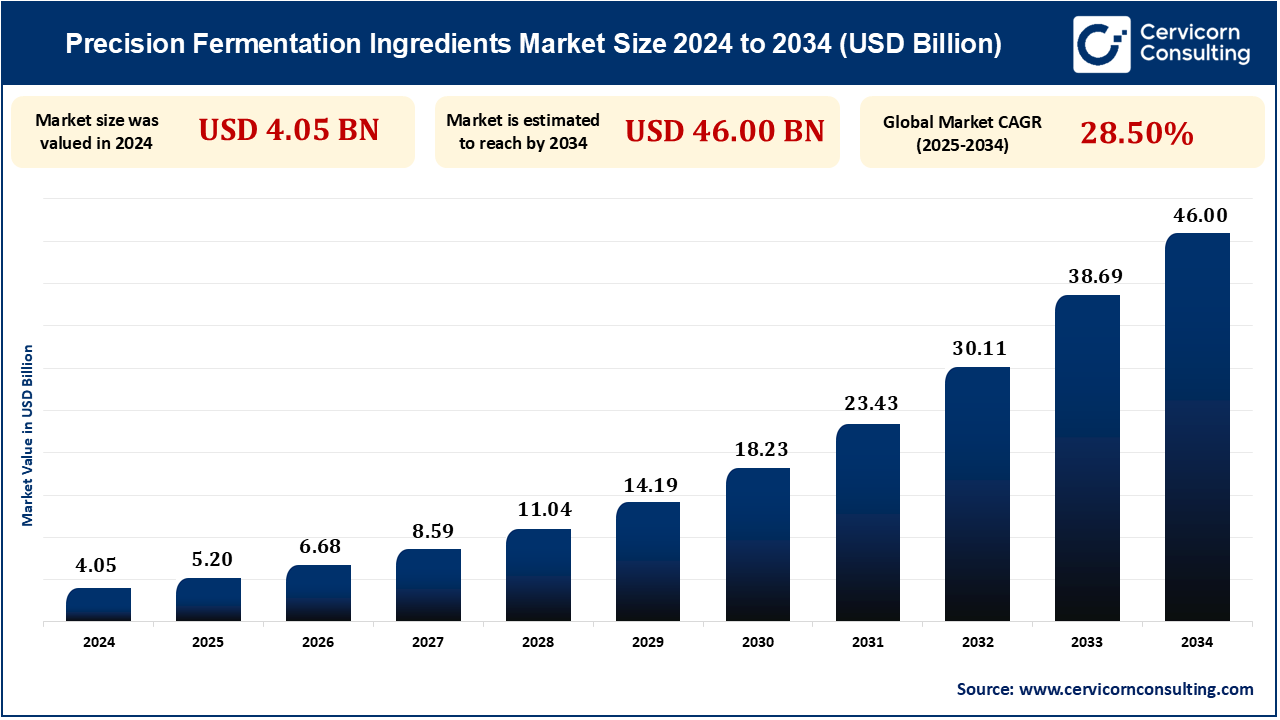

As of 2024, the global precision fermentation ingredients market was valued at approximately USD 4.05 billion. It is projected to reach USD 46 billion by 2034, reflecting a compound annual growth rate (CAGR) of 28.50%.

Precision fermentation is one of the biotechnologies for producing specific functional ingredients, such as proteins, fats, and enzymes, by programming microorganisms like yeast, bacteria, or fungi to produce such compounds. Common uses include manufacturing animal-free dairy proteins, alternative fats, and other bio-identical ingredients for food, pharmaceuticals, and cosmetics. The precision fermentation ingredients market is growing at an astounding rate, basically because of high demand for sustainable, animal-free, bio-identical ingredients from different industries such as food and beverages, cosmetics, and pharmaceuticals. Other market drivers are the increasing demand for plant-based alternatives, concerns for the environment, and the desire for ethical production methods. Governments and regulatory bodies have begun some recognition and approvals of precision fermentation products; therefore, it becomes legitimate for the market. For instance, some precision fermentation-derived ingredients have received FDA and EFSA approvals for food use.

There are relatively higher growth opportunities for precision fermentation ingredients along various applications. The overall trends driving the market forward are the increasing consumer demand for sustainability and ethical-based products, innovative plant-based formulations, and health-oriented developments. At this point, there are still various possibilities for inventions concerning the production of new products, entering developing markets, and crafting production processes that are cheaper and more efficient. The precision fermentation ingredients market has gained traction in North America and Europe; however, most engaging opportunities can still be found in emerging markets, particularly Asia and Latin America. Rise in incomes worldwide and the demand for producing healthy and sustainable foods, present very good growth potential for precision fermentation products within the markets.

Sustainable and ethical ingredients for food, cosmetics, and pharmaceuticals have continuous and increasing demand, constituting one of the most important drivers of the precision fermentation ingredients market. With increasing environmental concerns, animal welfare issues, and the necessity to develop more resilient food production systems, sustainability has reached the very top priority on the list of buyers and manufacturers. There is a growing group of informed consumers out there that are on the hunt for dairy-free, vegan, or any product made with ethical sourcing. Precision fermentation is one way brands can meet these demands and still keep the functionalities of traditional animal-derived ingredients. Hence, it propelled the demand for such sustainable and ethical ingredients, which acts as one prime driving force leading to the growth of this market for precision fermentation. As consumers, businesses, and policymakers alike continue to stress the importance of sustainability, in the future, precision fermentation is expected to enable a scalable, environmental-friendly, and ethical substitute for traditional animal-based ingredients while preserving the taste, functionality, and nutritional benefits.

One of the main factors attributed to a limited penetration of precision fermentation ingredients across the food and beverage, pharmaceuticals, and biotechnology markets is the high price of the precision fermentation processes. In most cases, precision fermentation uses microorganisms like yeasts, bacteria, and fungi to produce specific ingredients whereby engineered DNA could be integrated into their genomic sequences. These systems demand an intricate level of control to effectively optimize production for selected ingredients, which usually requires good quality raw materials (sugar, amino acids, and other nutrients), though, unfortunately, at a considerable price. Such high production costs make it impossible for a large portion of companies to competitively price precision fermentation ingredients against alternatives that are established, tried, and much cheaper. Therefore, the penetration of the market in these mass-market segments is limited and ranges from large-scale commodity chemicals to food products that are common to human consumption. Hence, while precision fermentation is expected to provide premium, possibly even niche market, ingredients such as plant-based proteins or functional foods, competing in the mass-market applications leaves much to be desired.

With several industries, including food & beverage, pharmaceuticals, and cosmetics, placing a heavy emphasis on sustainable, animal-free substitutes, consumers and corporations alike seek alternatives to animal-derived or chemically synthesized ingredients. This concerted push creates massive market potential for any products derived from precision fermentation. Disruption of the established supply chains for the use of precision fermentation is therefore lucrative because it provides high-margin benefits and aids the companies in acquiring a consumer base, thriving on ethical, clean-label, and sustainable products worth billions of dollars. The consumer demand for plant-based, sustainable, or ethically produced ingredients will create a significant growth opportunity for the precision fermentation ingredients market. This market shift is likely to catalyze and drive the acceptance and innovation of precision fermentation technology across various industries, thus fulfilling the promises made with respect to the planet and humans.

| Attribute | Details |

| Precision Fermentation Ingredients Market Size in 2024 | USD 4.05 Billion |

| Precision Fermentation Ingredients Market Size in 2033 | USD 46 Billion |

| Precision Fermentation Ingredients Market CAGR | 28.50% |

| By Ingredient Type |

|

| By Application |

|

| By Source |

|

| By Region |

|

| Key Players |

|

North America chiefly dominates the precision fermentation ingredients market, augmenting the current sustainable consumer demand, boosting the investment in food technology, and also a friendly, enabling regulatory environment. The US and Canada have adopted plant-based and alternative proteins. With that, there is a growing interest in animal-free dairy, egg, and meat. Precision fermentation solutions have gotten some attention as a sustainable solution for the fulfillment of climate goals, with the potential of state support and funding initiatives. The US Food and Drug Administration (FDA) and Health Canada are at the same time evaluating and providing necessary approvals for the precision fermentation-based ingredients. Besides, the generally recognized as safe (GRAS) certification process for precision fermentation-enabled products has further contributed towards encouraging companies to bring their products onto the market.

Urbanization, increasing demand for sustainable food solutions, and government support for alternative proteins are some factors due to which APAC is in the forefront as a leading market for precision fermentation ingredients. The overwhelming growth of food-tech and biotech investment in the APAC region is mainly due to the extensive investments in precision fermentation in key economies such as China, India, Japan, and Singapore. India, China, and South Korea are implementing advancements in fermentation technologies that allow components derived from microorganisms to be manufactured on a large-scale. Such components may include proteins, enzymes, and other functional ingredients made with precision fermentation. Governments in the APAC region are becoming more encouraging toward the development of biotechnology and the sustainable production of food. Moreover, governments across Asia Pacific are providing an increasing range of funding and tax incentives to companies involved in precision fermentation, plant-based proteins, and cultivated meat. This trend has encouraged global firms such as Perfect Day, Impossible Foods, and Beyond Meat to expand their operations into the APAC region owing to the high local demand present for such plant-based and animal-free products; local firms are rapidly adopting precision fermentation technology to produce goods that are tailored for the needs of the local consumers.

In 2024, protein and enzymes held the largest share of the market. Increased demand for plant-based proteins-alternatives to whey and casein-and enzymes used in food, beverage, and pharmaceutical applications are driving this segment growth. Rising demand for protein substitutes is driven by the ascendance of plant-based diets and vegan alternatives. Enzyme-based applications become the backbone of food production (cheesemaking, baking), and in pharmaceuticals and bio-manufacturing. Companies like Perfect Day, Geltor, and Impossible Foods embrace protein production via precision fermentation to address the demands for taste and sustainability.

The segment of yeast accounted for the largest revenue in the precision fermentation ingredients market in 2024. Yeast-based fermentation is the top in the production of plant-based proteins and dairy alternatives. Yeast, because of its efficiency among all organisms in precision fermentation, can readily be engineered to produce the ever-increasing demand for products, such as whey proteins, amino acids, and flavors. Furthermore, it is commonly used in the food and drink sector for fermentation processes, ranging from alcoholic beverages to bread and biodegradable items.

It is expected that, due to the growing demand for plant-based products, the food & beverage sector will be the leading segment in terms of application, in the precision fermentation ingredients market in 2024. Plant-based meat substitutes, dairy alternatives, and functional foods are behind the growing demand among consumers. The largest application area is taken up by this, propelled further by a growing adoption of plant-based proteins (e.g., for dairy, meat and egg substitutes). Key companies such as Impossible Foods, Beyond Meat, and Oatly are harnessing precision fermentation for product innovation in this area.

Empower your strategy with expert insights, purchase this premium research@ https://www.cervicornconsulting.com/buy-now/2380

Ask here for more details@ sales@cervicornconsulting.com