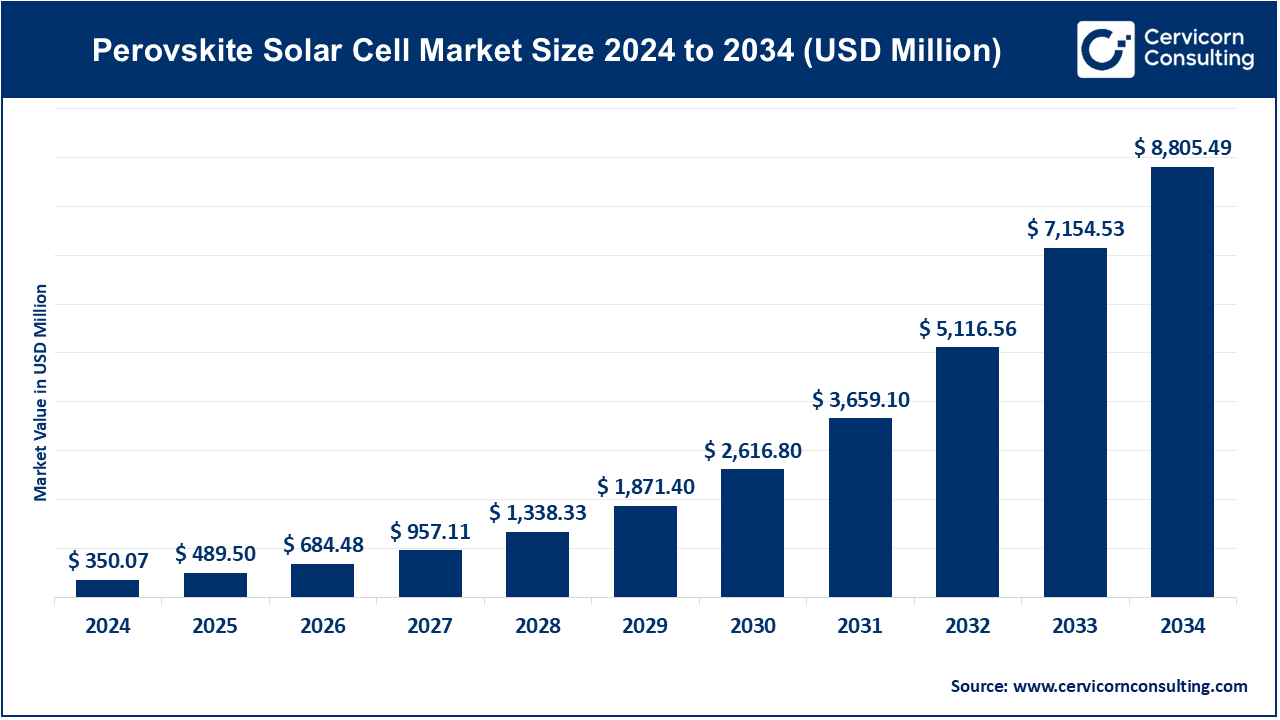

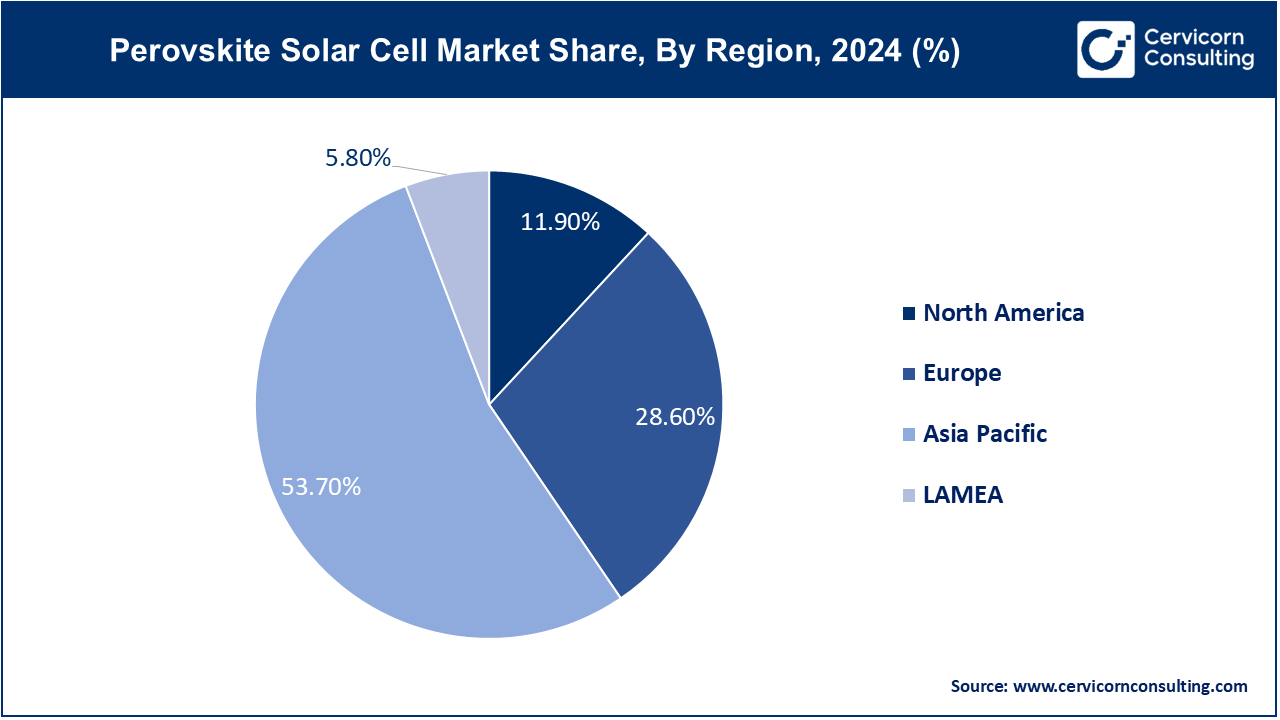

The global perovskite solar cell market size was accounted for USD 350.07 million in 2024 and is expected to be worth around USD 8,805.49 million by 2034, growing at a compound annual growth rate (CAGR) of 38.05% from 2025 to 2034.

The perovskite solar cells (PSCs) market is poised for substantial expansion as a result of their exceptional energy conversion efficiency, cost-effectiveness, and ease of fabrication. Governments and businesses across the globe are increasingly prioritizing renewable energy sources to meet sustainability goals and combat climate change. Perovskite solar cells offer an attractive solution due to their ability to be produced at a fraction of the cost of traditional silicon-based solar panels. As a result, there is growing interest from both industry players and research institutions in scaling up production capabilities. The flexibility of PSCs also opens up possibilities for new applications, such as integration into building materials, wearable electronics, and other unconventional surfaces, further driving their potential in the solar energy market.

Perovskite solar cells (PSCs) are a new generation of solar cells that use a perovskite-structured compound as the light-absorbing material. Perovskite materials, typically composed of a hybrid organic-inorganic lead or tin halide, are known for their excellent light absorption and efficient energy conversion properties. These solar cells have gained significant attention due to their high power conversion efficiency, low manufacturing cost, and the potential for scalable production. Unlike traditional silicon-based solar cells, perovskite cells can be fabricated using solution processing techniques like spin coating, making them more flexible and adaptable to various substrates. As a result, PSCs are seen as a promising alternative to conventional photovoltaic technologies.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 489.50 Million |

| Market Growth Rate | CAGR of 38.05% from 2025 to 2034 |

| Market Size by 2034 | USD 8,805.49 Million |

| Largest Market | Asia Pacific |

| Fastest Growing Market | North America |

| Segment Coverage | By Structure, Application, End Use Industries, Type and Regions |

Technological Versatility

Enhanced Aesthetics

Material Stability and Durability

Scalability and Manufacturing Challenges

Improvement in Efficiency

Integration with Energy Storage

Commercialization Hurdles

Competitive Landscape

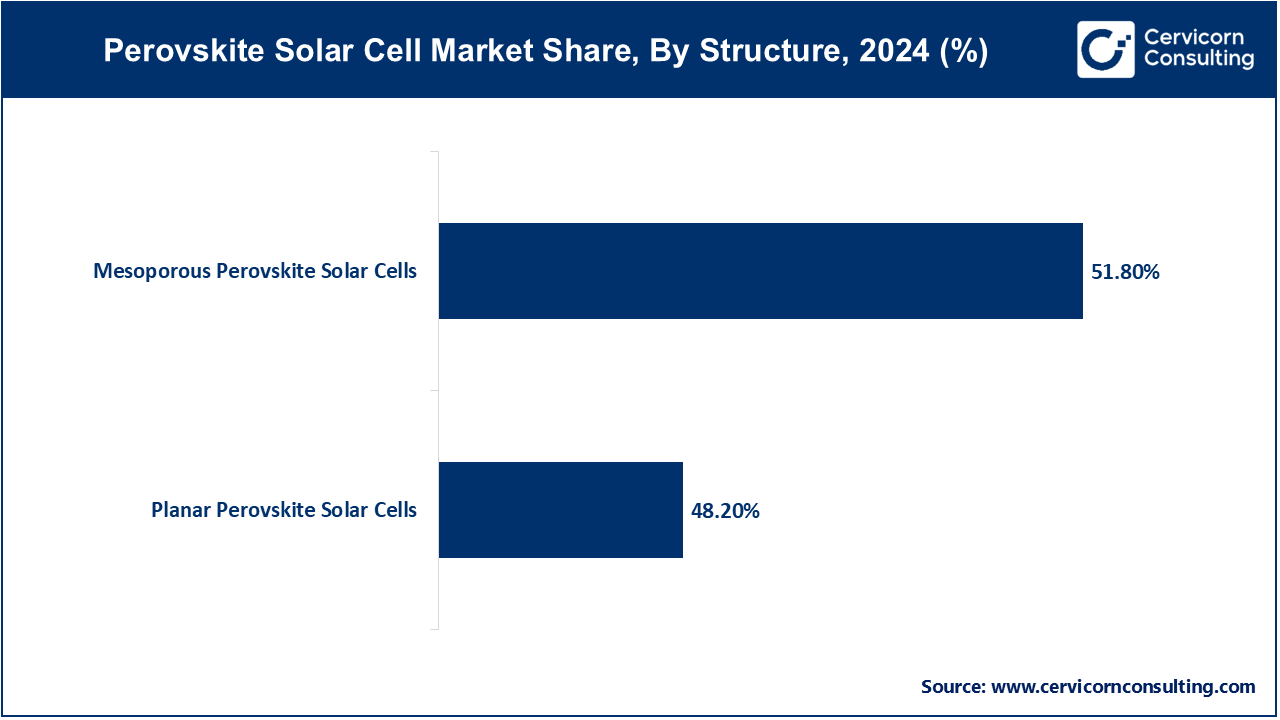

Planar Perovskite Solar Cells: This segment has captured market share of 48.20% in 2024. Planar perovskite solar cells offer simplicity in fabrication processes and potential cost reductions. Recent trends focus on enhancing efficiency through improved perovskite material formulations and interface engineering. Drivers include advancements in manufacturing techniques, such as vacuum deposition and solution processing, aimed at achieving higher performance and stability.

Mesoporous Perovskite Solar Cells: In 2024 this segment has reported market share of 51.80%. Mesoporous perovskite solar cells incorporate a porous scaffold to enhance surface area and light absorption. Market trends emphasize optimizing pore structure and surface morphology for improved charge transport and stability. Drivers include research into novel scaffold materials and fabrication methods to achieve higher efficiencies and durability in real-world applications.

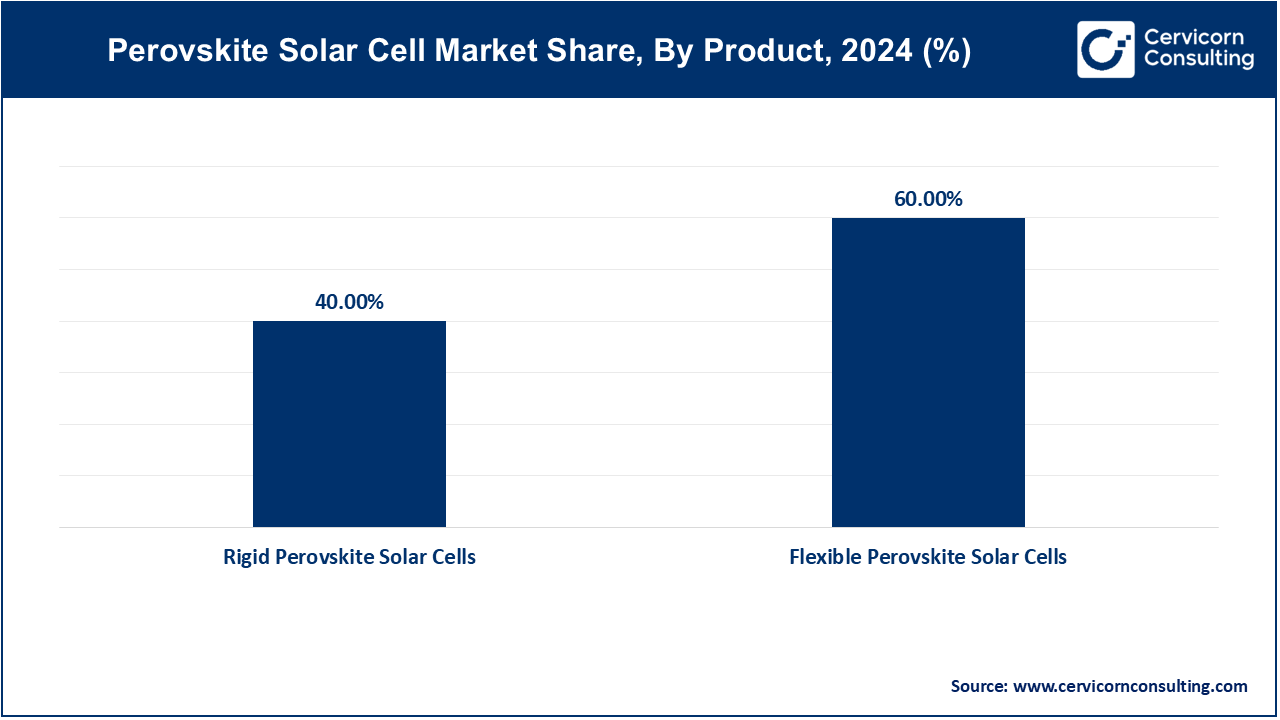

Rigid Perovskite Solar Cells: This segment has registered market share of 40% in 2024. Rigid perovskite solar cells are typically used in traditional solar panel applications, offering robustness and ease of integration into fixed installations. Market trends involve increasing efficiency through optimized cell architecture and material formulations, driven by advancements in encapsulation techniques to enhance durability and reliability in outdoor environments.

Flexible Perovskite Solar Cells: This segment has covered highest market share of 60% in 2024. Flexible perovskite solar cells are designed for applications requiring lightweight and bendable characteristics, such as wearable electronics and curved surfaces. Trends focus on developing flexible substrates and encapsulation materials to ensure mechanical durability and stability under bending stress. Drivers include innovations in roll-to-roll manufacturing processes and flexible electronic integration, aiming for widespread adoption in diverse applications beyond conventional solar panels.

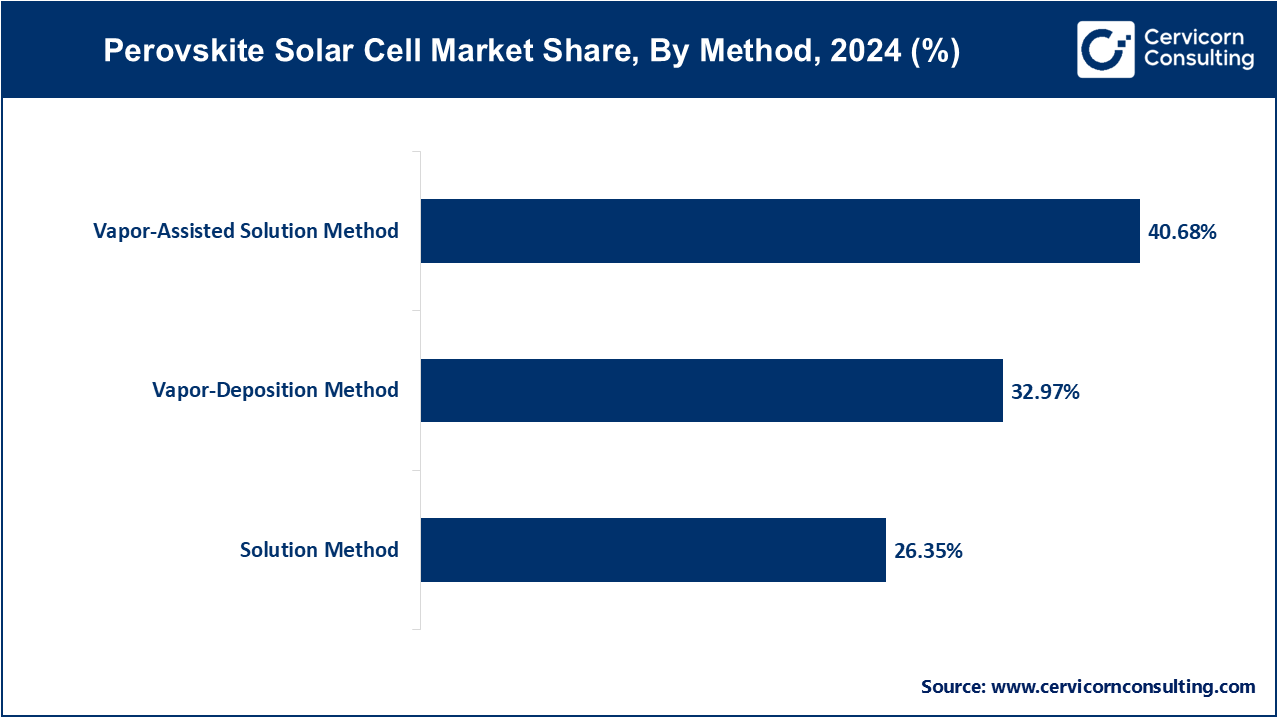

Solution Method: This segment has reported market share of 26.35% in 2024. The solution method involves the deposition of perovskite precursor materials from a solution onto a substrate. Market trends emphasize the development of scalable and cost-effective deposition techniques, such as spin-coating and inkjet printing, to achieve uniform perovskite layers with high efficiency. Drivers include advancements in solvent engineering and precursor chemistry for improved film quality and stability.

Vapor-Deposition Method: The vapor deposition methods segment has accounted market share of 32.97% in 2024. Vapor deposition methods, like chemical vapor deposition (CVD) or physical vapor deposition (PVD), offer precise control over film thickness and composition. Trends focus on optimizing deposition parameters and equipment design to enhance perovskite crystal quality and device performance. Drivers include research into new vapor-phase precursors and deposition strategies to achieve higher efficiency and reproducibility in large-scale manufacturing.

Vapor-Assisted Solution Method: In 2024, the vapor-assisted solution method segment has achieved market share of 40.68%. The vapor-assisted solution method combines aspects of both solution and vapor deposition techniques. Trends include refining hybrid processes that utilize vapor-phase additives to improve perovskite film morphology and crystallinity. Drivers include innovations in vapor-assisted additives and process integration, aiming for enhanced device stability and scalability in commercial production.

Smart Glass: Perovskite solar cells integrated into smart glass are trending for their dual functionality of energy generation and transparency, suitable for building facades and windows.

Solar Panel: Market trends focus on enhancing efficiency and reducing costs of perovskite-based solar panels through technological advancements and manufacturing scale-up.

Perovskite in Tandem Solar Cells: Advancements in combining perovskite with other materials in tandem solar cells aim to achieve higher efficiencies and stability.

Portable Devices: Perovskite solar cells are increasingly used in portable electronics due to their lightweight, flexibility, and potential for high energy conversion efficiency.

Utilities: Large-scale deployment of perovskite solar cells in utility-scale solar farms is driven by their potential for cost-effective renewable energy generation.

BIPV (Building-Integrated Photovoltaics): Integrating perovskite solar cells into building materials such as roofs and facades is a growing trend, driven by the demand for energy-efficient and aesthetically pleasing building designs.

Manufacturing: Perovskite solar cells find application in manufacturing industries for powering facilities and reducing energy costs, driving adoption in sustainable energy solutions.

Energy: Perovskite solar cells contribute to the energy sector by enhancing renewable energy sources with efficient and scalable solar power generation technologies.

Industrial Automation: In industrial automation, perovskite solar cells support sustainable practices by providing clean energy solutions for powering automated systems and machinery.

Aerospace: Aerospace industries integrate perovskite solar cells for lightweight and efficient power generation in satellites, drones, and other aerospace applications.

Consumer Electronics: Perovskite solar cells are increasingly used in consumer electronics for portable power solutions, catering to the demand for lightweight and efficient energy sources in devices like smartphones and wearables.

Hybrid PSCs: Hybrid perovskite solar cells combine organic and inorganic materials, offering high efficiency and low-cost manufacturing potential, driven by advancements in material science and device engineering.

Flexible PSCs: Flexible perovskite solar cells cater to applications requiring lightweight and bendable characteristics, leveraging advancements in flexible substrates and encapsulation technologies for durable and versatile energy solutions.

Multi-Junction PSCs: Multi-junction perovskite solar cells integrate multiple layers of perovskite materials to capture a broader spectrum of sunlight, driving efficiency improvements and enabling applications in tandem solar cells and concentrated photovoltaics.

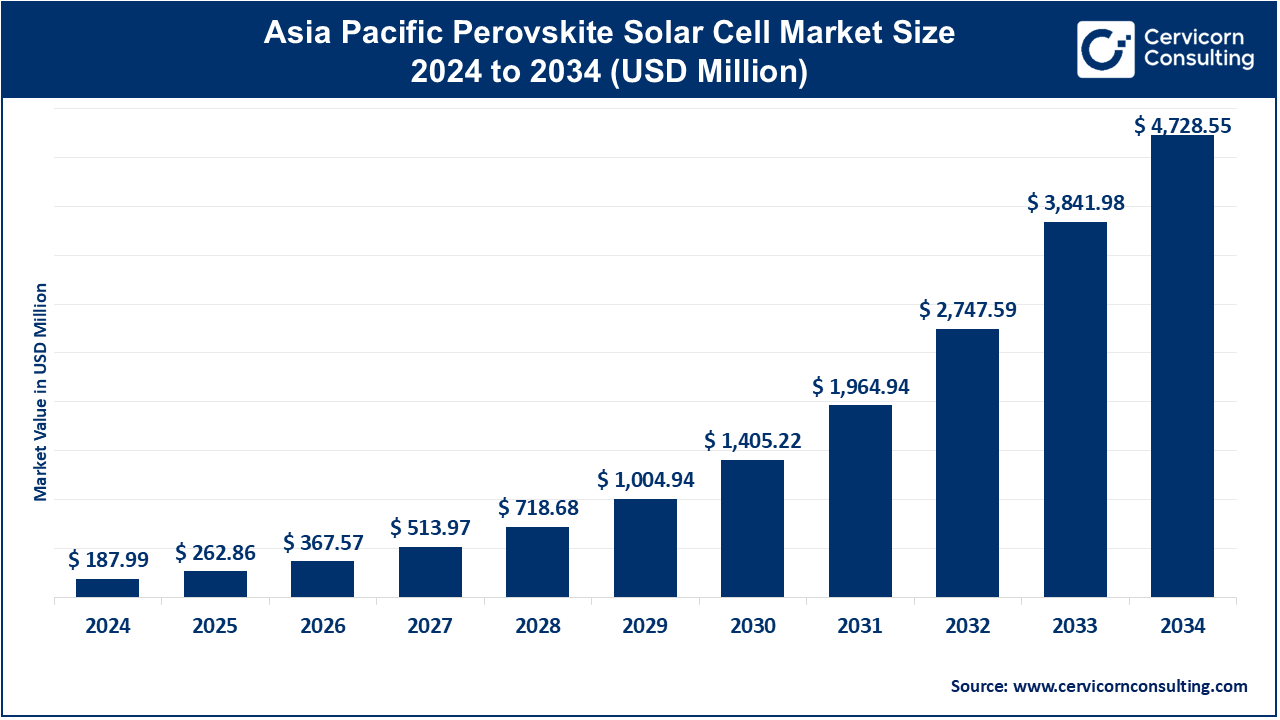

The Asia Pacific perovskite solar cell market size is calculated at USD 187.99 million in 2024 and is projected to grow around USD 4,728.55 million by 2034. Asia-Pacific is witnessing rapid growth, driven by China, Japan, and South Korea's investments in renewable energy. The region's manufacturing prowess, coupled with favorable government policies and rising energy demand, positions it as a key hub for production and adoption of PSCs.

The North America perovskite solar cell market size was valued USD 41.66 million in 2024 and is expected to reach around USD 1,047.85 million by 2034. North America is known for its robust research and development infrastructure, North America leads in technological advancements and early adoption of perovskite solar cells (PSCs). The region benefits from government initiatives promoting renewable energy and strong investments in clean technologies, driving market growth.

The Europe perovskite solar cell market size is measured at USD 100.12 million in 2024 and is expected to grow around USD 2,518.37 million by 2034. The Europe is at the forefront of renewable energy adoption, with stringent environmental regulations and ambitious sustainability targets. The Europe is bolstered by supportive policies, research collaborations, and a growing emphasis on energy independence.

The LAMEA perovskite solar cell market size was valued USD 20.30 million in 2024 and is forecasted to reach around USD 510.72 million by 2034. LAMEA shows potential for perovskite solar cells adoption, supported by increasing awareness of renewable energy benefits and improving economic conditions. The region benefits from abundant sunlight, making solar energy an attractive option. However, challenges such as infrastructure limitations and regulatory uncertainties may impact market growth.

Emerging players such as Saule Technologies and Swift Solar, leveraging their expertise in scalable manufacturing processes and flexible solar cell applications, respectively. Dominating the market are Oxford PV and Greatcell Solar, driven by their advancements in efficiency enhancement and commercial scalability of perovskite solar cells. Moreover, Oxford PV has partnered with Meyer Burger to scale up production capacity and efficiency of tandem solar cells. Greatcell Solar has collaborated with leading academic institutions to improve the stability and durability of Perovskite materials.

Additionally, Saule Technologies has innovated by integrating perovskite cells into building facades for energy-efficient constructions, while Swift Solar has focused on improving the reliability of their Perovskite solar modules through advanced encapsulation technologies. These collaborations and innovations underscore efforts to address technological challenges and expand market adoption of perovskite solar cells.

Saule Technologies (Olga Malinkiewicz, CEO)

"Our focus remains on scaling up production capabilities while ensuring the reliability and efficiency of our perovskite solar cell technology."

Oxford PV (Frank Averdung, CEO)

"We are committed to advancing the efficiency and commercial viability of perovskite solar cells, leveraging our tandem cell technology for maximum impact."

Swift Solar (Joel Jean, CEO)

"Swift Solar continues to push the boundaries of perovskite solar technology, aiming to deliver high-performance, cost-effective solutions for renewable energy."

Exeger (Giovanni Fili, CEO)

"Our mission is to integrate light-harvesting perovskite technology into everyday products, revolutionizing how devices are powered sustainably."

These statements reflect a commitment to advancing technology, improving efficiency, and scaling up production capabilities within the perovskite solar cell market.

Market Segmentation

By Structure

By Product

By Method

By Application

By End Use Industries

By Type

By Regions