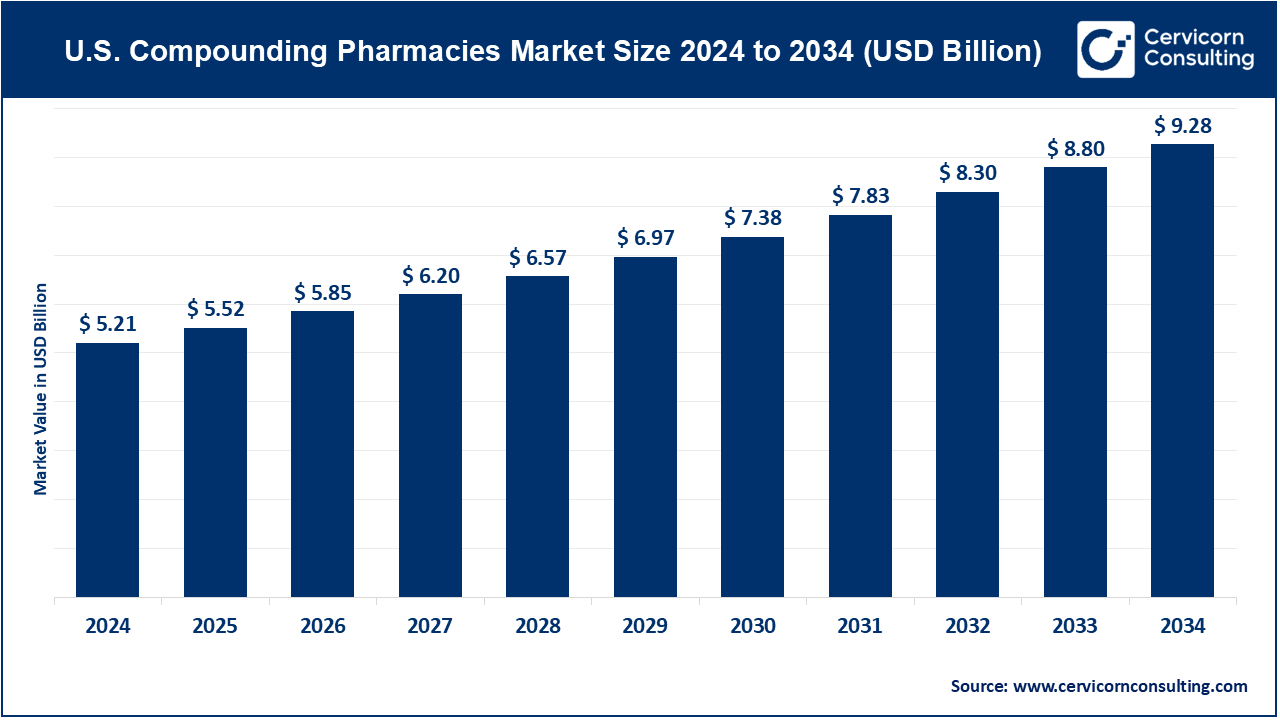

The U.S. compounding pharmacies market size was valued at USD 5.52 billion in 2025 and is expected to be worth around USD 9.28 billion by 2034, growing at a compound annual growth rate (CAGR) of 6% over the forecast period from 2025 To 2034.

The U.S. compounding pharmacy market is expanding due to increasing demand for personalized and alternative medication solutions. As more patients seek tailored treatments for conditions like hormonal imbalances, chronic pain, and rare diseases, compounding pharmacies are filling gaps left by traditional pharmaceutical options. The growth is further fueled by an aging population requiring unique formulations, such as altered dosages or easier-to-consume medication forms, particularly for children and the elderly. Additionally, the rising prevalence of medication allergies and shortages of commercially available drugs has made compounding pharmacies a vital resource. Innovations like sterile compounding for injectable medications and the growing use of bioidentical hormones for therapies are opening new opportunities. In October 2024, the U.S. exported USD 7.69 billion worth of pharmaceutical products, which helps the compounding pharmacy market grow. This growth encourages new ideas, better research, and more people learning about customized medicines. It also leads to partnerships and improvements in compounding pharmacy services, allowing them to meet special healthcare needs both in the U.S. and worldwide.

Compounding pharmacies create customized medications tailored to meet specific patient needs. Unlike standard pharmacies, they mix or alter ingredients to create unique prescriptions, such as changing dosages, combining medications, or removing allergens. These services are helpful for patients who need a specific formulation that isn't available commercially, such as a liquid version of a pill for children or flavored medications to improve taste. Compounding is regulated by the U.S. Food and Drug Administration (FDA) and state pharmacy boards to ensure safety and quality. Common areas include hormone replacement therapy, pain management, dermatology, and veterinary medicine.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 5.52 Billion |

| Projected Market Size (2034) | USD 9.28 Billion |

| Growth Rate (2025 to 2034) | 6% |

| Key Segments | Type, Product, Therapeutic Area, Age group, Compounding Type, Sterility, End User |

| Key Companies | Vertisis Custom Pharmacy, Triangle Compounding, Sixth Avenue Medical Pharmacy, PenCol Pharmacy, Fresenius Kabi USA, Fagron, Clinigen Limited, ImprimisRx (Harrow Health, Inc.), Central Admixture Pharmacy Services, Inc., Avella Specialty Pharmacy |

Rising Demand for Bioidentical Hormone Replacement Therapy (BHRT)

Rise in Chronic Diseases

High Operational Costs

Lack of Standardized Practices

Partnership with Healthcare Providers

Specialty Drug Compounding

Competition from Generic Pharmaceuticals

Limited Reimbursement

The U.S. compounding pharmacies market is segmented into type, therapeutic area, product, age group, compounding type, sterility, and end-user. Based on type, the market is classified into 503B, and 503A. Based on therapeutic area, the market is classified into nutritional supplements, dermatology, specialty drugs, pain management, and hormone replacement therapy. Based on product, the market is classified into oral, liquid preparations, topical, rectal, ophthalmic, nasal, and otic. Based on age group, the market is classified into geriatric, adult, and pediatric. Based on compounding type, the market is classified into pharmaceutical dosage alteration (PDA), currently unavailable pharmaceutical manufacturing (CUPM), and pharmaceutical ingredient alteration (PIA). Based on sterility, the market is classified into sterile, and non-sterile. Based on end-user, the market is classified into hospitals and clinics, specialty clinics, others.

503A: The 503A segment has accounted revenue share of 82% in 2024. These compounding pharmacies are kind of traditional pharmacies which makes the personalized medicines for the patients based on the specific prescription from the authorised healthcare professional. The section 503A of the Federal Food, Drug, and Cosmetic Act permits such pharmacies to compound medicines to fulfil the specific needs of the patients like adjusting dosage, mixing medicines, or removing allergies.

503B: The 503B segment has generated revenue share of 18% in 2024. The type of pharmacies are also known as outsourcing facilities. These are specialized pharmacies which operates under the section 503B of the Federal Food, Drug and Cosmetic Act. Such pharmacies can manufacture the compounded pharmacies in bulk without any requiring individual prescriptions which allows the pharmacies to supply hospitals, clinics, and the healthcare facilities in bulk.

Hormone Replacement Therapy (HRT): The compounded hormone replacement therapy especially BHRT includes manufacturing personalized formulas that mimics the body’s natural hormones which helps in offering more customized approach in comparison to mass-produced options. This is especially popular among the people who suffers from issues like thyroid issues, menopause, andropause, or other hormonal imbalances. Patients generally look for the compounded HRT as it can provide exact dosages and unique form of dosages such as creams, gels, injections, or capsules which are not usually available with commercial drugs.

Pain Management: The pain management segment has held revenue share of 31% in 2024. The pain management segment is an important and expanding area of the market as compounding pharmacies offers the personalizes solutions for the patients having chronic or acute pain who might not get relief from the medicines which are commercially available. Compounded pain management enables the making of personalized drugs to match the unique requirements of the patients who are suffering from situations such as arthritis, neuropathy, fibromyalgia, or post-surgical pain.

Specialty Drugs: Specialty drugs generally includes biologics, high-cost medications, or therapies, which caters the specific medical conditions like cancer, autoimmune diseases, and genetic disorders. When the commercially available options are not suitable owing to the dosage restrictions, allergies to inactive ingredients, or other patient requirements the compounded speciality medications offers an important substitute.

Dermatology: The dermatology segment offers treatments for the wide range of skin issues such as acne, eczema, psoriasis, rosacea, and hyperpigmentation. The compounded dermatology medications let the pharmacists to create medicines that caters the specific patient needs like blending active chemicals into single cream, gel, or lotion. Patients who might not react well to the commercially available treatments or may needs alternative concentrations and delivery methods will be benefited most from such customized approach.

Nutritional Supplements: The nutritional products that are made by compounding enables the pharmacists to customize vitamins, minerals, amino acids, and other nutrition to fulfil the particular dietary needs or health objectives. Patients who have the special dietary needs, allergies, or illness that impacts the nutritional absorption will be benefitted from this.

Pediatric: As the age, size, and developmental needs of paediatric patients vary widely, it is important to use exact dosages, alternate delivery systems, and kid-friendly flavors to ensure compliance. The compounding pharmacies can adjust treatment regimens by blending various medications into a single a single dose, adjusting medication strengths, and creating liquid formulations for kids who have issue in swallowing tablets.

Adults: Adults may need specialized care for a variety of ailments like hormone imbalances, pain management, mental health concerns, and chronic illness such as diabetes, hypertension, and autoimmune disorder. The compounded pharmacies can improve the convenience and efficacy of treatment by modifying doses, adjust formulations to eliminate allergens, or developing the substitute delivery systems like creams, gels, or sublingual pills.

Geriatric: The compounding pharmacies offers specialized like liquid for people who have trouble swallowing pills or transdermal gels for pain management, because seniors frequently need exact dosages or alternative formulations that are not available in the normal pharmaceuticals. Furthermore, the compounded medicines can remove the unnecessary additives or allergens which might result in adverse reactions in the geriatric population.

Pharmaceutical Ingredient Alteration (PIA): The PIA segment has accounted revenue share of 38% in 2024. The segment focuses on the modification or elimination of the specific ingredients in medications to better meet the needs of each patient. Patients who may be allergic, intolerant, or sensitive to any of the substances in mass-produced medications like preservatives, dyes, gluten, or lactose can be benefitted from the compounding medicines. The compounding pharmacies can make specialized formulations which enables patients in taking drug safely and without having any side-effects by adding, removing, or modifying such ingredients.

Currently Unavailable Pharmaceutical Manufacturing (CUPM): CUPM addresses the concern of drug shortages, discontinued products, or the niche medications that are not available commercially but are required by the patients. The compounding pharmacies in the CUPM are able to re-create these necessary medicines which ensures the continuity of care for the patients that depends on them for the management of the chronic diseases or particular health issues.

Pharmaceutical Dosage Alteration (PDA): The patients who needs the dosages that are non-standard which are not commercially available like the patients who needs reduce or gain dosages owing to weight, age, kidney or liver function, or sensitivity to medications. Compounded pharmacies are able to manufacture personalized formulations which exactly match the required dosage, improving effectiveness and safety of the treatment.

Sterile: The sterile segment has captured highest revenue share of 59% in 2024. The sterile segment is an important area which focuses on the creation of sterile medicines that are necessary for treatments including injections, eye drops, intravenous therapy, and surgical drugs which needs high standard of purity and safety. The sterile compounding involves strict process to make sure that the medicines don’t have any bacteria, pollutants, or harmful practices since the minor contamination can cause major health risks.

Non- Sterile: The non-sterile segment has held revenue share of 41% in 2024. The non-sterile segment of the compounding pharmacies focuses on the preparation of medicines which don’t need any sterile conditions such as creams, ointments, gels, capsules, and oral liquids. Such personalized medicine are used in various treatments which includes dermatological conditions, hormone replacement therapy, pain management, and pediatric care. The non-sterile compounding let the pharmacists to customize the dosage, flavor, or formulation of the medicines to meet the patient requirements.

The recent new entrants in the U.S compounding pharmacies industry are changing the landscape of the industry by investing in new technologies and business models. These new companies are embracing the new technologies like advanced automation, data management and digital services to provide compounded drugs more correctly and safely and making them readily available. For example, some entrepreneurs have created automated compounding technologies which reduce preparation time for custom medications and enhance workflow for conventional pharmacists. Other companies are extending the boundaries of compounding through tele pharmacy, in which patients can speak to a pharmacist by telephone or by video and receive customized medications in the mail.

CEO statements

Scott Brunner, CEO of the Alliance for Pharmacy Compounding (APC):

"Misconceptions about the industry may make clinicians reluctant to prescribe any compounded drug, even when a patient could benefit from a custom dosage or when an essential drug is in shortage, as is the case with GLP-1 agonists. "

Key players in the U.S. compounding pharmacies induistry have implemented diverse strategic initiatives to ensure continued growth, including mergers, collaborations, product development, and regional expansions. The initial phase of the COVID-19 pandemic, marked by significant disruptions, led to an increased focus on resilience and adaptability within the industry. In response, companies are now concentrating on developing innovative approaches to enhance compounding pharmacies solutions and meet evolving market demands. Some notable examples of key developments in the market include:

Market Segmentation

By Type

By Therapeutic Area

By Product

By Age Group

By Compounding Type

By Sterility

By End-User

Chapter 1 Market Introduction and Overview

1.1 Market Definition and Scope

1.1.1 Overview of U.S. Compounding Pharmacies

1.1.2 Scope of the Study

1.1.3 Research Timeframe

1.2 Research Methodology and Approach

1.2.1 Methodology Overview

1.2.2 Data Sources and Validation

1.2.3 Key Assumptions and Limitations

Chapter 2 Executive Summary

2.1 Market Highlights and Snapshot

2.2 Key Insights by Segments

2.2.1 By Type Overview

2.2.2 By Therapeutic Area Overview

2.2.3 By Product Overview

2.2.4 By Age Group Overview

2.2.5 By Compounding Type Overview

2.2.6 By Sterility Overview

2.2.7 By End-User Overview

2.3 Competitive Overview

Chapter 3 Impact Analysis

3.1 COVID 19 Impact on U.S. Compounding Pharmacies Market

3.1.1 COVID-19 Landscape: Pre and Post COVID Analysis

3.1.2 COVID 19 Impact: Major Government Policy

3.1.3 Market Trends and Opportunities in the COVID-19 Landscape

3.2 Russia-Ukraine Conflict: Market Implications

3.3 Regulatory and Policy Changes Impacting Markets

Chapter 4 Market Dynamics and Trends

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Rising Demand for Bioidentical Hormone Replacement Therapy (BHRT)

4.1.1.2 Rise in Chronic Diseases

4.1.2 Market Restraints

4.1.2.1 High Operational Costs

4.1.2.2 Lack of Standardized Practices

4.1.3 Market Opportunity

4.1.3.1 Partnership with Healthcare Providers

4.1.3.2 Specialty Drug Compounding

4.1.4 Market Challenges

4.1.4.1 Competition from Generic Pharmaceuticals

4.1.4.2 Limited Reimbursement

4.2 Market Trends

Chapter 5 Premium Insights and Analysis

5.1 U.S. Compounding Pharmacies Market Dynamics, Impact Analysis

5.2 Porter’s Five Forces Analysis

5.2.1 Bargaining Power of Suppliers

5.2.2 Bargaining Power of Buyers

5.2.3 Threat of Substitute Products

5.2.4 Rivalry among Existing Firms

5.2.5 Threat of New Entrants

5.3 PESTEL Analysis

5.4 Value Chain Analysis

5.5 Product Pricing Analysis

5.6 Vendor Landscape

5.6.1 List of Buyers

5.6.2 List of Suppliers

Chapter 6 U.S. Compounding Pharmacies Market, By Type

6.1 U.S. Compounding Pharmacies Market Snapshot, By Type

6.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

6.1.1.1 503B

6.1.1.2 503A

Chapter 7 U.S. Compounding Pharmacies Market, By Therapeutic Area

7.1 U.S. Compounding Pharmacies Market Snapshot, By Therapeutic Area

7.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

7.1.1.1 Nutritional Supplements

7.1.1.2 Dermatology

7.1.1.3 Specialty Drugs

7.1.1.4 Pain Management

7.1.1.5 Hormone Replacement Therapy

Chapter 8 U.S. Compounding Pharmacies Market, By Product

8.1 U.S. Compounding Pharmacies Market Snapshot, By Product

8.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

8.1.1.1 Oral

8.1.1.2 Liquid Preparations

8.1.1.3 Topical

8.1.1.4 Rectal

8.1.1.5 Ophthalmic

8.1.1.6 Nasal

8.1.1.7 Otic

Chapter 9 U.S. Compounding Pharmacies Market, By Age Group

9.1 U.S. Compounding Pharmacies Market Snapshot, By Age Group

9.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

9.1.1.1 Geriatric

9.1.1.2 Adult

9.1.1.3 Pediatric

Chapter 10 U.S. Compounding Pharmacies Market, By Compounding Type

10.1 U.S. Compounding Pharmacies Market Snapshot, By Compounding Type

10.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

10.1.1.1 Pharmaceutical Dosage Alteration (PDA)

10.1.1.2 Currently Unavailable Pharmaceutical Manufacturing (CUPM)

10.1.1.3 Pharmaceutical Ingredient Alteration (PIA)

Chapter 11 U.S. Compounding Pharmacies Market, By Sterility

11.1 U.S. Compounding Pharmacies Market Snapshot, By Sterility

11.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

11.1.1.1 Sterile

11.1.1.2 Non-Sterile

Chapter 12 U.S. Compounding Pharmacies Market, By End-User

12.1 U.S. Compounding Pharmacies Market Snapshot, By End-User

12.1.1 Market Revenue (($Billion) and Growth Rate (%), 2022-2034

12.1.1.1 Hospitals and Clinics

12.1.1.2 Specialty Clinics

12.1.1.3 Others

Chapter 13 U.S. Compounding Pharmacies Market, By Region

13.1 Overview

13.2 U.S. Compounding Pharmacies Market Revenue Share 2024 (%)

13.3 U.S. Market Segmental Analysis

Chapter 14 Competitive Landscape

14.1 Competitor Strategic Analysis

14.1.1 Top Player Positioning/Market Share Analysis

14.1.2 Top Winning Strategies, By Company, 2022-2024

14.1.3 Competitive Analysis By Revenue, 2022-2024

14.2 Recent Developments by the Market Contributors (2024)

Chapter 15 Company Profiles

15.1 Vertisis Custom Pharmacy

15.1.1 Company Snapshot

15.1.2 Company and Business Overview

15.1.3 Financial KPIs

15.1.4 Product/Service Portfolio

15.1.5 Strategic Growth

15.1.6 Footprints

15.1.7 Recent Development

15.1.8 SWOT Analysis

15.2 Triangle Compounding

15.3 Sixth Avenue Medical Pharmacy

15.4 PenCol Pharmacy

15.5 Fresenius Kabi USA

15.6 Fagron

15.7 Clinigen Limited

15.8 ImprimisRx (Harrow Health, Inc.)

15.9 Central Admixture Pharmacy Services, Inc.

15.10 Avella Specialty Pharmacy