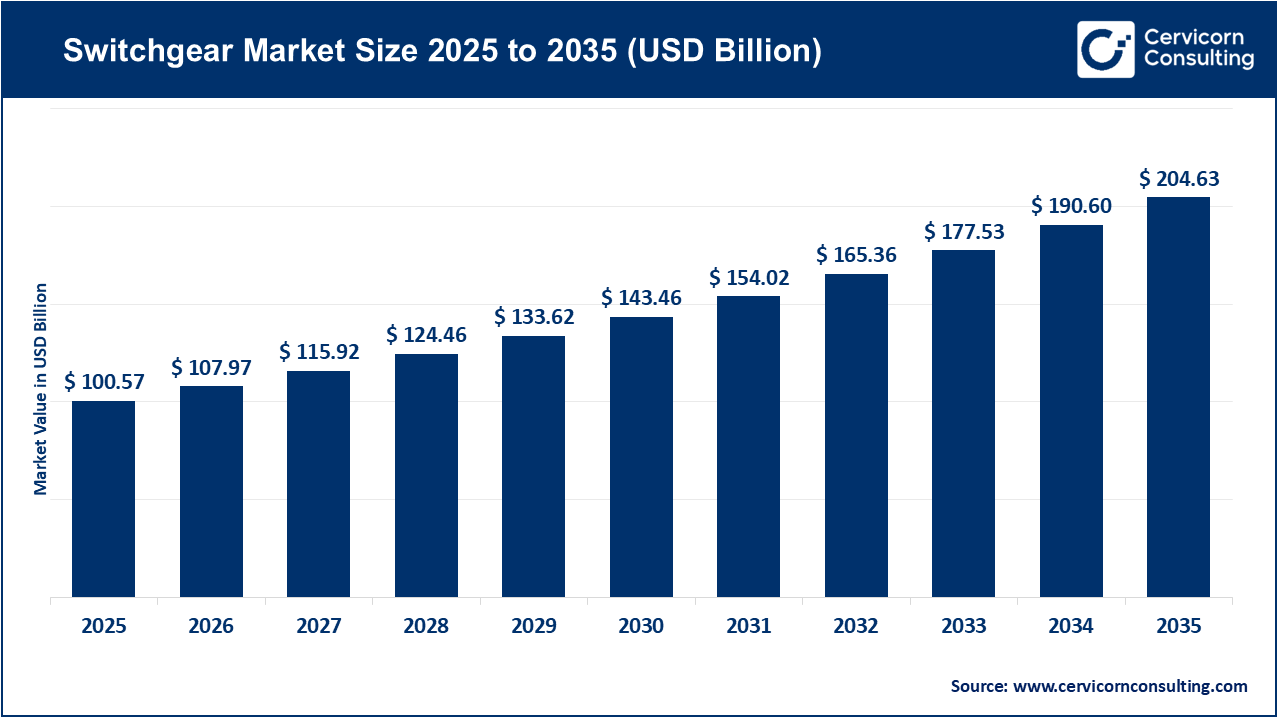

The global switchgear market size was reached at USD 100.57 billion in 2025 and is expected to exceed around USD 204.63 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 7.4% over the forecast period from 2026 to 2035. The switchgear market is experiencing significant growth due to increasing electricity consumption, ongoing grid expansion, and widespread electrification initiatives. In 2023, global electricity demand rose by more than 2.5%, resulting in over 800 terawatt-hours of additional consumption. This trend has increased the need for reliable protection and control equipment within transmission and distribution networks. Utilities continue to be the main users, representing about 40% to 45% of total switchgear installations. This is driven by the replacement of aging grids in North America and Europe, as well as the construction of new substations and feeder lines in developing regions. At the same time, the integration of renewable energy sources is further supporting switchgear deployment. In 2023, more than 500 gigawatts of new renewable power capacity were added worldwide, with each installation requiring medium- and high-voltage switchgear to ensure proper grid connection and protection.

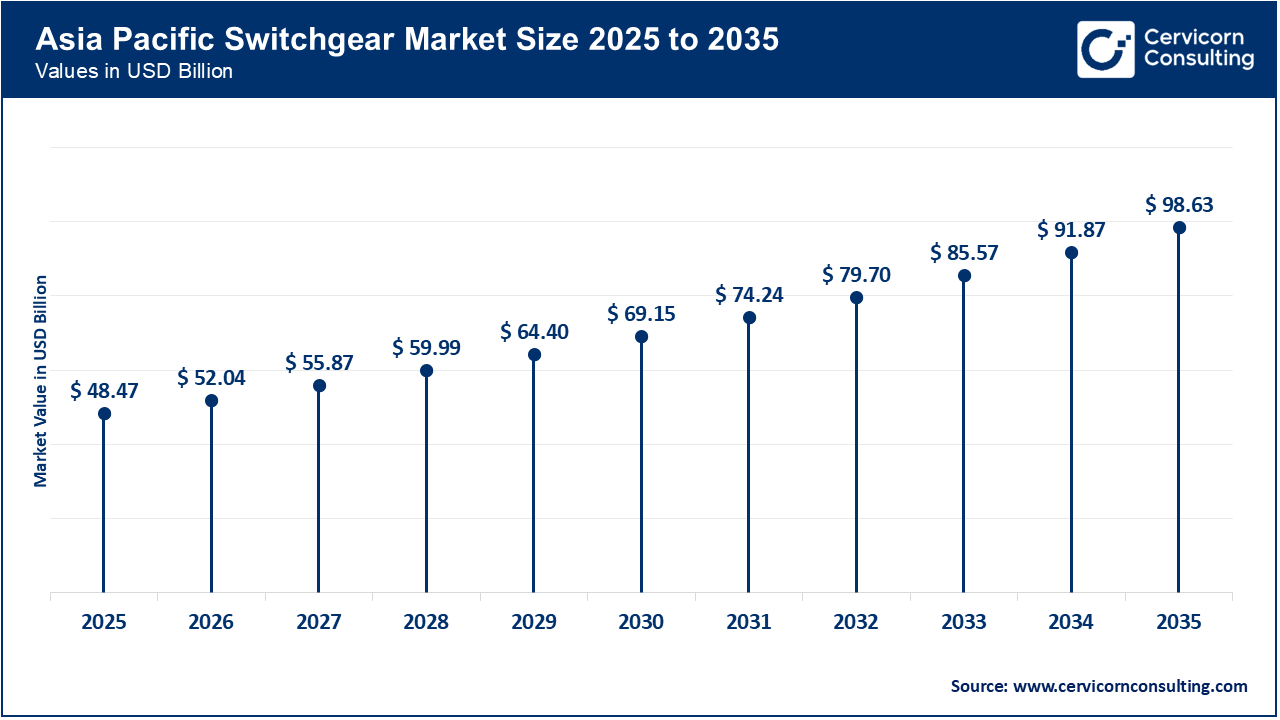

Industrialization, urban development, and the adoption of digital power management systems are important factors driving switchgear production and use. The Asia-Pacific region is currently the largest consumer of switchgear, accounting for more than half of new annual installations. This is mainly due to rapid grid expansion in countries like China and India. As a result, manufacturing output is increasing, with leading electrical equipment manufacturers expanding their factory capacity by 20% to 30% in recent years. This expansion is aimed at meeting the growing demand from sectors such as data centers, railways, electric vehicle charging infrastructure, and industrial facilities. Furthermore, the use of smart and digitally monitored switchgear is on the rise. Utilities have reported reductions of 15% to 25% in outage duration and maintenance costs after implementing condition-monitoring and automated switchgear systems. These developments are expected to support long-term market growth, extending beyond the basic need for grid expansion.

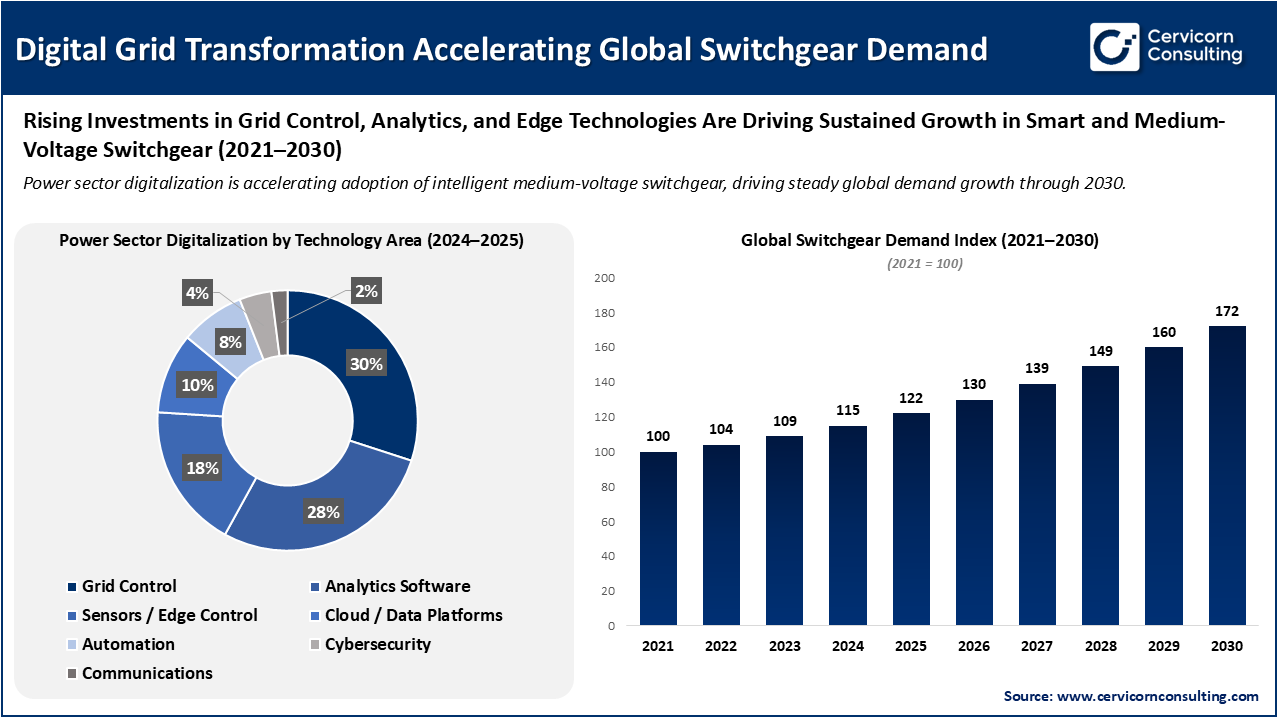

Increasing Need to Digitalize the Power Sector Driving the Switchgear Market

The digitalization of the power sector is significantly driving the demand for switchgear. As utilities and industries move from manual, asset-heavy networks to smart and data-driven grids, there is a growing need for advanced equipment. Power utilities are now deploying digital substations, IoT-enabled sensors, and automated protection systems to enhance grid visibility, reduce outages, and manage the increasing complexity of power flows from renewable and distributed energy sources. Recent statistics show that over 70% of utilities worldwide have started smart grid or digital substation initiatives, which is directly increasing the adoption of intelligent switchgear with real-time monitoring and remote-control features.

The use of digital switchgear allows for predictive maintenance, enabling utilities to reduce unplanned outages by 20% to 30% and lower operational costs by up to 25%. This is especially important as electricity demand, electric vehicle charging, and renewable generation continue to grow. As a result, investments in automation, cybersecurity, and grid resilience are making digital switchgear a fundamental part of modern power infrastructure.

1. Torrent Electricals switchgear portfolio launch

In January 2026, Torrent Electricals entered the switchgear market by launching a new product portfolio for residential and industrial customers.

The launch reflects the growing importance of switchgear in the electrical goods sector, supported by rising electrification and infrastructure development. With this expansion, Torrent and other companies are increasing competition, making products more accessible, and helping to expand the use of reliable electrical protection systems in smaller commercial and residential markets. These developments are expected to deepen the market and support the growth of regional manufacturing.

2. Major manufacturing investments by CG Power & Industrial Solutions (Murugappa Group)

CG Power & Industrial Solutions has announced an investment of approximately INR 748 crore (USD 90 million) to establish a new greenfield switchgear manufacturing facility in western India.

This initiative is projected to double the company's production capacity for medium and extra-high-voltage equipment and automation systems. By expanding local manufacturing, CG Power seeks to reinforce supply chains, minimize reliance on imports, and position India as a key export hub for power infrastructure components. These advancements are expected to address the increasing requirements of utilities, industries, and renewable energy projects, thereby supporting sustained market growth.

3. Socomec new India manufacturing investment

Socomec, a French power solutions provider, has announced plans to invest USD 7-10 million in a new manufacturing facility in India, aligning with its growth strategy under the 'Make in India' initiative.

As a leading player in the Indian solar DC switchgear market, the company intends to expand local production to meet increasing demand from sectors including data centers, renewable energy, electric vehicle charging, and healthcare. This investment reflects the confidence of international companies in the regional switchgear market and is anticipated to enhance technological capabilities, increase supply chain flexibility, and support competitive pricing.

4. Siemens Energy switchgear and transformer factories investment

Siemens Energy will invest EUR 2 billion (USD 2.3 billion) by 2028 to expand its transformer and switchgear manufacturing facilities worldwide.

This investment will help modernize power-grid equipment production, improve technology, and increase the company's manufacturing presence. As power networks adapt to smart grids, renewable energy, and higher electrification, these investments are important for supply reliability and innovation in switchgear technology. Increasing production capacity will also allow faster delivery and help utilities adopt advanced grid solutions more efficiently.

Report Scope

| Area of Focus | Details |

| Market Size in 2026 | USD 107.97 Billion |

| Market Size in 2035 | USD 204.63 Billion |

| CAGR 2026 to 2035 | 7.40% |

| Dominant Region | Asia-Pacific |

| Key Segments | Voltage, Installation, End User, Insulation, Region |

| Key Companies | ABB Ltd., Fuji Electric, Eaton Corporation, Larsen & Toubro Limited, General Electric, Schneider Electric, Hitachi Limited, Mitsubishi Electric, Bharat Heavy Electricals Limited (BHEL), Siemens AG, Crompton Greaves, Legrand, Powell Industries, Atlas Electric, Inc. |

The switchgear market is segmented into North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

The North America switchgear market size was valued at USD 18.81 billion in 2025 and is projected to surpass around USD 38.27 billion by 2035. The North America market is witnessing notable growth, largely due to increased investments in grid modernization and the replacement of outdated transmission and distribution systems. As renewable energy sources are integrated and transportation becomes more electrified, the need for a stable and efficient power supply is rising. Utilities and developers are upgrading their networks to support cleaner energy and to address the growing demand for electricity. This trend has led to a higher adoption of advanced switchgear, especially those with digital monitoring systems that improve reliability and grid resilience. In the United States, the demand for high- and medium-voltage switchgear is projected to rise further, driven by ongoing infrastructure development and significant investments in the power sector.

Recent Developments:

The Asia-Pacific switchgear market size was estimated at USD 48.47 billion in 2025 and is anticipated to record USD 98.63 billion by 2035. Asia-Pacific leads the global switchgear market, mainly because of rapid electrification, fast urbanisation, and large-scale infrastructure projects in countries like China and India. The expansion of utility grids, higher industrial energy needs, and the growing number of renewable energy plants are major factors increasing the demand for switchgear in the region. Both digital and conventional switchgear are being used to address the varied requirements of the market. Ongoing efforts to expand grid coverage, modernize networks, and increase renewable energy capacity are expected to further drive the growth of the switchgear market in Asia-Pacific over the coming years.

Recent Developments:

The Europe switchgear market size was estimated at USD 26.25 billion in 2025 and is predicted to grow around USD 53.41 billion by 2035. The Europe market is experiencing steady growth, primarily driven by the increasing capacity of renewable energy sources and the implementation of more stringent safety and regulatory standards. The accelerated deployment of wind and solar power systems has led to a greater demand for advanced switchgear capable of supporting grid integration and fulfilling environmental criteria. In response, EU governments are allocating significant investments toward enhancing grid resilience and developing digital substation projects, which are essential for managing the variable output associated with renewable energy and for improving overall efficiency. Consequently, the demand for modern switchgear equipped with automation and predictive maintenance capabilities is projected to rise throughout the region.

Switchgear Market Share, By Region, 2025 (%)

| Region | Revenue Share, 2025 (%) |

| Asia-Pacific | 48.2% |

| Europe | 26.1% |

| North America | 18.7% |

| LAMEA | 7.0% |

The LAMEA switchgear market was valued at USD 7.04 billion in 2025 and is anticipated to reach around USD 14.32 billion by 2035. The LAMEA is expanding, mainly because of higher government investments in infrastructure, rural electrification, and industrial growth. Many countries in these regions are upgrading power grids and building new transmission and distribution networks, which is driving demand for medium and low voltage switchgear. Electrification projects in underserved areas are also increasing the need for modular and cost-effective switchgear solutions designed for local needs.

Recent Developments:

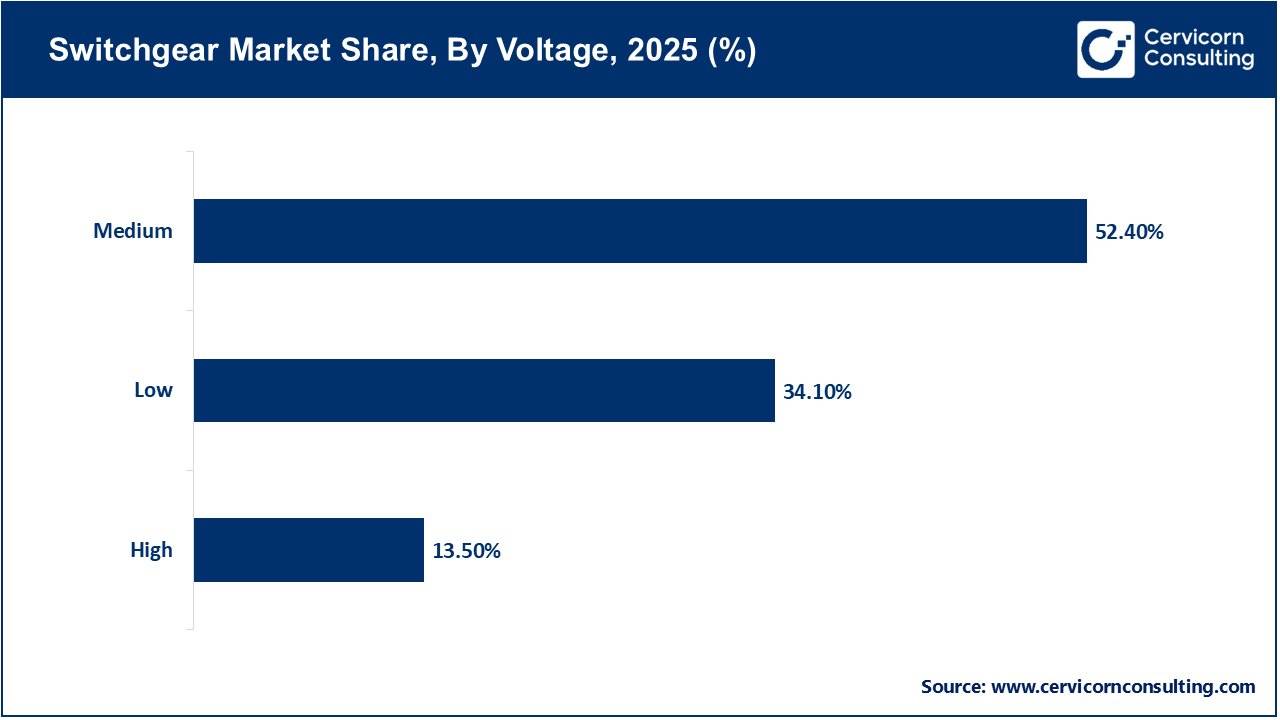

The switchgear market is segmented into voltage, installation, insulation, end user, and region.

Medium-voltage (MV) switchgear holds a dominant position in the market because it is essential for distribution networks and is extensively utilized in substations, industrial facilities, commercial buildings, and renewable energy systems. This widespread use results in MV switchgear accounting for the largest share of both installations and revenue. The typical voltage range of 3 to 36 kV allows MV switchgear to serve a broad spectrum of utilities and industries. Furthermore, the ongoing demand for distribution automation and ring main units (RMUs) continues to drive production volumes for manufacturers and suppliers.

High-voltage (HV) switchgear represents the fastest-growing segment in the market, primarily because of the expansion of transmission networks, cross-border interconnections, and the requirement to transmit power from large-scale renewable projects including offshore wind and solar parks. Rising investments in extra-high voltage (EHV) and HV lines and substations are increasing the demand for larger and more advanced switchgear. Additionally, utility upgrades focused on enhancing transfer capacity and strengthening grid resilience are expected to further support the growth of the HV switchgear market.

Indoor switchgear is widely used in established substations, commercial buildings, and many industrial facilities. This is because it is easier to integrate with control rooms and provides better environmental protection for sensitive digital components. Indoor switchgear is also the standard for secondary distribution in built environments. As a result, indoor units make up the majority of the installed base in mature markets.

Switchgear Market Share, By Installation, 2025 (%)

| Installation | Revenue Share, 2025 (%) |

| Indoor | 53.4% |

| Outdoor | 46.6% |

Outdoor installation is the fastest-growing segment in the switchgear market. This growth is driven by rapid distribution network extensions, the increasing use of pad-mounted and pole-mounted RMUs, and rural electrification projects. Space-constrained urban distribution projects also prefer compact outdoor solutions. Utilities are increasingly deploying automated outdoor switchgear to reduce construction costs and extend service to new areas.

Air-insulated switchgear is the most widely used technology across the globe due to its lower capital cost, simple design, and proven application in conventional substations and industrial facilities. AIS is preferred in areas with enough space and where reducing costs is a priority. This has resulted in AIS holding the largest installed base by units and generating the highest traditional revenue in many regions.

Switchgear Market Share, By Insulation, 2025 (%)

| Insulation | Revenue Share, 2025 (%) |

| Air | 44.8% |

| Gas | 32.6% |

| Vacuum | 15.1% |

| Oil | 7.5% |

Gas-insulated switchgear is the fastest-growing segment. The growth of GIS is mainly due to its compact size, higher reliability in crowded or difficult environments, and its suitability for urban substations and offshore platforms. As urban areas become more crowded and the demand for underground or compact substations rises, the adoption of GIS is increasing, despite its higher unit costs.

Transmission and distribution utilities account for the largest share of end-user demand for switchgear. The grid operators are mainly responsible for purchasing most of the medium- and high-voltage switchgear that is required for new substations, grid upgrades, and equipment replacements. The capital programs of utilities are focused on improving reliability and resilience, as well as integrating renewable energy sources, which significantly drive the procurement of switchgear in the market.

Switchgear Market Share, By End User, 2025 (%)

| End User | Revenue Share, 2025 (%) |

| Transmission & Distribution Utility | 41.2% |

| Industrial | 33.5% |

| Residential & Commercial | 25.3% |

The industrial segment is currently the fastest-growing end-user category for switchgear. Industries including manufacturing, data centers, mining, oil and gas, and large process plants are increasing their investments in electrification, power quality solutions, backup systems, and on-site renewable energy integration. This rising investment is driving the demand for advanced medium- and low-voltage switchgear that provides automation, improved safety features, and reliability. As a result, the industrial segment is experiencing faster growth compared to the more established procurement cycles of utilities.

ABB Ltd.

Schneider Electric

By Voltage

By Installation

By Insulation

By Current

By End User

By Region