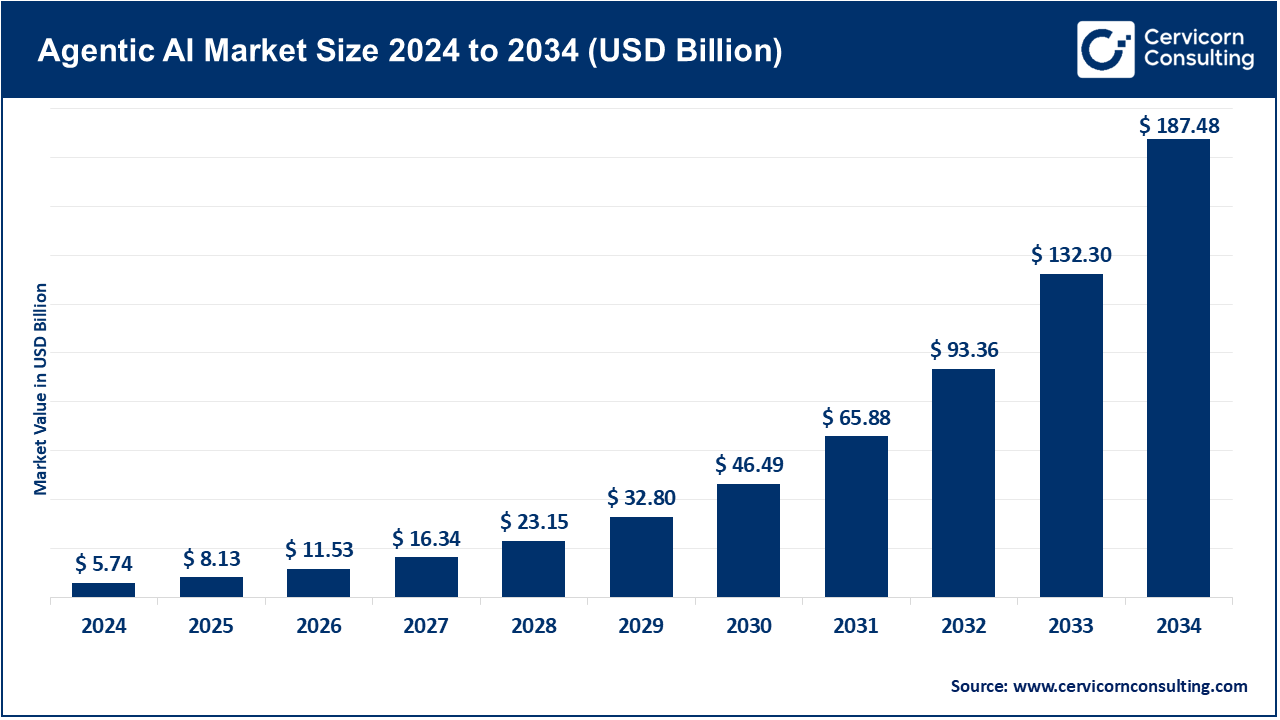

The global agentic AI market size was valued at USD 8.13 billion in 2025 and is expected to be worth around USD 187.48 billion by 2034, exhibiting a compound annual growth rate (CAGR) of 41.71% over the forecast period from 2025 to 2034.

The agentic AI market is driven by rapid innovation in foundational AI models such as large language models (LLMs) and reinforcement learning algorithms. These technologies enable AI agents to perform complex tasks across various domains, including customer care, workflow automation, finance, and software development, with minimal human supervision. Organizations are adopting these systems to enhance productivity, reduce costs, and support decision-making. The growing demand for intelligent digital assistants, autonomous operations, and 24/7 customer engagement is fueling investment in agentic AI within sectors like healthcare, fintech, e-commerce, and logistics.

Moreover, the primary factors driving the growth of the agentic artificial intelligence market include increased computing power, widespread availability of open-source AI platforms, and substantial investment from technology firms and startups. Modular, composable AI systems are emerging, allowing agents to connect with numerous APIs, data feeds, and external tools to improve their capability and scalability. Regulatory support for AI innovation and a heightened emphasis on proactive, personalized user experiences also create a conducive environment for market growth. As companies pursue more context-aware and adaptable solutions, agentic AI is becoming the foundation for the next wave of digital transformation.

What is Agentic AI?

Agentic AI refers to artificial intelligence that possesses autonomy, the capability for goal-setting, and decision-making, enabling it to act in accordance with its own free will to achieve assigned goals. Compared to typical AI, which performs tasks based on provided instructions, agentic AI can plan, learn from feedback, and adapt dynamically to changing environments. Such agents are increasingly being utilized across applications, from automated customer service to intelligent workflow automation, software development copilots, robotic process automation, financial modeling, and personalized healthcare suggestions. The primary benefits of agentic AI include increased productivity, reduced operating costs, enhanced scalability of services, continuous learning, and the ability to execute complex, multi-step operations autonomously.

Key Adoption Trends and Performance Insights for Agentic AI Solutions

| Insight | Details |

| AI Adoption in Enterprises | 77% of businesses are exploring or using AI-driven automation solutions. |

| Task Automation Potential | Agentic AI can automate up to 60% of repetitive tasks in business workflows. |

| Developer Productivity Gain | AI agents increase developer efficiency by up to 40% using code copilots. |

| Cost Reduction through AI Automation | Companies report an average of 25–30% operational cost savings. |

| Enterprise AI Deployment Barriers | 42% cite integration complexity, and 35% cite data privacy and governance. |

| Most Active Sectors | Healthcare, Finance, E-commerce, SaaS, Logistics |

| AI Agent Use in Customer Support | Reduces response time by 70% and increases customer satisfaction by 25%. |

| Customization Demand | 64% of enterprises want highly tailored AI agents for domain-specific tasks |

Rise of Autonomous AI Agents for Task Orchestration

Integration with Enterprise Tools and APIs

Emergence of Open-Source Agentic Frameworks

Agentic AI in Developer Productivity and Copilot Systems

Report Scope

| Area of Focus | Details |

| Market Size in 2026 | USD 11.53 Billion |

| Expected Market Size in 2034 | USD 187.48 Billion |

| Projected CAGR from 2025 to 2034 | 41.41% |

| Dominant Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Key Segments | Component, Deployment Mode, Organization Size, End Users, Region |

| Key Companies | Amazon.com, Inc., Ampcome Technologies Private Limited, Google LLC, Microsoft Corporation, The AnyLogic Company, Oracle Corporation, UiPath Inc., Coupa Software Inc., Epicor Software Corporation, Zycus Inc. |

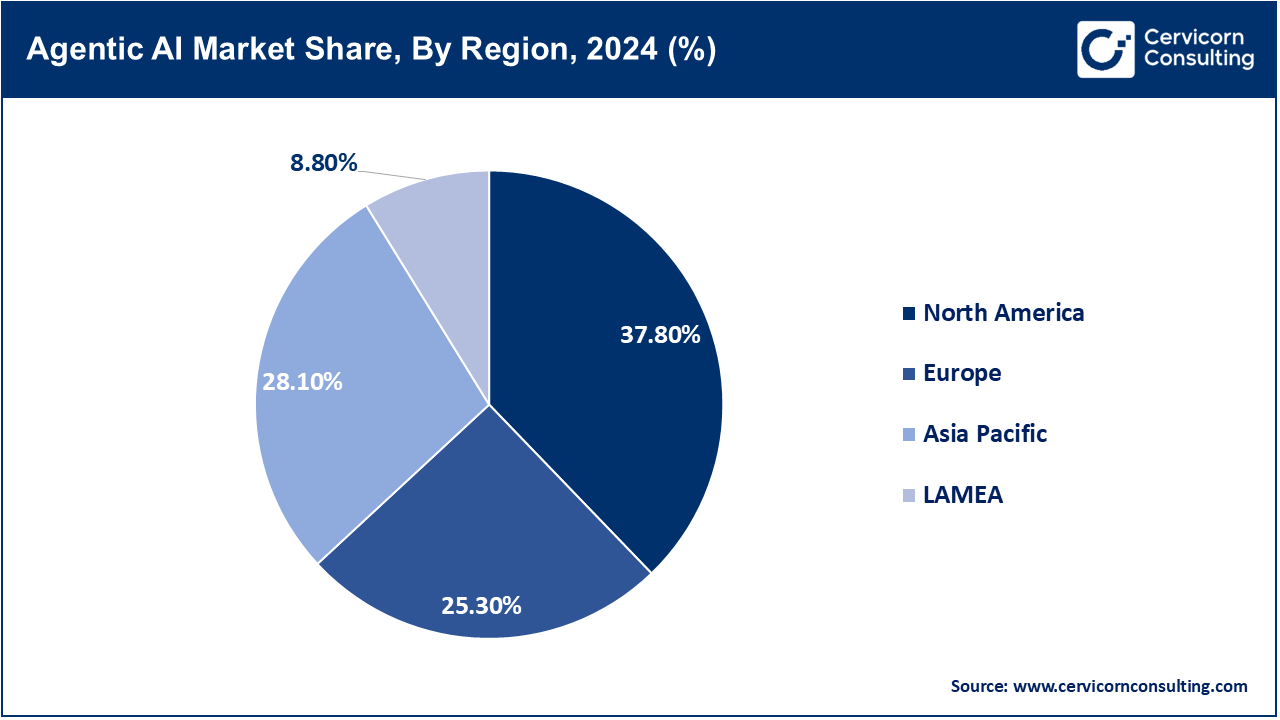

The agentic AI market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA.

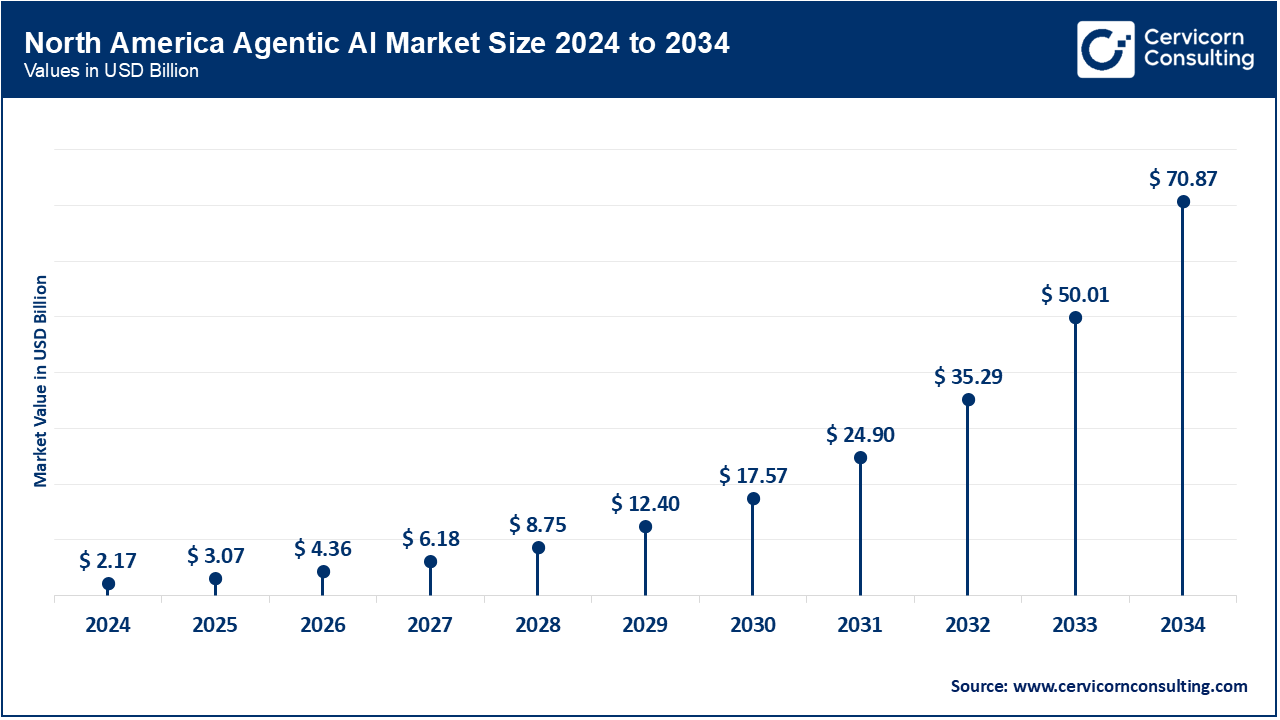

North America, particularly the United States, holds a leading position in the Agentic AI market due to its robust technology ecosystem, high R&D investment, and the presence of global AI leaders like OpenAI, Google, Microsoft, and IBM. The region is characterized by rapid enterprise adoption across finance, healthcare, telecom, and retail, with AI agents being utilized for everything from autonomous IT management to advanced customer service automation. The U.S. government and defense sectors are also exploring secure agentic AI for decision support and intelligence processing. High digital maturity, widespread cloud adoption, and a favorable regulatory environment have established North America as the most mature and commercially active region in the agentic AI space.

The Asia-Pacific region is the fastest-growing market for agentic AI, driven by increasing investments in AI innovation, expanding digital infrastructure, and robust government initiatives in countries such as China, India, South Korea, and Japan. Tech giants such as Alibaba, Tencent, and Baidu are developing their own AI agent ecosystems, while regional startups are integrating agents into e-commerce, finance, and healthcare services. Governments across APAC are promoting AI in public services and smart city projects, accelerating agent deployment in transportation, health, and citizen engagement. The region's growing pool of AI talent and rapidly digitizing SMEs position it as a hotspot for future growth.

Europe’s agentic AI market is growing steadily, led by a strong emphasis on ethical AI, data protection, and sector-specific innovation. While regulatory compliance under GDPR presents integration challenges, it also promotes the development of responsible, explainable AI agents, especially in finance, healthcare, and government sectors. Countries like Germany, France, and the UK are investing in AI research hubs and startups, advancing localized agent solutions in supply chain optimization, manufacturing automation, and public sector services. European organizations are particularly interested in on-premises and hybrid deployment models, ensuring compliance while leveraging agentic automation for efficiency and resilience.

Latin America, the Middle East, and Africa (LAMEA) represent an emerging opportunity in the Agentic AI space. While adoption is still in its early stages compared to other regions, countries like the UAE, Saudi Arabia, Brazil, and South Africa are making significant progress through digital transformation programs and smart city initiatives. The Middle East is utilizing AI agents in government services and oil and gas sectors, while Latin American fintech and telecom sectors are employing agents for customer engagement and fraud detection. Challenges such as limited infrastructure and AI talent are being addressed through global partnerships and regional innovation hubs, positioning LAMEA as a promising growth frontier.

The agentic AI market is segmented into components, deployment modes, organization size, end users, and regions. Based on component, the market is classified into solution and services (consulting and integration services, and training and support services). Based on the deployment mode, the market is categorised into on-premises and cloud. Based on organization size, the market is categorised into large enterprises, and small and medium enterprises (SMEs). Based on end-users, the market is classified into healthcare, manufacturing, BFSI, automotive, IT & telecom, government & public sector, and others.

Agentic AI solutions dominate the market as organizations across industries increasingly deploy standalone agent tools to automate complex tasks such as task planning, multistep decision-making, and customer interaction. These solutions offer end-to-end functionality with minimal setup, making them particularly appealing for large-scale deployments in areas such as IT support, workflow orchestration, and knowledge management. Their plug-and-play nature allows for faster ROI, and enterprises are integrating these agents into customer service desks, CRM platforms, and internal tools to enhance efficiency and reduce human intervention.

Agentic AI Market Revenue Share, By Component, 2024 (%)

| Component | Revenue Share, 2024 (%) |

| Solutions | 68.4% |

| Services | 31.6% |

The services segment is experiencing the fastest growth as businesses seek guidance in aligning agentic AI with their digital transformation goals. These services help organizations with strategy development, model customization, and technical integration of agents into existing systems. For example, firms are hiring consultants to embed agents into legacy ERP software or to fine-tune foundation models to industry-specific language. This demand is particularly high in regulated environments where accuracy, compliance, and data handling protocols require tailored implementations.

Cloud deployment remains the dominant mode due to its scalability, agility, and lower upfront cost. Cloud-based agentic AI solutions easily integrate with external APIs, SaaS tools, and cloud data platforms, enabling rapid development and orchestration of complex agent behavior. Cloud platforms like AWS, Azure, and Google Cloud offer built-in ML services and agent hosting infrastructure, which accelerates adoption. Furthermore, updates, collaboration, and monitoring are seamless in the cloud, making it the preferred choice for both global enterprises and AI startups.

While cloud leads, on-premises deployment is rapidly gaining traction among sectors requiring strict data control and compliance. Organizations in healthcare, defense, and government prioritize on-prem deployments to ensure sensitive data doesn’t leave secure environments. These setups allow for stricter identity management, custom access controls, and better compliance with national or regional regulations. With increasing concerns around AI security and data residency laws, on-premises deployment is preferred for mission-critical applications involving patient data, citizen records, or classified information.

Large enterprises dominate the market due to their extensive IT infrastructure, varied operational needs, and the resources necessary to adopt and experiment with emerging technologies. These companies are deploying agentic AI to enhance productivity in software development, compliance reporting, internal knowledge retrieval, and multi-system coordination. Additionally, many are establishing internal AI task forces or Centers of Excellence (CoEs) to manage the implementation and governance of AI agents across departments, providing them with a first-mover advantage.

Agentic AI Market Revenue Share, By Organization Size, 2024 (%)

| Organization Size | Revenue Share, 2024 (%) |

| Large Enterprises | 63.2% |

| SMEs | 36.8% |

SMEs are experiencing a surge in adoption, driven by affordable cloud-based tools, open-source agent frameworks, and low-code platforms. These businesses leverage agentic AI for automating lead management, document analysis, customer onboarding, and support ticket resolution. The democratization of AI tools is empowering non-technical users within SMEs, such as HR professionals or finance teams, to deploy and customize agents with minimal effort. This accessibility significantly reduces time-to-value and gives SMEs the agility to compete with larger players in digital maturity.

The IT and Telecom sector leads in adoption due to its high volume of automated processes and the need for intelligent monitoring. These companies utilize agentic AI for software development automation, including code generation and bug detection, real-time network management, AI-powered help desks, and performance diagnostics. Additionally, telecom providers are integrating AI agents into customer service processes to offer multilingual support, manage subscriptions, and facilitate predictive maintenance.

Healthcare is the fastest-growing sector for agentic AI adoption. Hospitals, clinics, and health tech companies are deploying AI agents to streamline administrative tasks, such as appointment scheduling, insurance claims processing, and EHR updates, as well as for medical applications, including triage support, symptom assessment, and drug research assistance. With the increasing physician shortages and heightened demand for virtual care, AI agents are helping alleviate pressure on human staff while enhancing patient experience and accuracy. Moreover, regulatory advancements and AI-specific health tools are further promoting adoption in this sector.

The competitive landscape of the agentic AI sector is dynamic and rapidly evolving, characterized by intense innovation and a mix of established tech giants, cloud providers, and emerging startups. Companies are competing on multiple fronts, including advanced orchestration capabilities, autonomous reasoning, multi-agent collaboration, and ease of integration into enterprise ecosystems. A key differentiator is the ability to offer agentic systems that are adaptable, explainable, and capable of handling complex tasks without continuous human oversight. Players are also focusing on industry-specific use cases, compliance features, and partnerships with AI model providers to strengthen their value proposition. As demand grows across various sectors, the market experiences frequent product launches, acquisitions, and R&D investments aimed at gaining a strategic advantage.

Market Segmentation

By Component

By Deployment Mode

By Organization Size

By End Users

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Agentic AI

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Component Overview

2.2.2 By Deployment Mode Overview

2.2.3 By Organization Size Overview

2.2.4 By End User Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Increasing Demand for Intelligent Automation

4.1.1.2 Advancements in Foundation Models and APIs

4.1.2 Market Restraints

4.1.2.1 Data Privacy and Security Concerns

4.1.2.2 Integration Complexity

4.1.3 Market Challenges

4.1.3.1 Ensuring Agent Reliability and Interpretability

4.1.3.2 Managing AI Hallucinations and Overreach

4.1.4 Market Opportunities

4.1.4.1 Vertical-Specific Agent Solutions

4.1.4.2 Expansion into Low-Code/No-Code Platforms

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Agentic AI Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Agentic AI Market, By Component

6.1 Global Agentic AI Market Snapshot, By Component

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Solution

6.1.1.2 Services

Chapter 7. Agentic AI Market, By Deployment Mode

7.1 Global Agentic AI Market Snapshot, By Deployment Mode

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 On-Premises

7.1.1.2 Cloud

Chapter 8. Agentic AI Market, By Organization Size

8.1 Global Agentic AI Market Snapshot, By Organization Size

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Large Enterprises

8.1.1.2 Small and Medium Enterprises (SMEs)

Chapter 9. Agentic AI Market, By End-User

9.1 Global Agentic AI Market Snapshot, By End-User

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Healthcare

9.1.1.2 Manufacturing

9.1.1.3 BFSI

9.1.1.4 Automotive

9.1.1.5 IT & Telecom

9.1.1.6 Government & Public Sector

9.1.1.7 Others

Chapter 10. Agentic AI Market, By Region

10.1 Overview

10.2 Agentic AI Market Revenue Share, By Region 2024 (%)

10.3 Global Agentic AI Market, By Region

10.3.1 Market Size and Forecast

10.4 North America

10.4.1 North America Agentic AI Market Revenue, 2022-2034 ($Billion)

10.4.2 Market Size and Forecast

10.4.3 North America Agentic AI Market, By Country

10.4.4 U.S.

10.4.4.1 U.S. Agentic AI Market Revenue, 2022-2034 ($Billion)

10.4.4.2 Market Size and Forecast

10.4.4.3 U.S. Market Segmental Analysis

10.4.5 Canada

10.4.5.1 Canada Agentic AI Market Revenue, 2022-2034 ($Billion)

10.4.5.2 Market Size and Forecast

10.4.5.3 Canada Market Segmental Analysis

10.4.6 Mexico

10.4.6.1 Mexico Agentic AI Market Revenue, 2022-2034 ($Billion)

10.4.6.2 Market Size and Forecast

10.4.6.3 Mexico Market Segmental Analysis

10.5 Europe

10.5.1 Europe Agentic AI Market Revenue, 2022-2034 ($Billion)

10.5.2 Market Size and Forecast

10.5.3 Europe Agentic AI Market, By Country

10.5.4 UK

10.5.4.1 UK Agentic AI Market Revenue, 2022-2034 ($Billion)

10.5.4.2 Market Size and Forecast

10.5.4.3 UKMarket Segmental Analysis

10.5.5 France

10.5.5.1 France Agentic AI Market Revenue, 2022-2034 ($Billion)

10.5.5.2 Market Size and Forecast

10.5.5.3 FranceMarket Segmental Analysis

10.5.6 Germany

10.5.6.1 Germany Agentic AI Market Revenue, 2022-2034 ($Billion)

10.5.6.2 Market Size and Forecast

10.5.6.3 GermanyMarket Segmental Analysis

10.5.7 Rest of Europe

10.5.7.1 Rest of Europe Agentic AI Market Revenue, 2022-2034 ($Billion)

10.5.7.2 Market Size and Forecast

10.5.7.3 Rest of EuropeMarket Segmental Analysis

10.6 Asia Pacific

10.6.1 Asia Pacific Agentic AI Market Revenue, 2022-2034 ($Billion)

10.6.2 Market Size and Forecast

10.6.3 Asia Pacific Agentic AI Market, By Country

10.6.4 China

10.6.4.1 China Agentic AI Market Revenue, 2022-2034 ($Billion)

10.6.4.2 Market Size and Forecast

10.6.4.3 ChinaMarket Segmental Analysis

10.6.5 Japan

10.6.5.1 Japan Agentic AI Market Revenue, 2022-2034 ($Billion)

10.6.5.2 Market Size and Forecast

10.6.5.3 JapanMarket Segmental Analysis

10.6.6 India

10.6.6.1 India Agentic AI Market Revenue, 2022-2034 ($Billion)

10.6.6.2 Market Size and Forecast

10.6.6.3 IndiaMarket Segmental Analysis

10.6.7 Australia

10.6.7.1 Australia Agentic AI Market Revenue, 2022-2034 ($Billion)

10.6.7.2 Market Size and Forecast

10.6.7.3 AustraliaMarket Segmental Analysis

10.6.8 Rest of Asia Pacific

10.6.8.1 Rest of Asia Pacific Agentic AI Market Revenue, 2022-2034 ($Billion)

10.6.8.2 Market Size and Forecast

10.6.8.3 Rest of Asia PacificMarket Segmental Analysis

10.7 LAMEA

10.7.1 LAMEA Agentic AI Market Revenue, 2022-2034 ($Billion)

10.7.2 Market Size and Forecast

10.7.3 LAMEA Agentic AI Market, By Country

10.7.4 GCC

10.7.4.1 GCC Agentic AI Market Revenue, 2022-2034 ($Billion)

10.7.4.2 Market Size and Forecast

10.7.4.3 GCCMarket Segmental Analysis

10.7.5 Africa

10.7.5.1 Africa Agentic AI Market Revenue, 2022-2034 ($Billion)

10.7.5.2 Market Size and Forecast

10.7.5.3 AfricaMarket Segmental Analysis

10.7.6 Brazil

10.7.6.1 Brazil Agentic AI Market Revenue, 2022-2034 ($Billion)

10.7.6.2 Market Size and Forecast

10.7.6.3 BrazilMarket Segmental Analysis

10.7.7 Rest of LAMEA

10.7.7.1 Rest of LAMEA Agentic AI Market Revenue, 2022-2034 ($Billion)

10.7.7.2 Market Size and Forecast

10.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 11. Competitive Landscape

11.1 Competitor Strategic Analysis

11.1.1 Top Player Positioning/Market Share Analysis

11.1.2 Top Winning Strategies, By Company, 2022-2024

11.1.3 Competitive Analysis By Revenue, 2022-2024

11.2 Recent Developments by the Market Contributors (2024)

Chapter 12. Company Profiles

12.1 Amazon.com, Inc.

12.1.1 Company Snapshot

12.1.2 Company and Business Overview

12.1.3 Financial KPIs

12.1.4 Product/Service Portfolio

12.1.5 Strategic Growth

12.1.6 Global Footprints

12.1.7 Recent Development

12.1.8 SWOT Analysis

12.2 Ampcome Technologies Private Limited

12.3 Google LLC

12.4 Microsoft Corporation

12.5 The AnyLogic Company

12.6 Oracle Corporation

12.7 UiPath Inc.

12.8 Coupa Software Inc.

12.9 Epicor Software Corporation

12.10 Zycus Inc.