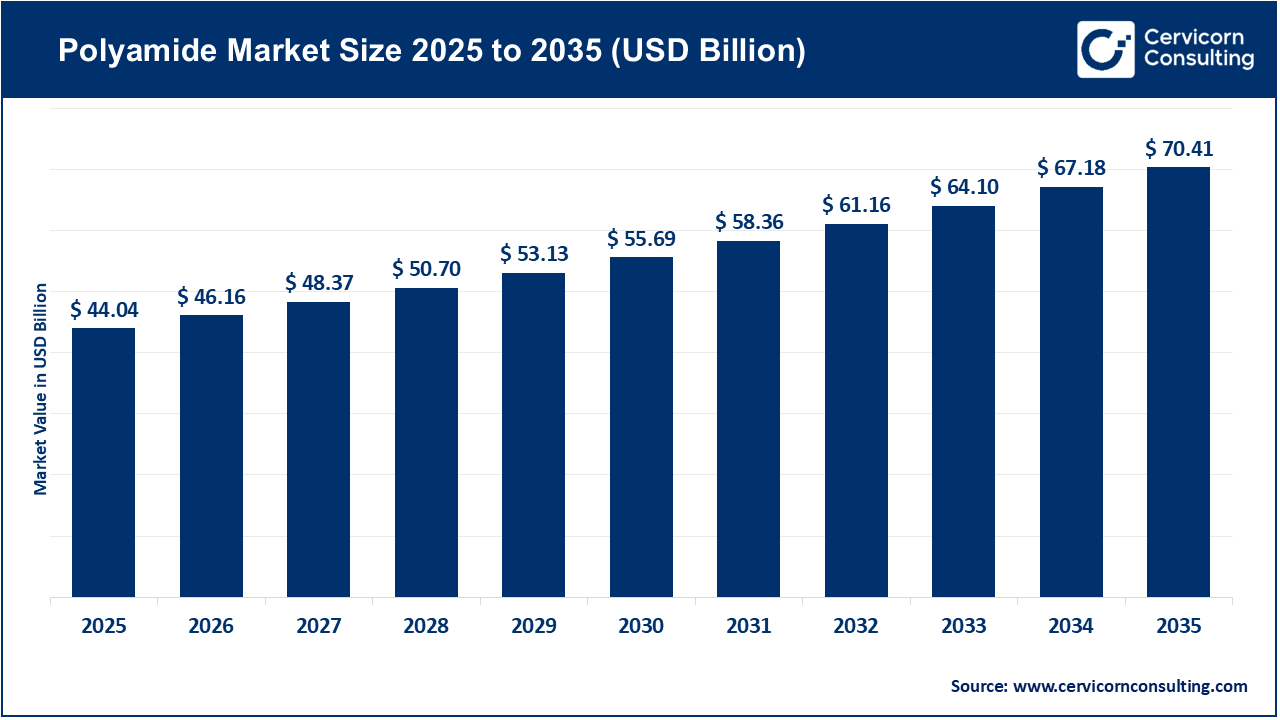

The global polyamide market size was accounted for USD 44.04 billion in 2025 and is expected to be worth around USD 70.41 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 4.8% over the forecast period from 2026 to 2035. The growth of the polyamide market is mainly driven by the accelerated shift toward lightweight automotive design, particularly in the rapidly growing electric vehicle sector. As automakers strive to increase EV driving range, reducing vehicle weight has become a key engineering focus. Consequently, polyamides, especially PA 6 and PA 66, are preferred over traditional metals such as aluminium and steel due to their high strength-to-weight ratio and durability. This trend is crucial because every kilogram of weight saved improves battery efficiency and reduces energy use. For example, recent developments in composite materials for automotive use highlight the use of mineral-filled polyamide 6 to replace heavier parts, enhancing fuel economy in internal combustion engines and extending range on electric platforms.

Another major factor driving the polyamide market is global efforts toward decarbonization and environmental regulation. National initiatives, such as the European Union's goal of achieving net-zero emissions by 2050, are encouraging manufacturers to choose low-carbon materials. Although these regulations often add compliance costs, they are also boosting demand for bio-based and recycled polyamides, which is reshaping market dynamics. As a result, the polyamide market is experiencing a structural shift. Sustainable "green" polyamides are becoming more widely available, moving beyond niche applications and being adopted by larger brands.

Sustainability-Driven Circular Innovation Driving the Polyamides Market

The most transformative trends in the polyamide industry are the shift from linear "take-make-dispose" models to circular system design that uses green chemistry. Companies are aiming to go beyond mechanical recycling, which often damages polymer performance, and are leaning more toward chemical recycling or "depolymerization" technologies. These processes break polyamide waste down into its monomer base, like caprolactam for PA6, and reintroduce it into production as a virgin-quality recycled resin suitable for performance applications. This shift is heavily driven by company sustainability goals. For example, global fashion brands like Zara are striving to eliminate virgin polyester and polyamide from their supply chains by 2030. Consequently, the industry is seeing increased adoption of "bio-attributed" and "bio-based" polymers made from renewable feedstocks, such as castor oil or biomass. These materials not only reduce dependence on fossil resources and mitigate oil price volatility but also meet current engineering performance standards.

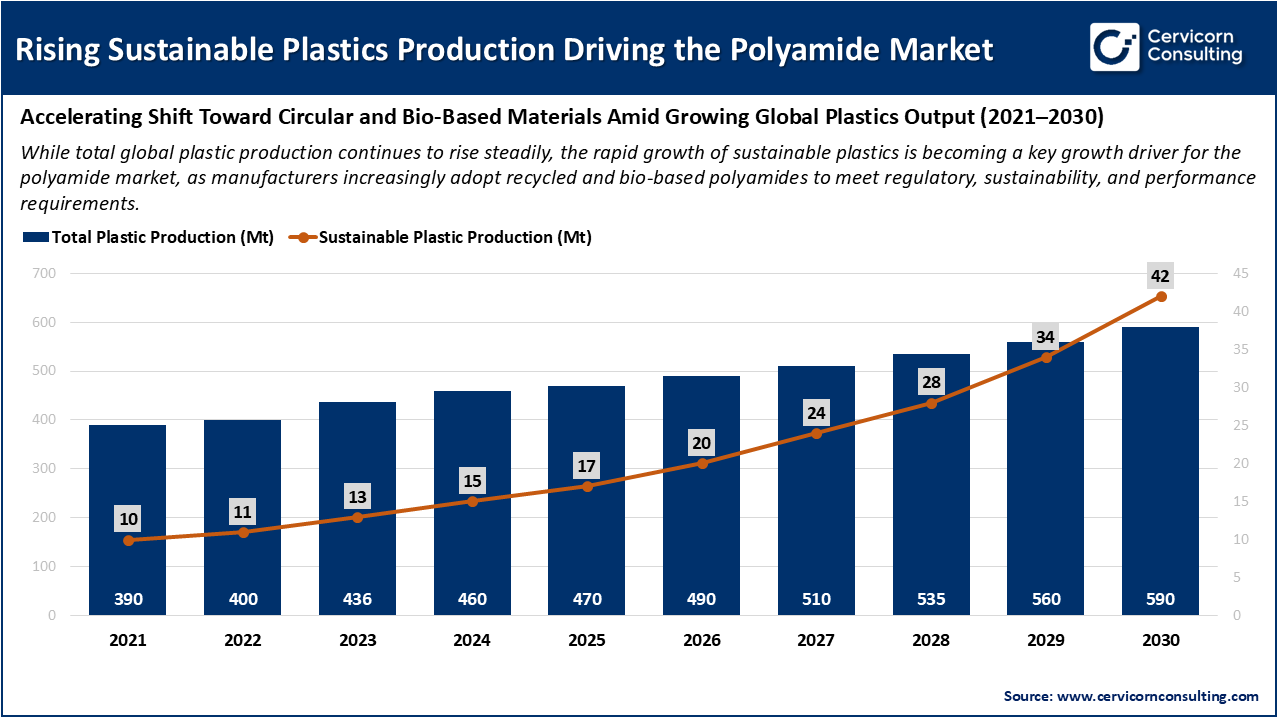

Rising Sustainable Plastics Production Driving the Polyamide Market

Global plastic production is expected to grow steadily from 2021 to 2030, while the output of sustainable plastics is projected to rise at a much faster pace. Sustainable plastics, which include recycled and bio-based materials, are expanding more rapidly due to increasing regulatory requirements, stronger commitments to sustainability from brands, and ongoing improvements in recycling technologies and green chemistry. This trend is especially significant for the polyamide market, where demand is moving toward recycled and bio-based polyamides. These materials offer performance similar to virgin polyamides, help reduce dependence on fossil-based feedstocks, and support circular economy objectives in industries such as automotive, textiles, and industrial manufacturing.

1. Corporate Strategic Capacity and Infrastructure Investment

A significant milestone within the polyamide industry occurred in the 2023-2024 period, with considerable capacity consolidation and expansion by the major global players, most notably in the formation of Envalior. The new entity is the result of DSM Engineering Materials and Lanxess High Performance Materials merging under the ownership of Advent International, marking a major shift towards specialized, pure-play engineering materials companies. Such consolidation will enable extensive research and development into the next generation of polyamides to support the EV and electronic market segments. Additionally, companies such as BASF are rapidly expanding production levels at their integrated "Verbund" sites such as Zhanjiang, China. These integrated infrastructure models are designed to have specific production capacities in key manufacturing regions, offer supply chain resilience, and reduce the carbon footprint associated with long-distance logistics of moving materials and products.

2. Government Policy and Regulatory Sustainability

A major benchmark in regulatory activity has been set through the revision of the European Union’s End-of-Life Vehicles (ELV) Directive and the Ecodesign for Sustainable Products Regulation (ESPR), which came into force in 2023 and is expected to fully transition under ESPR frameworks in 2024. Key developments include a regulatory requirement for recycled content in new vehicles-policy proposals, for example, state that a minimum of 25% of plastics must be from recycled sources for new cars. This change in policy converts recycled polyamide from an optional "green" choice into a regulatory requirement for automotive OEMs. Importantly, these regulations are expected to accelerate investment in automotive plastic waste, sorting, and recycling infrastructure. This will improve traceability and recovery rates, ensuring that polyamides used in vehicle production are efficiently reclaimed at end-of-life and reintegrated into the manufacturing cycle. Collectively, these measures support a closed-loop material system and play a critical role in helping the automotive industry achieve net-zero mission targets by 2030.

3. Technical Innovations in Post-Consumer Chemical Recycling

In late 2024, the industry achieved a major technical milestone with the commercial-scale validation of advanced pyrolysis and depolymerization technologies for glass-fibre-reinforced polyamide waste. Historically, the combination of glass fibers and other additives prevented the recycling of automotive polyamide back into the manufacturing stream at high quality. Advanced pyrolysis now enables the recovery of both polymer monomers and glass fibers without loss of yield or degradation of polymer quality. These developments significantly improve the life cycle assessment (LCA) of polyester monomers. Most importantly, this innovation has created a true closed loop for engineering plastics, where material from landfilled stockpiles or waste generated from automotive production is transformed back into high-grade resin for the same application, reducing reliance on virgin fossil-based feedstock.

4. Strategic Mergers and Global Market Positioning

Market realignment had already begun, and this was also confirmed through several prominent mergers and acquisitions that clearly reinforced this shift, particularly those aimed at securing sustainable feedstock supply. Strategic collaborations between chemical manufacturers and bio-technology firms have successfully produced bio-based hexamethylenediamine (HMD) at a commercial scale, which was previously believed unattainable. This milestone is especially relevant in the PA66 segment, which has historically involved a complex precursor route for manufacturing and has thus been subject to supply chain volatility. This strategy of bio-based precursor routes not only supports an improved environmental footprint for PA66 production but also helps insulate it from price volatility in the petrochemical market.

Report Scope

| Area of Focus | Details |

| Market Size in 2026 | USD 46.16 Billion |

| Market Size in 2035 | USD 70.41 Billion |

| CAGR 2026 to 2035 | % |

| Dominant Region | Asia-Pacific |

| Key Segments | Product, Application, Process, Region |

| Key Companies | BASF SE, DuPont de Nemours, Inc., Royal DSM N.V., Evonik Industries AG, Arkema S.A., Lanxess AG, Ascend Performance Materials LLC, Solvay S.A., Toray Industries, Inc., UBE Industries, Ltd., EMS-Chemie Holding AG, RadiciGroup, Mitsubishi Chemical Corporation, Honeywell International Inc., Celanese Corporation |

The polyamide market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

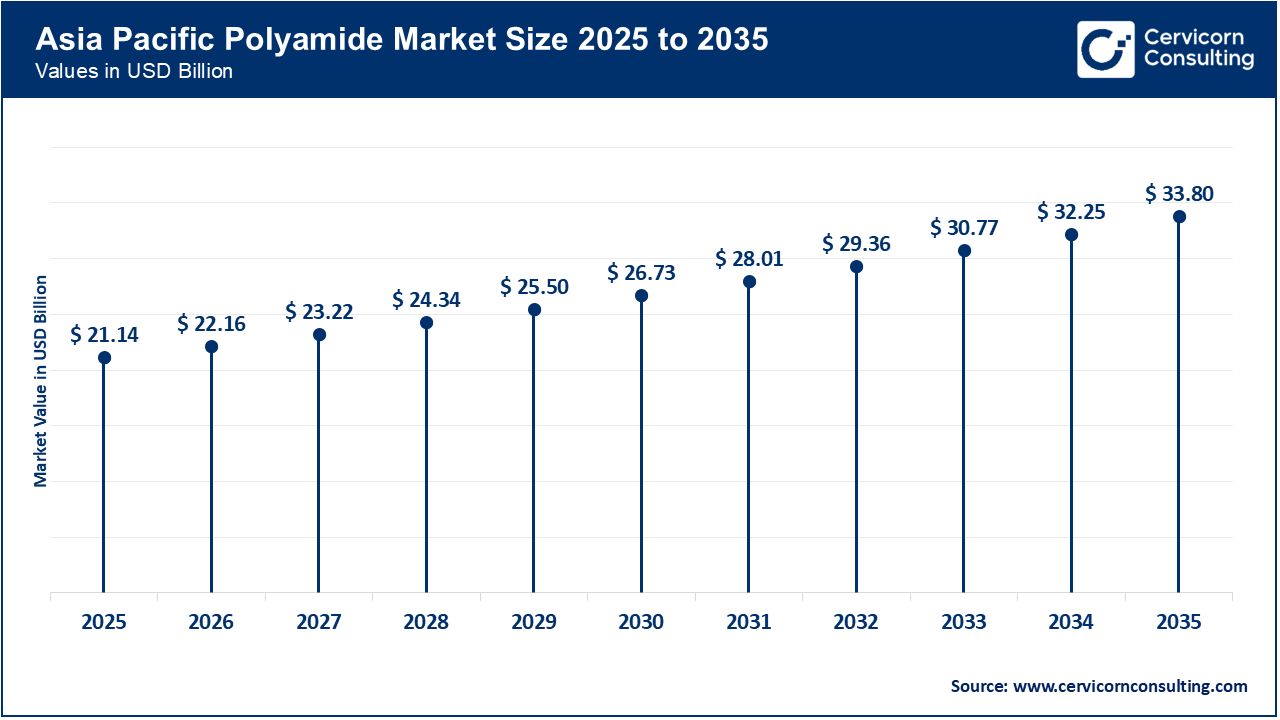

The Asia-Pacific polyamide market size was valued at USD 21.14 billion in 2025 and is predicted to surpass around USD 33.80 billion by 2035. Asia Pacific remains the dominant region in the global market and is also the largest producer and consumer of polyamides. This leadership is mainly driven by the strong presence of automotive, electronics, and textiles, which are produced in China, India, Japan, and Korea. The region benefits from a well-integrated supply chain, from making caprolactam and adipic acid to the assembly of finished high-tech products, and experiences rapid demand growth for high-performance polyamide grades for electric vehicles in China. Additionally, affordable labor and industry growth policies are encouraging investment from global chemical firms toward a more industrial scale of advanced engineering applications and the regional polyamide ecosystem.

Recent Developments:

The North America polyamide market size was estimated at USD 10.57 billion in 2025 and is forecasted to grow around USD 16.90 billion by 2035. North America has become the fastest-growing market. This growth is fueled by a resurgence in local high-tech manufacturing and the rapid expansion of EV infrastructure throughout the region. Beyond regulatory pressures, the market benefits from strong demand in high-value applications such as aerospace, medical, and advanced automotive sectors. Continued investments in additive manufacturing and the availability of bio-based polymers further support market growth. Additionally, data indicate that a focus on domestic semiconductor production and electrical grid modernization will create new opportunities for polyamide consumption. From an innovation standpoint, the United States hosts the highest number of R&D institutions, and a well-established venture capital system enhances the potential for developing new polymer technologies in the region. Overall, the U.S. market is characterised by high-tech materials and engineering, as well as high-volume production, enabling it to grow faster than more mature markets.

Recent Developments:

The Europe polyamide market size was reached at USD 9.25 billion in 2025 and is projected to hit around USD 14.79 billion by 2035. The Europe market is increasingly driven by structural trends surrounding sustainability and the circular economy, propelled by stringent regional regulations. The European market will continue to transition towards higher-margin specialty polyamides and recycled grades (rPA). The European Green Deal and Automotive emissions standards are forcing manufacturers to use more bio-based and recyclable materials to reduce their carbon footprint. In market studies around the fashion industry, which is a large consumer of polyamide fibers, there is an increased focus on sustainability alternatives as the market approaches environmental tipping points.

Recent Developments:

Polyamide Market Share, By Region, 2025 (%)

| Region | Revenue Share, 2025 (%) |

| Asia Pacific | 48% |

| North America | 24% |

| Europe | 21% |

| LAMEA | 7% |

The LAMEA polyamide market was valued at USD 3.08 billion in 2025 and is anticipated to reach around USD 4.93 billion by 2035. Industrial development is occurring in the Latin America, Middle East, and Africa (LAMEA) region, which is gradually penetrating the global market. Growth is mainly supported by infrastructure projects, mining activities, and oil and gas operations, where durable polyamide components are required for operational sustainability. The Middle East is expanding its downstream petrochemical and polymer manufacturing as a strategic shift from oil-dependent economies. At the same time, South Africa and Brazil are set to grow in composite automotive assembly and consumer products, increasing demand for engineering plastics. Although the LAMEA market is likely to remain smaller than other regions, there is significant long-term potential due to a growing middle class and industrial activity.

Recent Developments:

The polyamide market is segmented into product, application, and region.

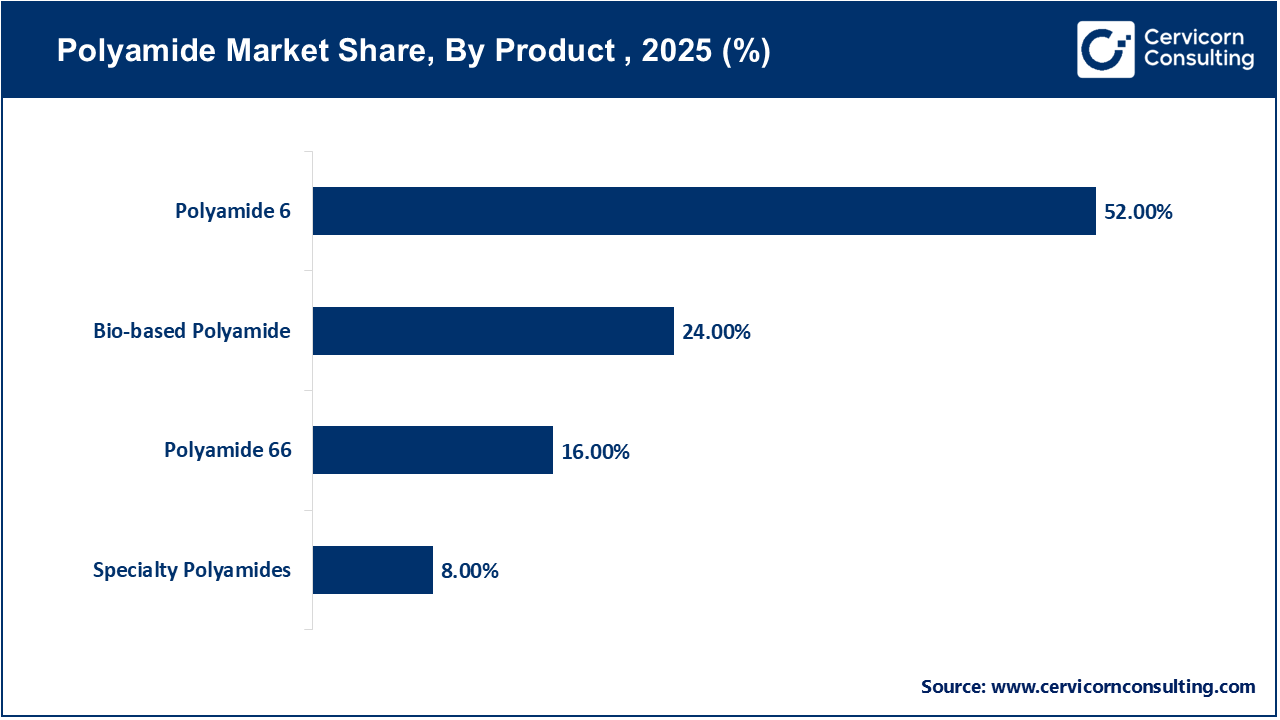

Polyamide 6 (PA6) remains the largest segment of the polyamide market due to its high total production and consumption, driven by its excellent cost-to-performance ratio. Its versatility, which ensures ongoing leadership, offers a balanced combination of mechanical strength, toughness, and ease of processing, making it the industry's "workhorse" material for thousands of industrial applications. This material is produced in various forms, from injection-moulded automotive interior parts to high-tenacity industrial yarns and food packaging films. The global infrastructure supports large-scale PA6 production. Thanks to significant economies of scale, PA6 will continue to be the preferred choice for high-volume manufacturing where cost and performance are both critical. Moreover, PA6 can be easily modified with glass fibers or mineral fillers to suit multiple sectors without the cost implications associated with the chemical precursors of PA66.

The bio-based segment is experiencing the fastest growth in the market, driven by an accelerated trajectory due to decarbonization efforts across the entire supply chain. This growth is fueled by increasing demand for "drop-in" solutions- materials derived from renewable sources such as PA11, PA1010, and castor oil- which can deliver performance characteristics comparable to traditional petroleum-based polyamides. This expansion is especially prominent in premium sectors like high-end sports equipment, luxury consumer electronics, and eco-friendly high-end fashion. Additionally, the "green premium" is gaining wider acceptance among consumers and brands striving to achieve net carbon neutrality by 2040.

Engineering plastics are the largest segment in the polyamides market due to the continuous replacement of metal components in high-performance industries. The need for lightweight, durable, and precisely molded components in the automotive, electrical, and industrial machinery sectors ensures that polyamides remain the engineering material of choice without sacrificing mechanical performance. Polyamide-based engineering plastics, especially nylon polyamides, are highly valued because they maintain dimensional stability and mechanical strength even under continuous stress and chemical exposure. Additionally, engineering-grade nylon polyamides are often formulated with additives for flame retardancy, UV resistance, and thermal conductivity, enabling them to perform where some plastics would fail. The segment's growth is further supported by advances in injection molding technology and 3D printing, which continue to offer design flexibility, reduce material waste, and accelerate production cycles.

Polyamide Market Share, By Application, 2025 (%)

| Application | Revenue Share, 2025 (%) |

| Engineering Plastics | 58% |

| Fibers | 42% |

The textile and fiber segment is the fastest-growing application area for the global market, driven by the global "athleisure" trend and increasing demand for high-performance industrial yarns. Polyamide fibers are the preferred material for various functional apparel and sportswear due to their elasticity, moisture management, and durability. Beyond clothing, rapid growth is also attributed to initiatives in industrial applications such as tire cords, airbags, and conveyor belts, where nylon's energy absorption and tensile strength are critical for safety and performance. Sustainability and the shift toward a circular, textile-based economy are powerful drivers of market growth. Leading brands are increasingly requiring recycled polyamide fibers, especially those made from discarded fishing nets or textile waste, in response to rising consumer demand for sustainability. The combination of functional performance and sustainable practices is expected to promote continued growth in the global polyamide fiber market.

By Product

By Process

By Application

By Region