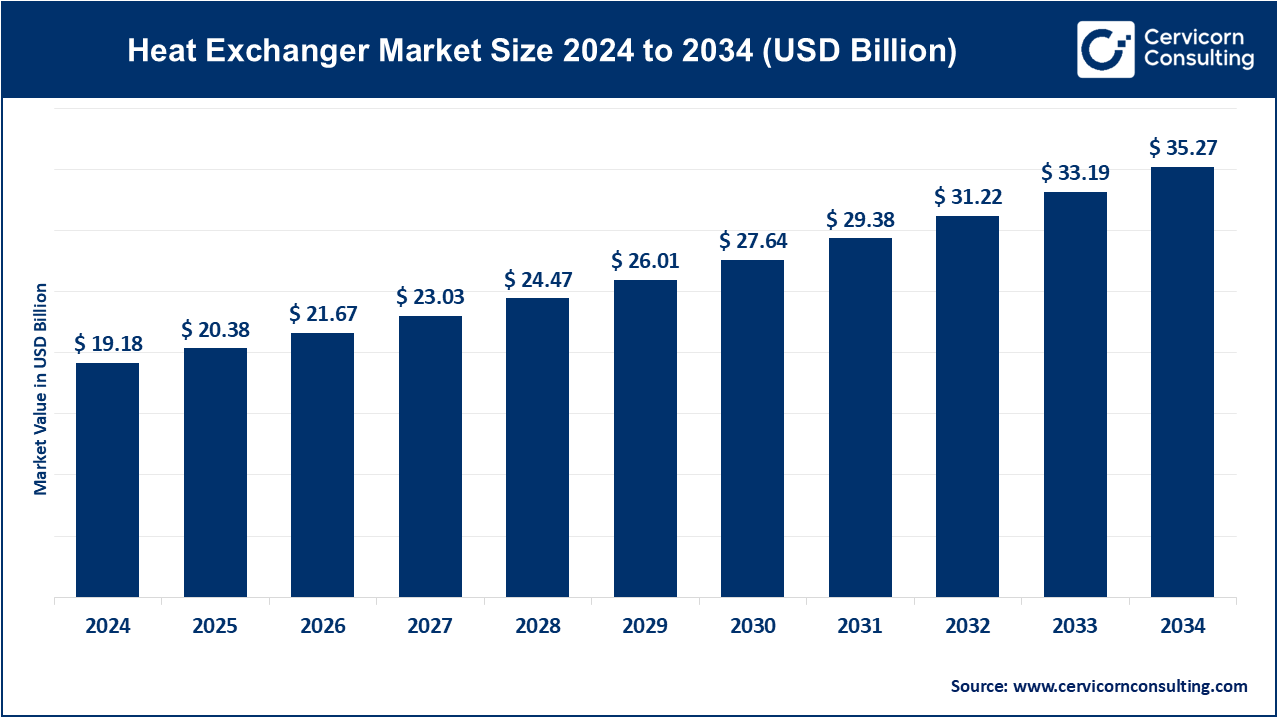

The global heat exchanger market size was reached at USD 19.18 billion in 2024 and is estimated to exceed around USD 32.27 billion by 2034, exhibiting a CAGR of 6.28% during the forecast period 2025 to 2034. The heat exchanger market is expected to grow owing to rise in the focus towards efficient thermal management across various sectors such as power generation, oil & gas, food & beverages, petrochemical & chemical, and refrigeration & HVAC.

The global heat exchanger market is expected to witness significant growth owing to increasing demand across such industries as oil and gas, chemical processing, power generation, and HVAC. Industrialization and energy-saving systems lead to boosting heat exchanger applications worldwide. The acquisition of these industries can also spur the heat exchanger market growth with rigorous regulations on the environment, and heavy investment on cutting-edge heat exchange solutions to ensure good energy management, and emission reduction. The market is expanding rapidly in the Asia-Pacific region due to industrial growth and infrastructural development in countries like China and India. The heat exchanger market has good demand, offering opportunities for innovation, and expansion in the coming years, with a growing emphasis on sustainability and energy optimization.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 20.38 Billion |

| Expected Market Size in 2034 | USD 35.27 Billion |

| Projected CAGR 2025 to 2034 | 6.28% |

| High-impact Region | Europe |

| Highest Growth Region | Asia-Pacific |

| Key Segments | Product, Material, End User, Region |

| Key Companies | Xylem Inc, SPX FLOW, Inc., Southern Heat Exchanger Corporation, Mersen, Koch Heat Transfer Company, Kelvion Holding GmbH, Johnson Controls International, HRS Heat Exchangers, Hisaka Works, Ltd., Güntner Group GmbH, Funke Wärmeaustauscher Apparantebau GmbH, Danfoss, Chart Industries, Inc, API Heat Transfer, Alfa Laval |

Automotive Sector

Economic Growth

High Initial Cost

Maintenance Requirements

Customization Trends

Emerging Markets

Raw Material Costs

Competition

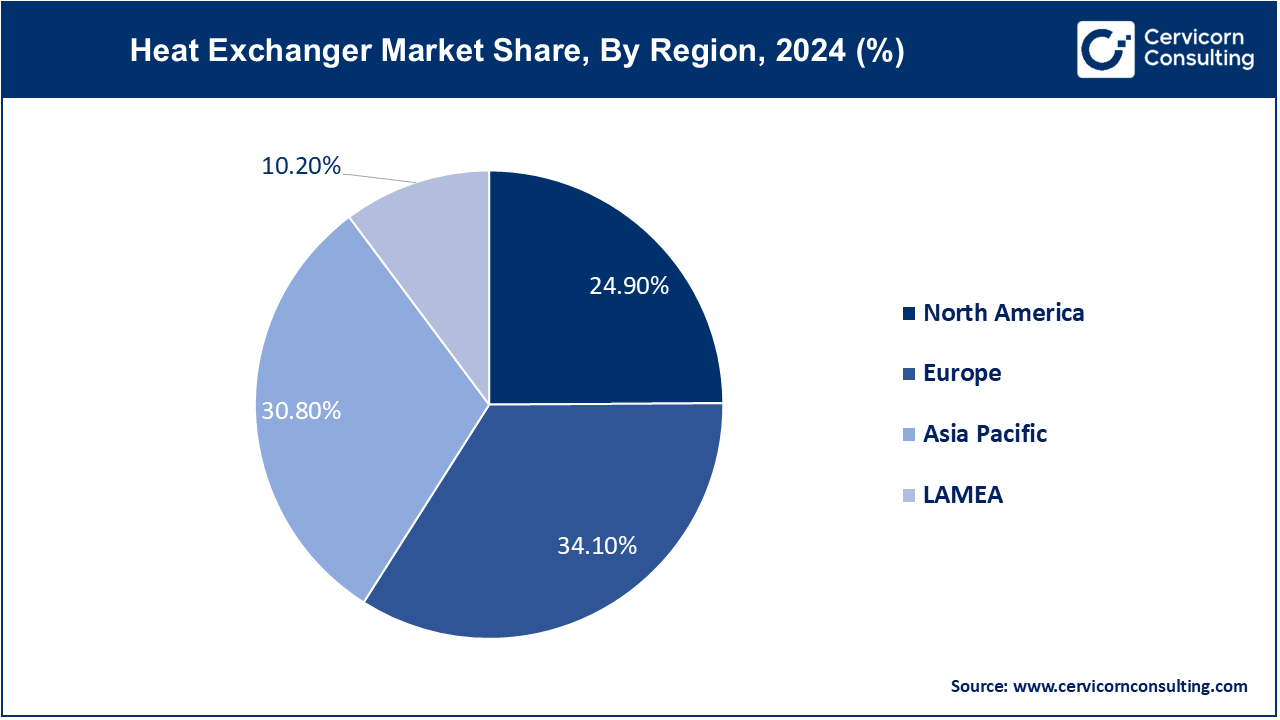

The heat exchanger market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

The North America heat exchanger market size was valued at USD 4.78 billion in 2024 and is expected to reach around USD 8.78 billion by 2034. The North America market is expected to grow owing to the professional industrial base in the field of industrial energy efficiency. Lead industries such as oil and gas, power generation, and HVAC are greatly dependent on the performance enhancement given by heat exchangers. The U.S. and Canada stand out as major markets-since, they have severe environmental regulations and renewable energy technology where they can flourish further. Besides, the food and beverage and automobile industries have increasingly begun to use the heat exchanger, thus driving betterment in the sector.

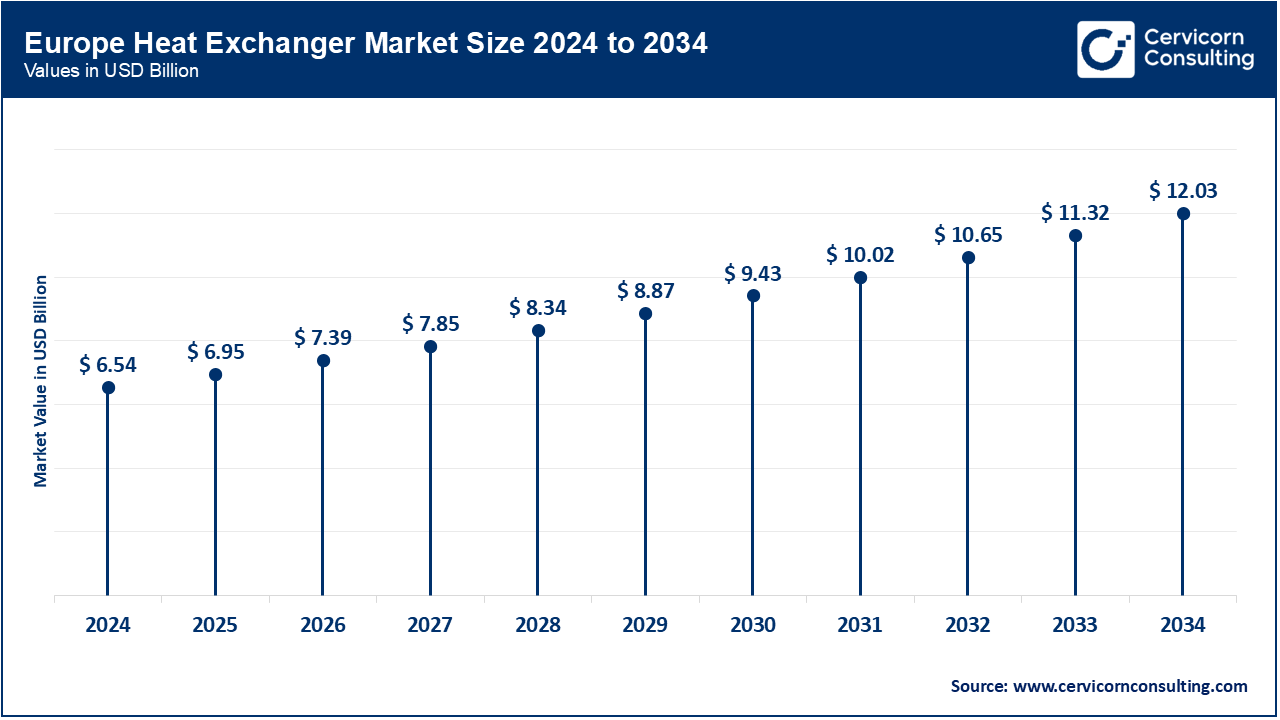

The Europe heat exchanger market size was estimated at USD 6.54 billion in 2024 and is expected to reach around USD 12.03 billion by 2034. The European market receives impetus from the continent's heavy focus on energy conservation, sustainability, and close-knit adherence to environmental regulations. Europe is fully industrialized with its big sectors being chemical processing, HVAC and power-generation, setting off size demand for heat exchangers. Countries such as Germany, France, and the United Kingdom are playing the lead role, focusing on renewable energy integration and systems for waste energy recovery. The changing market demand for the introduction of advanced technologies such as the compact and high-efficiency heat exchangers in line with green energy goals in Europe also strengthens the industry.

The Asia-Pacific heat exchanger market size was accounted for USD 5.91 billion in 2024 and is projected to hit around USD 10.86 billion by 2034. The Asia-Pacific region is the largest growing market, driven by quick urbanization, industrialization, and infrastructure. The primary market of China, India, and Japan is growing in chemicals and processing, power generators, and HVAC. This in addition to the region highlighting its growing emphasis on energy efficiency and alternative source of energy. The growth of the sector is further buoyed by the rising demand for residential and commercial HVAC systems in Asia-Pacific countries due to the increasing urban population.

The LAMEA heat exchanger market size was valued at USD 1.96 billion in 2024 and is predicted to surpass around USD 3.60 billion by 2034. The Latin America, Middle East, and Africa (LAMEA) region is moderately developing. The market is majorly driven by the fuel demands and increasing industrialization. The Middle East is the major industry for oil and gas, while Latin America operates within chemical processing and foods industries, contributing to the market growth. In Africa, due to the increasing focus on infrastructure development and water management, there exist opportunities for the market. The economic challenges and limited industrialization in some regions are two major problems.

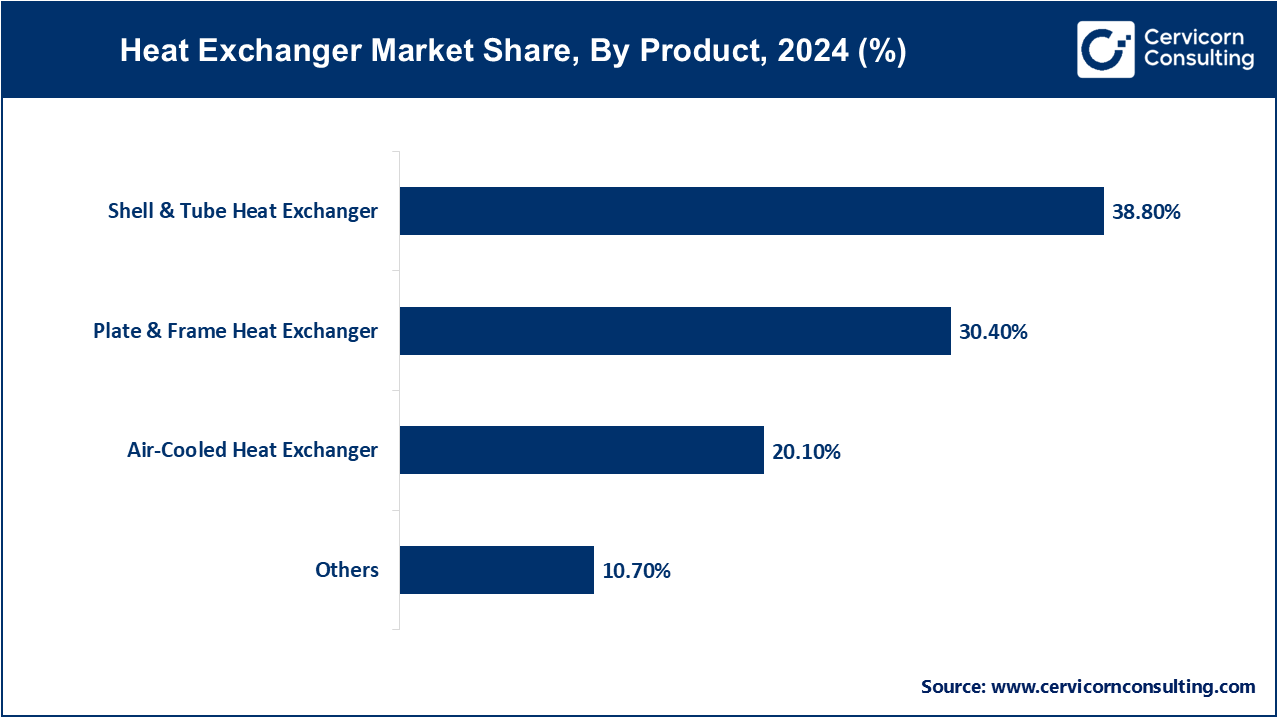

Plate & Frame Heat Exchanger: The Plate & Frame Heat Exchanger segment is projected to witness high growth over the forecast period. Heat exchangers based on plate frame are very popular for their miniaturized size, high thermal performance, and simple maintenance. They are constructed by stacking thin sheets, and so efficient heat exchange between fluids is possible without mixing. Such exchangers are suitable for the usage in the applications like HVAC, food & beverage and chemical industry owing to the pressure and temperature and pressure capability.

Shell & Tube Heat Exchanger: The Shell and tube heat exchangers segment has dominated the market in 2024. Shell and tube heat exchangers are the oldest and most widely used kind of heat exchangers in virtue of its excellent construction and strong capability to withstand high temperatures and pressures. Made of a stack of tubes encased in a shell, these heat exchangers offer efficient heat exchange between two fluids and can be applied to process heavy industry, such as oil and gas production, power generations, petrochemicals, and so on. Being both robust and able to better tolerate extreme operational conditions, they are the option to allow such large-scale applications.

Air-Cooled Heat Exchanger: Air-cooled heat exchangers (ACHEs) have recently become very popular owing to non-polluting and water-conserving characteristics. These coolers exploit ambient air to cool liquids, thus dispensing with the use of water as a means for cooling. ACHEs are widely implemented in such industries as oil and gas, power generation, and petrochemicals, particularly in areas with water shortages. Due to its low operating cost and environmental impact, it can be considered as a green alternative to the aqueous cooling systems.

Others: The specialist items of the "Others" category with respect to the heat exchanger market are welded, brazed, and spiral heat exchangers. These exchangers are for very specific uses which need them to be small, have excellent corrosion resistance, and be able to use very viscous fluids. Welded and brazed exchangers are widely employed in the chemical and pharmaceutical sector, while spiral exchangers are more appreciated for sludge treatment or for applications with the possibility of fouling. Such products offer custom solutions to the specific industrial issues and, in consequence, they are contributing to the innovative design of heat transfer technologies.

Metal: The metal segment has dominated the market in 2024. Metal heat exchangers (commonly produced by stainless steel, copper and aluminum) are the sales leaders, due to its high thermal conductivity, strength and corrosion resistance. Stainless steel is very commonly employed because of its general utility, its resistance to high temperature, and its compliance in a hygienic environment (food and pharmaceuticals). Copper exhibits high thermal transport efficiency, which is makes it suitable for the cooling systems of HVACs and electronic devices, whereas aluminum is highly valued for automobile and aerospace applications due to its low weight.

Alloys: Alloy heat exchangers are being adopted to a greater extent due to their enhanced strength, corrosion resistance, and performance at extreme conditions. Titanium alloys, nickel and Inconel alloys are widely used for chemical processing, marine and power generation applications. Titanium, for instance, has excellent seawater corrosion properties, and is thus attractive in the context of desalination plants. Nickel-based alloys are all around us, and are suitable for high-temperature-high-pressure applications, which at the same time will assure the reliability of key applications.

Others: The "Others" group consists of non-metallic materials such as graphite, ceramics and composites, many of which are becoming increasingly relevant in niche applications where resistance to very aggressive chemical substances is necessary. Graphite heat exchangers are widely used in chemical industry due to their excellent thermal conductivity and corrosion resistance. Due to good resistance to the working conditions of high temperature, ceramics have been applied satisfactorily in high-temperature work, e.g., incineration, and gas turbine.

Chemical & Petrochemical: The chemical and petrochemical segment has dominated the market in 2024. In the chemical and petrochemical industry, the role of heat exchangers is of great importance since various processes need fine temperature control including distillation, condensation and reaction cooling. Heat exchangers play a crucial role in the performance and safety of operations with corrosive chemicals and hot fluids. Materials, for example, stainless steel, titanium, and alloys are favoured for their corrosion resistance and robustness.

Oil & Gas: The Oil & Gas segment is expected to witness strong growth over the forecast period. The heat exchanger is an important device that gasoline and oil production industries use for the refinery, gas compression and cooling requirements. Such kind of systems allows high-efficient heat transfer even in high-pressure and high-temperature conditions of significance for crude oil processing, liquefied natural gas (LNG) and petrochemical industry. Heat exchangers are built to handle harsh conditions, e.g., acid fluids and high temperature conditions.

Heat Exchanger Market Revenue Share, By End-Use, 2024 (%)

| End-Use | Revenue Share, 2024 (%) |

| Chemical & Petrochemical | 23.70% |

| Oil & Gas | 21.20% |

| HVAC & Refrigeration | 18.70% |

| Power Generation | 14.10% |

| Food & Beverage | 11.80% |

| Pulp & Paper | 5.20% |

| Others | 8.30% |

HVAC & Refrigeration: Heat exchangers are the core of HVAC, refrigeration, and other temperature control systems and have been important for providing good heating, cooling, and ventilation in residential, commercial, and industrial buildings. These systems are made on the basis of miniaturized, compact, and extremely efficient heat exchangers through which it is possible to obtain an optimum indoor climate using a small amount of energy. Plate, finned-tube- and air-cooled heat exchangers are widely exploited because of their small dimension and good efficiency.

Power Generation: Power plants (fossil, nuclear, and renewable power plants) make use of heat exchangers to extract the ultimate amount of energy and cooling. Shell-and-tube heat exchangers are employed in thermal and nuclear power plants for controlling condensate condensation and sensible heat recovery and in the smart exploitation of renewable energies (geothermal and solar thermal steam generators), and in the case of plate heat exchangers, losses are minimized. With the increasing demand for energy and the increasing promotion of clean power generation techniques, it is necessary both for the stability and high performance of heat exchangers.

Food & Beverage: The food and beverage industry employs heat exchangers in the pasteurization, sterilization, and chilled process stage and as a result guarantees safe and quality products. These plate heat exchangers are widely used in this field because of the hygienic design and easy cleanability that fully conform to the strict food hygiene conditions. Applications range from dairy products and juices through to processed foods and brewing industries, etc.

Pulp & Paper: Heat exchangers are needed in the pulp and paper industry for, for example, pulping (hydrolysis), bleaching and paper drying applications, etc. Those stages are performed at high temperature and in a corrosive environment, and therefore corrosion-resistant and corrosion-pened heat exchangers are required. Heat exchangers, shell-and-tube and spiral, are commonly used as it allows to work effectively at high fluid flow rates.

Others: For "Others," there are highly narrow specializations (pharmaceuticals, textiles, marine technologies) where, by definition, heat exchangers occupy a small niche. In the pharmaceutical domain, heat exchangers are employed to regulate temperature precisely for drug formulation and sterilization. They are also applied to textiles for coloration and drying as well as to marine applications for seawater cooling and energy recovery.

Market Segmentation

By Product

By Material

By End-Use

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Heat Exchanger

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Product Overview

2.2.2 By Material Overview

2.2.3 By End User Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Automotive Sector

4.1.1.2 Economic Growth

4.1.2 Market Restraints

4.1.2.1 High Initial Cost

4.1.2.2 Maintenance Requirements

4.1.3 Market Challenges

4.1.3.1 Raw Material Costs

4.1.3.2 High Competition

4.1.4 Market Opportunities

4.1.4.1 Customization Trends

4.1.4.2 Emerging Markets

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Heat Exchanger Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Heat Exchanger Market, By Product

6.1 Global Heat Exchanger Market Snapshot, By Product

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Air-Cooled Heat Exchanger

6.1.1.2 Shell & Tube Heat Exchanger

6.1.1.3 Plate & Frame Heat Exchanger

6.1.1.4 Others

Chapter 7. Heat Exchanger Market, By Material

7.1 Global Heat Exchanger Market Snapshot, By Material

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Metals

7.1.1.2 Alloys

7.1.1.3 Others

Chapter 8. Heat Exchanger Market, By End-User

8.1 Global Heat Exchanger Market Snapshot, By End-User

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Chemical & Petrochemical

8.1.1.2 Oil & Gas

8.1.1.3 HVAC & Refrigeration

8.1.1.4 Pulp & Paper

8.1.1.5 Food & Beverage

8.1.1.6 Power Generation

8.1.1.7 Others

Chapter 9. Heat Exchanger Market, By Region

9.1 Overview

9.2 Heat Exchanger Market Revenue Share, By Region 2024 (%)

9.3 Global Heat Exchanger Market, By Region

9.3.1 Market Size and Forecast

9.4 North America

9.4.1 North America Heat Exchanger Market Revenue, 2022-2034 ($Billion)

9.4.2 Market Size and Forecast

9.4.3 North America Heat Exchanger Market, By Country

9.4.4 U.S.

9.4.4.1 U.S. Heat Exchanger Market Revenue, 2022-2034 ($Billion)

9.4.4.2 Market Size and Forecast

9.4.4.3 U.S. Market Segmental Analysis

9.4.5 Canada

9.4.5.1 Canada Heat Exchanger Market Revenue, 2022-2034 ($Billion)

9.4.5.2 Market Size and Forecast

9.4.5.3 Canada Market Segmental Analysis

9.4.6 Mexico

9.4.6.1 Mexico Heat Exchanger Market Revenue, 2022-2034 ($Billion)

9.4.6.2 Market Size and Forecast

9.4.6.3 Mexico Market Segmental Analysis

9.5 Europe

9.5.1 Europe Heat Exchanger Market Revenue, 2022-2034 ($Billion)

9.5.2 Market Size and Forecast

9.5.3 Europe Heat Exchanger Market, By Country

9.5.4 UK

9.5.4.1 UK Heat Exchanger Market Revenue, 2022-2034 ($Billion)

9.5.4.2 Market Size and Forecast

9.5.4.3 UKMarket Segmental Analysis

9.5.5 France

9.5.5.1 France Heat Exchanger Market Revenue, 2022-2034 ($Billion)

9.5.5.2 Market Size and Forecast

9.5.5.3 FranceMarket Segmental Analysis

9.5.6 Germany

9.5.6.1 Germany Heat Exchanger Market Revenue, 2022-2034 ($Billion)

9.5.6.2 Market Size and Forecast

9.5.6.3 GermanyMarket Segmental Analysis

9.5.7 Rest of Europe

9.5.7.1 Rest of Europe Heat Exchanger Market Revenue, 2022-2034 ($Billion)

9.5.7.2 Market Size and Forecast

9.5.7.3 Rest of EuropeMarket Segmental Analysis

9.6 Asia Pacific

9.6.1 Asia Pacific Heat Exchanger Market Revenue, 2022-2034 ($Billion)

9.6.2 Market Size and Forecast

9.6.3 Asia Pacific Heat Exchanger Market, By Country

9.6.4 China

9.6.4.1 China Heat Exchanger Market Revenue, 2022-2034 ($Billion)

9.6.4.2 Market Size and Forecast

9.6.4.3 ChinaMarket Segmental Analysis

9.6.5 Japan

9.6.5.1 Japan Heat Exchanger Market Revenue, 2022-2034 ($Billion)

9.6.5.2 Market Size and Forecast

9.6.5.3 JapanMarket Segmental Analysis

9.6.6 India

9.6.6.1 India Heat Exchanger Market Revenue, 2022-2034 ($Billion)

9.6.6.2 Market Size and Forecast

9.6.6.3 IndiaMarket Segmental Analysis

9.6.7 Australia

9.6.7.1 Australia Heat Exchanger Market Revenue, 2022-2034 ($Billion)

9.6.7.2 Market Size and Forecast

9.6.7.3 AustraliaMarket Segmental Analysis

9.6.8 Rest of Asia Pacific

9.6.8.1 Rest of Asia Pacific Heat Exchanger Market Revenue, 2022-2034 ($Billion)

9.6.8.2 Market Size and Forecast

9.6.8.3 Rest of Asia PacificMarket Segmental Analysis

9.7 LAMEA

9.7.1 LAMEA Heat Exchanger Market Revenue, 2022-2034 ($Billion)

9.7.2 Market Size and Forecast

9.7.3 LAMEA Heat Exchanger Market, By Country

9.7.4 GCC

9.7.4.1 GCC Heat Exchanger Market Revenue, 2022-2034 ($Billion)

9.7.4.2 Market Size and Forecast

9.7.4.3 GCCMarket Segmental Analysis

9.7.5 Africa

9.7.5.1 Africa Heat Exchanger Market Revenue, 2022-2034 ($Billion)

9.7.5.2 Market Size and Forecast

9.7.5.3 AfricaMarket Segmental Analysis

9.7.6 Brazil

9.7.6.1 Brazil Heat Exchanger Market Revenue, 2022-2034 ($Billion)

9.7.6.2 Market Size and Forecast

9.7.6.3 BrazilMarket Segmental Analysis

9.7.7 Rest of LAMEA

9.7.7.1 Rest of LAMEA Heat Exchanger Market Revenue, 2022-2034 ($Billion)

9.7.7.2 Market Size and Forecast

9.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 10. Competitive Landscape

10.1 Competitor Strategic Analysis

10.1.1 Top Player Positioning/Market Share Analysis

10.1.2 Top Winning Strategies, By Company, 2022-2024

10.1.3 Competitive Analysis By Revenue, 2022-2024

10.2 Recent Developments by the Market Contributors (2024)

Chapter 11. Company Profiles

11.1 Xylem Inc

11.1.1 Company Snapshot

11.1.2 Company and Business Overview

11.1.3 Financial KPIs

11.1.4 Product/Service Portfolio

11.1.5 Strategic Growth

11.1.6 Global Footprints

11.1.7 Recent Development

11.1.8 SWOT Analysis

11.2 SPX FLOW, Inc.

11.3 Southern Heat Exchanger Corporation

11.4 Mersen

11.5 Koch Heat Transfer Company

11.6 Kelvion Holding GmbH

11.7 Johnson Controls International

11.8 HRS Heat Exchangers

11.9 Hisaka Works, Ltd.

11.10 Güntner Group GmbH

11.11 Funke Wärmeaustauscher Apparantebau GmbH

11.12 Danfoss

11.13 Chart Industries, Inc

11.14 API Heat Transfer

11.15 Alfa Laval