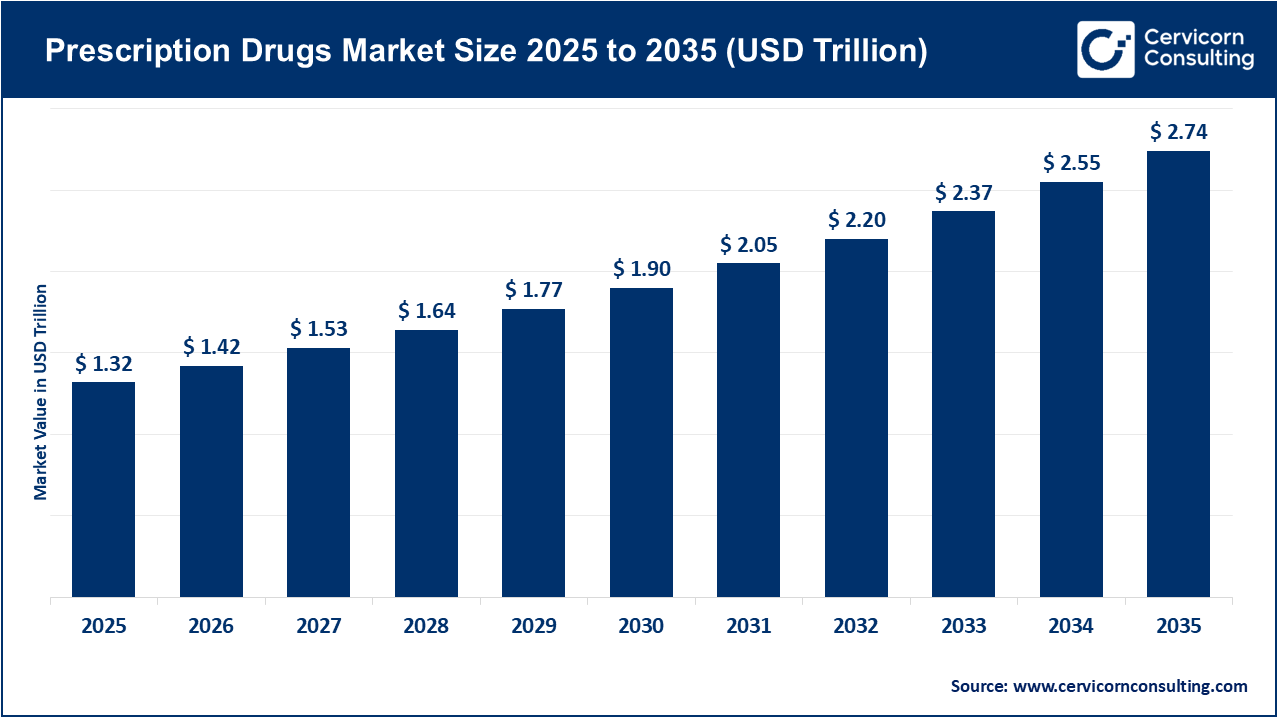

The global prescription drugs market size was valued at USD 1.32 trillion in 2025 and is expected to be worth around USD 2.74 trillion by 2035, exhibiting at a compound annual growth rate (CAGR) of 7.6% over the forecast period from 2026 to 2035. The prescription drugs market grows because more people live longer and have chronic diseases like diabetes, cancer, and heart conditions. Aging populations worldwide need ongoing treatment, which increases demand for medicines. Healthcare spending is rising in many countries, and better insurance coverage makes prescription drugs more accessible to patients. Technological and scientific innovations, such as personalized medicine and advanced biologics, are creating new and more effective treatments, further driving market growth. Research also shows the global prescription drugs market is expected to keep expanding with strong annual growth rates over the next decade.

Recent developments are also shaping the prescription drugs market. Governments are updating policies to speed up access to new drugs and make pricing more sustainable in some regions, while pharmaceutical companies invest billions in local manufacturing and new drug launches to strengthen supply chains and innovation. Initiatives like direct-to-patient sales and the use of digital tools and AI in drug discovery are changing how medicines reach patients and improving the development process. These trends, along with rising demand from emerging markets and global investment in pharmaceutical capacity, are helping the market grow even faster today.

Impact of Rising Health Concerns and Chronic Disease Burden on the Prescription Drugs Market

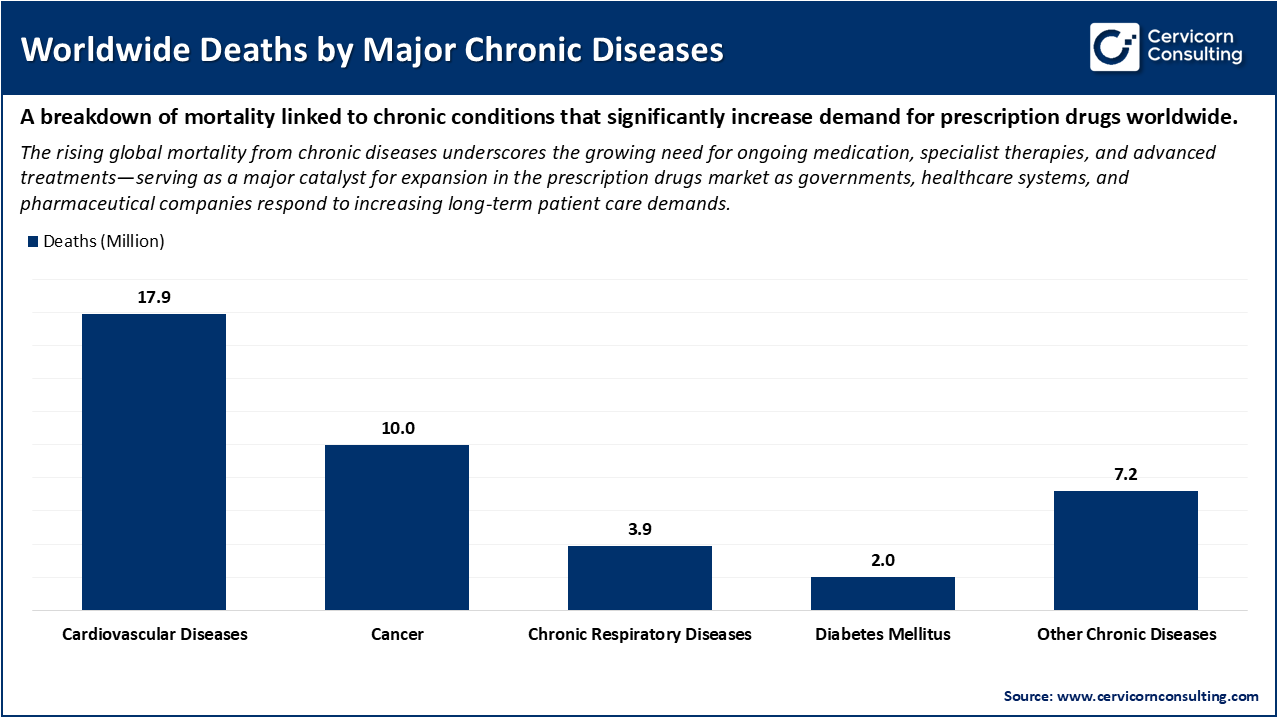

The prescription drugs market is strongly driven by rising health concerns and the growing burden of chronic diseases worldwide. Chronic conditions such as diabetes, cardiovascular disease, obesity, and cancer require long-term medical treatment and regular medication, which directly increases demand for prescription medicines. The growing prevalence of these diseases fueled by aging populations, unhealthy lifestyles, and urbanization means more patients need ongoing pharmaceutical care, leading to sustained market expansion. Reports show that global chronic disease rates are climbing, with conditions like obesity and heart disease contributing significantly to overall health challenges, increasing the need for drugs that manage these illnesses over time.

Recent developments further underline this trend. Sales of medications for chronic conditions such as cardiovascular disease and diabetes have surged in regions like India, reflecting a rising disease burden and growing patient awareness. Additionally, new treatment uses, for example, weight-loss drugs being increasingly prescribed for hormone disorders like PCOS in the U.S. show how expanding health concerns are broadening prescription demand even beyond traditional indications. As chronic diseases become more common across age groups, healthcare systems and pharmaceutical companies are responding with more tailored therapies, boosting innovation and contributing to the overall growth of the prescription drugs market.

Rising deaths from chronic diseases such as heart disease, cancer, and respiratory disorders highlight the growing global burden of long-term illnesses. These conditions require continuous treatment, long-duration medication, and advanced therapies, which significantly increases demand for prescription drugs. As chronic disease prevalence climbs each year, healthcare systems and patients depend more on pharmaceutical solutions—driving consistent and long-term growth in the prescription drugs market.

Recent Developments and Key Investments by Leading Companies in the Prescription Drugs Market

| Company | Recent Development and Investment | Impact on Prescription Drugs Market |

| Eli Lilly | Announced a USD 6 billion new manufacturing plant in Alabama to increase drug production, including weight-loss and metabolic drugs. | Expands domestic manufacturing, strengthens supply chain resilience, and supports growth in high-demand therapeutic areas. |

| Pfizer | Entered a licensing agreement with YaoPharma for a new oral weight-management drug; includes up to USD 1.94 billion in milestones. | Adds potentially significant new products to pipeline and reinforces position in metabolic and chronic treatment segments. |

| Novartis | Announced a USD 23 billion U.S. investment in R&D and production infrastructure across multiple sites. | Boosts capacity for innovative drugs (oncology, immune, metabolic), improving delivery of therapies for chronic conditions. |

| GSK (GlaxoSmithKline) | Plans to invest USD 30 billion in the U.S. by 2030 to support drug and vaccine launches and business growth. | Encourages long-term growth and presence in major markets, increasing accessibility of prescription therapies. |

1. FDA’s New Fast-Track Drug Approval Program & First Approval

The U.S. Food and Drug Administration (FDA) approved Augmentin XR under its newly launched fast-track review initiative designed to speed up approvals for critical medicines. This drug was reviewed and approved in just two months under the program, instead of the usual 10–12 months. This milestone accelerates the entry of important drugs into the market. Faster approvals reduce time-to-market for innovative medicines, improve patient access, and encourage pharmaceutical companies to invest more in developing high-impact treatments. Overall, it boosts the prescription drugs market by enabling quicker commercialization of new therapies and strengthening drug supply resilience.

2. Eli Lilly’s Breakthrough GLP-1 Weight-Loss Drug Results

Eli Lilly announced that its new weight-loss drug, retatrutide, produced significant weight reduction and additional health benefits in late-stage trials. This drug exceeded expectations and showed up to 29% body-weight loss in patients. Breakthrough clinical results for high-demand therapies like GLP-1 drugs draw significant attention and investment into the prescription drugs market. These results expand treatment possibilities and patient demand, particularly in chronic conditions such as obesity and metabolic disorders. The success of such drugs increases market growth through both sales and expanded research pipelines.

3. Pfizer–YaoPharma Weight-Management Licensing Agreemen

Pfizer signed an exclusive licensing deal with YaoPharma to develop and commercialize a promising weight-management drug (YP05002) in the GLP-1 class, with potential payments up to USD 1.94 billion. Strategic alliances like this bring new drugs into development and future commercialization. By securing exclusive global rights for a therapeutic candidate, Pfizer strengthens its pipeline and broadens its portfolio in booming disease segments. This drives competition, boosts innovation, and ultimately fuels growth in the prescription drugs market as more treatments emerge.

4. EU Pharma Regulation Reform to Speed Patient Access

The European Union reached a provisional agreement to overhaul drug regulations to modernize the rules, speed patient access, and balance innovation incentives. This pharma package includes enhanced data protection for new drugs. Regulatory reforms that streamline market access and clarify data protections incentivize drug developers by reducing uncertainty and enhancing returns on investment. Faster access to medicines increases competitive momentum in the prescription drugs market, especially in Europe. It also strengthens global collaboration and harmonizes approval processes, drawing additional investment into research and production.

The prescription drug market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

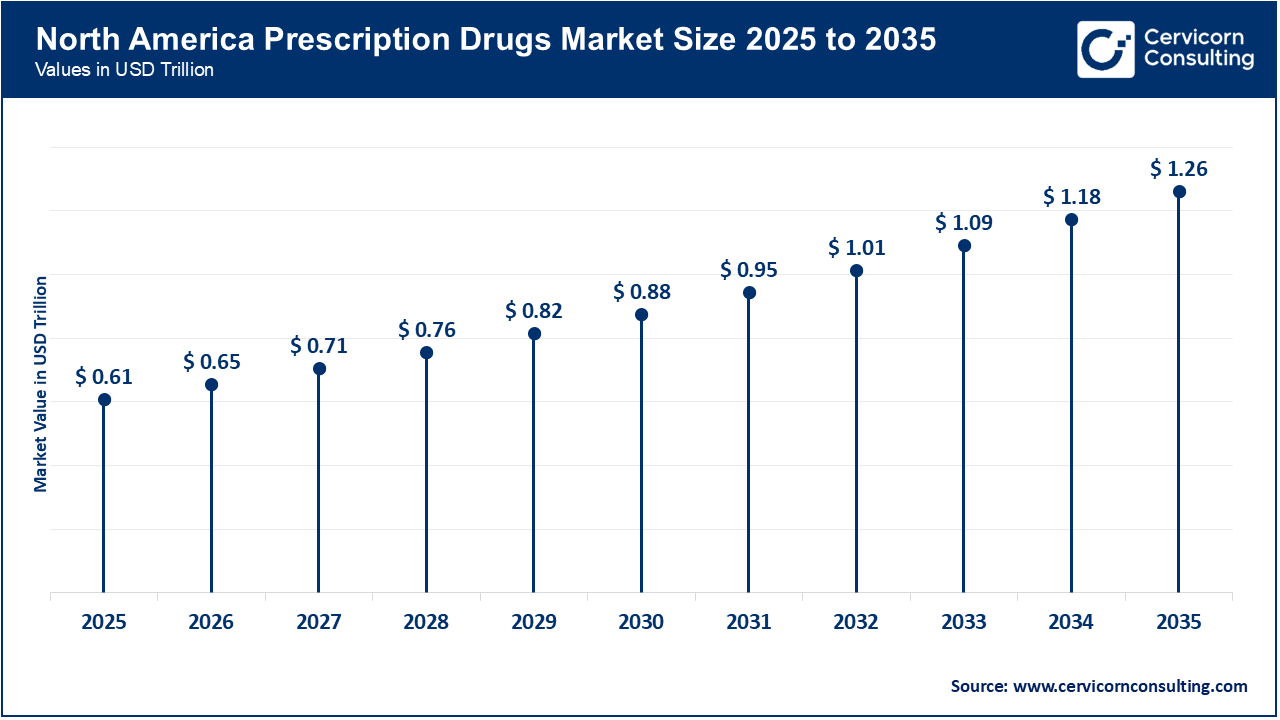

The North America prescription drugs market size was valued at USD 0.61 trillion in 2025 and is predicted to garner around USD 1.26 trillion by 2035. The North America market remains the largest globally due to strong investment in pharmaceutical research and development, advanced healthcare infrastructure, and a high prevalence of chronic diseases increasing demand for treatment. The United States and Canada lead in innovative drug approvals and adoption, supported by streamlined regulatory processes that help bring new therapies to patients quickly. The region’s well-developed insurance systems and high healthcare spending also encourage broad access to prescription medicines, further strengthening market growth. North America’s dominance is reflected in having the largest share of global prescription drug sales and ongoing investment in biologics and specialty medications.

Recent Developments:

The Asia-Pacific prescription drugs market size was accounted for USD 0.25 trillion in 2025 and is projected to record USD 0.53 trillion by 2035. The Asia-Pacific region is one of the fastest-growing market, driven by rising healthcare spending, expanding access to quality care, and increasing prevalence of chronic diseases. Improving economic conditions and growing middle-class populations increase demand for modern therapeutic options, while government initiatives in countries like China and India support pharmaceutical manufacturing and innovation. The region’s rapid adoption of new medicines and focus on scaling healthcare infrastructure fuel strong growth potential for both multinational and local drugmakers. Asia-Pacific’s increasing investments in healthcare and broader insurance coverage are key drivers of market expansion.

Recent Developments:

The Europe prescription drugs market size was estimated at USD 0.35 trillion in 2025 and is forecasted to hit around USD 0.72 trillion by 2035. The Europe market is propelled by strong healthcare systems, increasing patient awareness, and regulatory actions aimed at improving access and supply resilience. The region’s efforts to modernize pharmaceutical regulations help create a more predictable environment for drug developers and ensure patients gain faster access to important medicines. European markets also emphasize balanced spending and cost-effective treatments. While price controls and reimbursement policies influence market dynamics, ongoing reforms aim to support innovation while maintaining affordability. Europe remains a key player, with robust demand across major therapeutic areas such as oncology and immunology.

Recent Developments

Prescription Drugs Market Share, By Region, 2025 (%)

| Region | Revenue Share, 2025 (%) |

| North America | 46.1% |

| Europe | 26.3% |

| Asia-Pacific | 19.2% |

| LAMEA | 8.4% |

The LAMEA prescription drugs market was valued at USD 0.11 trillion in 2025 and is anticipated to reach around USD 0.23 trillion by 2035. The LAMEA market is growing as healthcare access improves and public health systems invest in expanding services. Rising incidence of chronic diseases and greater government focus on healthcare reforms help support rising demand for prescription medicines. Economic development in countries like Brazil, South Africa, Saudi Arabia, and the UAE leads to increased healthcare spending and infrastructure upgrades, encouraging pharmaceutical companies to expand distribution and reach underserved populations. Though the market size is smaller than in North America or Europe, LAMEA’s growth potential is significant due to improving medical coverage and rising consumer awareness.

Recent Developments:

The prescription drugs market is segmented into type, therapy area, route of administration, distribution, and region.

Branded drugs dominate the prescription drugs market because they provide advanced and innovative treatments backed by strong clinical research. These products are often the first choice for serious and complex diseases, making demand high worldwide. Pharmaceutical companies invest heavily in marketing and physician education, which increases awareness and usage. Their higher pricing and strong brand value also help maintain a larger share of total market revenue. Even when generics enter the market, many patients and doctors continue to prefer branded options due to trust and proven effectiveness.

Prescription Drugs Market Share, By Type, 2025 (%)

| Type Segment | Revenue Share, 2025 (%) |

| Branded | 72.4% |

| Generic | 27.6% |

Generic drugs are the fastest-growing segment because more patients and healthcare providers want affordable treatment options. Many branded drugs are losing patent protection, allowing generics to enter the market at much lower prices. Governments encourage generic use to reduce national healthcare costs, and insurance plans often prioritize them for reimbursement. As chronic disease cases continue rising, generics help make long-term treatment more accessible. Their expanding availability in developing countries also supports rapid global growth.

Oncology dominates the prescription drugs market because cancer rates are increasing in nearly every region of the world. Treatment requires multiple drug types, including targeted therapies, immunotherapies, and chemotherapy, which boosts market demand. Pharmaceutical companies focus heavily on cancer research because it generates high revenue and strong investment returns. Many new drug approvals each year come from the oncology pipeline, reinforcing its leadership. Continued innovation and rising awareness of early cancer diagnosis make this segment the largest by value.

Prescription Drugs Market Share, By Therapy Area, 2025 (%)

| Therapy Area | Revenue Share, 2025 (%) |

| Oncology | 19.8% |

| Immunology | 15.6% |

| Ophthalmology | 6.4% |

| Respiratory | 7.9% |

| Dermatology | 5.2% |

| Gastroenterology | 9.1% |

| Urology | 4.3% |

| Gynecology | 3.7% |

| Endocrinology | 10.5% |

| Others | 17.5% |

Immunology is the fastest-growing segment due to the rising number of autoimmune disorders and strong adoption of biologic and biosimilar drugs. New therapies target very specific immune responses, offering better outcomes for patients with chronic conditions like arthritis, psoriasis, and Crohn’s disease. These treatments often require lifelong use, which increases recurring demand. The pipeline for immunology drugs is expanding quickly as companies discover new targets and treatment methods. As awareness of immune-related diseases grows, the segment continues to accelerate in revenue and innovation.

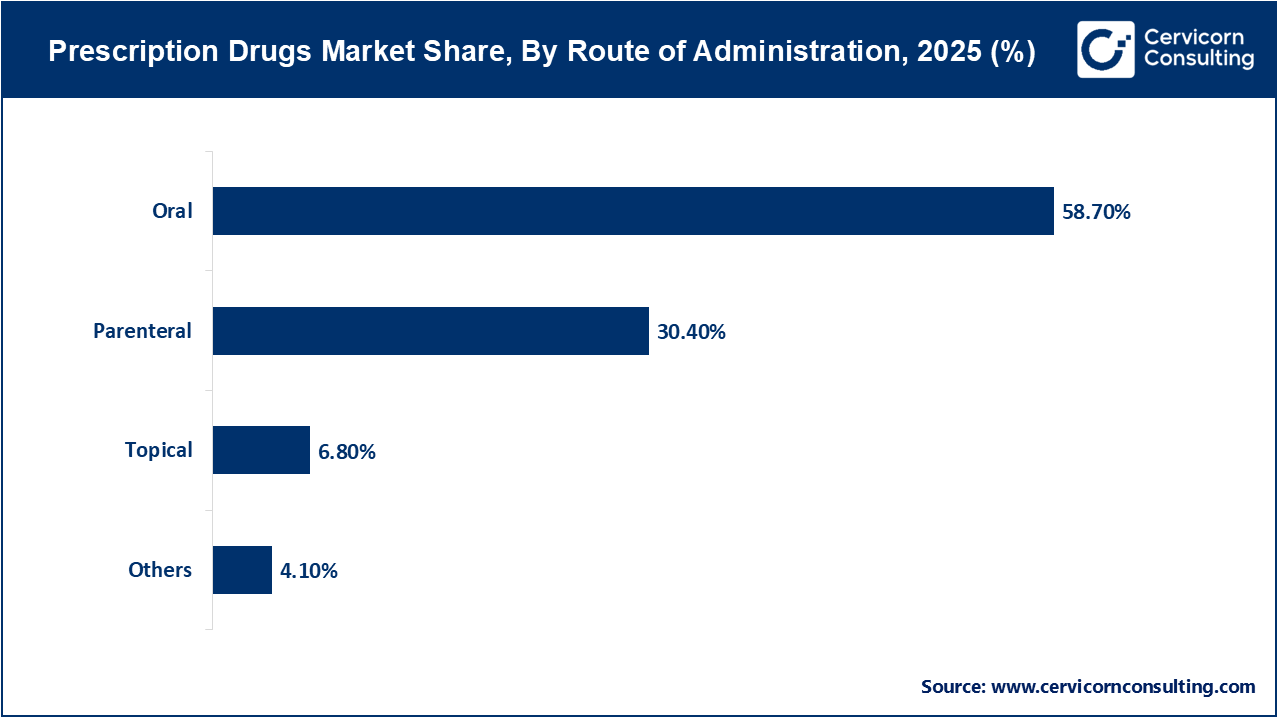

Oral drugs dominate because tablets and capsules are the most convenient option for patients and easy to administer without medical assistance. They are widely used for chronic diseases such as diabetes, hypertension, infections, and mental health conditions. Production costs are lower compared with injectables, making oral drugs more common in all regions. Their long shelf life and simple storage requirements also support their market leadership. Physicians prefer prescribing oral medicines when possible because they improve patient compliance and comfort.

Parenteral drugs are growing the fastest because many modern biologics and advanced therapies cannot be taken orally. Injectable medicines are essential for treating cancer, autoimmune conditions, and hormone-related disorders. New drug delivery technologies such as auto-injectors and prefilled syringes make self-administration easier for patients at home. Long-acting injections reduce the need for frequent dosing, increasing convenience and adherence. As precision medicine grows, injectable treatments are expected to expand further, strengthening their growth rate.

Retail pharmacies dominate because they offer easy access for patients who need monthly refills and routine prescriptions. They have a strong physical presence in both cities and local neighborhoods, making them convenient for everyday healthcare needs. Retail pharmacies also partner with insurance providers, improving affordability for patients. Many now offer basic health services, consultations, and digital prescription management, increasing customer engagement. Their broad product availability and trusted role in healthcare keep them the leading distribution channel.

Prescription Drugs Market Share, By Distribution Channel, 2025 (%)

| Distribution Channel | Revenue Share, 2025 (%) |

| Hospital Pharmacy | 34.6% |

| Retail Pharmacy | 46.2% |

| Online Pharmacy | 12.8% |

| Others | 6.4% |

Online pharmacies are the fastest-growing channel due to increasing consumer preference for convenience and home delivery services. Patients enjoy comparing prices online and receiving medicines without visiting a store. The expansion of telemedicine supports digital prescriptions, making the entire process easier and faster. After the pandemic, more people trust online healthcare platforms, improving adoption. As governments update regulations and digital health infrastructure grows, online pharmacies are expected to continue rapid expansion.

By Type

By Therapy Area

By Route of Administration

By Distribution

By Region