The global steel e-commerce market size reached at USD 22.34 billion in 2025 and is expected to be worth around USD 81.87 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 13.9% over the forecast period 2026 to 2035. The steel e-commerce market is growing because more businesses want faster and easier ways to buy steel online. Digital platforms provide real-time pricing, transparent inventory, and quick order processing. This helps buyers save time and reduce procurement costs. The market is also supported by rising demand from construction, automotive, and manufacturing industries. Companies now prefer online channels because they offer better logistics tracking, secure payments, and dependable delivery services. As more SMEs shift to digital procurement, the use of online steel platforms continues to increase.

Recent developments are also helping the steel e-commerce market grow. Major steel producers are launching their own digital platforms, and marketplace players are adding services like financing, cut-to-size processing, and instant quotations. Several companies are investing in AI tools to predict demand and optimize pricing. Platforms such as JSW One, XOM Materials, and mjunction have expanded their digital capabilities in 2023–2024, improving customer reach and order volumes. These developments show that the industry is moving toward a more digital, efficient, and transparent steel supply chain.

Impact of Digital Transformation as a Core Catalyst Accelerating Growth in the Steel E-commerce Market

Digital transformation is a major force driving growth in the steel e-commerce market because it is changing how steel is sourced, purchased, and delivered across industries. Companies are shifting from manual procurement and offline negotiations to digital platforms that offer faster processes, real-time price visibility, and automated order tracking. Technologies like cloud platforms, AI-driven pricing tools, and digital logistics systems are improving accuracy, reducing procurement delays, and lowering operational costs for both buyers and sellers. Digital platforms also allow steel companies to reach new customers, expand geographically, and manage large order volumes with fewer resources. As more organizations adopt online procurement policies and integrate digital tools into their supply chains, the steel e-commerce market continues to gain momentum and becomes a preferred channel for modern industrial buying.

How Steel Production and Digital Adoption Levels Drive Growth in the Steel E-commerce Market

This chart highlights how the combination of steel production capacity and digital adoption directly influences the growth of the steel e-commerce market. Countries like China, the USA, Japan, South Korea, and Germany show both high steel output and strong digitalization, making them leaders in adopting online procurement, automation, and AI-enabled steel platforms. Meanwhile, emerging markets such as India and Turkey demonstrate rising digital readiness alongside significant production, positioning them as fast-growing regions for digital steel trade. In contrast, countries with lower digital adoption, even if they produce steel, are slower to embrace e-commerce due to limited infrastructure and technology gaps. Overall, the chart shows that higher digital maturity amplifies the market potential by enabling faster transactions, improved transparency, and greater adoption of online steel platforms.

Major Activities and Investments by Top Players

| Company | Recent Developments | Key Investment |

| JSW One Platforms | Expanded digital marketplace for MSMEs, improved logistics and delivery services | Invested in platform automation, warehouse digitization, and regional capacity expansion |

| XOM Materials | Enhanced online ordering tools and added AI-based pricing features | Invested in platform integration with suppliers and digital supply chain systems |

| mjunction | Strengthened online steel auction and B2B procurement services | Increased investments in digital procurement technology and cloud infrastructure |

| ArcelorMittal Digital Marketplace | Improved customer self-service tools and online quoting functionality | Invested in digital customer platforms and process automation |

| Tata Steel (Digital Channels) | Expanded online product catalog and self-service procurement options | Invested in digital distribution networks and data analytics capabilities |

1. Rapid Expansion of Digital Steel Marketplaces by Major Steel Producers

Major steel companies such as JSW, Tata Steel, and ArcelorMittal have expanded their online platforms, offering direct digital sales, real-time pricing, and online payment options.

This milestone is driving the steel e-commerce market because it increases trust and adoption of online steel purchasing. When large and well-known steel makers invest in digital channels, buyers feel more confident using e-commerce platforms for large-volume transactions. This shift reduces reliance on traditional dealers, improves price transparency, and attracts more SMEs to online procurement. As more producers join the digital space, the industry experiences faster digital transformation, higher competition, and better customer service online.

2. Integration of AI-Based Pricing, Demand Forecasting, and Inventory Tools

Leading platforms like XOM Materials and JSW One have introduced AI-driven tools for automated pricing, demand prediction, and inventory optimization.

This milestone helps the steel e-commerce market grow because AI improves operational efficiency and provides buyers with accurate, real-time prices. It also helps suppliers manage stock better and reduce delivery delays. Predictive analytics enables customers to plan procurement with more confidence, making online buying more reliable. As AI tools spread across platforms, the market becomes more efficient, transparent, and scalable.

3. Strengthening of Logistics and Supply Chain Digitalization

Several platforms have upgraded their logistics systems by adding warehouse automation, digital tracking, and faster last-mile delivery solutions.

This milestone is driving the steel e-commerce market because reliable logistics are essential for selling heavy materials like steel online. Better delivery performance reduces customer waiting time and increases repeat purchases. Digital tracking also provides visibility across the supply chain, improving trust and reducing operational errors. Stronger logistics make the online purchase experience similar to consumer e-commerce, encouraging more businesses to shift their procurement online.

4. Expansion of Financing, Credit, and Buy-Now-Pay-Later (BNPL) Options

Platforms now offer flexible financing, credit lines, and secure payment integrations to support SME buyers.

This milestone accelerates the steel e-commerce market because access to credit removes a major barrier for small and medium businesses that often require steel in bulk but lack upfront cash flow. Digital financing helps these companies purchase larger quantities and manage operations more effectively. It also attracts new buyers who previously relied on offline dealers for credit. As financing tools become more common, the market sees higher transaction volumes and broader customer participation.

The steel e-commerce market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

The North America steel e-commerce market size was reached at USD 4.51 billion in 2025 and is expected to record USD 16.54 billion by 2035. The North America is driven by rapid digital transformation, strong industrial automation, and high adoption of online procurement tools among construction, automotive, and manufacturing sectors. Companies in the region increasingly rely on digital platforms to improve transparency, reduce procurement time, and manage supply chain disruptions. The growth of smart logistics, real-time tracking, and integration of supply chain software further supports widespread e-commerce adoption. Strong emphasis on sustainability and traceable sourcing also contributes to the shift toward digital steel purchasing.

Recent Developments:

The Asia-Pacific steel e-commerce market size was accounted for USD 9.99 billion in 2025 and is projected to surpass around USD 36.60 billion by 2035. The Asia-Pacific is the fastest-growing region for the market, driven by massive construction activities, industrial expansion, and rapid adoption of digital platforms in countries such as China, India, and Southeast Asia. Rising smartphone penetration and supportive government initiatives for digital commerce have accelerated B2B online procurement. Large steel producers in the region are launching their own e-commerce portals to streamline sales and reach new customer segments. APAC’s strong logistics ecosystem and large SME base create high potential for further digital steel adoption.

Recent Developments:

The Europe steel e-commerce market size was estimated at USD 5.54 billion in 2025 and is forecasted to hit around USD 20.30 billion by 2035. The Europe market is driven by policy-led digital transformation, sustainability targets, and a strong push toward modernized procurement systems across industries. European manufacturers increasingly adopt online steel platforms to comply with traceability and environmental reporting requirements. Platforms in Europe also focus on providing certifications, eco-friendly product details, and digitally verified supplier networks. This region benefits from strong infrastructure, digital logistics, and cross-border e-commerce within the EU, helping accelerate market growth.

Recent Developments:

Market Share, By Region, 2025 (%)

| Region | Revenue Share, 2025 (%) |

| Asia-Pacific | 44.7% |

| Europe | 24.8% |

| North America | 20.2% |

| LAMEA | 10.3% |

The LAMEA steel e-commerce market was valued at USD 2.30 billion in 2025 and is anticipated to reach around USD 8.43 billion by 2035. The LAMEA is driven by growing industrialization, infrastructure development, and the rising need for cost-efficient and transparent steel procurement. As regional markets modernize, businesses are shifting from traditional supply chains to online platforms that provide price visibility, reliable sourcing, and competitive logistics solutions. Adoption is still emerging but growing steadily, supported by digital trade initiatives and investments in construction, oil & gas, and manufacturing projects.

Recent Developments:

The steel e-commerce market is segmented into product type, business model, end-user industry, and region.

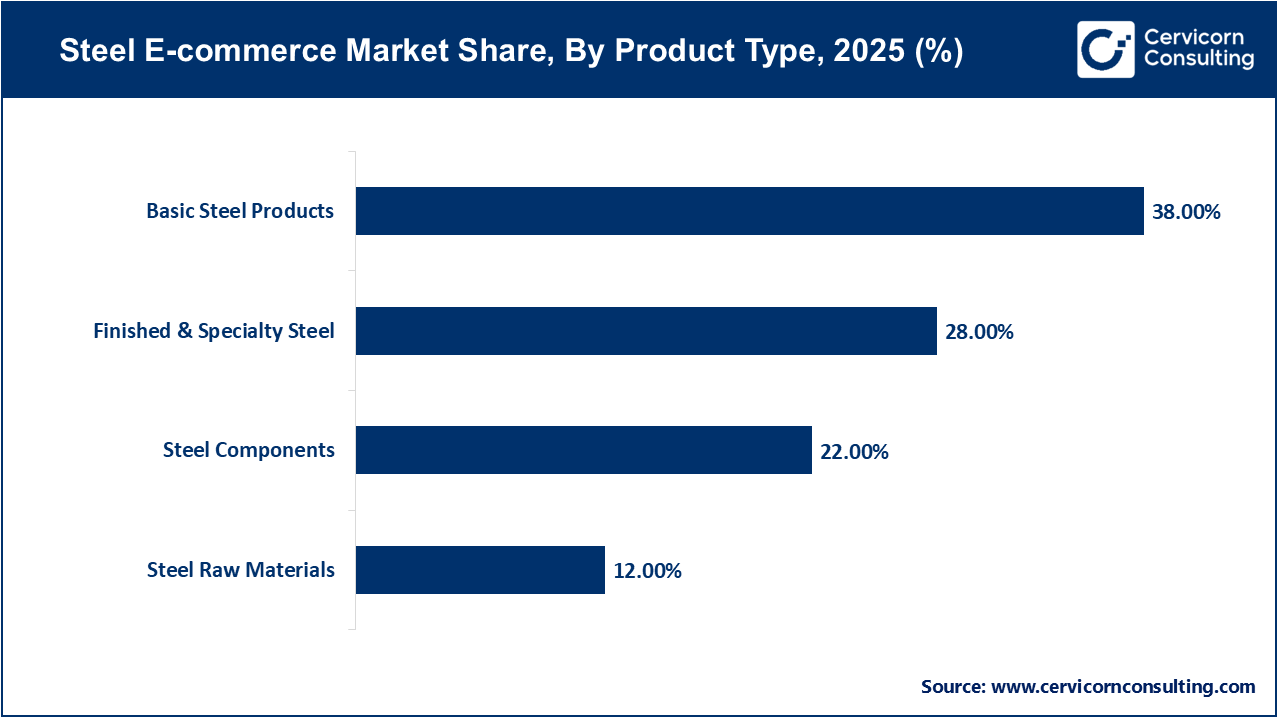

Basic steel products dominate the steel e-commerce market because they are required in large volumes across construction, infrastructure, manufacturing, and automotive applications. These products including hot rolled, cold rolled, and galvanized steel are purchased frequently and in bulk, making them ideal for online procurement platforms that provide real-time pricing and faster order processing. Their high consumption rate and consistent demand make them the largest revenue contributor for steel e-commerce platforms.

Finished and specialty steel is the fastest-growing segment because industries such as automotive, machinery, and consumer goods increasingly prefer precision-grade materials. Digital platforms make it easier for buyers to compare specifications, certifications, and customized sizes, driving more online purchasing of specialized steel. As manufacturers adopt digital procurement to ensure quality and reduce delays, the demand for specialty steel through e-commerce platforms is rising quickly.

The B2B segment dominates the steel e-commerce market because the majority of steel consumption comes from industrial buyers such as contractors, manufacturers, and fabricators. These users require large quantities, regular supply, and predictable pricing, which digital platforms are increasingly able to provide. B2B buyers also benefit from online features like bulk discounts, contract pricing, and logistics tracking, making this segment the core revenue driver.

Market Share, By Business Model, 2025 (%)

| Business Model | Revenue Share, 2025 (%) |

| B2B | 86% |

| B2C | 14% |

The B2C segment is growing the fastest as small contractors, local fabricators, and DIY customers adopt online purchasing for convenience, transparency, and quick delivery. While smaller in volume, this segment is expanding rapidly due to rising digital awareness and increasing availability of steel products in retail-friendly quantities. E-commerce platforms offering simple interfaces and flexible payment options are accelerating B2C growth.

Construction and infrastructure dominate the steel e-commerce market because these sectors consume the highest volume of steel globally, including structural steel, reinforcement bars, sheets, and beams. E-commerce adoption is strong in this segment due to the need for timely procurement, transparent pricing, and consistent supply for large-scale projects. As governments and private developers invest heavily in infrastructure modernization, this segment continues to lead the market.

Market Share, By End-User Industry, 2025 (%)

| End-User Industry | Revenue Share, 2025 (%) |

| Construction & Infrastructure | 33% |

| Automotive & Transportation | 17% |

| Oil & Gas | 8% |

| Energy | 7% |

| Manufacturing & Engineering | 19% |

| Shipbuilding | 4% |

| Aerospace | 2% |

| Consumer Goods | 4% |

| Appliances & Machinery | 3% |

| Others | 3% |

The automotive and transportation sector is the fastest-growing end-user segment because digital procurement is becoming essential for managing complex supply chains and ensuring timely access to high-quality steel. Electric vehicle growth, lightweight material demand, and precision-grade steel requirements are driving automotive manufacturers toward online platforms. As OEMs digitalize procurement systems and seek greater efficiency, this segment is accelerating faster than others in steel e-commerce.

By Product Type

By Business Model

By End-User Industry

By Region