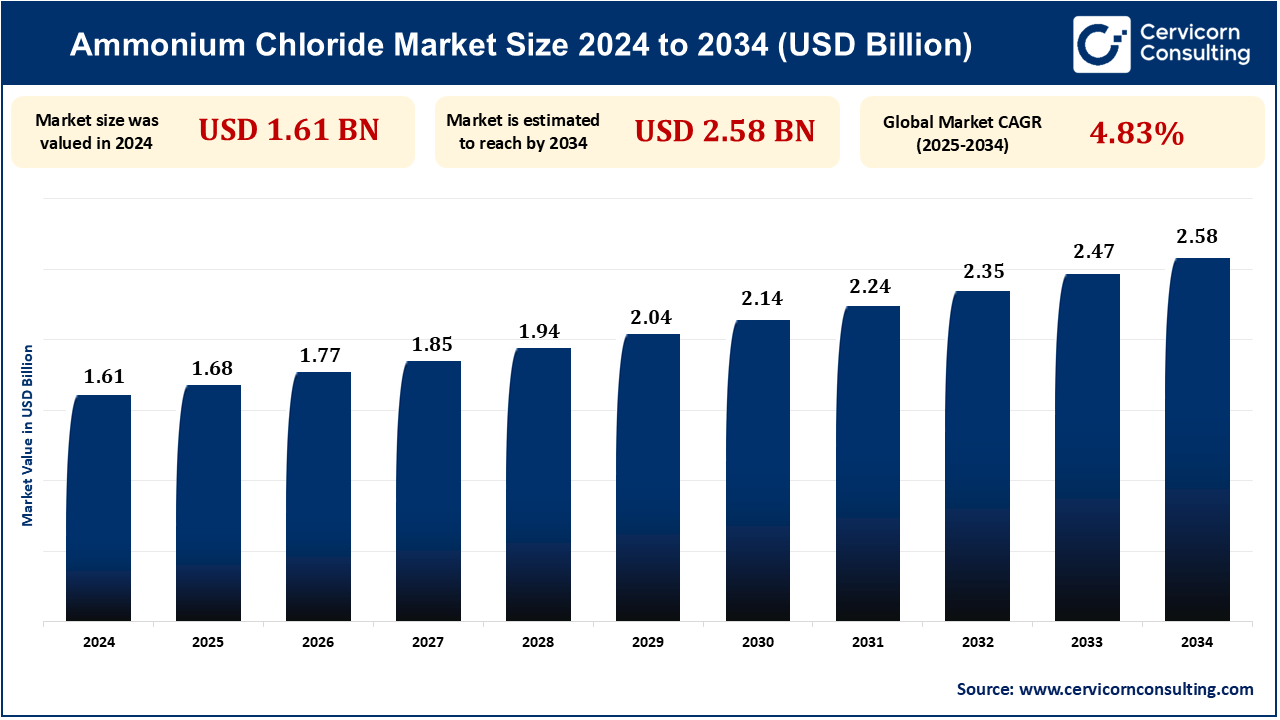

As of 2024, the global ammonium chloride market was valued at approximately USD 1.61 billion. It is projected to reach USD 2.58 billion by 2034, reflecting a compound annual growth rate (CAGR) of 4.83%.

Ammonium chloride has a very wide application in various industrial processing since it is an inorganic chemical. It is a white crystalline salt which is highly soluble in water. The ammonium chloride market is following an upward trend owing to the wide variety of applications it has in different industries. The market is thereby influenced by factors such as industrial demand, the agricultural sector's growth, and the increasing use of ammonium chloride in pharmaceuticals and food additives. Ammonium chloride is used extensively in fertilizers due to its high nitrogen content, which is essential for plant growth. Some of these could also include agro-oriented products, like high-yield crops that would greatly stimulate demand in agriculture, primarily by the use of farm practices. Ammonium chloride is also used in chemical manufacturing in the formulation of different chemicals like hydrochloric acid which is used for cleaning and treatment of metals.

Further, increasing environmental concerns, especially regarding nitrogen-based fertilizers, could impact the ammonium chloride market. There may be more regulations on fertilizers and agricultural chemicals that could influence growth. The ammonium chloride market is expected to continue its upward trajectory, with substantial growth in emerging economies and steady demand across traditional sectors like agriculture, food, and pharmaceuticals. However, players are expected to overcome sustainability hurdles and fluctuating raw material costs to sustain market competitiveness. Furthermore, excessive use of ammonium chloride in fertilizers can lead to environmental problems such as soil acidification and water pollution, which have thereby led to strict regulations in some regions, thus constraining market growth.

Ammonium Chloride Market Regional Scope

The rising demand for ammonium chloride in agriculture especially in the fertilizer sector is one of the biggest driving forces for the ammonium chloride market. The use of ammonium chloride as a nitrogen source in fertilizers is crucial to crop yield improvement and supports global food production. The agriculture sector will remain the biggest growth driver for the ammonium chloride market as a fertilizer. A United Nations report mentions that by 2050 the global population will rise to about 9.7 billion. Hence, this puts immense pressure on the agriculture sector to produce more food on limited land area, which in turn will increase the demand for fertilizers that enhance soil fertility and lead to higher crop yields. The practices of modern farming, especially precision agriculture, ensure that ammonium chloride is used more efficiently to produce the best crop yields. Governments in many countries have started motivating agricultural improvements to fulfill their food security goals. In most countries such as India, China, and Nigeria, there has been an increasing volume of public sector investments in fertilizers that also include ammonium chloride among several other fertilizers. Since ammonium chloride helps in achieving maximum crop yield by keeping the fertility of the soil intact, it plays an important role in facing modern agricultural challenges, thereby driving market growth.

Ammonium chloride is mainly employed in fertilizers; hence, its environmental impact on agriculture is a severe constraint for the market. Amid growing public interest and environmental risks posed by the production, usage, and disposal of ammonium chloride, there has arisen a clamor for strict controls. Too much nitrogen from ammonium chloride fertilizers gets washed away into nearby water bodies during rainfall or irrigation. This nutrient-rich, polluted water is dumped into a river, lake, or ocean thereby promoting the phenomenon of eutrophication which leads to rapid growth of algae due to nutrient upsurge. Algal blooms could rapidly reduce dissolved oxygen in water, impairing the life of aquatic organisms and also disturbing ecosystems. The manufacture of ammonium chloride liberates greenhouse gases such as carbon dioxide (COâ‚‚) and nitrous oxide (Nâ‚‚O), which aggravate the situation of global warming and climate change. Hence, the rising concern about environmental impacts is escalating the pressure for sustainable alternatives of ammonium chloride. A cocktail combination of slow-release fertilizers, organic fertilizers, and bio-based items that curb the risks of nitrogen escape, soil land degradation, and greenhouse gas emissions is observed to be accepted by many farmers and firms. These trends will elevate the challenge of ammonium chloride market growth in regions embroiled in the prioritization of environmental issues.

The ammonium chloride market has many growth opportunities directly associated with sustainable fertilizers’ development and controlled-release technology adoption due to changes in global agricultural practices and high sustainability priorities. A global transformation towards sustainable agriculture is underway as a pressing need to protect the environment, conserve freshwater resources, and restore soil health drives industry change. Sustainable agriculture aims to strike a balance between agricultural productivity and environmental stewardship; hence the potential for controlled-release fertilizers and eco-friendly formulations. Worldwide government and regulatory bodies increasingly push for sustainable farming practices through farm gate regulations on fertilizer use and incentives for eco-friendly solutions. Therefore, the increase in sustainable and controlled-release fertilizers opens avenues for growth in the ammonium chloride market. The growing global demand for environmentally friendly farming solutions will provide ammonium chloride producers with the opportunity to emerge as players in new markets through the introduction of fertilizers aimed at reducing environmental impact, enhancing the efficiency of production, and embracing sustainable productive practices. By developing slow-release formulations and precision agriculture technologies that meet sustainability regulations, ammonium chloride producers are expected to increase their market shares and pave the way for a more sustainable agriculture future.

| Attribute | Details |

| Ammonium Chloride Market Size in 2024 | USD 1.61 Billion |

| Ammonium Chloride Market CAGR | 4.83% |

| By Application |

|

| By Grade |

|

| By Form |

|

| By End-User |

|

| By Region |

|

| Key Players |

|

The ammonium chloride market in North America is projected to experience the highest growth rate, driven by agricultural growth, industrial applications, advancements in technology, and sustainability. The North American ammonium chloride market is gaining traction in the fertilizer, pharmaceutical, textiles, and industrial chemical markets, solidifying its position as the fastest-growing region in ammonium chloride. The rising trend of sustainable agriculture in North America is being supported by consumers and regulators through an increased demand for environmentally friendly farming practices for our food systems. Greater interest in addressing nitrogen runoff is leading to a new demand for controlled-release fertilizers, opening opportunities for the ammonium chloride market to develop new products. The governments in the US and Canada are encouraging sustainable agriculture through subsidies, grants, and other financial assistance to agribusinesses. Moreover, globally influential ammonium chloride companies like Nutrien, CF Industries, and BASF are growing in North America and increasing their production capacity to accommodate the heightened demand for fertilizers.

In 2024, the Asia-Pacific region was the single largest consumer of ammonium chloride in the world due to several important drivers behind this trend. The Asia-Pacific region is home to over 60% of the world’s population, and food demand is on the rise because of accelerated urbanization and economic development. The growth in the population is placing significant demands on the agriculture sector to improve agricultural productivity, resulting in increased fertilizer demand and, hence, ammonium chloride. Furthermore, the governments of key countries in the region (e.g., China, India, and Indonesia), are striving to improve agricultural productivity to make food security improvements, thereby also adding to the demand for fertilizers like ammonium chloride. Ammonium chloride is also used in industrial applications other than agriculture to process metals, pharmaceuticals, textiles, and in food processing applications. Since the manufacturing sector is expanding in the Asia-Pacific region, especially in countries like China and India, ammonium chloride consumption in industrial applications is growing. In this way, the reasons why the Asia-Pacific region stands out as the largest consumer of ammonium chloride in 2023 have to do with all of the agricultural activity; economies of scale justify ammonium chloride; government policy to boost agricultural productivity; and increased industrial manufacturing resulting in demand for their industrial applications of ammonium chloride.

The industrial-grade ammonium chloride segment dominated the largest market share in 2024. This segment leads due to its extensive use in several industrial applications, particularly in the fertilizer industry, which is one of the largest consumers of ammonium chloride. In this sector of the market, the demand for fertilizers continues to grow, especially in emerging economies. Fertilizers, particularly as a nitrogen source, represent the largest use of industrial-grade ammonium chloride and are one of its leading markets. Fertilizer consumption continues to increase globally, especially in emerging markets, such as Asia, Africa, and parts of Latin America, supporting continued demand for ammonium chloride.

The ammonium chloride market was led by the fertilizers segment in 2024 as a result of significant agricultural demand, cost advantages, and government support in major regions such as Asia-Pacific and Latin America. Ammonium chloride is a major nitrogen product in fertilizers that provides substantial benefits to soil fertility and crop production. To feed the world’s growing population, agricultural productivity will have to increase. The Asia-Pacific Region, especially countries including China, India, and Southeast Asia with crops of rice, wheat, and other vegetables, are major users of ammonium chloride fertilizer. Additionally, ammonium chloride was viewed as a less expensive and more widely available option relative to other nitrogen-based fertilizers, as many countries and consumer markets are cost-sensitive. Many countries, especially developing, provide government subsidies for chemical fertilizers; thus, creating an even higher demand for ammonium chloride.

The solid ammonium chloride segment dominated the largest market share in 2024. Solid ammonium chloride remains the dominant segment in the market by form in 2024, primarily due to its heavy demand in fertilizers, industrial applications, and cost-effectiveness. The agricultural industry, especially in the Asia-Pacific region, represents one of the primary sectors leading to the development of this dominance. Furthermore, solid ammonium chloride is favored for use in industry because it is easier to handle, store, and transport compared to liquid ammonium chloride. Solid ammonium chloride is also cheaper and has a longer shelf life, thus making it more appealing for bulk use in agriculture and industrial applications.

The agriculture segment dominated the largest market share in 2024. With the world’s population ever-increasing, this will result in a greater need for fertilizers in farming resulting in a stronger demand for ammonium chloride in the agricultural industry. Extensive usage of agricultural-grade ammonium chloride to produce higher crop yields, particularly in the Asia Pacific region, has greatly aided it in securing a dominant market position. The efficiency of ammonium chloride in promoting soil fertility and how it fosters sustainable agricultural practices, has allowed the demand of ammonium chloride to grow substantially with farmers. As sustainable agriculture and effective fertilizer use are increasingly making headlines, ammonium chloride will still play an important role as a low-cost nitrogen fertilizer to support food security and increase crop yields on a global scale.

The direct sales (B2B) segment dominated the largest market share in 2024. This channel holds the largest market share due to the bulk purchasing nature of industries such as agriculture (fertilizers), chemicals, pharmaceuticals, and metal processing. By removing intermediaries, direct sales reduce costs among large industrial buyers. Direct sales enable manufacturers to customize formulations and deliver consistent quality according to industry specifications. Direct sales channels are used by large ammonium chloride manufacturers, including BASF, Tuticorin Alkali Chemicals, Jiangsu Huachang Chemical, and others, to meet the needs of large purchasers.

Empower your strategy with expert insights, purchase this premium research@ https://www.cervicornconsulting.com/buy-now/2385

Ask here for more details@ sales@cervicornconsulting.com