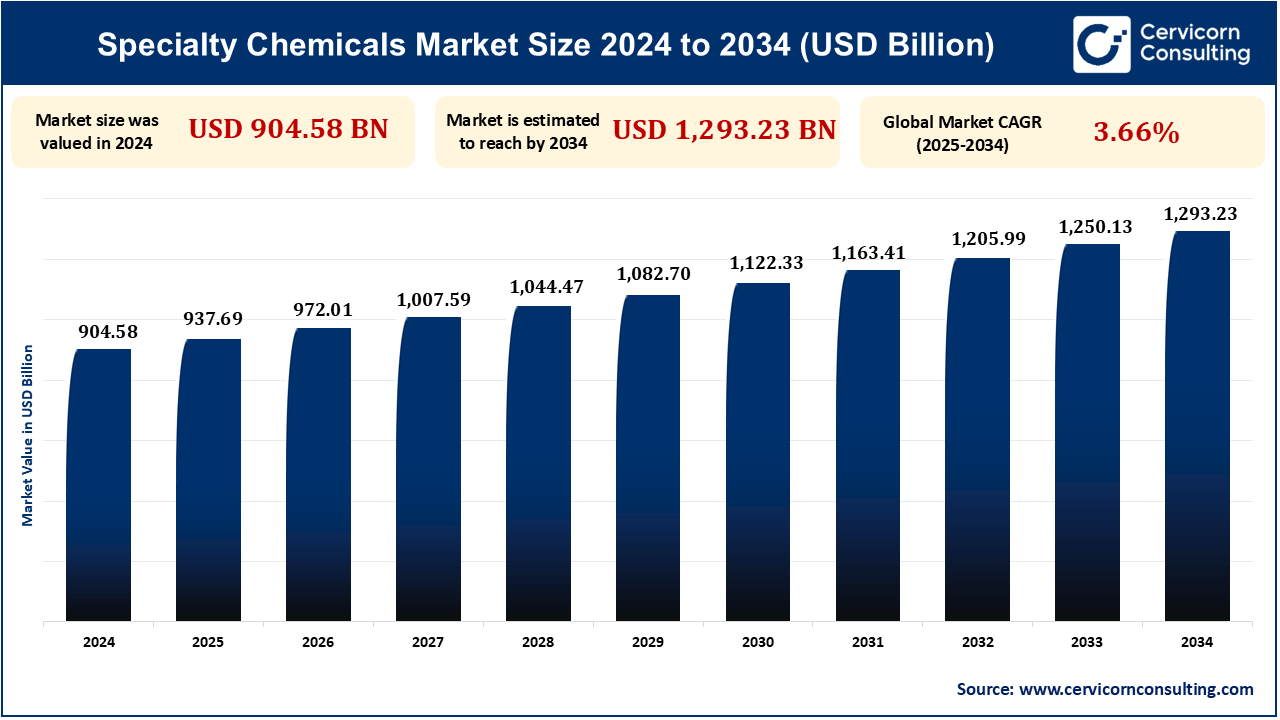

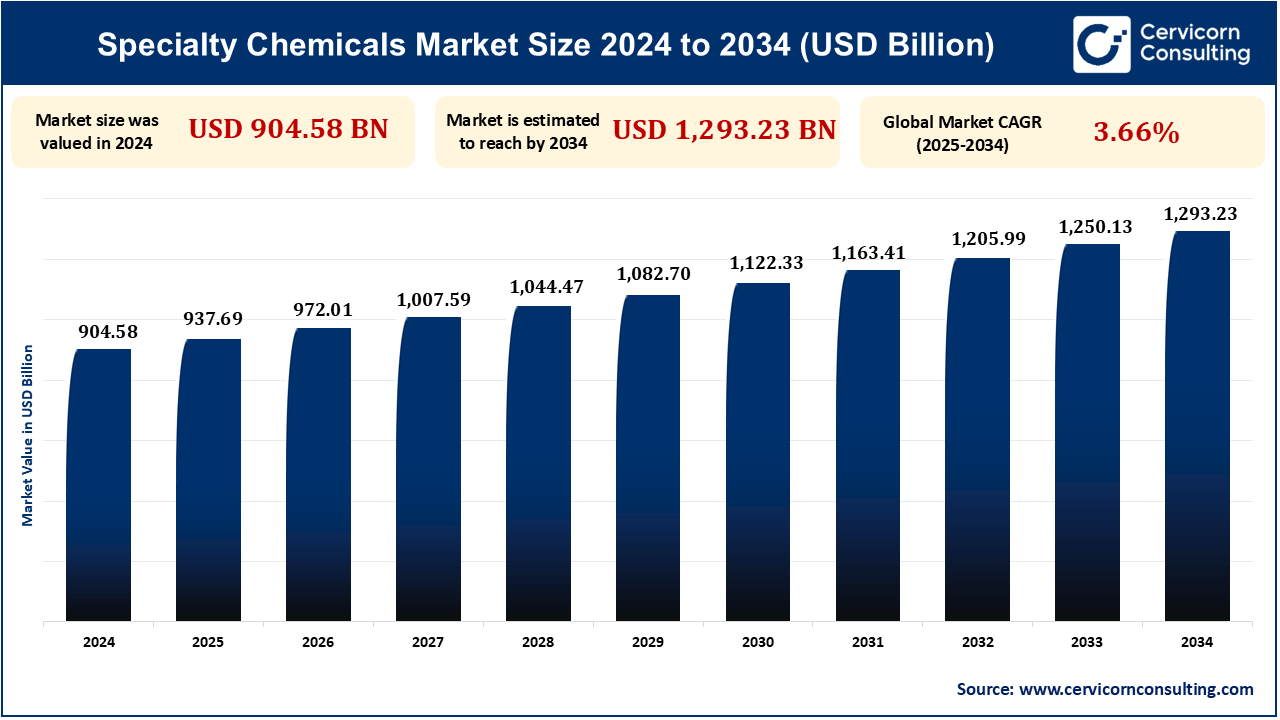

Specialty Chemicals Market Size, Trends and Forecast 2025 to 2034

The global specialty chemicals market size was measured at USD 904.58 billion in 2024 and is anticipated to reach around USD 1,293.23 billion by 2034, growing at a compound annual growth rate (CAGR) of 3.66% from 2025 to 2034. The market for specialty chemicals is driven by demand for high-performance, customized solutions in various industries. Sustainability is a priority, with environmentally friendly alternatives becoming popular. The market is growing in industries such as agriculture, automotive, and electronics. Emerging markets in Asia and Latin America are driving global growth.

The specialty chemicals market deals with high-performance, customized chemical solutions for numerous industries, such as agriculture, pharma, and electronics. These chemicals are to meet a certain requirement, bringing innovation and efficiency. One key driver of the market is the increasing demand for eco-friendly and sustainable products. Companies are emphasizing the production of greener alternatives to mitigate environmental issues.

One of the key spurs to the specialty chemicals market is the growing demand for sustainable and environmentally friendly solutions. With industries being confronted with mounting environmental issues, green chemistry and renewable resources are being promoted. Environmentally friendly products are being sought by consumers and businesses alike. This has fostered the emergence of innovative low-impact chemical alternatives. Eco-friendly consumers and regulatory pressures drive the transition to sustainability even faster. Therefore, businesses in the industry are making significant investments in green product development.

Specialty Chemicals Market Latest Investments

- In July 2023, Solenis completed its acquisition of Diversey Holdings, Ltd. on July 5, 2023, in an all-cash transaction valued at approximately $4.6 billion. This merger creates a more diversified company with increased scale and global reach, offering a "one-stop shop" for water management, cleaning, and hygiene solutions. Solenis now operates in over 130 countries with 71 manufacturing facilities and more than 15,000 employees worldwide. The acquisition was supported by Platinum Equity, which acquired Solenis in 2021, while Bain Capital, Diversey's majority shareholder, now holds a minority stake in Solenis. The combined entity enhances Solenis's capabilities to address sustainability challenges and provide comprehensive solutions to its customers globally.

- In August 2023, ICL broke ground on a USD 0.4 billion battery materials manufacturing plant in St. Louis, expected to be the first large-scale lithium iron phosphate (LFP) facility in the U.S. The plant, supported by a USD 0.19 billion grant from the U.S. Department of Energy, is planned to be operational by 2025. It will produce 30,000 metric tons of LFP to meet the growing demand for U.S.-produced battery materials. The facility is expected to create over 150 high-paying jobs and 800-900 union construction positions.

Specialty Chemicals Market Important Factors

Growing Demand for Sustainable and Green Chemistry Solutions

The specialty chemicals market is propelled by increasing need for greener and eco-friendly products. Green chemistry that seeks to minimize waste and use renewable resources is becoming popular. Firms are spending more on R&D to create green products. This will be helped by increasing regulations and customer forces for greener products. Sustainability is emerging as a key issue for industries, governments, and consumers.

- In February 2024, Praana Group's subsidiary Artek US bought Kemira's energy business for around USD 0.28 billion and combined it with Sterling Specialty Chemicals. The acquisition will form a strong global specialty chemicals business with a focus on water, energy, and sustainable solutions. The combined company, Sterling Specialty Chemicals, will have significant financial expansion and will provide solutions throughout the energy value chain, from exploration to refining, with a focus on lower water and energy use and CO2 emissions.

Rapid Technological Advancements and Innovations to Fuel the Market Growth

Technological advancements are leading the way in the specialty chemicals sector with innovations like precision engineering and nanotechnology. They produce more efficient, specialized chemicals for industries like healthcare, automotive, and electronics. They maximize performance, reduce costs, and improve market competitiveness.

- In April 2025, DSM Semichem LLC received a USD 0.007 billion grant from the Texas Semiconductor Innovation Fund (TSIF) to upgrade its specialty materials and chemicals plant in Plainview, Texas. The expansion will increase the total investment in the plant to USD 0.17 billion and add 40 new jobs. DSM makes electronic-grade sulfuric acid (ELSA), critical to clean semiconductor wafers employed in high-performance computing, 5G, artificial intelligence, and defense applications. With this grant, DSM will double the production of its ELSA, solidify the U.S. semiconductor supply chain, and position Texas as a core semiconductor material production center. The Texas CHIPS Act supports these efforts with grants for research, development, and worker training.

Volatility in Raw Material Prices and Supply Chain Disruptions May Restrain the Market’s Growth

Raw material price volatility and supply chain disruptions are major constraints in the specialty chemicals industry. Geopolitical tensions, natural disasters, and trade restrictions lead to price volatility in raw materials such as petrochemicals and metals. Price volatility increases the cost of production and impacts pricing stability. The COVID-19 pandemic exposed vulnerabilities in the supply chain, contributing to market uncertainty. This volatility tests chemical manufacturers' capacity to sustain stable operations.

- For instance, in February 2023, BASF, the world's leading chemical company, shed 2,600 jobs worldwide, primarily in Germany, as a result of the energy crisis. The firm incurred an extra USD 3.5 billion in energy expenses in 2022, primarily from its dependence on Russian gas. In an attempt to avoid exorbitant expenses, BASF will shut energy-intensive plants and relocate production to areas such as Belgium, the U.S., and Asia and cut down energy consumption by becoming more sustainable using renewable power and hydrogen. The action follows bigger challenges faced by European manufacturers affected by rising energy prices and lack of competitiveness.

Expanding Demand for Specialty Chemicals in Emerging Markets to Revolutionize Market Growth

Emerging economies in Asia, Latin America, and Africa have a high potential for the specialty chemicals sector. When these economies develop, chemicals are required in increasing amounts in agriculture, automotive, building, and electronics. Local regulations and requirements-based customization are the means by which companies can access this. It offers opportunities of grabbing a large market share in rapidly developing economies.

- For instance, in January 2025, WACKER increased its Asia capacity for specialty silicones by commissioning two new manufacturing plants in Tsukuba, Japan, and Jincheon, South Korea. This investment, a double-digit billion USD figure, is geared to serve increasing demand from the automotive and building industries in the Asian market. The Tsukuba facility will concentrate on silicone-based thermal interface materials for electromobility, while the Jincheon facility will expand production of silicone sealants for building construction. The expansions confirm WACKER's position as a market and technology leader in high-performance silicone solutions and are consistent with its strategy of locating manufacturing close to its customers in the region.

Specialty Chemicals Market Scope

Specialty Chemicals Market Regional Insight

Europe is Expected to Grow at the Fastest Rate During the Forecast Period

Europe will experience premium growth in specialty chemicals market with green chemistry and sustainability as key drivers. Green policies in EU, including the European Green Deal, are instilling green business among manufacturers. This is adding to the necessity for low-emission products throughout construction, vehicle manufacturing, and agriculture. Key European chemical businesses are putting efforts into research and development to remain in line with stringent environmental measures. All such trends render Europe a solid contender for future specialization in specialty chemicals.

- For example, in October 2024, Covestro is spending approximately USD 0.11 billion in its worldwide R&D infrastructure until 2025 to enhance innovation and achieve future competitiveness. This investment targets future technologies for a complete circular economy, and a central component is a global digitalization strategy in R&D. The investments encompass modernized machinery, automated equipment, and new digital competence in laboratories and technical centers around the globe. These initiatives complement advances in process technology and facilitate quicker, more environmentally friendly research processes, especially in chemical recycling and the creation of sustainable solutions for key industries such as automotive and construction.

Asia Pacific Dominated the Specialty Chemicals Market in 2024

Asia Pacific led the market for specialty chemicals in 2024, fuelled by quick industrialization and urbanization. The most influential countries such as China, India, and Japan are top manufacturers and consumers across industries such as automotive, electronics, and agriculture. Infrastructure and technological upsurge drive the demand for specialty chemicals. More middle-class consumers drive up demand for chemicals in consumer goods like personal care and textiles. Competitive pricing and expanded production capacity further help ensure the region's market leadership.

- For example, in July 2024, China led the world specialty chemicals market because of its huge production capacity and huge market, and with huge growth being fueled by urbanization and consumer demand. However, China is still lagging behind in innovation, particularly in fine chemicals, but is rapidly bridging the gap with increased spending on R&D and government support. Meanwhile, India's special chemicals sector is building up momentum at an accelerating rate, driven by supportive policies and lower costs, and is set to become a probable hub of growth in the future. India's market will most probably swell significantly, and it will create opportunities for indigenous as well as foreign players to take a ride on its rising demand and locational advantages.

Specialty Chemicals Market Segmental Insight

By product type, the construction chemicals segment Led the Market

Construction chemicals will dominate the specialty chemicals industry due to the growing popularity of green building materials. Adhesives, sealants, and concrete admixtures are chemicals that enhance building performance and longevity. Urbanization and development of infrastructure drive demand for these chemicals. Green processes and sustainability lead the green construction solution market.

- For example, at the time of Sika's Capital Markets Day in October 2024, CEO Thomas Hasler highlighted increased call for sustainable, long-term, and enduring building solutions. It is because increasing infrastructure requirements as well as reduced maintenance and carbon footprints drive this call. Sika is adapting its innovation to match this call through its integration of performance and sustainability. The company is working to become a world leader in shifting the construction industry towards more durability and circularity. Sika recycles and saves resources to achieve this. Its experts showcased its innovative products enhancing strength and recyclability to investors and media members.

Specialty Chemicals Market Major Breakthroughs

- In December 2023, Kemira completed the divestment of its Oil & gas-related portfolio to Sterling Specialty Chemicals LLC, a US subsidiary of Artek Group, for approximately USD 0.28 billion. The transaction, announced on December 4, 2023, allows Kemira to focus on its core businesses, including water treatment and renewable solutions. Kemira expects to record a loss of around USD 0.10 billion during Q4 2023 due to the divestment. Approximately 250 employees and manufacturing facilities in the US and the Netherlands will transfer to the buyer. The revenue carved out from Kemira was around USD 0.47 billion in 2022, including Oil & Gas revenue of USD 0.41 billion.

- In October 2022, Albemarle Corporation completed the acquisition of Guangxi Tianyuan New Energy Materials Co., Ltd. for approximately USD 0.2 billion through its subsidiary, Albemarle Lithium UK Limited. Tianyuan's operations, located near the Port of Qinzhou in Guangxi, include a lithium conversion plant with a designed annual conversion capacity of up to 25,000 metric tons LCE, producing battery-grade lithium carbonate and lithium hydroxide. This acquisition strengthens Albemarle's ability to meet the increasing global demand for battery-grade lithium and supports the transition to more sustainable energy use.

Empower your strategy with expert insights, purchase this premium research@ https://www.cervicornconsulting.com/buy-now/2357

Ask here for more details@ sales@cervicornconsulting.com