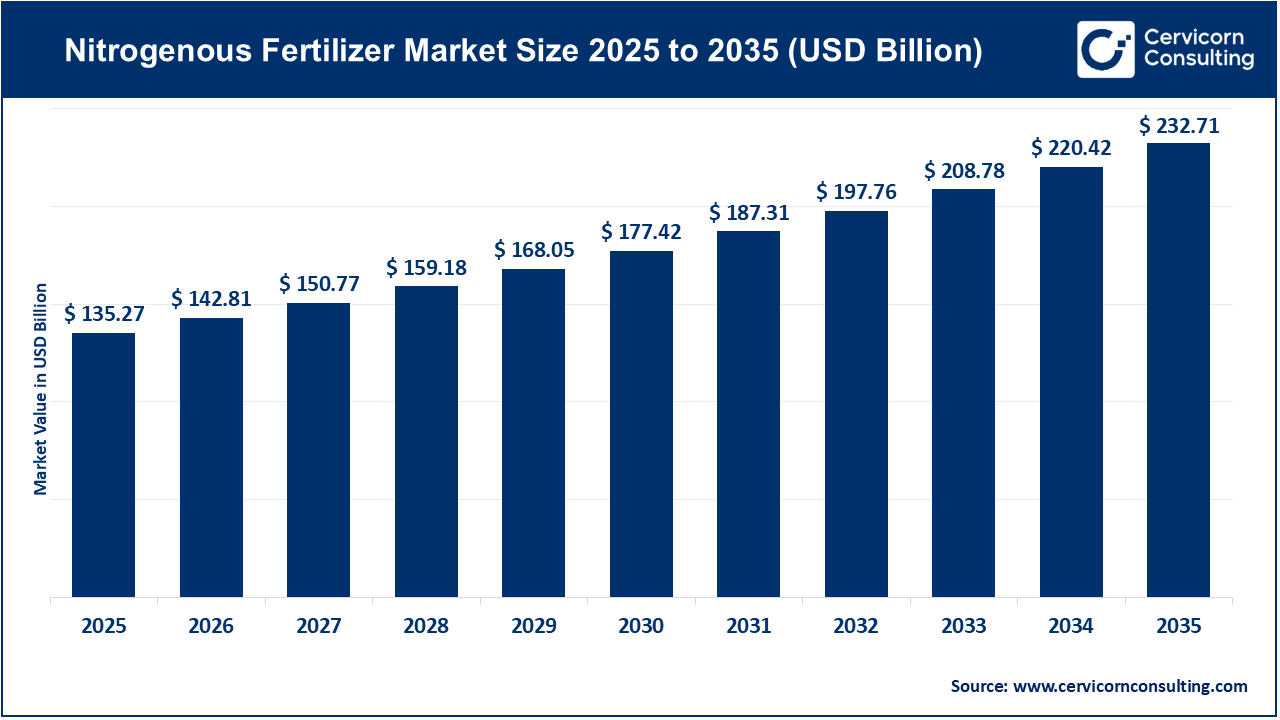

The global nitrogenous fertilizer market size was estimated at USD 135.27 billion in 2025 and is expected to be worth around USD 232.71 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 5.6% over the forecast period from 2026 to 2035. The global nitrogen fertilizer market is driven primarily by the growing food needs of the world due to population growth, and as a result, farmers are under constant pressure to maximize their crop yields on a limited amount of land. Nitrogenous fertilizers are a critical tool for enhancing plant growth, improving the quality of crops, and increasing soil fertility; thus, governmental programs focusing on food security are increasing the use of fertilizers. Additionally, the support of agricultural policies and government subsidy programs are supporting the increasing demand in the nitrogenous fertilizer marketplace.

The expansion of intensive and modern farming practices will continue to influence the growth of the nitrogenous fertilizer industry. As farmers learn about the significance of nutrient balancing for healthy crops and increase the amount of land they are using for commercial agricultural purposes, particularly in the cultivation of cash crops and cereals, the nitrogenous fertilizer industry will continue to thrive. Further, nitrogen fertilizer is becoming increasingly available to consumers, thanks in part to advances in supply chain, storage, and distribution technologies. Finally, farmers' ongoing efforts to improve productivity will continue to support the expansion of the nitrogenous fertilizer market.

Rising Demand for Staple Crops Driving Market Growth

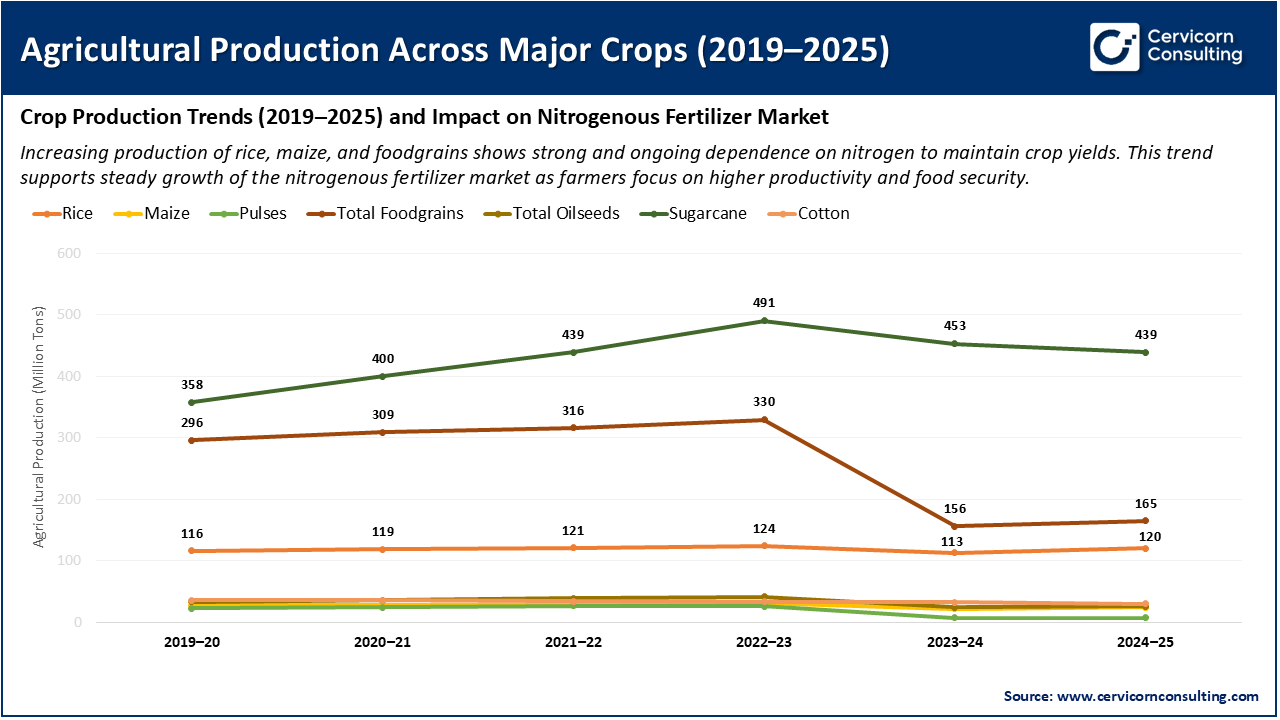

The nitrogenous fertilizer market is being driven by the increased need for staple crops, including rice, wheat, maize and corn. Staple crops are key food sources for daily life, and they are grown widely to feed the growing global population. Farmers are using increasing amounts of nitrogenous fertilizer to produce more crops and to keep the nutrients in their soils at optimum levels. To continuously replace the nitrogen needed for high yields from intensive production of these staple crops, the amount of fertilizer used increases significantly. With the focus of many governments on food security and self-sufficiency, the ongoing growth in the production of staple crops has created a strong and stable market for nitrogenous fertilizers.

Trends for agricultural output from 2019 to 2025 show steady increases for major crops (food grains, rice, maize) with fluctuations for other crops (sugarcane and cotton). Continuous and increasing production of these crops indicates dependence on nitrogen-based nutrients used for maintaining soil fertility and to increase production. Farmers are beginning to rely on these fertilizers so that they can continue producing food while also meeting the increasing demand for food and providing consistent supply to consumers even during periods of lower-than-expected production levels caused by crop variability. The increasing overall demand for nitro-based fertilizers directly supports the growth of the nitro-based fertilizer market throughout all of the major segments of agriculture.

1. Joint Venture to Set Up Overseas Urea Plant by Indian Fertilizer Firms and Uralchem

In December 2025, fertilizer companies in India partnered with Uralchem (Russia) to create a facility in Russia for the production of urea. This is a key development for the global nitrogen fertilizer sector as it increases long-term supply security for a major agricultural economy such as India, resulting in reduced dependency on unstable global import sources. With improved long-term assurance of fertilizer supply through diversification of source countries, fertilizer suppliers will feel more secure in making their investments and farmers will gain more predictable access to nitrogen-based products, resulting in increased crop yields and enhanced opportunities to sell products to market.

2. Increase in Government Subsidies on Fertilizers in India for 2025–26 Season

The government approved a subsidy increase for the Nutrient Based Subsidy Scheme for phosphatic and potassic fertilizers in 2025; thus, through this initiative farmers will continue to be able to purchase fertilizers with less financial strain. Although the subsidy itself is focused only on non-urea fertilizers, this program has provided an overall favourable policy environment encouraging farmers to apply and purchase a complete suite of nutrients (N, P, K, S) to achieve a balanced fertilization process. Therefore, by decreasing the cost burden and making these products affordable for consumers, this program has promoted greater use of fertilizers and subsequently increased the demand for fertilizers within the market.

3. Expansion of Fertilizer Production Capacity and Domestic Output Growth in India

The domestic production of fertilizers in India has increased recently, as evidenced by the increase in urea and notably increases in the production of more complex fertilizers (NPK/NP) being produced at an even faster rate than last year. This increased production capability is a significant milestone in that it allows India to become less reliant on imports for fertilizer and provides stability in supply for fertilizers. With the higher production capability of nitrogenous fertilizers in India, distribution will become easier and therefore more accessible for farmers in hard to reach or rural areas. This increased accessibility will also result in an increase in the use of fertilizers by small and marginal farmers which will ultimately increase the size of the total addressable market for these products.

4. Emergence of Low-Carbon & Sustainable Ammonia / Nitrogen Fertilizer Projects Globally

Sustainable fertilizer production, as evidenced by CF Industries' announcement (a joint venture to produce low-carbon ammonia) and Nitricity's funding for an organic nitrogen fertilizer plant located in California, was established in 2025. This represents an important advancement for the industry and demonstrates that increasing numbers of farmers and government are seeking more sustainable or "green" farming practices as the demand for these products continues to increase. Fertilizer producers that innovate and develop low-carbon, sustainable fertilizer production methods will gain a competitive advantage over other producers and will have the opportunities for long-term growth in the nitrogen-based fertilizer markets and have a more significant market share.

Report Scope

| Area of Focus | Details |

| Market Size in 2026 | USD 142.81 Billion |

| Expected Market Size in 2035 | USD 232.71 Billion |

| Projected CAGR 2026 to 2035 | 5.60% |

| Dominant Region | Asia-Pacific |

| Key Segments | Product, Form, Mode of Application, Crop Type, Region |

| Key Companies | Bunge Ltd., Sorfert, OCI Nitrogen, Eurochem Group, Kynoch Fertilizer, Yara International ASA, Omnia Holdings Limited, CF Industries Holdings Inc., Triomf SA, Nutrien Ltd., ICL Fertilizers, Coromandel International Limited |

The nitrogenous fertilizer market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

The North America nitrogenous fertilizer market size was valued at USD 23 billion in 2025 and is expected to attain around USD 39.56 billion by 2035. The North America market is primarily being driven by the implementation of advanced farming techniques and the increasing level of acceptance of precision farming within the industry. Farmers are striving to achieve maximum yield per acre with minimal environmental impact. The continued demand for cereals, corn and oilseeds in North America contributes to the ongoing usage of nitrogenous fertilizers within this region. Additionally, there is a growing focus on using sustainable and controlled-release nitrogen fertilizers throughout North America. Innovative technology and robust agricultural infrastructure will continue to support the market's sustained growth.

Recent Developments:

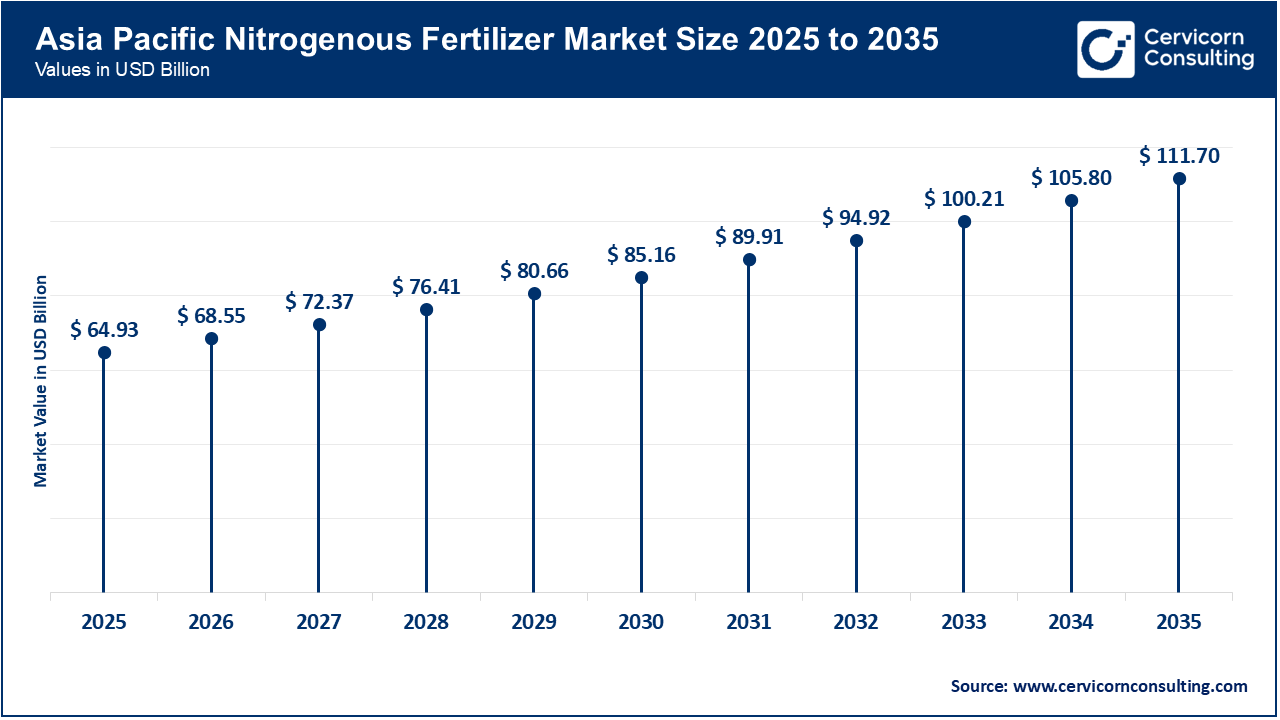

The Asia-Pacific nitrogenous fertilizer market size was estimated at USD 64.93 billion in 2025 and is forecasted to hit around USD 111.70 billion by 2035. Asia-Pacific region is projected to experience rapid market growth due to the increasing need for nitrogen fertilizers driven by its rapidly growing population, along with the high demand for staple crops. Countries with large agricultural economies are required by the governments of their respective countries to use nitrogen fertilizers to maintain their food security, as well as the availability of government subsidies and support programs that enable farmers to purchase nitrogen fertilizers at an affordable price. Furthermore, the continued development of commercial farms and irrigation systems in the Asia-Pacific region are also contributing to the continued growth of the nitrogenous fertilizer market.

Recent Developments:

The Europe nitrogenous fertilizer market size was accounted for USD 27.05 billion in 2025 and is estimated to surpass around USD 46.54 billion by 2035. There is a significant market for nitrogenous fertilizers in Europe due to the European Union's Environmental Directives, which focus on promoting sustainable agricultural practices. Farmers have been converting to utilizing more efficient and environmentally friendly products to comply with the various emission and nitrate directives they must abide by. The demand for these products will likely remain steady, as the EU is home to many hectares of cereals and therefore, the needs of the farmers will continue to be high. An important factor contributing to the growth of this market will include the controlled application of fertilizers, along with the development of new and innovative fertilizer formulations.

Recent Developments

Nitrogenous Fertilizer Market Share, By Region, 2025 (%)

| Region | Revenue Share, 2025 (%) |

| Asia-Pacific | 48% |

| North America | 17% |

| Europe | 20% |

| LAMEA | 15% |

The LAMEA nitrogenous fertilizer market was valued at USD 20.29 billion in 2025 and is anticipated to reach around USD 34.91 billion by 2035. The LAMEA will continue to expand due to increased areas under cultivation (farmland) and greater emphasis on food security. Farmers in Latin American and Middle Eastern countries are increasing their production of crops to decrease their reliance on imported products. As the number of farms engaged in commercial and export-oriented agriculture grows, the quantity of fertilizers will increase as well. Many governments provide assistance with the development of the agriculture sector through various agricultural development programs that support growth in this sector.

Recent Developments:

The nitrogenous fertilizer market is segmented into product, form, mode of application, crop type, and region.

The nitrogen fertilizer market is dominated by urea due to its high nitrogen content and use on all types of crops. Urea is affordable, easily handled, and readily available throughout most agricultural areas. Because of the ease with which farmers can apply it, the rapid absorption of nitrogen by the plant, and the support it provides for maximum yield (especially with staple food crop), urea continues to be the preferred nitrogen fertilizer in many countries. This dominance has been supported through strong government support and subsidies.

Nitrogenous Fertilizer Market Share, By Product, 2025 (%)

| Product | Revenue Share, 2025 (%) |

| Urea | 55% |

| Ammonia | 15% |

| Ammonium Nitrate | 8% |

| Calcium Ammonium Nitrate | 7% |

| Ammonium Sulfate | 6% |

| Methylene Urea | 4% |

| Others | 5% |

Methylene urea represents the fastest growing segment of the nitrogen fertilizer market because it has a slow-release formulation and improves the efficiency of nitrogen use and reduces nitrogen loss through leaching and volatilization. Increased awareness of sustainable agriculture practices has resulted in a greater demand for controlled-release nitrogen fertilizers and the ability to assist with long-term soil health has led to increased usage of Methylene Urea.

The majority of the nitrogenous fertilizer segment is represented by dry forms. The reasons for the widespread use of dry nitrogenous fertilizers are the ease of transportation, storage, and handling associated with their dry physical state. Also, granular and powdered forms can be easily used in tradition-based farming systems, and these may be applied to crops using traditional spreading equipment. Furthermore, the extended shelf life and compatibility with traditional spreading equipment make dry nitrogenous fertilizers the product of choice within large-scale farming operations.

Nitrogenous Fertilizer Market Share, By Form, 2025 (%)

| Form Segment | Revenue Share, 2025 (%) |

| Dry | 75% |

| Liquid | 25% |

The liquid nitrogenous fertilizer segment is growing faster than the dry nitrogenous fertilizer segment. The reason for the rapid growth of this segment is the fact that liquid nitrogenous fertilizers have better uniformity of application and support for fast absorption rates. The rise in liquid nitrogenous fertilizer use within precision agricultural methods and modern agricultural irrigation systems, coupled with better control over nutrient dosage, is leading to growth of the liquid nitrogenous fertilizer market. Additionally, the development of liquid nitrogenous fertilizer compatibility with fertigation systems is enhancing growth potential.

Soil application continues to dominate the nitrogenous fertilizer industry, as it is the oldest and most common way of applying fertilizers. Soil application is relatively inexpensive, can be used on any crop and has become second-nature to farmers who utilize this method extensively. It is also a highly effective method of increasing soil nutrient levels.

Nitrogenous Fertilizer Market Share, By Mode of Application, 2025 (%)

| Mode of Application Segment | Revenue Share, 2025 (%) |

| Soil | 65% |

| Fertigation | 21% |

| Foliar | 9% |

| Others | 5% |

Fertigation is emerging as the fastest growing segment due to the increasing use of irrigation to grow crops. Fertigation is a method in which nutrients are delivered directly to the roots of crops via a water system. The efficiency of this technique is enhanced because fertilization is combined with irrigation, resulting in reduced nutrient loss. Growth of drip irrigation and sprinkler systems continues to increase adoption of fertigation.

Cereals and grains are presently the key segment driving demand for nitrogen fertilizer due to large-scale production and the fact that cereals and grains provide the majority of the world's staple foods. Crops such as rice, wheat, and maize require large quantities of nitrogen to optimize yields, and extensive land areas are utilized to raise them and as such, nitrogen fertilizer is continually required for these crops. In addition, governments around the world have implemented food security programs which further supports demand for nitrogen fertilizer used in the development of cereals and grains.

Nitrogenous Fertilizer Market Share, By Crop Type, 2025 (%)

| Crop Type Segment | Revenue Share, 2025 (%) |

| Cereals and Grains | 51% |

| Oilseeds and Pulses | 18% |

| Fruits and Vegetables | 21% |

| Others | 10% |

Fruits and vegetables are growing rapidly in the nitrogen fertilizer market as a result of increasing consumer demand for healthy and high value crops. These crops require more balanced nutrition and frequent applications of nutrients in order to have the best quality and greatest yield possible. Furthermore, as commercial horticulture and protected farming grow, nitrogen fertilizer usage continues to increase, thereby supporting faster overall growth.

EuroChem Group

Kynoch Fertilizer (South Africa)

Yara International ASA

By Product

By Form

By Crop Type

By Region