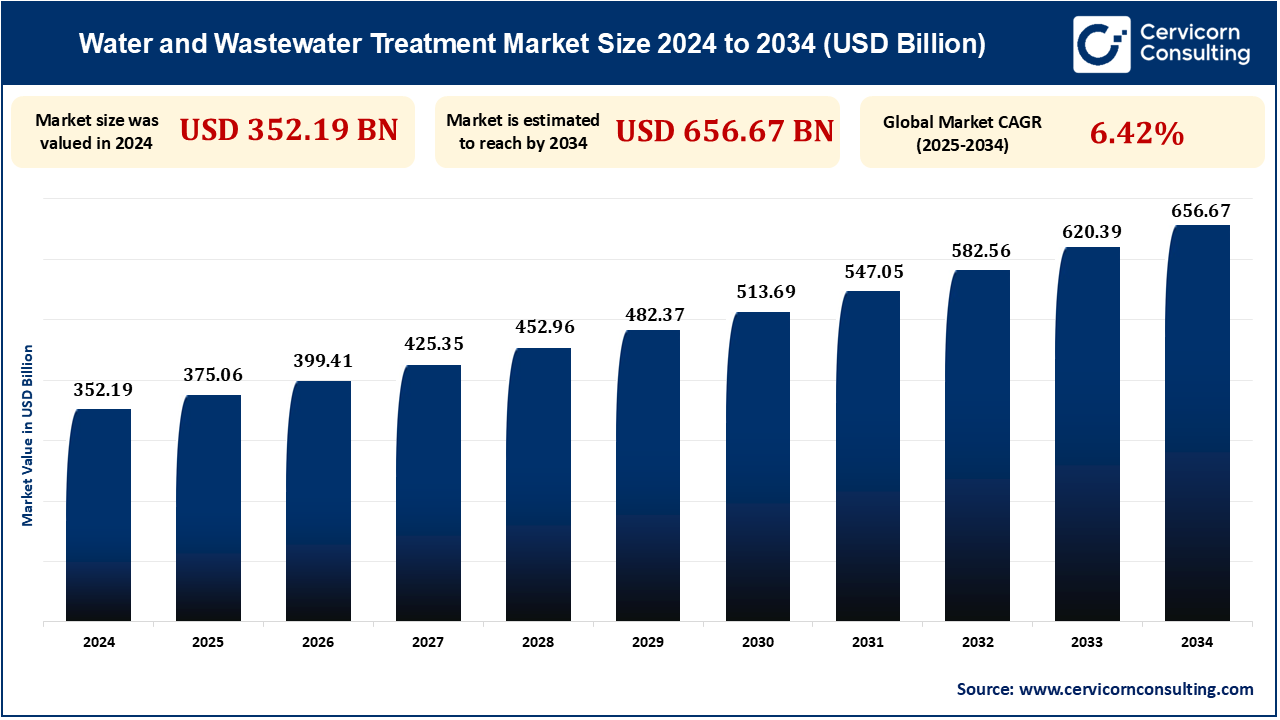

The global water and wastewater treatment market size was measured at USD 352.19 billion in 2024 and is anticipated to reach around USD 656.67 billion by 2034, growing at a compound annual growth rate (CAGR) of 6.42% from 2025 to 2034.

The factors contributing to growth in the global water and wastewater treatment market include the increasing population and urbanization. Stricter environmental regulations are also the major forces driving demand for water efficiency solutions that mend the current and future challenges in water scarcity issues and sustainability in terms of environmental impacts. Advances in technology also increase the demand for recycling and reusing water, which has expanded this section.

The processes that deal with the treatment of water and wastewater with various technologies such as filtration, chemical treatment, biological treatment, and desalination fall within the confines of this segment. It is mainly focused on the aspects of providing clean available resources for conservation aimed at the environment.

One of the primary driving forces behind the growth of the market is the global increase in the demand for clean water, especially for drinking by humans, which originates from the increasing populations worldwide. This creates a consequent growth in demand for potable water and increases the need for and importance of the wastewater treatment industry, which in turn will facilitate the sustainable approach of water usage for both urban and industrial purposes.

The greatest factor driving demand for market value growth in the water and waste treatment market is more and more acute water scarcity at the world level. Its increasing population in urban areas causes an increased need for potable water, ending the need to develop efficient water treatment facilities. The effects of climatic changes are causing severe water shortages in various places; thus, there is immense pressure on society to reuse and recycle water. Countries have started putting stricter regulations toward the appropriate management of available water. This will indirectly invest in advanced treatment techniques. Thus, this is another concern regarding water security, whereby industries and municipalities push to adopt innovative measures toward usage and treatment, making the market important to global challenges.

Significant growth potential exists in the global water and wastewater treatment market due to technological progress in the field. Examples are membrane filtration, ultraviolet disinfection, reverse osmosis, and other innovations that make operational processes more effective, cheaper, and environmentally sustainable. With the increasing number of smart sensors and artificial intelligence in water treatment systems, real-time monitoring and optimized management of water scales are realized. Without a doubt, these improvements not only increase the productivity of water treatment plants but also reduce costs and conserve energy. Moreover, innovative solutions could create new avenues for tapping into the market in the eyes of governments and private organizations putting more focus on sustainable water management practices.

Among several constraints in the market for water and wastewater treatment, the most relevant is the high cost of capital for setting up a treatment plant or procuring an advanced technology including the necessary expenditure for setting up large-scale infrastructure such as filtration systems, pipelines, and special equipment given that a large amount needs to be paid in advance. Apart from this, operating costs for making these systems work usually amount to a lot of money, especially in areas where access to finances is limited. Such financial hindrances can create major difficulties in water treatment technology adoption among municipalities and companies, which is mostly true for the developing world. All these high costs associated with water treatment usually interfere with the wide adoption of technologies and would delay the growth rate of the market at places where it is needed greatly.

Rapid urbanization, population growth, and industrialization are exerting pressure on already-stressed water resources and infrastructure. The expansion of urban populations directly increases the demand for clean, safe drinking water, as well as their need for adequate wastewater treatment. Water pollution and contamination have become new, pressing concerns that have then opened up advanced technology for treatment in developing countries. The governments in these regions are embodying stricter environmental regulations, urging industries and municipalities to spend on water treatment systems to protect the health of the public and the environment. Flooded by climate change and increased instances of drought, water scarcity concerns are further becoming aggravated, which calls for proper water management. Providing reliable water access, especially in the deprived areas of the rural-urban divide, is thus a significant growth opportunity for the water and wastewater treatment market in these countries that drives further investments in infrastructure and technology.

| Attributes | Details |

| Market Size in 2024 | USD 352.19 Billion |

| Market CAGR | 6.42% from 2025 to 2034 |

| Key Players |

|

| By Application |

|

| By Process by Equipment |

|

| By Region |

|

Being the fastest growing market for water and wastewater treatment, Asia Pacific is facing challenges of rapid urbanization, industrialization, and concerns regarding water scarcity. Countries like China, India, and Southeast Asian nations, with high population growth, are increasing the demand for clean water and wastewater management. Moreover, enhanced environmental regulations coupled with government incentives in sustainable water management are driving further developments in water treatment technologies.

A case in point is the Indian government's investment in water treatment infrastructure through its Namami Gange program, aimed at cleaning and rejuvenating the Ganges River. Apart from the government, several private players are investing in the region. In India, Veolia North America has been expanding its water service while also helping to improve water supply and wastewater treatment. These developments show the increased importance of this region on the global water treatment map.

North America, being the largest region in the global water and wastewater treatment market, stands tall on the pillars of advanced infrastructure, a well-established regulatory framework, and increasing demand for the available resources to be used for efficient water management. The two countries that are leading the pack in technological advancement are the United States and Canada. Together, they have embraced innovations in membrane filtration, reverse osmosis, and smart water management systems. Strict environmental regulations in the region impel the industries toward the use of sustainable water treatment solutions. One such case is American Water Works—the largest U.S. water utility company—which is investing in the ongoing expansion of its sewerage treatment installations.

For instance, in 2024, American Water Works announced a $500 million investment to enlarge wastewater treatment plants and upgrade aging infrastructure to meet rising water quality demands. This is a measure that attests to the ongoing activities to upgrade water infrastructure within the region and ensure sustainable water management practices, making it a key player within the market.

The municipal segment is the most significant portion of the global water and wastewater treatment market owing to several reasons. The demand for clean and safe drinking water has reached record heights, especially in new and upcoming economies, because of rapid urbanization and population growth. Growing urban populations exert notable pressure on water supply systems. Conversely, municipalities are responding to such pressure by emphasizing developing and modernizing water treatment infrastructure to keep pace with the rising demand for clean water and efficient wastewater management.

Municipalities are upgrading existing water treatment plants and building additional facilities to improve water supply and reduce pollution levels. Wastewater recycling has become an important strategy in municipal water treatment programs, as it satisfies water demand and mitigates pollution. Furthermore, globally, governments are prompting municipalities to invest in sustainable and smart water technologies, such as automated water quality monitoring, AI-based management systems, and energy-efficient solutions. These technologies enable municipalities to optimize operations, reduce water loss, and improve overall efficiency in the water and wastewater treatment processes. Increased emphasis on water conservation, the requirement to meet strict environmental standards, and emerging concerns regarding climate change are major factors propelling the municipal segment forward in the water treatment market.

The major things in this market are membranes of filtration for water and wastewater treatment because of their superior functions and immense demand in both municipal and industrial sectors. The applications of membrane filtration technologies, such as reverse osmosis (RO), ultrafiltration (UF), microfiltration (MF), and nanofiltration (NF), have gained ground in the removal of contaminants from water and wastewater. This process provides safe, healthy, and potable water through semi-permeable membranes allowing the separation of harmful particles including bacteria, viruses, and other impurities from water.

The most commonly employed technique of membrane filtration is its ability to produce high-quality treated water with more or less constant performance. For example, reverse osmosis has a very high tendency to remove dissolved salts, heavy metals, and various contaminants, which is why it is more acceptable among industries, municipalities, and desalination plants. Furthermore, these membrane-based filtration systems consume less energy compared to other conventional treatment options like thermal distillation or chemical treatment, making them cost-effective over time.

As they offer flexibility and scalability, membrane-filtration-based systems are suitable for several applications, from small-scale municipal systems to large industrial facilities. The ever-increasing need for high-purity water among industries such as pharmaceuticals, food and beverage, and electronics will continue to propel this fledgling market for membrane filtration systems. Moreover, the increasing need for wastewater treatment and recycling, particularly in water-scarce regions, acts as a further driver for this technology. The continuous invention of membrane materials and technology, leading to high performance, long lives, and greater energy efficiency, further strengthens the segment's market leadership.

Empower your strategy with expert insights, purchase this premium research@ https://www.cervicornconsulting.com/buy-now/2334

Ask here for more details@ sales@cervicornconsulting.com