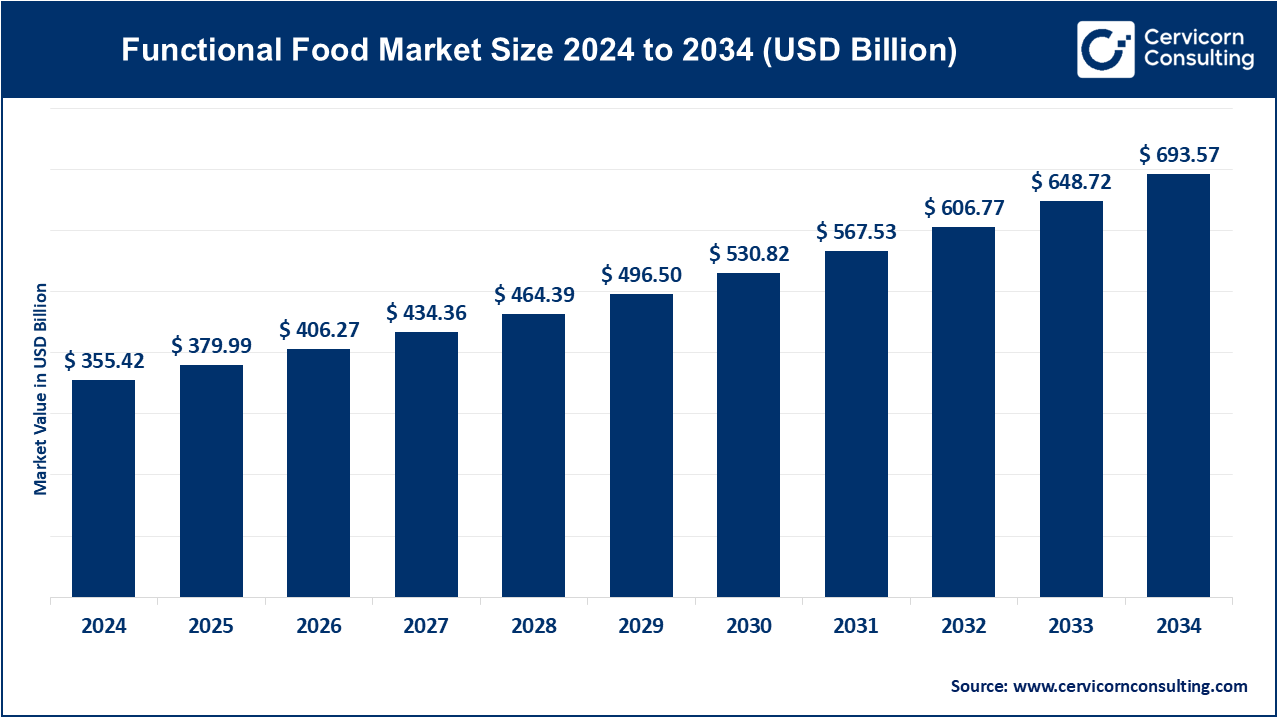

The global functional food market size was reached at USD 355.42 billion in 2024 and is expected to be worth around USD 693.57 billion by 2034, exhibiting a compound annual growth rate (CAGR) of 6.91% over the forecast period from 2025 to 2034. The functional food market is primarily driven by a growing awareness of health issues among consumers. They are actively looking for foods that provide extra health benefits beyond basic nutrition. The increasing number of lifestyle diseases like obesity, diabetes, and heart disease has led to a surge in demand for functional foods rich in vitamins, minerals, probiotics, and other bioactive compounds. As the global population ages, an increasing number of people are seeking dietary solutions to enhance their immunity, gut health, and brain function. Changing eating habits, urbanization, and greater access to health information online are also fuelling demand for functional and preventive nutrition.

Additionally, the functional food market is experiencing rapid growth due to breakthroughs in food technology and science, which enable the creation of various functional foods targeting specific health issues. Major food and beverage companies are investing in research and development, introducing fortified and clean-label products that tap into consumer demand for natural, organic, and plant-based ingredients. The global functional foods market is projected to expand at a compound annual growth rate (CAGR) of over 7% in the next few years, with particularly strong demand in markets like North America, Europe, and Asia-Pacific, according to industry reports. Online shopping and wider retail distribution channels are also enhancing product visibility and consumer access, thus further driving the market growth.

What is a Functional Food?

Functional food refers to any food that provides health benefits beyond its standard nutritional value, with the ability to enhance overall health or even reduce disease risk. These foods are often enriched or fortified with bioactive compounds such as vitamins, minerals, probiotics, prebiotics, fiber, and plant antioxidants. Examples of functional foods include fortified foods, probiotic foods, prebiotic foods, dietary fiber foods, and phytochemical foods. Their applications cover various areas, including digestive health, heart health, bone health, immunity, mental health, and weight management, making them integral to daily diets and preventive healthcare practices.

Functional Food Market: Important Stats and Industry Insights

| Category | Insight |

| Top Consumer Demands | Gut health, immunity, weight management, and cognitive support are leading consumer priorities. |

| Most Popular Ingredients | Probiotics (51.6% market share in 2022), dietary fibers, vitamins, omega-3 fatty acids, and plant-based proteins are among the most sought-after functional ingredients. |

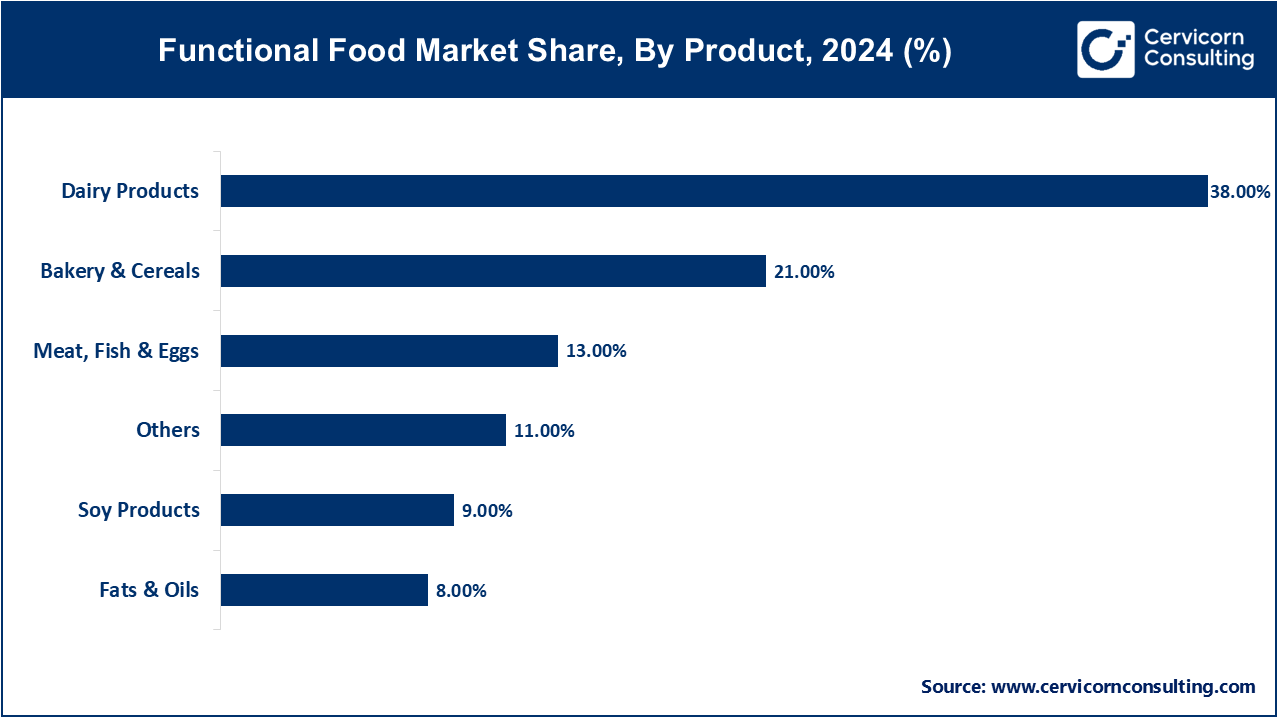

| Leading Product Segments | Dairy products lead the market with over 38% share, followed by bakery and cereals at 26%. Functional beverages and snacks are also gaining traction. |

| Major Consumer Demographics | Health-conscious millennials and the aging population are the primary consumers, seeking foods that offer preventive health benefits. |

| Emerging Trends | Clean-label products, plant-based functional foods, personalized nutrition, and reduced-sugar offerings are shaping the market. |

| Key Growth Drivers | Rising health awareness, increasing prevalence of chronic diseases, busy lifestyles, and technological advancements in food processing are propelling market growth. |

| Regional Hotspots | Asia Pacific is the fastest-growing region, driven by increasing health consciousness and demand for functional foods. North America and Europe also hold significant market shares. |

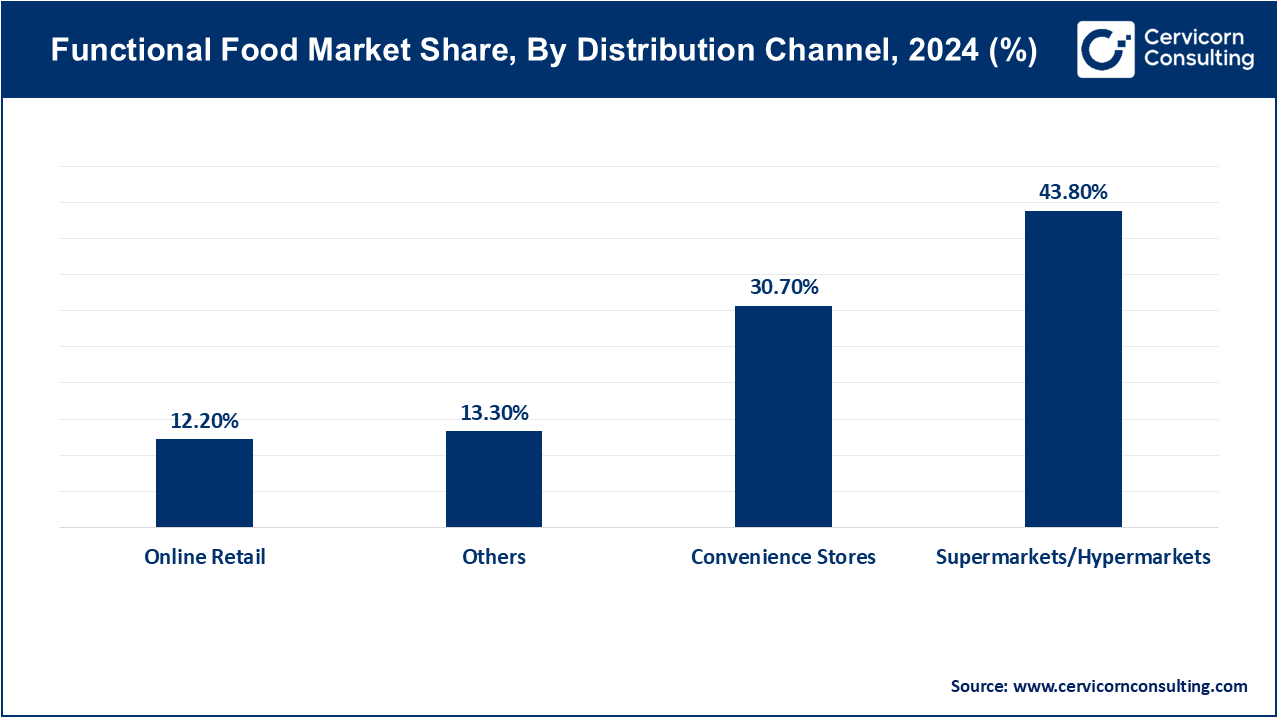

| Key Purchase Channels | Supermarkets, health stores, and online platforms are the primary channels through which consumers purchase functional foods. |

| Regulatory Focus | Emphasis on labeling accuracy, substantiation of health claims, and ensuring ingredient safety is paramount across regions. |

The demand for high-protein functional foods has significantly increased, driven by consumers' focus on health, fitness, and weight management. According to the International Food Information Council, the percentage of U.S. consumers seeking for more protein has risen from 59% in 2022 to 71% in 2024. This has led to a surge in protein-fortified products across various categories, including snacks, drinks, and even sweets. Companies like Huel have seen strong growth, launching new product forms like confectionery and iced coffee, while highlighting clean ingredients and whole foods.

People are increasingly aware of the necessity of gut health, which has led to a rise in demand for functional foods that contain probiotics, prebiotics, and fiber. Kombucha, yogurt, and digestive health supplements are becoming mainstream. This trend is driven by a growing awareness of the connection between gut health and overall wellness, including immune and mental health.

The growing popularity of plant-based diets is influencing the functional foods market. Consumers are seeking plant-based foods that offer functional benefits, such as protein-rich legumes, omega-3 seeds, and antioxidant-rich fruits and vegetables. This trend is fueled by increasing environmental consciousness and a preference for sustainable, ethical foods.

Functional beverages are on the rise as consumers seek convenient ways to maintain good health. These drinks are more likely to contain added vitamins, minerals, probiotics, or other nutrient-rich ingredients. For instance, the Coca-Cola Company has partnered with a probiotic firm to introduce a new line of functional beverages focused on gut health. Functional alternatives are also gaining popularity as a new feature in the drink-mix segment, with year-over-year sales increasing by 14.3% as of December 31, 2023.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 379.99 Billion |

| Expected Market Size in 2034 | USD 693.57 Billion |

| Projected CAGR 2025 to 2034 | 6.91% |

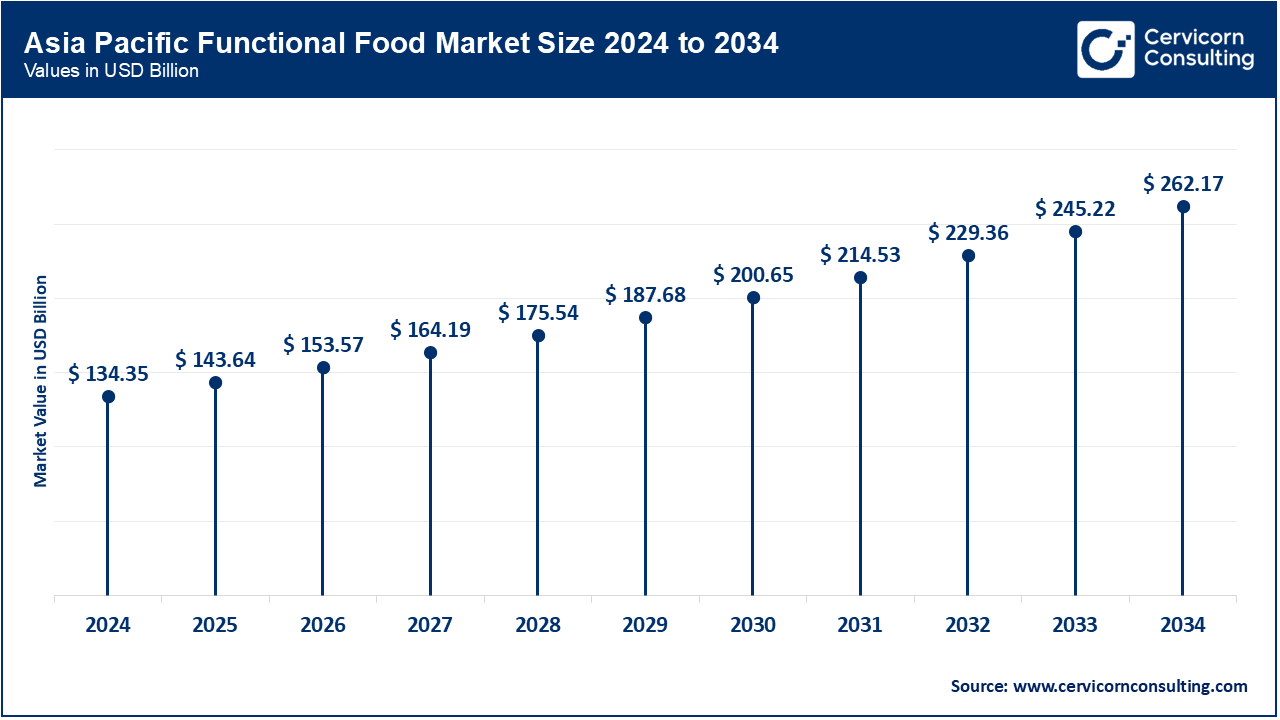

| Dominant Area | Asia Pacific |

| Fastest Growing Area | Asia Pacific |

| Key Segments | Product, Ingredient, Application, Distribution Channel, Region |

| Key Companies | Nestlé S.A., The Kellogg's Company, Hearthside Food Solutions LLC, Lotus Bakeries, Valio Eesti AS, Laird Superfoods, Abbott Laboratories, Yakult Honsha Co., Ltd., Danone SA, PepsiCo Inc., Hindustan Unilever Ltd, General Mills, Clif Bar & Company, Cocos Organic, Care Nutrition |

The functional food market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA.

The North America functional food market size was valued at USD 112.86 billion in 2024 and is expected to reach around USD 205.99 billion by 2034. North America maintains a strong presence in the market, primarily driven by the United States, which is a pioneer in functional food innovation and consumption. Its established health and wellness market, high consumer awareness, and the strong presence of leading companies such as PepsiCo, General Mills, and Kellogg's all contribute to its leadership. North American consumers are highly label-conscious, follow clean-label principles, and seek functional ingredients such as probiotics, omega-3, and plant proteins. Additionally, the high incidence of lifestyle diseases such as obesity, diabetes, and cardiovascular disease drives the demand for functional foods that aid in weight control, improve heart health, and enhance immunity.

The Asia-Pacific functional food market size was estimated at USD 134.35 billion in 2024 and is projected to hit around USD 262.17 billion by 2034. Asia-Pacific stands as the dominant and fastest-growing region, with countries like China, India, Japan, and South Korea leading the charge. With rising disposable incomes and dietary changes, there is increasing emphasis on preventive healthcare, fueling consumer demand for fortified beverages and foods. Traditional Asian ingredients like green tea, turmeric, ginseng, and fermented foods are being seamlessly integrated into modern functional foods, blending cultural awareness with health benefits. Furthermore, governments and regional brands are actively promoting improved eating habits, a movement further supported by an emerging middle class that demands premium health-nourishing food products.

The Europe functional food market size was accounted for USD 89.21 billion in 2024 and is predicted to surpass around USD 174.09 billion by 2034. Europe holds a significant share, supported by a well-regulated environment and a health-conscious population. Germany, France, and the United Kingdom exhibit high adoption rates of functional food, especially in the digestive health, immunity, and heart health segments. The European Food Safety Authority (EFSA) has implemented stringent regulations regarding health claims, thus ensuring product credibility and consumer confidence. The region is also at the forefront of sustainability and organic food trends, driving companies to develop clean-label, plant-based, and sustainable functional foods. Additionally, Europe's aging population is increasing the demand for functional foods that support brain health, joint health, and healthy aging.

Market Revenue Share, By Region, 2024 (%)

| Region | Revenue Share, 2024 (%) |

| North America | 29.70% |

| Europe | 25.10% |

| Asia-Pacific | 37.80% |

| LAMEA | 7.40% |

The LAMEA functional food market size was reached at USD 26.30 billion in 2024 and is anticipated to reach around USD 51.32 billion by 2034. LAMEA is an emerging region, showing promising growth driven by rising urbanization, enhanced health consciousness, and a gradual shift toward preventive care. Latin America is witnessing increased demand for fortified dairy products, energy drinks, and fiber-rich foods, particularly among the youth in Mexico and Brazil. The Middle East is seeing an oversupply of halal-approved functional foods and immunity-boosting products, while Africa is experiencing nascent adoption, primarily in urban areas. Multinationals are making significant investments in education programs and product localization despite challenges such as falling incomes, unstable regulatory environments, and limited product offerings, positioning themselves to seize this nascent opportunity.

The functional food market is segmented into product, ingredient, application, distribution channel, and regions. Based on product, the market is classified into dairy products, meat, fish & eggs, bakery & cereals, soy products, fats & oils, and others. Based on the ingredient, the market is categorised into dietary fibers, minerals, carotenoids, fatty acids, prebiotics & probiotics, vitamins, and others. Based on application, the market is categorised into weight management, digestive health, sports nutrition, immunity, clinical nutrition, cardio health, and others. Based on distribution channel, the market is classified into supermarkets/hypermarkets, online retail, convenience stores, and others.

Dairy Products: Dairy products continue to dominate the functional food market. This is largely due to strong consumer confidence in dairy as a natural, healthy source of functional nutrients such as probiotics, calcium, and vitamin D. Functional dairy foods like yogurt drinks, fortified milk, and probiotic-enriched cheese are popular among adults of all ages and thus are a key component of healthy diets. Furthermore, dairy's functionality as a delivery system for bioactives contributes to its appeal. This category is driven by continuous product innovation, including plant-based dairy alternatives fortified with functional ingredients, which are rapidly gaining popularity among lactose-intolerant and vegan consumers.

Bakery & Cereals: The bakery and cereals segment is experiencing the fastest growth, fueled by rising demand for convenient, on-the-go, healthy eating and snacking patterns. Functional foods like protein-fortified breads, fiber-fortified breakfast cereals, and vitamin and mineral-fortified energy bars are becoming increasingly popular among working professionals, students, and health and fitness enthusiasts. This growth is also spurred by consumers' interest in clean-label and gluten-free products, which are being incorporated into functional bakery foods. Additionally, ingredient innovations—such as ancient grains, seeds, and plant proteins—are broadening the category's appeal across various demographic groups.

Vitamins: Vitamins remain the most dominant ingredient category, given their essential role in preventing deficiencies and supporting various bodily functions such as immunity, metabolism, and skin health. Foods with added vitamins—particularly A, B-complex, C, D, and E—are widely accepted and favored by consumers around the globe. These nutrients are especially in high demand in soft drinks, breakfast cereals, milk products, and even sweets. The simplicity of incorporating vitamins into a wide range of food matrices without affecting taste or texture gives them a unique advantage over other complex functional ingredients. National governments and health institutions also promote vitamin fortification programs, particularly in areas with high micronutrient deficiencies, further boosting this segment.

Dietary Fibers: Dietary fibers are emerging as the fastest-growing ingredient, as digestive health becomes a top concern among consumers worldwide. High-fiber diets have been linked to numerous health benefits, including improved gut health, regulated blood sugar, lowered cholesterol, and effective weight management. Functional foods such as cereals, baked goods, and beverages containing soluble and insoluble fibers are gaining popularity in the market. Increased awareness of the gut-brain axis and its significant impact on mental well-being is also driving demand for prebiotic fibers that support a healthy microbiome. Moreover, advances in ingredient technology now allow food manufacturers to incorporate fibers without compromising the taste and mouthfeel of foods.

Immunity: Immunity-based functional foods have taken a commanding lead in the application segment, particularly in the aftermath of the COVID-19 pandemic. Consumers are increasingly seeking foods that enhance immune function, including those fortified with vitamins D and C, zinc, selenium, and probiotics. This demand is reflected in the surge of immune-boosting beverages, yogurts, and cereals entering the market. With seasonal illnesses and pandemic-driven anxiety still influencing consumer behavior, brands are heavily focusing on conveying the health benefits associated with immune support. Additionally, scientific validation of certain ingredients—such as lactobacillus strains and elderberry extracts—has bolstered consumer confidence and encouraged product adoption in this category.

Sports Nutrition: The sports nutrition application is experiencing rapid growth, driven by an increasing global focus on fitness, active lifestyles, and preventive health. No longer limited to professional athletes, consumers are increasingly incorporating performance-enhancing functional foods into their daily diets. Demand is robust for foods like protein-enriched snacks, electrolyte drinks, branched-chain amino acids (BCAs), and foods rich in omega-3 content. This category is also buoyed by crossover trends in weight management and cognitive performance, as consumers seek multifunctional solutions in a single product. Furthermore, the rise of boutique fitness centers, gyms, and fitness apps is further promoting awareness and consumption of sports nutrition-focused functional foods.

Supermarkets/Hypermarkets: Supermarkets and hypermarkets dominate the distribution channel for functional foods due to their extensive coverage, product diversity, and established reputation among consumers. These supermarket chains provide easy access to various functional food categories—from fortified dairy products and snacks to beverages and dietary supplements—all under one roof. Promotional strategies, such as product bundling, effective in-store displays, and health-oriented marketing campaigns, further boost sales in this category. Their ability to promote trendy new products not only informs consumers but also encourages product trials, making these stores key drivers of mass consumption of functional foods, particularly in urban and suburban markets.

Online Retail: Online retail is the fastest-growing channel, spurred by the digital transformation of consumer shopping behavior and increased internet access. Convenience, along with a greater selection, subscription options, and personalized recommendations based on consumer behavior, is offered by e-commerce platforms. For health-conscious consumers, the ability to easily compare labels, read consumer reviews, and discover premium or specialty functional food brands is a significant advantage. Moreover, the influence of health advocates, fitness bloggers, and nutritionists promoting functional foods online is driving a wave of direct-to-consumer purchases. Innovations such as AI-powered nutrition tracking and smart labels are becoming increasingly integrated into online purchasing platforms, enhancing the customer experience.

The functional food industry is highly competitive and fragmented, comprising a mix of global giants and emerging players that are constantly innovating to capture a larger share of the market. Market leaders such as Nestlé, Danone, PepsiCo, General Mills, and Unilever dominate with a diverse range of products, strong brands, and access to global distribution channels. These companies are significantly investing in R&D, acquisitions, and strategic alliances to introduce new formulations focused on immunity, gut health, and weight management. Regional and niche players, however, are expanding rapidly by promoting clean-label, plant-based, and personalized nutrition offerings that cater to local tastes and wellness requirements. Competition is intensifying as consumers' demands for transparency, sustainability, and functional effectiveness drive product innovation and marketing strategies throughout the industry.

Market Segmentation

By Product

By Ingredient

By Application

By Distribution Channel

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Functional Food

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Product Overview

2.2.2 By Ingredient Overview

2.2.3 By Application Overview

2.2.4 By Distribution Channel Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Rising Health Consciousness Among Consumers

4.1.1.2 Growth of the Aging Population

4.1.2 Market Restraints

4.1.2.1 High Cost of Functional Ingredients and Products

4.1.2.2 Regulatory Hurdles and Misleading Claims

4.1.3 Market Challenges

4.1.3.1 Consumer Skepticism Toward Functional Claims

4.1.3.2 Complex Supply Chains and Ingredient Stability

4.1.4 Market Opportunities

4.1.4.1 Personalized Nutrition and Functional Food Innovation

4.1.4.2 Expansion in Emerging Markets

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Functional Food Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Functional Food Market, By Product

6.1 Global Functional Food Market Snapshot, By Product

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Dairy Products

6.1.1.2 Meat, Fish & Eggs

6.1.1.3 Bakery & Cereals

6.1.1.4 Soy Products

6.1.1.5 Fats & Oils

6.1.1.6 Others

Chapter 7. Functional Food Market, By Ingredient

7.1 Global Functional Food Market Snapshot, By Ingredient

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Dietary Fibers

7.1.1.2 Minerals

7.1.1.3 Carotenoids

7.1.1.4 Fatty Acids

7.1.1.5 Prebiotics & Probiotics

7.1.1.6 Vitamins

7.1.1.7 Others

Chapter 8. Functional Food Market, By Application

8.1 Global Functional Food Market Snapshot, By Application

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Weight Management

8.1.1.2 Digestive Health

8.1.1.3 Sports Nutrition

8.1.1.4 Immunity

8.1.1.5 Clinical Nutrition

8.1.1.6 Cardio Health

8.1.1.7 Others

Chapter 9. Functional Food Market, By Distribution Channel

9.1 Global Functional Food Market Snapshot, By Distribution Channel

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Supermarkets/Hypermarkets

9.1.1.2 Online Retail

9.1.1.3 Convenience Stores

9.1.1.4 Others

Chapter 10. Functional Food Market, By Region

10.1 Overview

10.2 Functional Food Market Revenue Share, By Region 2024 (%)

10.3 Global Functional Food Market, By Region

10.3.1 Market Size and Forecast

10.4 North America

10.4.1 North America Functional Food Market Revenue, 2022-2034 ($Billion)

10.4.2 Market Size and Forecast

10.4.3 North America Functional Food Market, By Country

10.4.4 U.S.

10.4.4.1 U.S. Functional Food Market Revenue, 2022-2034 ($Billion)

10.4.4.2 Market Size and Forecast

10.4.4.3 U.S. Market Segmental Analysis

10.4.5 Canada

10.4.5.1 Canada Functional Food Market Revenue, 2022-2034 ($Billion)

10.4.5.2 Market Size and Forecast

10.4.5.3 Canada Market Segmental Analysis

10.4.6 Mexico

10.4.6.1 Mexico Functional Food Market Revenue, 2022-2034 ($Billion)

10.4.6.2 Market Size and Forecast

10.4.6.3 Mexico Market Segmental Analysis

10.5 Europe

10.5.1 Europe Functional Food Market Revenue, 2022-2034 ($Billion)

10.5.2 Market Size and Forecast

10.5.3 Europe Functional Food Market, By Country

10.5.4 UK

10.5.4.1 UK Functional Food Market Revenue, 2022-2034 ($Billion)

10.5.4.2 Market Size and Forecast

10.5.4.3 UKMarket Segmental Analysis

10.5.5 France

10.5.5.1 France Functional Food Market Revenue, 2022-2034 ($Billion)

10.5.5.2 Market Size and Forecast

10.5.5.3 FranceMarket Segmental Analysis

10.5.6 Germany

10.5.6.1 Germany Functional Food Market Revenue, 2022-2034 ($Billion)

10.5.6.2 Market Size and Forecast

10.5.6.3 GermanyMarket Segmental Analysis

10.5.7 Rest of Europe

10.5.7.1 Rest of Europe Functional Food Market Revenue, 2022-2034 ($Billion)

10.5.7.2 Market Size and Forecast

10.5.7.3 Rest of EuropeMarket Segmental Analysis

10.6 Asia Pacific

10.6.1 Asia Pacific Functional Food Market Revenue, 2022-2034 ($Billion)

10.6.2 Market Size and Forecast

10.6.3 Asia Pacific Functional Food Market, By Country

10.6.4 China

10.6.4.1 China Functional Food Market Revenue, 2022-2034 ($Billion)

10.6.4.2 Market Size and Forecast

10.6.4.3 ChinaMarket Segmental Analysis

10.6.5 Japan

10.6.5.1 Japan Functional Food Market Revenue, 2022-2034 ($Billion)

10.6.5.2 Market Size and Forecast

10.6.5.3 JapanMarket Segmental Analysis

10.6.6 India

10.6.6.1 India Functional Food Market Revenue, 2022-2034 ($Billion)

10.6.6.2 Market Size and Forecast

10.6.6.3 IndiaMarket Segmental Analysis

10.6.7 Australia

10.6.7.1 Australia Functional Food Market Revenue, 2022-2034 ($Billion)

10.6.7.2 Market Size and Forecast

10.6.7.3 AustraliaMarket Segmental Analysis

10.6.8 Rest of Asia Pacific

10.6.8.1 Rest of Asia Pacific Functional Food Market Revenue, 2022-2034 ($Billion)

10.6.8.2 Market Size and Forecast

10.6.8.3 Rest of Asia PacificMarket Segmental Analysis

10.7 LAMEA

10.7.1 LAMEA Functional Food Market Revenue, 2022-2034 ($Billion)

10.7.2 Market Size and Forecast

10.7.3 LAMEA Functional Food Market, By Country

10.7.4 GCC

10.7.4.1 GCC Functional Food Market Revenue, 2022-2034 ($Billion)

10.7.4.2 Market Size and Forecast

10.7.4.3 GCCMarket Segmental Analysis

10.7.5 Africa

10.7.5.1 Africa Functional Food Market Revenue, 2022-2034 ($Billion)

10.7.5.2 Market Size and Forecast

10.7.5.3 AfricaMarket Segmental Analysis

10.7.6 Brazil

10.7.6.1 Brazil Functional Food Market Revenue, 2022-2034 ($Billion)

10.7.6.2 Market Size and Forecast

10.7.6.3 BrazilMarket Segmental Analysis

10.7.7 Rest of LAMEA

10.7.7.1 Rest of LAMEA Functional Food Market Revenue, 2022-2034 ($Billion)

10.7.7.2 Market Size and Forecast

10.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 11. Competitive Landscape

11.1 Competitor Strategic Analysis

11.1.1 Top Player Positioning/Market Share Analysis

11.1.2 Top Winning Strategies, By Company, 2022-2024

11.1.3 Competitive Analysis By Revenue, 2022-2024

11.2 Recent Developments by the Market Contributors (2024)

Chapter 12. Company Profiles

12.1 Nestlé S.A.

12.1.1 Company Snapshot

12.1.2 Company and Business Overview

12.1.3 Financial KPIs

12.1.4 Product/Service Portfolio

12.1.5 Strategic Growth

12.1.6 Global Footprints

12.1.7 Recent Development

12.1.8 SWOT Analysis

12.2 The Kellogg's Company

12.3 Hearthside Food Solutions LLC

12.4 Lotus Bakeries

12.5 Valio Eesti AS

12.6 Laird Superfoods

12.7 Abbott Laboratories

12.8 Yakult Honsha Co., Ltd.

12.9 Danone SA

12.10 PepsiCo Inc.

12.11 Hindustan Unilever Ltd

12.12 General Mills

12.13 Clif Bar & Company

12.14 Cocos Organic

12.15 Care Nutrition