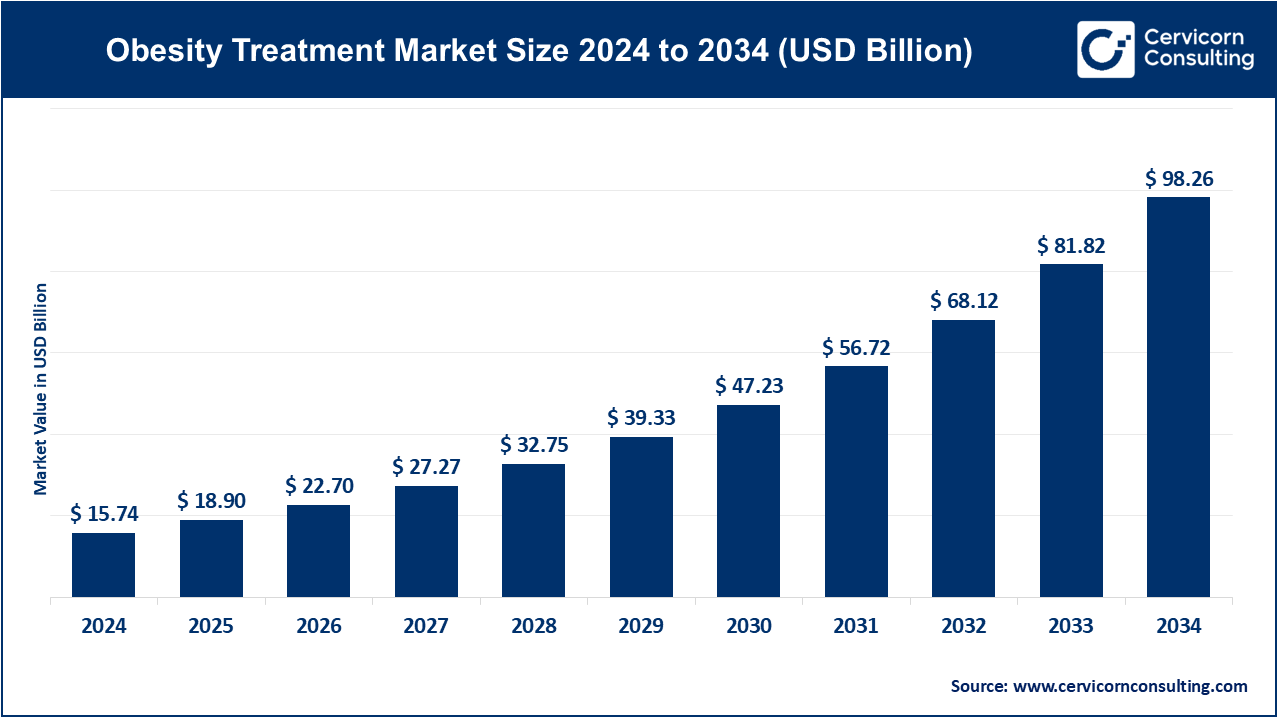

The global obesity treatment market size was reached at USD 15.74 billion in 2024 and is expected to be worth around USD 98.26 billion by 2034, exhibiting at a compound annual growth rate (CAGR) of 20.10% over the forecast period 2025 to 2034. The obesity treatment market is being driven by the increasing global prevalence of obesity, which is now recognized as a chronic disease rather than a lifestyle issue. This shift in perception has led to greater medical intervention, research spending, and policy action in support of treatment approaches. The surge of inactivity with poor dietary habits and city expansion across the globe has driven the increasing obesity rates. Medical technology advances together with new drug development particularly GLP-1 receptor agonists have created more effective and affordable treatments that enhance market demand.

The market shows signs of increasing momentum through its recent developments. Novo Nordisk formed a strategic alliance in May 2025 with U.S. company Septerna to create oral small-molecule drugs for obesity and related metabolic conditions. This strategic move by Novo Nordisk enhances their market position since Eli Lilly's Zepbound has started to surpass Wegovy as the most prescribed drug in the United States. Governments have begun to recognize the economic consequences of obesity. The UK government is evaluating the inclusion of Wegovy and Mounjaro weight-loss injections in its healthcare systems for minimizing sick days and increasing workforce productivity which demonstrates growing institutional backing for obesity treatment initiatives.

What is an Obesity Treatment?

Obesity treatment involves all medical and therapeutic methods which help people decrease excessive body fat for better health and the prevention of obesity-related diseases. The treatments for obesity involve lifestyle modifications through diet and exercise alongside behavioral therapy and medication options including surgical interventions for extreme cases of obesity such as bariatric surgery. The main purpose of obesity treatment goes beyond weight reduction because it aims to address health conditions like diabetes along with hypertension and cardiovascular diseases and enhance life quality while lowering future disease risks.

Global and Clinical Data on Obesity and Its Treatment

| Statistic | Data/Value |

| Percentage of adults classified as obese in the US | 42.4% |

| Global number of children and adolescents with obesity | Over 150 million |

| Percentage increase in obesity rates since 2000 | Nearly tripled globally |

| Average weight loss from GLP-1 medications in clinical trials | 10-15% of body weight |

| Bariatric surgery success rate (sustained weight loss at 5 years) | Approximately 50-70% |

| Percentage of adults willing to use prescription medication for weight loss | Around 35% |

| Reduction in type 2 diabetes risk after effective obesity treatment | Up to 60% |

Advancements of GLP-1 Receptor Agonists

The landscape of obesity treatment has evolved significantly due to the effectiveness of GLP-1 receptor agonists semaglutide (Wegovy) and tirzepatide (Mounjaro) in reducing hunger and facilitating substantial weight loss. This rise in the drugs' popularity has led to a significant increase in global sales of anti-obesity medications.

In 2024, worldwide spending on these treatments reached an all-time high of USD 30 billion. The surging demand resulted in supply chain disruptions, prompting telehealth providers to explore liraglutide as an alternative option for patients.

Emergence of Non-Invasive Oral Treatments

Obesity treatment is undergoing transformation through emerging non-invasive oral solutions that serve as alternatives to injectable medications. The company Syntis Bio developed SYNT-101, an oral liquid that replicates the effects of gastric bypass surgery by generating a temporary gut lining. Early trials demonstrate that patients experience beneficial weight reduction without severe side effects, which brings optimism to those who need simpler therapeutic options.

Integration of Digital Health Tools

AI, together with wearables, provides personalized obesity management solutions to patients. Wearables and AI systems enable monitoring of patient progress while offering customized intervention capabilities to users. Research findings from a recent study reveal that AI demonstrates over 84% accuracy in predicting successful weight reduction, which leads to improved treatment adherence and outcomes.

Strategic Collaborations and Research Investments

Pharmaceutical companies are investing aggressively in the research of obesity medications through collaborative partnerships. For example, in May 2025, Novo Nordisk collaborated with Septerna, a biotechnology company, under a USD 2.2 billion agreement to develop innovative treatments targeting important biological mechanisms of obesity.

Such partnerships fuel innovation by providing new solutions that will benefit patients globally.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 18.90 Billion |

| Expected Market Size in 2034 | USD 98.26 Billion |

| Projected Market CAGR from 2025 to 2034 | 20.10% |

| High-impact Region | North America |

| High-growth Region | Asia-Pacific |

| Key Segments | Drug Class, Route of Administration, Distribution Channel, Region |

| Key Companies | GlaxoSmithKline plc, Novo Nordisk A/S, VIVUS LLC, AstraZeneca, Rhythm Pharmaceuticals, Inc., Currax Pharmaceuticals, Johnson & Johnson, Eli Lilly and Company, Pfizer, Amgen, Boehringer Ingelheim International GmbH, Gelesis, Medtronic, Sanofi |

The obesity treatment market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA.

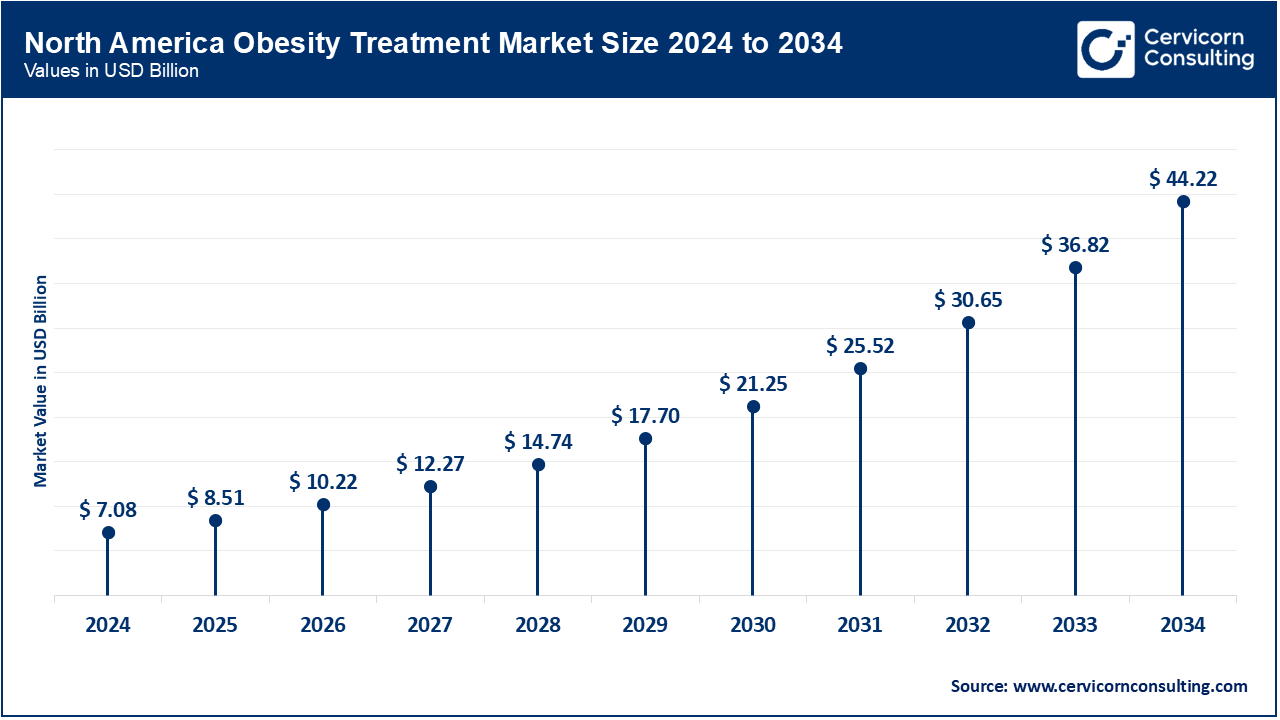

The North America obesity treatment market size was reached at USD 7.08 billion in 2024 and is expected to reach around USD 44.22 billion by 2034. North America continues to lead the market, mainly due to high obesity rates, quick regulatory approvals, and the rapid implementation of new drugs. The CDC reports that obesity affects more than 42% of adults and around 20% of children in the U.S. The approval and commercial uptake of drugs such as Wegovy (semaglutide) and Zepbound (tirzepatide) - GLP-1 receptor agonists - have transformed treatment options. In 2023, prescriptions for Wegovy surged by over 300% compared to the previous year. Furthermore, payers and insurers are increasingly covering these treatments, enhancing access and uptake. Major pharmaceutical companies like Novo Nordisk and Eli Lilly are also preparing to ramp up U.S. production to meet extraordinary demand.

The Asia-Pacific obesity treatment market size was estimated at USD 3.12 billion in 2024 and is projected to hit around USD 19.46 billion by 2034. The Asia-Pacific region is experiencing the most rapid growth, fueled by changing lifestyles, swift urbanization, rising disposable incomes, and an increase in awareness about the health dangers linked to obesity. The rising rates of obesity are particularly notable in countries like India, China, Japan, and South Korea. For example, China is expected to have more than 150 million obese adults by the year 2030, which is driving national healthcare reform. Japan's emphasis on metabolic syndrome has resulted in the launch of weight-reduction programs covered by insurance. Pharmaceutical firms are partnering with local healthcare providers and government bodies to roll out innovative anti-obesity medications. In India, campaigns raising awareness about diabetes and weight management are also encouraging early treatment adoption, setting the stage for market growth in the region.

Obesity Treatment Market Revenue Share, By Region, 2024 (%)

| Region | Revenue Share, 2024 (%) |

| North America | 45% |

| Europe | 14.60% |

| Asia-Pacific | 19.80% |

| LAMEA | 20.70% |

The Europe obesity treatment market size was valued at USD 2.30 billion in 2024 and is predicted to surpass around USD 14.35 billion by 2034. Europe represents a stable and steadily growing market due to its robust healthcare infrastructure, strong regulatory support, and increased government interest in preventive medicine. Western European nations like Germany, the UK, France, and the Netherlands are actively integrating weight control as a component of chronic disease prevention. In 2023, the UK NHS integrated semaglutide (Wegovy) into the national weight loss program and enabled the prescription of this drug through primary care. There are also several obesity research centers and public health programs in Europe, such as the WHO's European Obesity Strategy 2022–2030, which promote early treatment and intervention across member states. Although drug costs and reimbursement policies vary by country, the overall acceptability of pharmacotherapy in treating obesity is rising throughout the region.

The LAMEA obesity treatment market size was valued at USD 3.26 billion in 2024 and is anticipated to grow around USD 20.34 billion by 2034. LAMEA represents a diverse and emerging market. Obesity rates are alarmingly high in Latin America, particularly in Mexico, which ranks among the highest globally, especially in children. To combat this, governments are enacting policy measures, including food labeling laws and taxes on sugary drinks. Brazil is showing a growing interest in therapy options that require prescriptions. In the Middle East, nations such as Saudi Arabia, the UAE, and Qatar face significant adult obesity rates, driven by sedentary lifestyles and dietary shifts. These countries are heavily investing in healthcare facilities, with GLP-1 medications becoming increasingly popular among wealthier populations. In Africa, while awareness and access are still limited, urbanization and the adoption of Western eating habits are contributing to rising obesity rates, sparking interest in cost-effective solutions. Multinational pharmaceutical firms are starting to establish a presence in this area through local initiatives and online health programs.

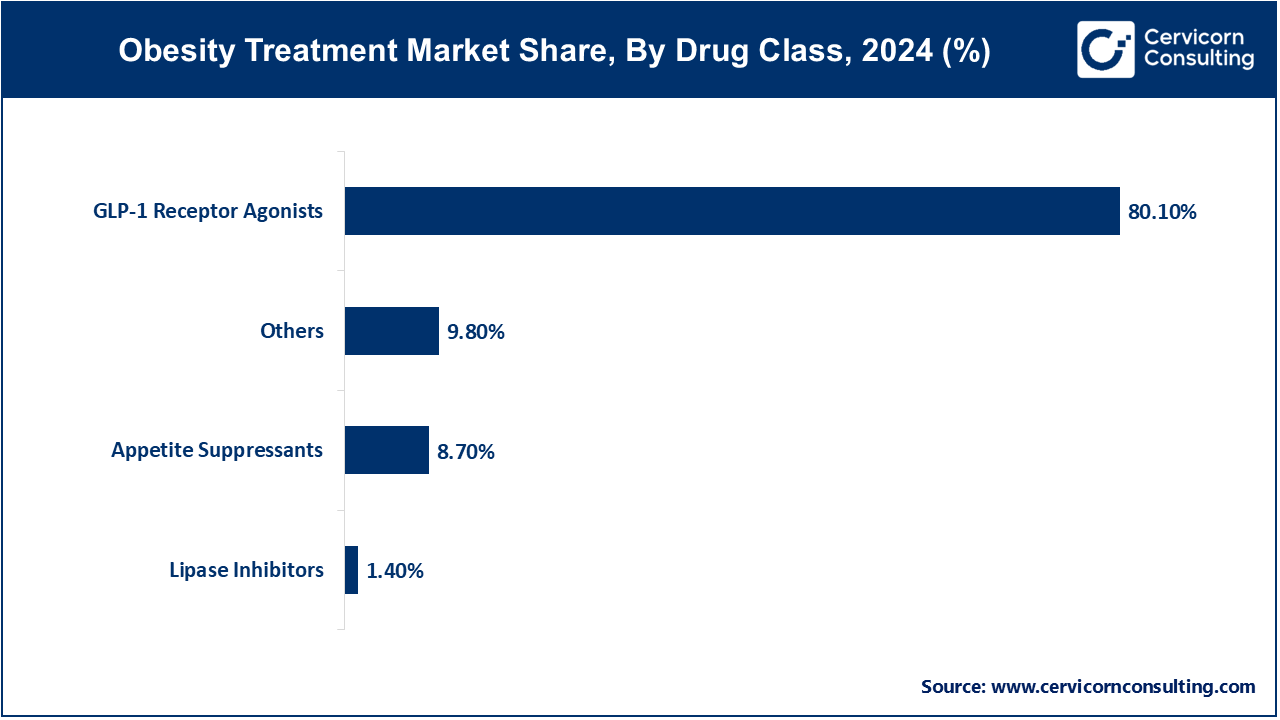

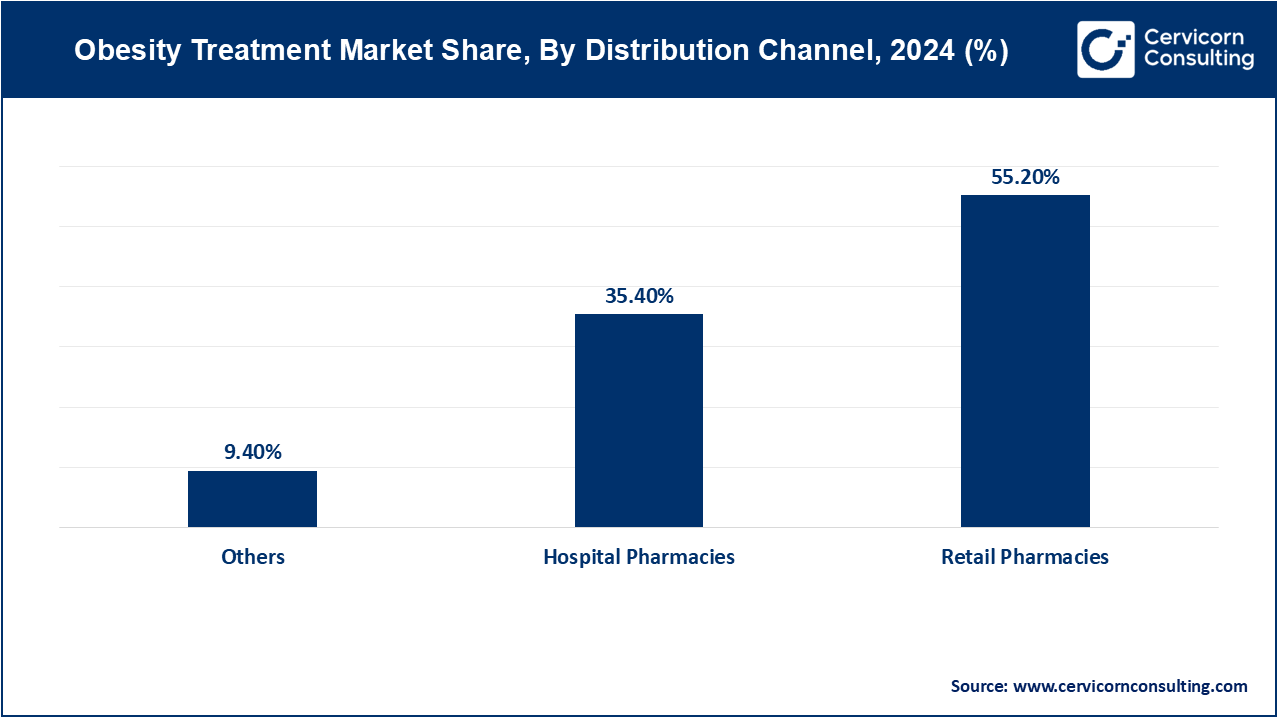

The obesity treatment market is segmented into drug class, route of administration, distribution channel, and region. Based on drug class, the market is classified into GLP-1 Receptor Agonists (Semaglutide (Wegovy), Tirzepatide (Zepbound), Liraglutide (Saxenda)), Appetite Suppressants, Lipase Inhibitors, and others. Based on the route of administration, the market is classified into parenteral and oral. Based on distribution channel, the market is categorised into hospital pharmacies, retail pharmacies, and others.

GLP-1 receptor agonists dominate the obesity treatment market due to their proven ability to promote remarkable weight loss and improve metabolic well-being. Drugs like Semaglutide (Wegovy) and Tirzepatide (Zepbound) mimic natural hormones that suppress hunger and regulate blood glucose. They have a strong efficacy and safety record, making them a doctor's favorite, and they are highly sought after in Europe and the U.S.

Small-molecule drugs represent the fastest-growing subsegment, as oral anti-obesity drugs are being favoured for their convenience and cost-effectiveness. With ongoing clinical trials and recent FDA approval, these drugs have promising data to support long-term weight loss. They are becoming a first-line substitute among patients who want to avoid injectable drugs.

Parenteral administration is the dominant route for obesity treatments, primarily due to the success of injectable GLP-1 medications like Wegovy and Saxenda. These medications have sustained bioavailability and are generally prescribed in a healthcare setting, which accounts for their widespread use. Their ability to perform so well at weight loss has cemented this delivery mode as standard in the majority of treatment programs.

Obesity Treatment Market Revenue Share, By Route of Administration, 2024 (%)

| Route of Administration | Revenue Share, 2024 (%) |

| Parenteral | 82.40% |

| Oral | 17.60% |

The oral route is the fastest-growing segment due to increasing patient preference for non-invasive therapies. Advancements in formulation are enabling the oral delivery of drugs that were previously administered only through injections. As more effective oral drugs enter the market, this category will experience significant growth in both developed and emerging healthcare systems.

Hospital pharmacies lead the market in distribution due to their role in initiating and managing treatment plans for patients with severe obesity and comorbid conditions. These settings allow for close monitoring and administration of prescription-only medicine, such as newly approved injectables. Being part of clinical care teams also promotes reliability and adherence to treatment.

Retail pharmacies are the fastest-growing channel as accessibility and convenience become critical in obesity management. With increasing demand for GLP-1 and other prescription drugs, retail outlets are getting increasingly stocked and manned to address those demands. Being ubiquitous makes it easier for them to reach out, particularly for follow-up prescriptions and patient education.

The obesity treatment market's competitive landscape is rapidly evolving, fueled by innovative therapies, strong pipelines, and key partnerships among major pharmaceutical companies. Leading firms like Novo Nordisk, Eli Lilly, Pfizer, and Amgen dominate this space, with GLP-1 receptor agonists such as Wegovy (semaglutide) and Zepbound (tirzepatide) gaining traction due to their remarkable effectiveness and rising global demand. Significant research and development investments further intensify the competition, as numerous next-generation anti-obesity medications advance into late-stage clinical trials. Additionally, mergers, acquisitions, and partnerships with digital health platforms are reshaping the future of obesity management, as companies strive to provide comprehensive, long-term weight management solutions beyond mere medication. With regulatory bodies speeding up approvals and governments prioritising obesity care, the market is set for significant competitive transformations in the coming years.

Recent Developments

Market Segmentation

By Drug Class

By Route of Administration

By Distribution Channel

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Obesity Treatment

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Drug Class Overview

2.2.2 By Route of Administration Overview

2.2.3 By Distribution Channel Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Rising Prevalence of Obesity Worldwide

4.1.1.2 Advances in Pharmacological Treatments

4.1.2 Market Restraints

4.1.2.1 High Cost of Treatment

4.1.2.2 Side Effects and Safety Concerns

4.1.3 Market Challenges

4.1.3.1 Stigma and Social Perceptions

4.1.3.2 Complex Nature of Obesity

4.1.4 Market Opportunities

4.1.4.1 Development of Non-Invasive Treatment Options

4.1.4.2 Increasing Government Initiatives and Awareness Programs

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Obesity Treatment Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Obesity Treatment Market, By Drug Class

6.1 Global Obesity Treatment Market Snapshot, By Drug Class

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 GLP-1 Receptor Agonists

6.1.1.2 Appetite Suppressants

6.1.1.3 Lipase Inhibitors

6.1.1.4 Others

Chapter 7. Obesity Treatment Market, By Route of Administration

7.1 Global Obesity Treatment Market Snapshot, By Route of Administration

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Parenteral

7.1.1.2 Oral

Chapter 8. Obesity Treatment Market, By Distribution Channel

8.1 Global Obesity Treatment Market Snapshot, By Distribution Channel

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Hospital Pharmacies

8.1.1.2 Retail Pharmacies

8.1.1.3 Others

Chapter 9. Obesity Treatment Market, By Region

9.1 Overview

9.2 Obesity Treatment Market Revenue Share, By Region 2024 (%)

9.3 Global Obesity Treatment Market, By Region

9.3.1 Market Size and Forecast

9.4 North America

9.4.1 North America Obesity Treatment Market Revenue, 2022-2034 ($Billion)

9.4.2 Market Size and Forecast

9.4.3 North America Obesity Treatment Market, By Country

9.4.4 U.S.

9.4.4.1 U.S. Obesity Treatment Market Revenue, 2022-2034 ($Billion)

9.4.4.2 Market Size and Forecast

9.4.4.3 U.S. Market Segmental Analysis

9.4.5 Canada

9.4.5.1 Canada Obesity Treatment Market Revenue, 2022-2034 ($Billion)

9.4.5.2 Market Size and Forecast

9.4.5.3 Canada Market Segmental Analysis

9.4.6 Mexico

9.4.6.1 Mexico Obesity Treatment Market Revenue, 2022-2034 ($Billion)

9.4.6.2 Market Size and Forecast

9.4.6.3 Mexico Market Segmental Analysis

9.5 Europe

9.5.1 Europe Obesity Treatment Market Revenue, 2022-2034 ($Billion)

9.5.2 Market Size and Forecast

9.5.3 Europe Obesity Treatment Market, By Country

9.5.4 UK

9.5.4.1 UK Obesity Treatment Market Revenue, 2022-2034 ($Billion)

9.5.4.2 Market Size and Forecast

9.5.4.3 UKMarket Segmental Analysis

9.5.5 France

9.5.5.1 France Obesity Treatment Market Revenue, 2022-2034 ($Billion)

9.5.5.2 Market Size and Forecast

9.5.5.3 FranceMarket Segmental Analysis

9.5.6 Germany

9.5.6.1 Germany Obesity Treatment Market Revenue, 2022-2034 ($Billion)

9.5.6.2 Market Size and Forecast

9.5.6.3 GermanyMarket Segmental Analysis

9.5.7 Rest of Europe

9.5.7.1 Rest of Europe Obesity Treatment Market Revenue, 2022-2034 ($Billion)

9.5.7.2 Market Size and Forecast

9.5.7.3 Rest of EuropeMarket Segmental Analysis

9.6 Asia Pacific

9.6.1 Asia Pacific Obesity Treatment Market Revenue, 2022-2034 ($Billion)

9.6.2 Market Size and Forecast

9.6.3 Asia Pacific Obesity Treatment Market, By Country

9.6.4 China

9.6.4.1 China Obesity Treatment Market Revenue, 2022-2034 ($Billion)

9.6.4.2 Market Size and Forecast

9.6.4.3 ChinaMarket Segmental Analysis

9.6.5 Japan

9.6.5.1 Japan Obesity Treatment Market Revenue, 2022-2034 ($Billion)

9.6.5.2 Market Size and Forecast

9.6.5.3 JapanMarket Segmental Analysis

9.6.6 India

9.6.6.1 India Obesity Treatment Market Revenue, 2022-2034 ($Billion)

9.6.6.2 Market Size and Forecast

9.6.6.3 IndiaMarket Segmental Analysis

9.6.7 Australia

9.6.7.1 Australia Obesity Treatment Market Revenue, 2022-2034 ($Billion)

9.6.7.2 Market Size and Forecast

9.6.7.3 AustraliaMarket Segmental Analysis

9.6.8 Rest of Asia Pacific

9.6.8.1 Rest of Asia Pacific Obesity Treatment Market Revenue, 2022-2034 ($Billion)

9.6.8.2 Market Size and Forecast

9.6.8.3 Rest of Asia PacificMarket Segmental Analysis

9.7 LAMEA

9.7.1 LAMEA Obesity Treatment Market Revenue, 2022-2034 ($Billion)

9.7.2 Market Size and Forecast

9.7.3 LAMEA Obesity Treatment Market, By Country

9.7.4 GCC

9.7.4.1 GCC Obesity Treatment Market Revenue, 2022-2034 ($Billion)

9.7.4.2 Market Size and Forecast

9.7.4.3 GCCMarket Segmental Analysis

9.7.5 Africa

9.7.5.1 Africa Obesity Treatment Market Revenue, 2022-2034 ($Billion)

9.7.5.2 Market Size and Forecast

9.7.5.3 AfricaMarket Segmental Analysis

9.7.6 Brazil

9.7.6.1 Brazil Obesity Treatment Market Revenue, 2022-2034 ($Billion)

9.7.6.2 Market Size and Forecast

9.7.6.3 BrazilMarket Segmental Analysis

9.7.7 Rest of LAMEA

9.7.7.1 Rest of LAMEA Obesity Treatment Market Revenue, 2022-2034 ($Billion)

9.7.7.2 Market Size and Forecast

9.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 10. Competitive Landscape

10.1 Competitor Strategic Analysis

10.1.1 Top Player Positioning/Market Share Analysis

10.1.2 Top Winning Strategies, By Company, 2022-2024

10.1.3 Competitive Analysis By Revenue, 2022-2024

10.2 Recent Developments by the Market Contributors (2024)

Chapter 11. Company Profiles

11.1 GlaxoSmithKline plc

11.1.1 Company Snapshot

11.1.2 Company and Business Overview

11.1.3 Financial KPIs

11.1.4 Product/Service Portfolio

11.1.5 Strategic Growth

11.1.6 Global Footprints

11.1.7 Recent Development

11.1.8 SWOT Analysis

11.2 Novo Nordisk A/S

11.3 VIVUS LLC

11.4 AstraZeneca

11.5 Rhythm Pharmaceuticals, Inc.

11.6 Currax Pharmaceuticals

11.7 Johnson & Johnson

11.8 Eli Lilly and Company

11.9 Pfizer

11.10 Amgen

11.11 Boehringer Ingelheim International GmbH

11.12 Gelesis

11.13 Medtronic

11.14 Sanofi