The water electrolysis industry is experiencing significant growth due to the rising global emphasis on green hydrogen production as a key component of the energy transition. Governments and industries worldwide are investing in electrolyzer technology to support decarbonization efforts, particularly in power generation, transportation, and industrial applications. Back-up policies such as the EU Hydrogen Strategy, U.S. Inflation Reduction Act, and India National Green Hydrogen Mission are driving the need for electrolysers to produce hydrogen at scale, as well as investments in infrastructure.

Moreover, increased efficiency in electrolyzers, decreasing cost of renewable power, and enhanced private investment are propelling the market. Organizations are putting emphasis on manufacturing capacity on a bulk level, efficiency of the system, and minimizing operational costs as a part of competition. Utilization of renewable resources like solar and wind power enhances long-term market growth prospects.

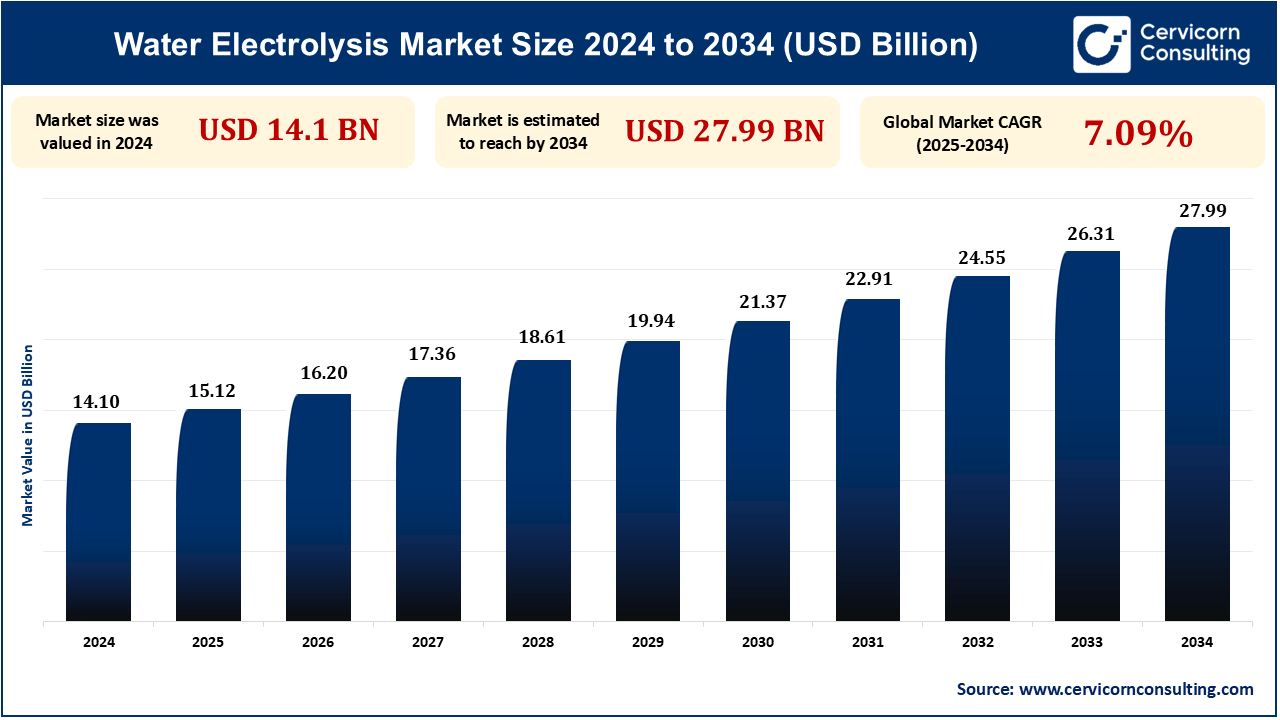

The global water electrolysis market size is calculated at USD 15.12 billion in 2025 and is expected to exceed around USD 27.99 billion by 2034, exhibiting at a compound annual growth rate (CAGR) of 7.09% over the forecast period 2025 to 2034.

Green hydrogen, produced using water electrolysis with renewable energy, is gaining momentum as it has the capability to decarbonize industries such as transport, steel, and chemicals. Governments worldwide are making laws and offering subsidies to ensure its adoption. For instance, the European Union Hydrogen Strategy is to have 40 GW of electrolyzers installed by 2030. Air Liquide and Linde are among the companies heavily investing in electrolysis projects. The demand is being fueled by the drive towards carbon neutrality and net-zero emissions, making water electrolysis a central technology for clean hydrogen production, lowering the dependence on fossil fuels and curbing greenhouse gas emissions.

Advances in technology of electrolyzers like Proton Exchange Membrane (PEM) and Solid Oxide Electrolysis Cells (SOEC) are making processes more efficient and lowering costs. PEM electrolyzers, for instance, have short startup times and high hydrogen purity, which makes them suitable for grid balancing. Solid oxide electrolyzers are run at high temperatures, which increases efficiency by being able to use waste heat from industry processes. Advances in catalyst materials, including non-platinum-group metals, are reducing the cost of electrolysis. Such advances are being led by the likes of Nel Hydrogen, ITM Power, and Siemens Energy, who are reducing the levelized cost of hydrogen and making green hydrogen increasingly commercially viable.

The refining of petroleum is the largest consumer of hydrogen, used mainly for hydrocracking and desulfurization. With the increasing regulations on fuel emissions worldwide, refineries must output low-sulfur fuels, relying more on hydrogen. Hydrogen traditionally comes from steam methane reforming (SMR), which results in the emission of carbon dioxide. Industries are now looking towards green hydrogen, which is derived from water electrolysis, to reduce their carbon footprint and become sustainable. This is also supported by government policies promoting the adoption of cleaner energy. As refineries look towards sustainable alternatives of hydrogen, demand for water electrolysis technology continues to be high on the increase. For instance, Shell has developed a 10 MW electrolyzer at its Rheinland refinery to produce green hydrogen for desulfurization processes. This initiative reduces reliance on fossil-based hydrogen and aligns with the EU’s clean energy goals.

Water electrolysis involves high capital expenditure because of the high cost of electrolyzer systems, infrastructure, and integration with renewable energy. Installation of an electrolysis plant on a large scale can be as expensive as $500 to $1,500 per kilowatt of installed capacity, which is not as competitive as steam methane reforming (SMR) or blue hydrogen. The expensive materials used in electrolyzers, such as iridium and platinum for PEM systems, contribute to the expenses. Support components like compression, purification, and storage also add to the overall expenses. While cost savings through economies of scale and technology improvements are expected, up-front financial challenges remain an issue for widespread applications.

Hydrogen storage of energy has turned out to be a suitable alternative for balancing out the intermittent renewable energy sources like wind and solar. Hydrogen is stored over a long period and burned in power plants or fuel cells when required, compared to batteries. With electricity grids across the world becoming more integrated with more and more renewables, there is growing need for flexible storage. Water electrolysis enables green hydrogen to be stored, which can be converted back into electricity or industrially applicable. Countries investing in energy storage, such as Germany and Japan, are driving innovation for hydrogen storage plants, and consequently, there are good growth opportunities for electrolysis technology providers.

| Attributes | Details |

| Water Electrolysis Market Size in 2025 | USD 15.12 Billion |

| Water Electrolysis Market CAGR | 7.09% from 2025 to 2034 |

| Key Players |

|

| By Technology |

|

| By Application |

|

| By End User |

|

| By Region |

|

Asia-Pacific is witnessing a strong growth in the water electrolysis market with increased investments in green hydrogen production, industrial applications, and clean energy initiatives. China leads production and consumption of hydrogen and has huge government-backed plans for hydrogen refueling infrastructure and industrial applications. Japan and South Korea are leaders in hydrogen fuel cell technology, with hydrogen fuel cell vehicles and energy storage options. India has initiated its National Green Hydrogen Mission to promote domestic electrolyzer production and industrial-scale hydrogen manufacturing. Australia, with its renewable energy endowments, is setting itself up as a significant hydrogen exporter to international markets.

North America is a leading region in the water electrolysis market due to robust government backing, green hydrogen investments, and the presence of large industry players. The U.S. is the leader in the region, with projects such as the Bipartisan Infrastructure Law, which provides funding for clean hydrogen initiatives. Canada is also plugging into hydrogen hubs to help fund its decarbonization targets. Mexico is transforming into a renewable hydrogen-producing country, using its vast solar and wind reserves. The surge of interest from the region to hydrogen fuel cell cars, manufacturing processes, and power storage is fueling demand for effective electrolyzer technologies.

The PEM electrolyzers use a solid polymer electrolyte that is permeable to protons but impermeable to gases, hence highly efficient, small, and responsive to variable renewable energy like wind and sun. PEM electrolyzers operate at high current density and produce highly pure hydrogen with little maintenance. Due to their fast start-up and dynamic behavior, PEM electrolyzers find wide usage in mobility applications, industrial hydrogen supply, and renewable energy storage, and are therefore a significant enabler of the green hydrogen economy.

The chemical industry is the largest user of hydrogen, which they use to make ammonia, methanol, and petrochemical refining. Green hydrogen can be produced using electrolysis of water, isolating its application from fossil fuels and minimizing carbon footprint for the chemical industry. Companies are investing more capital spending in electrolyzers to address sustainability objectives and comply with stringent environment regulations.

Empower your strategy with expert insights, purchase this premium research@ https://www.cervicornconsulting.com/buy-now/2324

Ask here for more details@ sales@cervicornconsulting.com