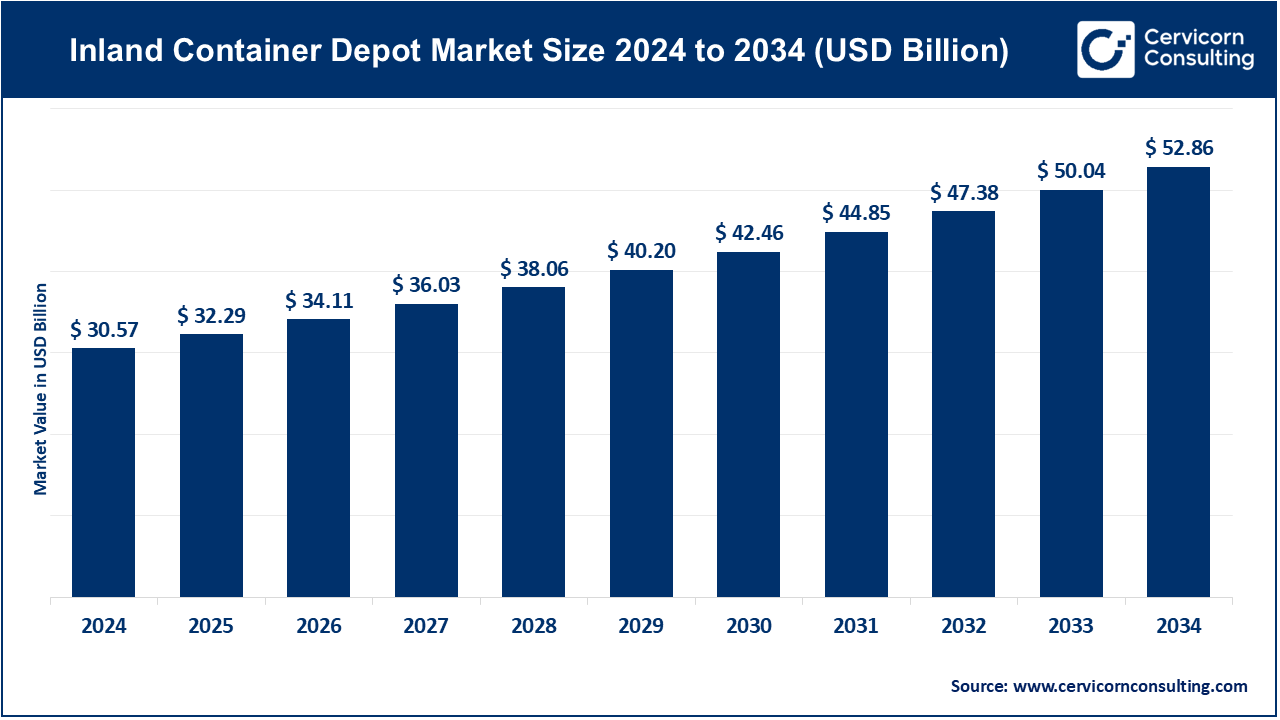

The global inland container depot market size was reached at USD 30.57 billion in 2024 and is expected to be worth around USD 52.86 billion by 2034, exhibiting at a compound annual growth rate (CAGR) of 5.63% over the forecast period 2025 to 2034. The inland container depot (ICD) market is witnessing significant growth due to the surge in global trade volumes and the increasing demand for efficient intermodal logistics solutions. According to the World Trade Organization, global merchandise trade volume grew by 2.7% in 2023, with containerized cargo contributing a substantial share. This growth has intensified the need for strategically located ICDs to streamline cargo handling, customs clearance, and onward transportation. Moreover, the increased frequency of container traffic from inland manufacturing zones to major seaports has led to congestion challenges, which ICDs help mitigate by serving as cargo aggregation and decongestion hubs. For instance, Indian Railways reported a 14% year-on-year rise in container rail traffic in 2023, a trend that directly benefits ICD operations.

Government initiatives and policy reforms have also been crucial in driving ICD market development. Programs such as India’s PM Gati Shakti National Master Plan and the Dedicated Freight Corridor (DFC) have accelerated the creation of integrated logistics infrastructure. As part of this initiative, over 200 logistics infrastructure projects have been identified for implementation, including new ICDs and dry ports. Additionally, customs automation through the ICEGATE platform has enabled faster cargo clearance at ICDs, reducing average dwell time by 20–30% in several locations. Private sector participation is also growing, with logistics companies like DP World, Adani Logistics, and CONCOR investing in expanding ICD networks, digitization, and rail connectivity. These combined developments are fostering a more efficient and integrated supply chain ecosystem, fueling long-term ICD market growth.

What is an Inland Container Depot?

An Inland Container Depot (ICD) is a dry port facility located away from a coastal seaport, designed to handle the storage, consolidation, and movement of containerized cargo. It operates as an extension of a seaport, allowing for customs clearance, warehousing, and container handling closer to inland industrial and manufacturing zones. ICDs are essential for decongesting seaports, facilitating efficient cargo flow, and reducing transportation costs, especially in regions that are far from maritime ports. These facilities play a crucial role in export-import trade by streamlining the logistics chain between the point of origin and final destination.

Types of ICDs are generally categorized based on their functionality and the nature of cargo they handle. These include dry cargo ICDs for general goods, reefer ICDs for temperature-controlled shipments, and hazardous cargo ICDs for chemicals or dangerous goods. Applications of ICDs span across multiple industries such as automotive, agriculture, pharmaceuticals, FMCG, electronics, and textiles, where they are used for cargo consolidation, customs processing, intermodal transfer, and temporary storage. Their growing importance in trade logistics is further supported by government policies aimed at improving inland connectivity and reducing port congestion.

Expansion of Inland Ports to Alleviate Coastal Congestion

Table: Global Inland Port Developments

| Country | Inland Port Name | Year Established | Key Transport Mode | Handled Volume (TEUs/year) | Investment (USD) | Government/Private Partner | Purpose |

| United States | Greer Inland Port, SC | 2013 | Rail | ~160,000+ | $50 million | South Carolina Ports Authority | Reduce pressure on Port of Charleston |

| United States | Alliance Global Logistics Hub, Texas | 1990s | Rail/Air/Road | ~500,000+ | Private Sector | Hillwood, BNSF Railway | Freight distribution, warehousing |

| Germany | Duisburg Inland Port | 1900s | Rail/Waterway | >4 million TEUs | Multi-Billion | duisport GmbH | Largest inland port in Europe |

| China | Chongqing Inland Port | 2008 | Rail/Waterway | ~1 million+ | $2 billion+ | Chongqing Gov + BRI | Connect to Europe via Belt and Road |

| Ethiopia | Modjo Dry Port | 2009 | Road/Rail | >85% of national cargo | $150 million | Ethiopian Shipping Logistics Services | Key inland cargo hub for Ethiopia |

| India | Dadri Inland Container Depot | 1995 | Rail/Road | ~250,000 | ₹300 Cr ($36M) | CONCOR (Govt of India) | Serves North India cargo needs |

Integration of Free Trade Zones with Inland Container Depots

Technological Advancements in Port Operations

Strategic Investments by Global Port Operators

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 32.29 Billion |

| Expected Market Size in 2034 | USD 52.86 Billion |

| Projected Market CAGR 2025 to 2034 | 5.62% |

| Dominant Area | Asia-Pacific |

| Key Segments | Service Type, Cargo Type, Region |

| Key Companies | Boasso Global, Hapag Llyod, Container Corporation of India (CONCOR), Maersk, Gati Limited, APM Terminals, Abu Dhabi Terminals, Hutchison Ports, DP World, PSA International, GAC, Freightliner Group Ltd |

Rising Global Trade and Containerization

Government Infrastructure Initiatives

High Initial Capital and Operational Costs

Regulatory and Customs Bottlenecks

Expansion into Landlocked Countries and Emerging Trade Corridors

Growth of E-Commerce and Third-Party Logistics (3PL) Integration

Poor Last-Mile Connectivity

Competition from Emerging Logistics Models

The inland container depot market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA.

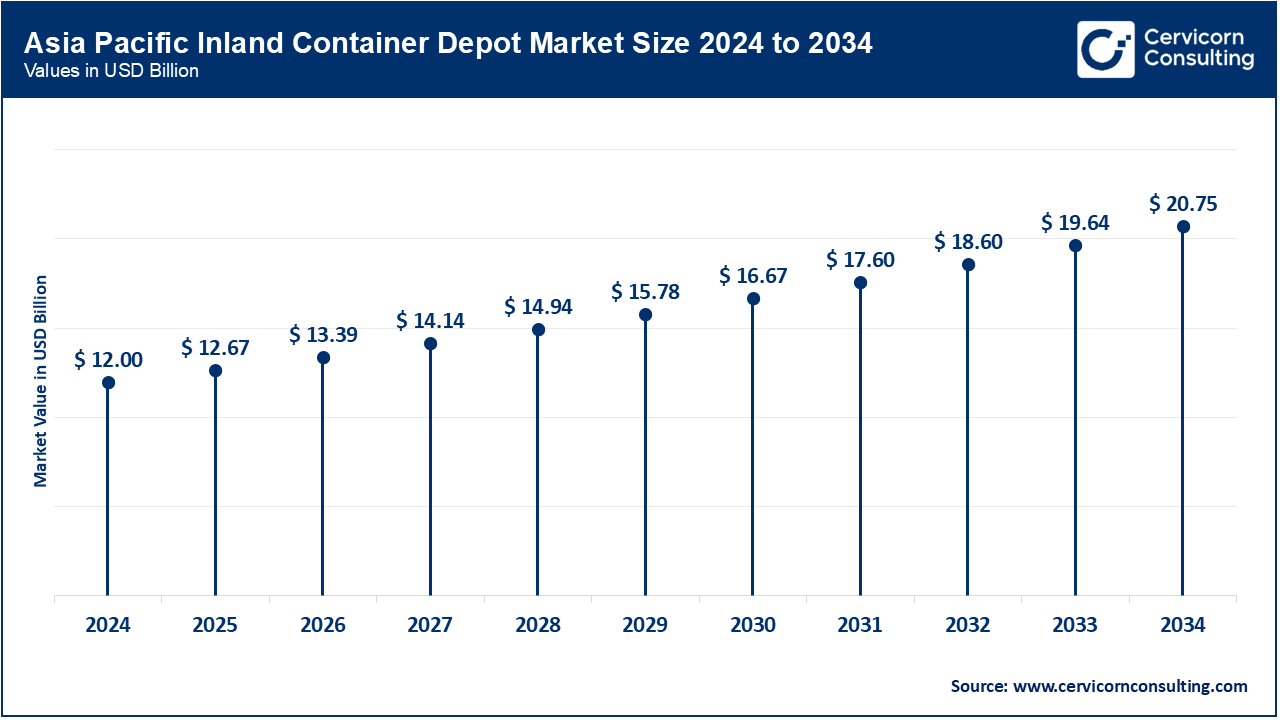

Asia-Pacific leads the global market, holding the largest market share in 2024. The region’s dominance is fueled by high trade volumes, robust manufacturing hubs, and strong government investments in logistics infrastructure. Countries like China, India, and Japan have rapidly expanded their inland port networks to support international and domestic freight movement. India, for instance, has developed over 400 ports and logistics hubs, backed by more than USD 80 billion in investments. The adoption of digital technologies and multi-modal transportation systems further enhances operational efficiency, reinforcing Asia-Pacific's top position in the global ICD market.

North America is emerging as the fastest-growing region, driven by its well-integrated logistics ecosystem and rising import-export activities. The United States and Canada have strategically positioned ICDs that connect seaports to inland cities, reducing congestion and transit costs. Investments in smart logistics, automation, and infrastructure modernization are propelling growth. Government support for sustainable freight and enhanced trade routes has made the region a hotspot for ICD expansion. The corporate sector’s emphasis on efficient supply chain management also contributes to North America’s strong momentum in this space.

Europe holds a significant share of the market, thanks to its advanced transport infrastructure and commitment to sustainable logistics. Countries like Germany, the Netherlands, and France have developed highly efficient intermodal terminals that support rail, road, and barge connectivity. The European Union’s policies on green transport and reduced carbon emissions further spur innovation in the ICD sector. As part of the EU Green Deal, logistics providers are increasingly adopting eco-friendly practices and smart port technologies, ensuring that Europe remains a stable and mature market in global ICD operations.

Inland Container Depot Market Revenue Share, By Region, 2024 (%)

| Region | Revenue Share, 2024 (%) |

| North America | 28.21% |

| Asia-Pacific | 39.25% |

| Europe | 24.07% |

| LAMEA | 8.47% |

The LAMEA region is an emerging market, witnessing steady growth due to expanding trade routes and infrastructure development. Brazil and Mexico are investing in port-to-inland connectivity to streamline agricultural and industrial exports. In the Middle East, countries like the UAE and Saudi Arabia are focusing on logistics diversification through dry port development as part of their economic transformation plans. Africa, meanwhile, is enhancing its inland logistics with support from international funding and partnerships to improve trade efficiency. Although LAMEA's current market share is smaller, ongoing developments and policy reforms are expected to fuel its future growth in the ICD market.

The inland container depot market is segmented into service type, cargo type and region. Based on service type, the market is classified into storage services, handling services, customs clearance, transportation services, and maintenance & repair services. Based on cargo type, the market is classified into dry cargo, liquid cargo, reefer cargo, and hazardous cargo.

Storage Services: Storage services involve short-term and long-term container storage at inland depots before or after customs clearance. These services are essential for managing cargo flow and ensuring timely distribution. The growing volume of international trade and container traffic is driving demand for larger, automated storage facilities. Innovations such as RFID tracking and smart yard management systems are being implemented to optimize space and turnaround time. Global logistics players like DP World and Hutchison Ports are expanding storage capabilities in regions like Africa and Central Asia to support increasing cargo volumes.

Handling Services: Handling services include loading, unloading, stacking, and moving containers within the ICD premises. This segment is experiencing steady growth due to rising imports/exports and the need for efficient container operations. Automation of container handling equipment, such as RTGs (Rubber Tyred Gantry cranes) and automated reach stackers, is improving operational efficiency. Countries like Germany and China are investing in advanced equipment to reduce manpower dependence and minimize handling times, supporting growth in this segment.

Customs Clearance: Customs clearance services support the legal documentation and compliance processes for imports and exports. This segment is growing rapidly as governments push for paperless trade and faster clearances. The adoption of digital platforms such as single-window systems and blockchain-based clearance is significantly reducing processing times. For instance, Kenya’s Nairobi ICD saw a 30% improvement in cargo clearance time through digitization. Growing trade volumes and regulatory reforms are further enhancing this segment’s importance.

Transportation Services: Transportation services involve first-mile and last-mile delivery of containers to and from seaports, industrial zones, and warehouses. The shift toward multimodal logistics integrating road, rail, and inland waterways is fueling growth in this segment. Investments in dedicated freight corridors, particularly in India and the EU, are boosting rail-linked ICDs. As sustainability becomes a focus, companies are introducing electric and CNG-based transport fleets to reduce emissions and improve cost efficiency.

Maintenance & Repair Services: Maintenance and repair services cater to the inspection, cleaning, and repair of containers, especially those used for reefer or hazardous cargo. This niche segment is gaining traction in high-volume depots and regions handling specialized goods. With the rise in pharmaceutical and perishables trade, there’s growing need for refrigerated container servicing. Facilities in hubs like Singapore and Rotterdam are expanding their service bays to include temperature control calibration, washing stations, and ISO tank repairs.

Dry Cargo: Dry cargo includes non-liquid goods such as electronics, textiles, machinery, and packaged food. It is the most dominant cargo segment in ICDs globally. The rise of manufacturing hubs in Asia-Pacific and increasing exports from China, India, and Vietnam contribute to the demand for dry cargo handling. This segment benefits from simplified handling requirements and compatibility with most container types. ICDs across Southeast Asia and Eastern Europe are expanding to accommodate the growing dry cargo traffic.

Liquid Cargo: Liquid cargo encompasses oils, chemicals, and industrial liquids transported in ISO tanks or flexi-tanks. While smaller in share, this segment is showing gradual growth due to demand from chemical and petrochemical sectors. ICDs near industrial belts in countries like UAE and Brazil are building capabilities to handle bulk liquids securely. The need for temperature regulation, spill containment, and specialized equipment is driving investment in customized handling systems for liquid cargo.

Reefer Cargo: Reefer cargo refers to temperature-sensitive goods such as food, pharmaceuticals, and flowers. With the global increase in perishable goods trade and vaccine distribution, this segment is witnessing robust growth. European countries like the Netherlands and Germany have expanded reefer storage at ICDs with advanced monitoring systems. In Asia, rising food exports from Thailand and India are fueling demand for reefer-capable inland facilities. ICDs are increasingly integrating cold chain logistics to meet stringent product integrity standards.

Hazardous Cargo: Hazardous cargo includes chemicals, flammable items, batteries, and radioactive materials. Although this segment is highly regulated and relatively small, its strategic importance is growing. Rising demand for electric vehicle (EV) batteries and industrial chemicals is pushing the need for ICDs with certified hazardous goods storage. Facilities in China, the U.S., and Germany are setting up fireproof containers, gas detection systems, and emergency protocols to safely manage these cargos.

The inland container depot (ICD) market is shaped by a highly competitive landscape, where leading global and regional players are focusing on infrastructure expansion, digitalization, and strategic partnerships to gain a competitive edge. Companies such as DP World, Maersk, APM Terminals, and PSA International are heavily investing in modernizing ICD facilities, enhancing multimodal connectivity, and integrating smart logistics solutions. In India, CONCOR and Gati Limited are driving growth through the development of transshipment hubs and direct port delivery services. Meanwhile, players like Abu Dhabi Terminals and Hutchison Ports are strengthening their positions through regional expansion and collaboration with shipping lines. As trade volumes rise and supply chains evolve, these companies are adopting technology-driven solutions and sustainable practices to streamline operations, reduce costs, and cater to the growing demand for efficient inland logistics.

Market Segmentation

By Service Type

By Cargo Type

By Region