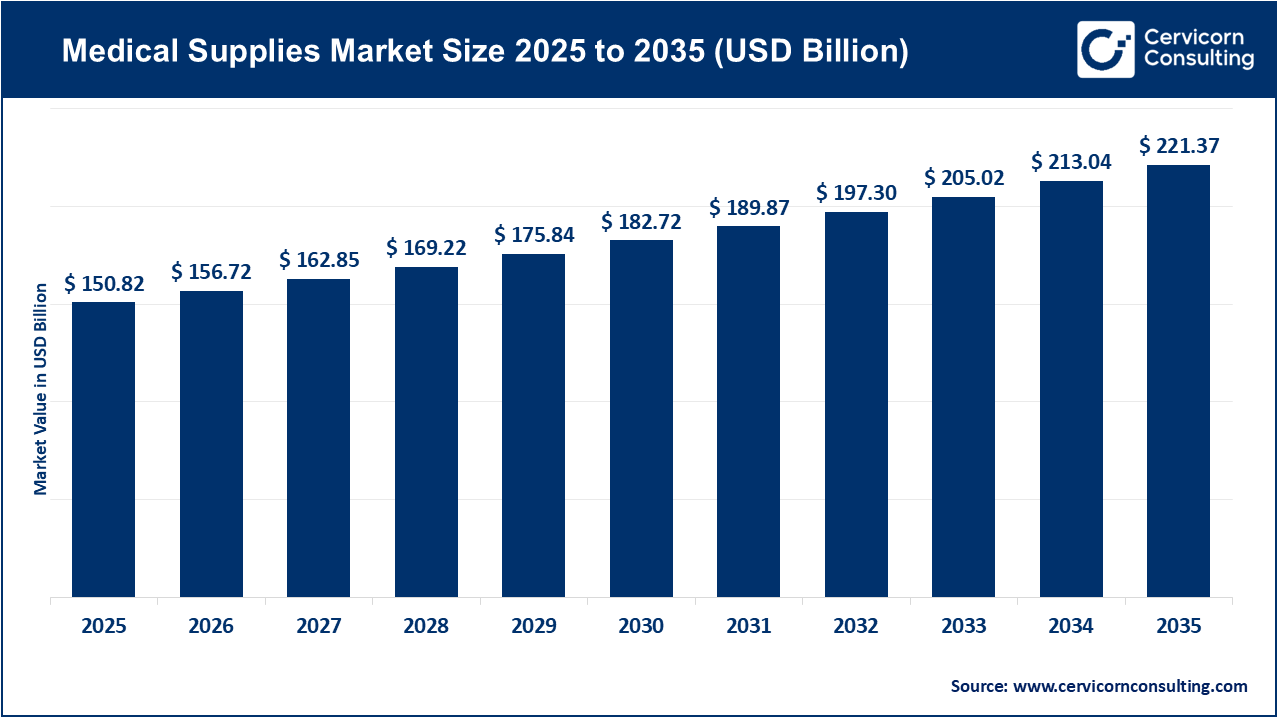

The global medical supplies market size was valued at USD 150.82 billion in 2025 and is expected to be worth around USD 221.37 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 3.9% over the forecast period 2026 to 2035. The medical supplies market is growing steadily because healthcare needs are increasing across the world. The increasing number of people who suffer from chronic illnesses are requiring medical supplies (such as gloves, syringes, wound care products, as well as basic diagnostic tools) for long periods of time in order to receive ongoing treatment. The increase in the number of hospitals and clinics, as well as the growing number of home health care providers have also contributed to the growth of the medical supplies market by creating a demand for medical supplies. The increasing government funding for healthcare and the more affordable access to these services has also aided in the overall growth of this market.

Advancements in technology have also contributed to the growth of the medical supplies market, particularly because healthcare systems are becoming more focused on improving the safety and efficiency of care delivery. With stricter infection control measures now being implemented and enforced in all hospitals and clinics, the number of disposable and single-use supplies being utilized has increased significantly. The growing awareness of hygiene, patient safety, and disease prevention has further driven demand for these essential medical supplies. In addition, the emergence of home healthcare services and remote patient monitoring has created the need for portable and easy to use medical products. Continuous product innovations and efficient supply chain management allow for continued success in the medical supplies market.

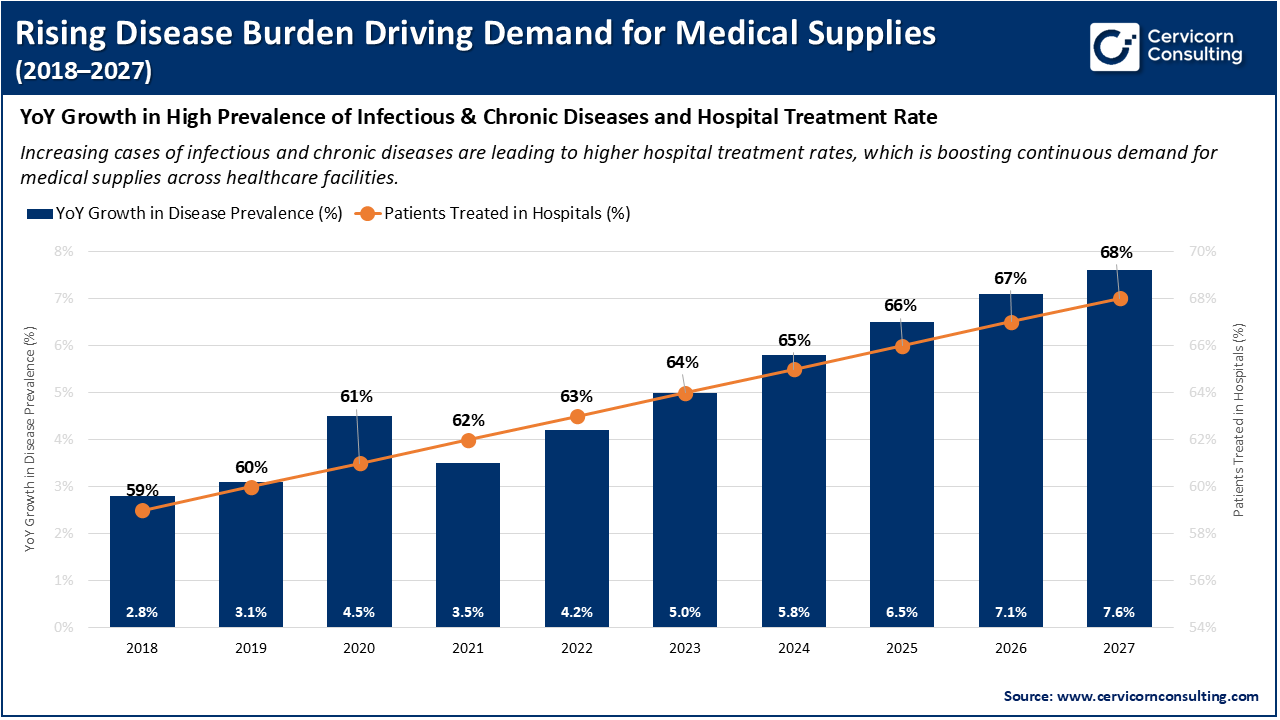

High Prevalence of Infectious and Chronic Diseases Driving the Medical Supplies Market

Infectious and chronic diseases are a driving force behind the growth of the medical supplies market due to their need for ongoing diagnosis, treatment, and prevention. The increase in infectious diseases results in increased demand for protecting equipment, testing kits, syringes and disinfectants, as well as other disposable medical supplies to help prevent the transmission of infections. Chronic diseases, including diabetes, cardiovascular disorders and respiratory illnesses require continuous medical care over the long term and thus require continued use of monitoring devices, wound care products and injection supply products that are used repeatedly by those patients. Additionally, the growing number of patients has placed a burden on healthcare systems, which has led to an increased need for reliable and readily available medical supplies to meet their needs. As providers focus on improving health outcomes for their patients and controlling infection, the medical supply market has experienced consistent growth over time.

1. Meril Life Sciences expands domestic-manufacturing footprint & introduces new devices

In 2024–2025, Meril Life Sciences opened a new plant as part of the government’s production-linked incentive programme and introduced innovative products, including a new robotic surgical system it developed in India and a new transcatheter mitral valve repair device. The opening of this new factory will improve production efficiencies and volume of domestic medical device manufacturing while decreasing the need for imported products. More advanced medical products are now more easily accessible to physicians and patients as a result. Additionally, Meril Life Sciences is helping to increase the diversity of products produced in India, which will reduce prices and shorten time frames for suppliers to reach the market with the latest innovations.

2. Wipro GE Healthcare commits large investment to R&D and manufacturing in India

Wipro GE Healthcare has invested approximately USD 960 million in research and development and manufacturing within India to enhance their research & development and manufacturing capabilities and produce advanced diagnostic equipment such as CT (computed tomography), PET/CT (Positron Emission Tomography) scanners, etc. This investment allows companies to increase the number of medical devices and consumable items made in the country, thereby providing greater access to medical devices and consumable items. It will also lead to a growth of the overall medical supplies industry as availability and cost of medical supplies and equipment increase while increasing demand for medical supplies and consumption of said medical supplies.

3. Government policy push: Make in India–style support and stronger regulatory framework for medical devices

The government reaffirmed its commitment to turn India into a MedTech hub by focusing on domestic production of medical devices and consumables in 2025. In addition to this effort, the government has put in place incentives for new businesses, funding opportunities for companies starting up and regulatory reform to promote local production. The combination of these efforts reduces reliance on importation of products and encourages home-grown companies. This environment promotes the growth of new medical supplies manufacturers through providing an opportunity for investment, innovation and increased production capacity, therefore creating a more stable supply chain for medical supplies, ultimately driving growth in the medical supplies market.

4. MarkEn HealthTech & Rexton forge global manufacturing partnership to expand medical supplies production

Marken HealthTech and Rexton, two global leaders in medical manufacturing, joined forces in early 2025 with the goal of creating greater international capacity for the production of medical devices and consumables worldwide. The collaboration between Marken HealthTech and Rexton expands the production capabilities for medical supplies, particularly in Asia, Africa, and Europe. This will provide more availability of critical medical supplies to areas that may have previously experienced shortages or delays. Moreover, through bolstering cross-regional capabilities for manufacturing and distributing, this partnership will conserve energy within the supply chain by reducing bottlenecks, thus supporting ongoing expansion of the market for medical supplies.

Report Scope

| Area of Focus | Details |

| Market Size in 2026 | USD 156.72 Billion |

| Estimated Market Size in 2035 | USD 221.37 Billion |

| Projected CAGR 2026 to 2035 | 3.9% |

| Dominant Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Key Segments | Type, Application, End User, Region |

| Key Companies | Abbott, Cardinal Health, Inc., BD, Johnson & Johnson, Medtronic, B. Braun Melsungen AG, Thermo Fisher Scientific, Inc., Boston Scientific Corporation, Baxter International, Inc., Smith & Nephew, Avanos Medical, Inc., ConvaTec Group Plc., Teleflex Incorporated |

The medical supplies market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

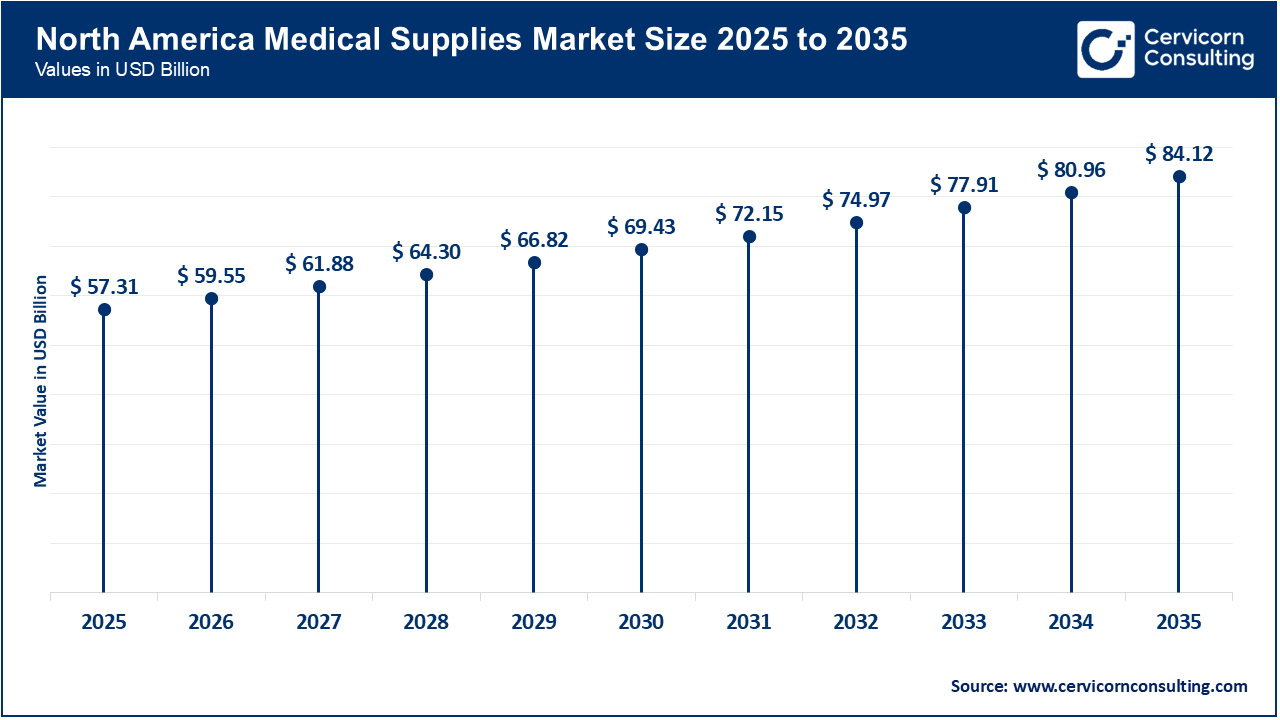

The North America medical supplies market size was valued at USD 57.31 billion in 2025 and is expected to be worth around USD 84.12 billion by 2035. North America is leading region, owing to the development of a well-consolidated healthcare system, significant investment in healthcare, and the rising prevalence of chronic disease due to the ageing population. North American hospitals use many different types of medical supplies that include advanced medical supply technology, particularly with respect to PPE and infusion, diagnostic, and other disposable supplies, in hospital, outpatient, and home care environments. The established distribution and reliable reimbursement systems give manufacturers confidence in fulfilling the high demand for medical supplies in North America.

Recent Developments:

The Asia-Pacific medical supplies market size was estimated at USD 36.20 billion in 2025 and is forecasted to hit around USD 53.13 billion by 2035. The Asia-Pacific market has emerged as the fastest-growing market. This growth has been generated by the increased demand for a wide variety of products which have leads to government and private sector investment into strengthening healthcare systems across emerging nations and will continue to provide opportunities for the producers and distributors of medical supplies.

Recent Developments:

The Europe medical supplies market size was accounted for USD 42.23 billion in 2025 and is projected to surpass around USD 61.98 billion by 2035. The medical supply industry continues to thrive in Europe due to its growing population, its many strict regulations on manufacturing and the manufacture of healthcare products, and its culture of commitment to quality in healthcare. As a result of the high levels of infection control, sterilization, patient safety and quality control in healthcare, there is a continuing need for personal protective equipment, disinfectants, and sterilizing consumables, as well as other medical supplies, by hospitals and clinics in Europe. In addition, Europe also has a large share of the global market for contract manufacture and supply chain services for medical devices and consumables.

Recent Developments

Medical Supplies Market Share, By Region, 2025 (%)

| Region | Revenue Share, 2025 (%) |

| North America | 38% |

| Europe | 28% |

| Asia-Pacific | 24% |

| LAMEA | 10% |

The LAMEA medical supplies market was valued at USD 15.08 billion in 2025 and is anticipated to reach USD 22.14 billion by 2035. The medical supply industry is expected to flourish in LAMEA as healthcare systems are beginning to invest in their infrastructure and services. With rising healthcare costs, increasing prevalence of chronic diseases, and an overall increase in the demand for medical supplies, there will be an increased need for basic and essential medical supplies such as disinfectants, PPEs, infusion/injectable supplies, and wound care/gauze supplies. The LAMEA region has high potential for growth because increased supply chain development will create greater access to medical supplies in both the public and private sectors.

Recent Developments:

The medical supplies market is segmented into type, application, end user, and region.

Personal Protective Equipment (PPE) has emerged as the largest segment, with its high usage across healthcare settings in hospitals, clinics, and labs. PPE items such as gloves, masks, gowns, and face shields will continue to be required in daily healthcare operations. A high emphasis on infection control policies and an increase in awareness of safety for healthcare workers has helped to maintain continual demand for PPE products. Additionally, with continued high levels of disposables being discarded frequently, this segment continues to maintain its leading position in this market.

Medical Supplies Market Share, By Type, 2025 (%)

| Type | Revenue Share, 2025 (%) |

| Diagnostic Supplies | 16% |

| Disinfectants | 9% |

| Infusion & Injectable Supplies | 14% |

| Catheters | 10% |

| PPE | 17% |

| Wound Care Consumables | 11% |

| Sterilization Consumables | 7% |

| Radiology Consumables | 6% |

| Dialysis Consumables | 5% |

| Others | 5% |

The diagnostic supplies is fastest-growing segment of the medical supplies market due to the increasing need for rapid and accurate detection of diseases. Increasing occurrences of testing for infectious and chronic diseases has resulted in increased demand for testing kits, reagents, and sample collection items. Furthermore, the increasing adoption of point-of-care testing and routine health screenings continues to support rapid growth within this segment. The adoption of improved diagnostic technologies has further supported the growth of this segment.

Infection control is the leading area within the medical supplies market. All healthcare procedures require the use of this application, with disinfectants, PPE, sterilization supplies, and consumables being utilized on a daily basis to reduce hospital acquired infections. In addition to the strong demand from this segment, the demand is reinforced through strict hygiene regulations and patient safety standards. Therefore, infection control is a critical segment for both hospitals and clinics.

Medical Supplies Market Share, By Application, 2025 (%)

| Application | Revenue Share, 2025 (%) |

| Infection Control | 20% |

| IVD | 17% |

| Wound Care | 14% |

| Radiology | 12% |

| Cardiology | 11% |

| Respiratory | 10% |

| Urology | 8% |

| Others | 8% |

IVD is the fastest growing application within the medical supplies market due to growing volumes of diagnostic testing. As chronic and infectious diseases continue to increase, there will be continued growth in laboratory testing to diagnose these illnesses. Personalised healthcare and preventative medicine will further support the growth of this application. Adoption of rapid and accurate diagnostic testing solutions will also contribute to the growth of the IVD segment.

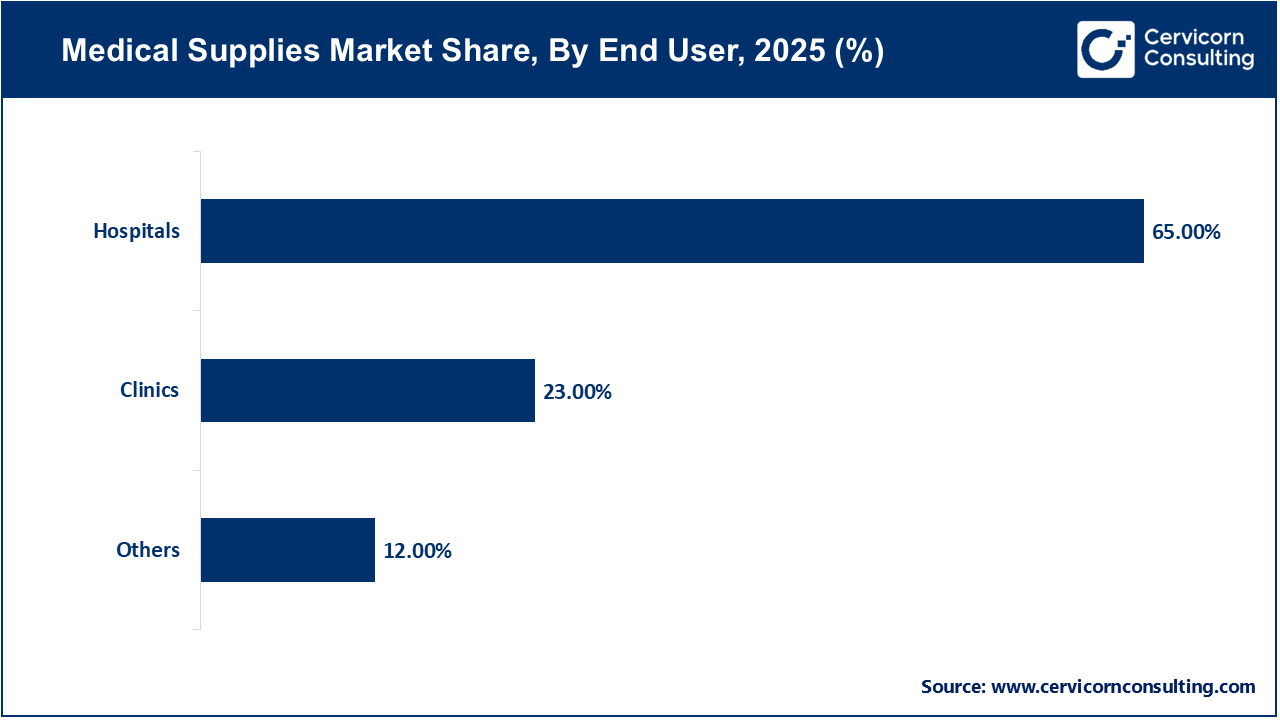

Hospitals are the leading end-user in the medical supplies market because they are the premier locations for all diagnosis, treatment, surgery, and all other medical procedures. Hospitals utilize huge amounts of medical supplies on a daily basis. Hospitals require infusion, catheterization, disinfectant and wound dressing medical products in high volume on a daily basis. Because of the high number of patients, along with the complicated nature of the medical care they are providing, the need for medical supplies increases as hospitals continue to expand their facilities and services.

Clinics are the next fastest growing end-user segment. Clinics are becoming more popular than ever with outpatient care, as a greater number of patients are turning to clinics to receive quicker and less costly medical attention, as well as to schedule follow-up routine checkups. The growing number of specialist clinics generates a greater need for diagnostic, wound care, and infection control medical supplies. This evolution supports the continued growth of the clinic segment of the medical supplies market.

By Type

By Application

By End User

By Region