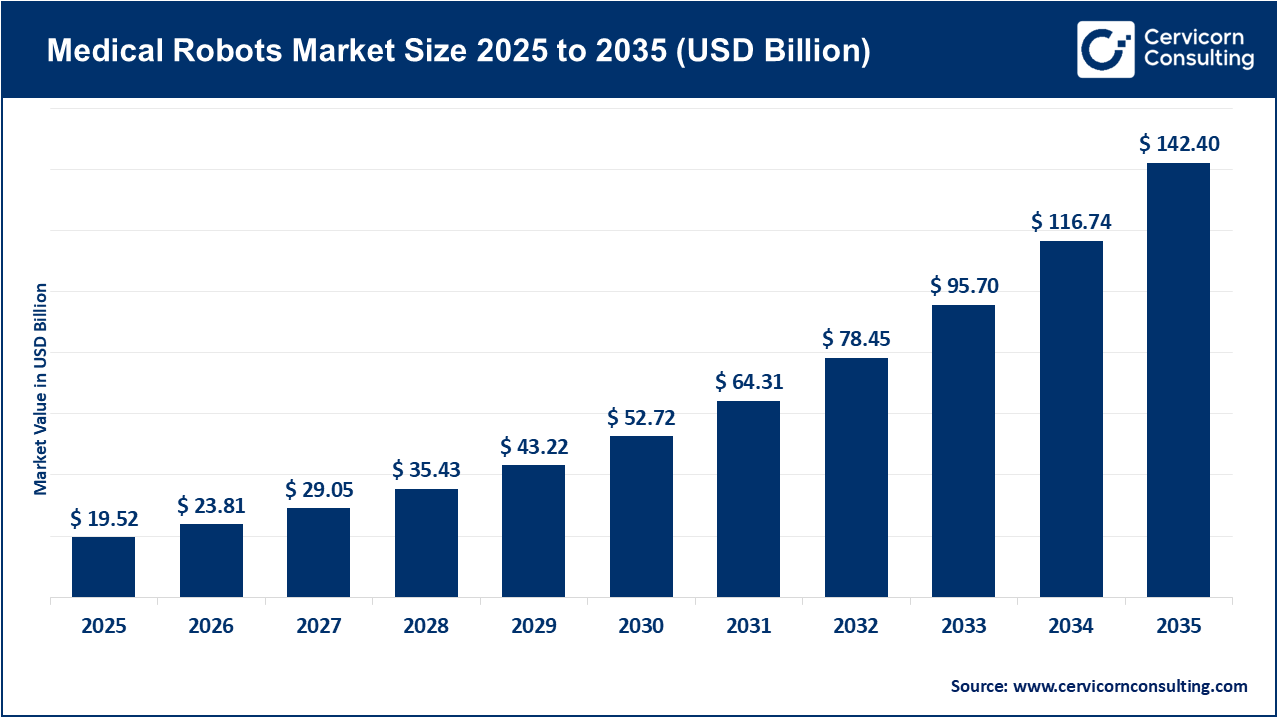

The global medical robots market size was estimated at USD 19.52 billion in 2025 and is expected to surpass around USD 142.40 billion by 2035, exhibiting a compound annual growth rate (CAGR) of 21.98% over the forecast period from 2026 to 2035. The medical robots industry continues to expand due to increased demand for robot-assisted systems that deliver greater accuracy, effectiveness, and better outcomes for health care providers. It is expected that by 2030 there will be a shortage of at least 10 million health care professionals within the world health care system and the gap is much larger in specialty areas. For instance, in the U.S. alone, the number of ophthalmology surgeons is predicted to decline by 12% from 2035 whereas the demand for surgical care in this specialty will grow by 25% almost concurrently. Globally, the aging population and chronic disease burden, along with expanding surgical care requirements, will outpace the speed of training new doctors/supportive clinicians.

There has been an accelerated movement towards the use of minimally invasive surgery, increasing demands for robotic rehabilitation and assistive devices, along with the incorporation of advances in Artificial Intelligence (AI), Machine Learning, and real-time imaging technologies to create medical robots which are becoming more accurate, dependable, as well as versatile. As the performance of AI-driven surgical navigation, robotic vision systems, and cloud connected robotic systems increases, hospitals will continue to upgrade traditional surgical techniques, which will contribute to further market growth of robotic-assisted techniques.

Medical Robots Market Strengthens Healthcare Delivery and Drives Industry Growth

The global medical robots market is rapidly expanding as hospitals, clinics, and healthcare systems increasingly adopt robotic systems to enhance precision, improve patient outcomes, and streamline operational workflows. Medical robots spanning surgical, rehabilitation, diagnostic, pharmacy automation, and service robots are making advanced procedures more accessible and efficient, helping reduce human error and shorten recovery times.

By utilizing highly accurate and minimally invasive procedures, medical robotics are expected to interest both patients and providers within the healthcare system equally. Using artificial intelligence, real-time imaging, machine learning, and sensor-assisted systems, these robots will be capable of performing complex surgical procedures, assisting with rehabilitation therapies, aiding in automated pharmacy dispensing, and providing logistical support, i.e., transporting between locations in hospitals, Emergency Departments, and other healthcare organizations. These technological advancements are leading to increased acceptance among facilities to adopt robotics; the higher usage of robotics will facilitate the growth of several specialities' procedural Volumes.

With more robotics integrated into surgical suites, Robotic-Assisted Minimally Invasive Procedures (RAMIP) have become a significant driver of this technology's adoption by surgical providers, thanks to the benefits they offer (smaller incisions, less blood loss, and faster recovery). The justification for the higher initial cost of robotic equipment stems from the long-term efficiencies gained through improved clinical outcomes. Additionally, Rehabilitation Robotics (RR), Tele-presence (T-P), and Hospital Robotics (HR) are emerging as hybrid, multifunctional systems designed to assist with manual hospital tasks, such as pharmacy deliveries and cleaning, and to support more integrated care delivery.

North America accounts for the largest share of revenue in the medical robots market due to its advanced healthcare system and extensive use of robotic surgical systems. Meanwhile, the Asia-Pacific region is experiencing rapid growth fueled by increased investment in healthcare technology. Furthermore, Europe and other regions continue to expand through the development of new clinical applications and rising healthcare expenditures.

Market Insights:

1. First Fully Robotic Heart Transplant in the U.S. Demonstrates Next-Gen Surgical Capability

On March 3, 2025, Baylor St. Luke’s Medical Center in Houston, Texas, performed the first full robotic heart transplant in the US. This milestone event marks the first time an entire heart has been replaced by an advanced robotic surgery technique (a computerized system that works in conjunction with a surgeon). This procedure utilized advanced 3D imaging and robotic systems to allow the surgeon to complete the transplant with minimal incisions and eliminate the potential complications from open heart surgery. The success of this surgery strengthens the confidence of clinicians in utilizing robotic surgical techniques, which will lead to increased adoption by many advanced medical care facilities across the United States.

2. Breakthrough AI-Guided Autonomous Surgery Platform Unveiled

On September 8, 2025, Levita Magnetics announced the world’s first autonomous robotic surgical platform powered by AI named MARS (Magnetic/A.I. Robotic Surgery). MARS is the first of its kind to utilize both magnetic and robotic technologies to perform surgical procedures through smaller incisions while significantly reducing the number of trained personnel required. MARS is a revolutionary leap forward in robotic surgical technology and will have major implications for future standards of practice and the surgical treatment of bariatric and gallbladder conditions, as well as other common surgical procedures.

3. Strategic Robotics Acquisitions Expand Capabilities and Product Portfolios

As evidence of the growing interest in robotics in medicine, Zimmer Biomet made a significant strategic acquisition on July 10, 2025, by purchasing Monogram Technologies for approximately USD 177 million. This acquisition enhances Zimmer Biomet's product offerings and capabilities with the addition of both semi-autonomous and fully-autonomous robotic technologies for orthopedic surgery.

4. Next-Gen Robotic Platforms Receive Regulatory Clearances

The 2025 regulatory landscape for medical robots saw multiple high-impact approvals:

5. Major Surgical Systems Achieve Global Regulatory and Market Expansion

Several robotic platforms have broadened international availability:

Report Scope

| Area of Focus | Details |

| Market Size in 2026 | USD 23.81 Billion |

| Market Size in 2035 | USD 142.40 Billion |

| CAGR 2026 to 2035 | 21.98% |

| Dominant Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Key Segments | Type, Product Type, Technology, Distribution Channel, Application, End Users, Region |

| Key Companies | Intuitive Surgical, Inc., Medtronic plc, Stryker Corporation, Siemens Healthineers AG,, Johnson & Johnson (Ethicon) Zimmer Biomet Holdings, Inc., Omron Corporation, Verb Surgical Inc., Toshiba Medical Systems Corporation, Hitachi, Ltd., Cyberdyne, Inc., Panasonic Healthcare Co., Ltd., Globus Medical, Inc., Accuray Incorporated |

The medical robots market is segmented by region into North America, Europe, Asia-Pacific, Latin America, and LAMEA. Here is a brief overview of each region:

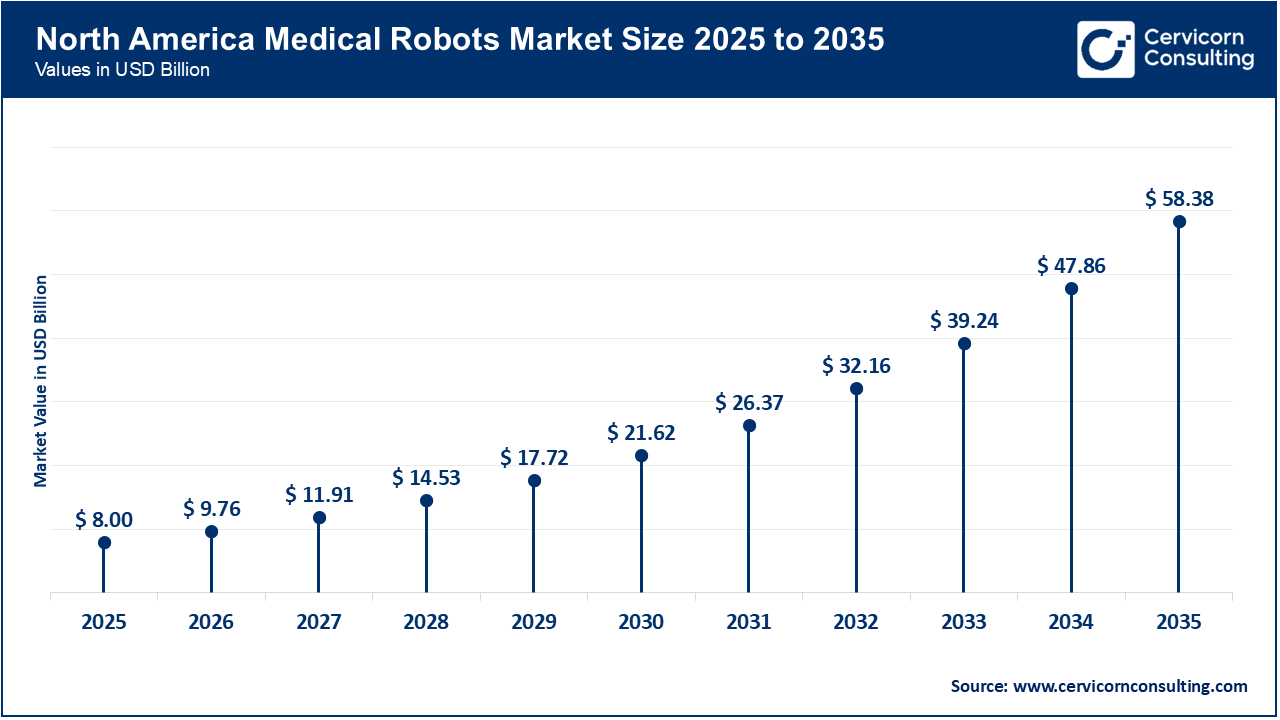

The North America medical robots market size was reached at USD 8 billion in 2025 and is predicted to hit around USD 58.38 billion by 2035. North America is the largest regional market, accounting for over 40% of global market share. Factors such as a well-established healthcare system, high hospital spending on new medical technologies, and early adoption of advanced medical technologies have driven North America's dominance in this sector. Hospitals, ambulatory surgical centres, and rehabilitation centres are employing robotic surgical systems, automated hospitals, and diagnostic robots to provide patients with greater accuracy, increased efficiency, and improved outcomes. Additionally, North America benefits from substantial investments in research and development (R&D), established medical device manufacturers, and supportive regulatory conditions. There is also a high level of digital literacy among healthcare professionals in North America, along with extensive knowledge related to robotics.

Recent Developments:

The Asia-Pacific medical robots market size was accounted for USD 6.44 billion 2025 and is forecasted to grow around USD 46.99 billion by 2035. The Asia-Pacific market is the fastest-growing global market, driven by developing healthcare systems, a rising middle-income population, and increasing government investment in new medical technology. Countries like China, Japan, South Korea, and India are quickly adopting surgical robots, rehabilitation equipment, and hospital automation solutions. The high volume of procedures, growing awareness of minimally invasive techniques, and the increasing demand for remote healthcare services all contribute to the market’s rapid expansion. The expansion of local manufacturing capabilities and partnerships between local and international robotics companies will continue to promote adoption across Asia-Pacific.

Recent Developments:

The Europe medical robots market size was reached at USD 3.12 billion in 2025 and is projected to hit around USD 22.78 billion by 2035. The Europe is driven by the commitment to provide high-quality and effective medical care through technology. The need for better patient outcomes, combined with increasing investments in automation and surgical robotics by hospitals, continues to fuel a rapid rise in the adoption of surgical and rehabilitation robotic systems. The introduction of new regulations and the formation of strategic partnerships between hospitals and universities have further facilitated ongoing technological advancements through collaboration among numerous research groups, resulting in a regulatory framework that encourages innovation. The European healthcare system remains central to these activities and is considered a key factor in shaping the future of both medical and technological progress.

Recent Developments:

Medical Robots Market Share, By Region, 2025 (%)

| Region | Revenue Share, 2025 (%) |

| Asia-Pacific | 33% |

| North America | 41% |

| Europe | 16% |

| LAMEA | 11% |

The LAMEA medical robots market was valued at USD 1.95 billion in 2025 and is anticipated to reach around USD 14.24 billion by 2035. The medical robots market in the LAMEA region is steadily expanding due to increasing urbanization, improved healthcare infrastructure, and greater adoption of information technology (IT) and digital technologies in healthcare. In LAMEA, hospitals and other healthcare facilities are making significant investments in surgical robots, rehabilitation platforms, and pharmacy automation. Demand is driven by the growth of telemedicine, the development of smart hospitals, and various government initiatives aimed at modernising healthcare delivery. Although the use of medical robots in these regions remains lower than in developed markets, the growth of robotics has been supported by the availability of affordable robotics, access to financing, and partnerships between local and international robotic manufacturers.

Recent Developments:

The medical robots market is segmented into type, product type, technology, distribution channel, application, end users, and geography.

Stationary robots are the most popular robot type in the field of medical robotics. This popularity comes from their application in high-precision surgical procedures and due to their superior accuracy, dexterity, and control compared to other medical robots. They are most frequently used by minimally-invasive surgeons in the areas of orthopaedics, neurology, and urology. Ongoing innovation in the areas of imaging integration, haptic feedback, and artificial intelligence-assisted navigation continues to provide stimulus for the growth of stationary surgical robots.

Medical Robots Market Share, By Type, 2025 (%)

| Type | Revenue Share, 2025 (%) |

| Stationary Robots | 75% |

| Mobile RobotsMobile Robots | 25% |

Mobile robots have represented the most rapidly growing area of application in the field of medical robotics, driven by the growing trend of hospital automation, workflow optimization, and the need for contactless delivery of services. Mobile robots are becoming increasingly common in hospitals to perform functions like medication transport, cleaning (sanitizing), logistics, and real-time patient support. The increased usage of mobile robots is a function of the continuing increase in investments in smart hospitals and the chronic shortage of healthcare professionals, each of which are motivating hospitals to implement robotic support systems.

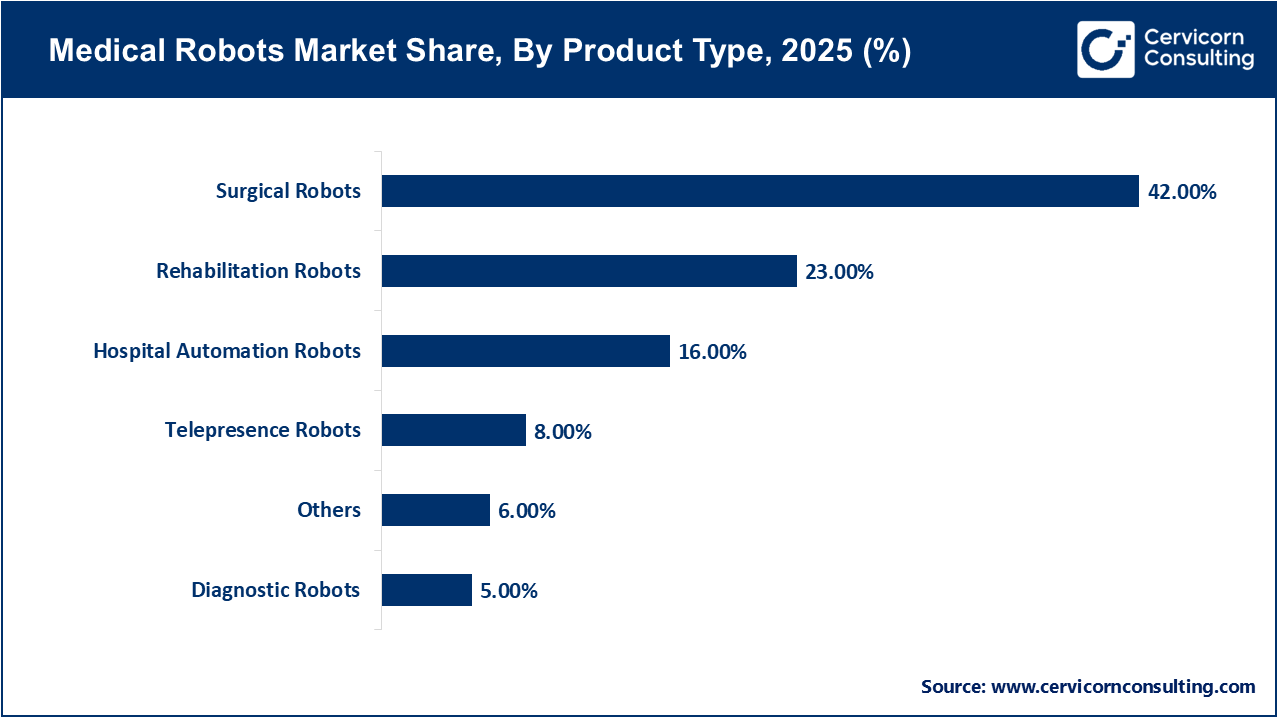

Surgical Robotics has captured a significant portion of the current medical robotics market due primarily to the widespread adoption by hospitals of surgical robots for minimally invasive surgeries across various specialties (including urology, orthopaedic, gynaecology and cardiology). The benefits associated with use of surgical robots in MIPS (minimally invasive procedures), such as improved precision, decreased error rate by physicians, reduced length of stay (LOS), and improved patient outcomes, have made it almost impossible to ignore the importance of surgical robots in modern-day healthcare. The constant development and introduction of new technologies that continue to improve upon the already-established benefits of surgical robots will only further solidify surgical robots' position as leaders in establishing the next generation of surgical technologies, both during and after surgery.

Rehabilitation Robotics, which currently ranks as the fastest-growing segment within the medical robotics market, due to the increasing prevalence of neurological disorders and an aging population coupled with increased demand for physical therapy and rehabilitation of patients following hospitalization. Rehabilitation robots are becoming increasingly popularized for stroke rehabilitation, spinal cord injury treatment, mobility assistance, and to provide consistent, data-driven therapy without the need for physical interaction with the patient by using therapists. Additionally, rising awareness of home-based rehabilitation and the increasing presence of advanced wearable robotic device technologies and artificial intelligence enabled systems are enhancing the adoption of rehab robotics.

The teleoperated segment is the world's top supplier of medical robots. The teleoperated medical robot supplies are supported through the largest number of contracts with hospitals and physician offices to deliver the most significant commercial success regarding robot usage in the medical sector. Teleoperated medical robot technology allows physicians and other healthcare professionals to work remotely. Teleoperated medical robots can provide remote guidance during surgical procedures, conduct diagnostic studies, and facilitate virtual consultations with healthcare providers. For these reasons, teleoperated medical robots continue to be the most utilized medical robot globally.

Medical Robots Market, By Technology, 2025 (%)

| Technology | Revenue Share, 2025 (%) |

| Teleoperation Medical Robots | 55% |

| Semi-autonomous Medical Robots | 30% |

| Fully autonomous Medical Robots | 15% |

With hospitals increasingly seeking to combine human expertise with the speed of automated solutions powered by AI, the segment of semi-autonomous medical robots has seen the highest growth rate. Semi-autonomous medical robots help physicians complete specific responsibilities by completing tasks that assist them, such as navigating procedures, providing imaging support, completing repetitive tasks on routine basis and supplying real-time data to clinicians. These advances in technology are enabling the growth of semi-autonomous medical robots, which can aid in areas such as surgical robotic surgery, robotic-assisted rehabilitation, and the effective automation of hospital tasks. As hospitals look to create more efficient processes, improve support for clinical workers, and ensure greater accuracy across all services, demand for semi-autonomous medical robots will grow rapidly.

The majority of medical robots are purchased through offline distribution methods. Medical robot systems are complicated to use and expensive (high-value products), as hospitals, clinics, and research facilities typically deal directly with manufacturers or authorized distributors to purchase these products. These offline methods allow hospitals, clinics and research facilities access to product demonstrations, the ability to customize the system for their needs, regulatory compliance assistance, as well as installation and training and long-term service agreements.

Medical Robots Market, By Distribution Channel, 2025 (%)

| Distribution Channel | Revenue Share, 2025 (%) |

| Offline | 80% |

| Online | 20% |

The fastest growing distribution channel for medical robotics is now through online distribution. The growth of digitalisation and the increased availability of components, software upgrades, and smaller robotic systems through online channels are driving this rapid growth. While robotic surgical systems and complete automation systems continue to be primarily sold through offline channels, the online channel for products related to rehabilitation robotics, telepresence robots and aftermarket product services is rapidly increasing.

The surgical robot segment of the medical robotics industry continues to grow rapidly and continues to experience growth at a rapidly increasing rate due to the increasing popularity of robotic-assisted technology for performing minimally invasive surgery (MIS) and laparoscopic surgery. Robotic-assisted surgery platforms for laparoscopic surgeries across urology, gynaecology, and general surgery are becoming commonplace in many hospitals as a result of the reduction in the amount of trauma associated with surgeries performed using traditional surgical techniques; shorter lengths of hospital stay after surgery, and improved patient outcomes as a result of using robotic-assisted surgical platforms. The large volume of procedures performed, strong clinical evidence supporting the application of robotic-assisted surgery in MIS, and continuous technological development in the design and manufacture of these medical robotic platforms all contribute to the growth of this application segment.

Medical Robots Market, By Application, 2025 (%)

| Application | Revenue Share, 2025 (%) |

| Laparoscopy & Minimally Invasive Surgery | 34% |

| Orthopaedic Surgery | 19% |

| Neurology / Neurosurgery | 9% |

| Cardiology | 7% |

| Physical Rehabilitation | 12% |

| Pharmacy Automation & Drug Dispensing | 8% |

| Diagnostics | 6% |

| Others | 5% |

Rehabilitation Robots - The fastest growing segment of medical robotics. Rehabilitation robots are fast becoming the solution of choice for hospitals and rehabilitation centres to provide continual therapy based upon robust evidence, while decreasing the reliance on human labour to perform therapy. The growth of post-stroke recovery, spinal cord injury rehabilitation, and wearable robotic exoskeletons and the rapid advancements in AI-enabled rehabilitation systems are driving rapid adoption and expanding beyond the traditional healthcare setting into homes.

The majority of the medical robots market is comprised of Hospitals, as complex surgical operations take place predominantly in hospitals, and advanced diagnostics and treatment of large patient volumes also occur in hospitals. Hospitals have the financial resources necessary to implement high-value robotic (surgical) equipment, as well as the technical support infrastructure (both workforce and equipment) to support adoption of advance healthcare technologies such as Surgical Robots, Hospital Automation Solutions (automation of clinical procedures) and Advanced Diagnostic Platforms (e.g., MRI and CT scanners). In addition, as hospitals continue to invest in advanced technology and can supply trained medical personnel to operate and manage these systems, they will continue to lead the way in utilising robotic equipment.

Medical Robots Market, By End Users, 2025 (%)

| End Users | Revenue Share, 2025 (%) |

| Hospitals | 55% |

| Ambulatory Surgery Centers (ASCs) | 15% |

| Rehabilitation Centers | 13% |

| Specialty Clinics & Diagnostic Centers | 9% |

| Pharmacies & Retail Healthcare | 5% |

| Other | 3% |

While Hospitals remain the largest end-user of medical robots, Rehabilitation centres represent one of the fastest-growing end-user segments of the robotic equipment market, driven by the increasing prevalence of neurological and orthopaedic injuries, and increasing age-related mobility impairments amongst the elderly population. In response to these factors, Rehabilitation centres have begun to rapidly increase the number of robotic rehabilitation systems (robot-assisted therapy) they utilise to provide patients with a high level of rehabilitation therapy, while reducing the amount of manual labour needed by providing therapy at all levels of intensity and continually adapting to each patient's individual rehabilitation needs and goals. Increased demand for post-stroke and spinal cord injury rehabilitation has led to a growing number of robotic exoskeleton-based mobility solutions being developed to enhance mobility for patients with severe physical impairments. Additionally, a growing number of outpatient rehabilitation models and home-based rehabilitation programmes are being established.

Intuitive Surgical

Medtronic

Siemens Healthineers

By Type

By Product Type

By Technology

By Distribution Channel

By Application

By End Users

By Geography