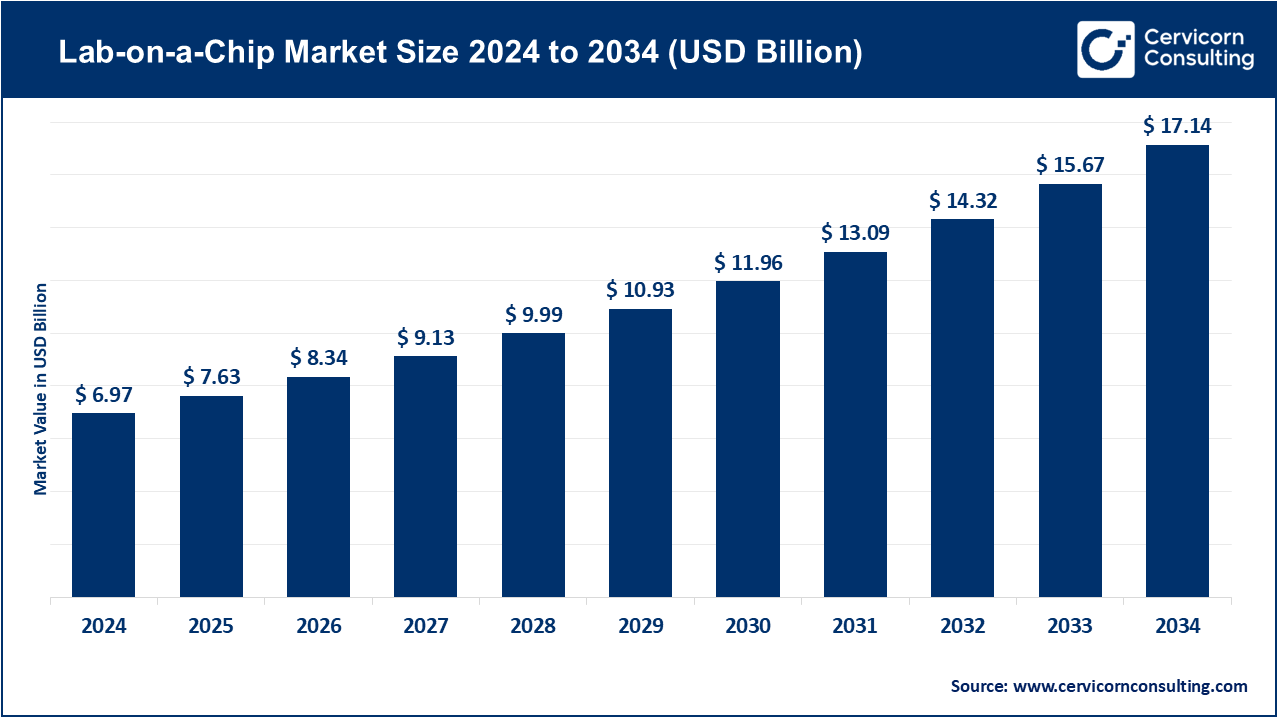

The global lab-on-a-chip market size was valued at USD 6.97 billion in 2024 and is expected to be worth around USD 17.14 billion by 2034, growing at a compound annual growth rate (CAGR) of 9.42% during the forecast period 2025 to 2034. The lab-on-a-chip market has expanded due to industries and healthcare practitioners looking for compact, affordable, and high throughput diagnostics. LOC systems consolidate diagnostic functions into a single microchip. By doing this, LOC systems minimize volume and time for sample analysis as well as reduce reagent consumption. LOC systems also enhance portability for rapid point-of-care testing. LOC technology can serve a variety of diagnostic functions outside of clinical settings. It can detach, switch, or integrate to serve clinical diagnostics, genomics, proteomics, drug discovery, and even environmental sensing. More importantly, LOC technology facilitates personalized medicine, advanced testing for infectious diseases, and decentralized testing. It has become a pivotal component of next-generation healthcare systems.

What is lab-on-a-chip?

LOC systems consolidate diagnostic functions into a single microchip. By doing this, LOC systems minimize volume and time for sample analysis as well as reduce reagent consumption. LOC systems also enhance portability for rapid point-of-care testing. LOC technology can serve a variety of diagnostic functions outside of clinical settings. It can detach, switch, or integrate to serve clinical diagnostics, genomics, proteomics, drug discovery, and even environmental sensing. More importantly, LOC technology facilitates personalized medicine, advanced testing for infectious diseases, and decentralized testing. It has become a pivotal component of next-generation healthcare systems.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 7.63 Billion |

| Estimated Market Size in 2025 | USD 17.14 Billion |

| Projected CAGR 2025 to 2034 | 9.42% |

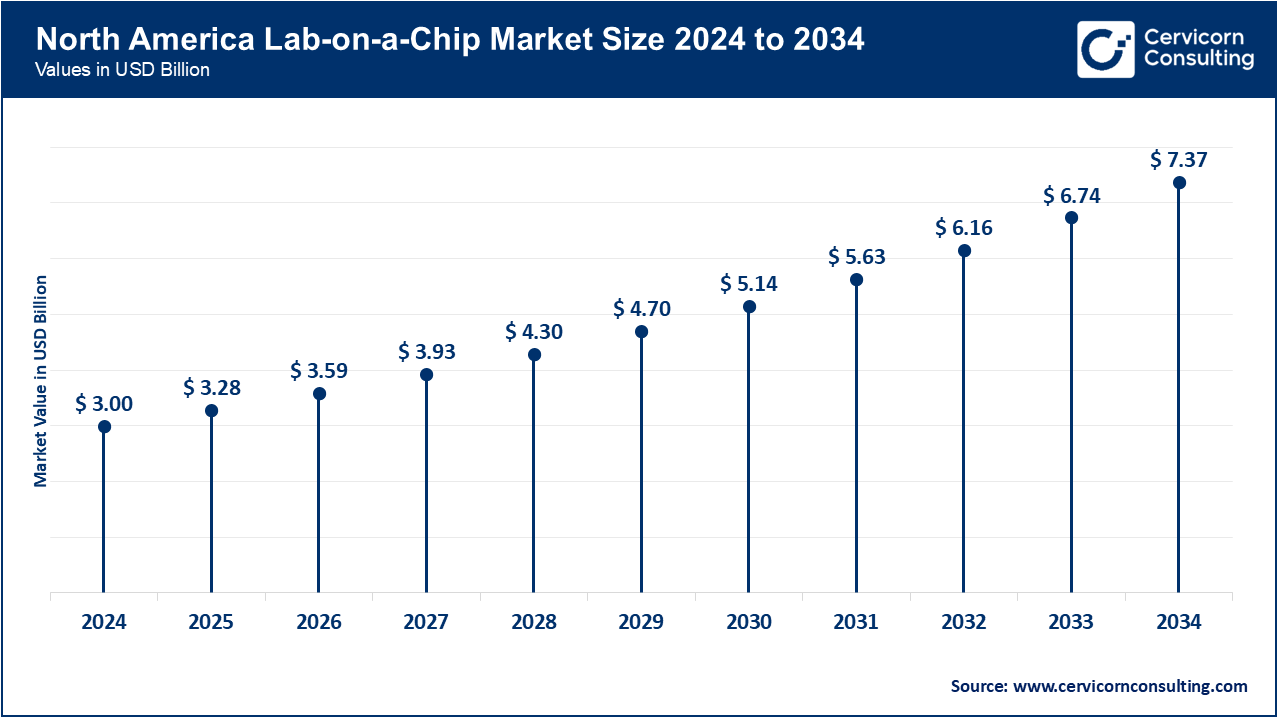

| Dominant Region | North America |

| Growing Region | Asia-Pacific |

| Key Segments | Product, Technology, Application, End-User, Region |

| Key Companies | Thermo Fisher Scientific, Inc., Illumina, Inc., Danaher, Merck KGaA, Abbott Laboratories, QIAGEN, Agilent Technologies, Standard BioTools, Revvity, Inc., Bio-Rad Laboratories |

The lab-on-a-chip market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region.

North America has been the leading region in the application of lab-on-a-chip technology in healthcare, diagnostics, and research. In June 2025, portable LOC instruments were deployed by Stanford researchers to allow hospitals and clinics to conduct point-of-care rapid cancer biomarker diagnostics. The U.S. and Canadian LOC devices are being used in diagnostic laboratories and pharmaceutical R&D to improve throughput and decrease the time required for tests.

Europe has been focusing on the adoption of LOC technology with attention to regulatory compliance, precision diagnostics, and the incorporation of digital health systems. In May 2025, Illumina integrated LOC array chips into a pilot project for multiplex genetic analysis in population health studies. Germany, France, the U.K. and the Netherlands have been using LOC systems in hospitals, research institutes, and biotech companies to enhance clinical diagnostics and genomic research.

Asia-Pacific has been expanding LOC usage rapidly due to technological investments, government funding, and the increased demand for point-of-care diagnostics. In August 2025, a consortium in Japan announced the production of electrophoresis-based LOC devices which analyze RNA fragments used in oncology research. LOC platforms are being deployed for diagnostics, drug discovery, and genomics in hospitals, universities, and pharmaceutical labs in China, India, South Korea, and Japan.

Lab-on-a-Chip Market Share, By Region, 2024 (%)

| Region | Revenue Share, 2024 (%) |

| North America | 43% |

| Europe | 26% |

| Asia-Pacific | 22% |

| LAMEA | 9% |

LAMEA continues to see gradual LOC adoption across hospitals, research facilities, and environmental testing laboratories. In February 2025, the WHO rolled out LOC kits for detecting tuberculosis and malaria in African nations, increasing diagnostic access in more remote regions. Pilot initiatives employing LOC platforms for testing communicable diseases and monitoring the environment have also begun in Brazil, South Africa, and the UAE, demonstrating the capabilities of LOC technology in emerging markets.

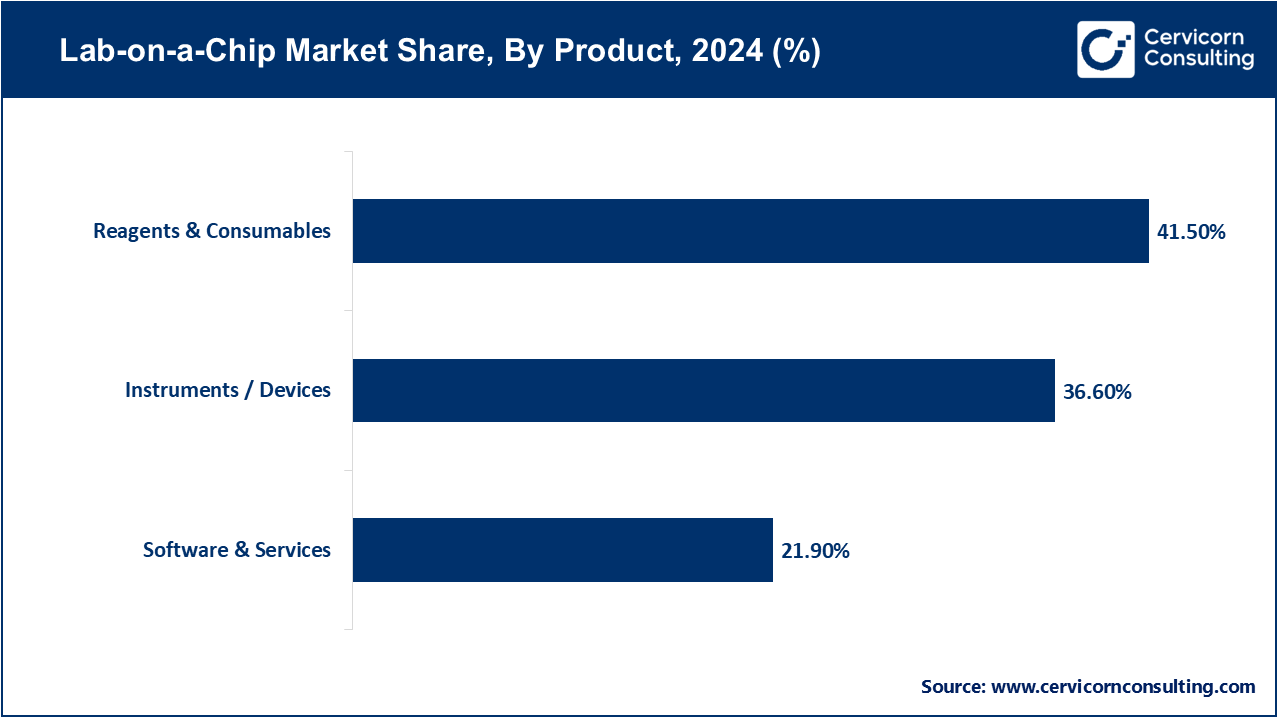

Instruments/Devices: Lab-on-a-Chip instruments refer to tiny platforms that automate various processes in the laboratories including sample preparation, amplification, separation, and detection on a single chip. They play a vital role in making possible point-of-care diagnostics, shortening analysis times, and making it portable to use in the field and at clinical locations. These devices play a pivotal role in the implementation of LOC in clinical diagnostics, genomics and research. In June 2025, researchers at Stanford announced a portable LOC instrument that allows quick detection of cancer biomarkers allowing a rapid diagnostics out of the conventional labs.

Reagents & Consumables: LOC testing is based on reagents and consumables, including the assay kits, microfluidic cartridges, and chemical/biological materials needed to operate the device. They guarantee scalability, repeatability, and accuracy of tests and allow a broad spectrum of applications ranging between infectious disease screening and genetic analysis. This category of component is the most commonly bought as the use increases. Thermo Fisher introduced a new consumable product line in April 2025 to be used on LOC platforms in order to enhance accuracy in genetic testing procedures.

Software & Services: Software and services are important to transform the outputs of LOC tests into actionable insights. They are automating, powered by AI, and interoperable with hospital information systems and telehealth systems and make LOC devices easier to manage and more valuable in clinical use. The solutions also facilitate regulatory compliance and digital health efforts throughout the world. In May 2025, a European healthtech startup unveiled an AI-based LOC software, capable of analysing the profile of different pathogens within less than 15 minutes.

Microfluidics: The most popular LOC platform is microfluidic technology, which can control small amounts of fluids through microchannels to analyze the material rapidly and accurately. It is very useful in diagnostics, genomics and high-throughput testing and can have numerous reactions occurring on one chip. In January 2025 scientists at Harvard commercialized a droplet-based microfluidic LOC to prenatal genetic screening with faster and more accurate tests.

Electrophoresis-based: LOC is an electrophoresis method in which molecules (e.g. DNA, RNA, proteins) are separated in microchannels by the application of electric fields. The technology can be used to perform rapid and accurate biomolecular analysis, which is useful in clinical diagnostics and molecular studies. In April 2025, a Japanese group announced a LOC electrophoresis chip that can analyze RNA fragments within less than 10 minutes to be used in oncology research.

Lab-on-a-Chip Market Share, By Technology, 2024 (%)

| Technology | Revenue Share, 2024 (%) |

| Microfluidics | 41.70% |

| Electrophoresis-based | 30.40% |

| Array-based | 18.10% |

| Other Emerging Technologies | 9.80% |

Array-based: Array-based LOC, uses a single chip with multiple reaction sites such that a high-throughput analysis can be done in parallel on a sample. This technology finds application especially in genomics, proteomics and multiple biomarker detection. In May 2025, Illumina incorporated LOC array chips into an experiment of multiplex genetic analysis in population health research.

Other New Technologies: New LOC technologies are based on nanotechnology, 3D printing, and hybrid platforms to be more precise, flexible, and scalable. These are used to increase LOC applications to high-level drug testing, environmental monitoring, and personalized medicine. In August 2025, Swiss researchers were able to demonstrate a 3D-printed nanotech-enabled LOC that was capable of conducting multiple drug sensitivity tests on tumor cells simultaneously.

Clinical & Diagnostics: LOC is commonly used in the area of infectious disease diagnostics, chronic diseases monitoring, and cancer diagnostics. They cut down on test time, sample size and dependency on central labs thus enabling analysis on point-of-care. In February 2025, the WHO introduced LOC kits in tuberculosis and malaria detection in some African nations to enhance the rural diagnostics.

Genomics & Proteomics: LOC devices find application in genomics and proteomics in high-throughput DNA/RNA sequencing, protein biomarker detection and single-cell analysis. They increase the speed of research processes and they are also accurate and reproducible. Oxford scientists within the month of March 2025 declared a LOC chip that could examine single-cell RNA within less than 30 minutes.

Drug Discovery & Development: The LOC systems are used in the early phase of drug discovery, pharmacokinetics and high-throughput screening of compounds. They enhance productivity, save on reagents and minimize R&D cycles. In June 2025, Pfizer collaborated with a start-up in the U.S. to implement LOC devices to screen early-stage drugs at a lower cost of lab tests by up to 40%.

Lab-on-a-Chip Market Share, By Application, 2024 (%)

| Application | Revenue Share, 2024 (%) |

| Clinical & Diagnostics | 39.20% |

| Genomics & Proteomics | 23.50% |

| Drug Discovery & Development | 18.20% |

| Environmental & Food Safety Testing | 10.70% |

| Forensics | 8.40% |

Environmental and Food Safety Testing: The use of LOC devices in food analysis is becoming more popular in identifying food contaminants, pesticide residues, and waterborne pathogens. They facilitate quick screening and regulatory control in environmental testing and monitoring in agriculture. LOC devices were adopted by the European Food Safety Authority in August 2025 to identify residues of pesticides in vegetables within hours.

Forensics: LOC systems come into use in the analysis of crime scenes when it comes to quick profiling of DNA and detecting toxins. They save time in the analysis and allow on-site testing, which can be useful in law enforcement and when conducting forensic investigations. The UK Home office tested LOC kits in May 2025 and saved days of processing, reducing it to less than two hours of on-site forensic DNA profiling.

Hospitals & Clinics: LOC devices are used in hospitals and clinics to perform diagnostic tests in bedside and assist in making quick clinical decisions. Such devices enhance patient care and lessen the load in the laboratories. In January 2025, Mayo Clinic tested LOC systems to detect bedside sepsis, reducing the test turnaround by 4 hours to 25 minutes.

Diagnostic Laboratories: Diagnostic laboratories combine LOC technology to speed up throughput and a decrease in time of sample processing associated with infectious diseases and genetic testing. Quest Diagnostics added LOC-based infectious disease panels in some of their U.S. labs in April 2025, which helped them increase their capacity during the flu season.

Biotechnology and Pharmaceutical companies: Pharma and biotech uses of LOC platforms are biomarker analysis, drug testing and clinical trial support. They enhance the efficiency in R and D and cut down on the expenses spent on experimentation. In June 2025, Novartis implemented the LOC technology in analysing biomarkers in cancer clinical trials.

Lab-on-a-Chip Market Share, By End-User, 2024 (%)

| End-User | Revenue Share, 2024 (%) |

| Hospitals & Clinics | 44.50% |

| Diagnostic Laboratories | 22.30% |

| Pharmaceutical & Biotechnology Companies | 17.20% |

| Academic & Research Institutes | 10.40% |

| Food & Environmental Testing Agencies | 5.60% |

Academic & Research Institutions: LOC devices are used in universities and research institutes as a tool of experimentation, teaching, and advanced biomedical research. Cambridge University introduced LOC devices into advanced biomedical engineering classes in February, 2025 where students will train on the next generation of diagnostic devices.

Food and Environmental testing agencies: LOC is used by government and private agencies in waters, foods contamination and environmental surveillance. In July 2025, the Food Safety and Standards Authority introduced pilot systems of LOC in screening pesticides and toxins in grain supplies in India.

Market Segmentation

By Product

By Technology

By Application

By End-User

By Region