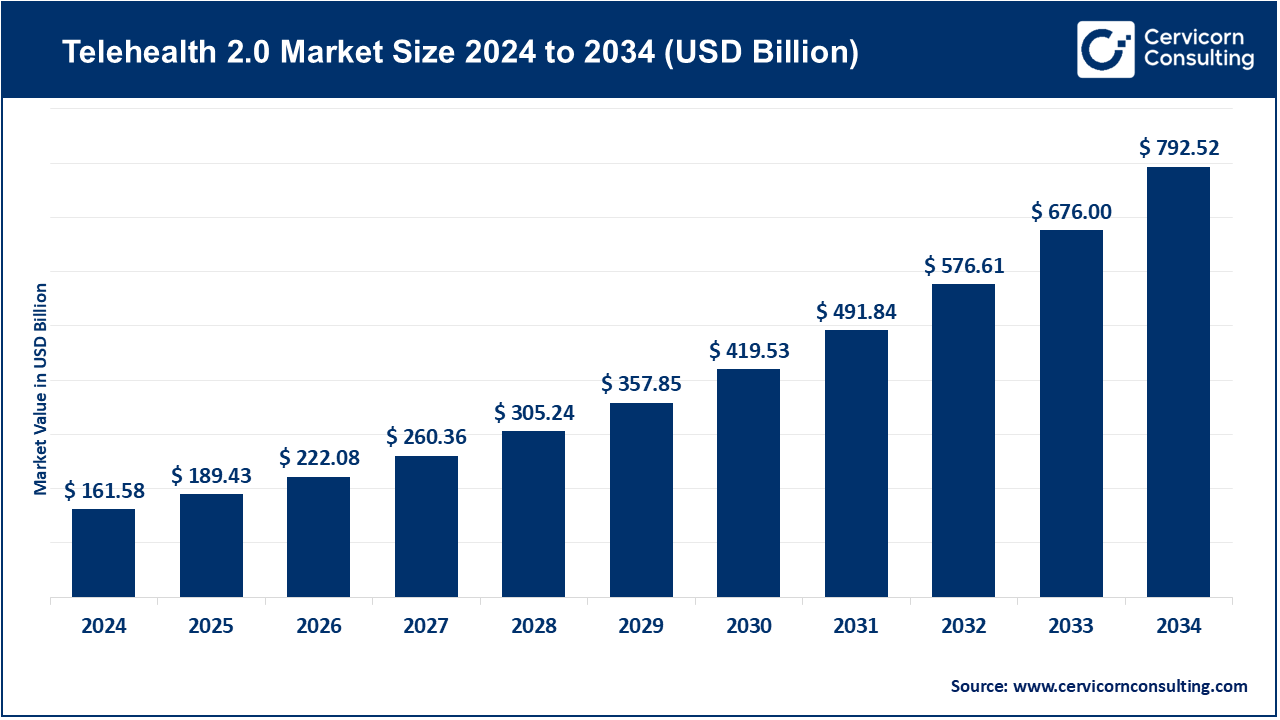

The global telehealth 2.0 market size was valued at USD 161.58 billion in 2024 and is anticipated to reach around USD 792.52 billion by 2034, growing at a compound annual growth rate (CAGR) of 17.24% over the forecast period from 2025 to 2034. The telehealth 2.0 market is experiencing tremendous growth in market share given the increasing need to access easy, affordable and technology driven health services. The growing chronic disease rates, aging population and health care workforce shortages are some of the factors contributing to it. The incorporation of AI, IoT devices, cloud platforms, and remote monitoring is streamlining care delivery and it is optimising efficiency. friendly government policies, reimbursement frameworks and investment in digital health infrastructure also spur growth. The rapid pace driven by consumers who want convenience, hybrid care and the personalized, digital health solutions provides evidence that Telehealth 2.0 is a transformative factor in the evolution of healthcare.

What is telehealth 2.0?

The telehealth 2.0 is the market of more than video-based consultations but solutions that focus on using the AI to generate diagnostics, integrating wearables, providing digital therapeutic approaches, and health analytics in real-time. These systems facilitate virtual-first care, continuous care and improved chronic disease management and provide connection to electronic health records. The future of telehealth is a game-changer as the solutions bring sustainability, scalability, and innovations with a patient-centric focus by reducing hospital dependency, expanding access to under-served regions, and overall supporting value-based care.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 189.43 Billion |

| Estimated Market Size in 2034 | USD 792.52 Billion |

| Expected CAGR 2025 to 2034 | 17.24% |

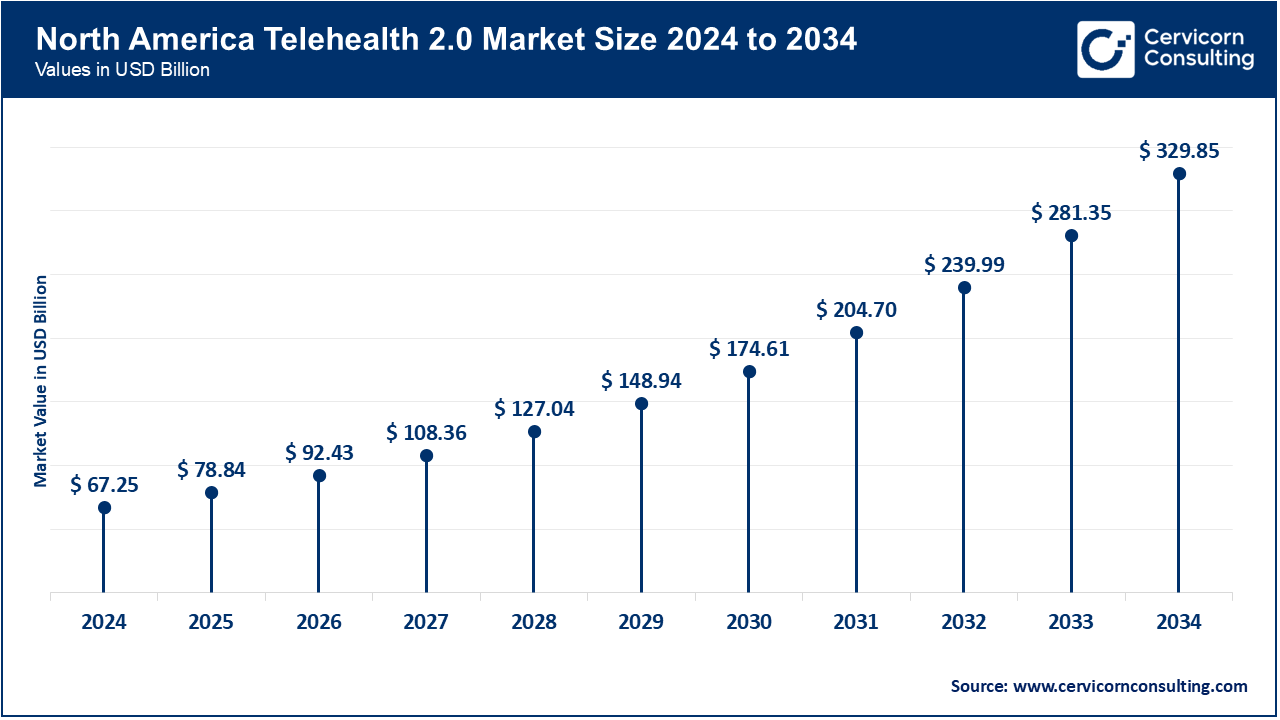

| Leading Region | North America |

| Fastest Expanding Region | Asia-Pacific |

| Key Segments | Component, Mode of Delivery, End User, Application, Region |

| Key Companies | Teladoc Health, Amwell, MDLIVE, Doctor on Demand, HealthTap, MDLink, 98point6, GlobalMed, SOC Teleme, PlushCare, Doxy.me, MeMD, Talkspace, Hims & Hers Health, Ro (Roman) |

The telehealth 2.0 market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region.

The region is performing best in the market due to favorable regulations, high levels of digital health adoption, and advanced infrastructure. The U.S. continues to reimburse telehealth for Medicare, allowing greater access to virtual care. There is also noteworthy public investment in AI-assisted telehealth aimed at rural populations in Canada, with a national pilot launched in Alberta in April 2025. Private sector innovation in telehealth is also strong. CVS Health telehealth centers were opened in five states in June 2025. This synergistic growth ensures Telehealth 2.0 keeps pace with the rest of the world.

Europe has a robust Telehealth 2.0 infrastructure resulting from the EU's initiatives on digital transformation and cross-border healthcare integration. The UK’s National Health Service (NHS) has adopted remote monitoring for chronic disease management. In May 2025, the NHS announced a national scale virtual ward expansion for the remote management of heart failure and COPD. Germany is leading the integration of telehealth and electronic health records with the ‘Digital Health Act,’ updates which commenced in April 2025. France is witnessing rapid growth of teleconsultations in mental health with a major platform expansion in Paris scheduled for June 2025. In Spain, teledermatology with integrated AI was launched nationally in July 2025. Collectively Europe is improving patient access and system efficiency with a digital-first approach.

The region is now seeing the emergence of Telehealth 2.0, which is being accelerated by the large population, urbanization, and the need for accessible healthcare services. China has implemented AI-integrated telehealth for the chronic disease care, launching a national diabetes monitoring program in Beijing in August 2025. We also note the continuing aggressive expansion of tele-consultation platforms in India, with Tata Digital Health launching telehealth hubs for the rural population in Uttar Pradesh in July 2025. Japan is testing telehealth services for the aged population with the “Silver Care Digital” telehealth program which started in May 2025. South Korea has also started utilizing 5G tele-consultation with the launch of Samsung-sponsored telehealth services in Seoul in June 2025. All these developments show the incorporation of advanced technologies to offer cost-effective and accessible healthcare services in the region.

Telehealth 2.0 Market Share, By Region, 2024 (%)

| Region | Revenue Share, 2024 (%) |

| North America | 41.62% |

| Europe | 24.80% |

| Asia-Pacific | 26.20% |

| LAMEA | 7.38% |

LAMEA integrates evolving technologies and healthcare at a different pace, often filling infrastructural and demographic gaps. Brazil is advancing telemedicine for public health delivery, with São Paulo launching a regional telehealth program for primary care in July 2025. A significant telemedicine program transformation is also taking place in the Middle East, where Saudi Arabia expanded its “Sehhaty'' platform with AI-driven services in May 2025, aligned with Vision 2030 goals. The UAE continues to strengthen e-health regulations, launching new digital-first clinics in June 2025 in line with its sustainability framework. To combat specialist shortages, South Africa is employing telehealth, starting with an oncology teleconsultation program in Cape Town in April 2025. These initiatives demonstrate LAMEA’s dependency on Telehealth 2.0 to overcome healthcare hurdles and, at the same time, stimulate creative solutions in the face of systemic obstacles.

Solutions: Solutions on telehealth cover the entire spectrum of a patient's journey with the inclusion of diagnostic, monitoring, and consultation within a single framework. Doxy.me launched Telehealth.org on May 2025 as a one-stop solution for secure and scalable telehealth services. This platform also focused on interoperability and compliance which provided seamless adoption for healthcare systems. The platform’s focus on compliance and interoperability during its relaunch accentuated the need for integrated solutions that facilitate hybrid care. Protecting patient information and offering convenient access continues to dominate the telehealth landscape framework, making solutions the core of Telehealth 2.0.

Services: These telehealth services integrate consultation, set-up, training, ongoing support, and adoption to ensure telehealth solutions are seamlessly integrated by healthcare providers. Medicare’s telehealth services provision was extended through September 2025, offering continued coverage for patients utilizing these services. The provision underscored the lack of services and heightened need of telehealth access within rural and underserved regions. This policy served as a reaffirmation of telehealth as a vital tool in the public healthcare strategy. Service models are increasingly seen as fundamental to resolving the issues of access in traditional healthcare services.

Platforms: Platforms serve as the digital infrastructure through which healthcare practitioners and patients are able to interact seamlessly and share important data for video consultations. In February 2025, Doximity’s Dialer platform clinched the KLAS Telehealth Video Conferencing Award, which attests to its reliability and popularity among healthcare providers. This award demonstrates how the platform bolsters effortless virtual interactions without herculean downloads. As the need for interfaces of professional quality increases, the focus of integration and scalability attempts is the evolution of platforms. Their capacity to host multi-specialty services is what solidifies the platforms' relevance in Telehealth 2.0.

Devices: These are wearables, diagnostic kits, and remote monitoring tools which provide real time insights as they integrate into telehealth ecosystems. NowPatient telehealth platform was able to integrate a blood pressure monitoring device in February 2025. This enabled the collection and transmission of an important vital sign. This event demonstrated the ability of the devices to enable patients to track their health and equally inform the health providers. This is a clear indicator of the integration taking place between consumer electronics and medical tools of a higher standard. Devices are critical for proactive care models which focus on prevention and not treatment.

Software: Within telehealth, software pertains to specific applications used for scheduling, AI-powered triage, analytics, and overall patient management. During remote monitoring conferences of May 2025, AI-powered software applications that could refine clinical workflows and improve patient safety surfaced. These applications synthesized data from several sources to create actionable insights for providers. That event underscored AI’s contribution to personalized digital care. It is evident that analytics and software, with its flexibility, is paving innovations in Telehealth 2.0.

Web-Based Telehealth: Telehealth conducted on the internet is available through web browsers. There is no need to download anything, which makes it more accessible. In February 2025, Doximity’s Dialer was noted for virtual consultations done through browsers, unshackling patients who struggle with technology. Its streamlined access points to the flexibility of browser systems in supporting large healthcare networks. This mode remains vital in increasing inclusivity for both patients and providers. Web platforms thus serve as entry-level adoption tools in Telehealth 2.0.

Cloud-Based Telehealth: Telehealth services offered through cloud platforms enable cross-border healthcare because cloud systems allow for ease of telehealth operations. This was the case when Hims & Hers acquired the Europe-based telehealth platform Zava in July 2025. This acquisition demonstrated ease of cloud-based telehealth in supporting multinational operations and cost efficiency. Even with greater ease of interoperability, telehealth remains to be the most flexible model for rapid digital adoption on a global scale.

Telehealth 2.0 Market Share, By Mode of Delivery, 2024 (%)

| Mode of Delivery | Revenue Share, 2024 (%) |

| Web-based Telehealth | 28.71% |

| Cloud-based Telehealth | 39.84% |

| On-premise Telehealth | 14.15% |

| Mobile Applications | 17.30% |

On-Premise Telehealth: On-premise systems offer telehealth services through locally hosted systems, which provides organizations with greater control over security and compliance. March 2025 review on federal in-person mandates renewed attention on secure telehealth services. This highlighted the ongoing need for on-premise deployments in compliance-heavy environments, such as hospitals and government facilities. While these systems tend to slow organizational scaling, they are specifically designed for entities with heightened privacy concerns. On-premise systems are pivotal in scenarios where infrastructure control and regulatory compliance are predominant deciding factors.

Mobile Applications: Telehealth services are now available to users remotely through smartphones, expanding reach and convenience. Medmate, an Australian platform, started offering GP consultations through mobile apps for as low as $20, intentionally catering to low income and rural populations in Australia. This was an innovative example of how mobile apps can enhance affordability and inclusiveness in healthcare. Their mobile apps and user-friendly interfaces help to close the healthcare gap in rural areas, appealing to younger users. Apps remain the most consumer-friendly method of providing services in the Telehealth 2.0 era.

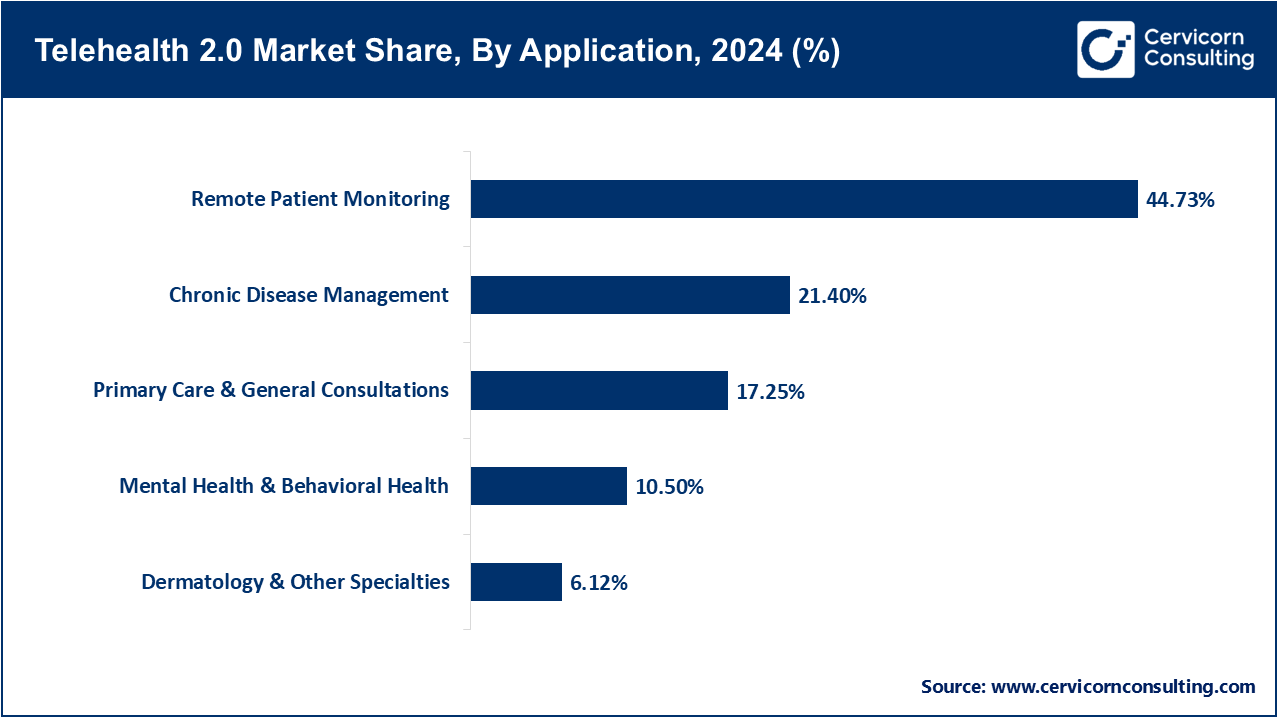

Remote Patient Monitoring (RPM): Remote Patient Monitoring (RPM) employs devices and platforms to track and assess a patient’s health metrics beyond clinical settings. A leading industry panel in June 2025 highlighted the effectiveness of RPM in managing hypertension and heart disease while preventing excessive hospital admissions. The emphasis pointed out the value of real-time supervision in advancing preventive healthcare. RPM is pivotal in alleviating costs throughout the healthcare system while enhancing the management of chronic conditions. This integration marks a pivotal moment in Telehealth 2.0’s evolution towards proactive care.

Chronic Disease Management: This segment focuses on persistent conditions such as diabetes, which require ongoing surveillance. A February 2025 study of virtual audio interventions reported enhanced glucose management in diabetic patients, underscoring telehealth’s capacity to extend chronic care well beyond clinic walls. Chronic disease management is now a telehealth imperative, as it combines clinical data with lifestyle analytics. The application illustrates the impact of persistent digital health.

Primary Care & General Consultations: General health and treatment services and basic treatment concerns are routine consultations that are done digitally. U.S. policy revisions in April 2025 confirmed financing extensions for general telehealth consultations under Medicare, bolstering their role in the public health system. This move confirmed that virtual visits are no longer a last resort and are now standard care. General consultations are now embedded in the healthcare system. Their low cost and ease of use guarantees widespread uptake.

Mental Health & Behavioral Health: Teletherapy and counseling that is done online is telehealth for mental health and it addresses the issue of accessibility. Through its revision policy in March 2025, CMS maintained the approval for audio-only telehealth applications for mental health services for the period up to September, which is critical for patients without internet access. This highlighted telehealth’s role in addressing the growing need for mental health services. At-home access has removed much of the stigma associated with seeking mental health care thus enhancing its use. Behavioral health is still one of the leading areas of telehealth adoption.

Dermatology & Other Specialties: In dermatology, the use of imaging and consultation to inform the diagnosis of a patient is fundamental. In 2025, virtual healthcare sessions validated the use of telehealth in managing dermatological and chest pain conditions as their outcomes were comparable to in-person consultations. This enabled the use of telehealth in dermatology and other areas that require visual information for diagnosis. Dermatology exemplifies the adaptability of telehealth in various branches of medicine. Its rapid development underscores the expanding reach of Telehealth 2.0.

Hospitals & Clinics: These organizations execute telehealth at scale, allowing providers to expand services and utilize telehealth optimally. As of May 2025, telehealth services were reported to have expanded into rural and underserved areas, bridging gaps in access to telehealth specialty services. Such initiatives illustrated the dependence hospitals have on telehealth to alleviate congestion in patient throughput. Clinics use telehealth for routine consultations. Hospitals continue to be the primary Telehealth 2.0 adopters, as they have the requisite infrastructure and complete systems.

Patients/Individuals: Patients still remain the primary users of telehealth services as they access telehealth services for cost savings and convenience. The case of Medmate’s mobile consultations offered to patients in rural Australia showcased the digital empowerment of patients as they adopted virtual consultations for easy and affordable access. Patient adoption is becoming the most important influence in the emergent economy. The adaptation of the telehealth model is being now driven by individuals.

Telehealth 2.0 Market Share, By End User, 2024 (%)

| End User | Revenue Share, 2024 (%) |

| Hospitals & Clinics | 40.18% |

| Patients/Individuals | 23.12% |

| Payers (Insurance Providers) | 14.30% |

| Home Healthcare Providers | 15.60% |

| Employers | 6.80% |

Payers (Insurance Providers): Telehealth offerings are being integrated into the payment systems by insurers, allowing members affordable access to services. UnitedHealthcare and Cigna are some of the insurers who, in 2024–2025, added the reimbursement of RPM devices for glucose and blood pressure monitoring with the patient’s mobile phone. This action marks the recognition by insurers of the financial benefits of digital care. With the addition of telehealth, payers are able to alleviate long-term burdens tied to healthcare spending. Insurers are therefore, critical stakeholders to drive the Telehealth 2.0 movement.

Home Healthcare Providers: Agencies offer telehealth services to assist patients, especially elderly and chronically ill patients, who require support at home. A study from UC Irvine in May 2025 showed that nearly 19% of home healthcare agencies stopped offering telehealth services by 2024 because of lack of Medicare reimbursement. This highlighted the difficulties of sustaining virtual models without funding. However, telehealth services provided at home are especially important for elderly patients. Its development relies on robust policy frameworks.

Employers: Employers use telehealth as part of the wellness and healthcare services to employees, at the same time reducing absenteeism and boosting productivity. Reports in June 2025, informed about states moving towards reimbursement parity which motivated telehealth adoption by employers as part of employee benefits. This also showed telehealth's expansion into occupational health. For employers, telehealth is a satisfying, economical, and effective solution, at the same time, enhancing employee satisfaction. Their participation expands telehealth's use beyond the boundaries of primary care.

Market Segmentation

By Component

By Mode of Delivery

By Application

By End User

By Region