Chemical & Mechanical)

Chapter 9. Technical Textile Market, By Material

9.1 Global Technical Textile Market Snapshot, By Material

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Natural Fibers (Cotton, Wool, Jute)

9.1.1.2 Synthetic Fibers (Polyester, Polyamide, Polypropylene)

9.1.1.3 High-Performance Fibers (Aramid, Carbon, Glass fibers)

9.1.1.4 Biodegradable & Bio-based Fibers (PLA, PHA)

Chapter 10. Technical Textile Market, By Application

10.1 Global Technical Textile Market Snapshot, By Application

10.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

10.1.1.1 Healthcare & Hygiene (Medtech)

10.1.1.2 Transportation (Mobiltech)

10.1.1.3 Construction (Buildtech)

10.1.1.4 Agriculture (Agrotech)

10.1.1.5 Industrial Filtration & Cleaning (Indutech)

Chapter 11. Technical Textile Market, By End-User

11.1 Global Technical Textile Market Snapshot, By End-User

11.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

11.1.1.1 Automotive & Aerospace

11.1.1.2 Medical & Healthcare

11.1.1.3 Defense & Military

11.1.1.4 Construction & Infrastructure

11.1.1.5 Agriculture & Forestry

Chapter 12. Technical Textile Market, By Region

12.1 Overview

12.2 Technical Textile Market Revenue Share, By Region 2024 (%)

12.3 Global Technical Textile Market, By Region

12.3.1 Market Size and Forecast

12.4 North America

12.4.1 North America Technical Textile Market Revenue, 2022-2034 ($Billion)

12.4.2 Market Size and Forecast

12.4.3 North America Technical Textile Market, By Country

12.4.4 U.S.

12.4.4.1 U.S. Technical Textile Market Revenue, 2022-2034 ($Billion)

12.4.4.2 Market Size and Forecast

12.4.4.3 U.S. Market Segmental Analysis

12.4.5 Canada

12.4.5.1 Canada Technical Textile Market Revenue, 2022-2034 ($Billion)

12.4.5.2 Market Size and Forecast

12.4.5.3 Canada Market Segmental Analysis

12.4.6 Mexico

12.4.6.1 Mexico Technical Textile Market Revenue, 2022-2034 ($Billion)

12.4.6.2 Market Size and Forecast

12.4.6.3 Mexico Market Segmental Analysis

12.5 Europe

12.5.1 Europe Technical Textile Market Revenue, 2022-2034 ($Billion)

12.5.2 Market Size and Forecast

12.5.3 Europe Technical Textile Market, By Country

12.5.4 UK

12.5.4.1 UK Technical Textile Market Revenue, 2022-2034 ($Billion)

12.5.4.2 Market Size and Forecast

12.5.4.3 UKMarket Segmental Analysis

12.5.5 France

12.5.5.1 France Technical Textile Market Revenue, 2022-2034 ($Billion)

12.5.5.2 Market Size and Forecast

12.5.5.3 FranceMarket Segmental Analysis

12.5.6 Germany

12.5.6.1 Germany Technical Textile Market Revenue, 2022-2034 ($Billion)

12.5.6.2 Market Size and Forecast

12.5.6.3 GermanyMarket Segmental Analysis

12.5.7 Rest of Europe

12.5.7.1 Rest of Europe Technical Textile Market Revenue, 2022-2034 ($Billion)

12.5.7.2 Market Size and Forecast

12.5.7.3 Rest of EuropeMarket Segmental Analysis

12.6 Asia Pacific

12.6.1 Asia Pacific Technical Textile Market Revenue, 2022-2034 ($Billion)

12.6.2 Market Size and Forecast

12.6.3 Asia Pacific Technical Textile Market, By Country

12.6.4 China

12.6.4.1 China Technical Textile Market Revenue, 2022-2034 ($Billion)

12.6.4.2 Market Size and Forecast

12.6.4.3 ChinaMarket Segmental Analysis

12.6.5 Japan

12.6.5.1 Japan Technical Textile Market Revenue, 2022-2034 ($Billion)

12.6.5.2 Market Size and Forecast

12.6.5.3 JapanMarket Segmental Analysis

12.6.6 India

12.6.6.1 India Technical Textile Market Revenue, 2022-2034 ($Billion)

12.6.6.2 Market Size and Forecast

12.6.6.3 IndiaMarket Segmental Analysis

12.6.7 Australia

12.6.7.1 Australia Technical Textile Market Revenue, 2022-2034 ($Billion)

12.6.7.2 Market Size and Forecast

12.6.7.3 AustraliaMarket Segmental Analysis

12.6.8 Rest of Asia Pacific

12.6.8.1 Rest of Asia Pacific Technical Textile Market Revenue, 2022-2034 ($Billion)

12.6.8.2 Market Size and Forecast

12.6.8.3 Rest of Asia PacificMarket Segmental Analysis

12.7 LAMEA

12.7.1 LAMEA Technical Textile Market Revenue, 2022-2034 ($Billion)

12.7.2 Market Size and Forecast

12.7.3 LAMEA Technical Textile Market, By Country

12.7.4 GCC

12.7.4.1 GCC Technical Textile Market Revenue, 2022-2034 ($Billion)

12.7.4.2 Market Size and Forecast

12.7.4.3 GCCMarket Segmental Analysis

12.7.5 Africa

12.7.5.1 Africa Technical Textile Market Revenue, 2022-2034 ($Billion)

12.7.5.2 Market Size and Forecast

12.7.5.3 AfricaMarket Segmental Analysis

12.7.6 Brazil

12.7.6.1 Brazil Technical Textile Market Revenue, 2022-2034 ($Billion)

12.7.6.2 Market Size and Forecast

12.7.6.3 BrazilMarket Segmental Analysis

12.7.7 Rest of LAMEA

12.7.7.1 Rest of LAMEA Technical Textile Market Revenue, 2022-2034 ($Billion)

12.7.7.2 Market Size and Forecast

12.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 13. Competitive Landscape

13.1 Competitor Strategic Analysis

13.1.1 Top Player Positioning/Market Share Analysis

13.1.2 Top Winning Strategies, By Company, 2022-2024

13.1.3 Competitive Analysis By Revenue, 2022-2024

13.2 Recent Developments by the Market Contributors (2024)

Chapter 14. Company Profiles

14.1 Asahi Kasei

14.1.1 Company Snapshot

14.1.2 Company and Business Overview

14.1.3 Financial KPIs

14.1.4 Product/Service Portfolio

14.1.5 Strategic Growth

14.1.6 Global Footprints

14.1.7 Recent Development

14.1.8 SWOT Analysis

14.2 Baltex

14.3 Du Pont

14.4 Filspec

14.5 Freudenberg Performance Materials

14.6 Heathcoat Fabrics

14.7 Huntsman International

14.8 Khosla Profil

14.9 Milliken & Company

14.10 Mitsui Chemicals

14.11 Nikol Advance Materials

14.12 Nobletex

14.13 Srf

14.14 Toray Industries

14.15 Toyobo