The biofuels market is seeing rising growth levels with increasing global attention towards substitute energy sources, policies, and technology innovation for biofuels. Green issues over climate change and mandatory GHG emission cuts have led to policy incentives such as blending requirements and tax credits for the use of biofuels. Furthermore, the price volatility of fossil fuels and increasing energy security demands are compelling the shift towards biofuels. Advances in feedstock use through algae-based and cellulosic biofuels are also further stimulating industry potential. The U.S., Brazil, and Indonesia are among the leading countries to introduce policies that would increase production and inclusion of biofuels into transportation markets.

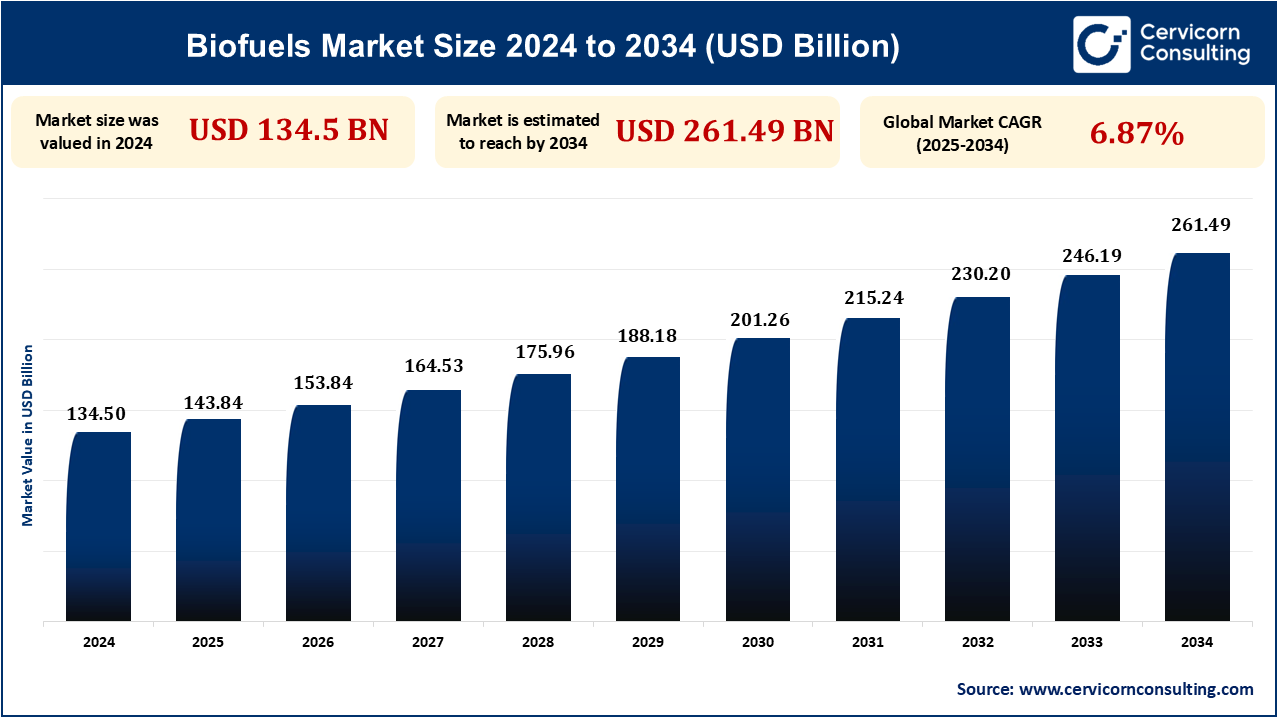

The global biofuels market size was reached at USD 134.50 billion in 2024 and is expected to be worth around USD 261.49 billion by 2034, exhibiting at a compound annual growth rate (CAGR) of 6.87% over the forecast period 2025 to 2034.

Second-generation biofuels, produced from non-food biomass such as agricultural residues, forestry wastes, and algae, are picking pace with their lower environmental footprint. These biofuels are food-neutral as well as land-neutral in terms of use, making them an apt alternative to first-generation biofuels. Governments and research centers are heavily investing in advanced biofuels for increasing efficiency and scale. For Example, The U.S. Department of Energy's Bioenergy Technologies Office (BETO) is also sponsoring programs to manufacture cellulosic ethanol, a second-generation biofuel that is energy-efficient and has lower carbon emissions than traditional bioethanol.

Numerous governments globally have established blending mandates as a way of combating reliance on fossil fuels as well as decreasing greenhouse emissions. Mandates for blending, like that of the United States Renewable Fuel Standard (RFS) and the European Union Renewable Energy Directive (RED II), promote the use of biofuels as a component of transportation fuel. The mandates spur the large-scale uptake and technological innovation in biofuel production. For instance, Brazil mandates an ethanol blending level of up to 27% in gasoline, which is one of the highest in the world and one of the greatest reductions in carbon footprint.

Despite technological advancement, biofuel production is still more costly than conventional fossil fuels because of the high cost of raw materials, sophisticated refining technology, and lack of economies of scale. Expensive enzymes, fermentation technology, and feedstock plants burden the production cost, making biofuels uncompetitive in the international energy market. Advanced biofuels, like cellulosic ethanol, also need specific equipment and factories for production, which elevates costs. These economic concerns dissuade bulk commercialization notwithstanding the environmental benefits of biofuel. For instance, The cellulosic ethanol production is still more expensive compared to traditional gasoline, discouraging its commercialization not with standing the actions of governments and industries towards cleaner sources of fuel.

The aerospace and shipping industries are increasingly turning to biofuels to minimize carbon footprints and meet strict environmental regulations. Bio-based marine fuels and sustainable aviation fuel (SAF) are gaining traction as plausible alternatives to traditional fossil fuels, with less greenhouse gas emissions and better energy efficiency. Governments and regulatory bodies are nudging airlines and shipping companies towards changing to biofuels, in the hope of widespread use. United Airlines successfully conducted a commercial flight on 100% SAF in 2023, highlighting the future of biofuels that can bring down aviation carbon emissions and becoming a benchmark for green flying in the future.

The Asia-Pacific region is becoming a major player in the biofuels market, as a result of increasing energy needs, government support, and the presence of feedstocks, such as sugarcane and palm oil. Countries like India, China, and Indonesia are increasing biofuels production to lessen dependence on fossil fuels. For instance, India increased its Ethanol Blending Programme (EBP) in 2023, with a target of 20% blending by 2025, with a support of $3 billion to add new capacity in ethanol units. Indonesia, the world's biggest palm oil exporter, is growing with a B35 biofuels policy that requires 35% to be blended with palm oil-based biofuel for diesel fuels.

North America is an established market for biofuels due to robust government policies, blending mandates, and investments in renewable energy. The U.S. and Canada are sizable markets for biofuels, especially as the production of ethanol and biodiesel are accelerating rapidly. The U.S. Renewable Fuel Standard (RFS) requires a specific amount of biofuel to blend with gasoline, which will drive demand growth in the biofuel market. Canada’s Clean Fuel Standard is another action to spur new biofuels in the transportation sector. For example, Chevron in 2023 has pledged an investment of $600 million to expand renewable diesel manufacturing capacity to aid mounting demand for sustainable fuels. Likewise, POET, the U.S.'s largest bioethanol producer has increased its capacity for ethanol production by 40 million gallons a year, to aid mounting demand for biofuel.

Biodiesel is a renewable energy source derived from vegetable oils, animal fats, or recycled cooking oils through a chemical process called transesterification. Biodiesel is often mixed with petroleum diesel to reduce emissions and increase fuel efficiency. Serving the transportation, agriculture, and industrial machinery sectors, biodiesel is a common choice as a fuel. While the U.S. and Germany have been the two countries most successful in adopting biodiesel, this has most often occurred in accordance with regulatory blending mandates. For example, in 2023, Shell increased its biodiesel production capacity in the Netherlands to capitalize on needed sustainable fuels for the European market.

Biofuels are essential to reducing greenhouse gas emissions from road transport, and ethanol and biodiesel are usually blended with gasoline and diesel to comply with emissions standards. For instance, the U.S., Brazil, and Germany have established biofuel blending mandates to spur a shift towards cleaner transportation fuels. The European Union has initiated similar efforts through its Renewable Energy Directive (RED II), which establishes a 14% renewable energy share in transport fuels by 2030, promoting biofuel adoption in the automotive sector.

Empower your strategy with expert insights, purchase this premium research@ https://www.cervicornconsulting.com/buy-now/2328

Ask here for more details@ sales@cervicornconsulting.com