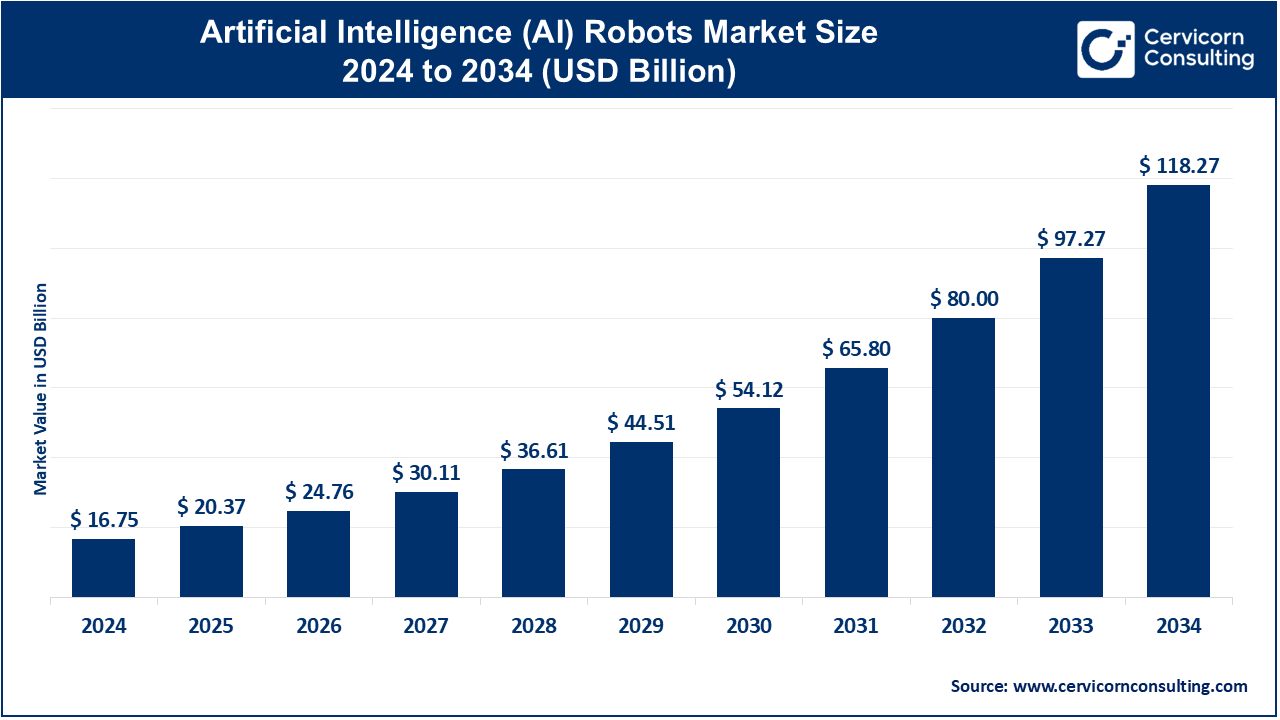

The global artificial intelligence (AI) robots market size was reached at USD 16.75 billion in 2024 and is expected to be worth around USD 118.27 billion by 2034, exhibiting a compound annual growth rate (CAGR) of 21.58% over the forecast period from 2025 to 2034.

The AI robot market is driven by technological innovations in artificial intelligence, increasing demand for automation, and substantial investment from both private and public sectors. The integration of AI into delivery and logistics processes is a key driver for the AI robot market. Amazon, for example, has proposed a substantial integration of AI to enhance its delivery and logistics processes. The foundation of the plan is the development of agentic AI-based warehouse robots by its Lab126 division. These robots represent a significant upgrade from single-use machines, capable of performing numerous tasks such as unloading trailers and picking parts on demand. This innovation aims to enhance efficiency, particularly during peak seasons, while also reducing emissions and waste.

Additionally, the global push for automation is evident in the increasing application of AI robots across various industries. For instance, in April 2024, the International Federation of Robotics reported that industrial robot installations rose by 12%, totaling 44,303 units in 2023. This increase reflects the industry's ongoing need for greater productivity and competitiveness in the rapidly evolving market environment. These trends underscore the increasing importance of AI robots in enhancing operational efficiency, mitigating labour shortages, and driving innovation in various industries.

What is an Artificial Intelligence (AI) robot?

Artificial Intelligence (AI) robots are machines that integrates mechanical components with AI algorithms to mimic human-like intelligence. They can perceive and understand their surroundings, make decisions, and perform tasks independently or with some human guidance. Unlike traditional robots, AI robots learn from experience and data using methods like machine learning, computer vision, and natural language processing. These robots are used in many industries, including healthcare (surgical robots and elderly care), manufacturing (predictive maintenance and quality control), logistics (warehouse automation and delivery robots), education (interactive learning robots), retail (customer service robots), and defence (surveillance and unmanned drones).

AI Robot Applications and Industry Adoption

| Sector | AI Robot Application | Key Insight |

| Healthcare | Surgical robots, elderly care assistants | Over 46% of healthcare firms use AI robots for supply chain efficiency |

| Manufacturing | Assembly, inspection, predictive maintenance | AI robots contributed to a 12% increase in global industrial installations (2023) |

| Logistics & Delivery | Autonomous delivery bots, warehouse automation | Amazon’s new AI robots expected to significantly reduce delivery emissions and cost |

| Retail | Customer service, stock monitoring | AI service robots increasingly used in malls and smart stores |

| Education | Teaching assistants, interactive learning bots | AI tutors and bots used in over 35% of online education platforms |

| Defense & Security | Surveillance drones, bomb disposal units | AI-powered drones widely deployed for border security and intelligence |

Humanoid Robots in Logistics and Delivery

Humanoid robots are increasingly being tested for real-world applications in logistics, particularly in package delivery. Amazon, for instance, is testing artificial intelligence-driven humanoid robots at a specialized test facility in San Francisco, where the robots are trained to ride electric vans and drop packages on customers' doorsteps independently. This application aims to enhance delivery speed and efficiency while reducing reliance on human labor, marking a significant step toward the practical use of humanoid AI robots in supply chains.

Rise of Physical and Generative AI in Robotics

The robots are currently utilizing "Physical AI" to train for tasks in simulated environments, mirroring the training methods for AI models like ChatGPT. This is complemented by generative AI technology, which enables robots to model scenarios and generate responses or movements autonomously. These technologies are advancing robots from simple automation to smart adaptability, allowing them to excel in dynamic or unpredictable environments, such as homes, construction sites, or disaster areas.

AI-Driven Sustainability in Robotics

AI robots are increasingly being engaged in creating sustainable industries by enhancing energy efficiency, minimizing errors, and reducing wastage in operations. For example, Amazon's new generation of AI robots can perform multiple warehouse functions with high accuracy, significantly lowering energy consumption and emissions. These robots collectively contribute to the broader trend of integrating robotics with ecological goals, leading to more sustainable manufacturing and logistics systems.

Expansion into Personal and Consumer Applications

AI robots are rapidly emerging in consumer and personal markets, providing solutions for home automation, elder care, and education. One such example is Honor's $10 billion investment in consumer robotics, in collaboration with Unitree, to create humanoid robots for domestic use. The AI-powered assistants will assist with household tasks, monitor well-being, and serve as interactive companions, marking a shift from industrial applications to widespread personal acceptance in home and lifestyle technology.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 20.37 Billion |

| Expected Market Size in 2034 | USD 118.27 Billion |

| Projected Market CAGR from 2025 to 2034 | 21.58% |

| Dominant Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Key Segments | Offering, Technology, Robot Type, Deployment Mode, Application, Region |

| Key Companies | Alphabet, Microsoft Corporation, IBM Corporation, Intel Corporation, NVIDIA Corporation, ABB, Fanuc, Yaskawa, Kawasaki, Mitsubishi, SoftBank Corp., Hanson Robotics Ltd., CloudMinds Technology Inc., Neurala, Inc., Vicarious |

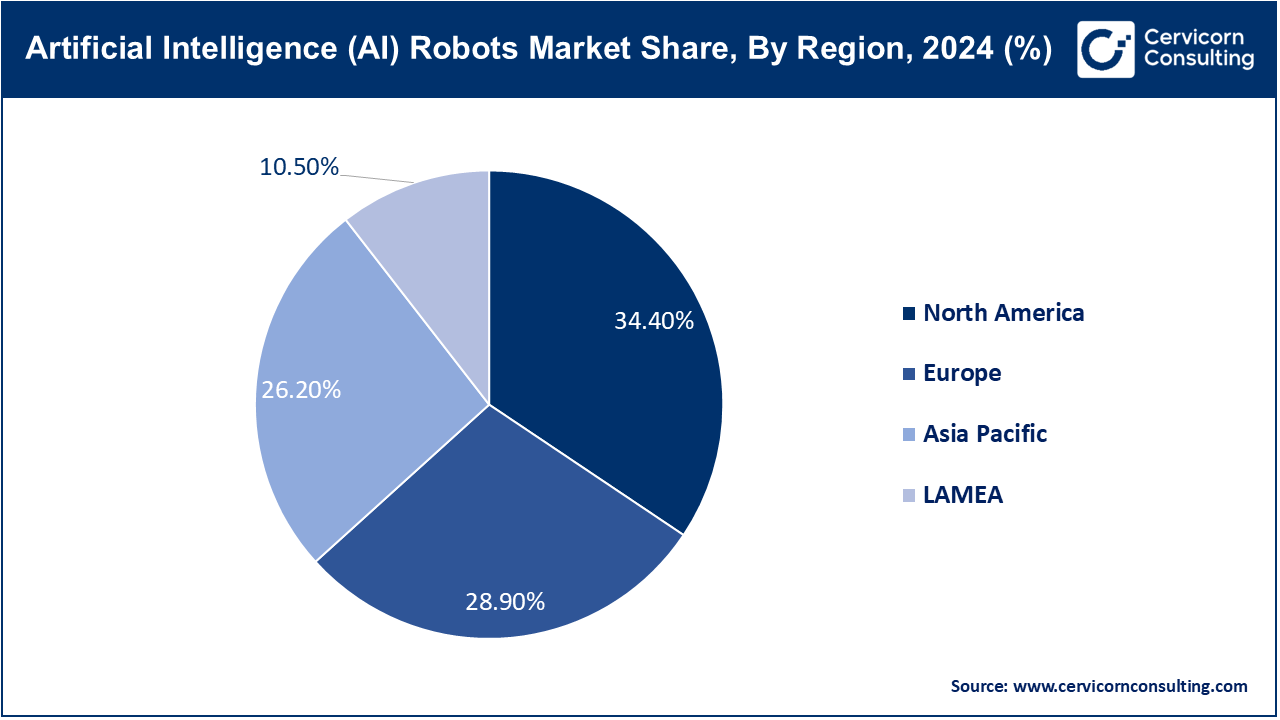

The Artificial Intelligence (AI) robots market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA.

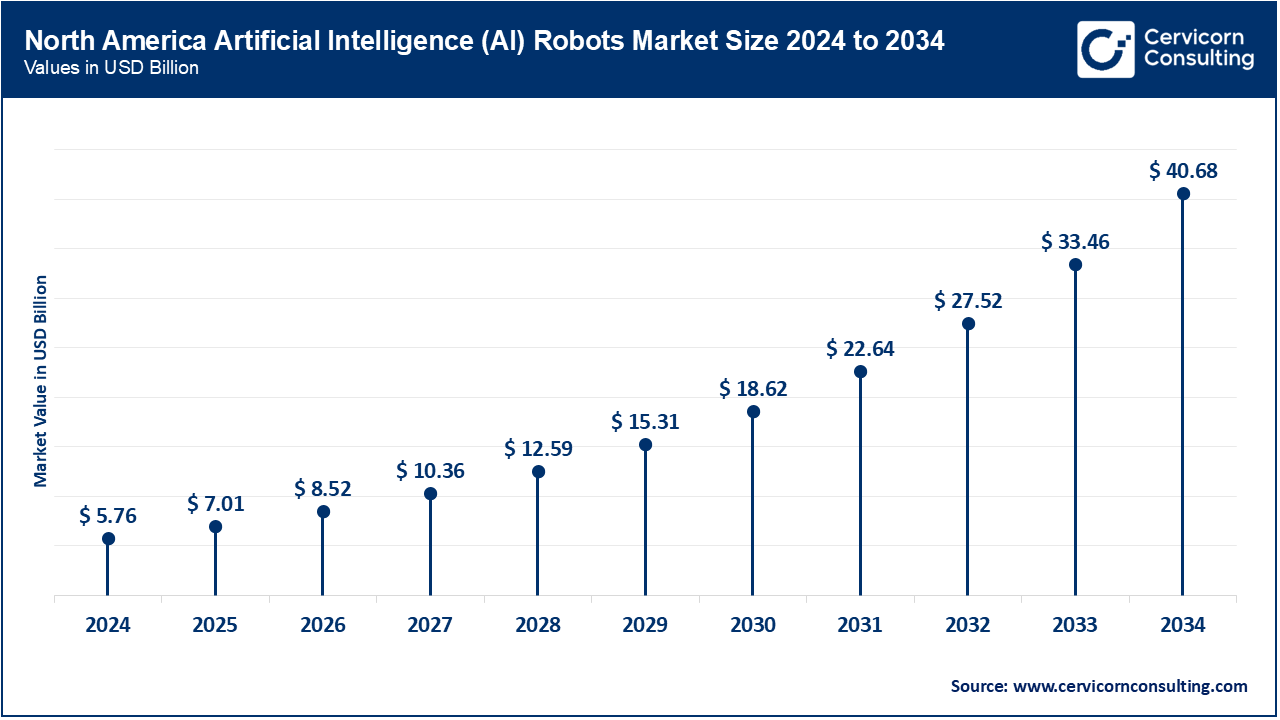

The North America AI robots market size was valued at USD 5.76 billion in 2024 and is expected to reach around USD 40.68 billion by 2034. North America leads the AI robots market due to its strong technology infrastructure, substantial R&D expenditure, and early adoption of advanced robotics in manufacturing, healthcare, defense, and logistics. Leading technology companies, including IBM, Microsoft, NVIDIA, and Alphabet (Google), dominate the AI-based automation sector. U.S. government and private sector initiatives, such as DARPA-funded robot projects, autonomous defense systems, and smart factories, are key drivers of market growth. Additionally, the demand for service robots in hospitals and the development of humanoid and personal robots signal North America's leadership in both industrial and consumer-facing AI robot applications.

The Asia Pacific AI robots market size was estimated at USD 4.39 billion in 2024 and is projected to hit around USD 30.99 billion by 2034. APAC is the fastest-growing region, propelled by rapid industrialization, government-backed robotics initiatives, and expanding manufacturing hubs in China, Japan, and South Korea. Japan leads in the development of humanoid and carebots for the elderly, while China is heavily investing in AI and robotics for smarter manufacturing and the automation of public services. South Korea's strong robotics and electronics base also contribute to its prominence. The region's large population, increasing labor costs, and aging population drive the demand for service robots in healthcare, agriculture, and education. Government initiatives, such as Japan's "Society 5.0" and China's "Made in China 2025," further promote the adoption of AI robots.

The Europe AI robots market size was accounted for USD 4.84 billion in 2024 and is predicted to surpass around USD 34.18 billion by 2034. Europe is a mature market for AI robots, with a strong emphasis on ethical AI deployment, robotics standards, and cross-border research collaboration. Germany, France, and the UK extensively use AI robots in smart manufacturing, automotive production, and healthcare automation. Germany, as a global leader in industrial robotics, integrates AI into its production lines to optimize efficiency in production and supply chains. The European Union's Horizon initiative and AI strategy prioritize driving innovation while ensuring the responsible use of AI technology. AI-based agricultural robots are increasingly gaining interest in the Netherlands, alongside humanoid robots for education and elderly care in Scandinavian nations.

The LAMEA AI robots market size was reached at USD 1.76 billion in 2024 and is anticipated to reach around USD 12.42 billion by 2034. The LAMEA region is experiencing steady growth in the market, primarily driven by emerging digital transformation strategies and increasing automation in sectors such as oil & gas, healthcare, and security. In the Middle East, countries like the UAE and Saudi Arabia are investing in AI and robotics as part of their Vision 2030 initiatives, adopting service robots in airports, malls, and hospitals. Brazil and Mexico are exploring the use of AI robotics in manufacturing and agriculture in Latin America. However, poor infrastructure, high costs, and a lack of skills are challenges for wider adoption. Nevertheless, increasing awareness and cross-country collaborations are helping to bridge these gaps, especially in cities and government-supported innovation clusters.

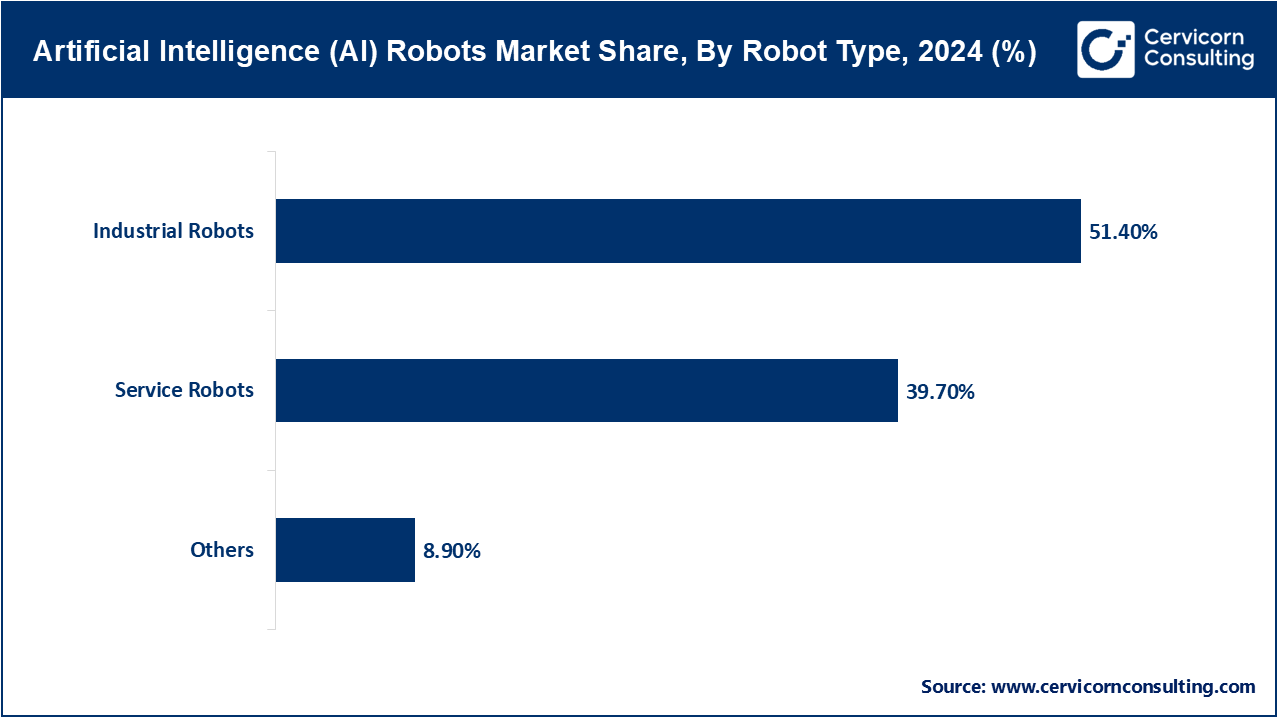

The AI robot market is segmented by offering, technology, robot type, deployment mode, application, and region. Based on offering, the market is classified into software, services, and hardware. Based on the technology, the market is categorised into machine learning, context awareness, computer vision, and natural language processing. Based on deployment mode, the market is categorised into industrial robots, service robots, and others. Based on operation type, the market is classified into cloud, and on-premises. Based on application, the market is categorised into industrial, law enforcement, education and entertainment, military & defense, healthcare assistants, public relations, personal assistance and care, research and space exploration, stock management, agriculture and others.

Hardware remains the foundational segment of the AI robots market, driven by rising investment in actuators, power systems, sensors, and processors that enable mobility, perception, and interactivity within the physical world. With robots operating in dynamic environments—spanning factories to homes—demand is rising for high-performance hardware that supports autonomy, precision, and safety. NVIDIA and Intel are spearheading next-generation AI chip development that accelerates edge processing, making robots more responsive. Demand is also increasing for ruggedized and miniaturized components on mobile and humanoid robot platforms.

Software is the fastest-growing segment as AI functionality is increasingly powered by advanced machine learning algorithms, cloud-based management, and edge AI platforms. Software enables robots to learn, understand instructions, identify objects and images, and respond to changing conditions. Growth in cloud robotics, AI-as-a-service platforms, and open-source platforms like ROS (Robot Operating System) facilitates immediate prototyping and deployment of smart robotics solutions across industries. Additionally, remote updating and the need for autonomous decision-making are propelling the demand for robust AI software solutions.

Machine Learning (ML) is the driving technology behind most AI robots, enabling them to process data, learn from experience, and improve task performance over time without requiring explicit reprogramming. ML models enable robots to adapt to unstructured environments, like an ever-changing warehouse with obstacles or a hospital with varying human interactions. Adaptability is crucial in robotics used in autonomous vehicles, industrial sorting, and intelligent healthcare. Reinforcement learning, a subset of machine learning, is also being researched to enable robots to learn through trial and error in simulations and apply this knowledge in the real world.

Natural Language Processing (NLP) is one of the fastest-growing technologies, with robots now increasingly replacing human interaction in the form of customer service robots, learning companions, and home assistants. NLP enables robots to listen and understand spoken words, respond, and even detect emotional cues through tone. NLP is most prevalent in humanoid robots like Hanson Robotics' Sophia and SoftBank's Pepper, enhancing human-robot interaction and expanding accessibility in healthcare and education, especially for the elderly and children.

Industrial Robots dominate the market and have long been embedded in manufacturing sectors, especially in automotive, electronics, and heavy machinery production lines. These robots are becoming smarter and more networked with the rise of Industry 4.0, enabling seamless coordination with other machines and intelligent systems. They perform high-precision operations like welding, assembly, and painting, and integrating with intelligent systems also allows for predictive maintenance and adaptive automation, reducing downtime and optimizing productivity.

Service Robots are the fastest-growing segment, expanding into sectors such as healthcare, hospitality, retail, and domestic settings. They provide services like cleaning (robot vacuum cleaners), delivery, patient care, and customer service. AI enables them to navigate through dense environments, identify user preferences, and personalize interactions. The post-COVID-19 world has further accelerated their adoption for contactless and remote care. The increasing consumer demand for personal robots for home care and emotional support is also fueling explosive growth.

On-premises deployment dominates the market, driven by industries where data privacy, security, and real-time responsiveness are critical, such as military applications, manufacturing, and medical robotics. These systems are not internet-based, making them well-suited for high-reliability and low-latency applications. Surgical robots, for example, have rigorous safety requirements and require on-premises data processing to ensure accuracy. On-premises models are also employed where internet access is not trusted or subject to policy restrictions.

Cloud deployment is the fastest-growing mode, as robots become more connected and collaborative. Cloud AI enables robots to offload computation, receive updates at regular intervals, and share real-time insights from data across systems. The platform facilitates faster deployment, scalability, and ongoing improvement with data aggregation. Service robots for retail or hospitality, for instance, can learn from usage data among stores and become increasingly intelligent through aggregation. Companies like CloudMinds are at the forefront of cloud-brain platforms for networked robots.

Industrial applications lead the market, with AI robots widely used in assembly lines, warehouse automation, quality control, and packaging. These robots operate at maximum efficiency, minimize manual handling, and are exceptionally accurate and swift. AI robots detect micro-defects in parts during electronics production, resulting in improved product quality. Robotics in logistics also reign supreme in order picking and sorting—driving the rise of e-commerce.

Healthcare Assistants is the fastest-growing application, driven by aging populations, the management of chronic diseases, and shortages of healthcare workers. AI-powered robots assist with surgery, rehabilitation, aged care, and hospital logistics (e.g., medicine distribution or cleaning). They provide real-time monitoring, patient interaction, and physical support. Robots were used for contactless delivery and to disinfect hospitals during the COVID-19 pandemic. With increased funding in telemedicine and robot care, this segment is growing extremely fast.

The competitive landscape of the Artificial Intelligence (AI) Robots market is characterized by intense innovation, strategic partnerships, and rapid technological advancements among key players. Major companies such as ABB, Alphabet (Google), IBM, Microsoft, NVIDIA, Intel, and SoftBank dominate the market with sustained R&D expenditure and multidomain AI robotics solutions across industry, healthcare, defense, and services. These large players are embedding sophisticated AI features, such as computer vision, machine learning, and natural language processing, into their robot offerings to provide intelligent, autonomous solutions. Concurrently, emerging players such as UBTech Robotics, Neurala, and Brain Corporation are gaining traction with niche applications in education, personal care, and autonomous driving. Technology leaders partnering with robotics firms, along with mergers and acquisitions and the development of open-source AI platforms, further define the competitive landscape. Companies from Asia and Europe are also entering the global market with cost-efficient and niche AI robots, making the market highly dynamic and innovation-driven.

Sundar Pichai – CEO, Alphabet (Google)

Demis Hassabis – CEO, Google DeepMind

Satya Nadella – CEO, Microsoft Corporation

Jensen Huang – CEO, NVIDIA Corporation

Market Segmentation

By Offering

By Technology

By Robot Type

By Deployment Mode

By Application

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Artificial Intelligence (AI) Robots

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Technology Overview

2.2.2 By Offering Overview

2.2.3 By Application Overview

2.2.4 By Robot Type Overview

2.2.5 By Deployment Mode Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Growing Demand for Automation in Industries

4.1.1.2 Advances in AI and Machine Learning Technologies

4.1.2 Market Restraints

4.1.2.1 High Initial Investment and Maintenance Costs

4.1.2.2 Lack of Skilled Workforce

4.1.3 Market Challenges

4.1.3.1 Ethical and Privacy Concerns

4.1.3.2 Technical Limitations in Unstructured Environments

4.1.4 Market Opportunities

4.1.4.1 Integration with IoT and 5G Technologies

4.1.4.2 Expansion in Healthcare and Personal Assistance

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Artificial Intelligence (AI) Robots Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Artificial Intelligence (AI) Robots Market, By Technology

6.1 Global Artificial Intelligence (AI) Robots Market Snapshot, By Technology

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Machine Learning

6.1.1.2 Context Awareness

6.1.1.3 Computer Vision

6.1.1.4 Natural Language Processing

Chapter 7. Artificial Intelligence (AI) Robots Market, By Offering

7.1 Global Artificial Intelligence (AI) Robots Market Snapshot, By Offering

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Software

7.1.1.2 Services

7.1.1.3 Hardware

Chapter 8. Artificial Intelligence (AI) Robots Market, By Deployment Mode

8.1 Global Artificial Intelligence (AI) Robots Market Snapshot, By Deployment Mode

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Cloud

8.1.1.2 On-premises

Chapter 9. Artificial Intelligence (AI) Robots Market, By Robot Type

9.1 Global Artificial Intelligence (AI) Robots Market Snapshot, By Robot Type

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Industrial Robots

9.1.1.2 Service Robots

9.1.1.3 Others

Chapter 10. Artificial Intelligence (AI) Robots Market, By Application

10.1 Global Artificial Intelligence (AI) Robots Market Snapshot, By Application

10.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

10.1.1.1 Industrial

10.1.1.2 Law Enforcement

10.1.1.3 Education and Entertainment

10.1.1.4 Military & Defense

10.1.1.5 Healthcare Assistants

10.1.1.6 Public Relations

10.1.1.7 Personal Assistance and Care

10.1.1.8 Research and Space exploration

10.1.1.9 Stock Management

10.1.1.10 Agriculture

10.1.1.11 Others

Chapter 11. Artificial Intelligence (AI) Robots Market, By Region

11.1 Overview

11.2 Artificial Intelligence (AI) Robots Market Revenue Share, By Region 2024 (%)

11.3 Global Artificial Intelligence (AI) Robots Market, By Region

11.3.1 Market Size and Forecast

11.4 North America

11.4.1 North America Artificial Intelligence (AI) Robots Market Revenue, 2022-2034 ($Billion)

11.4.2 Market Size and Forecast

11.4.3 North America Artificial Intelligence (AI) Robots Market, By Country

11.4.4 U.S.

11.4.4.1 U.S. Artificial Intelligence (AI) Robots Market Revenue, 2022-2034 ($Billion)

11.4.4.2 Market Size and Forecast

11.4.4.3 U.S. Market Segmental Analysis

11.4.5 Canada

11.4.5.1 Canada Artificial Intelligence (AI) Robots Market Revenue, 2022-2034 ($Billion)

11.4.5.2 Market Size and Forecast

11.4.5.3 Canada Market Segmental Analysis

11.4.6 Mexico

11.4.6.1 Mexico Artificial Intelligence (AI) Robots Market Revenue, 2022-2034 ($Billion)

11.4.6.2 Market Size and Forecast

11.4.6.3 Mexico Market Segmental Analysis

11.5 Europe

11.5.1 Europe Artificial Intelligence (AI) Robots Market Revenue, 2022-2034 ($Billion)

11.5.2 Market Size and Forecast

11.5.3 Europe Artificial Intelligence (AI) Robots Market, By Country

11.5.4 UK

11.5.4.1 UK Artificial Intelligence (AI) Robots Market Revenue, 2022-2034 ($Billion)

11.5.4.2 Market Size and Forecast

11.5.4.3 UKMarket Segmental Analysis

11.5.5 France

11.5.5.1 France Artificial Intelligence (AI) Robots Market Revenue, 2022-2034 ($Billion)

11.5.5.2 Market Size and Forecast

11.5.5.3 FranceMarket Segmental Analysis

11.5.6 Germany

11.5.6.1 Germany Artificial Intelligence (AI) Robots Market Revenue, 2022-2034 ($Billion)

11.5.6.2 Market Size and Forecast

11.5.6.3 GermanyMarket Segmental Analysis

11.5.7 Rest of Europe

11.5.7.1 Rest of Europe Artificial Intelligence (AI) Robots Market Revenue, 2022-2034 ($Billion)

11.5.7.2 Market Size and Forecast

11.5.7.3 Rest of EuropeMarket Segmental Analysis

11.6 Asia Pacific

11.6.1 Asia Pacific Artificial Intelligence (AI) Robots Market Revenue, 2022-2034 ($Billion)

11.6.2 Market Size and Forecast

11.6.3 Asia Pacific Artificial Intelligence (AI) Robots Market, By Country

11.6.4 China

11.6.4.1 China Artificial Intelligence (AI) Robots Market Revenue, 2022-2034 ($Billion)

11.6.4.2 Market Size and Forecast

11.6.4.3 ChinaMarket Segmental Analysis

11.6.5 Japan

11.6.5.1 Japan Artificial Intelligence (AI) Robots Market Revenue, 2022-2034 ($Billion)

11.6.5.2 Market Size and Forecast

11.6.5.3 JapanMarket Segmental Analysis

11.6.6 India

11.6.6.1 India Artificial Intelligence (AI) Robots Market Revenue, 2022-2034 ($Billion)

11.6.6.2 Market Size and Forecast

11.6.6.3 IndiaMarket Segmental Analysis

11.6.7 Australia

11.6.7.1 Australia Artificial Intelligence (AI) Robots Market Revenue, 2022-2034 ($Billion)

11.6.7.2 Market Size and Forecast

11.6.7.3 AustraliaMarket Segmental Analysis

11.6.8 Rest of Asia Pacific

11.6.8.1 Rest of Asia Pacific Artificial Intelligence (AI) Robots Market Revenue, 2022-2034 ($Billion)

11.6.8.2 Market Size and Forecast

11.6.8.3 Rest of Asia PacificMarket Segmental Analysis

11.7 LAMEA

11.7.1 LAMEA Artificial Intelligence (AI) Robots Market Revenue, 2022-2034 ($Billion)

11.7.2 Market Size and Forecast

11.7.3 LAMEA Artificial Intelligence (AI) Robots Market, By Country

11.7.4 GCC

11.7.4.1 GCC Artificial Intelligence (AI) Robots Market Revenue, 2022-2034 ($Billion)

11.7.4.2 Market Size and Forecast

11.7.4.3 GCCMarket Segmental Analysis

11.7.5 Africa

11.7.5.1 Africa Artificial Intelligence (AI) Robots Market Revenue, 2022-2034 ($Billion)

11.7.5.2 Market Size and Forecast

11.7.5.3 AfricaMarket Segmental Analysis

11.7.6 Brazil

11.7.6.1 Brazil Artificial Intelligence (AI) Robots Market Revenue, 2022-2034 ($Billion)

11.7.6.2 Market Size and Forecast

11.7.6.3 BrazilMarket Segmental Analysis

11.7.7 Rest of LAMEA

11.7.7.1 Rest of LAMEA Artificial Intelligence (AI) Robots Market Revenue, 2022-2034 ($Billion)

11.7.7.2 Market Size and Forecast

11.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 12. Competitive Landscape

12.1 Competitor Strategic Analysis

12.1.1 Top Player Positioning/Market Share Analysis

12.1.2 Top Winning Strategies, By Company, 2022-2024

12.1.3 Competitive Analysis By Revenue, 2022-2024

12.2 Recent Developments by the Market Contributors (2024)

Chapter 13. Company Profiles

13.1 Alphabet

13.1.1 Company Snapshot

13.1.2 Company and Business Overview

13.1.3 Financial KPIs

13.1.4 Product/Service Portfolio

13.1.5 Strategic Growth

13.1.6 Global Footprints

13.1.7 Recent Development

13.1.8 SWOT Analysis

13.2 Microsoft Corporation

13.3 IBM Corporation

13.4 Intel Corporation

13.5 NVIDIA Corporation

13.6 ABB

13.7 Fanuc

13.8 Yaskawa

13.9 Kawasaki

13.10 Mitsubishi

13.11 SoftBank Corp.

13.12 Hanson Robotics Ltd.

13.13 CloudMinds Technology Inc.

13.14 Neurala, Inc.

13.15 Vicarious