Engineering Services Market Size, CAGR, Report 2025 to 2034

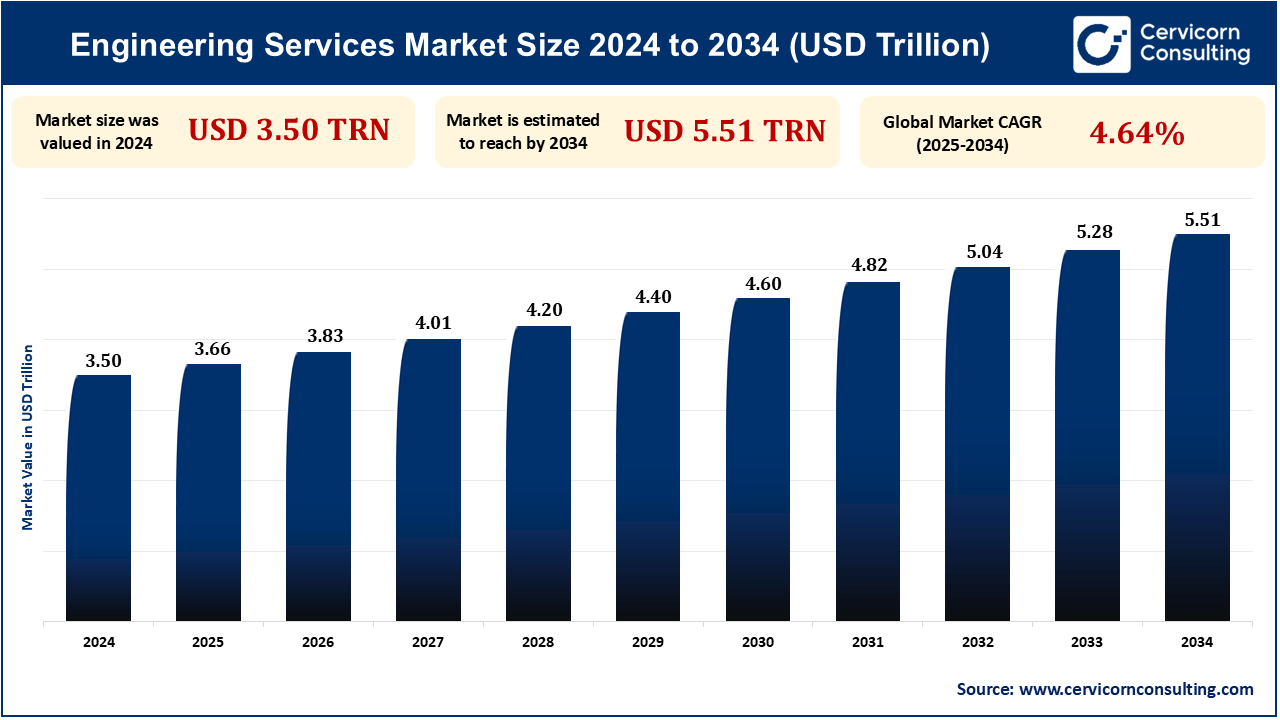

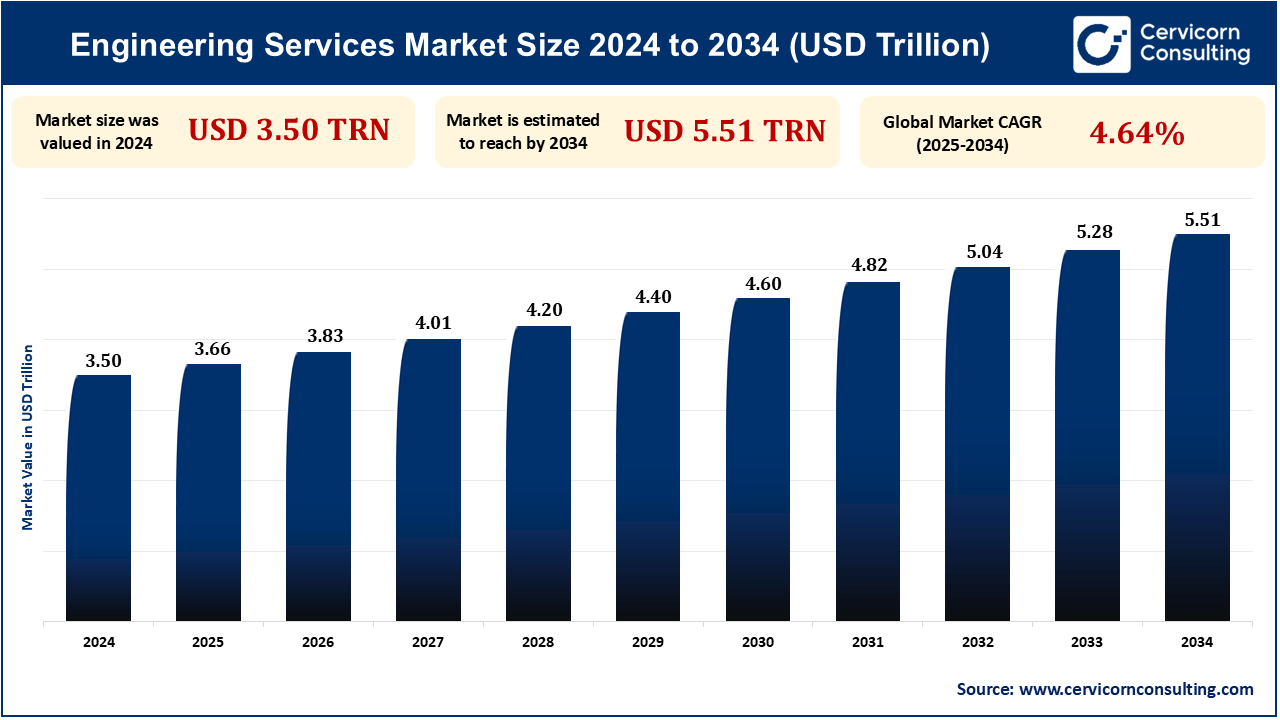

As of 2024, the global engineering services market was valued at approximately USD 3.50 trillion. It is projected to reach USD 5.51 trillion by 2034, reflecting a compound annual growth rate (CAGR) of 4.64%.

Engineering services represent a wide range of professional activities that involve the application of engineering principles in designing, developing, and managing activities associated with the improvement or enhancements of systems, products, and infrastructure. Engineering services encompass numerous related disciplines, including civil engineering, mechanical engineering, electrical engineering, and software engineering, and are important in the construction, manufacturing, and information technology sectors. Overall, we are seeing considerable growth across the engineering services industry as a result of technology changes, government infrastructure spending, and global sustainability. However, challenges still exist, like the skills of the workforce and regulations. To stay competitive in this new landscape, companies must remain aligned and focused on innovation, sustainability, and digital transformation of engineering.

A lot of businesses aim to reduce expenses by sending board services overseas. This has an impact on the growth of engineering service providers in countries like India and China, as well as other nations with a large number of available engineers. The engineering services market is expected to grow rapidly due to digitalization, increased spending on infrastructure, and sustainability initiatives. The deployment of next-gen technologies (such as artificial intelligence, big data analytics, and automation) will play an important role in the industry. Overall, we are seeing considerable growth across the engineering services industry as a result of technology changes, government infrastructure spending, and global sustainability. However, challenges still exist, like the skills of the workforce and regulations. To stay competitive in this new landscape, companies must remain aligned and focused on innovation, sustainability, and digital transformation of engineering.

Engineering Services Market Key Takeaways

- 2024 Market Size: USD 3.50 Trillion

- 2034 Projected Market Size: USD 5.51 Billion

- CAGR (2025-2034): 4.64%

- North America: 23.7% in 2024

- Asia Pacific: 36.8% Revenue Share in 2024

- Electrical Segment: 29.40% Revenue Share in 2024

- Civil Segment: 21.80% Revenue Share in 2024

Engineering Services Market Latest Investments

- In March 2025, Schneider Electric declared plans to invest more than USD 700 million into the US energy market. The investment targets the manufacturing of electrical equipment and expands a number of existing factories located in Missouri, Ohio, and Tennessee. The plan will create more than a thousand jobs and increase the energy supply on account of increased demand resulting from growth in artificial intelligence and more domestic manufacturing.

- In March 2025, Holcim announced plans to spin off its North American business, Amrize, targeting annual adjusted EBITDA growth of 8-11% and sales growth of 5-8% from 2025 to 2028. The spin-off, expected by mid-2025 with a projected valuation of $30 billion, aims to capitalize on the robust U.S. construction market despite current challenges.

- AECOM reported a USD 300 million investment into smart city solutions to improve infrastructure and urban development in key cities throughout Asia-Pacific, which they announced in February 2025. The investment made by the company is in cutting-edge engineering services that focus on sustainable construction, smart transportation, and eco-friendly building design.

- In January 2025, advanced aerospace engineering services received a co-investment of USD 250 million by Boeing and Raytheon Technologies. The program will emphasize new materials and technologies, with an overriding focus on aerospace systems, including the design and manufacture of the aircraft.

Engineering Services Market Important Factors

Growing Technological Advancements

One of the significant growth drivers influencing the engineering services market is the increasing speed of technological developments. As industries develop and innovate further, engineering services become significant in implementing new technology aimed at increasing productivity, efficiency, and competitiveness. The adoption of AI and ML in engineering services is fundamentally changing industries, such as automotive (self-driving cars), manufacturing (smart factories), and healthcare (AI-driven diagnostics). AI-powered product development, design automation, and predictive maintenance are expected to account for 40% of engineering services by 2025.

Technological advancements support market growth by improving engineering services' capabilities and driving innovation in service delivery. As industries continue to invest in technologies, the demand for engineering services steadily increases. The automotive, aerospace, manufacturing, construction, and healthcare sectors are industries that have been increasingly relying on technology for efficient functioning, safety, and quality production purposes. With emerging technologies, engineering services are also expected to play a key role in shaping the future of industries globally.

75% of automotive and aerospace companies are expected to incorporate digital twins into their engineering services by 2027. The engineering services market will continue to grow as industries adopt innovative solutions (AI, automation, IoT, 3D printing, and digital twins) in their respective markets that will enhance services, growth, and transformation.

The High Cost of Advanced Engineering Services to Restrain the Market’s Growth

Growth in costs for advanced engineering services has been one of the restraining factors confronting engineering services worldwide. As engineering solutions evolve to be ever more technology-driven, costs for research and development, software tools, skilled manpower, and infrastructure keep rising. Advanced engineering services may be out of reach for small and medium enterprises (SMEs) due to cost considerations. Shortages of necessary tools and materials are also causing project delays and increasing expenses. For instance, the construction of the US LNG (Liquefied Natural Gas) plant faced delays because there was not enough equipment available. This shortage increased the construction costs by 25% to 30% in the last five years.

Engineering services often rely on specific facilities like manufacturing plants, testing labs, and prototype centers. Pay in the construction sector has risen much faster than inflation. For example, in Australia, construction workers received average pay increases of 18.9%, far above the national inflation rate of 2.2%. The rise in construction projects, especially in energy fields like LNG plants, has led to a shortage of equipment such as generators and transformers. This scarcity has also raised construction costs. Additionally, delivery times for equipment have stretched from one year to nearly two years. According to Statistics Canada, the engineering services industry in Canada reported operating revenues of US$ 30.28 billion in 2023, a 9.0% increase from the previous year. Operating expenses rose by 8.4% to US$ 27.35 billion, resulting in an operating profit margin of 9.8%, the highest since the pandemic began.

Expansion of Engineering Services in Renewable Energy offers an opportunity for Market Growth

One of the most exciting opportunities in the engineering services market is with the expansion of engineering services in the renewable energy sector. The world is focused on sustainable energy sources to mitigate climate change and other carbon impacts; therefore, there is a growing demand for engineering services on the design, development, and optimization of renewable energy infrastructures. Renewable energy includes solar, wind, hydro, geothermal energy, and technology to store energy.

By 2023, global spending on renewable energy hit around USD 500 billion, which is over 70% of all energy investments. Engineering services are expanding with this spending, especially in solar, wind, and offshore projects. The International Energy Agency (IEA) predicts renewable energy will increase by 70% between 2023 and 2030, boosting demand for engineering skills.

The Asia-Pacific region, led by China, India, and Japan, is set to be the biggest market for engineering services in renewable energy. By 2025, it will contribute to over half of global renewable energy investments. This growth in engineering services is powered by the worldwide shift towards clean energy and technological advances in solar, wind, and energy storage.

Engineering Services Market Scope

| Attributes |

Details |

| By Engineering Disciplines |

- Civil

- Mechanical

- Electrical

- Piping and Structural

- Others

|

| By Delivery Model |

|

| By Service |

- Product Engineering

- Process Engineering

- Automation Related Services

- Asset Management Related Services

- Others

|

| By Industries |

- Aerospace and Defense

- Automotive

- Chemical and Petrochemical

- Electric Power Generation

- Municipal Utility Projects

- Mining

- Oil and Gas

- Transportation

- Others

|

| By Region |

- North America

- APAC

- Europe

- LAMEA

|

| Key Players |

- AECOM Technology Corporation

- Jacobs Engineering Group Inc.

- Worley Limited

- Fluor Corporation

- Tetra Tech, Inc.

- SNC-Lavalin Group Inc.

- Ramboll Group A/S

- KBR, Inc.

- ARUP Group Limited

- Buro Happold Group

- Burns & McDonnell

- Deloitte Consulting LLP

- Mott MacDonald Group Limited

- Hyder Consulting PLC

- Stantec Inc.

|

Engineering Services Market Regional Insight

North America is Expected to Grow at the Fastest Rate During the Forecast Period

- 2024 Market Size: USD 0.83 Trillion

- 2034 Projected Market Size: USD 1.31 Billion

- CAGR (2025-2034): 5.23%

The engineering services market in North America is likely to be the fastest-growing in the world due to technological development, expanding infrastructure, growing demand for digital engineering solutions, and strong manufacturing. Investments in infrastructure modernization and smart city projects in both the US and Canada continue to fuel significant demand for engineering services in the construction, transportation, and energy sectors. In 2023, North America was responsible for 19% of the money spent worldwide on renewable energy projects. By 2025, experts predict this spending to go over US$ 100 billion. Achieving this goal will need a lot of help from companies that provide engineering services. These companies will need to oversee and manage the work required to build renewable energy infrastructure. According to the Energy Information Administration (EIA), the US is expected to see over a 25% increase in renewable energy capacity between 2023 and 2025, substantially increasing the demand for engineering services related to renewable energy (specifically solar energy and wind energy) and grid infrastructure.

In North America, there is also a surge in investments in medical devices, biotechnology, and healthcare automation. This increase is pushing up the need for engineering services in robotic surgery, prosthetics, and AI diagnostics. In 2023, engineering sector wages in North America rose by 6.5% compared to the previous year, particularly benefiting those in engineering consulting and project management roles. In 2021, the Biden administration used USD 1.2 trillion on improvements to infrastructure, including funding for renewable energy projects, highway repairs, and reconstruction of bridges (including green energy).

- In February of 2025, ICON announced that it would collaborate with Lennar, which is one of the largest homebuilders in America, to produce 3D-printed homes to help reduce home build cost and improve supply chain velocity in the housing market. ICON’s 3D printing technology is expected to facilitate a faster home-building process with a more sustainable construction approach.

- In November 2024, GE disclosed that it would release new intelligent grid technologies that would optimize energy benefits and incorporate renewable energy sources into the grid. The new system will assist utilities in North America in improving grid reliability, energy efficiency, and resilience. GE's intelligent grid solutions will be deployed across various states in the United States, and particularly, where there are significant levels of solar and wind energy integration.

Asia-Pacific Dominated the Engineering Services Market in 2024

- 2024 Market Size: USD 1.29 Trillion

- 2034 Projected Market Size: USD 2.03 Billion

- CAGR (2025-2034): 4.7%

In the upcoming years, the Asia-Pacific (APAC) region will experience strong growth in the engineering services market. Rapid economic growth, industrialization, and ongoing investment in technology, infrastructure, and manufacturing will carry the APAC region to the number one position for engineering services. Increasing demand is being fueled by the high populations, growing middle-class, and aggressive growth and investment plans for several sectors within the region.

Several APAC countries, like China, India, Japan, South Korea, and Southeast Asia, are experiencing rapid industrialization and urbanization. China and India are still at the forefront in renewable energy investment in the APAC. In 2023, China represented 45% of global solar panel installation capacity, and India is one of the largest producers of wind energy. Engineering services for solar, wind, and battery storage are projected to grow 7-8% annually in the region through 2025, especially in China, India, and Vietnam. India is working hard to increase its solar energy production. By the year 2030, India plans to have 500 gigawatts (GW) of renewable energy. This big goal is creating a greater need for engineering services. Meanwhile, China is supporting projects such as the Belt and Road Initiative. India is also pushing ahead with its Smart Cities Mission. At the same time, there are plans to connect countries in Southeast Asia.

All these efforts are opening up great opportunities for major investments in technology and infrastructure throughout the Asia-Pacific region. High demand is expected from engineering services sectors covering construction, renewables, technology integration, and transport systems. However, issues like lack of skilled labor and geopolitical risks will need to be borne in mind as the unprecedented pace of development generates such change.

- In January 2025, First Solar revealed a US$ 500 million plan to design and build solar panels in Queensland, Australia, to help the country achieve net-zero by 2050. In total, the project will involve the construction of several large transition solar power plants and the introduction of new battery storage systems.

- In December 2024, Shimizu implemented an AI-based construction automation system to improve construction processes. The system leverages machine learning algorithms to enhance project planning, shorten construction periods, and improve safety management.

Engineering Services Market Segmental Insight

By service type, the product engineering segment led the market

- In 2024, the product engineering sector accounted for the largest market share. It has always been the largest share because of the advancement of product development from innovation to product engineering. In the same way, sectors in automotive and electronics to consumer goods, aerospace, and industrial machinery are using product engineering firms for the same reasons—they have demand and trends toward product engineering services requiring skills in design and prototyping. The automotive sector is one of the largest consumers of product engineering services, with an estimated spend of USD 50 billion on engineering services by 2026.

- Key trends include electrification, autonomous driving, and advanced driver-assistance systems (ADAS). Product engineering does include advanced technologies such as IoT, AI, and machine learning, as industries collectively are adopting them into product development to enhance new smart technologies’ functionality, safety, and performance. IoT-enabled products are projected to account for 30% of all consumer electronics product designs by 2027. As smart technologies penetrate additional industries, more need arises for smart product design. Furthermore, businesses often outsource their product engineering services to global offshore engineering firms for cost considerations and a new array of talent. Thus, the scope of product engineering services available in the market is on the increase.

By technology, the artificial intelligence (AI) & automation segment led the market

- In 2024, the artificial intelligence (AI) & automation segment accounted for the largest market share. Rapid advancements in artificial intelligence (AI) & automation are taking over industries by increasing operational efficiencies and decreasing costs, while developing smarter systems in engineering. AI and automation in manufacturing are the shining stars of the Industry 4.0 IIoT revolution. Smart factories combine AI and automation technologies by integrating IoT sensors and robotics to automate repetitive tasks, optimize supply chain efficiencies, and reinforce quality control.

- The rapidly rising number of applications of AI, machine learning, robotics, and automation in manufacturing, design, maintenance, or data analysis is changing the position of engineering service deliveries. Approximately 40% of manufacturing firms are expected to adopt AI technologies for predictive maintenance by 2025. 80% of automotive manufacturers are expected to use AI in their design and production lines, focusing on automation and AI-based quality control systems. The more industries embrace digital transformation and automation, the larger this technology sector will grow due to companies looking for improved efficiency, cost savings, and innovation.

By end-use industry, the automotive segment led the market

- The automotive segment held the largest market share in 2024. The automotive segment is currently experiencing consistent growth and remains the leader in engineering services, meeting the demands for increasingly complex vehicle architecture designs, electric vehicles (EVs), autonomous driving technologies, and digital systems integration. By 2030, it's expected that electric vehicles (EVs) will make up more than 35% of all vehicle sales globally. This shift will greatly increase the need for engineering services related to battery technology, systems for charging, and the design of powertrains.

- Furthermore, there is an expected increase in demand for engineering services in the automotive industry due to new technological advancements. As more factories start using connected systems, robotic process automation (RPA), along with digital twin technologies, the need for these services grows. These changes together contribute to the rising need for specialized engineering support. These advancements will enhance efficiency and innovation in the way cars are made.

- The automotive segment depends on complex global supply chains, in which engineering services focus on supply chain management to optimize logistics, as well as keeping quality control to ensure manufacturing companies run effectively and feel efficient in these times of exceptional supply chain conditions. Cars are becoming more complex owing to the growing need to make them better for the environment, safer, and more advanced. This situation is increasing the demand for engineering services in the car industry.

- The worldwide automotive research and development market is expected to expand substantially, with a significant portion of expenditure on the development of autonomous systems and electric vehicles, in particular. Global automotive R&D spending is expected to reach over US$ 200 billion in 2025. The automotive sector of the engineering services market will continue to grow as the automotive industry goes through changes related to regulatory requirements, new technologies, and market competition.

Engineering Services Market Major Breakthroughs

- In February 2025, IBM introduced a new AI-based platform that utilizes machine learning and data analytics to enhance engineering processes across a variety of industries, including manufacturing, automotive, and aerospace. The platform assists organizations with product development, manufacturing productivity, and predictive maintenance.

- In February 2025, Nobel Biocare expanded its portfolio with a new implant system incorporating digital workflows for achieving greater precision and predictability in dental implant procedures.

- In January 2025, Siemens Digital Industries declared a substantial strategic investment in the area of additive manufacturing (3D printing). Funding will also go to projects with applications involving rapid prototyping, custom parts fabrication, and supply chain optimization. The aim is to make the application of 3D printing services into new industries beyond engineering, such as automotive, aviation, and consumer products-demonstrating a specific interest in digital engineering.

- In January 2025, Jacobs Engineering provided a sizable investment in its vision to focus on renewable energy, green design/build projects, and circular economy projects for new sustainable infrastructure project delivery. This provides a continuous path through Jacobs's ongoing work assisting engineering partners with their construction of solar energy, wind generation, and carbon-neutral structures.

Empower your strategy with expert insights, purchase this premium research@ https://www.cervicornconsulting.com/buy-now/2372

Ask here for more details@ sales@cervicornconsulting.com