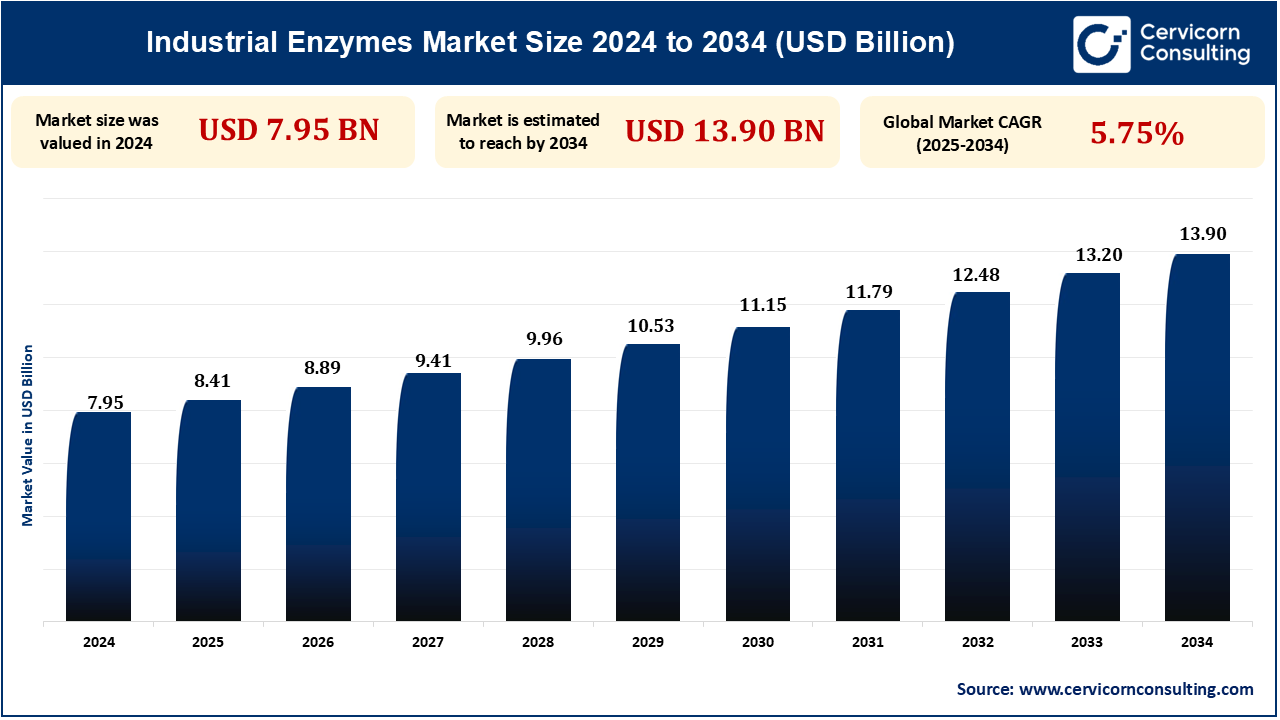

The global industrial enzymes market size was reached at USD 7.95 billion in 2024 and is expected to be worth around USD 13.90 billion by 2034, exhibiting at a compound annual growth rate (CAGR) of 5.75% over the forecast period 2025 to 2034.

The industrial enzyme market is growing at an exponential level with increasing demand in many industries such as food and beverages, pharmaceuticals, biofuels, detergents, and textiles. The growth is being driven by the increased application of sustainable, eco-friendly processes that are less energy-hungry and wasteful. As companies demand more efficient processes, the employment of enzymes in fermentation, digestion, and biocatalysts has been of great effectiveness in speeding up the adoption of their use. Emerging markets and advancements in enzyme technology are also enhancing the growth rate of the industry.

The market for industrial enzymes is being more and more driven by the need for greener, cleaner production. Enzymes minimize the ecological impact of manufacturing processes through the substitution of toxic chemicals and allow more energy-efficient production. The applications are more evident in food and beverage, biofuels, and detergents markets, where companies are looking for technologies that are sustainable and will satisfy consumer and regulatory requirements. Global momentum toward carbon-neutrality and green production has driven the investments in enzyme-based technologies higher.

Emerging enzyme engineering technologies and CRISPR/Cas systems are revolutionizing industries and agriculture. Enzyme engineering has resulted in the generation of more stable enzymes that can function efficiently under stress conditions, whereas CRISPR/Cas and prime and base editing facilitate precise gene editing in crops such as rice and maize. These technologies enhance stress tolerance, improve photosynthesis efficiency, and enhance nutritional content by biofortification. By enhancing qualities like taste, texture, and shelf life, CRISPR technologies are crucial for meeting the global food security and sustainability requirements. With enzyme solutions further customized for industrial use, such technologies hold immense promise for agriculture and industry alike.

Government policies across the globe are promoting tighter measures for the use of green technology, such as industrial enzymes. The U.S. EPA May 2023 regulation excludes certain genetically modified pesticidal crop traits from registration as well as tolerance in the goal of reducing regulatory burdens as well as innovation development. It promotes the advancement of pesticide-resistant crops with low pesticide use, safeguarding farmers and ensuring safety. These policies create a climate favourable for the industrial enzymes market, pushing industries like food, biofuels, and textiles to adopt enzyme-based processes. With constant government support, the application of enzymes is expected to grow rapidly until 2025.

One of the most important constraints in the industrial enzymes market is the initial cost of enzyme production and R&D. Although enzymes have long-term efficiency and sustainability benefits, the initial cost of enzyme production plants and R&D can be high. This is particularly challenging for small and medium-sized enterprises (SMEs) that may struggle to finance R&D projects. While others are investigating low-cost production techniques, the cost limitations to the mass introduction of enzyme processes are still the major obstacle. In spite of this, with improving enzyme technology and falling costs of production, this limitation might decrease in the long term but is currently an issue for the industry in the short term.

This joint venture by AB Enzymes and APC Group is a major change for the industrial enzyme industry. The breakthrough products of AB Enzymes have been represented exclusively in China, India, the majority of Southeast Asia, and the Middle East by APC Group. This strategic alliance is due to increasing demands on environmentally friendly technologies and stricter regulation in pulp and paper industries, among others. With the utilization of enzymes in different processes of the paper-making industry, the collaboration caters to the increasing trend towards environmentally friendly technologies. With AB Enzymes' expanding geographic presence through the strong distribution network of APC, this collaboration highlights the trend towards greater strategic alliances with room for expansion to leverage the potential to grow the market and introduce enzyme-based solutions in multiple industries.

| Attributes | Details |

| Industrial Enzymes Market Size in 2024 | USD 7.95 Billion |

| Industrial Enzymes Market CAGR | 5.75% from 2025 to 2034 |

| By Product |

|

| By Source |

|

| By Application |

|

| By Region |

|

| Key Players |

|

Asia-Pacific is a fast-expanding industrial enzyme market, with China, India, Japan, and South Korea in the lead. China is a leading market, using enzymes in food processing, biofuel production, and textile production. India is embracing enzymes to improve efficiency in agriculture, animal feed, and food processing. Japan is the leader in enzyme-based technologies, especially in biotechnology and pharmaceuticals. South Korea is developing enzyme technology for food processing, waste treatment, and biofuel. The Asia-Pacific region's enzyme market is growing extremely fast with a rapidly growing industrial base and a rising need for sustainable technologies.

The market for industrial enzymes in North America is led by the U.S., Canada, and Mexico. The U.S. is a dominant force in the industrial enzymes market owing to its large-scale manufacturing sector, especially in food and beverages, biofuels, and cleaning agents. Canada is focusing on green processes through the use of enzymes in sectors such as pulp and paper, food, and animal feed. Mexico is witnessing the growth of the market for industrial enzymes because of its growing industrial and agricultural base. With the growing automation, sustainability, and energy efficiency, the use of enzymes will grow in all industries. The country also requires enzymes for the development of biotechnology and the manufacture of biofuels.

Carbohydrases are enzymes that hydrolyze complex carbohydrates into simpler sugars. They are widely applied in the food and beverage industry for baking, brewing, and dairy manufacturing. Carbohydrases improve the digestibility and nutritional quality of products. They are also employed in the manufacture of biofuels to hydrolyze starches into fermentable sugars. These enzymes are vital in enhancing the quality of many food products. Carbohydrases are also incorporated into animal feed to enhance the absorption of nutrients.

Plant enzymes are obtained from different sources of plants like fruits, seeds, and leaves. They are applied on a large scale in the food and beverages sector in the form of the extraction of fruit juice and the recovery of sugar. Food processing employs plant enzymes such as amylases, cellulases, and pectinases for hydrolyzing carbohydrates and fiber. They are also used in the textile industry for natural finishes. Plant enzymes are more environmentally friendly and have a growing usage due to the consumer's demand for natural products. They also have use in animal feed for enhanced digestion.

Enzymes have widespread use in food and beverage processing for enhancing flavor, texture, and nutritional content. Carbohydrases are used in bakery to alter starches, and proteases and lipases are used in the meat and dairy sectors. Enzymes are also involved in brewing, fruit juice production, and alcoholic fermentation. Rising demand for processed and convenience foods is fueling the growth of enzymes in this segment. In addition, enzymes help preserve food and increase shelf life by controlling microbial activity. The food industry continues to gain from enzymes to improve product quality and uniformity.

Empower your strategy with expert insights, purchase this premium research@ https://www.cervicornconsulting.com/buy-now/2347

Ask here for more details@ sales@cervicornconsulting.com