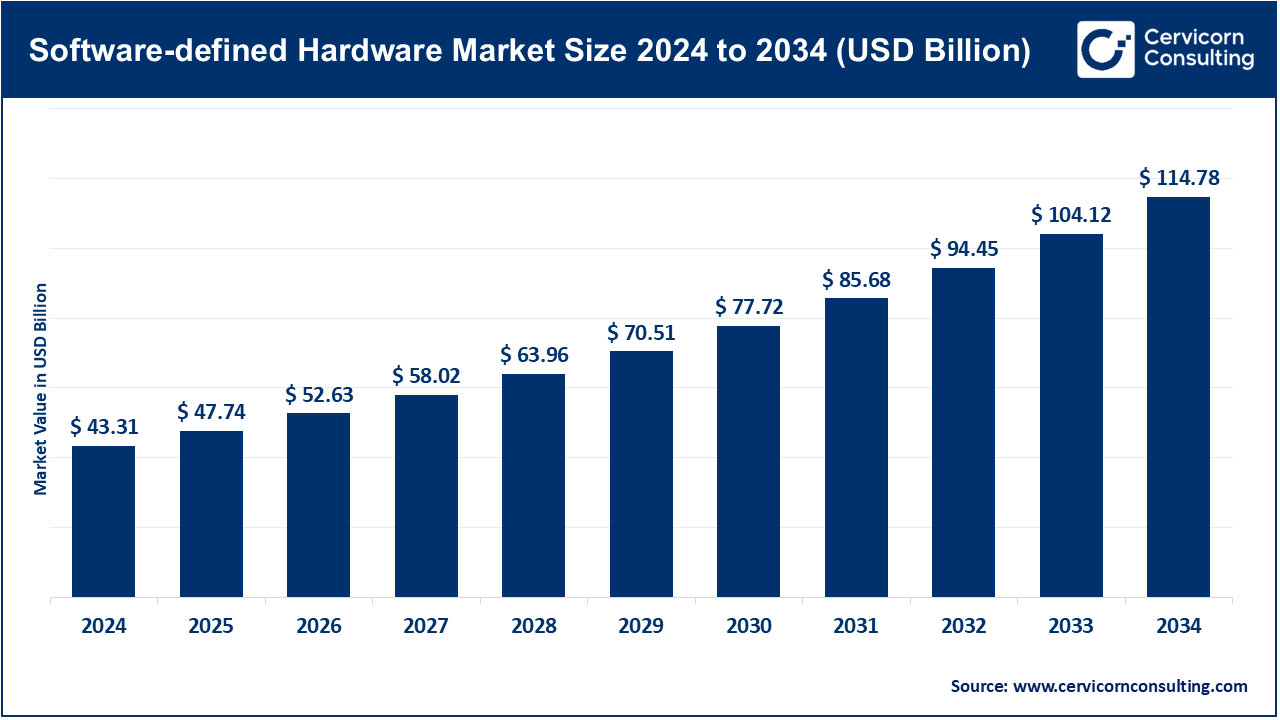

The global software-defined hardware market size was valued at USD 43.31 billion in 2024 and is expected to be worth around USD 114.78 billion by 2034, expanding at a compound annual growth rate (CAGR) of 10.24% over the forecast period from 2025 to 2034. The software-defined hardware (SDH) market is changing significantly due to the need for more flexible, programmable, and efficient computing systems. The dependent model of SDH enables components to be changed on-the-go unlike tradition fixed-function hardware. This is a shift that fundamentally benefits sectors like data centres, Telecoms, autonomous vehicles, and aerospace industries. SDH exacerbation is thus further propelled by edge computing and AI workloads since SDH provides enables SDH devices to respond in real-time. As these industries employ a need for much more flexible and adjustable requisites, SDH technology is becoming a backbone for next gen digital innovation.

What is software-defined hardware?

Under the design paradigm known as "software-defined hardware," a hardware device's functionality is controlled and reconfigured by software rather than being fixed. The capabilities of a chip or component in a traditional hardware system are hard-wired and difficult to modify once manufactured. In contrast, software-defined hardware utilizes a programmable architecture, such as field-programmable gate arrays (FPGAs) or reconfigurable processors, which allows software to dynamically alter the hardware's circuitry and performance characteristics. Greater flexibility, adaptability, and the ability to add new features or update a device's capabilities with a straightforward software update—without requiring a physical hardware replacement—are made possible by this separation of function from physical design. This method is widely used in fields like data centers, networking, and telecommunications.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 47.74 Billion |

| Expected Market Size in 2034 | USD 114.78 Billion |

| Projected CAGR 2025 to 2034 | 10.24% |

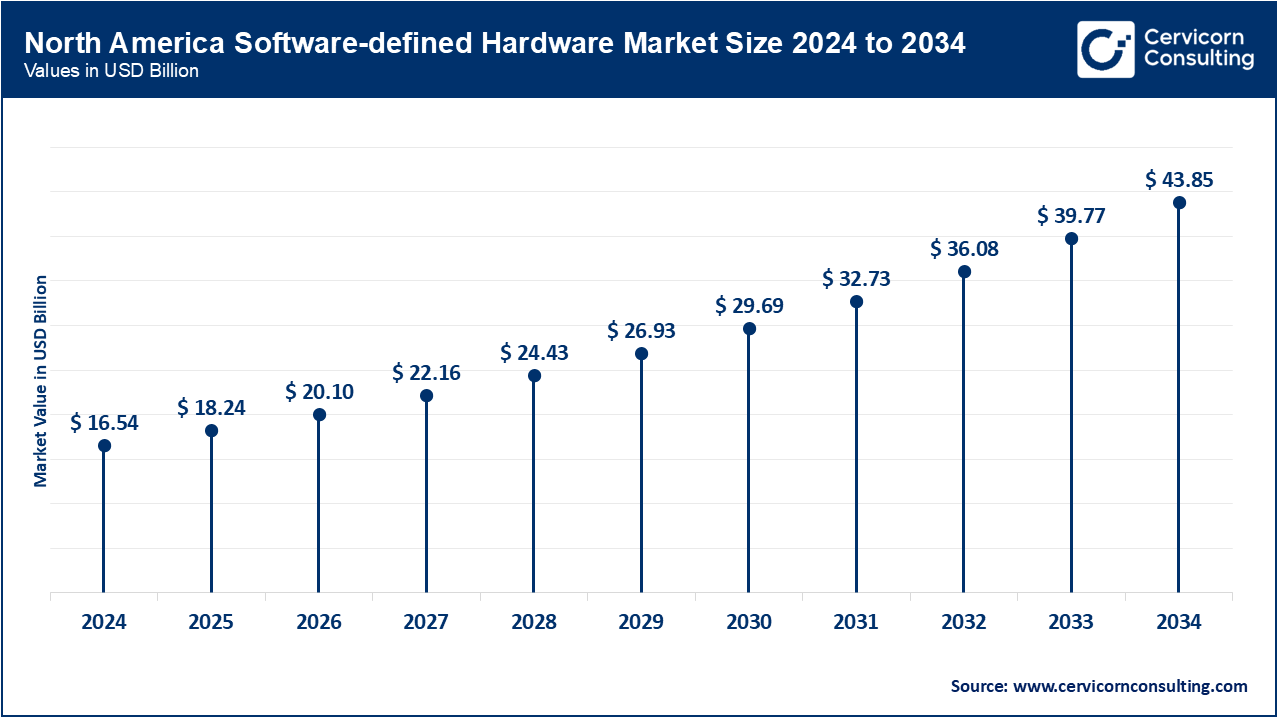

| Leading Region | North America |

| Fastest Expanding Region | Asia-Pacific |

| Key Segments | Component, Hardware Type, Deployment Mode, Application, Industry Vertical, Region |

| Key Companies | NVIDIA Corporation, Intel Corporation, Advanced Micro Devices (AMD), Qualcomm Technologies, Inc., Xilinx (a part of AMD), Broadcom Inc., IBM Corporation, Microsoft Corporation, Alphabet Inc., Apple Inc., Synopsys, Inc., Ansys, Inc., NXP Semiconductors, Marvell Technology, Inc., Arm Ltd. |

The software-defined hardware market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region.

North America comprises the US, Canada, Mexico and other countries in the region, functioning as a key center for the SDH function development in enterprise, data center and edge applications. The US is the front runner with widespread AI optimized hardware adoption. Canada and Mexico are more focused on automation applications in manufacturing and telecom infrastructure. In November 2023, AMD participated in FGP-FPGA server market with Instinct MI300X series servers aimed at AI training workloads which focused on expanding FPGA-accelerated server offering in the region. This illustrates the continued focus North America has on investment in scalable, software-defined compute. It highlights the region's leadership in SDH innovation and adoption across sectors.

Incorporating Germany, France, the UK, Italy, Spain, Russia, and the Netherlands along with the rest of the continent has a unique blend of SDH automotive, industrial, telecom, and defense applications. The region offers primary focus on data sovereignty along with standardization and energy efficiency of programmable systems. In june2024, NXP launched new software defined vehicle R&D center located in Germany which adds to their SDP portfolio and partnerships with major automakers aimed at participating in the development of updateable vehicle compute platforms. This indicates the Europe’s assertive position in the integration of SDH technology with mobility industrial convergence, enhancing the geopolitical significance of the region to the Union.

This region includes China, Japan, India, South Korea, New Zealand, Australia, and Taiwan. It is distinguished by rapid SDH adoption in manufacturing, telecoms, and consumer electronics. Governments promote the Industry 4.0 and edge AI initiatives, while businesses pour resources into programmable hardware. Propelling the regions aim for self-developed cloud and edge hardware infrastructures, Alibaba released a RISC-V based Xuantie C910 SDH optimized processor in August 2022. Asia-Pacific has emerged as a leader in the development of open and flexible hardware.

Software-defined Hardware Market Share, By Region, 2024 (%)

| Region | Revenue Share, 2024 (%) |

| North America | 38.20% |

| Europe | 26.80% |

| Asia-Pacific | 24.60% |

| LAMEA | 10.40% |

In South America, Brazil is the largest emerging market and paired with the Middle East and Africa they compose LAMEA. Here SDH adoption is driven by the telecommunications modernization, smart city projects, and defense technologies, but lags behind more advanced economies. In March 2025, Brazil’s telecom operator the Vivo announced a pilot deployment of FPGA-based programmable network nodes in partnership with Intel, targeting enhanced 5G service flexibility. This is one of the initial proof-of-concept SDH implementations in Latin America demonstrating the shift towards software-centric infrastructure in the region.

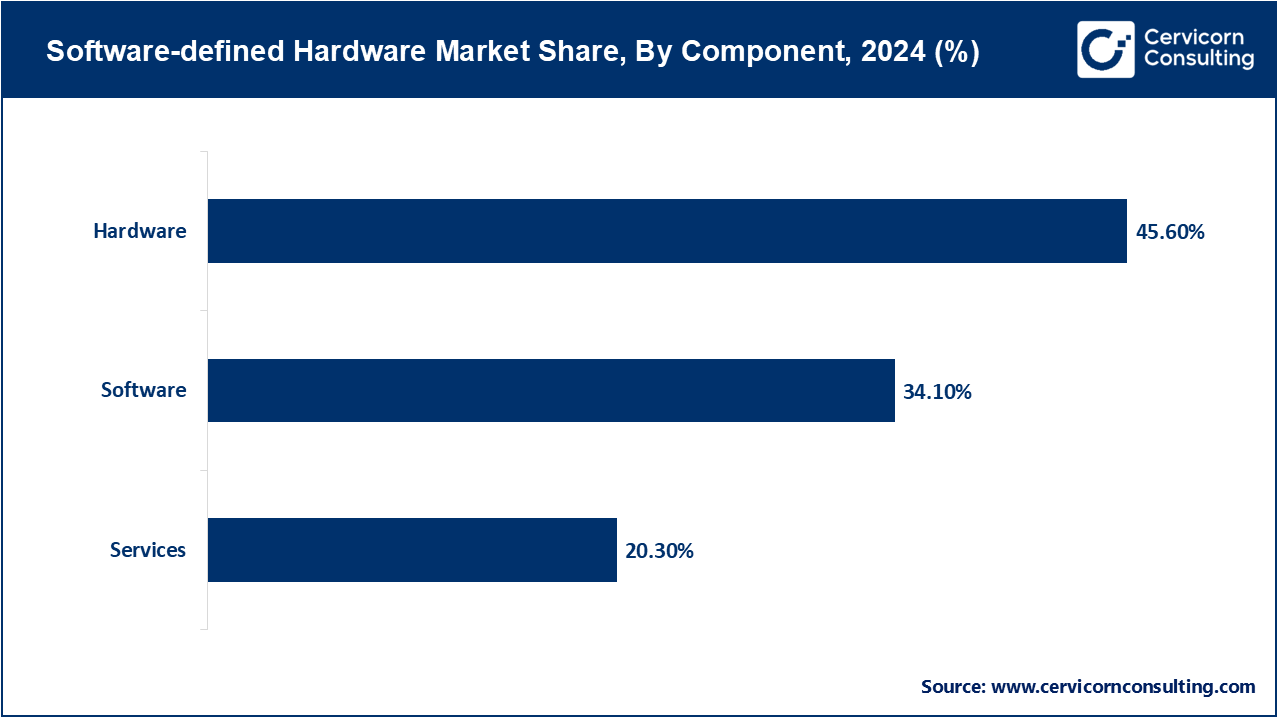

Hardware: Hardware in SDH includes physical equipment such as CPU, FPGA, GPU and ASIC that support the reconstruction of software controlled by software. It forms the foundation of all programmable computing systems. In August 2024, AMD acquired the ZT system for 4.9 billion USD to strengthen its appearance in AI and server hardware. This step enhances the ability of the AMD to distribute scalable, the software-configurable infrastructure infrastructure. Hardware is the backbone of SDH innovation.

Software: Software enables programming, configuration and control of hardware systems in SDH, often abstracts hardware complexity for easy user interactions. This includes SDK, compiler, orchestration tools and AI control platforms. In July 2025, Synopsys finalized its USD 35 billion acquisitions of ANSYS, integrating the design and simulation software for chip and system-level coordination. This merger strengthens SDH software ecosystem. Integration programmable hardware simplifies growth in the environment.

Services: SDH markets include consultation, integration, maintenance and life-cycle management to deploy and optimize SDH solutions in services. These services ensure successful adaptation and performance tuning of hardware-software stacks. In February 2024, Siemens expanded its digital services portfolio by launching AI-based SDH support tools for industrial customers. Launch Target Predictive Hardware Configuration and Adaptive Test. Services are important in reducing complexity and maximizing SDH efficiency.

FPGA: The FPGA segment has captured highest revenue share in the market. FPGAS are programable logic devices that can be re-configured to post-manufacturing to handle special, high-speed functions. They are important for age computing and AI workload. In March 2025, Altera launched its Agilex 3 FPGA series in the embedded world, which led to AI acceleration and increase in power efficiency. They are adapted for robotics, medical imaging and industrial automation. The launch is a step ahead in low-power, high-demonstration programable devices. Their role in flexible SDH systems continues to expand rapidly.

ASIC: Asics are custom-designed chips that are sewn for specific tasks, offering better speed and efficiency but limited flexibility. They are used in high-volume, performance-mating applications. In June 2023, Intel introduced the embedded FPGA IP in its Asics to combine efficiency with some revival. This hybrid approach reduces dynamic power by about 28%. It also refers to the increasing trend of merger of fixed and flexible designs. Such innovation supports SDH finance in special systems.

GPU: The GPU parallel processor is ideal for high-thruput AI functions and visual rendering, which is now integral part of SDH due to software-level regeneration. In 2024, AMD integrated its AI engine ML into the GPU-CPU hybrid, which enables machine learning workload with support for BFLOAT 16 accuracy. This update increases the performance in training and estimates scenarios. This shows how GPU architecture is developing for software-defined adaptability. These innovations are being rapidly adopted in cloud and edge AI systems.

CPU: CPUs are central processing units that execute the instructions in general-purpose computing, making a control layer in the SDH system. In March 2025, Alibaba introduced the Xuantie C930, a RISC-V-based server-grade CPU aiming at cloud-native applications. It supports the software-defined control over distributed workloads. The launch reflected the momentum towards open, reprogrammable CPU ecosystems. The CPUs remain a foundational component in SDH architecture. Their design evolution now emphasizes flexibility and open hardware standards.

On-Premises: The on-premises SDH systems are situated physically within an organization’s premises, allowing full control, enhanced security, and customization. Siemens introduced AI-driven embedded hardware testing tools for on-premises use in industrial settings. These tools aid in the efficient development and validation processes of programmable systems. This shift supports the necessity for industry-configurable, in-house solutions. Such configurations are still crucial for sensitive or latency-dependent use cases. On-Premises SDH continues to address the needs of industries such as defense, healthcare, and manufacturing.

Cloud-Based: The cloud-based segment has generated highest revenue share in the market. Remote management characterizes cloud-based SDH systems, which feature scalable and programmable hardware available over the internet. AWS launched the Coyote V2 in April 2025 to improve both the FPGA runtime and programming abstraction. The update significantly cuts down the time required for compiling and deploying the systems. Simplified SDH deployment in cloud-based AI and data processing hubs is now possible. This change lets more developers access programmable infrastructure, enabling rapid advancement in technology. With greater flexibility and lower costs, the adoption rate of cloud SDH is skyrocketing.

Hybrid: As defined, Hybrid SDH includes a combination of on-premise and cloud deployment, offering flexibility towards workload management and enhanced data sovereignty. Together with Aeroflex, QuickLogic in 2024 deployed embedded FPGA cores over industrial and automotive SoCs operating under hybrid cloud frameworks. This also allows for secure compute whilst taking advantage of cloud scalability. The use of these models is increasing in industries with real-time and data-sensitive business operations. The design guarantees agility and resilience. Multi-site and cross-area SDH frameworks are supported under hybrid deployment.

Data Centers: The data center segment accounted for a highest revenue share in the market. In data center systems, SDH employs configurable hardware for the AI, storage, and networking function operations management. Altera FPGA development kits for data center AI workload FPADs was expanded in September 2024. These kits are improving the computing density and energy efficiency. The update supports real-time model updates and intensive operations. Modular expansion of server capability SDH hardware enables supplementary data centers. SDH's agility on AI infrastructure is increasingly being leveraged by data centers.

Networking: Networking applications use SDH to reprogram routers, switches, and data planes as per the traffic. Xilinx Versal Premium series with embedded FPGAs for 5G networking gear came into use in September 2023. The enhancement provided real time throughput and reduced latency in mobile infrastructures. It also offered on-the-fly programmable networking upgrades. The trend of increased adoption of networking SDH is noted among telecom and private 5G. The ability to program these devices greatly enhances scalable and resilient infrastructure.

Automotive: The flexibility and upgradability of automotive SDH systems permits customization in electric vehicles and software-defined cars. NXP’s TTTech Auto acquisition in January 2025 reinforced its CoreRide SDV platform functional safeties. It integrates the automotive-grade hardware with SD frameworks, merging software defined control. OTA update capability is enhanced along with fail-safe functions. Advancements of these features including autonomous driving and electrification are supported. There is a marked shift toward SDH and modular architecture by automotive OEMs.

Industrial Automotive: The fully integrated SDH systems in industrial automation enables intelligent control, predictive maintenance, and cyclic programmable machinery. As of March 2025, Altera's Agilex 3 FPGAs were featured driving the smart factory use cases at Embedded World. They enabled the real-time responsive control of robotic arms and the vision systems on a microsecond timescale. These FPGAs provide a flexible backbone for adapting to changes in production environments. SDH capable systems and unconfigured FPGAs enhance SDH embrace due to reduction in downtimes and enduring upgradability. Efficiency across programmable industrial hardware is sharply increasing and is highly welcomed by all industrial branches.

IT & Telecom: The IT and telecom segment leading the market with highest revenue share. The IT and telecom industry employs SDH to upgrade infrastructure for more dynamic network functions and scalable computing environments. AMD has expanded its FPGA capabilities across telecom base stations for Xilinx, which was acquired in December 2023. This allows for real-time configuration of various signal processing tasks. The merger strengthens AMD's position in programmable infrastructure. Telecom companies now use SDH to address 5G and expanding data traffic. Increased network flexibility enhances servicing and reduces operational cost burden.

Automotive: Automotive SDH supports the modular vehicle platforms with AI, connectivity, and autonomous features integration. In June 2023, both the automotive and networking segments gained cutting-edge Versal Premium chips from Xilinx. These Versal FPGAs enables the edge AI for autonomous driving. Adoption demonstrates convergence of programmable systems across multiple sectors. Automakers seek features that enable advancements driven by software updates. Complex vehicle systems with SDH are easier to manage throughout the lifecycle.

Healthcare: Within the healthcare sector, SDH aids in the creation of adaptive diagnostic tools, imaging systems, as well as AI applications for imaging in evolving clinical environments. In the Altera Agilex 3 demos for medical imaging held in March 2025, the low latency and field upgradeability were emphasized. The FPGAs assisted in more precise imaging and device enhancement. This trend indicates promising for rising the demand for smart, reprogrammable medical devices. SDH minimizes hardware supplantation. Innovations in healthcare can be executed with more real-time dynamism.

Aerospace & Defense: In aerospace and defense, SDH facilitates the construction of secure and upgradeable systems for radar, avionics, and other mission-critical computing systems. In 2024, QuickLogic collaborated with Aeroflex to offer embedded FPGA IP in defense SoCs. These solutions support encrypted the communications along with dynamic response protocol execution. Reconfigurable logic increases the capability of the hardware to withstand harsh environments. Programmable systems with stringent dependability are critical in defense applications. SDH fulfills these changing operational demands.

Consumer Electronics: The post-sale feature updates enabled by SDH make devices smarter and AI-ready, thus benefitting consumer electronics. AMD’s AI Engine ML was incorporated into consumer-grade GPUs in laptops and desktops in 2024. This enabled real-time AI acceleration in consumer applications. Devices were freed from their hardware shackles to perform localized AI tasks. SDH assists in extending product life while decreasing time-to-market. Consumer brand manufacturers now enhance their design flexibility at the chipset level.

Market Segmentation

By Component

By Hardware Type

By Deployment Mode

By Application

By Industry Vertical

By Region