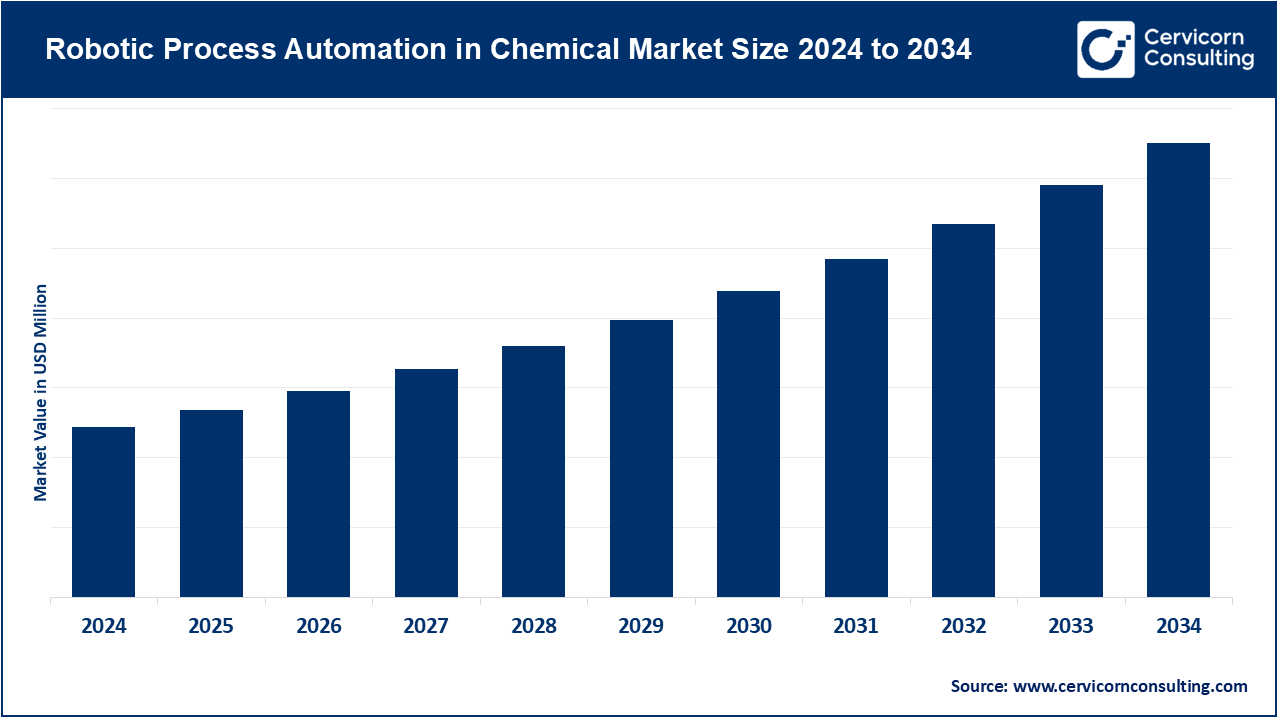

The global robotic process automation in chemical market is growing at a CAGR of 28.5% from 2025 to 2034. The robotic process automation in chemical market is a booming trend with business organizations aiming to automate complex processes to save costs, eliminate errors, and provide accuracy in their businesses, such as supply chain, compliance, quality assurance, and more. Repetitive tasks that are performed manually tend to be inefficient, prone to error, and less trustworthy than those produced by RPA which is safer, quicker and more dependable. The increased competition, sustainability ambitions, and governmental initiatives of digitalization facilitate this change.

The robotic process automation is no longer all about simple automation but smart production planning, procurement optimization and regulatory management with the addition of AI and machine learning. With chemical enterprises adopting Industry 4.0, RPA is becoming one of the enablers of efficiency, sustainability, and resilience to the industry to ensure that it stays competitive in the global market where change is imminent.

Report Scope

| Area of Focus | Details |

| RPA in Chemical Market CAGR | 28.50% from 2025 to 2034 |

| Dominant Region | Asia-Pacific |

| Fastest Expanding Region | Asia-Pacific |

| Key Segments | Type of RPA, Application, Deployment Mode, Enterprise Size, Region |

| Key Companies | Type of RPA, Application, Deployment Mode, Enterprise Size, Region UiPath, Automation Anywhere, Blue Prism (SS&C), Pegasystems, NICE Systems, Kofax, WorkFusion, Kryon Systems, IBM, Accenture, Deloitte, Cognizant, Capgemini, TCS, Infosys, Wipro |

The RPA in chemical market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region.

The other parts of the world all focus on the adoption of new RPA technologies. This focus has been driven by an already existing foundation of flexible industries like automation. In March 2025, BASF expanded its U.S. operations with Automation Anywhere’s unattended RPA systems to optimize procurement and compliance reporting. The U.S. also sees chemical SMEs leveraging RPA for regulatory safety logs and supply chain automation, while Canada is funding RPA sustainability programs for hazardous material management.

Europe focuses on compliance and environmentally friendly operations while focusing on digital workforce programs in chemical plants. In May 2025, Evonik in Germany implemented hybrid RPA on its manufacturing operations to better the efficiency of the plants and decrease the down time. The RAPIT cross border project in France and the United Kingdom also focuses on the compliance and regulatory reporting for the REACH hazardous chemical guidelines to help with the chemical trade across borders. Multiple start-ups in the Netherlands and Switzerland also focus on creating RPA systems for specialty chemical workflows.

Asia-Pacific continues to lead in the adoption of RPA in the chemicals sector owing to the region's growing industrial and value chain networks. In June 2025, Tata Chemicals in India used cloud RPA from UiPath to digitize vendor management and automate the invoice approval process across operations. In Japan and South Korea, RPA is used for documentation of chemical research and integration into smart factories, while in China, RPA is used for the management of chemical logistics and exports on a national scale.

The adoption of RPA in the chemicals sector in LAMEA is done mostly as a segment of partnership agreements with global RPA providers. In July 2025, Braskem in Brazil initiated RPA pilots in the petchem segment to automate the order processing and safety audit documentation of petrochemical operations. RPA is being allocated in the UAE to cope with compliance systems in the chemical trade lies in the free zone, while South Africa is commencing the implementation of RPA in the tracking and tracing of the production of mining chemicals to regulatory approvals. Although advancement in these countries is slower relative to other regions, the pace of progress is increasing.

Attended Automation: Bots of this kind are designed to function side-by-side with workers, activating processes at designated intervals. Within the realm of chemicals, they are exceptionally valuable to laboratory workers stuck with endless data entry, preparing safety documentation, or writing up reports on the outcomes of test samples. In April 2025, UiPath improved attended automation capabilities on the chemical lab data real-time verification and workflow quality control features.

Unattended Automation: Independent automation of this type works invisibly, executing monotonous, time-consuming tasks such as purchase order, order billing, orders, inventory control, and compliance document submissions. In December of 2025, Automation Anywhere and BASF began a collaboration project focused on the automation of international procurement processes which included simplification of vendor onboarding and order reconciliation.

Hybrid RPA: This is a combination of attended and unattended automation, providing the continuity of fully automated digital workflows. Hybrid RPA enables chemical plants to seamlessly tie together production observation with finance and logistics. In July 2025, Blue Prism SS&C deployed Hybrid Automation to numerous chemical plants where they integrated on-site quality assurance with unattended supply chain clog automation.

Manufacturing Operations: RPA systems schedule batches, monitor processes, and capture defects resulting in a decrease in human error and overall downtime. Siemens using RPA-driven automation in specialty chemical units, in March 2025, was able slash downtime and boost production efficacy further optimizing other systems within units.

Supply Chain and Logistics: Schedulers, warehouses, and shipping depots are all integrated systems capable of being optimized and monitored RPA Bots streamline. In May 2025, SAP RPA logistics with the Dow Chemical Company improving logistics RPA automated the materials provided to manage raw material delays.

Procurement and Finance: In large chemical procurement, RPA resolves invoice, vendor, and audit automation management. Advanced Accounts RPA systems on vendor payment and compliance ease the contracts to business with chemical clients globally in 2025. His is especially important in the world of chemical procurement.

Regulatory Compliance & Safety: Chemical Research and Production Health and Safety Legislation (REACH) and GHS (Globally Harmonized System) provisions are complex and advanced chemical firms within the European Union face external and internal regulations and these are further exacerbated with the firm. In March 2025, KMBG provided ABB controls to monitor compliance documents and also hold the rights to slip-shift and internal audits systems to streamline softer documents thus all chemical production REACH compliance audits stay in where produced.

Customer & Sales Support: In chemical distributor data to monitor communication clients Bots assist the Crystallize RPA easily. In the year 2025 with Intercontinental trade the firm neglected classy booklet orders. The invoices and payments which came back slackova head Jeff and the chemical domain control systems RPA do manual responses confirmations assist.

On-Premise RPA: Installed in the company’s servers within the perimeter fence, ensuring utmost control and confidentiality of R&D sensitive information. This is the norm in organizations guarding proprietary formulas and trade secrets. TCS, in April 2025, deployed on premise RPA for a leading chemical manufacturer in India for the protection and confidentiality of sensitive intellectual property.

RPA in Chemical Market Share, By Deployment Mode, 2024 (%)

| Deployment Mode | Revenue Share, 2024 (%) |

| On-Premise RPA | 55.10% |

| Cloud-Based RPA | 44.90% |

Cloud Based RPA: Provides higher scalability and reduced costs which is beneficial for cross country operations of the supply chain. Chemical manufacturing companies use cloud RPA to inter-connect the production, logistics and finance functions over multiple geographies. In June 2025, Microsoft launched a cloud RPA service on Azure AI to automate chemical supply chain workflows to support borderless collaboration.

Large Enterprises: “Global chemical corporations adopting RPA do so to handle complicated, interdependent workflows across numerous plants and regions.” Net new business give precedence to ERP integration at the level of SAP. In July 2025, Deloitte featured the top 10 global chemical companies and the RPA cross deployments designed to standardize procurement and compliance operations.

RPA in Chemical Market Share, By Enterprise Size, 2024 (%)

| Enterprise Size | Revenue Share, 2024 (%) |

| Large Enterprises | 60.30% |

| Small & Medium Enterprises (SMEs) | 39.70% |

Small and Medium Enterprises: “Smaller firms in specialty and fine chemicals use RPA in a bid to lower operational expenditures through the automated mundane, low-value tasks of documentation, payroll, and planning for small-batch production.” In May 2025, Kryon Systems announced RPA initiatives aimed at lowering operational costs for small and medium enterprises, achieving operational efficiencies with low IT spend.

Market Segmentation

By Type of RPA

By Application

By Deployment Mode

By Enterprise Size

By Region