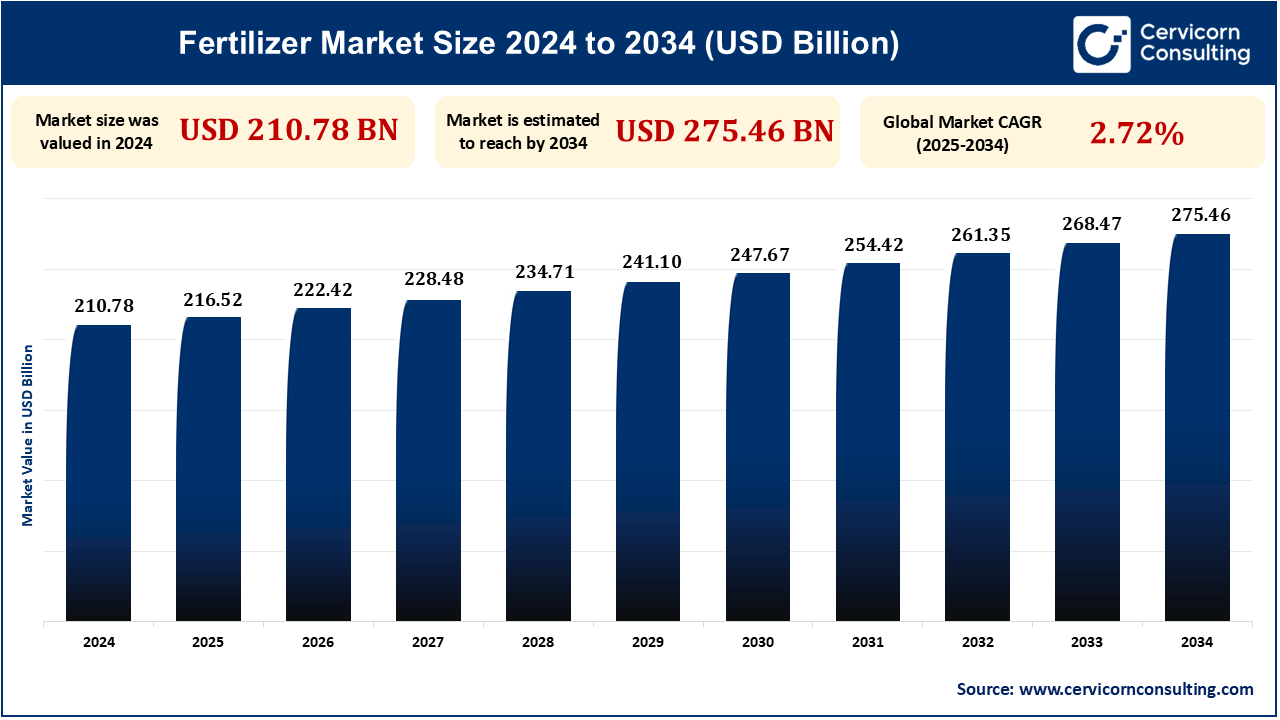

The global fertilizer market size was reached at USD 216.52 billion in 2024 and is expected to surge around USD 275.46 billion by 2034, exhibiting at a compound annual growth rate (CAGR) of 2.72% over the forecast period 2025 to 2034.

Fertilizer markets are increasing exponentially with the increased global food demand, supplemented by the need for higher agricultural productivity. As the global population continues to rise, farmers have been compelled to raise yields and maintain soil fertility, thus fueling a surge in fertilizer use. Advances in fertilizers and rising levels of precision farming adoption have also pushed markets upwards. In addition, governments are implementing policies to support agricultural farming, which continues to drive demand for fertilizers. This expansion signals the critical position fertilizers hold in meeting world food security needs.

Yara's acquisition of Agribios Italiana's organic fertilizer sector has thus entrenched its foothold in the European market, particularly in Italy. With a 10% market share in Italy, Yara is now eyeing an increase of 30% in sales in Italy and the greater region over the next three years as it utilizes its extensive distribution network. The deal complements the current business of Yara in mineral fertilizers by adhering to regenerative agriculture and healthy soils. At strategic purchase, it also agrees with the EU's vision of increasing organic land coverage that positions Yara at the heart of Europe's future sustainable agriculture.

ICL has acquired Custom Ag Formulators (CAF) for USD 60 million, broadening its growing solutions product lines. CAF is a liquid adjuvant, upgraded nutrients, and specialty product company with U.S.-based liquid and dry-form facilities. The acquisition adds ICL's capabilities to address localized crop demands through its current distribution networks. CAF's strategic positions provide same-day shipping to major U.S. growing areas. Tailor-made fertilizers enhance nutrient use efficiency, and yields, and minimize wastage. The market for specialty fertilizers is anticipated to expand significantly with the use of technologies such as soil sensors and satellite imagery.

Synthetic fertilizer manufacture is critically dependent on natural gas and, as a consequence, is exposed to price volatility and supply risks, particularly as world energy markets become increasingly unstable. Such dependence is of concern regarding the environmental footprint of fertilizer manufacture, especially its carbon footprint. Any attempts at change toward more sustainable manufacturing practices, such as bio-based fertilizers, are slowly gaining momentum. Sustained high fertilizer prices, in addition to the Russia-Ukraine war, have fuelled growing global food security issues, with prices rising owing to high energy prices, supply chain constraints, export bans, and growing demand. The global fertilizer market is an exposed market, with some countries having the majority of exports, and such countries mainly impact countries that rely on imports from Belarus and Russia. Smaller markets, in particular those in Africa, are exposed to shortages and increased costs, jeopardizing coming harvests and food security.

Fertilizer manufacturers are teaming up with technology companies to enhance nutrient delivery and fertilizer application effectiveness. In 2023, partnerships resulted in the creation of smart sensors for precision fertilization, saving waste, and minimizing environmental footprint. The partnership between John Deere and Yara combines Yara's agronomic expertise with John Deere's precision technology, connecting Yara's At farm platform with John Deere's Operations Center for tailored crop nutrition recommendations. UK, German, and French trials in 2024 can boost yields by as much as 7% and cut nitrogen fertilizer application by 14%. Such partnerships are pushing the boundaries of digital agriculture technologies. E-commerce platforms and IoT technology also create new channels for distribution.

| Attributes | Details |

| Fertilizer Market Size in 2024 | USD 210.78 Billion |

| Fertilizer Market Size in 2034 | USD 275.46 Billion |

| Fertilizer Market CAGR | 2.72% From 2025 to 2034 |

| Key Players |

|

| By Type of Fertilizers |

|

| By Type |

|

| By Nutrient Content |

|

| By Application |

|

| By Crop Type |

|

| By Region |

|

Asia-Pacific is the largest and fastest-growing fertilizer market, driven by demand to support the rapidly expanding people population in the region. Major agricultural countries like China, India, and Indonesia rely on fertilizers to boost their increased crop yield and food security. The world is also increasing the use of more technologically advanced farming methods, such as employing high-efficiency and organic fertilizers. With the growing modernization of farming practices in these nations, the consumption of conventional as well as green fertilizers keeps increasing.

North America, comprising the U.S., Canada, and Mexico, is a dominant force in the international fertilizer market because of its immense agricultural output. The U.S. and Canada are heavy users of fertilizers to sustain large-scale farming activities, particularly for crops such as corn, wheat, and soybeans. Mexico, with its growing agricultural industry, is also increasingly employing fertilizers for crops such as corn and vegetables. Organic farming methods and advances in precision agriculture are also pushing the demand for more effective and environmentally friendly fertilizers in the region.

Dry fertilizers are solid products that are mostly used in granular or powdered form. They are usually applied on the surface of the land and get absorbed over time as they dissolve. These fertilizers are ideal for commercial farming as they can easily be stored, transported, and applied. Dry fertilizers are mostly slow-release, and they help release consistent nutrients to crops over time. They are widely used in agriculture and horticulture for crops and lawns that require perennial nutrient supply.

Fertilizers for agribusiness are utilized primarily to increase the fertility of the soil as well as raise crop yields and, as a result, have an important role to play in intensive farming activities. Fertilizer application in this line of business is necessitated by the need for higher productivity to meet the growing world population. Fertilizers enable the health of food crops like cereals, fruits, and vegetables by providing them with necessary nutrients such as nitrogen, phosphorus, and potassium. With enhanced agriculture practices, fertilizers are applied using sophisticated machinery and precision technology to create perfect growing conditions for plants.

Organic fertilizers are obtained from renewable resources such as compost, animal manure, and plant residues. They release nutrients slowly and modify soil structure in the long term, enhancing long-term soil health. Organic fertilizers contain high levels of organic matter, which increases the water-holding capacity of the soil and microbial activity. Therefore, organic fertilizers are environmentally friendly and increasingly popular because they are sustainable and have low environmental costs. They are widely applied in organic farming and gardening, where synthetic inputs are excluded.

Phosphorus fertilizers are needed for root growth in plants, blossoming, and fruiting. Phosphorus facilitates energy transfer and storage in plants and plays a critical role in seed development. Phosphorus fertilizers are commonly applied in the early stage of crop growth to produce robust root systems and in high-energy-requiring crops like legumes and tubers. Phosphorus fertilizers consist of products such as superphosphate and ammonium phosphate, and they serve to increase general plant health and productivity.

Empower your strategy with expert insights, purchase this premium research@ https://www.cervicornconsulting.com/buy-now/2331

Ask here for more details@ sales@cervicornconsulting.com