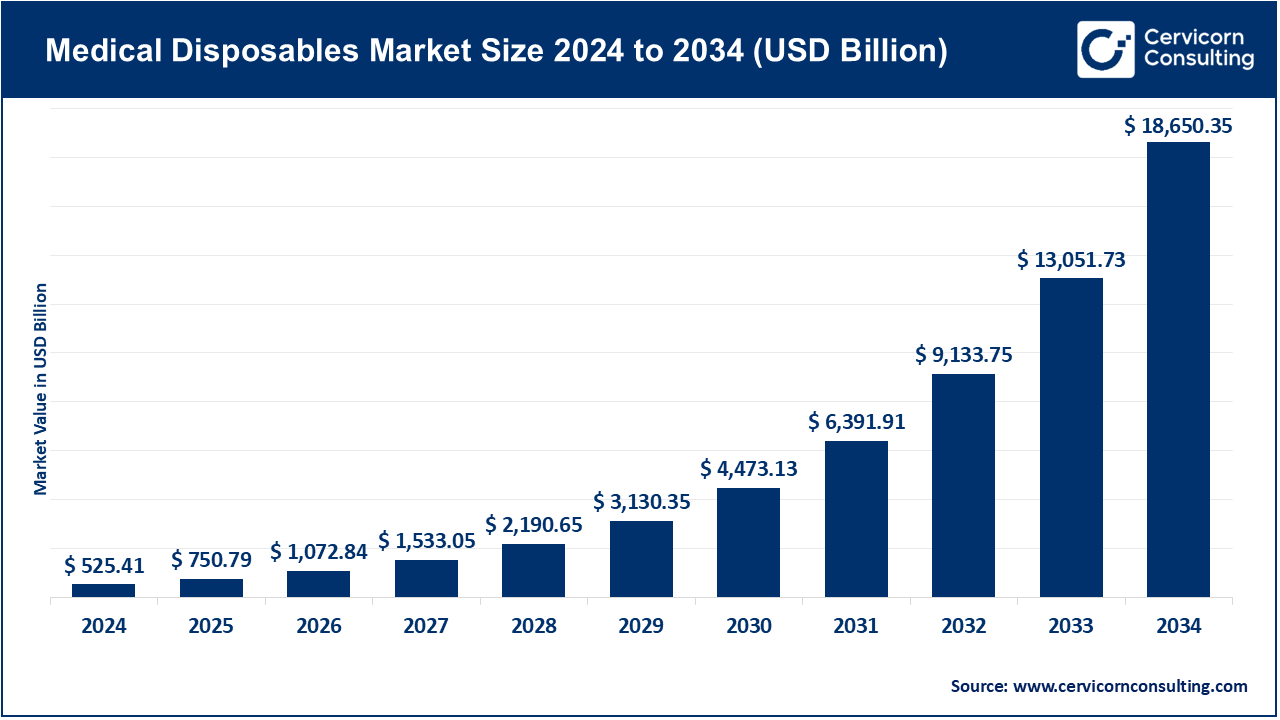

The global medical disposables market size was valued at USD 525.41 billion in 2024 and is expected to be worth around USD 18,650.35 billion by 2034, growing at a compound annual growth rate (CAGR) of 14.2% over the forecast period from 2025 to 2034.

Infection control, patient care and operational effectiveness are some of the recent concerns being raised by the healthcare industry making a lot of medical disposables to be demanded in hospitals, diagnosis centers and in homes where people are offered healthcare. The increased rate of chronic and infectious diseases, as well as the elevated level of awareness of hospital-acquired infections (HAIs), have stimulated the transition to single-use and sterile products, which minimize the risk of cross-contamination. Furthermore, the increase in less invasive operations and growth of homecare industry have boosted the consumption of disposable gloves, masks, syringes and diagnostic kits. Sustainable and biodegradable materials are also becoming more popular with healthcare providers and manufacturers focusing on the environmental concern.

The medical disposables market is still being redefined by technological innovation. The use of AI to optimize the supply chain, automation, IoT-enabled production have contributed to improving the standard of the products and distribution efficiency. Also, the combination of intelligent material and antimicrobial and antiviral features is enhancing the level of safety. The government activities, stringent regulatory systems, and growing investments on healthcare facilities are also contributing towards market growth. With healthcare being decentralized and value-based, the need to have cost-effective, environmentally-friendly, and technologically advanced medical disposables is likely to continue to be high in the next few years.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 750.79 Billion |

| Estimated Market Size in 2034 | USD 18,650.35 Billion |

| Projected CAGR 2025 to 2034 | 14.20% |

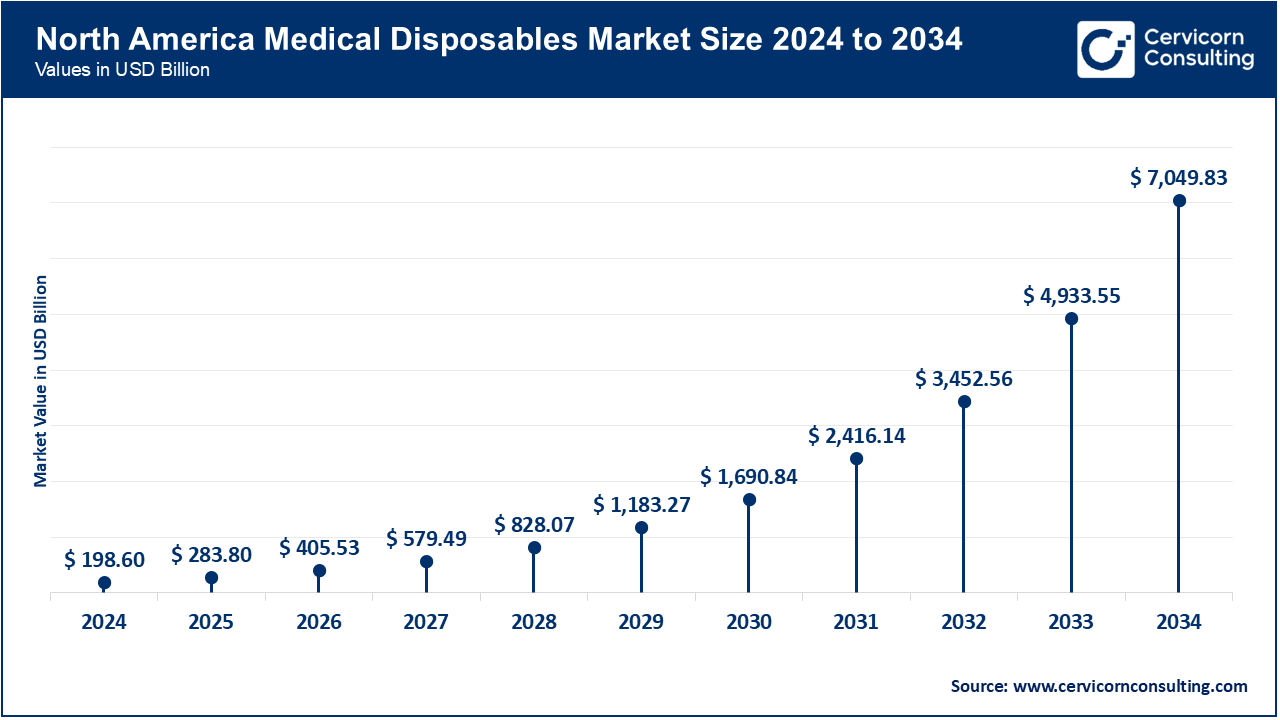

| Dominant Region | North America |

| Growing Region | Asia-Pacific |

| Key Segments | Product Type, Material Type, End User, Application, Region |

| Key Companies | 3M, Becton, Dickinson and Company (BD), Cardinal Health, Inc, Medline Industries, LP, Smith & Nephew plc, Johnson & Johnson Services, Inc., Abbott Laboratories, B. Braun Melsungen AG, Terumo Corporation, Paul Hartmann, Mölnlycke Health Care AB, Nipro Corporation, Teleflex Incorporated, Hollister Incorporated, Kimberly-Clark Corporation |

The medical disposables market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region.

North America has the highest share owing to its advanced healthcare systems, as well as its focus on infection prevention. By March 2025, over 70% of U.S. hospitals and ASCs reported higher procurement of eco-friendly single-use products like gloves, gowns, and syringes. The CDC infection control funding program of February 2025 strengthened the usage of disposable products across hospitals and outpatient settings. Market leaders like 3M, BD, and Cardinal Health have developed disposables that are recyclable and biodegradable to meet self-imposed sustainability standards. The rise in outpatient and home healthcare also increases demand. The attention to healthcare innovation and the rapid adoption of new technology will ensure the region remains innovative and the adoption will be industry-leading.

The Europe medical disposables market size was estimated at USD 148.17 billion in 2024 and is forecasted to reach around USD 5,259.40 billion by 2034.

Europe is still second in market size mainly due to strong hygiene requirements and sustainability efforts. By April 2025, Germany, France, and the U.K. switched to biodegradable nonwoven disposables in their healthcare facilities under the EU’s Green Healthcare Directive. The increased spending in March 2025 on the adoption for hospital waste management and infection prevention drove further adoption. Market leaders Paul Hartmann AG, Mölnlycke Health Care, and Smith & Nephew strengthened partnerships with national systems to improve sterile product availability. The European Commission’s initiatives on the circular economy and greener production methods are handy. Europe’s regulatory strength and focus on environmentally friendly healthcare keeps maintaining needed growth.

The Asia-Pacific medical disposables market size was valued at USD 134.50 billion in 2024 and is expanding to USD 4,774.49 billion by 2034.

Due to government incentives and increased healthcare infrastructure, Asia-Pacific is exhibiting rapid growth. By the end of May 2025, India, China, and Japan would account for 40% of the world’s disposable masks and gloves. Public-private partnerships in China and South Korea in June 2025 were focused on boosting the domestic manufacturing of infection prevention products and home healthcare. Increased hygiene awareness and the growing burden of chronic diseases in Thailand and Vietnam are also increasing demand. Nipro, Medline and Terumo and others are strengthening their regional facilities to support supply chains for both domestic and export markets. The developed production base and the continued modernization of the healthcare system further support the region’s leadership momentum.

Market Share, By Region, 2024 (%)

| Region | Revenue Share, 2024 (%) |

| North America | 37.80% |

| Europe | 28.20% |

| Asia-Pacific | 25.60% |

| LAMEA | 8.40% |

The LAMEA medical disposables market was valued at USD 44.13 billion in 2024 and is anticipated to reach around USD 1,566.63 billion by 2034.

LAMEA's market is growing rapidly due to developing hospital infrastructures and growing investments in public health. As of April 2025, Brazil, the UAE, and South Africa adopted surgical and diagnostic applications of sterile disposable kits. To ease import dependence, local manufacturing and sterilization systems are encouraged. Through the May 2025 Saudi health initiative, enhanced infection prevention became available with automation and waste management upgrades. As LAMEA is transformed by rising awareness of hygiene, the need to manage chronic illnesses, and reforms in healthcare systems, it is positioned as an important market region for growth beyond 2026.

Wound Management Products: It comprises, bandages, gauzes, and dressings that are required to provide post-surgery care, as well as, chronic wound management. By April 2025, hospitals and clinics in North America and Europe began to increase their purchases of the newest wound dressing with antimicrobial agents to lower the risk of infection and enhance the healing process. Such companies as Smith and Nephew and 3M introduced new hydrocolloid and foam dressings which enhanced patient comfort and decreased the frequency of dressing changes.

Drug Delivery Disposables: Syringes, IV sets, and catheters make up this category of products that are important in the controlled delivery of drugs and fluids. As of February 2025, medical professionals both in the U.S. and in India were reporting the increased use of prefilled syringes and safety IV catheters in order to reduce contamination and needle-stick injuries. Becton Dickson (BD) launched single-use catheters in May 2025 that are environmentally friendly and can encourage hospital sustainability.

Diagnostic & Laboratory Disposables: Diagnostic specimen containers, pieptes tips, and collection kits are also essential items needed to process samples and do molecular tests. In June 2025, the demand in Europe and Asia-Pacific was very high in the diagnostic centers in terms of the rapid test cartridges and disposable pipette filters that could support the testing of infectious diseases. The competition between Thermo Fisher Scientific and Qiagen saw both companies extend the lines of their disposable kits to enhance efficiency in lab automation.

Dialysis and Infusion Disposables: These are commonly used in renal care and critical care, as they encompass dialysis filters, tubing sets and infusion bags. Fresenius Medical Care introduced next-generation single-use dialyzers in March 2025 to improve the efficiency of filtration and minimise the risk of infection. These products were also implemented in healthcare facilities in southeast Asia and Latin America during the increasing cases of chronic diseases of the kidney.

Incontinence and Sterilization Products: Disposable adult diapers, underpads and sterilization wraps are becoming significant to the aged care and infection prevention. According to the long-term care facilities in Japan and Europe, demand of hygiene products that are eco-friendly and disposable has grown tremendously by May 2025. Kimberly-Clark had to develop more biodegradable incontinence products to lessen environmental impact without sacrificing the comfort of patients.

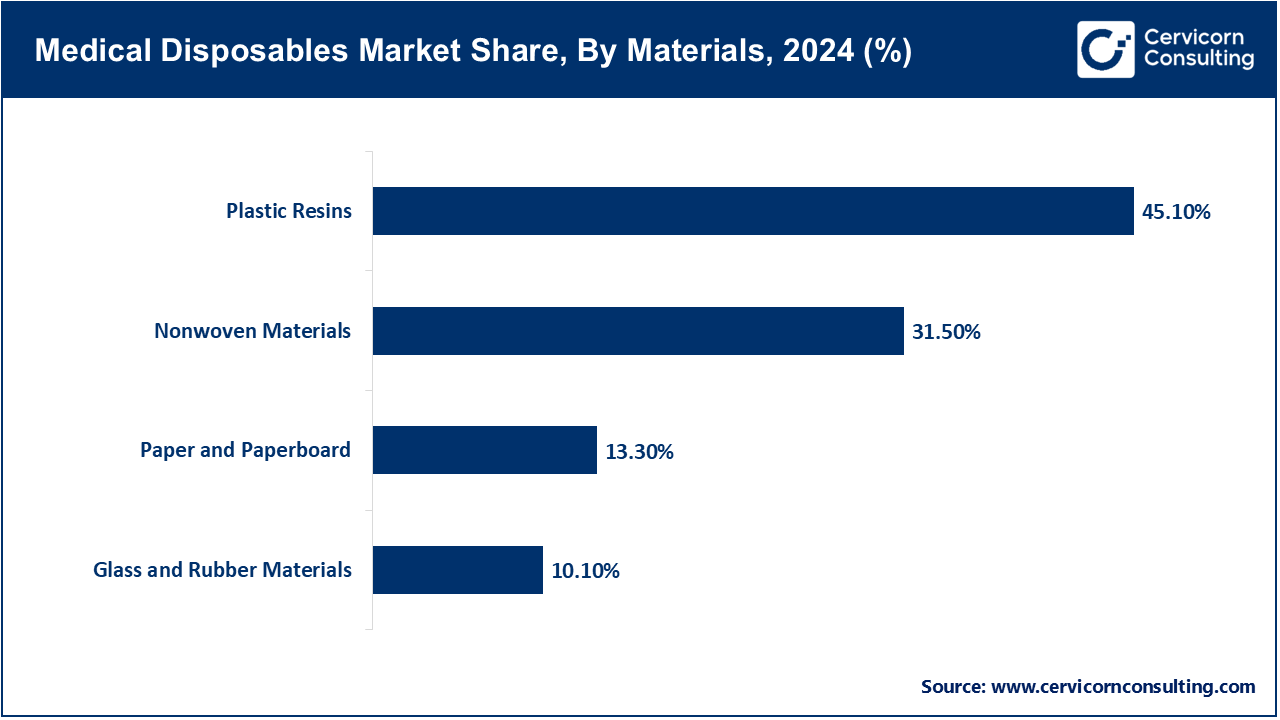

Plastic Resins: Polypropylene, polyethylene and PVC are superior in the disposable manufacturing based on durability and low cost. By January 2025, the world producers focused on recyclable and medical-grade resins to meet the sustainability requirements. Various plants in Europe had changed to bio-based polypropylene to comply with new environmental requirements.

Nonwoven Materials: Nonwovens are applied to masks, gowns, drapes, and covers in operating rooms to prevent infection. By March 2025, higher filtration nonwovens with better breathability had been adopted by healthcare institutions in North America and Asia-Pacific. The increased nonwoven composites used in the protection of the surgical barriers were introduced by companies such as DuPont and Ahlstrom-Munksjo.

Paper and Paperboard: It is used in the packaging of paper and paperboard, sterilization wraps, and test kits. In April 2025, eco-friendly producers in Germany and South Korea increased the application of biodegradable hospital medicine packaging to minimize waste production in hospitals.

Glass and Rubber Materials: These are applied to disposable syringes, vials and stopper systems. In May 2025, there was rising demand of borosilicate glass components globally because of its thermal resistance and its ability to interact with vaccines and injected medications.

Hospitals & Clinics: Hospitals were the biggest purchasers of medical disposables and by using the advanced infection control and diagnosing consumables hospitals were able to better care about patients. By June 2025, the large hospital chains in the U.S. and Europe grew purchasing single-use surgical kits and disposable catheters, which reduced the risk of cross-contamination.

Home Healthcare: Home healthcare experienced the growth of disposable medical products as a result of aging population and the treatment of chronic illnesses like glucose testing strips, IV lines, and wound care products. By April 2025, such companies as Medline and Cardinal Health had introduced compact home-care kits aimed at the patients with chronic diseases.

Market Share, By End User, 2024 (%)

| End User | Revenue Share, 2024 (%) |

| Hospitals and Clinics | 40.20% |

| Ambulatory Surgical Centers (ASCs) | 21.60% |

| Diagnostic Centers and Laboratories | 16.20% |

| Home Healthcare Settings | 13.50% |

| Long-Term Care and Nursing Homes | 8.50% |

Ambulatory Surgical Centers (ASCs): ASCs are moving towards the use of sterile surgical drapes, gowns, and single-use instruments in minor procedures. By May 2025, several centers in the U.S. and Japan were already using disposable laparoscopic instruments in order to lower sterilization costs and enhance the efficiency of the operations.

Diagnostic Centers & Laboratories: Diagnostic labs are primarily dependent on disposable test pipette tips, sample tubes and test kits that are used to perform high volume testing. By July 2025, European and North American laboratories were more automated, with AI-based disposable kits, which guarantee accuracy and minimize chances of contamination.

Cardiovascular Disease Management: ECG electrodes, disposable catheters, and even pressure monitoring kits are most frequently used to treat the heart. By 2025 North American hospitals have integrated the use of advanced single-use hemodynamic monitoring systems to aid in real time cardiac monitoring.

Diabetes and Chronic Disease Care: CGM sensors, insulin disposal drugs and lancets have become popular. In April 2025, the healthcare systems in Asia-Pacific extended their diabetic care schemes with reusable-disposable hybrid devices to monitor home care.

Market Share, By Application, 2024 (%)

| Application | Revenue Share, 2024 (%) |

| Surgical and Procedural Use | 30.70% |

| Infection Prevention and Control | 24.60% |

| Wound Management | 18.30% |

| Diagnostic Testing | 14.80% |

| Drug Delivery and Fluid Management | 11.60% |

Infectious Disease Control: The foundation of the disposable use of infection prevention is PPE, masks, gloves, and test kits. In May 2025, greater monitoring of influenza and COVID-19 in Europe improved the demand of the high-barrier disposable protection equipment.

Surgical and Postoperative Care: Surgical kits, wound dressings and disposable scalpels aid in sterile surgeries. As of June 2025, the single-use surgical kits that were pre-packed (the reduction of infection rates and a better turnaround) were used in most hospitals in India and Latin America.

Market Segmentation

By Product Type

By Material Type

By End User

By Application

By Region