Next-Generation IVD Market Size and Growth 2025 to 2034

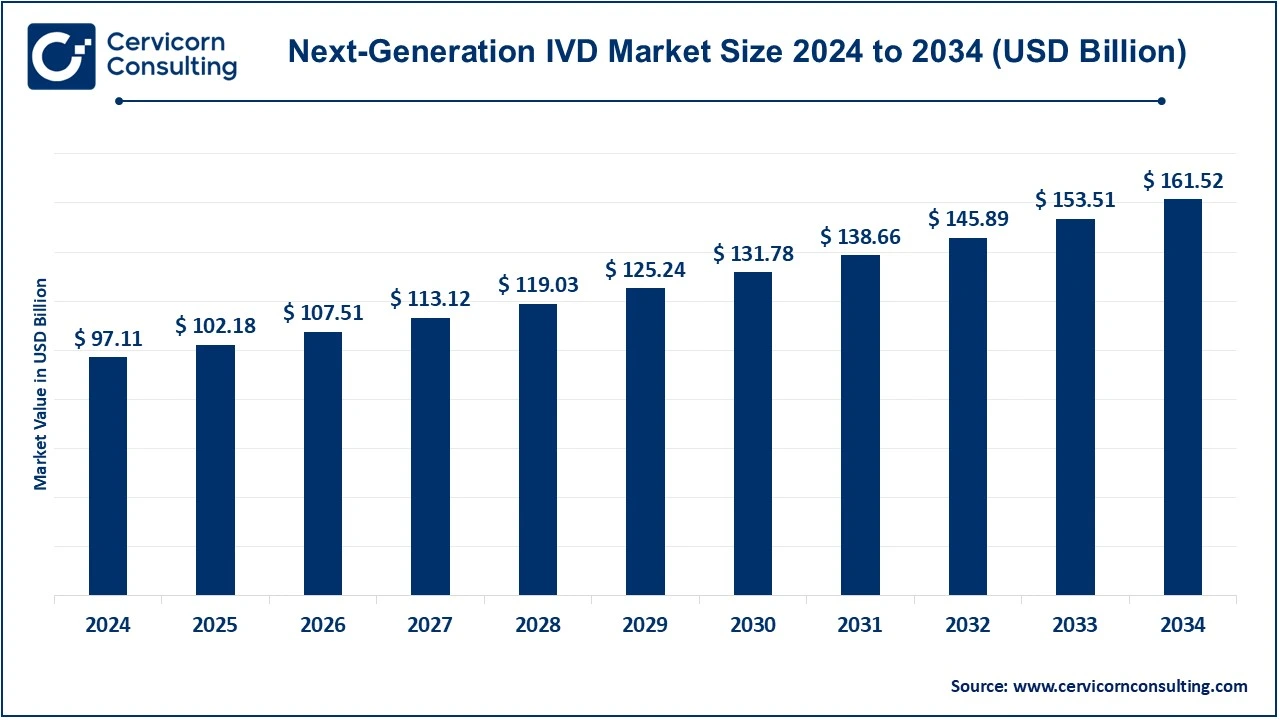

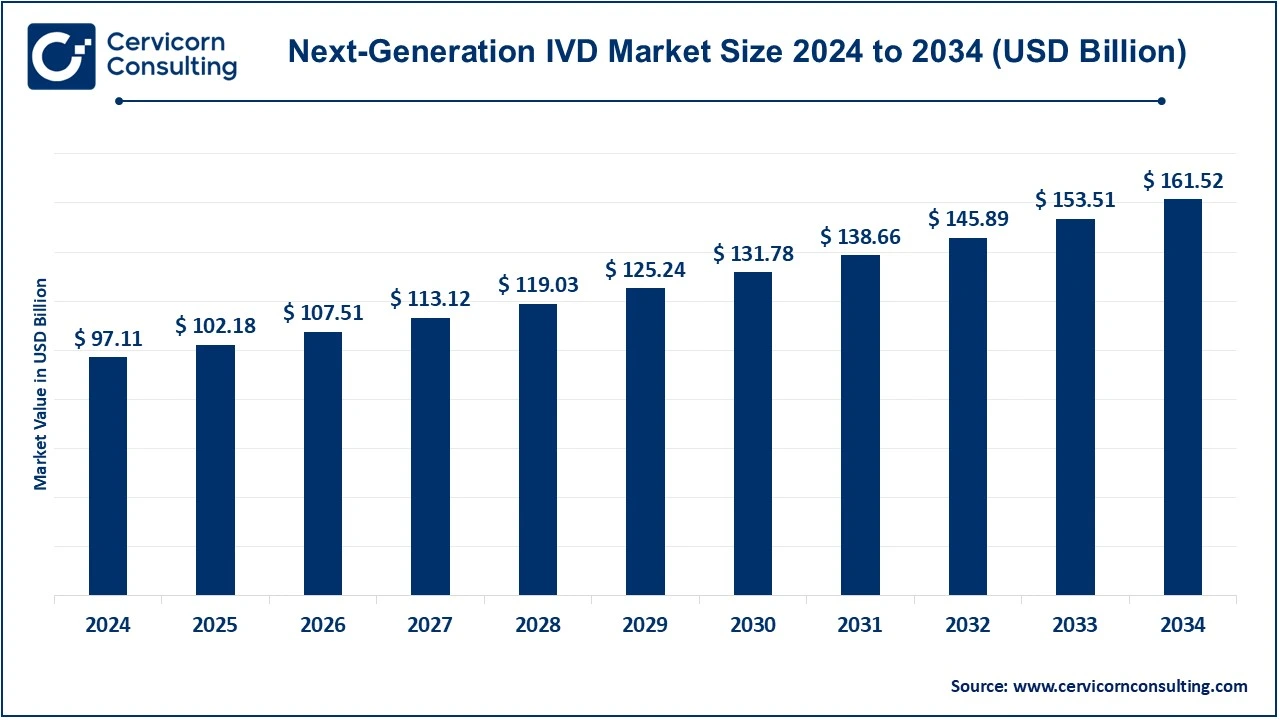

The global next-generation IVD market size was reached at USD 97.11 billion in 2024 and is expected to be worth around USD 161.52 billion by 2034, growing at a compound annual growth rate (CAGR) of 5.21% during the forecast period 2025 to 2034.

The next-generation IVD market is expanding significantly due to increasing chronic disease cases, technological advancements, and the growing need for fast and accurate testing. The rising adoption of personalized medicine and home-based diagnostic solutions further fuels market growth. Governments and healthcare organizations are investing heavily in research and innovation to enhance disease detection and treatment planning. AI and automation in diagnostics are also playing a crucial role in improving accuracy and efficiency. Additionally, the COVID-19 pandemic accelerated the demand for rapid diagnostics, leading to increased investments in point-of-care and molecular testing solutions. As awareness of early disease detection rises, more healthcare providers and patients prefer advanced IVD solutions, ensuring continued market expansion.

What is a Next-Generation In Vitro Diagnostics (IVD)?

Next-generation in vitro diagnostics (IVD) refers to advanced laboratory tests that analyze blood, tissues, and other biological samples to detect diseases and health conditions more accurately and efficiently. These diagnostics use cutting-edge technologies like molecular diagnostics, artificial intelligence (AI), and automation to improve disease detection, treatment planning, and patient monitoring. Unlike traditional IVD, next-generation IVD offers faster results, higher precision, and personalized medicine approaches, making healthcare more effective. These advanced diagnostics are widely used in detecting cancer, infectious diseases, and genetic disorders.

Key insights beneficial to the next-generation IVD market

- According to study, 80% of healthcare decisions rely on IVD, with next-gen diagnostics improving accuracy by 30-40%.

- The adoption of AI-driven IVD solutions has increased by 50% in the last five years.

- Over 60% of new diagnostic tests in development focus on next-gen molecular and digital diagnostics.

- The demand for point-of-care testing is expected to grow by 20% annually.

- NGS-based tests have reduced genetic testing costs by over 70%, boosting their adoption in precision medicine.

CEO Statements

Robert B. Ford, CEO of Abbott

"At Abbott, we are committed to advancing healthcare by pioneering innovative, next-generation diagnostic solutions that empower clinicians and patients alike. Our new-generation IVD technologies will provide faster, more accurate, and more accessible testing, helping to transform the way diseases are detected and managed. We’re excited about the possibilities these breakthroughs hold to improve patient outcomes and drive meaningful progress in global healthcare."

Alexandre Merieux, CEO of bioMérieux SA

“At bioMérieux, we are convinced that, only by¯taking into account our entire ecosystem and the¯public interest, will we be able to succeed in building a healthier world and a more inclusive society”.

Bernd Montag, CEO of Siemens Healthineers AG

"At Siemens Healthineers, we are committed to pioneering the next generation of in-vitro diagnostics, leveraging cutting-edge technology and AI to empower clinicians with more accurate, faster, and accessible diagnostic tools. Our goal is to enhance patient outcomes globally and drive a transformation in healthcare that prioritizes precision and efficiency."

Next-Generation IVD Market Report Highlights

- The U.S. next-generation IVD market size was valued at USD 33.58 billion in 2024 and is expected to reach around USD 55.85 billion by 2034.

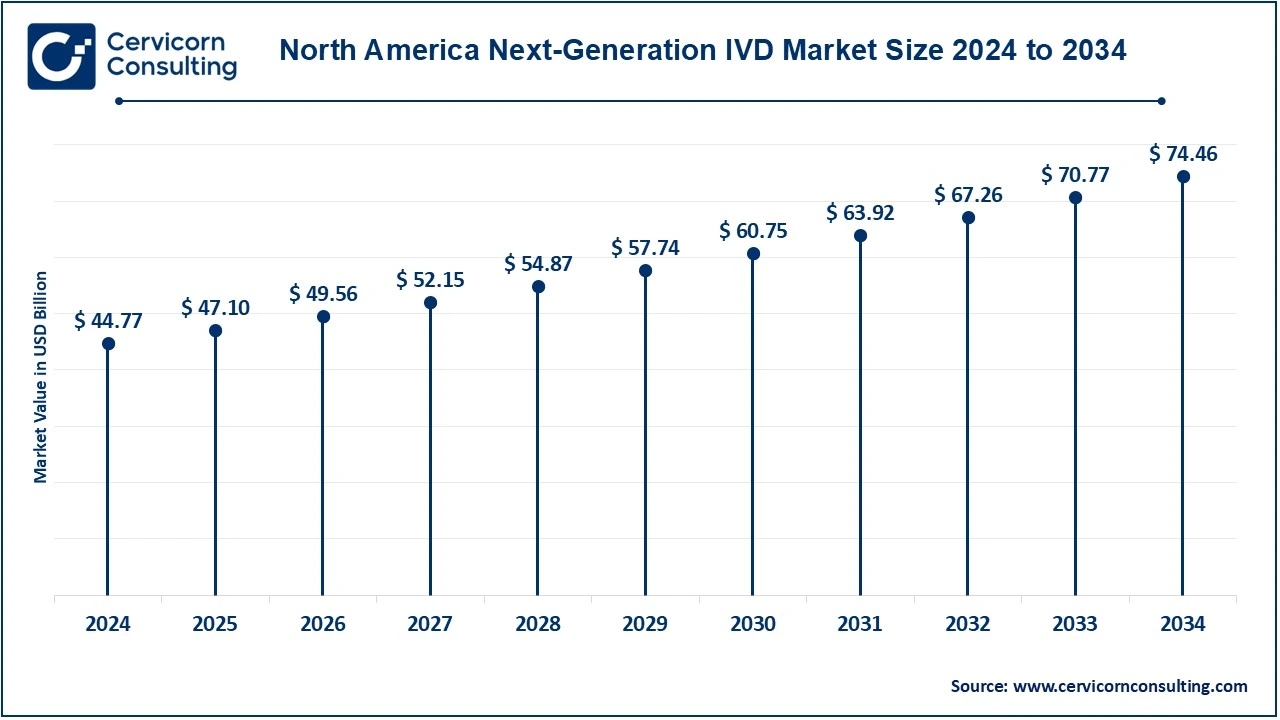

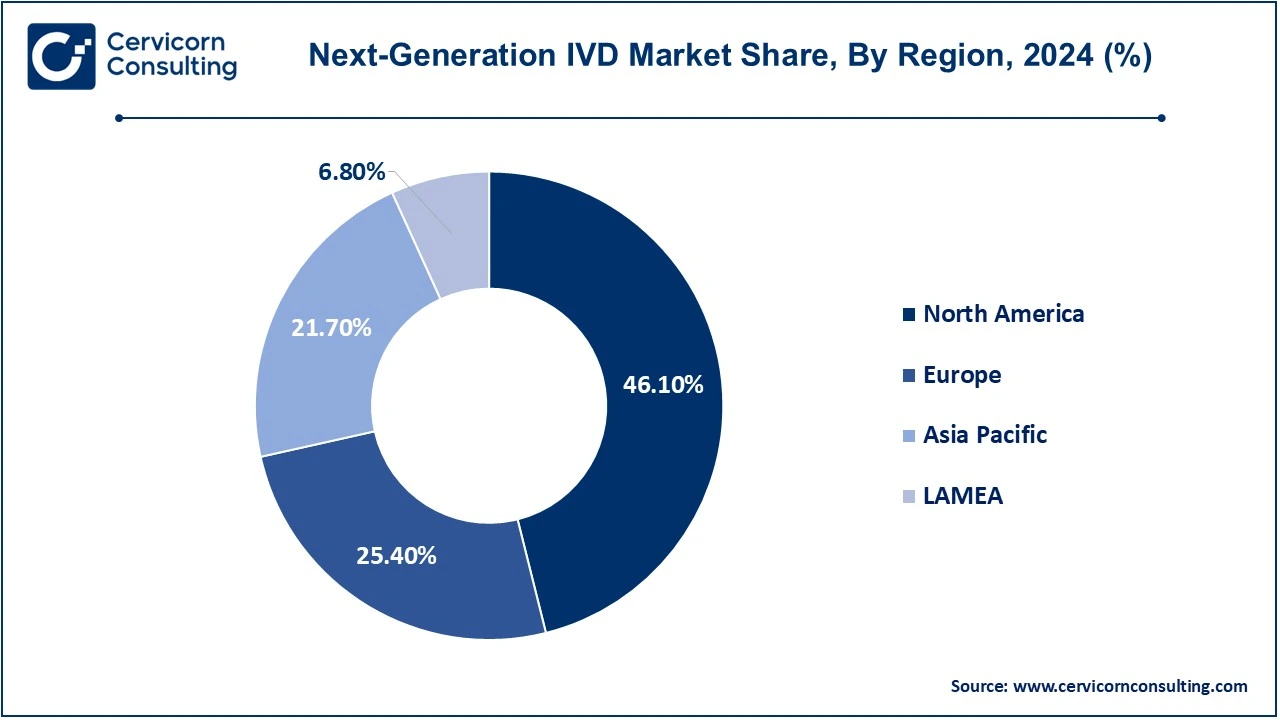

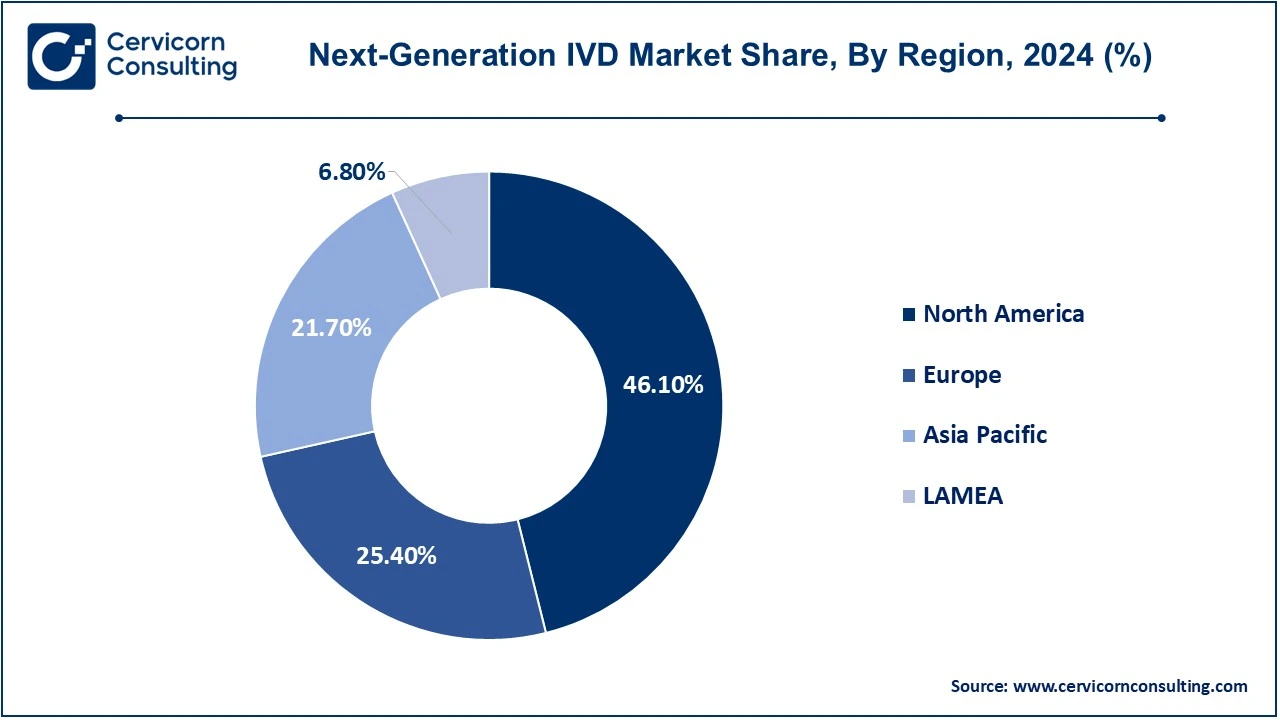

- North America led the market with a revenue share of 46.10% in 2024.

- Europe accounted for a revenue share of 25.40% in 2024.

- By product, the consumables segment has accounted revenue share of 65.40% in 2024.

- By type, the core laboratory diagnostics segment has captured revenue share of 68.72% in 2024.

- By end user, the hospitals & clinics segment has garnered revenue share of 43.21% in 2024.

- By application, the cancer segment has held highest revenue share of 33.86% in 2024.

Next-Generation IVD Market Growth Factors

- Advancements in Biotechnology: The increasing next-generation IVDs owe much to biotechnology, which has greatly changed them. Advanced biotechnology has helped provide an accurate diagnosis through NGS, CRISPR, and other molecular biology techniques as much faster, more cost-effective, and more precise diagnostic tests. Newer advances in molecular biology enable early and more precise detection of diseases at the molecular level that further directs towards highly personalized treatment options for better treatment. Advances in the sensitivity of detecting genetic mutations, variations, and biomarkers have transformed new IVD technologies and fueled market growth.

- Higher Incidence of Chronic Diseases: There is an increased prevalence rate for chronic diseases like diabetes, cancer, and cardiovascular and respiratory diseases, thus leading to a greater demand for diagnostic solutions. Again, this is an unavoidable result of health due to the impact of age and lifestyle through pathogenesis, hence confirming diagnostic tests as accurate, timely, and cost-effective at this point. Such chronic conditions have to be diagnosed much earlier and monitored continuously so that the treatment and management can become more effective; therefore, there is an increasing demand for next-gen IVD devices that can provide higher accuracy and faster results.

- Aging Population: The aging of the global population has also been one of the important growth drivers for the IVD market. Increased age implies increased susceptibility to geriatric diseases such as dementia, heart disease, and cancer. The demographic shift would come with an increased demand for diagnostic tools that can identify and monitor geriatric health conditions at stages where they are more likely to be well-treated and identified early. The demand is particularly high within the elderly population because of increased monitoring of chronic conditions with the help of home-testing solutions and point-of-care diagnostics that provide the possibility of continuous health monitoring within their confinements.

Next-generation IVD Market Trends

- Integration of AI and Data Analytics: This will serve as the foundation of the subsequent generations of IVDs. For example, AI can analyze vast data and detect patterns, thereby coming up with conclusions that are later used to further interpret accurately concerning the test. For example, the medical imaging industry's usage of AI algorithms comparing traditional methods in identifying abnormalities in a patient's picture results in a much more accurate forecast of patient outcomes. All this is built on the trend of using AI for diagnosis, which allows physicians and all other healthcare professionals to give timely, individualized care besides being able to reach faster, more accurate, and more efficient diagnoses.

- Personalized and Precision Medicine: Probably the most important trend in IVDs is the trend toward personalized, or precision, medicine. As genetic and molecular knowledge of diseases deepens, the need for diagnostic tests developed accordingly will deepen in response to the growing knowledge of individual patient profiles. Personalized diagnostics make it possible to detect diseases more reliably, predict prognosis, and establish proper treatment plans based on the genetic makeup of the patient, his environment, and lifestyle. All these trends will be driving growth for specialized diagnostic tests, like those for cancer, genetic disorders, and rare diseases, all of which represent the most promising growth areas for the IVD market in the future.

- Decentralized Testing: The next very crucial trend is the shift toward decentralized testing, point-of-care diagnostics, and home-based testing. Because the need for more rapid and easy-to-use diagnostic equipment is felt, the trend is increasingly shifting away from centralized laboratory testing to sites of testing at home, in outpatient clinics, or even remote ones. Among the involved devices are portable diagnostic kits, mobile health platforms, and wearables, all of which form a core part of the demand for decentralized testing solutions-all of which take precedence in today's modern world. These three exigencies teed up: rapid diagnosis, reduced healthcare costs, and greater patient convenience their demand needs to be reckoned with.

Report Scope

| Area of Focus |

Details |

| Market Size in 2024 |

USD 97.11 Billion |

| Projected Market Size in 2034 |

USD 161.52 Billion |

| CAGR 2025 to 2034 |

5.21% |

| Dominant Region |

North America |

| Accelerating Region |

Asia-Pacific |

| Key Segments |

Type, Product, Application, End User, Region |

| Key Companies |

Abbott, bioMérieux SA, QuidelOrtho Corporation, Siemens Healthineers AG, Bio-Rad Laboratories, Inc., Qiagen, Sysmex Corporation, Charles River Laboratories, Quest Diagnostics Incorporated, Agilent Technologies, Inc., Danaher Corporation, F. Hoffmann-La Roche Ltd. |

Next-Generation IVD Market Dynamics

Drivers

- Technological Innovation: Continuous technological advancement is pushing the next generation of IVD to the greatest degree to date. A new generation of technologies is transforming the way diseases are detected and monitored through artificial intelligence, machine learning, microfluidics, and molecular diagnostics. Artificial intelligence, for example, can be integrated into diagnostic equipment so they can analyze big data based on medical tests yielding high sensitivity or specificity for quicker decision-making. These technical developments are making diagnostics not only more accurate and accessible but also less costly and faster, all of which promote wider use.

- Rising Healthcare Costs: One of the primary motivators driving growth in the IVD market is the ever-increasing cost of healthcare, which compels the healthcare systems to resort to more efficient diagnostic solutions that may reduce the usage of costly and invasive procedures while cutting costs from improper diagnosis. Appropriate diagnostics prevents the execution of redundant treatments; unnecessary hospitalizations and emergency visits, thereby reducing the overall financial burden on healthcare systems. IVD tests offering faster, cheaper, and non-invasive alternatives as compared to conventional diagnostic methods are highly precious in controlling spending on healthcare and thus drive market growth.

- Public health needs: The need for a more sophisticated diagnostic solution arose from the growing concern about public health issues, particularly infectious diseases and cancer, as well as new and emerging global health challenges such as pandemics. The emergence of the SARS-CoV-2 virus pandemic has seriously focused attention on the rapidly increasing requirement for fast, accurate, and scalable tests. At the same time, public health issues have changed so that there is a greater need for IVD tools with capabilities to provide the earliest disease detection, monitoring of outbreaks, and efficient management of health care resources. Public health emergencies drive innovation in IVD technologies, demanding faster portable methods and more reliable diagnostic techniques.

Restraints

- High Development Costs: Next-generation IVD technologies are very expensive to develop. Sometimes, a high R&D cost may be challenging to firms. New technologies, especially genetic sequencing and AI-based systems, normally attract considerable R&D and regulatory approval costs. The scope for funding for small firms is less, and it may make the advanced high-tech diagnostic tools costly to healthcare providers in underdeveloped regions.

- Limited Reimbursement: Minuscule compensation opportunities for next-generation IVD tests keep them from spreading. In many healthcare systems, especially with stricter insurance policies among certain countries, it is not sufficient to compensate for advanced diagnostic tests on which patients would also then have to depend. Less than adequate compensation or pay may also make healthcare providers unwilling to adopt new IVD solutions, so it may have a limiting effect on the market expansion. Very relevant in high-cost IVD technologies, such as genomic tests or advanced diagnostic tools, which are too expensive for routine diagnosis and will be too pricey.

- Integration Challenges with Other Systems: It indeed proves to be very challenging in integrating the new IVD technologies into the available health infrastructures. Most of the hospitals, labs, and clinics are relying on legacy systems and processes that are not in harmony with the new diagnostic platforms. Managing data is complicated; so is managing the patient records and test results to get new diagnostic tools up and running. Training people on how to use new gadgets and compatibility with the EHR system could be costly and, therefore, may delay the adoption of advanced devices.

Challenges

- Delayed Approval by Regulatory Agencies: One of the biggest challenges to new next-generation IVD companies is receiving regulatory approval. The area would be critical to patients' health, and the U.S. FDA or the European Medicines Agency EMA would require particular safety, efficacy, and quality standards. The usually protracted and uncertain character of the approval process may delay product launches, increase development costs, and even affect the time-to-market for new diagnostic technologies. Moreover, this dynamic aspect of the regulatory processes and, in particular, for yet-to-be-fully-developed technologies, such as AI-based diagnostics and genetic testing, would only further complicate the process.

- Supply Chain Disruptions: Global disruption of the supply chain by natural catastrophes, political turmoils, or pandemics similar to COVID-19 will affect IVD device manufacturing and supply chains. Most diagnostic technologies employ high technology and special parts acquired from various parts of the world. Anyone breach in the supply chain only postpones the entire timeline for their production. These external shocks may result in shortages of diagnostic kits, delays in the roll-out of new products, and increased prices both to manufacturers and end-users. In this respect, the IVD market becomes vulnerable on account of its dependency on efficient and timely delivery of raw materials and components.

- Intellectual Property Concerns: Issues in Intellectual property now pose another grave challenge for companies in the market of next-generation IVDs. Innovations in technology in the diagnostics sector sometimes create problems related to patents and proprietary technologies, so, therefore, they must make sure that their innovations do not infringe on patents already in existence and at the same time ensure that their innovations are patented. The IVD product is technical and high technology-based. With rapid changes in technology, breakthroughs are often quickly implemented with potential patent challenges that can slow innovations and create legal impediments to market entry.

Opportunity

- Increased test sensitivity and accuracy: Next-generation IVDs are more sensitive and accurate, thereby allowing for earlier diagnosis and increased chances of disease treatment. Such technologies mean that tests can pick up on low concentrations of biomarkers, which reduces false positives and negatives. The result is better diagnostics with lesser repetition and much more prompt decisions for health care service providers. This is just what conditions such as cancers, cardiovascular diseases, and infections require because early diagnosis improves a patient's outcomes.

- Personalized medicine: The new generations of IVDs can support personalized medicine with customized diagnostic tests tailored for an individual's genetic and molecular profile. Such support calls on healthcare providers to do their best while avoiding mistake in treatment; they go a step higher to achieving better results from therapy. In cancer treatment, genetic testing can identify particular mutations for targeted therapies. With continuous progress in the fields of genomics and proteomics, personalized diagnostics will remain an increasingly powerful tool for optimum, highly specific, individualized care-perhaps most important in oncology and rare diseases.

- Global Health Applications: Next-generation IVDs could help address problems in global health by achieving inexpensive, rapid, and precise diagnostics in low-resource areas. These innovations enable swift tests for infectious diseases such as malaria, HIV, and tuberculosis and are applicable in regions with low infrastructural access to health care. Since these next-gen IVDs are portable and easier to use, they allow a wider deployment in remote settings for the better detection of disease, monitoring, treatment, and thus improved health outcome in the public.

Next-Generation IVD Market Segmental Analysis

The next-generation IVD market is segmented into type, product, application, end user, and region. Based on type, the market is classified into core laboratory diagnostics, point of care testing, and molecular diagnostics. Based on product, the market is classified into consumables, instruments, and software. Based on application, the market is classified into oncology, infectious diseases, diabetes, cardiology, and other. Based on end user, the market is classified into academic & research institutions, diagnostic laboratories, hospitals & clinics, and others.

Type Analysis

Core Laboratory Diagnostics: The core laboratory diagnostics segment has dominated the market in 2024. Advances in technology allow for the execution of core laboratory diagnostics in centralized facilities equipped with modalities such as PCR, NGS, and automated systems. They do everything from routine blood work to complex molecular analyses. In many instances, samples have to be processed centrally, and detailed diagnostic results obtained for diseases such as cancer, genetic disorders, or infections. These, therefore, form the core of the application of next-gen IVD technologies that necessitate specific equipment and expertise.

Point of Care Testing: In simple terms, POC testing refers to a diagnosis at or near the patient's location; for instance, a test done in a home or a clinic. The cornerstone of POC testing remains pregnancy tests and glucose meters. POC testing has gained popularity because it offers quick, cost-effective, and easy diagnostics that the consumer is demanding. Other innovations also include portable sensors and handheld PCR instrumentation that make possible the swift diagnosis of heart conditions, diabetes, infectious infections, and many others. Improved patient care is a byproduct of decisions being made at the speed with which they are now being made.

Molecular Diagnostics: Molecular diagnostics encompasses the techniques of diagnosing at the molecular level through any genetic material, such as DNA, RNA, or other forms of genetic material. One can detect genes carrying mutations, pathogens, and biomarkers with ultimate accuracy using techniques such as PCR and next-generation sequencing. This technology has become essential in personalized medicine, oncology, and infectious diseases. Early detection and disease monitoring will be important to build tailored treatment plans. That's why molecular diagnostics is being pushed toward the center stage of next-gen IVD technologies.

Application Analysis

Oncology/Cancer: The oncology/cancer segment has dominated the market in 2024. Next-generation IVD technologies belong to the oncology area, where early diagnosis of cancer is related to genetic profiling and supervision of anticancer treatment. The identified mutations are associated with cancerous growth, and their rate can be monitored non-invasively. Molecular diagnostics in cancer will become, step by step, an imperative for treatments via targeted therapies and immunotherapies, putting oncology at the top position when talking about next-gen IVD solutions.

Infectious Diseases: Rapid identification of pathogens that cause infections revolutionizes molecular diagnostics. These pathogens include viruses and fungi, and indeed various types of bacteria. Infected patients can be rapidly diagnosed using polymerase chain reaction and sequencing technologies. The control of prompt therapies further advances because of this. Rapid diagnoses have improved during the COVID-19 pandemic. It is still evolving with enhancements towards the diagnosis of novel infectious threats and antibiotic-resistant bacteria.

Diabetes: This relies on continuous glucose monitoring and molecular diagnostics in the care for diabetes improvement. They measure real-time glucose levels and enable patients to manage the disease condition better. Risk factors for complications of diabetes are indicated through genetic testing. Innovation is driving next-gen IVD tools for the monitoring of diabetes, which delivers more personal and proactive care.

Cardiology: New-generation IVD technologies in cardiology aid in cardiovascular disease diagnosis through the identification of new sensitivity biomarkers such as troponin, along with other genetic tests. The diagnostics can detect the conditions much earlier than ever-including myocardial infarction, heart failure, and arrhythmias. Genetic profiles and cardiac biomarkers result in better therapy that is more customized and leads to better results for patients.

Others: Other than the core area of oncology, infectious diseases, diabetes, and cardiology, the horizon IVDs are to be applied in neurology, maternal health, and genetics testing. Molecular diagnostics have been applied in neurodegenerative diseases such as Alzheimer's as well as in non-invasive prenatal testing-giving preliminary clues into fatal health issues. This versatility is opening the range of applications for IVD technology to a horizon that can include various medical fields.

Next-Generation IVD Market Regional Analysis

The Next-generation IVD market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region

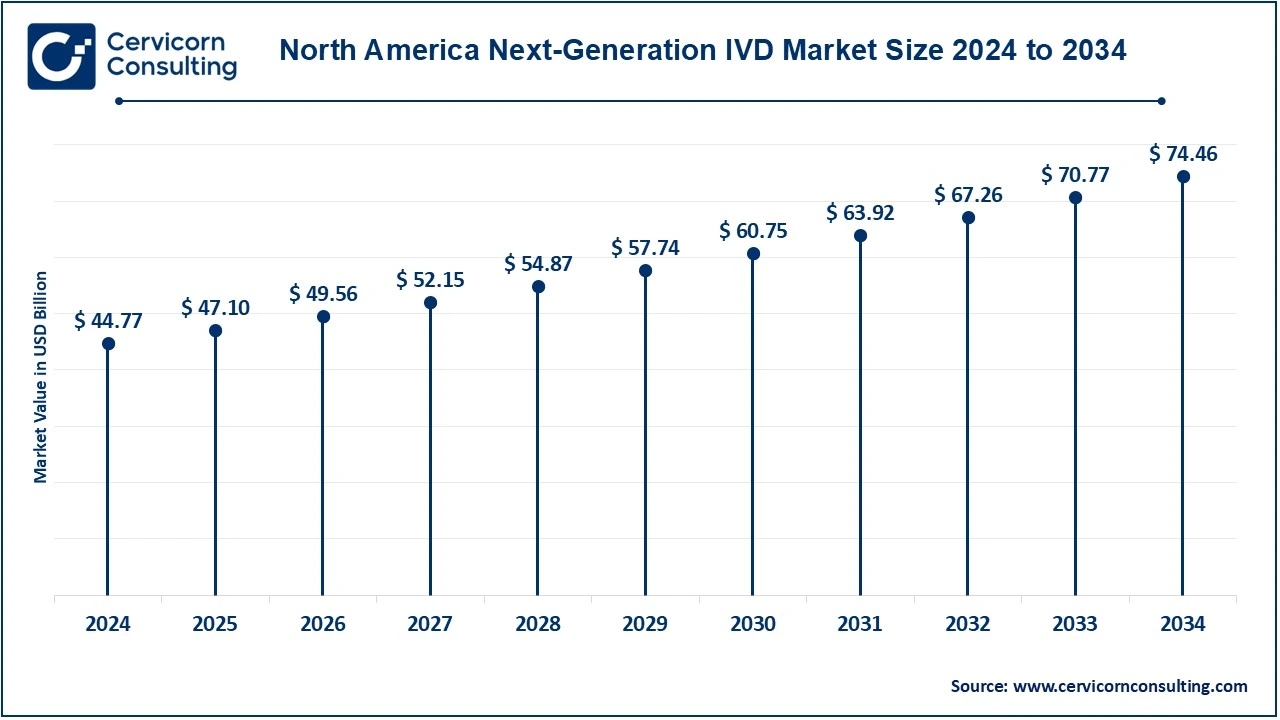

Why is North America key region for the next-generation IVD market?

The North America next-generation IVD market size was valued at USD 97.11 billion in 2024 and is expected to be worth around USD 161.52 billion by 2034. North American countries within that region targeted are the United States and Canada because of mature healthcare infrastructure, technological innovation, and high expenditure on healthcare. The U.S. houses major biotechnology companies and a dynamic ecosystem for health care for next-generation diagnostic technologies, molecular diagnostics, next-generation sequencing, and point-of-care testing. Canada also had an excellent healthcare system focused on precision medicine, which had been rapidly increasing demand for advanced diagnostic solutions, especially in oncology, cardiology, and infectious diseases. Favorable reimbursement policies and stricter regulatory frameworks further accelerate market growth in North America. Another country with strong healthcare systems, the focus here is precision medicine. In this context, the region demands innovative advanced diagnostic solutions, mainly in oncology, cardiology, and infectious diseases. Favorable reimbursement policies combined with a strong regulatory framework work in favor of the growth of the North American market.

Europe Next-generation IVD Market Growth

The Europe next-generation IVD market size was valued at USD 97.11 billion in 2024 and is expected to be worth around USD 161.52 billion by 2034. The Europe is also a large marketplace. Among European countries, Germany, the UK, France, and Italy stand on top of the list. These countries boast excellent healthcare systems, medical technology investment, and rising demand for personalized medicine. For instance, Avacta Group plc, October 2022, the clinical-stage oncology drug company whose product platforms are known by Affimer and preCISION, recently signed the acquisition of Launch Diagnostics Holdings Limited for a consideration of USD 25 million. Moreover, the acquirement would hold an earn-out of up to USD 13 million dependent on performance. According to the group, the acquirement represents the start of Avacta's M&A-driven growth strategy for its diagnostics division to establish an internationally integrated business for immunodiagnostics and molecular diagnostics. The company will exploit a fractured EU and UK market by buying firms that have complementary technology platforms to strengthen R&D and develop Avacta's diagnostics portfolio. Both the UK and France have public health systems, but much more developed, allowing for a broad uptake of sophisticated IVD solutions.

Why is Asia-Pacific hit rapid growth in the next-generation IVD market?

The Asia-Pacific next-generation IVD market size was valued at USD 97.11 billion in 2024 and is expected to be worth around USD 161.52 billion by 2034. Rapid growth is being seen in the still-emerging market in the APAC region due to increased healthcare needs, improvement in infrastructure, and growth in disposable incomes. India and China, with massive population bases and an increasingly growing healthcare system, are the two biggest markets to support the rise in demand for diagnostics, particularly in cases of chronic diseases such as diabetes, cancer, and cardiovascular disorders. Example: More than 100 million people in India are diabetic A new study published in the Lancet puts the number of people living with diabetes in India at 101 million - nearly 11.4% of the country's population. A survey commissioned by the health ministry also found that 136 million people - or 15.3% of the people - could be living with pre-diabetes. Type 2 is the most prevalent of this disease, wherein patients suffer from high blood sugar either due to their inability to produce sufficient amounts of insulin, the hormone, or not responding well to it. The leaders in terms of tech in healthcare with higher spending on healthcare and great innovation in diagnostic tools like NGS and molecular diagnostics, are Japan and South Korea.

LAMEA Next-generation IVD Market Growth

The LAMEA next-generation IVD market size was valued at USD 97.11 billion in 2024 and is expected to be worth around USD 161.52 billion by 2034. The adoption of IVD technology is slowly gaining pace and, currently, the LAMEA region Latin America, Middle East, and Africa maximum importance. Investment in health infrastructure of countries like Brazil, Mexico, and Argentina across communities of Latin American regions propel demands for advanced diagnostic tools, primarily by chronic patients with diabetes and cancer. Initiatives are underway in every nook and corner of the Middle East region, too--Saudi Arabia, United Arab Emirates, and Qatar among them, as the need for accurate diagnostics and targeted medicine grows. Thus, with an ever-growing point of interest towards integration of access and infrastructure around healthcare on the continent, diagnostics in Africa can prove to be extremely inexpensive, at least for infectious diseases.

Next-Generation IVD Market Top Companies

Recent Developments

Some of the recent new strategies and partnerships in the next-generation in vitro diagnostics (IVD) sector are driving innovation and partnerships significantly between leading industry players such as Abbott, bioMérieux SA, QuidelOrtho Corporation, Siemens Healthineers AG, and Bio-Rad Laboratories, Inc. These companies are leading the edge of diagnostic technology with real-time testing solutions through AI-driven platforms, molecular diagnostics, and point-of-care devices. Through partnering and acquisition, the combination of technologies for automated diagnostics, genomics, and microfluidics further energize to ensure speed, accuracy, and accessibility for diagnostics both from clinical and non-clinical sites. It is sure that in this dynamic IVD sector, the growing rate of innovation and collaboration underscores the need for even quicker, more precise, and customized solutions.

Some notable examples of key developments in the market include:

- In October 2023, Oxford Nanopore Technologies and bioMérieux have now agreed to launch a strategic partnership. Through the agreement, bioMérieux will invest USD 73.3 million in ONT and acquire up to an additional 3.5% of its shares. The investment will deepen collaboration between both parties in the in vitro diagnostics market that is established on earlier collaboration over the development of clinical applications. The Oxford Nanopore innovative nanopore sequencing technology, which permits real-time, high-accuracy analysis of DNA/RNA, will be the centre of focus between both firms in terms of bioMérieux IVD R&D, regulatory affairs, and market access. The merged entity shall form an IVD Advisory Board that propagates the adoption of nanopore-based solutions for clinical applications primarily in the characterization of pathogens.

- In November 2023, Veracyte and Illumina together worked to develop molecular tests for decentralized IVD applications. Companies are focusing on developing the Veracyte Percepta nasal swab and the Prosigna test for breast cancer.

- In February 2023, Janssen Biotech Inc. collaborated with F. Hoffmann-La Roche Ltd. to combine companion diagnostics for a targeted therapy. A few of these technologies include digital pathology, PCR, NGS, immunohistochemistry, and immunoassays.

Market Segmentation

By Type

- Core Laboratory Diagnostics

- Point of Care Testing

- Molecular Diagnostics

By Product

- Consumables

- Instruments

- Software

By Application

- Oncology/Cancer

- Infectious Diseases

- Diabetes

- Cardiology

- Other Applications

By End User

- Academic & Research Institutions

- Diagnostic Laboratories

- Hospitals & Clinics

- Others

By Region

- North America

- APAC

- Europe

- LAMEA