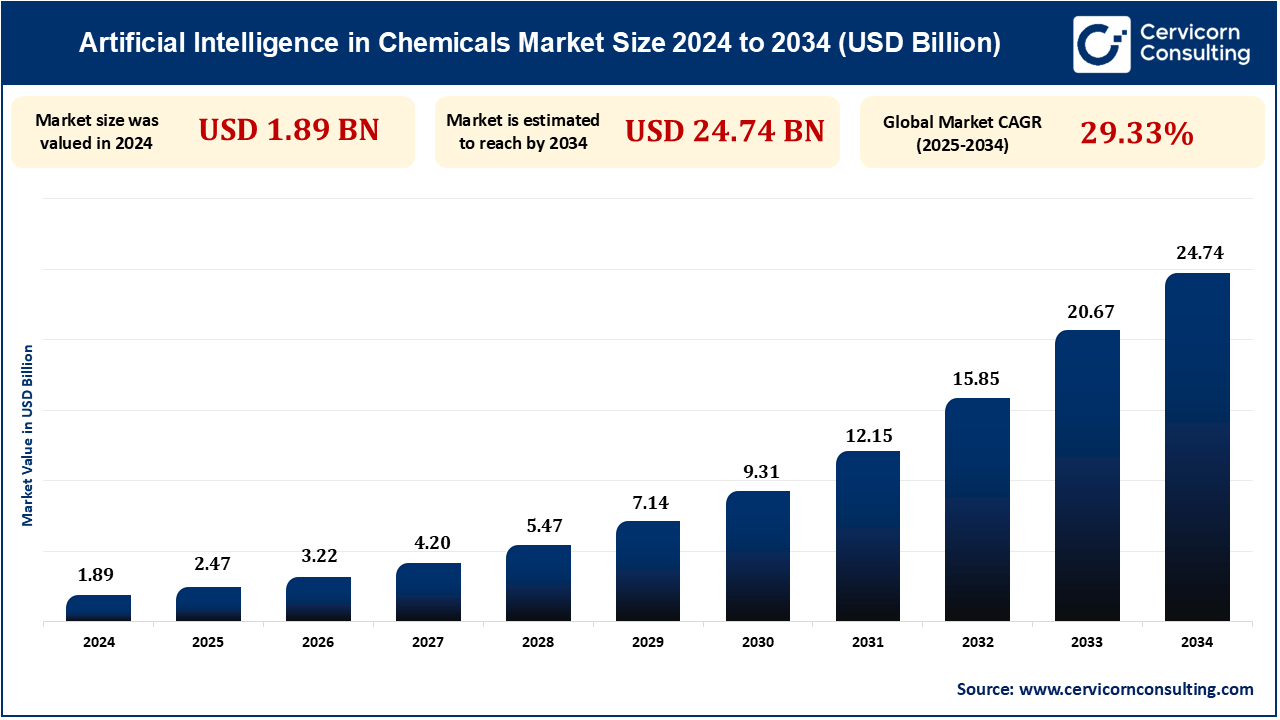

The global artificial intelligence (Al) in chemicals market size was measured at USD 1.89 billion in 2024 and is anticipated to reach around USD 24.74 billion by 2034, growing at a compound annual growth rate (CAGR) of 29.33% from 2025 to 2034. The Al in chemicals market is growing with escalating demand for process optimization, predictive maintenance, and accelerated R&D in material discovery. Integration of AI with Industry 4.0 and smart manufacturing fuels operational efficiency and innovation further.

The AI in chemicals industry is the merging of AI technologies to enhance efficiency, innovation, and decision-making in chemical production, R&D, and supply chain operations. It is focused on using machine learning, predictive analytics, and automation to optimize processes, reduce costs, and accelerate product development.

The growing need for process optimization, predictive maintenance, and faster product innovation is likely to propel the artificial intelligence (AI) in chemicals market growth over the forecast period. Key players in the market provide various AI-based solutions, platforms, and technologies to chemical manufacturers to improve operational efficiency, lower costs, and enable data-driven decision-making.

The increasing uptake of Industry 4.0 in the chemicals industry is driving the use of AI in smart manufacturing environments. Industry 4.0 emphasizes digitizing the production setup through interconnected devices, sensors, and analytics. AI is the analytical brain behind the connected systems, processing sensor data from IoT devices to provide actionable intelligence in real time. This convergence facilitates predictive maintenance, quality control by machines, process optimization, and dynamic scheduling. AI-based systems in a chemical plant can recognize subtle changes in process conditions and automatically correct control parameters, enhancing safety and saving waste. Coupled with robotics, digital twins, and edge computing, AI facilitates end-to-end automation of processes and smart decision-making. This trend toward digital transformation is especially pronounced in Europe, North America, and Asia-Pacific, where firms are heavily investing in smart factory strategies. Consequently, the integration of AI with Industry 4.0 technologies is emerging as a key growth driver in the chemical industry.

As environmental policies are tightening across the globe, chemical industries are now relying on AI to help them maintain compliance and sustainability. AI-based monitoring and analytics software can monitor emissions, waste output, and usage of chemicals in real-time, keeping production under regulatory limits. The software can also detect safety risks—such as leaks, spills, or equipment malfunction—prior to occurrence, enabling preemption of threats. Second, AI enables life-cycle analysis and environmental impact analysis through the simulation of how various chemicals and processes will affect the environment. This is significant in meeting global sustainability goals such as REACH, the European Green Deal, and ESG targets. AI also enables the design of safer and more environmentally friendly chemical formulations by anticipating the toxicity and environmental persistence of chemical compounds. By improving workplace safety and environmental stewardship, AI assists chemical companies in lowering regulatory fines, enhancing brand image, and attracting environmentally responsible investors, thus making this a key driver of AI adoption.

One of the main constraints holding back widespread use of AI in the chemical sector is that it entails a high initial upfront expenditure in deployment. Implementation of AI-based operations involves high costs in terms of procuring sophisticated software, sensors, data infrastructure, and automation hardware. Furthermore, getting AI technologies to interface with existing enterprise systems and installed plant operations typically involves a lot of customizing, maintenance, and expert staff. For small- to mid-sized chemical producers, it can be especially difficult to find the capital for this reason—particularly in economic downturn or commodity price uncertainty.

Furthermore, the return on investment (ROI) for AI applications may take time to materialize, making cost-conscious companies hesitant to adopt. Although cloud-based AI solutions have started to ease some financial barriers, large-scale implementation in areas such as predictive maintenance, quality control, and R&D modeling still requires notable upfront commitment. These capital and operational cost considerations continue to slow AI adoption across several segments of the chemical sector.

Growing adoption of AI-as-a-Service (AIaaS) platforms is a significant opportunity for chemical companies, especially small and medium enterprises with limited internal capabilities. Such platforms offer cloud-based, scalable AI solutions particularly tailored for several chemical applications like process optimization, equipment monitoring, supply chain planning, and formulation design. They dispense with huge initial investments in infrastructure and technical personnel. Additionally, AIaaS products can be plugged into existing enterprise software like ERP and MES systems, making it simpler to adopt. Startups and technology companies focused on AI for materials science—like Citrine Informatics, Kebotix, and Aionics—are constructing industry-specific platforms available through subscriptions.

| Attribute | Details |

| AI in Chemicals Market Size in 2024 | USD 1.89 Billion |

| AI in Chemicals Market Size in 2034 | USD 24.74 Billion |

| AI in Chemicals Market CAGR | 29.33% from 2025 to 2034 |

| By Type |

|

| By Application |

|

| By End User |

|

| By Region |

|

| Key Companies |

|

The Asia Pacific market will be the fastest-growing market for the AI in Chemicals industry, owing to the fast-growing industrialization, massive investment in intelligent manufacturing, and growing chemical output in countries such as China, India, Japan, and South Korea. As the region gears up to digitalisation, coupled with Industry 4.0-supportive policy interventions from governments, AI adoption in chemical facilities is gaining momentum. Also, a growing need for consumer chemicals, specialty chemicals, and agrochemicals in these economies is compelling companies to deploy AI in a bid to improve process optimization and innovation. The availability of a large pool of data science and engineering talent as well as growth in regional players' R&D investment also supports market growth. As emerging economies strive to boost productivity, streamline compliance, and enhance sustainability, AI offers a strategic solution, setting Asia Pacific as the most rapidly growing region in the forecast period.

North America was the biggest market for the AI in chemicals market share in 2024 because of early digital technology adoption by leading chemical producers and a mature industrial automation environment. The market is dominated by strong international chemical industry giants such as Dow, DuPont, and 3M, and technology partnerships with the likes of IBM, Microsoft, and AWS, having enabled high adoption of AI in R&D, process automation, and preventive maintenance. Regulatory emphasis on environmental compliance, worker safety, and green production further drives demand for AI-driven analytics and optimisation solutions. Moreover, a well-developed data infrastructure, advanced cloud computing capabilities, and strong cybersecurity architecture enable North American businesses to deploy AI at scale. Heavy investment by private companies and governments in AI research and development has meant that the region continues to lead in creating and commercializing AI-based solutions developed for chemical industry use.

Hardware segment by type had the largest share in the AI in chemicals market, driven primarily by the mounting use of AI-based systems across chemical manufacturing operations. Hardware such as GPUs, processors, servers, and storage systems provides the infrastructure to use AI algorithms for predictive analytics, process optimization, and real-time monitoring. The need for high-performance hardware has increased with the increasing implementation of deep learning models and sensor-based systems within chemical plants. Moreover, connectivity of edge devices and IoT devices to gather and process large amounts of data without any loss has also driven the adoption of hardware further. The segment remains leader as firms spend on AI infrastructure to improve operating efficiency and scalability.

Basic chemicals was the biggest end-user of the AI in Chemicals market due to its large-volume production and sophisticated process demands. Basic chemicals such as petrochemicals, polymers, and fertilizers are produced by complex processes that would be significantly improved through automation and optimization created by AI. AI technology optimizes yield, tracks safety, and slashes energy consumption in high-volume chemical production. As louder demands for cost reduction and eco-friendly production have mounted, AI has been applied to a growing extent to model chemical reactions, forecast equipment failure, and drive supply chain optimization in the industry. Escalating demands for predictive maintenance of high-capacity operations and real-time decision-making have encouraged increased quantities of commodity chemical producers to take up AI solutions, attesting to this market's leading industry role yet again.

Empower your strategy with expert insights, purchase this premium research@ https://www.cervicornconsulting.com/buy-now/2361

Ask here for more details@ sales@cervicornconsulting.com