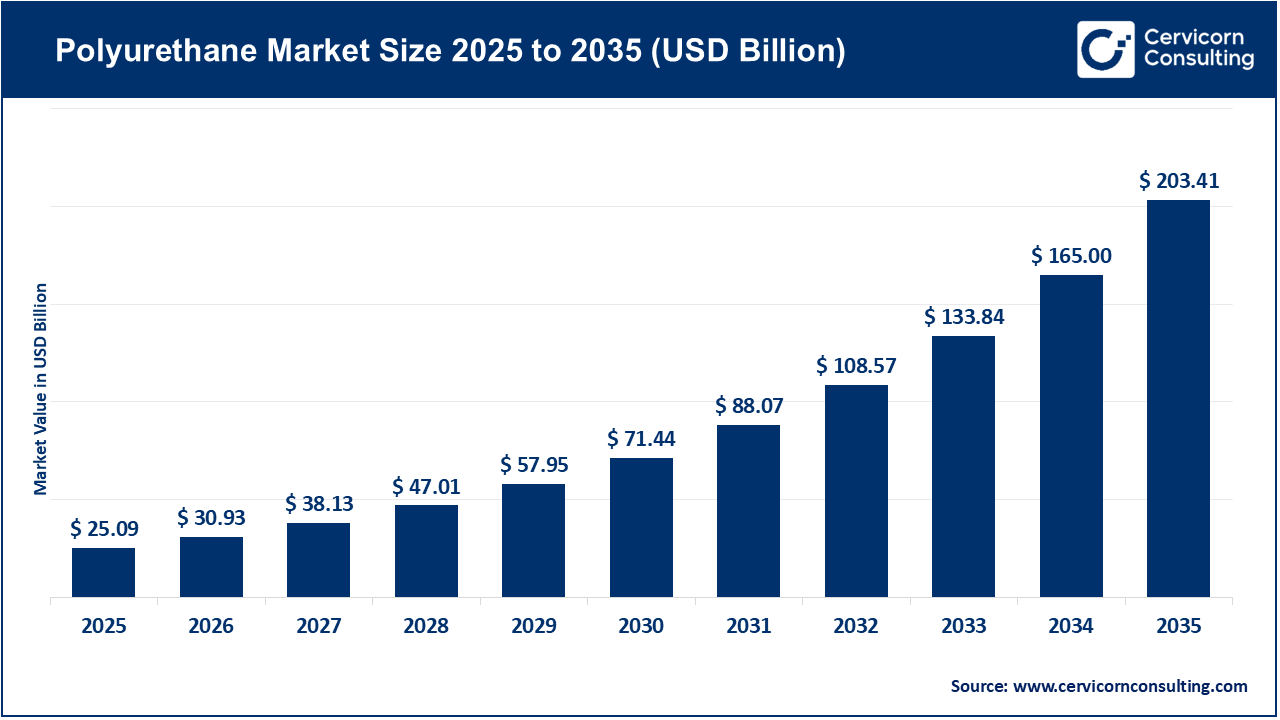

The global polyurethane market size was estimated at USD 88.64 billion in 2025 and is expected to be worth around USD 148.32 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 5.3% over the forecast period from 2026 to 2035. The global polyurethane (PU) market has entered a transformational stage driven by a strategic transition to sustainable and high-performing applications, as well as regional consolidation.

Polyurethane (PU) is one of the most adaptable classes of polymer in the contemporary chemical industry, covering applications from ultra-soft flexible foams in the bedding market, rigid insulation in aerospace and construction through high-performance applications. PU is adaptable because its unique chemical structure is synthesized through the exothermic reaction of a polyol with a diisocyanate. Interestingly, the industry is now characterized by a bifurcated environment: PU represents one of the fundamental building blocks of energy efficiency and lightweighting applications, while being a prominent target of environmental and health regulations given PU's basic dependency on petroleum-based feedstocks and health hazards from the precursors.

The global polyurethane market is likely to grow from USD 88.64 billion in 2025 to potentially much higher valuation by the end of the decade, given urbanization in emerging economies and the global mandate for carbon neutrality. According to studies, the synthesis of plastics, polyurethane being among them, is responsible for around 3% of global greenhouse gas emissions and this number is expected to grow as global synthetic polymer production will be near 600 million tons by 2060. Accordingly, the industry is currently pivoting towards the use of "Green PU" strategies to blend bio-based materials together with chemical recycling to distance crude oil from growth.

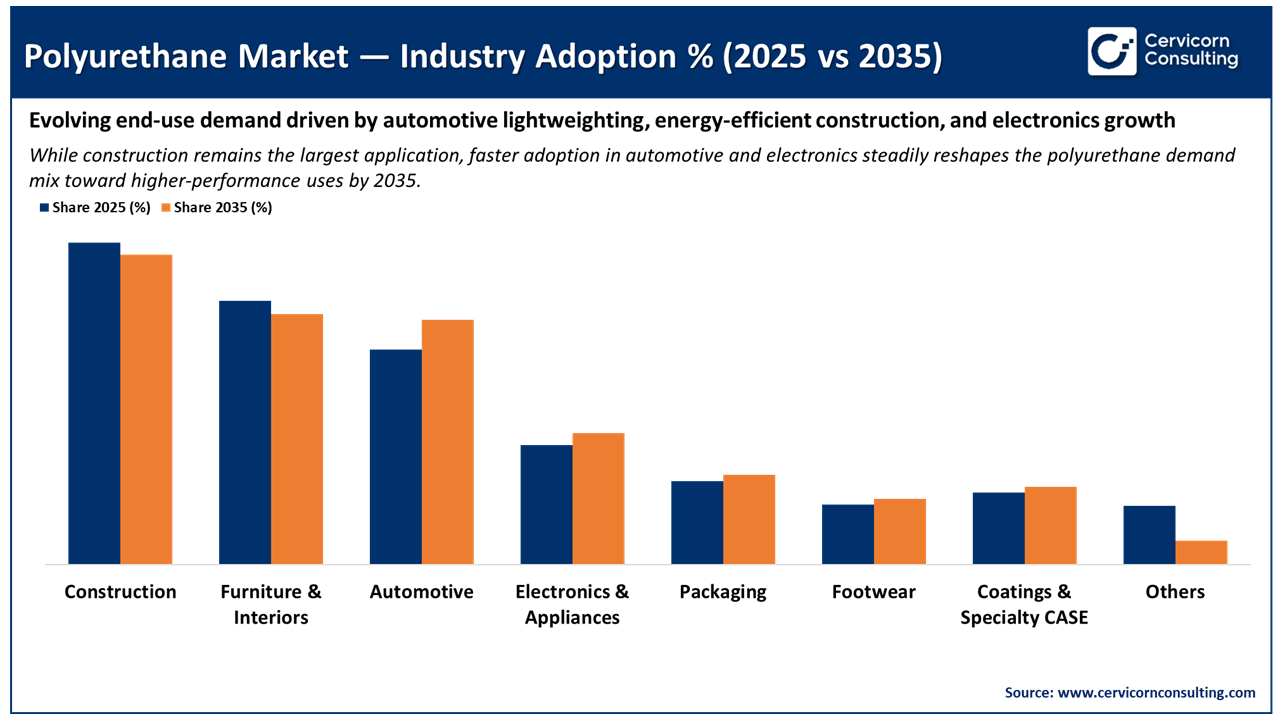

Shift Toward Automotive and Electronics Reshapes Polyurethane Demand

The chart highlights a clear evolution in polyurethane industry adoption between 2025 and 2035, showing a gradual rebalancing of demand across end-use sectors rather than a complete structural shift. Construction remains the largest application in both years, though its relative share declines slightly by 2035 as growth stabilizes in mature building markets. Furniture & interiors also see a modest reduction in share, reflecting saturation and slower replacement cycles. In contrast, automotive adoption increases notably, driven by lightweighting requirements, electric vehicle growth, and rising use of polyurethane in seating, interiors, and NVH components. Electronics & appliances, packaging, and footwear all post incremental gains, supported by appliance insulation needs, e-commerce logistics, and comfort-oriented consumer products. Overall, the data suggests that while traditional bulk applications continue to anchor the market, higher-growth, technology-driven sectors increasingly influence polyurethane demand dynamics by 2035.

1. Major Corporate Capacity Expansion and Plant Launches

In the recent past, the global polyurethane raw materials supply chain has seen consolidated and expanded capacity, especially in Methylene Diphenyl Diisocyanate (MDI). Wanhua Chemical has successfully grown to be the largest global MDI producer and it has executed numerous large-scale, capacity expansions in Ningbo and Fujian, China. Wanhua has clearly established the APAC region as the global production region, owning over 30% of global MDI capacity. Competitors to Wanhua like BASF and Covestro have primarily executed actions related to optimizing their production footprint. Some facilities in Europe have adapted to fluctuating energy costs and operational challenges, while new, efficient plants have recently been launched in Asia, and reflect a commitment to long-term growth of the electronics and automotive sectors.

2. Government Sustainability Initiatives and Green Building Mandates

Governmental policies have been the major driver of market change. For example, the European Green Deal and a variety of net-zero building mandates across North America have fueled the use of high-performance insulation. Rigid polyurethane foam is often described as the "gold standard" for thermal efficiency supporting the developer in meeting more stringent R-values in building codes. Also, China is now emphasizing resource recycling and has appointed specific recycling groups at the end of 2024 to reuse industrial plastics, including pu foams used in the construction and appliances categories.

3. Significant Developments in Bio-based Polyol R&D

There has been significant development for the transition to renewable primary feedstocks with the recent retrofitting of bio-based polyols from lignin, castor, and soybean oil. Recent studies have shown the viability of using lignin, a byproduct of the pulp and paper sector, as a partial replacement of petroleum oil-based polyols for use in flexible/rigid foams. The importance of these milestones is obvious in reducing the carbon footprint of pu products. For example, taking bio-based rigid PU foams made from black alder bark biomass to incorporate a local agricultural waste into an existing area of significant demand for insulation in building construction.

4. Regulated Environmental and Safety Policy Deployment

Regulated scrutiny by ECHA European Chemicals Agency, Environmental Protection Agency (EPA) are forcing the industry to respond. The end of the designation of potential sensitizers for certain isocyanates, and the tightening VOC emissions standards have forced regulated compliance contract limitations outlined in the construction sector. This has led to the introduction of ultra-low VOC spray foam systems and renewed attention on Non-Isocyanate Polyurethanes (NIPUs). Numerous examples exist where regulatory hurdles can be viewed as innovation drivers for safer next-generation polymer chemistries, through research and development within related scientific fields.

Report Scope

| Area of Focus | Details |

| Market Size in 2026 | USD 93.32 Billion |

| Market Size in 2035 | USD 148.32 Billion |

| Market CAGR 2026 to 2035 | 5.30% |

| Dominant Region | Asia-Pacific |

| Key Segments | Product, Raw Material, Application, Region |

| Key Companies | BASF SE, Mitsui & Co. Plastics Ltd, Covestro AG, DIC Corporation, Huntsman International LLC, Dow Inc., Eastman Chemical Company, RAMPF Holding GmbH & Co. KG, Mitsubishi Chemical Corporation, The Lubrizol Corporation, Recticel NV/SA, Tosoh Corporation, Woodbridge, RTP Company |

Market Opportunities

The polyurethane market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

The North America polyurethane market size was valued at USD 18.79 billion in 2025 and is forecasted to hit around USD 31.44 billion by 2035. North America led by rigid foam insulation (buildings, cold storage, refrigerated logistics) and flexible foams (furniture, bedding), with additional pull from automotive lightweighting and specialty CASE applications. The biggest structural tailwind is the region's push to cut building energy use via tax credits, commercial deductions, and newer model energy codes-which directly supports higher-performance insulation materials where PU is competitive on thermal performance per thickness.

Recent Developments:

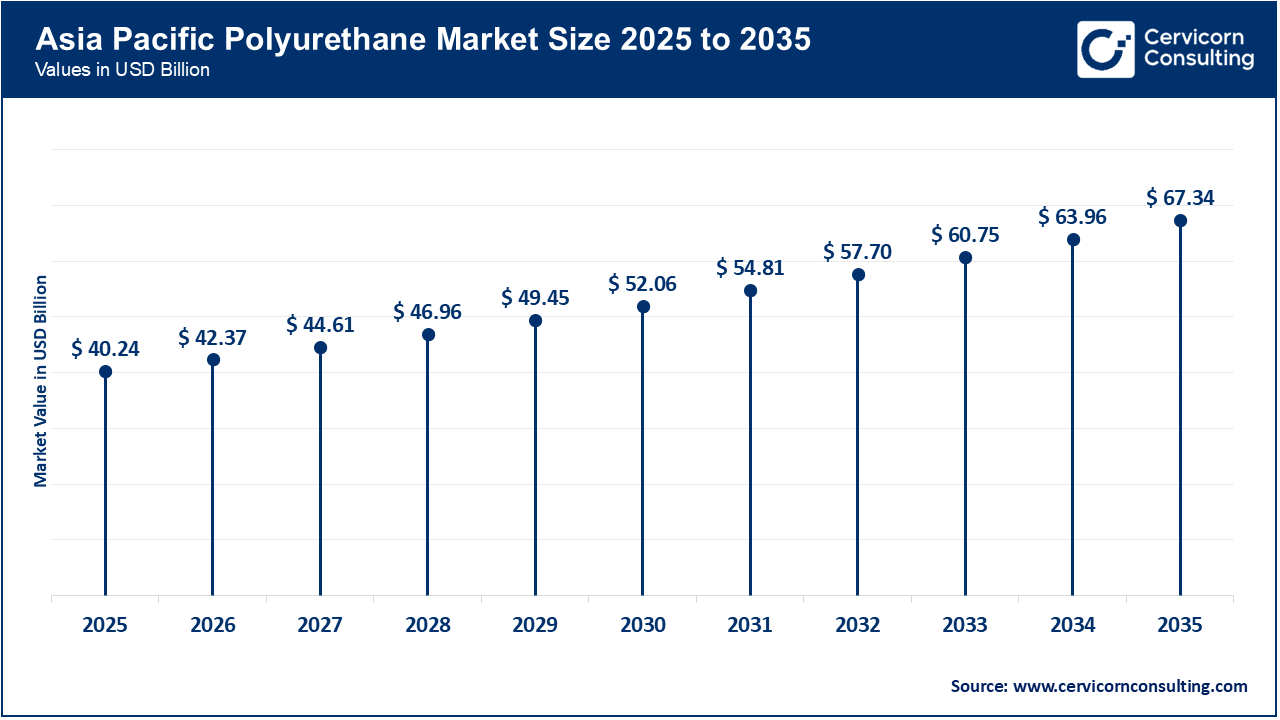

The Asia-Pacific polyurethane market size was accounted for USD 40.24 billion in 2025 and is projected to surge around USD 67.34 billion by 2035. Asia-Pacific is the fastest-expanding PU consumption base, driven by construction, appliances, automotive, and rapidly growing cold-chain logistics supporting food and pharma distribution. The key demand driver is the combination of urbanization and infrastructure build-out plus energy-efficiency measures that increasingly favor better thermal envelopes and efficient refrigeration both strong fits for rigid PU foam. Supply in the region is also evolving quickly, with major producers expanding regional isocyanates footprints and launching lower-carbon product grades to align with customer sustainability targets.

Recent Developments:

The Europe polyurethane market size was reached at USD 20.21 billion in 2025 and is forecasted to hit around USD 33.82 billion by 2035. Europe's PU market is anchored in insulation for renovation and new builds, plus steady use in automotive interiors, appliances, and CASE. The region's defining demand driver is regulation-backed energy efficiency and decarbonization of buildings, where PU's high insulation performance supports space-efficient retrofits (a big advantage in dense building stock). In parallel, Europe is one of the most active regions on circular economy pathways for PU (recycling concepts, lower-carbon feedstocks, and product designs that reduce embodied carbon).

Recent Developments:

Polyurethane Market Share, By Region, 2025 (%)

| Region | Revenue Share, 2025 (%) |

| Asia-Pacific | 45.4% |

| Europe | 22.8% |

| North America | 21.2% |

| LAMEA (Latin America, Middle East & Africa) | 10.6% |

The LAMEA polyurethane market was valued at USD 9.40 billion in 2025 and is anticipated to reach around USD 15.72 billion by 2035. LAMEA demand is uneven but generally propelled by construction and infrastructure (especially GCC megaprojects), district cooling/HVAC efficiency, and cold-chain expansion, which favors rigid PU insulation in panels, pipes, and refrigerated facilities. A key market driver is policy-led energy efficiency in buildings in hot climates especially, thermal insulation requirements and enforcement can materially increase insulation penetration and specification quality. Latin America also sees PU demand tied to appliances, footwear, furniture, and a notable focus on trade measures affecting upstream inputs like polyether polyols.

Recent Developments:

The polyurethane market is segmented into product, raw material, application, and region.

Polyurethane foams can be divided into rigid and flexible foams are dominate different industrial applications. Within the industrial sector, rigid foams have valued enhanced mechanical strength as well as insulation properties which protect volume in walls and roofs and as a stiffening layer. Rigid foams provide thermal efficiency while providing additional stiffening to roof assemblies. Flexible foams with a typical open-cell structure are commonly the most common material for car seats, furniture, and mattresses, due to their resilience to repeated cycles of compression and comfort. Together, these major foam segments constitute the majority of the PU market volume.

Polyurethane Market Share, By Product, 2025 (%)

| Product | Revenue Share, 2025 (%) |

| Rigid Foam | 31.4% |

| Flexible Foam | 28.6% |

| Coatings | 11.2% |

| Adhesives & Sealants | 10.0% |

| Elastomers | 10.4% |

| Others | 8.4% |

CASE (Coatings, Adhesives, Sealants, and Elastomers) segment is the fastest-growing, primarily due to the industry need for high duties protective layers for automobiles and electronics. The PU-based adhesives and sealants are finding success in the construction and manufacturing industries due to their superior bonding strength and durability. Water-based PU coatings will look to conduct lower rates of VOC emissions and is also a trend in this space while adhering to global environmental standards, guidelines and regulations.

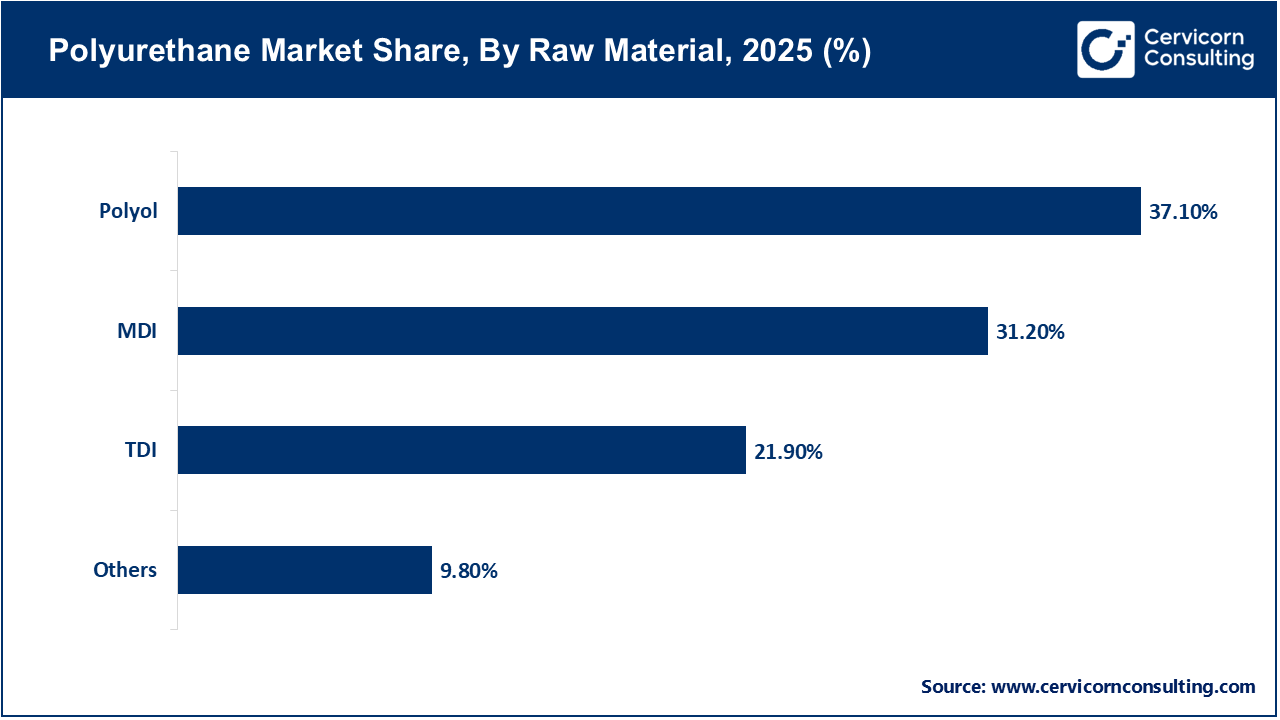

Methylene Diphenyl Diisocyanate (MDI) and Polyols are the raw material key Building Blocks of PU. MDI is the leading Isocyanate used in the majority of rigid foam applications. MDI has a lower volatility and allows for a greater number of functional groups than TDI. The bulky MDI molecule can allow more rigid segments of the polymer chain, which leads to an overall more structurally integrated product. Polyols, which can be derived from petroleum or also bio-based sources get a similar position of importance within raw materials, with Polyether polyols and Polyester polyols being the most common types of polyols in industrial applications.

Toluene Diisocyanate (TDI) continues to be the most common production of flexible foams for upholstery and furniture. TDI is a significant part of the market with developments in high resilience. Interestingly, speciality raw materials are developing for example, aliphatic isocyanates for UV stable coatings are now transitioning from development to commercial use of bio-based isocyanates.

The largest two application segments for polyurethane are construction and furniture. In construction, PU is utilized for thermal insulation, sealants, and binders, and serves as a key contributor to energy efficient building designs. In the furniture sector, there is stable consumption driven by a consistent demand for flexible foam for mattresses and seating. The construction and furniture sectors are heavily influenced by macroeconomic trends, such as interest rates and housing starts, yet both progress as segments due to continued global urbanization and rising living standards.

Polyurethane Market Share, By Application, 2025 (%)

| Application | Revenue Share, 2025 (%) |

| Construction | 27.2% |

| Furniture & Interiors | 22.1% |

| Automotive | 17.8% |

| Electronics & Appliances | 10.1% |

| Packaging | 6.9% |

| Footwear | 4.9% |

| Others | 11% |

There are also niche applications demonstrating high growth potential, like footwear and electronics packaging. Specifically, PU elastomers, which are used to manufacture lightweight and durable soles for athletic and casual shoes, are expected to grow significantly in the footwear segment. The synthetic PU leather market, being driven by demand for animal leather substitutes in vegan and sustainable alternatives, is also expected to grow. In electronics, PU foams provide key shock absorption and thermal insulation protection for components sensitive to the environment during transit and operation.

By Product

By Raw Material

By Application

By Region