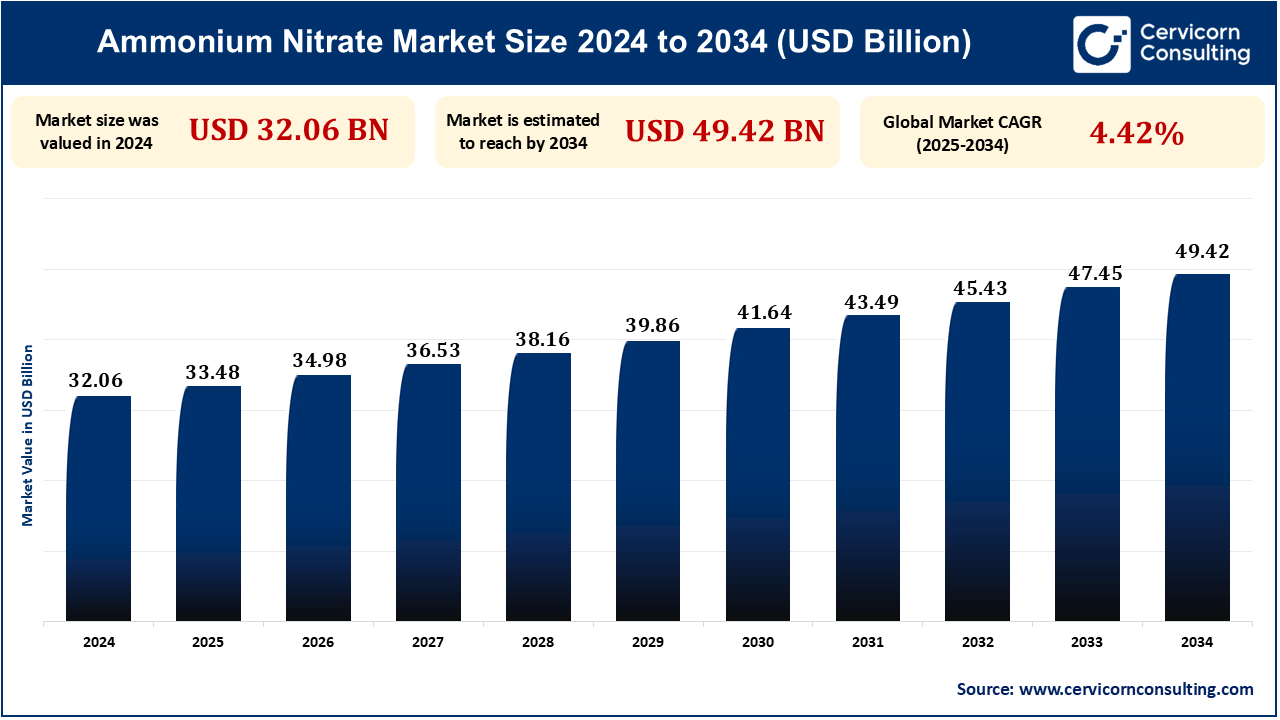

As of 2024, the global ammonium nitrate market was valued at approximately USD 32.06 billion. It is projected to reach USD 49.42 billion by 2034, reflecting a compound annual growth rate (CAGR) of 4.42%.

Ammonium nitrate (chemical formula: NH₄NO₃) is a soluble nitrogen-containing compound very widely used as a fertilizer and as an ingredient for explosives. It has long been recognized for its capacity to stimulate plant growth, as well as its use as one of the primary ingredients for blasting agents in the mining, quarrying, and construction sectors. Although there have been recent regulatory pressures, ammonium nitrate has remained one of the most widely used nitrogen chemicals in agriculture and industry. Future growth in this market will depend on ways to increase fertilizer efficiency, handle ammonium nitrate more safely, and address sustainability concerns. Due to its specific applications in agriculture and other blasting agents, ammonium nitrate remains a significant segment of the chemical market. Ammonium Nitrate (NH₄NO₃) is a highly versatile composition used to increase crop production and is also used as a component in blasting agents in the mining, construction, and demolition sectors.

The ammonium nitrate market is anticipated to witness steady growth owing to the demand for fertilizers in agriculture, and mining and infrastructure projects. But demand for safer and more sustainable practices, as well as regulatory pressures, are expected to thwart the growth rate. It is a matter of expectation from companies to apply sustainable innovation for making adequate practices via safer handling solutions and alternative eco-friendly fertilizers, which ultimately align with both regulations and consumer concerns for being environment-friendly.

Regional Market Insights

A major growth factor in the ammonium nitrate industry arises from the increased preference for nitrogen-based fertilizers to sustain agricultural production worldwide. Ammonium nitrate is an efficient fertilizer often adopted because of its rapid nitrogen release, high solubility, and established efficacy in increasing crop yields. Estimates suggest that the global population will exceed 9 billion by 2050, which translates to an increase in food production. Farmers will need to increase yield per crop, which will dramatically elevate the need for high-efficiency fertilizers for crops such as maize, wheat, and barley. Ammonium nitrate not only serves as a more effective nitrogen fertilizer than urea but is also especially effective in reducing nitrogen loss via volatilization in temperate and humid climate zones. Growth in the ammonia nitrate sector will continue to occur due to the push from the agricultural industry and the need for high-efficiency fertilizers. Potential end-users who plan on developing greener formulations that would be more environmentally friendly, safer, and within safer specifications are expected to engage with the expanded inorganic ammonium nitrate market. Emerging end-users focusing on the development of precision-farming solutions will also be expanding their market scope.

One of the primary constraints faced by the ammonium nitrate market is the restrictive regulatory framework and safety issues regarding its storage, transportation, and utilization. Due to its potential to be misused to create explosives and threats to national security, governments have imposed strict regulatory measures on ammonium nitrate around the world. Because ammonium nitrate is hazardous with the ability to become explosive, countries are beginning to enact a rigid policy framework to govern its handling, often requiring permits, licenses, and inspections, among others. For example, the Chemical Facility Anti-Terrorism Standards (CFATS) enforce strict requirements surrounding the storage of ammonium nitrate, along with the Seveso Directive which has strict regulations surrounding the chemicals even when a facility is in the design phase, among other standards. Businesses must make sure ammonium nitrate is stored safely, it is transported safely, and they are complying with regulatory requirements to have safe operations, and all of this increases operating costs. Ammonium nitrate remains an important input in agriculture and mining; however, the market is restricted due to regulatory requirements, safety and security concerns, and compliance costs. Anything less than these expectations or standards is no longer considered sufficiently compliant or trustworthy. Therefore, ammonium nitrate manufacturers will need to consider safe handling innovations, alternative formulations, and meeting regularities around monitoring, risk, and process safety to grow in this industry.

An important opportunity for the ammonium nitrate market lies in the steady demand for it from the mining sector and the construction sector due to an increase in global infrastructure projects and mineral extraction. Ammonium nitrate is a key ingredient in blasting agents like ANFO (ammonium nitrate fuel oil), a type of explosive that is commonly used in mining, quarrying, and construction because it is considered efficient and cost-effective. Governments around the world are spending substantial budgets to develop infrastructure projects, such as highways, tunnels, railways, and urbanization, that will require vast excavation and blasting. This is expected to grow demand for ammonium nitrate-based explosives. New blasting methods that are more efficient and safer, and make optimum utilization of ammonium nitrate, are being developed by companies. The development of boring emulsions and electronic blasting systems which are efficient will now make ammonium nitrate-based explosives more desirable. Demand for ammonium nitrate will be assisted by mining sector growth and infrastructure expansion. Ammonium nitrate producers can take advantage of that growth by strategically investing in safe handling systems and compliance with processes.

| Attributes | Details |

| Ammonium Nitrate Market Size in 2024 | USD 32.06 Billion |

| Ammonium Nitrate Market CAGR | 4.42% from 20235 to 2034 |

| By Form |

|

| By Application |

|

| By End User |

|

| By Region |

|

| Key Players |

|

North America is poised to witness the fastest growth in the ammonium nitrate market due to rising demand across multiple sectors like agriculture, construction, and mining. The expanding production capabilities and technological advancements will further fuel the market’s expansion in the coming years. Ammonium nitrate has a prominent use as a blasting agent in the mining sector, which has seen growth in areas such as Canada and specific areas in the US involved in mining. Moreover, demand for ammonium nitrate is expected to grow as infrastructure development and new construction continue on the rise. The agriculture industry in North America, especially the US and Canada, is also a large consumer of ammonium nitrate-based fertilizers. As the need to enhance agricultural production and food security continues to increase the need for fertilizers also increases. The growing use of ammonium nitrate products in construction is also supplied by public infrastructure projects, such as roads, bridges, and energy infrastructure. The construction industry is dependent on ammonium nitrate for blasting, and this demand is likely to increase as North America continues investments in infrastructure. Likewise, continued investment and supportive government policy for these associated sectors such as mining, construction, and agriculture also will influence the market dynamics for ammonium nitrate in North America.

In 2024, the ammonium nitrate market was dominated by the Asia-Pacific region, driven mainly by a high demand for fertilizers from the agricultural sector and industrial applications in mining and construction. Economic growth, government support, and a large agricultural sector make the Asia-Pacific region the largest global ammonium nitrate market. The Asia-Pacific region contains some of the largest agricultural markets in the world, such as China, India, and Southeast Asia. The demand for ammonium nitrate for fertilizer applications in the region is positive, as it will be necessary to increase crop production to sustain a growing population. The Asia-Pacific region is also an industrial activity center including mining and construction, and ammonium nitrate is heavily used as an explosive in mining in countries such as India and China. The APAC region also has plenty of access to raw materials necessary for ammonium nitrate production, such as natural gas and limestone, which has allowed local producers to satisfy the growing demand for ammonium nitrate in both fertilizer and explosive applications. Governments in the APAC region offer fertilizer subsidies and incentives which also include ammonium nitrate that is intended for agricultural use, thereby leading to the utilization of high levels of ammonium nitrate fertilizers in the APAC region.

The prilled ammonium nitrate segment dominated the largest market share in 2024. The segment is driven by its extensive use of fertilizers, making it the preferred form in global agricultural practices. Prilled ammonium nitrate is mainly utilized in fertilizers, particularly in agricultural contexts on a large scale, where it acts as a highly efficient nitrogen source for crops. The agricultural industry continues to be the top user of ammonium nitrate. Prilled ammonium nitrate is more user-friendly and easier to apply than other types, such as granular ammonium nitrate. It is an excellent choice for broadcasting or top-dressing large agricultural fields. It is also one of the cheapest types of ammonium nitrate and therefore, appealing for the agricultural producers and nitrogen fertilizer industries. Also, most of the leading ammonium nitrate producers produce prilled ammonium nitrate and it is available in large exports globally, contributing to its domination in the market.

The fertilizer segment led the ammonium nitrate market in 2024. Ammonium nitrate is among the most widely consumed nitrogenous fertilizers and is an efficient source of nitrogen to meet the nitrogen demand for plant growth. The need for ammonium nitrate fertilizers arises from the need to enhance agricultural productivity to sustain the rising global population. Due to its high nitrogen content and readily available nitrogen for plant uptake, ammonium nitrate fertilizer is often a fertilizer used by farmers who want to maximize the yield and quality of their crops. In many instances, government support is provided in the form of subsidies when ammonium nitrate fertilizers are utilized in agriculture.

The solid ammonium nitrate segment dominated the largest market share in 2024 driven by its widespread use in both the agriculture sector (for fertilizers) and explosives manufacturing, where ease of handling, stability, and efficiency are critical. Solid ammonium nitrate is a more stable and easy-to-handle material than liquid ammonium nitrate; it can be stored in bulk, thereby minimizing logistics and distribution expenses, especially for many agricultural and fertilizer companies. The solid form of ammonium nitrate is commonly used in the production of blasting agents in the mining and construction processes, as a solid, it is readily added to various explosives formulations.

In the year 2024, the agriculture segment accounted for the largest share of the market, propelled by the vast demand for nitrogen fertilizers used for improving crop yields and meeting global food requirements. In the agricultural sector, ammonium nitrate fertilizer is predominantly utilized. As a result, ammonium nitrate now stands as one of the most used nitrogen fertilizers, which is an essential nutrient for most plant growth, leading the ammonium nitrate consumer into agriculture. Ammonium nitrate fertilizer has also been popular due to the rapid release of nitrogen, which is beneficial for crops in immediate need of nitrogen.

The direct sales (B2B) segment dominated the largest market share in 2024 owing to the need for bulk transactions and long-term supply agreements in the agricultural and industrial sectors. In large-scale industrial buying situations, direct sales are the chosen distribution method for products, including ammonium nitrate, as seen specifically in the agriculture and mining industries where buyers regularly purchase extensive amounts of ammonium nitrate. This direct sales connection from manufacturers or suppliers allows the buyer to purchase larger amounts, custom pricing, and call-to-order delivery. The basin also enables the supplier of ammonium nitrate to meet the business needs of their agriculture or industrial customers with a custom solution. Businesses in the agriculture and explosives markets routinely sign long-term contracts with ammonium nitrate manufacturers for continuity in their product supply, and direct sales provide that approach to supply, price stability, and securities.

Empower your strategy with expert insights, purchase this premium research@ https://www.cervicornconsulting.com/buy-now/2386

Ask here for more details@ sales@cervicornconsulting.com