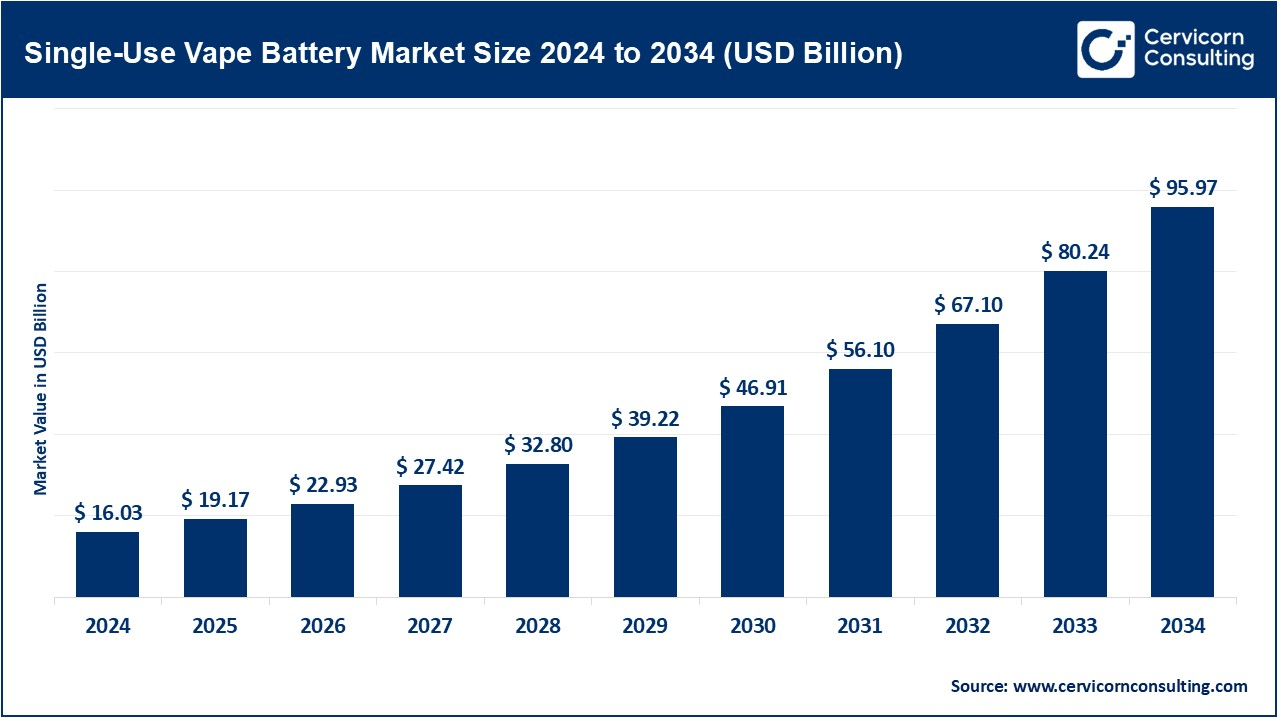

The global single-use vape battery market size was valued at USD 16.03 billion in 2024 and is expected to reach around USD 95.97 billion by 2034, growing at a compound annual growth rate (CAGR) of 19.59% during the forecast period 2025 to 2034.

The single-use vape battery market is a market for disposable vape batteries that deals specifically with batteries found in single-use (disposable) vaping devices. These, on the other hand, are rechargeable disposable devices filled with e-liquid and powered by integrated single-use batteries with convenience and ease of use in mind. Disposable vaping devices are convenient, needing no charging or maintenance. The market growth is due to vaping as an alternative, better battery technology, and disposable product preference. That aside, environmental and regulatory factors may alter the trajectory of growth for the market moving forward. Different countries are beginning to impose stricter regulations on vaping products. That means that specific flavors might get banned, or taxes may get introduced; such will in a major way influence the way the market functions, whether due to a decline in growth or guidance thereof. The US is one of the biggest markets for disposable vapes and single-use batteries, driven by smokers and recreational vapers. The APAC region is growing quickly due to rising incomes, smoking alternatives, and a young population, particularly in China, Japan, and South Korea.

A growing requirement for compact, high-performance batteries represents a significant market trend within the sector. As the market for disposable e-cigarettes and pods continues to expand, the industry needs to evolve and improve its battery technology. Several companies in the industry are also working on improving the key features of their product, such as higher energy density and faster charging time, to appeal to their customers. One of the key vectors of the industry is, therefore, developing technological innovations to meet the ever-growing demands of consumers. The increasing popularity of consumer electronics such as smartphones and tablets is providing ample opportunities for companies to develop their product range and improve the features of their products. Over the years, companies have developed batteries based on new materials and manufacturing processes, allowing market participants to become leading players in the premium sector of the growing e-cigarette market, where all product characteristics such as performance, safety, and reliability are crucial.

Disposable vape batteries represent a category of devices characterized by their non-removable, built-in batteries, which are typically pre-charged and integral to the operational system. These convenient apparatuses are frequently employed in conjunction with disposable or pre-filled e-liquid pods. Once the e-liquid has been depleted or the battery has reached its capacity limit (thereby rendering it empty), the entire unit is disposed of. Disposable vape batteries offer various flavors and nicotine levels but have shorter lifespans, raising environmental concerns.

The market has expanded substantially in recent years, largely attributable to the burgeoning popularity of disposable e-cigarettes. The industry has experienced rapid growth; many individuals favor the simplicity (and convenience) of portable devices rather than the complexities associated with reusable e-cigarette systems and traditional smoking. However, challenges persist because stricter regulations, environmental concerns, and health risks demand attention. Although companies must adapt to evolving customer preferences, this necessitates the provision of greener alternatives while also complying with requisite regulations.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 19.17 Billion |

| Expected Market Size in 2034 | USD 95.97 Billion |

| Projected CAGR 2025 to 2034 | 19.59% |

| Key Segments | Type, Application, Distribution Channel, Region |

| Key Companies | JUUL Labs, British American Tobacco (BAT), Altria Group, Inc., MXJO, Phillip Morris International (PMI), LG Chem, Imperial Brands, Efest Battery Technology, Samsung SDI, Sony, VapePower, Murata, Wismec, SMOK, Vaporesso, Aspire, Sigelei, GeekVape, KangerTech, Joyetech, Innokin, Panasonic |

Regulation Assistance and Expanding Legalization

Escalating Cultural and Social Transformations

High Environmental Pollution

Complexities of Disposable Vaporizers

Global Market Expansion and Accessibility

Developments in Vaping Device Technology

Limited Market Awareness

The Danger of Improper Disposal

Lithium-ion Batteries: The remarkable cost-effectiveness, efficiency, and compact design of these batteries make them a popular choice in disposable vaporizers. Users often prefer them for their outstanding performance and long-lasting durability.

Nickel-metal Hydride (NiMH) Batteries: Although less frequent, they are utilized in several disposable devices because of their durability and therapeutic efficacy. These are commonly used for their safety and environmental benefits, despite lower energy density.

Alkaline Batteries: Alkaline batteries are uncommon in disposable vaporizers but may appear in budget devices. Compared to lithium-ion batteries, they are often less expensive but perform worse.

Disposable Vape Pens: Disposable vaporizers are equipped with pre-filled e-liquid and feature an integrated battery. When either the battery depletes or the e-liquid is exhausted, the device is intended for disposal. This category of product represents the predominant type utilized in the current market.

Pre-filled Vape Cartridges: These are disposable cartridges containing e-liquid that are usually connected to a compatible disposable battery. Once the liquid is used up or the battery is dead, the entire cartridge is discarded.

Online: Disposable vaporizers are increasingly being purchased through e-commerce platforms, offering convenience and access to a variety of brands and products.

Specialty Vape Shops: Stores that sell only vaping supplies and provide a more specialized range of disposable vaporizers.

The single-use vape battery market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

North America: The disposable e-cigarette battery industry in North America has expanded rapidly in response to increased customer demand for simple-to-use disposable e-cigarettes. The growing popularity of e-cigarettes as a smoking cessation method has contributed to the expansion of this sector. Individuals with varying levels of smoking experience can derive advantages from these products. In the U.S. and Canada, many individuals experience chaotic lifestyles that become more manageable due to convenient access to transportation. Regulatory barriers, environmental concerns, and competition from alternate smoking cessation techniques are some of the market's obstacles. Nonetheless, new product advancements and marketing techniques are expected to help move the business ahead, despite these hurdles.

Europe: A significant number of European consumers consider electronic cigarettes to be a healthier alternative to conventional smoking. E-cigarettes and other disposable vaping devices are increasingly popular due to their user-friendly nature and appeal to smokers transitioning to vaping. European governments typically back vaping devices, particularly disposable ones, in an attempt to help people quit smoking. Disposable e-cigarettes are seen as a less harmful option, which adds to their popularity as European health rules place a greater emphasis on quitting smoking. Despite regulatory concerns, the market for disposable vaping devices is expected to grow throughout Europe, particularly in the UK and France.

Asia-Pacific: The Asia Pacific disposable nicotine addiction battery market is expanding rapidly as a result of shifting customer preferences, greater disposable income, and rise in consumer awareness of vaping as a smoking cessation method. The market is still developing in many countries but is expected to grow, especially in China, Japan, South Korea, and Australia. As incomes rise in China, India, South Korea, and Southeast Asia, more people can afford disposable vaporizers. While countries like Thailand, Indonesia, and the Philippines see rising popularity, some regulations may limit growth. The promotion of vaping as a smoking cessation tool in Australia and New Zealand has contributed to a growing acceptance of disposable vaporizers over traditional smoking practices.

LAMEA: Vaporizers sold as a safer alternative to traditional smoking have gained significant market share, especially in regions with extremely high smoking prevalence, such as Latin America and Africa, which have among the highest rates worldwide. Smoking is a widespread practice in the Middle East, particularly in countries such as Saudi Arabia and the United Arab Emirates, leading to a need for products to assist individuals in quitting smoking. In Latin America, disposable e-cigarettes are growing in popularity mostly because of their straightforward design and ease of use, which enables users to vape without the need for refills or charging. As disposable income increases and smoking rates continue to climb in South Africa, Nigeria, and Kenya, the prevalence of these vaporizers is increasing. Egypt and Lebanon, on the other hand, exhibit growing potential for vaping goods due to urbanization and health consciousness.

CEO Statements

Frank Chur, President and CEO of Joyetech:

Simon Lai, Chairman and CEO of Vaporesso:

Market Segmentation

By Type

By Application

By Distribution Channel

By Region

Chapter 1. Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of Single-Use Vape Battery

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2. Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Type Overview

2.2.2 By Distribution Channel Overview

2.2.3 By Application Overview

2.3 Competitive Overview

Chapter 3. Global Impact Analysis

3.1 Russia-Ukraine Conflict: Global Market Implications

3.2 Regulatory and Policy Changes Impacting Global Markets

Chapter 4. Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Regulation Assistance and Expanding Legalization

4.1.1.2 Escalating Cultural and Social Transformations

4.1.2 Market Restraints

4.1.2.1 High Environmental Pollution

4.1.2.2 Complexities of Disposable Vaporizers

4.1.3 Market Challenges

4.1.3.1 Limited Market Awareness

4.1.3.2 The Danger of Improper Disposal

4.1.4 Market Opportunities

4.1.4.1 Global Market Expansion and Accessibility

4.1.4.2 Developments in Vaping Device Technology

4.2 Market Trends

Chapter 5. Premium Insights and Analysis

5.1 Global Single-Use Vape Battery Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6. Single-Use Vape Battery Market, By Type

6.1 Global Single-Use Vape Battery Market Snapshot, By Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 Lithium-ion Batteries

6.1.1.2 Nickel-metal Hydride (NiMH) Batteries

6.1.1.3 Alkaline Batteries

Chapter 7. Single-Use Vape Battery Market, By Distribution Channel

7.1 Global Single-Use Vape Battery Market Snapshot, By Distribution Channel

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Online

7.1.1.2 Specialty Vape Shops

Chapter 8. Single-Use Vape Battery Market, By Application

8.1 Global Single-Use Vape Battery Market Snapshot, By Application

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Disposable Vape Pens

8.1.1.2 Pre-filled Vape Cartridges

Chapter 9. Single-Use Vape Battery Market, By Region

9.1 Overview

9.2 Single-Use Vape Battery Market Revenue Share, By Region 2024 (%)

9.3 Global Single-Use Vape Battery Market, By Region

9.3.1 Market Size and Forecast

9.4 North America

9.4.1 North America Single-Use Vape Battery Market Revenue, 2022-2034 ($Billion)

9.4.2 Market Size and Forecast

9.4.3 North America Single-Use Vape Battery Market, By Country

9.4.4 U.S.

9.4.4.1 U.S. Single-Use Vape Battery Market Revenue, 2022-2034 ($Billion)

9.4.4.2 Market Size and Forecast

9.4.4.3 U.S. Market Segmental Analysis

9.4.5 Canada

9.4.5.1 Canada Single-Use Vape Battery Market Revenue, 2022-2034 ($Billion)

9.4.5.2 Market Size and Forecast

9.4.5.3 Canada Market Segmental Analysis

9.4.6 Mexico

9.4.6.1 Mexico Single-Use Vape Battery Market Revenue, 2022-2034 ($Billion)

9.4.6.2 Market Size and Forecast

9.4.6.3 Mexico Market Segmental Analysis

9.5 Europe

9.5.1 Europe Single-Use Vape Battery Market Revenue, 2022-2034 ($Billion)

9.5.2 Market Size and Forecast

9.5.3 Europe Single-Use Vape Battery Market, By Country

9.5.4 UK

9.5.4.1 UK Single-Use Vape Battery Market Revenue, 2022-2034 ($Billion)

9.5.4.2 Market Size and Forecast

9.5.4.3 UKMarket Segmental Analysis

9.5.5 France

9.5.5.1 France Single-Use Vape Battery Market Revenue, 2022-2034 ($Billion)

9.5.5.2 Market Size and Forecast

9.5.5.3 FranceMarket Segmental Analysis

9.5.6 Germany

9.5.6.1 Germany Single-Use Vape Battery Market Revenue, 2022-2034 ($Billion)

9.5.6.2 Market Size and Forecast

9.5.6.3 GermanyMarket Segmental Analysis

9.5.7 Rest of Europe

9.5.7.1 Rest of Europe Single-Use Vape Battery Market Revenue, 2022-2034 ($Billion)

9.5.7.2 Market Size and Forecast

9.5.7.3 Rest of EuropeMarket Segmental Analysis

9.6 Asia Pacific

9.6.1 Asia Pacific Single-Use Vape Battery Market Revenue, 2022-2034 ($Billion)

9.6.2 Market Size and Forecast

9.6.3 Asia Pacific Single-Use Vape Battery Market, By Country

9.6.4 China

9.6.4.1 China Single-Use Vape Battery Market Revenue, 2022-2034 ($Billion)

9.6.4.2 Market Size and Forecast

9.6.4.3 ChinaMarket Segmental Analysis

9.6.5 Japan

9.6.5.1 Japan Single-Use Vape Battery Market Revenue, 2022-2034 ($Billion)

9.6.5.2 Market Size and Forecast

9.6.5.3 JapanMarket Segmental Analysis

9.6.6 India

9.6.6.1 India Single-Use Vape Battery Market Revenue, 2022-2034 ($Billion)

9.6.6.2 Market Size and Forecast

9.6.6.3 IndiaMarket Segmental Analysis

9.6.7 Australia

9.6.7.1 Australia Single-Use Vape Battery Market Revenue, 2022-2034 ($Billion)

9.6.7.2 Market Size and Forecast

9.6.7.3 AustraliaMarket Segmental Analysis

9.6.8 Rest of Asia Pacific

9.6.8.1 Rest of Asia Pacific Single-Use Vape Battery Market Revenue, 2022-2034 ($Billion)

9.6.8.2 Market Size and Forecast

9.6.8.3 Rest of Asia PacificMarket Segmental Analysis

9.7 LAMEA

9.7.1 LAMEA Single-Use Vape Battery Market Revenue, 2022-2034 ($Billion)

9.7.2 Market Size and Forecast

9.7.3 LAMEA Single-Use Vape Battery Market, By Country

9.7.4 GCC

9.7.4.1 GCC Single-Use Vape Battery Market Revenue, 2022-2034 ($Billion)

9.7.4.2 Market Size and Forecast

9.7.4.3 GCCMarket Segmental Analysis

9.7.5 Africa

9.7.5.1 Africa Single-Use Vape Battery Market Revenue, 2022-2034 ($Billion)

9.7.5.2 Market Size and Forecast

9.7.5.3 AfricaMarket Segmental Analysis

9.7.6 Brazil

9.7.6.1 Brazil Single-Use Vape Battery Market Revenue, 2022-2034 ($Billion)

9.7.6.2 Market Size and Forecast

9.7.6.3 BrazilMarket Segmental Analysis

9.7.7 Rest of LAMEA

9.7.7.1 Rest of LAMEA Single-Use Vape Battery Market Revenue, 2022-2034 ($Billion)

9.7.7.2 Market Size and Forecast

9.7.7.3 Rest of LAMEAMarket Segmental Analysis

Chapter 10. Competitive Landscape

10.1 Competitor Strategic Analysis

10.1.1 Top Player Positioning/Market Share Analysis

10.1.2 Top Winning Strategies, By Company, 2022-2024

10.1.3 Competitive Analysis By Revenue, 2022-2024

10.2 Recent Developments by the Market Contributors (2024)

Chapter 11. Company Profiles

11.1 JUUL Labs

11.1.1 Company Snapshot

11.1.2 Company and Business Overview

11.1.3 Financial KPIs

11.1.4 Product/Service Portfolio

11.1.5 Strategic Growth

11.1.6 Global Footprints

11.1.7 Recent Development

11.1.8 SWOT Analysis

11.2 British American Tobacco (BAT)

11.3 Altria Group, Inc.

11.4 MXJO

11.5 Phillip Morris International (PMI)

11.6 LG Chem

11.7 Imperial Brands

11.8 Efest Battery Technology

11.9 Samsung SDI

11.10 Sony

11.11 VapePower

11.12 Murata

11.13 Wismec

11.14 SMOK (Shenzhen IVPS Technology)

11.15 Vaporesso