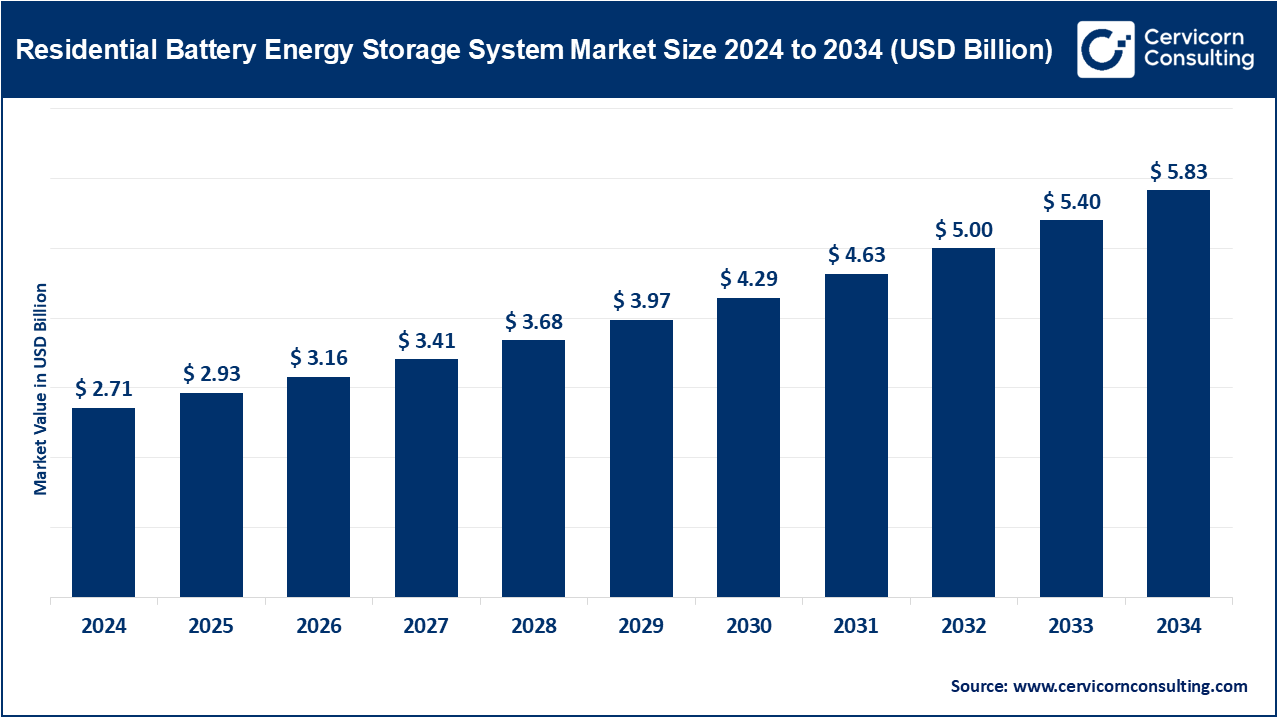

The global residential battery energy storage system market size is calculated at USD 2.93 billion in 2025 and is expected to reach around USD 5.83 billion by 2034, growing at a compound annual growth rate (CAGR) of 7.96% over the forecast period from 2025 to 2034. The residential battery energy storage system market is booming as residential energy storage systems become one of the major options that homeowners, developers, and utilities pursue to achieve net-zero goals, enhance energy efficiency, and minimize the impact on the environment. Green energy storage systems are not only developing in order to replace traditional solutions but also to pursue strategies working on reduced carbon emissions, increased energy reliability, the circulation of resources, and an overarching approach to climatic targets across the planet. It is perceived that with the increase in government incentives, heightened environmental control, and development of ESG, adoption is on rise in the residential building and smart buildings all over the world as there is an imminent need to make energy systems sustainable, scalable, and resilient.

What is residential battery energy storage system?

The residential battery energy storage system (RBESS) is a technology that stores electrical energy stored in batteries whether renewable energy sources or grid on a home or small-scale demand. These systems assist in controlling the demand of electricity, incorporation of renewable energy such as solar power and wind power, back-up power supply during power-cuts and also balance energy consumption. Recent progress in battery technology chemistry, energy management software-based solutions and low-cost manufacturing are enabling RBESS solutions to become more available and affordable. Stakeholders are able to switch to a low carbon, decentralised and circular energy system in a sustainable way and are quickly adapting due to their ability to capitalise on the innovations that are in the form of high-capacity lithium-ion batteries, solid-state sol storage as well as the smart grids.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 2.93 Billion |

| Estimated Market Size in 2025 | USD 5.83 Billion |

| Projected CAGR 2025 to 2034 | 7.96% |

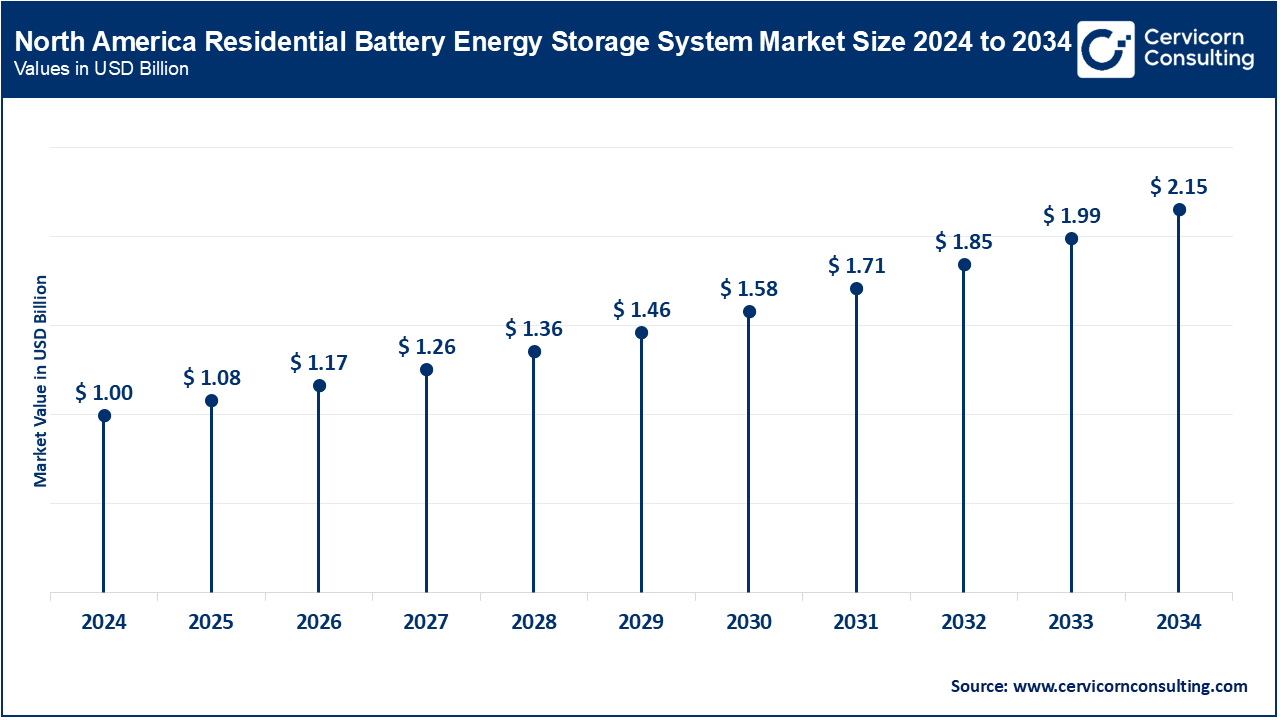

| Leading Region | North America |

| Accelerating Region | Asia-Pacific |

| Key Segments | Battery Type, Installation Type, Capacity Range, Component Type, End-User, By Application, Region |

| Key Companies | Tesla Energy, Panasonic Holdings Corporation, BYD Company Ltd., Enphase Energy, Inc., Sonnen GmbH, VARTA AG, Delta Electronics, Inc., Huawei Technologies Co., Ltd., Eaton Corporation PLC, LG Energy Solutions Ltd., General Electric (GE), Samsung SDI, Exide Industries Limited, Sunnova Energy International Inc., Moixa Energy Holdings Ltd. |

The residential BESS market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region.

There are positive policies, corporate ESG requirements, and augmented investments in clean energy technologies that are some of the factors that are driving the RBESS Market in North America. In July 2025, the U.S. department of energy provided a grant of USD 0.08 billion to further residential battery deployment and integrate energy storage into renewable energy efforts through the Inflation Reduction Act. Location to solar from the rooftop and grid modernization plans is also stimulating the interest of homeowners and utilities in turning to battery storage. The increase in residential batteries is further being boosted in the state of California and New York due to state-level incentives. A growing need to have a backup source of reliable power, as well as a need to manage peak loads, is helping to make RBESS systems more appealing. Corporates and utilities are also aggressively pursuing storage solutions in order to achieve sustainability objectives and the resilience of energy.

Strict climate policy rules, renewable energy requirements and powerful incentives on energy storage systems are leading to the growth of RBESS Market in Europe. As of May 2025 the European Commission Green Deal Industrial Plan encourages energy storage solutions in households and smart grids in a net-zero ambition. Governments such as in Germany and the Netherlands are on their way to introduce programs that favor rooftop solar and battery storage of residential customers. The escalating electricity prices and the need to become energy independent on the part of households are encouraging them to embark on the use of batteries. Joint programs by government and the corporate sector are on the threshold of advancing technology in battery performance. All in all, the emphasis on decarbonization and energy security in Europe is spurring residential battery implementation.

The Asia-Pacific residential BESS Market is expanding fast because of the government initiatives, integration of renewable energy and smart home. In May 2025, the Ministry of Economy, Trade, and Industry of Japan started to subsidize residential battery systems to enhance the efficiency of energy and grid stability. China is expanding greatly in the production of lithium-ion battery to support the increased residential demand, as well as South Korea and Australia encouraging households to embrace smart energy tools in their towns and cities. Increased demand of electricity, frequent power cuts, and growth of solar PV systems are among the drivers of adoption. Asia-Pacific is emerging as one of the main markets in terms of residential energy storage because of a major emphasis on sustainable energy infrastructure, carbon footprint reduction, etc. Residential batteries are regarded more and more seriously as a part of proactive and robust energy systems.

Residential BESS Market Share, By Region, 2024 (%)

| Region | Revenue Share, 2024 (%) |

| North America | 36.90% |

| Europe | 26.50% |

| Asia-Pacific | 29.20% |

| LAMEA | 7.40% |

In LAMEA, renewable energy installations, energy access initiatives, and sustainable investments aid in the growth of the RBESS Market. In April 2025, Brazil rolled out a project to install residential battery storage and rooftop solar panels in off-grid communities, to enhance energy security. The nations in the Middle East are integrating solar generation coupled with battery storage to households to lower the dependence on the grid. Solar-plus-storage is already being considered in African countries as an off-the-grid method of expanding access to electricity in rural locations. These projects promote energy autonomy, minimise emissions, and incite the circular answers to energy. The government and the private sector investments are facilitating the higher use of the residential battery systems regionally.

Lithium-ion Batteries: The lithium-ion-battery segment has dominated the market. Lithium-ion-battery storage systems have high energy density and energy storage, long cycle life, and are suitable in residential use. They effectively stock solar or the grid energy to be used at home. In March of 2025, Tesla installed Powerwall lithium-ion batteries in more than 500 California residences, which allow peak load and energy backup. These batteries are pocketable, light weight and have a steady performance. Their popularity indicates its effectiveness in the provision of uninterrupted residential energy. Batteries made of lithium-ion have also increased installation due to the rise in demand of clean power all over the world.

Lead-Acid Batteries: Lead-acid battery is a conventional storage technology characterized by cheap pricing and enhanced performance, but the system has shorter lifespan than lithium-ion batteries. They find frequent application in the stand-by home-based systems. In November 2024 several residential communities in New South Wales, Australia, fitted lead-acid battery arrays to guarantee emergency power in the case of outage. They are recyclable and widespread with these batteries. They have lower energy density though, and take up more space to store the same amount. They still exist in the areas with conservationism in favor of cheaper products.

Nickel-based Batteries: Batteries with nickel, like nickel-cadmium (Ni-Cd) have a high thermal stability and performance at different temperatures. They are adaptable to long time energy storage and extreme climates. In July 2024, nickel-based batteries were implemented in a residential microgrid in Osaka, Japan, to provide reliable energy source during summer heat waves. These batteries handle steady discharge cycles and coping with deep discharges. Applications involving an extreme level of durability favour the use of Nickel-based systems. Their implementation emphasizes their resilience in energy storage applications that deal with temperature change.

Backup Power: The backup power segment has dominated the market. Most backup power systems accumulate energy in a form of electricity that will come in handy in times of power outages in the flow of electricity in the grid. Rather, they play an important role where grids are weak. Later in August 2025, Puerto Rico registered a high rate of residential installations of backup batteries due to power interruption caused by the occurrence of frequent power outages caused by hurricanes. Stored energy could sustain homeowners with the use of important appliances. Such systems optimize the level of energy security and promote emergency preparedness. Resilience Built in Backup power is becoming a norm in disaster prone areas.

Renewable Integration: Systems of renewable integration have the potential of storing surplus energy that would come out of solar panels or wind turbines, to use later in the household. They make the grid less important, and they are more sustainable. In May 2025, a solar community housing development was built in Bavaria, Germany, which made battery installations that permit the storage of solar energy to be used in the evening hours. Such an integration guarantees optimal utilization of energy and cost-saving. It also helps in the trend of decentralized renewable energy networks. The number of people who are implementing these solutions is growing, as homeowners want to gain the best profit out of their investments in solar power.

Energy Management: Consumption of electricity is measured, regulated, and optimized in homes through energy management systems that help in cutting costs of energy bills and in being more efficient. They intelligently coordinate their discharge of batteries and their use of grid. Later beginning in January 2025, smart home projects in Austin, Texas retrofit energy management systems in homes with residential batteries to automate peak shaving and load balancing. Such systems are connected to smart meters and IoT devices to have real-time access to energy. Through optimized energy management the wastage is minimized and costs become more efficient. The introduction of the solutions is being accelerated by the growing number of people adopting smart homes.

On-Grid Systems: The on-grid systems segment has dominated the market. On-grid systems are established in relation with the main electricity grid so that the owners of houses can give back the surplus of energy or make use of energy when required. They assist in mediating between supply and demand. In February 2025, customers in the Seoul city in South Korea installed on-grid battery systems that are connected to a municipal solar project to handle excess energy. These systems lower the electric bills and aid grid stability. It is also stimulated by net metering, as well as incentives. Urban areas where there is a solid grid infrastructure make use of on-grid batteries.

Off-Grid Systems: Off-grid systems are outside the main power grid and are most suited where grid connection is not available. They have total energy independence. A village in Kerala, India, recently installed off-grid battery and solar panel in June 2024 to have constant electricity supply. Such systems do away with the reliance on unreliable or non-existent grids. They usually incorporate renewable energy and standby generators of reliability. Underserved areas make off-grid installations essential in accessing energy.

Hybrid Systems: Hybrid systems have the on-grid and off-grid properties and can provide an energy supply with energy independence as well as grid interconnection. They grant versatility to various energy demand. In September 2024, residential developments in Toronto, Canada, added hybrid battery systems to its smart homes as a means of maximising solar energy usage whilst remaining grid connected. Such systems provide resilience and effectiveness in different demands. This reduces expenses and power interruptions on the part of homeowners. Modern residential developments are inclining more to hybrid systems.

Residential Homes: The residential homes segment has dominated the market. Residential–it involves single-family homes or apartments where battery system is used as a backup system, renewable integration, or as a control system. These people form the chief market of RBESS. In March 2025, California residents put in lithium-ion batteries and rooftop-solar panels to reduce electric bills. The batteries give backup during the outages and enable load shifting. These installations enhance resilience and sustainability of the house energy. Residential adoption is incentive and again diminishing cost of batteries.

Smart Buildings: Buildings are smart when they couple automation systems with battery storage to ensure multi-unit energy consumption is maximized. They depend on the IoT and progressive energy management. A smart residential building in Singapore also installed battery systems that can centralize monitor and coordinate the energy flow through apartments in July 2024. The strategy mitigates the menace of peak demand and energy pricing. The battery implementation of the smart buildings enhances operations efficiency. These kinds of solutions are also becoming common in high rise, urban development.

Community Microgrids: Community microgrids comprise common battery systems to store and distribute energy in a locality or small city. They make local energy resilient. In November 2024 a pilot project in Austin Texas installed a microgrid with residential batteries to keep the electricity flowing when there is a heatwave. Microgrids minimize the aggregate use of energy, and increase independence of the grid. They are especially useful to disaster-prone regions or the remote ones. Community microgrids provide decentralized energy solutions on a scalable basis.

Small Capacity (<5 kWh): Batteries of small capacity have low capacity to hold energy of basic backup or low scaled solar integration. They are affordable to the lesser energy requirements. In January of 2025, Lisbon, Portugal houses implemented 5-kWh batteries to be used in operating vital appliances during brief interruptions. These systems are small and they fit in apartments in urban areas. They perform sustainable storage of energy at low costs. Small batteries suit households that have low energy needs.

Medium Capacity (515 kWh): The medium capacity segment has dominated the market. Medium-sized systems are used to serve the mean domestic energy use, with integration and peak shaving that includes renewables. They also strike a compromise between cost and capacity to store. In April 2025, the suburban homes of Melbourne, Australia, embedded 10 kWh batteries to absorb solar energy to use in the evening. Such systems assist the homes in cutting down bills on electricity. They are multifaceted to serve as a backup and optimization of energy. The medium-sized batteries are effective in covering the normal power requirements of a home.

Big Capacity (>15 kWh): Batteries of large capacities store considerable amounts of energy in energy-demanding houses or urban microgrids. They also allow long backup and renewable energy use. A residential microgrid in the province of Ontario, Canada, showed the use of >15 kWh battery systems allowing the powering of multiple homes and peak demand management, in August 2024. Such systems favor group energies and stability of the grid. The high-power consuming households ought to have large batteries. They present more energy autonomous and survivability.

Market Segmentation

By Battery Type

By Application

By Installation Type

By End-User

By Capacity Range

By Component Type

By Region