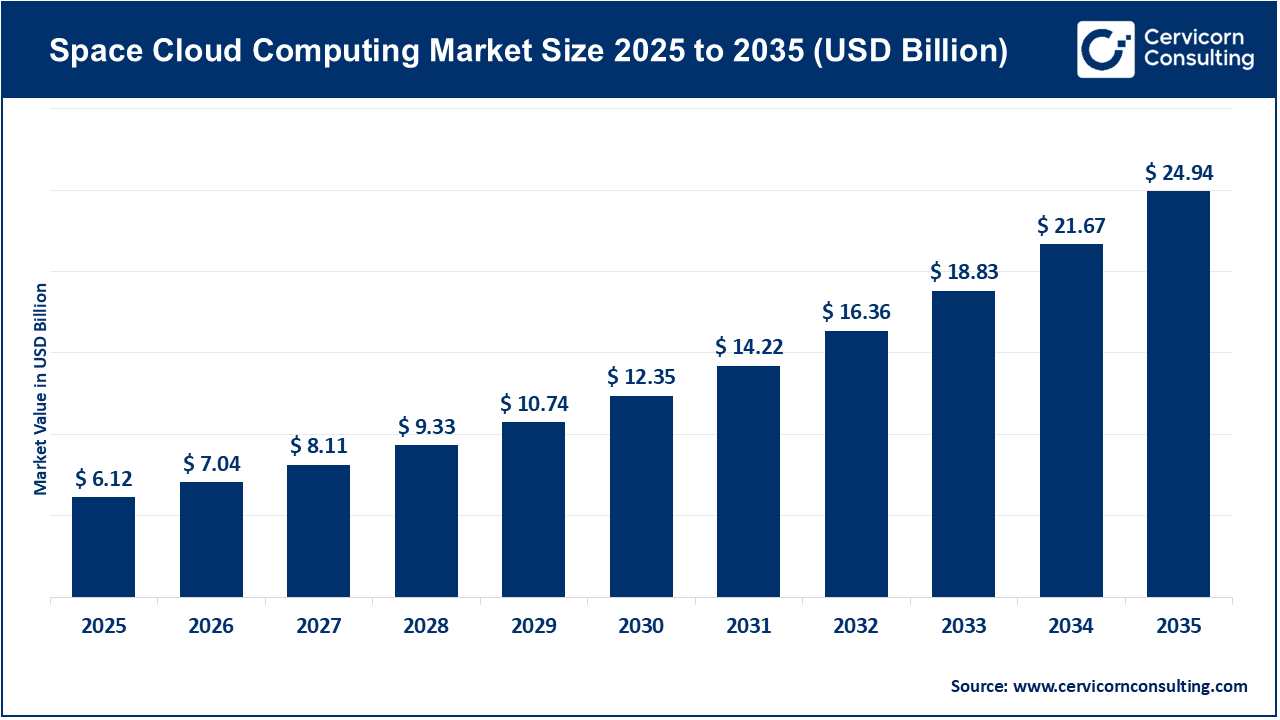

The global space cloud computing market size was valued at USD 6.12 billion in 2025 and is expected to be worth around USD 24.94 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 15.08% over the forecast period 2026 to 2035. The space cloud computing market is being driven by the rapid growth of satellite constellations, increasing demand for real-time data analytics, and the growing requirement for secure and autonomous data processing away from Earth. As larger numbers of satellites generate large amounts of imagery and telemetry data, ground-based systems face bandwidth and latency issues. This has led to the use of on-orbit data processing and AI, enabling analytics, decision-making, and mission automation in outer space. Civil government and military investment are major enablers, as governments invest in sovereign space cloud infrastructure to ensure secure communication and resilience as a strategic data access layer.

Additionally, the space cloud computing market continues to experience upward momentum with the public- private partnership frameworks being formed and venture funding supporting new-startup organizations, such as Axiom Space, D-Orbit, and Loft Orbital, which are establishing operational orbital data centers to delivery cloud services in space. Major cloud companies like AWS, Microsoft, and Google, have begun to extend their infrastructure into low Earth orbit (LEO), and space has been transformed into an extension of the global computing layer. Beyond recent efforts in experimentation by organizations like Axiom or collaborative partnerships, such as Google's Project Suncatcher, space cloud computing is being commercialized. These collective forces are establishing space cloud computing as the next frontier of digital infrastructure that will reshape how data is stored, processed, and shared worldwide.

What is space cloud computing?

Space cloud computing is the integration and use of cloud computing infrastructure, such as data storage, processing, and analytics in space or orbit environments, including satellites, space stations, or orbit data centers. Instead of sending large quantities of raw data back to Earth for processing, cloud space systems allow for on-orbit computing which reduces latency, bandwidth costs, and data congestions. This fusion of cloud and space technologies enables on-orbit use real-time decision-making, enhanced data security and storage, and effortless synergies between space assets and terrestrial networks. In this case, the cloud terminology is evolving to bring "the cloud" closer to where space-generated data is produced, thus, allowing for different ways to exploit that data for a host of objectives.

Applications of Space Cloud Computing

Investment Momentum in Space Cloud Computing

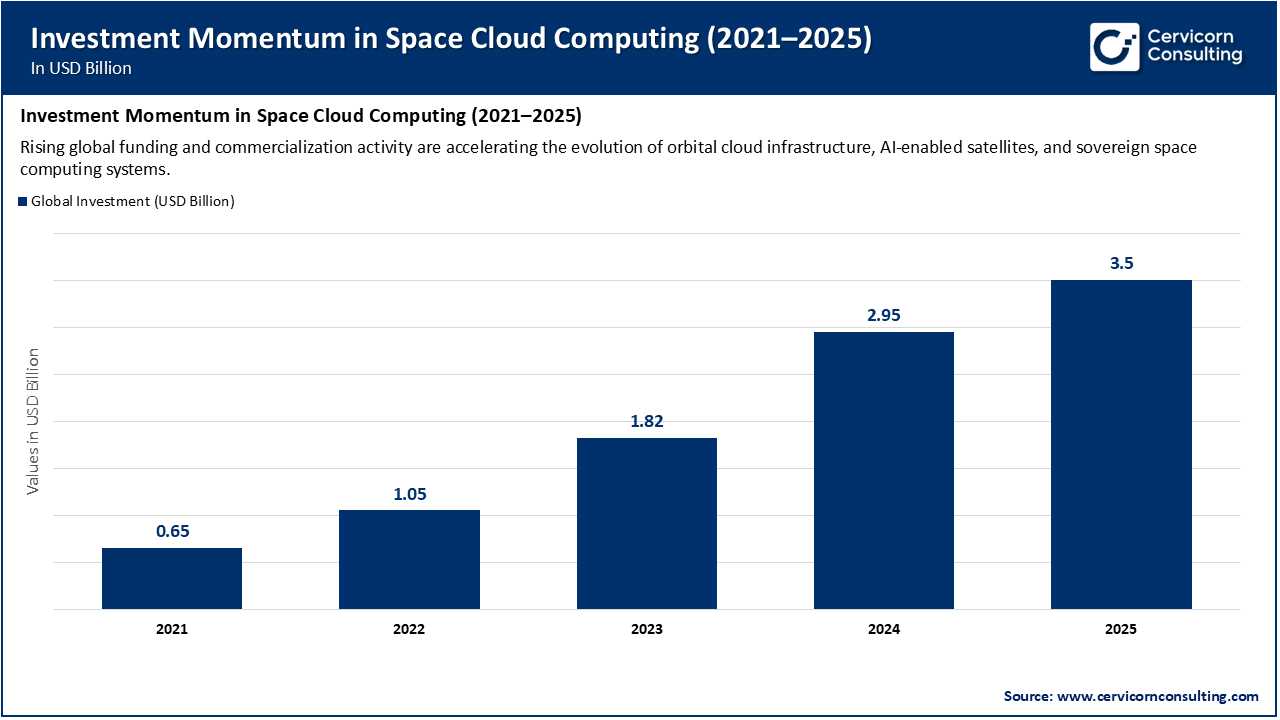

Investment in space cloud computing market is rapidly increasing, with more private capital and strategic investments focusing on startups that build orbital data-centres, processing in-space and cloud-native services for satellites. Loft Orbital raised USD 170 million in January 2025 to deploy its cloud in space platform. A record Q3 for the space sector reported USD 3.5 billion invested in the industry globally, nearly doubling USD 1.79 billion from the same quarter the year prior, which demonstrates both broadening investor appetite and investments beyond rockets and satellites. These trends demonstrate growing confidence that space-based cloud infrastructure will play a major role in analytics, connectivity and computing at the edge of low-Earth orbit and beyond.

The increased year-over-year investments indicate space cloud computing has now moved from the realm of conceptual innovation to operational commercialization. From 2021 to 2025, global investment more than quadrupled, led by venture capital and government-backed programs. This also means new orbital data centers are being built, AI-enabled in-orbit analytics are being deployed, and new hybrid Earth-to-orbit cloud ecosystems are being developed. The increasing influx of capital not only endorses the market’s long-term viability, it is also speeding up the technology's readiness making space the next layer of the global cloud architecture.

Recent Funding & Investments in Space-Cloud-Enabling Ventures

| Year | Initiative | Funding Amount | Implication for Space-Cloud Computing | Rationale |

| 2025 Jan | Loft Orbital | USD 170 million | Funding for a “cloud in space” platform, which uses compute modules on satellites. | One of the largest European investments specifically in an orbital cloud architecture space; led by institutional investors, reflecting Europe's confidence in the potential of space-cloud as a dual-use (commercial + defense) technology. |

| 2025 Mar | Starcloud Inc | USD 10 million additional seed (total USD 21 million) | Development of solar-powered orbital data centers ingesting data to analyze at the edge using AI. | An example of startup-led innovation in energy-efficient orbital computing, matching trends toward sustainability and AI-in-orbit computing. |

| 2025 May | Sophia Space | USD 3.5 million pre-seed round | Focused on modular in-orbit compute nodes designed to process Earth observation data on-site. | Proof that investors are funding hardware-plus-software solutions; suggests confidence that small modular orbital compute units will be the next frontier. |

1. Axiom Space Launching Orbital Data-Center Nodes

In April 2025, Axiom Space announced the development and will be launching “Orbital Data Center” (ODC) nodes that are meant for securely and scalable storing and processing data in Earth orbit, including for AI/ML workloads as well as cloud-enabled storage and processing of data from satellites and spacecraft. This milestone shows a clear transition from concept to infrastructure. Rather than just considering “cloud in space,” it indicates the case for on-orbit cloud-native data centres has become practical, helping with the growth of the space-cloud sector by allowing data to be processed closer to where it is produced, thereby minimizing latency, downlink load and dependence on terrestrial infrastructure.

2. Starcloud & Crusoe Partnership to Build the First Public Cloud in Orbit

In October 2025, Crusoe (an AI infrastructure company) announced a partnership with Starcloud to deploy first public cloud in space, with anticipation to be launched on a satellite in late 2026 and move in-service GPU-capacity by early 2027. The partnership is of note because it shifts the orbit from being a data-relay environment to a robust cloud computing environment that consists of GPU workloads and AI infrastructure. It changes the market from specialized satellite processing to general "cloud services in space" providing a larger portion of addressable use-cases while potentially increasing investor interest.

3. Google’s “Project Suncatcher” – Space-Based AI Data Centre Initiative

Google has started a research program named Project Suncatcher to put its tensor processing units (TPUs) and free-space optical links on solar-powered satellite constellations, intending to launch prototype satellites by the beginning of 2027. When a major player in the cloud and technology space like Google suggests their intention to start moving compute workloads into orbit, it affirms the case for space-cloud computing at scale. It also raises the question of what other high-intensity AI/ML workloads might be able to be sent to orbit, leveraging plentiful solar energy and build optimized for space, and what a new paradigm of how and what cloud computing might be able to be delivered in the cloud.

4. D‑Orbit S.p.A. and SkyServe Collaboration for In-Orbit Edge Computing

D-Orbit partnered with SkyServe (STORM platform) in April 2024 to perform Earth-observation imagery processing on its ION satellite carrier fleet. This will allow for onboard analytics, compression, smart discard, and edge-cloud processing capabilities to be done in orbit. This achievement embodies a practical example of space-cloud computing, shifting analytics and compute to the edge of space versus back to Earth. This helps to reduce data volume, increases the speed of generating insights, and makes constellations more efficient and less expensive. In essence, it lays the groundwork for commercial space-cloud services, enabling satellite operators to begin to monetise compute and analytics services in orbit.

Rising Demand for On-Orbit Data Processing

As satellite constellations develop and produce vast amounts of Earth observation, communications, and telemetry data, the reliance on information to be processed in orbit instead of transmitting to Earth is accelerating. On-orbit cloud computing has clear benefits; it reduces bandwidth costs, improves latency and enables real-time analytics for applications that benefit from instant information (e.g., defense, disaster monitoring, and space traffic management). This is a fundamental driver of market adoption.

Expansion of LEO Constellations and Space Commercialization

The fast deployment of Low Earth Orbit (LEO) satellites by companies like SpaceX, OneWeb, and even Amazon's Kuiper project has created a huge backbone of infrastructure for cloud-based data exchange. With commercialization also comes the ability to scale integration between space and terrestrial networks, leading companies to erect cloud nodes in space and deploy AI compute modules in orbit.

High Capital and Launch Costs

Building and deploying orbital data centers or compute nodes requires a humongous investment, not only with respect to spacecraft and payload design, but also with respect to launch logistics and risk management. This cost contributes to the barrier for small start-ups to enter the market and slows scaling overall, especially without government or institutional support.

Technical and Regulatory Complexities

Cloud computing in space faces major challenges in interoperability, data sovereignty, and frequency allocation. Cybersecurity and compliance across international jurisdictions add complexity to data management in orbit and slows the development of cross-sector adoption.

AI and Edge Computing Integration in Space

The increasing interest in launching artificial intelligence (AI) and machine learning (ML) workloads directly in orbit presents huge possibilities. Real-time AI analytics on satellites have the potential to increase object detection, enhance mission operations and create autonomous spacecraft business models: "AI-as-a-Service in Space."

Government and Defense Demand for Secure Space Cloud Infrastructure

Governments and defense agencies are increasingly looking for sovereign, secure data environments that do not suffer from terrestrial vulnerabilities. Initiatives such as Europe’s Space Cloud System (by Leonardo S.p.A.) illustrate how national security will spur investment in orbital computing and therefore create stable long-term revenue streams.

Space Environment Durability and Maintenance

Orbital hardware is subjected to radiation, micro-meteoroids, and extreme temperature fluctuations. Keeping space-based cloud hardware reliable, repairable, and upgradeable is a central technical challenge that inhibits system longevity and cost efficiency.

Lack of Standards and Interoperability

At this time, there are no international standards and protocols for cloud applications, cloud APIs, or data-sharing frameworks in space environments. This fragmentation limits collaboration between space agencies, commercial operators, and cloud providers, and stawns progress on an “interplanetary cloud network.”

The space cloud computing market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

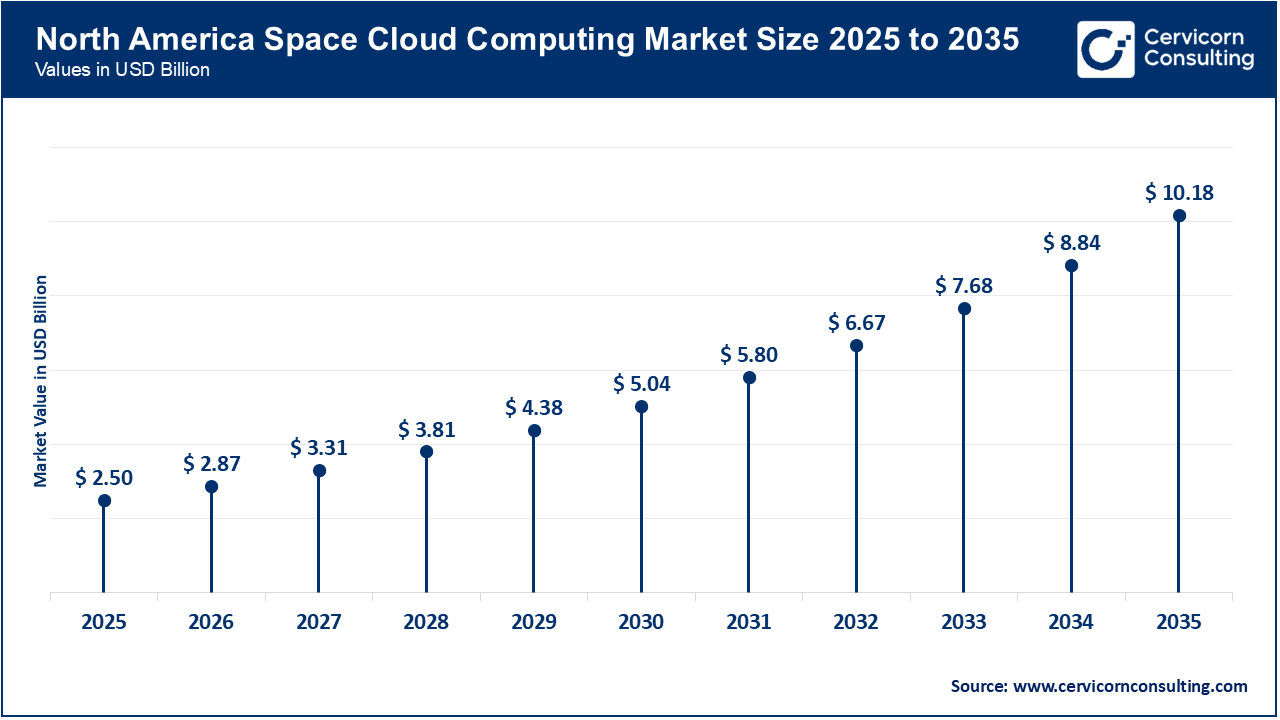

The North America space cloud computing market size was valued at USD 2.50 billion in 2025 and is expected to reach around USD 10.18 billion by 2035. North America is the leading region, as it has the greatest depth of cloud-services infrastructure, a strong commercial space sector, and significant government/defence demand. As major hyperscalers (e.g. AWS, Microsoft Azure) and NewSpace companies seek to develop and deploy orbital cloud infrastructure and/or services, the region has important advantages. According to market analysis, the region is primarily positioned to lead the space cloud computing market.

Recent Developments:

The Asia-Pacific space cloud computing market size accounted for USD 1.68 billion in 2025 and is estimated to reach around USD 6.83 billion by 2035. The Asia Pacific region is becoming the fastest-growing market due to digital transformation programs, increased activity from satellites and LEO, and large investments from governments and cloud players. Countries such as India, China and Southeast Asian economies are implementing cloud-first policies and exploring space infrastructure. In APAC, there is an increasing market opportunity for cloud services in orbit.

Recent Developments:

The Europe space cloud computing market size was estimated at USD 1.382 billion in 2025 and is projected to surpass around USD 5.64 billion by 2035. Europe’s region is steadily expanding due to growing digital and data sovereignty concerns, increased investment in space systems, and a regulatory upsurge for European-based cloud infrastructure. Europe must overcome the dual challenge of catching up with U.S. space/cloud pioneers while building its own regional industrial ecosystem; however, robust public-private initiatives are emerging, and “sovereign cloud infrastructure” is growing momentum in Germany and elsewhere.

Recent Developments:

Space Cloud Computing Market Share, By Region, 2025 (%)

| Region | Revenue Share, 2025 (%) |

| North America | 40.8% |

| Asia-Pacific (APAC) | 27.4% |

| Europe | 22.6% |

| LAMEA | 9.2% |

The LAMEA space cloud computing market was valued at USD 0.56 billion in 2025 and is anticipated to reach around USD 2.29 billion by 2035. LAMEA is emerging as a frontier in market. Growth is fueled by national digital-transformation strategies, the requirement for connectivity in remote/underserved areas and increased investment for infrastructure in data centres and satellite communications. The Middle East is borrowing a lead by investing in hyperscale data centres, infrastructure in AI, and space exploration missions, including initiatives such as Saudi Vision 2030 and the UAE’s National Space Program.

Recent Developments:

The space cloud computing market is segmented into service, deployment model, application, end-user, and region.

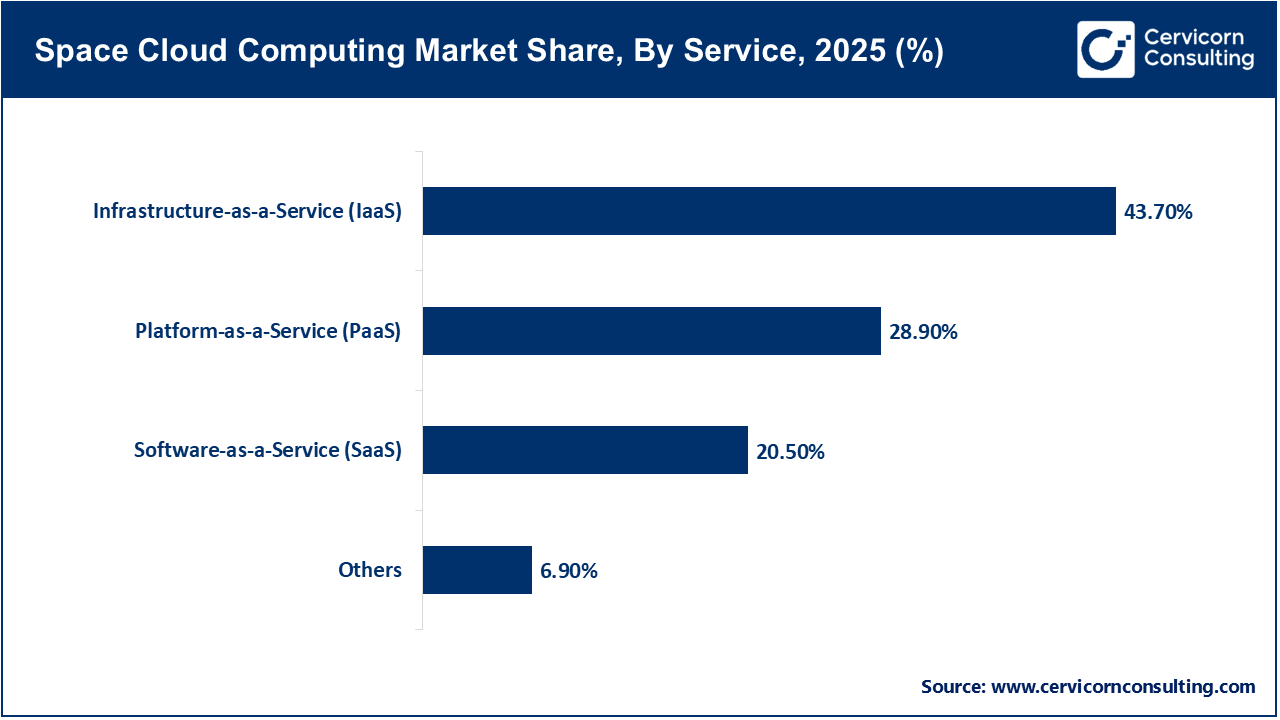

IaaS dominates the space cloud computing market because it is the backbone of orbital computing environments, including the computing hardware, networking, and storage nodes required for other services to exist and function in orbit. Companies like D-Orbit and Axiom Space lead the industry by deploying on-orbit infrastructure using a combination of data processing and storage. As most of the current projects in the market propose physical orbital data centers that leverage resources from satellites and cloud computing on Earth in the same way, IaaS employs the largest share of the market.

PaaS is the fastest-growing segment, while the market is moving away from infrastructure deployment to developing tools and environments that permit customers to build and manage space-native applications. New platforms like LEOcloud and Starcloud allow developers to deploy analytics, AI models, and IoT workloads directly in space environments without managing the infrastructure. This paradigm shift is accelerating innovation with accessible, modular, and scalable layers for orbital computing development.

Public cloud is the dominant deployment model in the space cloud computing environment, as most active projects are advanced by commercial satellite operators and cloud service providers providing shared access to orbital resources. This arrangement affords multiple organizations the ability to share space to access storage and computation more economically. AWS and Microsoft Azure, for example, are using their preeminent public cloud applications on Earth to extend their infrastructure to orbit, providing more democratized access to space computational resources for a larger global user base.

Space Cloud Computing Market Share, By Deployment Model, 2025 (%)

| Deployment Model | Revenue Share, 2025 (%) |

| Public Cloud | 46.2% |

| Private Cloud | 25.4% |

| Hybrid Cloud | 28.4% |

Hybrid cloud is the fastest-growing deployment model as organizations are increasingly integrating space-based and terrestrial cloud environments to enjoy benefits across security, performance, and flexibility. Defense and research agencies and enterprises are now decentralized for hybrid configurations that keep critical workloads on private orbital nodes in the cloud while executing analytics and communications through public cloud channels or storage locations. A growing trend toward hybrid architectures pits organization needs for continuous data flow between earth and orbit against performance, resilience, data sovereignty, and scalability.

Data storage & backup leads the application segment due to the immense volumes of data created by satellites and orbital infrastructures that must be securely stored and accessed. Cloud systems in space provide a venue for archiving large quantities of datasets with unique features like global redundancy, stronger cybersecurity, and less reliance on terrestrial infrastructures. Initiatives such as Cloud Constellation’s SpaceBelt are leading secure orbital storage networks for government and enterprise clients, showing that storage remains the foundational use case of space cloud computing.

Space Cloud Computing Market Share, By Application, 2025 (%)

| Application | Revenue Share, 2025 (%) |

| Data Storage & Backup | 34.6% |

| Data Processing & Analytics | 31.8% |

| Content Delivery / Communication | 17.9% |

| Simulation & Modelling / Software Development | 10.6% |

| Others | 5.1% |

Data Processing & Analytics is the fastest growth application as goals are to realize actionable insights in the satellite data from the satellite itself, not having to wait for the transmission to the earth. This segment represents an increasing need of edge computing and AI processing on the satellite to perform real-time monitoring, decision-making, and predictive analytics. Collaborations, such as D-Orbit partnering with SkyServe for in-orbit analytics, showcase the ability of onboard processing to reduce data latencies and bandwidth consumption and provide immediate value of operations.

Government and defense segments dominate the end-user landscape due to strong interest in secure communications, surveillance, and sovereign data control. These sectors have been the earliest adopters of orbital cloud technology to increase national security, intelligence analysis, and mission independence. Initiatives such as Leonardo’s Space Cloud System (SCS) in Europe will exemplify how defense institutions are increasingly leading investments to develop sovereign orbital computing capabilities and diminish reliance on terrestrial systems.

Space Cloud Computing Market Share, By End-User, 2025 (%)

| End-User | Revenue Share, 2025 (%) |

| Government & Defense | 42.3% |

| Commercial / Enterprise | 33.7% |

| Research Institutions & Academia | 16.5% |

| Others | 7.5% |

The commercial and enterprise segment is the fastest growing end-user segment as more private industry companies leverage space cloud computing for applications such as satellite communications, IoT connectivity, and earth observation analytics. Private sector enterprises in telecommunications, logistics, and energy sectors are utilizing space-enabled cloud services to facilitate global coverage and data reliability. With rising investments from startup ventures and corporations, the commercial space cloud ecosystem is evolving from experimentation to operational rapidly.

Industry Leaders’ Perspectives: Voices Shaping the Future of Space Cloud Computing (2025):

1. Jeff Bezos – Founder & Executive Chair, Amazon/Founder, Blue Origin

"The next generation of data centers won’t just be on Earth—they’ll orbit it. Space is where we’ll host AI and data infrastructure at planetary scale."

Jeff Bezos believes this vision is aligned with the increasing energy and data needs of the AI era. As he noted, data centers of the future particularly those serving high performance AI and cloud computing will move off-planet because they can reap the benefits of solar data abundance and low environmental impact from orbital. Such a statement is pushing strategic narratives of the concept of moving from a data transport layer (satellites) in space to data processing, storage, and infrastructure operation. One example of an infrastructure shift is Blue Origin’s, Blue Ring which aims to have orbital compute capacity specifically dedicated for commercial and government purposes and is a notable movement toward the real world concept of space cloud computing, and is the next big infrastructure movement.

2. Kam Ghaffarian – CEO & Executive Chairman, Axiom Space

“Space cloud computing is no longer a concept; it's an operational reality. Our orbital data centers stand to support customers in the areas of defense, science and global communications.”

Kam Ghaffarian’s remarks encapsulate space cloud computing emerging from the world of research and experimentation and finding its way into an operational mindset. Axiom Space’s Orbital Data Center (ODC) initiative aims to enable data storage, analytics and AI processing, all in orbit. His mindset exemplifies the sector's increasing maturity—creating operational systems to be utilized by real clients. The momentum, here, demonstrates that space cloud computing is now being treated with the same intensity as it was in 2010, as infrastructure as a service; opening commercial access to orbit, as earth bound cloud services began.

Market Segmentation

By Service

By Deployment Model

By Application

By End User

By Region