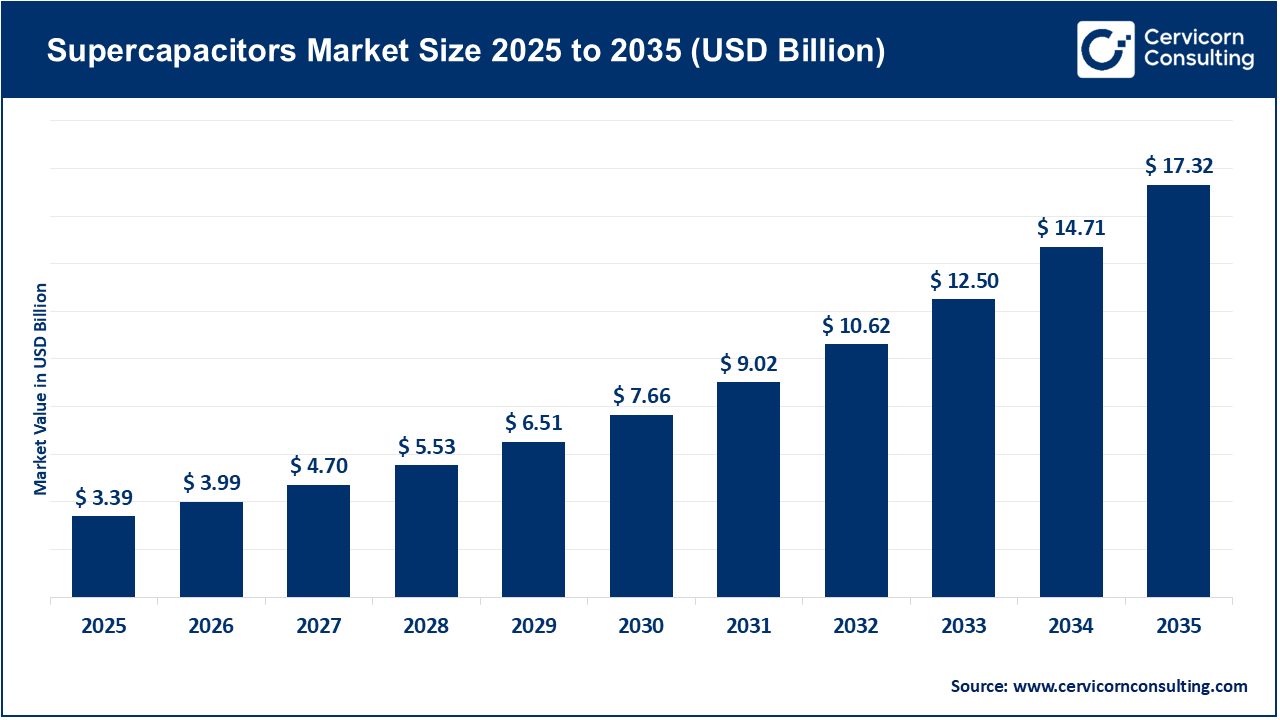

The global supercapacitors market size was estimated at USD 3.39 billion in 2025 and is expected to be worth around USD 17.32 billion by 2035, exhibiting a compound annual growth rate (CAGR) of 17.8% over the forecast period from 2026 to 2035. The supercapacitor market is experiencing strong growth at the intersection of high-power demand and global decarbonization goals. In the transportation sector, the increasing demand for electric vehicles (EVs) and hybrid electric vehicles (HEVs) has largely boosted sales of regenerative braking and peak-power solutions. Supercapacitors play a critical role by absorbing high-current pulses during braking and providing the necessary bursts of power during acceleration, which helps extend the lifespan of on-board batteries. Unlike lithium-ion batteries, which store energy via slow chemical reactions, supercapacitors store energy through the physical movement of ions, enabling nearly instantaneous charge and discharge cycles.

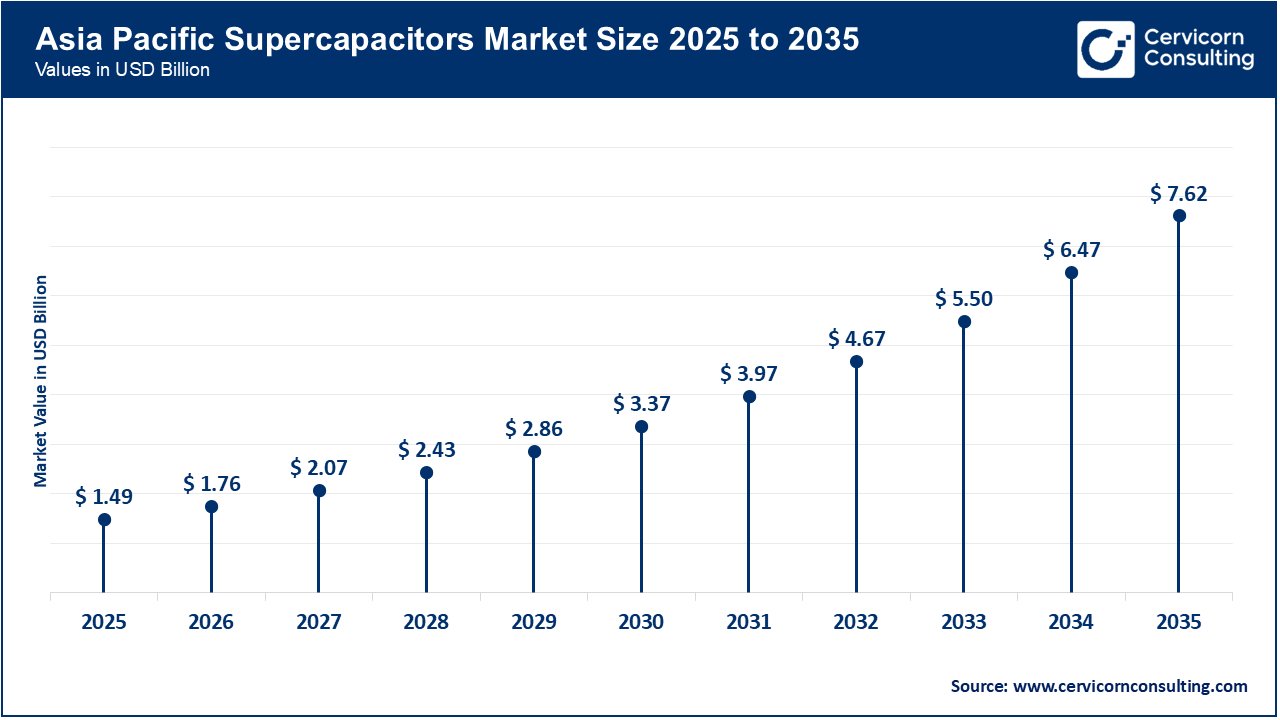

Grid modernization is an important growth factor for the market. The growing integration of intermittent renewable energy resources, such as wind and solar, has increased grid instability, along with requiring response times of milliseconds for stabilizing frequency and providing voltage support. Supercapacitors are uniquely capable of providing "firming" in these applications by supplying short-duration power when necessary, until slower-responding assets such as gas turbines or long-duration batteries can engage. This fast-response capability is becoming essential for the resilience of smart energy infrastructure. Additionally, Asia-Pacific continues to lead adoption due to its strong electronics manufacturing base and proactive government support for new energy vehicles. Meanwhile, North America and Europe are both experiencing rapid growth in their grid-scale and industrial automation markets, benefiting from infrastructure investment programs and green deal frameworks.

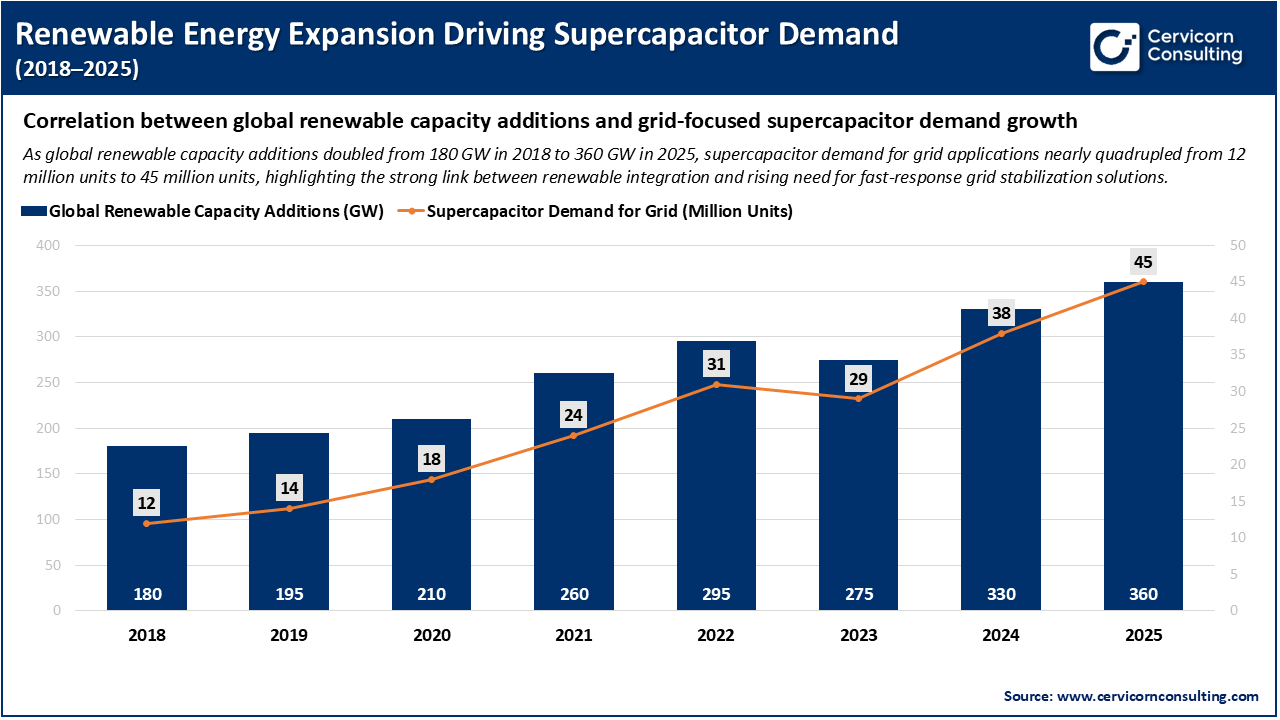

Integration of Supercapacitors in Renewable Energy Grids

A significant emerging trend in supercapacitors is their high energy storage capability to stabilize renewable energy grids. As national electrical systems increasingly incorporate larger percentages of wind and solar energy, the fluctuating nature of these sources poses challenges for grid frequency and voltage stability. Supercapacitors are being integrated into an emerging hybrid energy storage system (HESS) with lithium-ion batteries to manage rapid frequency fluctuations. Supercapacitors have the ability to automatically and quickly absorb and deliver power within short durations to protect the primary National Electric Vehicle battery from thermal stresses caused by high current pulses. By absorbing these transients, supercapacitors can extend the life of the battery asset by up to 30%, while also aiding in stabilising the electric grid.

The chart shows a clear link between the expansion of renewable energy and the rising demand for supercapacitors from 2018 to 2025. As global renewable capacity additions grew from 180 GW to 360 GW, the demand for supercapacitors in grid applications increased sharply from 12 million to 45 million units. Despite a small decline in renewable additions in 2023, the overall upward trend demonstrates that the growing integration of renewables is driving the need for fast-response energy storage and grid stabilization. This is expected to significantly boost the growth of the supercapacitors market.

1. Corporate advancements in high-power density modules

A significant milestone in the industry is the commercialization and relevant introduction of "SuperBattery" technology developed by firms like Skeleton Technologies. This innovative system combines the high power density of supercapacitors with the energy density of chemical batteries, creating a new class of super capacitor batteries. For example, the partnership between Skeleton Technologies and Shell to electrify haul trucks used to transport mined minerals demonstrates this, as these trucks require massive power to ascend from the pit and rapid charging while descending, which the superbattery system can deliver efficiently. Additionally, these systems can charge a battery within 90 seconds or less, significantly boosting productivity and efficiency in the industrial space.

2. Government Policy and Subsidy Frameworks

Government policy has played a crucial role in increasing the adoption of supercapacitors in the market. In the United States, the Inflation Reduction Act (IRA) offers significant incentives for manufacturing domestic energy storage technologies and supercapacitors, aligning with broader national energy security policy. In Europe, initiatives such as the European Union's Green Deal, along with the implementation of the "Battery Passport" program, create a supportive regulatory framework for energy storage devices that favours supercapacitors due to their lack of heavy metals and high recyclability. These policy frameworks establish a stable fiscal and regulatory environment that encourages long-term industrial investment and technology deployment.

3. Infrastructure Development and Demonstration Projects

The rapid expansion of physical infrastructure and the rollout of large demonstrator projects have proven the commercial viability of supercapacitor technology. For instance, the deployment of supercapacitor-powered electric buses in major cities like Shanghai and Graz has effectively showcased the concept of “opportunity charging," where a vehicle is recharged in seconds at a bus stop. These advancements serve as essential proof-of-concept for municipal authorities in various regions to assess and increase the electrification of public transportation.

4. Strategic Mergers and R&D Partnerships

Strategic partnerships and mergers focused on research and development are increasingly aimed at bridging the gap between laboratory innovation and commercial end users. In particular, long-term strategic collaborations between universities and industry players have significantly contributed to the development of sodium-ion and lithium-ion hybrid capacitors. These collaborations facilitate scaling of next-generation chemistries that achieve higher energy densities while maintaining the safety, durability, and long cycle life associated with supercapacitors. Additionally, by integrating supercapacitors with advanced power management systems, manufacturers can provide a “turnkey” storage solution for grid and industrial customers.

Report Scope

| Area of Focus | Details |

| Market Size in 2026 | USD 3.99 Billion |

| Market Size in 2035 | USD 17.32 Billion |

| CAGR 2026 to 2035 | 17.80% |

| Dominant Region | Asia-Pacific |

| Key Segments | Supercapacitors Market (By Type, Capacitance Range, Material, End User, Region |

| Key Companies | Technologies (Tesla), Panasonic Holdings Corp., Eaton Corporation PLC, Skeleton Technologies, CAP‑XX Limited, AVX Corporation, Ioxus Inc., Nippon Chemi‑Con Corporation, Kyocera Corporation / Kyocera AVX, LS Mtron Co., Ltd., NEC TOKIN / KEMET, ELNA Co., Ltd., Nichicon Corporation, Jinzhou Kaimei Power Co., Ltd., Samwha Capacitor / Supreme Power Solutions |

The supercapacitors market is segmented into North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

The Asia-Pacific supercapacitors market size was valued at USD 1.49 billion in 2025 and is expected to record around USD 7.62 billion by 2035. The Asia Pacific region is the leading area in market, due to rapid expansion of electronic and automotive manufacturing in China, Japan, and South Korea. In particular, China has become a hub for electric vehicle manufacturing, benefiting from government policies that promote the development of next-generation energy storage technology. The presence of well-developed supply chains for carbon materials and electrolytes offers a cost advantage to all companies in the APAC region. Moreover, the rapid urbanization of cities, along with investments in high-speed rail and public transit systems, creates steady demand for high-power supercapacitor modules.

Recent Developments:

The North America supercapacitors market size was estimated at USD 0.88 billion in 2025 and is projected to surpass around USD 4.50 billion by 2035. In North America, the market emphasises research and development, as well as electrical grid modernisation. The United States hosts many leading innovators in supercapacitor technology working with both private sector companies and Department of Energy-funded projects, and it has also benefited from defence contracts. The integration of grid resilience and large-scale renewable energy projects are key drivers in the North American market, alongside the rapidly expanding data center sector that uses supercapacitors with UPS systems to ensure data integrity during power transitions.

Recent Developments:

The Europe supercapacitors market size was reached at USD 0.75 billion in 2025 and is forecasted to grow around USD 3.81 billion by 2035. In Europe, the supercapacitor market is strongly driven by robust regulatory mandates such as the European Green Deal, which targets strict decarbonization goals. European manufacturers are also developing and deploying sustainable and recyclable energy storage solutions that align with the circular economy objectives of the European Union. With a focus on reducing carbon footprints across all industrial sectors, their supercapacitor market is reinforced in wind power, industrial automation, and heavy-duty transport systems.

Recent Developments:

Supercapacitors Market Share, By Region, 2025 (%)

| Region | Revenue Share, 2025 (%) |

| Asia-Pacific | 44% |

| North America | 26% |

| Europe | 22% |

| LAMEA | 8% |

The LAMEA supercapacitors market was valued at USD 0.27 billion in 2025 and is anticipated to reach around USD 1.39 billion by 2035. The LAMEA (Latin America, Middle East, and Africa) region is a rapidly growing market for supercapacitors, driven by industrialization and ongoing improvements in energy access and power infrastructure. For instance, in the Middle East, supercapacitors are being explored as an energy storage option for solar power projects due to their temperature resilience. Similarly, Africa and Latin America are focusing on supercapacitors as a solution to stabilize microgrids and off-grid power systems in disconnected and remote communities. The market is currently smaller than in other regions, but increasing investments in infrastructure and the demand for rugged, maintenance-free energy storage solutions present long-term market potential.

Recent Developments:

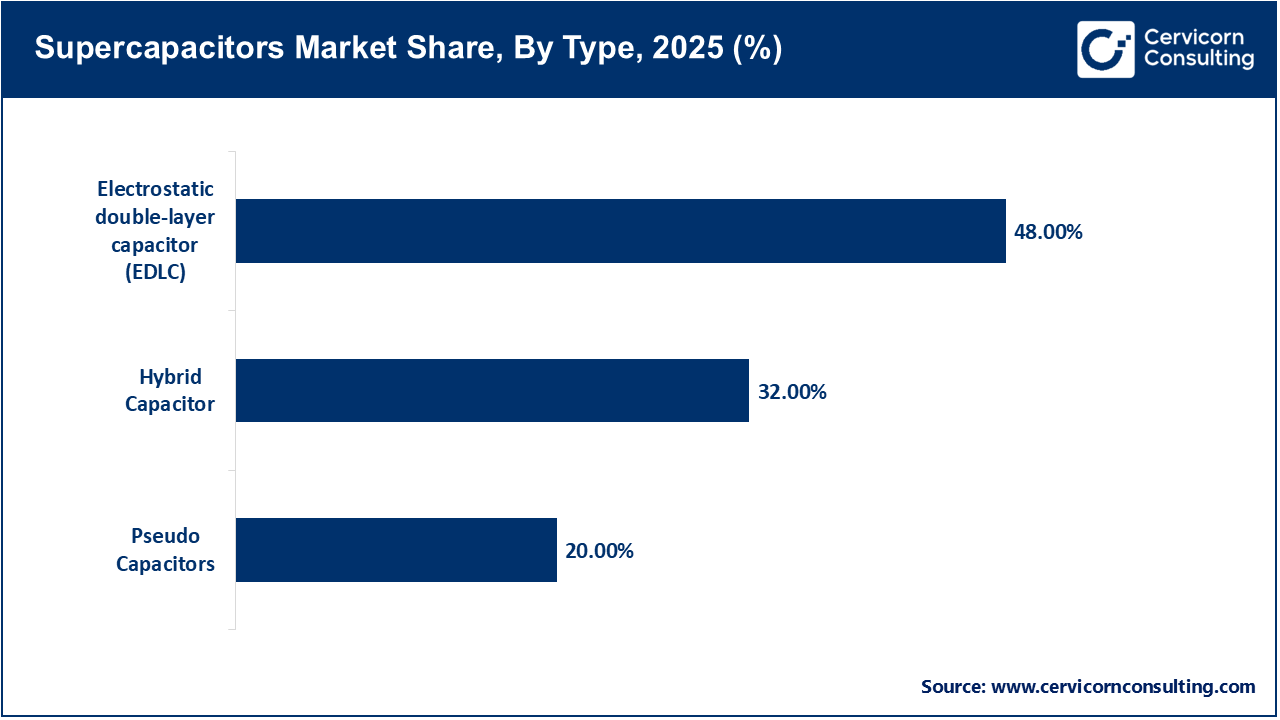

The supercapacitors market is segmented into type, capacitance range, material, end user, and region.

Electric Double Layer Capacitors (EDLCs) dominate a significant share of the supercapacitors market because of their technological maturity, cost-effectiveness, and long cycle life. EDLCs store energy through the physical adsorption of ions onto high-surface-area carbon electrodes, creating an electric double layer (Helmholtz layer) at the electrode-electrolyte interface. They can undergo millions of charge-discharge cycles without degradation. As a result, they are ideal for end users requiring high reliability and low maintenance, such as in-memory backup for industrial controllers, power smoothing in telecommunications, and pitch control in wind turbines.

Hybrid Capacitors are the fastest-growing segment in the market because they combine the high power density of EDLC electrodes with the high energy density of battery-like faradaic electrodes, typically lithium-ion or metal oxide-based. Integrating these two types of electrodes allows hybrid capacitors to deliver three to four times the effective energy density of standard EDLCs while offering higher power than similarly sized batteries. Recent advances in materials and cell design have helped manufacturers effectively address safety and stability concerns associated with hybrid chemistries.

A capacitance range of 100 to 1,000 Farads (F) represents the dominant segment of the market, primarily because it offers an optimal balance between size and energy storage capacity for demanding end users. In the automotive sector, supercapacitor modules within this range are frequently used for start-stop systems and high-power spikes in hybrid electric vehicles. Similarly, in industrial applications, these supercapacitors provide sufficient capacity to efficiently capture regenerative energy in cranes, elevators, and forklifts. The widespread use of this capacitance range is supported by standardized module designs that make integration into power electronic architectures easier.

Supercapacitors Market Share, By Capacitance Range, 2025 (%)

| Capacitance Range | Revenue Share, 2025 (%) |

| 100-1,000 F | 45% |

| <100 F | 30% |

| >1,000 F | 25% |

The 100 F segment of supercapacitors is the fastest-growing market segment, mainly driven by the rapid expansion of the Internet of Things (IoT) and smart infrastructure. Today, these smaller units are increasingly replacing or complementing coin-cell batteries in end-user devices that require short bursts of high power for wireless communication and sensor data processing. Additionally, the emergence of "battery-less" IoT devices, which harness energy from ambient light or vibrations, depends on sub-100 F supercapacitors to store and provide energy.

Carbon-based and metal oxide materials lead the supercapacitors market, mainly due to their high surface area, chemical stability, and low cost. Carbon materials are widely used in electrode components, with their porous structure enabling efficient ion adsorption, which is a key feature of EDLC operation. Metal oxides such as ruthenium oxide (RuO2) and manganese oxide (MnO2) are used in pseudocapacitors to facilitate rapid redox reactions and higher energy densities. These material combinations offer a reliable and affordable solution, making them the preferred choices for commercial supercapacitors.

Supercapacitors Market Share, By Material, 2025 (%)

| Material | Revenue Share, 2025 (%) |

| Carbon & Metal Oxide | 49% |

| Composite Materials | 31% |

| Conducting Polymers | 20% |

Advanced composite materials are the fastest-growing segment because of ongoing efforts by researchers and manufacturers to push the theoretical limits of capacitance. These composites typically incorporate carbon materials with graphene, carbon nanotubes (CNTs), or conductive polymers. By leveraging the superior electrical conductivity and mechanical strength of nanomaterials, advanced composite electrodes achieve higher power and energy densities compared to traditional activated carbon electrodes.

The automotive industry accounts for the largest segment of the market, primarily driven by the global shift toward vehicle electrification. Supercapacitors play a critical role in several automotive applications. In regenerative braking systems, they capture and store kinetic energy during deceleration more efficiently than conventional batteries. Supercapacitors create micro-hybrids for engine "start-stop" systems to minimize fuel consumption by turning off the engine when the vehicle is stationary. Moreover, as electric vehicle architectures transition from 400V to 800V systems, supercapacitors are highly effective at managing higher energy transients and protecting the main battery pack.

Supercapacitors Market Share, By End User, 2025 (%)

| End User | Revenue Share, 2025 (%) |

| Automotive | 32% |

| Consumer Electronics | 22% |

| Energy | 20% |

| Industrial | 12% |

| Healthcare | 8% |

| Others | 6% |

Energy users are the fastest-growing segment in the market, supported by the global transition toward “Grid 2.0.” The rapid expansion of decentralized energy sources, microgrids, and residential solar-plus-storage creates a significant need for localized power quality management. Supercapacitors are increasingly used as a "synthetic inertia" in renewable energy plants, allowing the grid to respond instantly to sudden loss of wind speed or solar irradiance, thereby enhancing overall grid stability. Additionally, the energy industry is experiencing growth in supercapacitors for peak-shaving applications to reduce consumers' electric bills by minimizing high demand charges.

By Type

By Capacitance Range

By Material

By End User

By Region