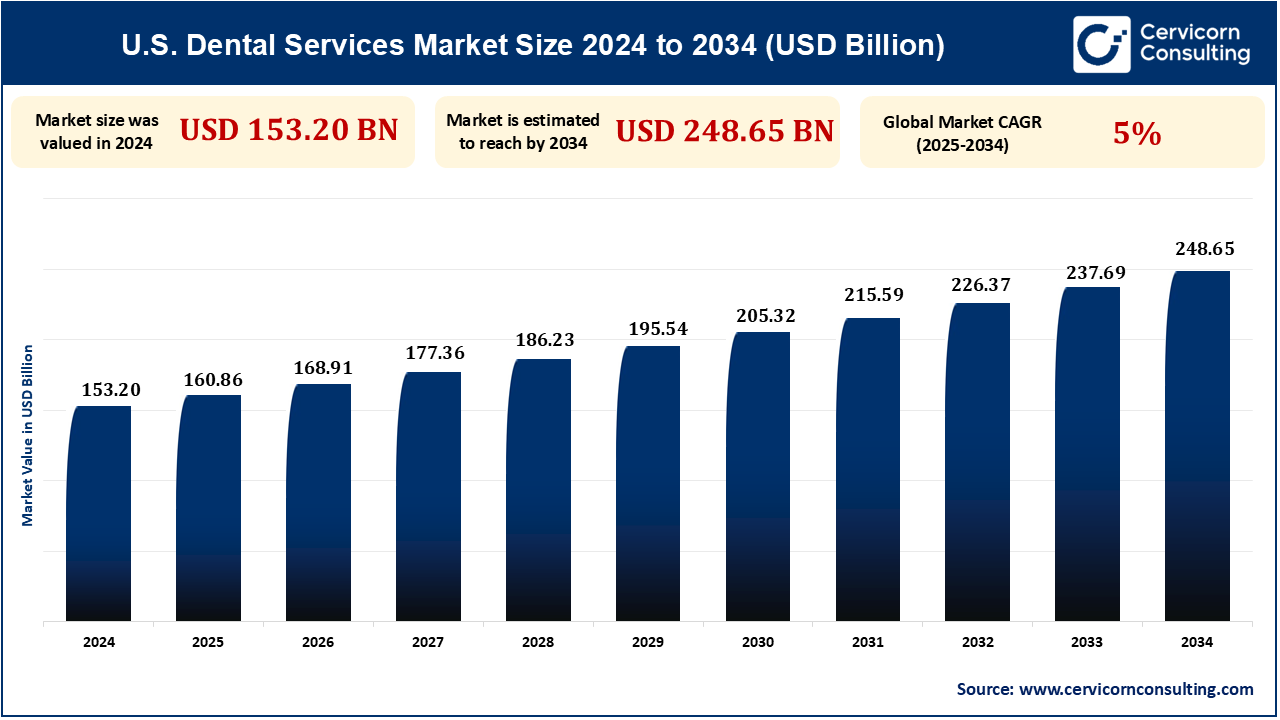

The U.S. dental services market size is expected to be worth around USD 248.65 billion by 2034 from valued at USD 153.20 billion in 2024 and is exhibiting at a compound annual growth rate (CAGR) of 5% over the forecast period 2025 to 2034.

The U.S. dental services market is expanding at a high rate with increasing awareness of oral health, the growing incidence of dental disorders, and technological innovations in cosmetic dentistry. Demand for preventive and restorative dental care is rising as consumers increasingly value dental aesthetics and hygiene.

In addition, technologies such as AI-based diagnosis, 3D printing, and laser dentistry are enhancing treatment outcomes and patient satisfaction. Aging population, growing dental insurance coverage, and growing investments in dental clinics are also driving the market growth further. Moreover, the development of teledentistry and minimally invasive dentistry is changing the industry and improving dental access and patient convenience.

U.S. Dental Services Market Latest Investments

Cosmetic dentistry is turning out to be the biggest driving force within the U.S. Dental Services industry as patients are increasingly turning to procedures that make their smile look improved. Procedures like teeth whitening, veneers, dental bonding, and gum contouring are on a higher demand as a result of social media influence and greater awareness about oral beauty. New technology, such as digital smile design (DSD) and laser dentistry, enables more accurate and less invasive treatments. Also, transparent aligners are becoming a replacement for traditional braces as a popular choice for teeth straightening, another reason for market growth. Demand is also on the increase among youth and professionals who highly value having a perfect smile. For instance, a survey by the American Academy of Cosmetic Dentistry (AACD) revealed that aesthetic services in U.S. dental practices grew by an average of 12.5% over a five-year period, with some practices experiencing nearly a 40% increase. Teeth whitening remains the most requested cosmetic dental service.

Teledentistry is transforming the dental services industry by making it more accessible and convenient for patients. Virtual consultations allow dentists to diagnose and offer advice on minor dental problems from a distance, minimizing the need for face-to-face visits. The COVID-19 pandemic has further fueled this trend by emphasizing the importance of remote healthcare solutions. Teledentistry is especially useful for rural or underserved patients who might have limited access to conventional dental care. In addition, AI-based platforms are being incorporated into teledentistry to make real-time diagnoses and recommendations, enhancing patient care and market growth. For example, a survey conducted in 2023 indicated that 30% of dental practices incorporated teledentistry, with 53% utilizing synchronous methods and 63% employing asynchronous approaches. The primary motivations included increased convenience for patients (53%) and enhanced accessibility to providers (39%).

High costs of sophisticated treatments and equipment are among the key constraints in the U.S. Dental Services market. Such treatments as dental implants, orthodontics, and cosmetic dentistry are expensive, requiring heavy investment, thus rendering them unavailable to the majority of the population. Even with insurance, out-of-pocket payments can still be heavy. Moreover, dentists have high operational expenses from costly dental technology, sterilization needs, and employees' salaries, which contribute to the elevated cost of dental care. This cost barrier restricts patient access to quality dental services, especially for the uninsured.

The expansion of dental insurance coverage and government-backed programs like Medicaid and Medicare Advantage is creating opportunities for broader patient access to dental services. In 2023, around 80 million Americans lacked dental insurance, but federal initiatives aim to improve coverage, especially for low-income groups. The U.S. dental insurance market is projected to grow at a CAGR of 7.2%, reaching $90 billion by 2030. Additionally, the rise of value-based care models—which emphasize preventive treatments over reactive care—is shifting the focus towards regular check-ups, early disease detection, and cost-efficient care. This trend provides growth prospects for dental clinics adopting preventive and subscription-based care models, ensuring better patient retention and long-term profitability.

| Attributes | Details |

| U.S. Dental Services Market Size in 2024 | USD 153.20 Billion |

| U.S. Dental Services Market Size in 2034 | USD 248.65 Billion |

| U.S. Dental Services Market CAGR | 5% from 2025 to 2034 |

| By Type |

|

| By End-use |

|

| Key Players |

|

Orthodontics deals with the correction of dental misalignments, overcrowding, and bite issues using braces, clear aligners, and retainers. The sector has experienced rapid growth due to the rise in demand for cosmetic procedures, particularly clear aligners like Invisalign. Expansion has also been driven by increased awareness of the long-term advantages of orthodontic correction, such as improved oral health and clear speech. Digital orthodontics like AI-based treatment planning and 3D scanning enhance precision and results. Orthodontics for adults and children is both on the rise, with a growing number of adults opting for corrective treatment for cosmetic reasons. High costs of treatment and the need for qualified orthodontists remain market-stopping.

Hospitals have a significant role to play in delivering emergency dental treatment, oral surgery, and advanced care. Most hospitals have specialized dental units that are capable of performing complex operations like trauma tre atment, tumor excision, and reconstructive surgeries. They are especially important for those patients who need multidisciplinary treatment, e.g., patients suffering from chronic conditions that affect the oral cavity. The integration of latest imaging technologies, anesthetic rooms, and robot-assisted treatment has enhanced treatment precision. Despite hospital-based dentistry being the only option available for emergency as well as for surgical procedures, high charges as compared to self-owned dental clinics remain a point of concern.

Empower your strategy with expert insights, purchase this premium research@ https://www.cervicornconsulting.com/buy-now/2350

Ask here for more details@ sales@cervicornconsulting.com