India Insurance Market Size and Growth Factors 2025 to 2034

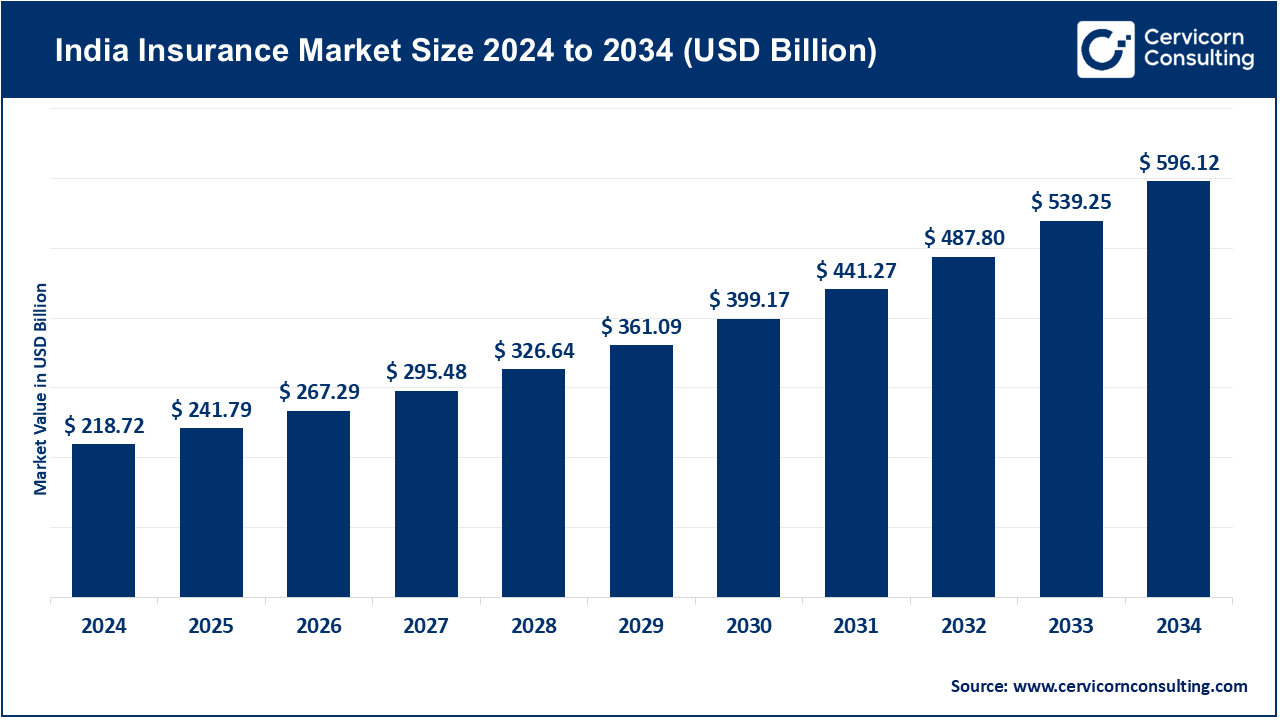

The India insurance market size was valued at USD 218.72 billion in 2024 and is anticipated to reach around USD 596.12 billion by 2034, expanding at a compound annual growth rate (CAGR) of 10.55% over the forecast period from 2025 to 2034.

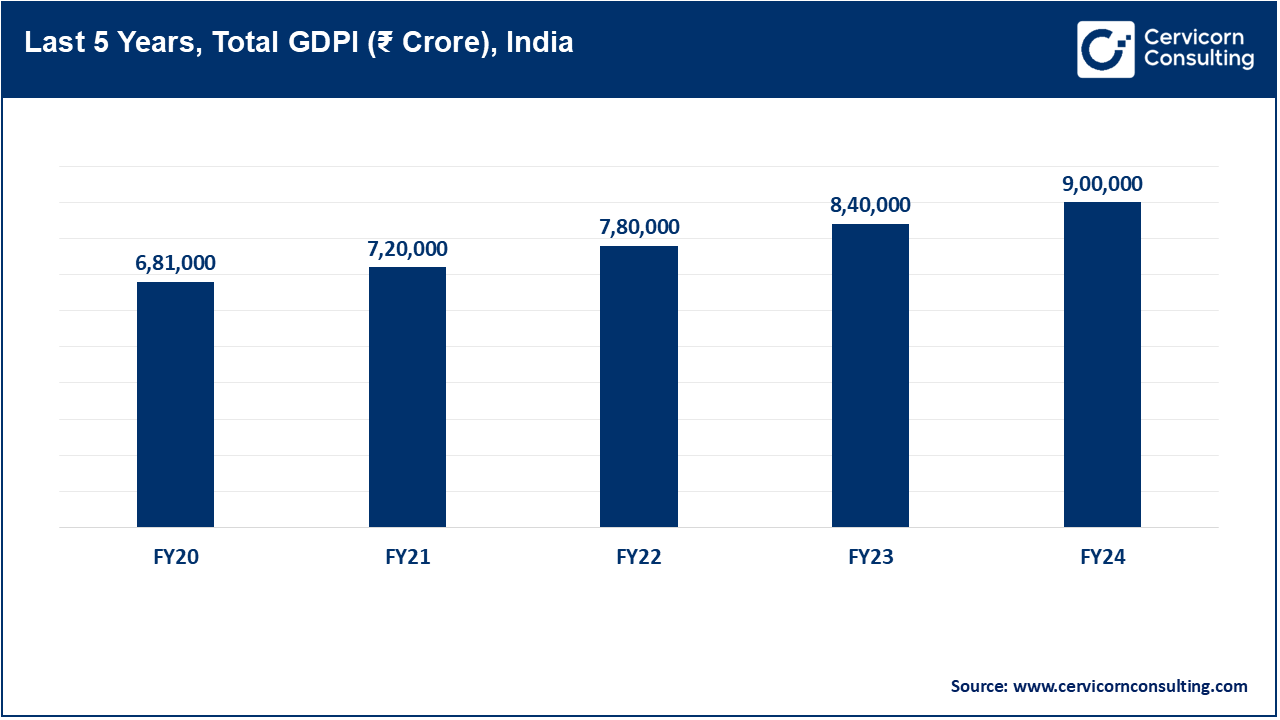

The Indian insurance market continues to experience significant expansion while fueled by the awareness of insurance in the population, rising disposable incomes, and favorable government policies. Life insurance accounts for the largest share of the market, representing more than sixty percent of the total premiums, while the non-life insurance market is rapidly growing on the back of advances in health, motor, and property insurance. Government initiatives, such as Ayushman Bharat and Pradhan Mantri Jeevan Jyoti Bima Yojana, have improved penetration in rural areas, helping achieve an annual growth rate of 12 to 15 percent in policy subscriptions. Furthermore, the middle-class population, now estimated to be 580 million, is expected to expand by 2030, driving the need for more advanced financial coverage. There is also steady growth of corporate insurance, which covers employee benefits and business liability insurance, as corporations seem to be focusing on risk management in the new regulatory and business climate. In general, the market is set to experience growth in the double digits for the next several years.

The Indian insurance market consists of industries that offer life and non-life insurance products to provide financial coverage for identified risks. It includes life insurance which provides covers for individuals and families upon death, permanent disability, or pre-defined critical illness, and general insurance which consists of health, motor, property, travel, and liability insurance coverage. The Insurance Regulatory and Development Authority of India (IRDAI) governs the market, which includes insurers from the public and private sectors.

India Insurance Market Report Highlights

- Increased awareness coupled with adoption of digital technologies is expected to boost growth of the India insurance market at a CAGR of 12 to 14% for the next five years.

- Life insurance remains the dominant segment of insurance, as it accounts for over 60% of total premiums, while non-life insurance is growing rapidly, particularly in the health and motor segments. ��

- Government policies like Ayushman Bharat and Pradhan Mantri Jeevan Jyoti Bima Yojana are promoting policy penetration and adoption in rural areas. �

- Younger and more technologically inclined consumers are being drawn to digital and mobile platforms, which streamline the purchasing and claims filing processes for policies. ��

India Insurance Market Trends

- Digital transformation and technology adoption: There is greater adoption of mobile apps, AI-based underwriting, chatbots, and policy management systems by insurers to improve customer engagement, make policy purchase easier, and speed up the settlement of claims. For example, a number of private insurers report that over 40% of policy purchases are made online and submission of claims through the internet has decreased the time of settlement by 30%. This is more pronounced among the younger cohorts such as Millennials and Gen Z consumers who are more inclined to use advanced technology to meet their financial needs.

- Rising demand for health and wellness-related insurance products: The other emerging trend is increasing the availability of health and wellness related insurance products due to escalating healthcare expenses, greater incidences of lifestyle diseases, and government initiatives related to health programs. The�penetration of health insurance in India is less than 5% of the population, which indicates a huge potential market. Demand is being met by private insurers in the form of tailored wellness plans, family covers, and even self-funded wellness programs, while the uptake of corporate health insurance is on the rise as companies begin to value employee health. Further, innovation and competition due to deregulation, as well as new innovation, transparency, and consumer protection laws, are strengthening the market. Together with the adoption of new technologies, these initiatives are making the insurance market in India more accessible, customer-oriented, and resilient, setting the stage for sustained double-digit growth for the insurance sector for several years.

India Insurance Market Dynamics

Market Drivers

- Increasing awareness about financial planning and risk protection: Greater education concerning financial planning and risk management is motivating people and families to invest in life and health insurance policies. Research shows that more than 70% of urban households understand the importance of insurance, a remarkable increase compared to a decade ago. Rural awareness is, however, lower, standing at 35 to 40%, but is improving because of outreach programs and digital advertising. Corporations are also accelerating growth by providing employee benefits, group insurance, and over 50% of large companies insure their employees with life and health coverage. This provides more than half of large companies indicating an increasing appreciation of risk management and financial security.

- Government support through policies and schemes: Government initiatives, policies, and accessibility frameworks directly enhance accessibility to vital services. With expanded coverage under Ayushman Bharat, Pradhan Mantri Jeevan Jyoti Bima Yojana, and Pradhan Mantri Suraksha Bima Yojana, low-income and rural households have seen a measurable uptick in policy uptake. Additionally, certain policies by IRDAI, such as permitting direct online sales, encouraging InsurTech, and the regulations on simplified disclosure norms, have fostered a more transparent and efficient market. A robust purchase cycle, high levels of corporate interest, and powerful government-provided frameworks have propelled the Indian insurance market to a CAGR of 12-14%, which positions them amongst the fastest growing sectors globally. Demand from the growing middle-class and increased digital penetration are key factors set to drive continued growth in financial products across the life and non-life categories.

Market Restraints

- Low insurance penetration in rural areas: However, the India insurance industry exhibits enduring constraints that hinder it from achieving its full potential. One prominent limitation is the low insurance penetration among rural and low-income demographics. While over 70% of people in urban areas are aware of insurance, a skimming 35-40% of rural residents are aware, hampered by low financial literacy, cultural constraints, and limited access to insurance providers. The lack of demand for life, health, and property insurance in rural areas stems from their reliance on meeting urgent needs only. This creates a challenge for insurers attempting to progress beyond urban markets.

- Complexity in product structures and claims processes: Product frameworks, as well as their respective claims procedures, serve as additional barriers to consumer engagement and policy acquisition. To the potential customers, most insurance products are characterized by elaborate terms, numerous exclusions, and multi-step claim processes, which sow confusion and distrust. Research shows more than 30% of insured people stop claiming benefits due to alleged complexity and negative past experiences, further eroding trust in the industry. Also, regulatory and operational constraints like delays for product approvals and extensive paperwork contribute to the problem. These factors both restrict the depth of the market as well as the erosion of trust and retention by customers. While the sector is starting to resolve issues with digital solutions and awareness programs, a greater focus is still needed on education and outreach in rural areas.

Market Opportunities

- Innovative digital insurance solutions: Rural India remains a substantial and comparatively under-exploited segment, with insurance penetration barely grazing 35�40%, set against an urban rate exceeding 70%. Government orientated schemes like the Pradhan Mantri Jeevan Jyoti Bima Yojana and the Pradhan Mantri Suraksha Bima Yojana have succeeded in providing baseline life and accident coverage to millions of village households, yet an expansive demographic remains outside the safety net. Increased income levels along with better access to banks and higher awareness levels enable a better tailored offering for rural families, farmers and small business owners. For example, certain rural specific products such as crop insurance and micro-insurance can foster social impact while also creating a business opportunity.

- Surge in digital adoption and InsurTech innovations: With nationwide smartphone diffusion exceeding 65% and even greater coverage of 4G connectivity in semi-urban and rural hinterlands, incumbents and start-ups alike may deploy mobile interfaces, AI-augmented underwriting, and digital post-purchase service to render policy acquisition and claims settlement rapid and transparent. Demand is also crystallizing for adaptive insurance constructs�transaction-based coverage, micro-premium health addendums, and behavior-linked wellness riders�appealing to an edgy, digitally literate demographic that prizes customization and fluidity.

Market Challenges

- Low awareness and financial literacy: A primary impediment to the growth of the insurance sector remains the limited awareness and financial literacy of substantial portions of the populace, especially in rural and semi-urban settings. Although urban indicators reveal insurance awareness approaching 70%, rural estimates hover between 35 and 40 percent, precipitating persistent underinsurance and a pervasive hesitation to secure life, health, or property coverage. Persisting misconceptions regarding the actual value of policies, a pervasive disbelief in the fairness of claim settlements, and a generally narrow grasp of available coverage options collectively suppress uptake. Even urban consumers confront challenges in effectively benchmarking insurance products, often resulting in suboptimal selections or policy lapses; these behaviours contribute to volatility in the market and jeopardise long-term sector growth.

- Affordability and cost sensitivity among consumers: Affordability, compounded by consumers� pronounced cost sensitivity, remains an enduring obstacle for the Indian insurance sector. Although household incomes have risen, large constituencies�particularly in rural areas and among lower-middle-class demographics�continue to classify insurance premiums as excessive when measured against their discretionary spending. Empirical surveys indicate that most low-income families defer purchasing protection for tomorrow in favour of securing basic needs for today, which either results in pronounced underinsurance or the selection of coverage that remains glaringly inadequate. Concurrently, when premiums in the health and life segments escalate, the likelihood of policy renewal declines; lapse ratios in some strata have surpassed thresholds of 10 to 12% on an annual basis. This pronounced reluctance to absorb cost subdues both breadth and depth of coverage and limits the uptake of comprehensive or ancillary risk solutions. Consequently, insurers are compelled to conceptualise micro-insurance, instalment-based premiums and user-based coverage, devices engineered to expand volumetric market access without undermining the viability of their business models.

India Insurance Market Segmental Analysis

Type Analysis

Life insurance: Within the insurance, life coverage occupies the preeminent position, contributing in excess of 60% to aggregate premium receipts. Three drivers underpin the expansion: rising consumer cognisance of mortality risk, the nascent yet accelerating imperative of retirement provision, and the expectation that insurance devices will serve as reservoirs of future investable cash. Contract typologies that marry risk cover and investment�particularly term covers, endowments, and unit-linked insurance plans�continue to resonate with metropolitan and peri-urban consumers. Surveys have further established that the accelerating adoption of Internet-distributed platforms is of consequence, with digital routes accounting for almost 40% of new policy premium transactions.

India Insurance Market Share, By Type, 2024 (%)

| Type |

Revenue Share, 2024 (%) |

| Life Insurance |

60% |

| Non-Life Insurance |

40% |

Non-life insurance: Non-life insurance, often termed general insurance, is advancing at an accelerated pace, propelled by escalating demand across the health, motor, property, and travel sectors. Of these, health insurance has recorded the most pronounced expansion. The dual forces of rising hospitalization expenses and public programmes, such as the Ayushman Bharat scheme, have spurred significant policy adoption, particularly among lower- and middle-income households. Motor insurance continues to be a key pillar, buttressed by the legal obligation for third-party liability coverage and by an ongoing surge in vehicle registration. Collectively, the non-life segment presently accounts for roughly 35�40% of aggregate premium income and is widely anticipated to expand faster than the life segment during the foreseeable horizon.

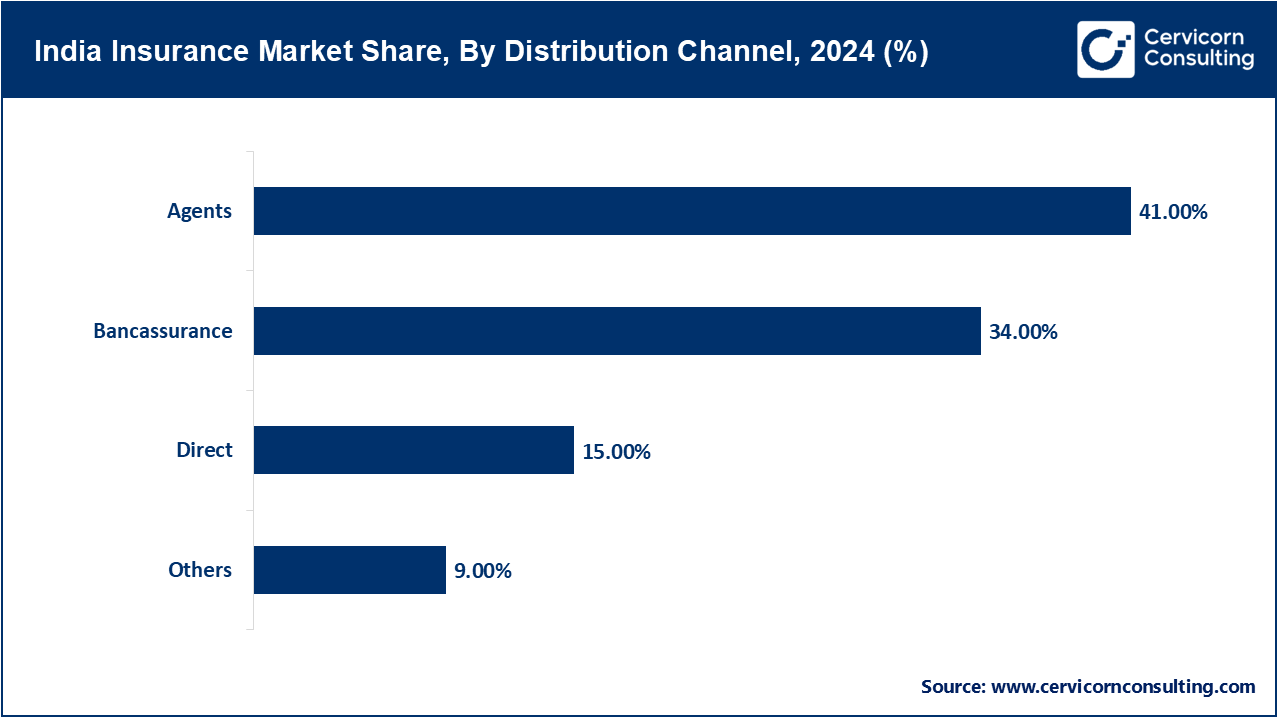

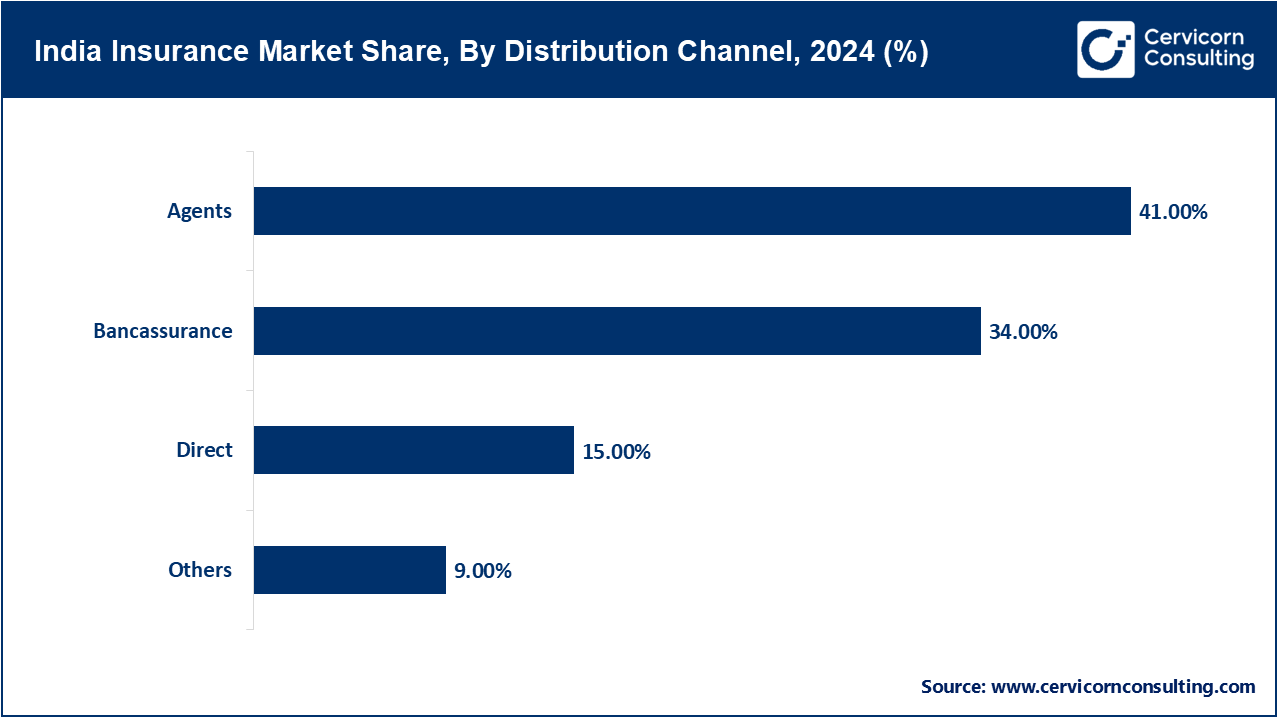

Distribution Channel Analysis

Insurance Agents: Insurance intermediaries, notably agents, continue to be the preeminent distribution medium, providing in excess of 50% of overall premium inflows, a dominance particularly pronounced in life insurance. Their success is attributable to a persistent focus on personalized service and their capacity to elucidate intricate product features. The comparative efficacy of agents is most apparent in semi-urban and rural settings, areas marked by limited digital proficiency and a pronounced reliance on in-person consultations, which cultivate stronger consumer trust.

Bancassurance: Bancassurance, the integration of insurance distribution within the retail banking framework, has solidified its negative position as a leading growth accelerant, now furnishing 20�25% of life premium income. The expansive and steadily growing base of 150 million bank account holders empowers this channel to exploit the pervasive branch and digital infrastructure of banking institutions to deliver insurance solutions across both metropolitan and rural demographics.

Direct Sales: Direct distribution through proprietary branch networks continues to be a key avenue for companies working with corporate accounts and wealth clients; concurrently, brokers retain a commanding presence in the property and casualty space by underwriting large commercial policies, complex liability packages, and niche specialty lines. Digital pathways, however, have rapidly gained prominence, undergirded by national smartphone penetration surpassing 65% and a secular surge in broadband access. Consequently, online channels now represent approximately 15% to 20% of annualised new written premium, with the millennial and Gen-Z segments gravitating toward mobile applications, web-based portals, and InsurTech interfaces that facilitate comparative analysis, purchase, and post-sale service including claims.

Other: Moreover, strategic alliances with financial technology firms, digital marketplaces, and microfinance providers are generating incremental distribution capacities, especially in the domains of microinsurance and offerings oriented toward rural populations. The observable pluralisation and hybridization of the distribution ecosystem illustrate the industry�s ability to recalibrate in real time, broadening overall market coverage, expediting transaction speeds, and synchronizing service design with progressive consumer expectations. This deliberate multi-channel architecture is instrumental not only for fulfilling the government�s articulated insurance penetration aspirations but also for sustaining the market�s projected compound annual growth rate of 12 to 14% for the foreseeable horizon.

End User Analysis

Individual: The individual segment remains the largest component of the insurance market, commanding more than 65% of total premiums. Heightened awareness within urban and semi-urban demographics, together with the rapid uptake of digital technology, has catalyzed a pronounced rise in individual policy purchases, with online channels now accounting for close to 40% of new individual policies.

India Insurance Market Share, By End User, 2024 (%)

| End User |

Revenue Share, 2024 (%) |

| Individual |

65% |

| Corporate |

35% |

Corporate: The segment is similarly expanding, now responsible for approximately 30-35% of overall market volume. Premium accumulation in this area is driven chiefly by group life, corporate health, liability, and asset insurance solutions. Corporate sponsors of various size are increasingly providing holistic insurance suites comprised of wellness initiatives, critical-illness rider, and associated group pension plans. These measures reflect a substantive re-evaluation of organizational responsibility toward proactive risk abatement and employee well-being. Concurrently, small and medium enterprises (SMEs) are progressively embedding insurance in their risk arsenals; the obligation is generally fulfilled with the assistance of brokers and self-service digital marketplaces, thereby institutionalizing continuity planning within a segment previously underserved.�

India Insurance Market Top Companies

Recent Developments

- August 2025: Odisha's Chief Minister launched the 'BharatNetra' program to promote fintech and insurtech education in the state. It will be offered in partnership with the National University of Singapore and the Global Finance and Technology Network, with a five-month hybrid Certificate in Fintech and Insurtech (CFI) slated to be offered to 7,000 students over five years. The first cohort of 375 students is set to begin in September 2025.

- August 2025: The Life Insurance Corporation of India (LIC) announced the commencement of a targeted revival drive focused on individually lapsed insurance contracts. The programme, which will remain operative until 17 October 2025, allows for reductions in overdue amounts on non-linked policies, with reductions of up to 30% and ceiling relief of ₹5,000, while granting a full waiver of outstanding dues on Micro Insurance Policies.

Market Segmentation

By Type

- Life Insurance

- Non-Life Insurance

By Product

- Health�

- Motor

- Property

- Travel

By Distribution Channel

- Bancassurance

- Agents

- Direct

- Others

By End User