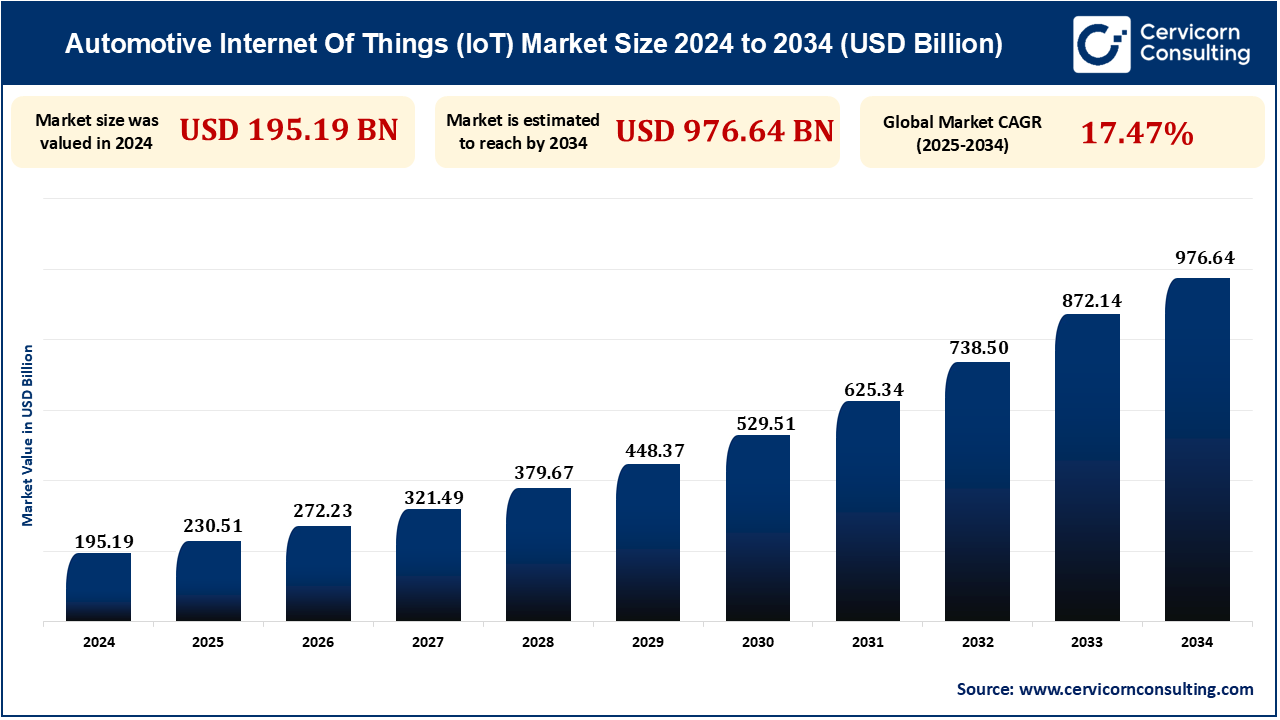

The global automotive IoT market size was measured at USD 195.19 billion in 2024 and is anticipated to reach around USD 976.64 billion by 2034, growing at a compound annual growth rate (CAGR) of 17.47% from 2025 to 2034. The automotive IoT market is growing due to rising demand for high-quality medicines, stringent regulatory requirements, increasing healthcare investments, and the need for purified water in production processes.

The automotive Internet of Things (IoT) market deals with the convergence of connected devices, sensors, and networks inside cars. IoT applications enhance real-time data capture, vehicle-to-vehicle (V2V), and vehicle-to-infrastructure (V2I) communication. IoT applications enhance safety, navigation, and fuel efficiency. The market also encourages innovations such as autonomous driving, smart maintenance, and in-car entertainment systems.

The increased requirement for internet-enabled vehicles equipped with sophisticated safety and convenience capabilities. Customers continue to demand intelligent driving experiences through real-time data, vehicle locating, and ADAS. Emerging technologies in electric cars and autonomous drive technologies again push the consumption of IoT technology even higher. They allow auto manufacturers to enhance driving performance as well as driver satisfaction. Because of this, the market continues to grow immensely with increased connectivity as well as smarter car technology solutions.

By Region:

By Component:

By Communication:

By System:

By Application:

The growth of electric and self-driving vehicles is propelling the automotive IoT market, as IoT facilitates intelligent features such as real-time analysis, remote diagnosis, and driver aid. Demand for EVs increases the demand for efficient connectivity, energy-saving systems, and high-end software integration. IoT contributes to enhancing the security and efficiency of vehicles. The trend will be expected to fuel long-term market growth.

NXP Semiconductors bought TTTech Auto in January 2025 for USD 0.62 billion to complement its software offerings for software-defined vehicles (SDVs). TTTech Auto specializes in safety-critical systems and middleware that will now be folded into NXP's CoreRide platform. The buyout is part of NXP's strategy to be a leader in automotive and Industrial IoT intelligent edge systems. The relocation is designed to assist auto manufacturers in handling growing SDV complexity, enhancing performance and safety, and reducing time to market. TTTech Auto will retain existing customers under the NXP brand, strengthening its global presence.

Increased demand from consumers for connected and safe cars is pushing the automotive IoT market. IoT facilitates features such as real-time navigation, emergency notifications, and remote diagnostics to improve the driving experience. Connected services, such as in-car Wi-Fi and voice assistance, drive this demand. As there is more IoT integration, consumer demand for smart cars will increase.

Qualcomm and Google announced in October 2024 a multi-year strategic collaboration to extend support for Snapdragon platforms on Android OS. Qualcomm will enhance Snapdragon mobile platforms to support longer Android OS, with the first being Android 15. Through this partnership, the two aim to minimize e-waste through longer support for devices. Longer support will cover select Snapdragon mobile platforms first. These two companies share a commitment to delivering better user experiences via improved performance and extended lifecycles for Android-powered devices. This move emphasizes a mutual vision for sustainability and innovation in mobile technology.

One of the major holdbacks for the Automotive IoT industry is the expense of deploying and sustaining IoT infrastructure. Adopting sophisticated technologies such as sensors, connectivity modules, and software updates involves a high investment. Small-scale manufacturers with finite budgets might not be able to integrate these systems. Maintenance and updates incur operational costs. The financial burden hinders end masse IoT integration throughout the industry.

In November 2024, The BMW Group is rolling out its Automated Driving In-Plant (AFW) system throughout its plant network. Beginning with Plant Dingolfing, AFW will be introduced in Leipzig, Regensburg, and Oxford by 2025. The system enables vehicles to drive on their own based on sensors and cloud architecture. Plant Leipzig seeks 90% of its BMW and MINI models to employ AFW. The technology improves production efficiency and takes advantage of onboard vehicle capabilities. This investment may increase the cost of its vehicles, particularly in the competitive EV segment.

A most significant opportunity in the Automotive IoT market is increasing Vehicle-to-Everything (V2X) communication technologies. V2X allows vehicles to exchange information among themselves, the infrastructure, and pedestrians, making roads safer and more efficient. V2X can alleviate traffic, avoid crashes, and drive route optimization. Since governments implement more intelligent cities, the demand for V2X is expected to increase. It brings enormous potential for expansion for the IoT market.

Audi is further enhancing its technology offerings in October 2024 with the inclusion of NXP's Trimension UWB technology to provide secure, hands-free access to vehicles in its new Premium Platform Electric cars. Audi has also entered into partnership with Gubagoo to outfit U.S. dealerships with contemporary chat and digital retailing solutions, improving customer experience through 24/7 support and seamless car-buying processes.

| Attributes | Details |

| Automotive IoT Market Size in 2024 | 195.19 Billion |

| Automotive IoT Market Size in 2033 | 872.14 Billion |

| Automotive IoT Market CAGR | 17.47% from 2025 to 2034 |

| By Application |

|

| By Component |

|

| By Communication |

|

| By Vehicle Type |

|

| By System |

|

| By Region |

|

Europe will lead the growth of the Automotive IoT market, driven by a push for green mobility and regulatory pressure. The EU's push for more stringent emissions standards and investment in smart infrastructure fuels IoT adoption. European manufacturers are creating connected and autonomous vehicle technology, driving demand for IoT. Europe is also witnessing the deployment of 5G and V2X technology. All these trends together result in the rapid development of IoT in Europe.

North America led the Automotive IoT market in 2024 because of the adoption of advanced technologies like autonomous cars and 5G. Its leading automobile manufacturers and technology firms invest heavily in IoT solutions. The U.S. is at the forefront of testing autonomous cars, connected car infrastructure, and artificial intelligence development. Major players such as Tesla, Ford, and Qualcomm support the dominance of North America. They further cement its leadership in the automotive IoT segment.

The software segment is key in the automotive IoT industry, underpinning the likes of ADAS, predictive maintenance, and real-time navigation. It includes vehicle operating systems, AI algorithms, and cloud-based solutions. Automotive systems and software-driven sophistication propel its revenue. Autonomous and connected car growth powers the growth of this segment.

For example, Mercedes-Benz and Google Cloud are expanding their collaboration in January 2025 to launch new AI-driven conversational capabilities for the MBUX Virtual Assistant. With the Automotive AI Agent built by Google Cloud with Gemini on Vertex AI, the assistant will deliver rich and personalized information regarding navigation and points of interest.

The upgraded system utilizes Google Maps Platform, providing new information on 250 billion locations worldwide. Customers will be able to use natural language interactions for applications such as restaurant searching and follow-up questioning. The new experience will roll out later this year in the Mercedes-Benz CLA lineup.

Embedded systems play a critical role in the automotive IoT industry, providing vehicle control, communication, and automation. They drive applications such as ADAS, infotainment, and telematics, with real-time processing capabilities. They provide connectivity with other cars, roadside infrastructure, and the cloud. With connected and autonomous cars, embedded systems are the driving force behind the technologies.

For example, during March 2025, Renesas Electronics is adding breadth to its power and embedded solutions to facilitate AI, automotive, and energy savings innovation. A new Power Products Group has been created through its recent acquisitions by the company. Renesas concentrates on power growth markets such as electric vehicles and AI infrastructure. The firm provides an extended portfolio of discrete power devices as well as power management ICs. Its target is to promote Renesas' standing within the market of power semiconductors.

Telematics is of key importance in the automotive world of IoT, where there is real-time data, navigation, and remote diagnosis. Telematics enables applications such as fleet management, emergency calls, and driving behavior monitoring. Telematics enhances vehicle efficiency, safety and offers insightful data analytics. Since connected cars are becoming increasingly in demand, telematics is behind intelligent driving experience.

For example, Verizon Connect launched in January 2025 Extended View Cameras and an adjustable Driver Vehicle Inspection Reporting (DVIR) system in order to increase fleet efficiency and safety. The Extended View Cameras provide near-360-degree visibility using multiple cameras and an in-cab display, eliminating blind spots and enhancing driver awareness. The configurable DVIR, as part of the Verizon Connect Reveal platform, allows for customized inspection reports, visual evidence uploads, and real-time vehicle defect notifications. These solutions are designed to assist fleets with operating safely, regulatory compliance, and cost and liability reduction. The Extended View Cameras can be found in the United States, and the DVIR is offered in both Canada and the United States.

Empower your strategy with expert insights, purchase this premium research@ https://www.cervicornconsulting.com/buy-now/2364

Ask here for more details@ sales@cervicornconsulting.com