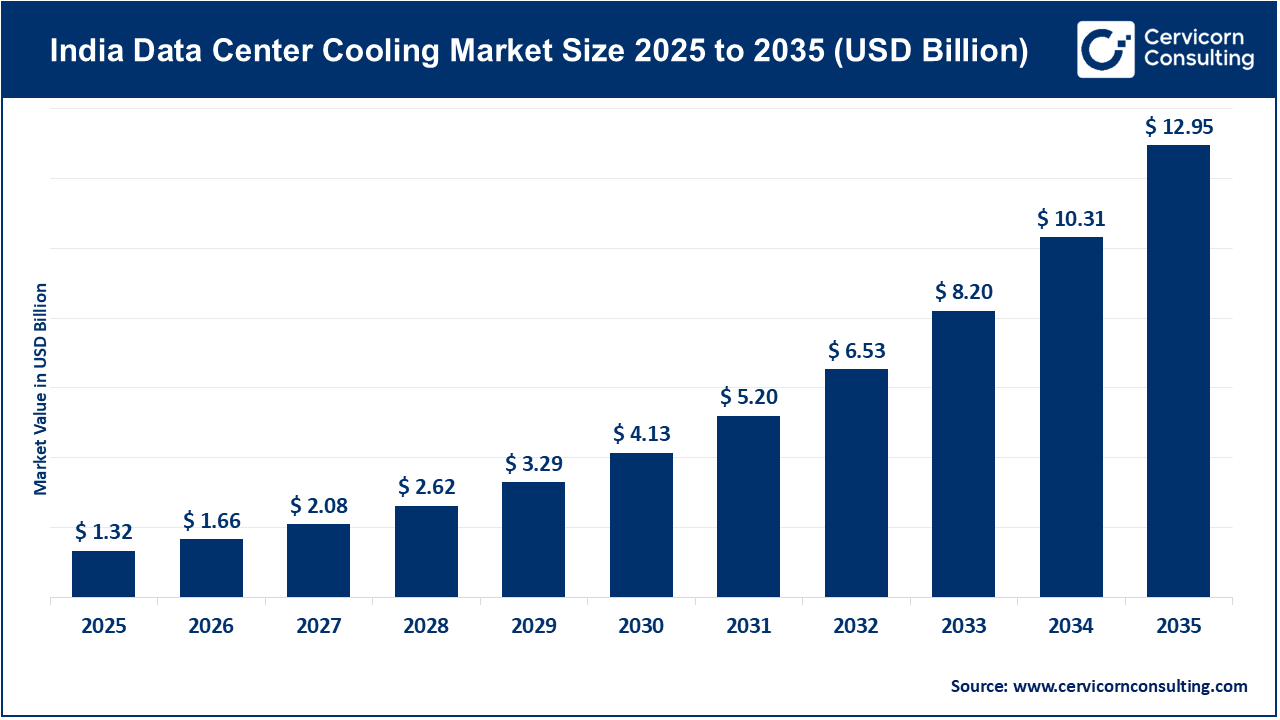

The India data center cooling market size was valued at USD 1.32 billion in 2025 and is expected to be worth around USD 12.95 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 25.7% over the forecast period 2026 to 2035. The market’s expansion is observed owing to massive investments done by data center operators and developers across the nation.

What is the Outlook of India’s Data Center Cooling Market?

With India’s data center capacity projected to reach 14 GW by 2035, the government and private investors are observed to step up with efforts to attract hyperscale facilities through subsidised land and tariff rebates. As enterprises, hyperscale cloud providers, and colocation operators scale up infrastructure across major Indian markets — including Mumbai, Chennai, Hyderabad and Bengaluru, the need for advanced cooling technologies continues to intensify. Cooling systems remain critical to ensuring optimal performance, reliability, and uptime for IT workloads, especially as server densities and power loads increase.

“Accoring to PwC report, investments in data center by operators and developers are expected to reach $70 billion by FY2035.”

The market is expected to witness sustained double-digit growth over the next decade, driven by the adoption of next-generation cooling architectures such as row-based cooling, hybrid cooling systems, and liquid cooling solutions. These technologies offer superior thermal management and improved power usage effectiveness (PUE), aligning with the industry’s increasing focus on energy efficiency and sustainability.

India’s Data Center Statistics: Capacity, Consumption & Investment Data to Look in 2026

Rapid Expansion of Data Center Capacity Across India

High Capital and Operational Costs of Advanced Cooling Systems

Shift Toward Energy-Efficient and Sustainable Cooling Technologies

State-wise Government Initiatives, Private Investments, and Strategic Significance in India’s Data Centers:

| State | State Government Initiatives | Private Investments | Significance |

| Maharashtra | Created data center-friendly policies with strong single-window clearance | Heavy investments by global hyperscalers and leading colocation providers concentrated in Mumbai and Navi Mumbai | India’s largest data center hub with high server density, driving sustained demand for large-scale and advanced cooling systems |

| Tamil Nadu | Started dedicated data center policy and incentives for renewable energy use, | Rapid inflow of hyperscale and colocation investments, particularly in Chennai | Fastest-growing state due to hyperscale expansion and sustainability-driven cooling adoption |

| Telangana | Initiated data center policy with focus on ease of doing business, plug-and-play infrastructure | Strong investments in Hyderabad from cloud, enterprise, and colocation operators | Emerging hub supporting modern cooling architectures such as row-based and hybrid systems |

| Karnataka | Working on digital infrastructure promotion, IT-focused ecosystem support, renewable energy integration | Presence of global IT firms and cloud service providers investing in Bengaluru | Steady demand for efficient cooling solutions driven by enterprise and cloud workloads |

| Gujrat | Industrial-friendly policies, renewable energy focus, land availability | Industrial-friendly policies, renewable energy focus, land availability | Emerging destination leveraging sustainability-driven cooling and industrial-scale infrastructure |

Room-based cooling segment continued to dominate the India data center cooling market in 2025 due to its widespread deployment across legacy and large-scale facilities. The ease of maintenance, proven reliability, and lower upfront investment compared to advanced cooling architectures support its continued dominance, especially in colocation and enterprise environments with moderate rack densities.

| Cooling Type | Revenue Share, 2025 (%) |

| Room-based Cooling | 45% |

| Row-based Cooling | 35% |

| Rack-based Cooling | 20% |

Row-based cooling is expected to grow at the fastest rate as data centers increasingly shift toward higher rack densities and energy-efficient designs. Row-based systems significantly reduce air mixing and hotspots, improving thermal efficiency and lowering power usage effectiveness (PUE). The rapid expansion of hyperscale and cloud facilities in India is accelerating adoption, as operators seek scalable solutions that can adapt to fluctuating workloads.

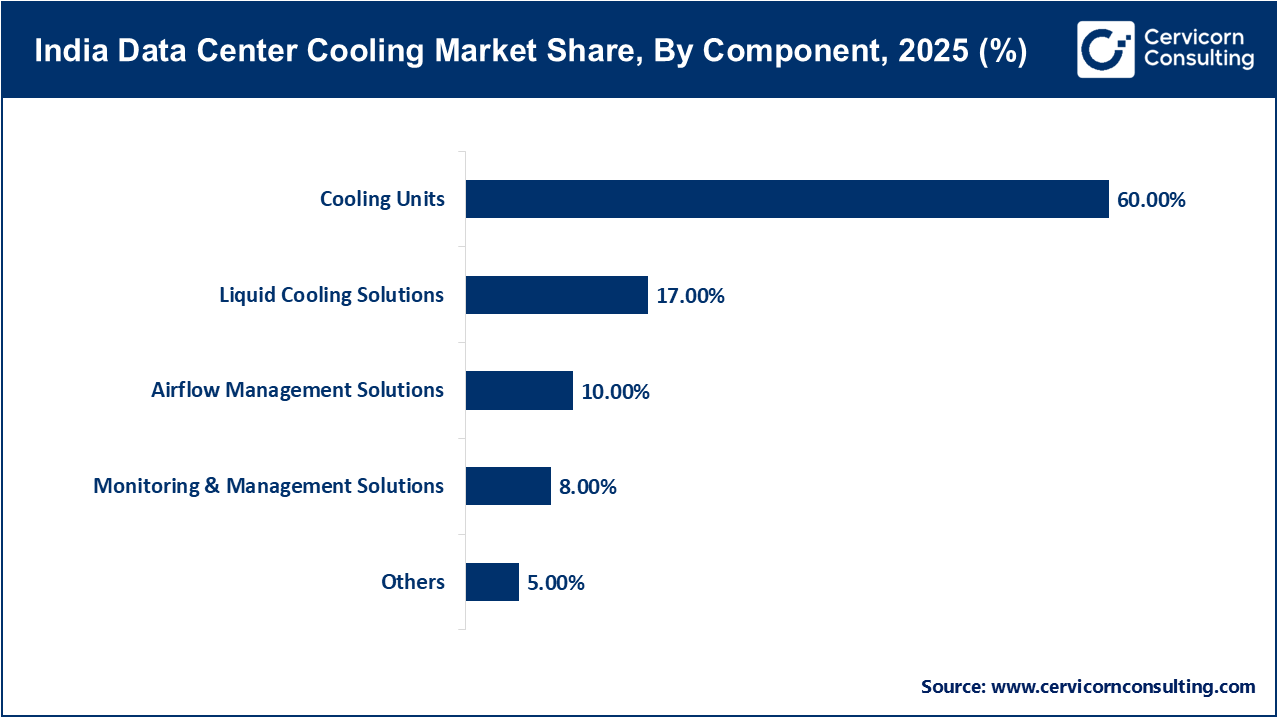

Cooling units dominated the market in 2025 as they form the backbone of every data center cooling infrastructure. Precision air conditioners, chillers, and in-row cooling units account for the largest capital expenditure during data center construction and expansion. Given India’s hot climate and rising server loads, operators continue to prioritize high-capacity and reliable cooling equipment to ensure uptime and compliance with thermal standards.

Liquid cooling solutions are witnessing the fastest growth due to the rapid increase in rack power densities driven by AI, machine learning, and data-intensive workloads. As hyperscale operators in India optimize for energy efficiency and sustainability, liquid cooling is transitioning from a niche solution to a strategic investment.

“How Did Colocation Centers Dominate the India Data Center Cooling Market?

Colocation data centers segment dominated the market in 2025 as enterprises increasingly outsource infrastructure to reduce capital expenditure and meet India’s evolving data localization requirements. These facilities operate at scale and host multiple tenants, making efficient and standardized cooling systems essential. High utilization rates and continuous expansion by colocation providers directly translate into strong demand for cooling infrastructure.

The cloud data centers segment is expected to grow the fastest, driven by surging demand for cloud computing, AI platforms, digital payments, and OTT services. Hyperscale cloud providers require advanced cooling technologies to support dense server configurations and continuous workloads. Their focus on efficiency, sustainability, and rapid scalability is accelerating adoption of next-generation cooling systems across India.

“The Air-based Cooling Held the Largest Share of the Market in 2025”

Air-based cooling segment stayed the dominant technology in 2025 due to its established presence, lower initial costs, and widespread familiarity among operators. Most Indian data centers still rely on traditional air-based systems, particularly in facilities with low to medium rack densities. The availability of skilled technicians and standardized designs further supports its continued dominance.

| Cooling Technology | Revenue Share, 2025 (%) |

| Air-based Cooling | 62% |

| Immersion Cooling | 13% |

| Hybrid Cooling | 25% |

Hybrid cooling is growing rapidly as data center operators seek to balance performance, cost, and sustainability. By combining air and liquid or evaporative cooling techniques, hybrid systems allow operators to incrementally upgrade infrastructure without complete redesigns. This flexibility makes hybrid cooling particularly attractive for facilities transitioning toward higher densities while managing capital constraints.

“The BFSI Segment Led the India Data Center Cooling Market with the Largest Share.”

The BFSI segment dominated the market in 2025 due to its heavy dependence on always-on digital infrastructure for banking transactions, payment processing, and fraud detection. Stringent regulatory requirements, data security concerns, and zero-downtime expectations compel BFSI institutions to invest in highly reliable and redundant cooling systems.

| End User | Revenue Share, 2025 (%) |

| BFSI | 35% |

| Telecom & IT | 26% |

| Healthcare | 12% |

| Government | 9% |

| Defense | 7% |

| Retail & E-commerce | 11% |

Telecom and IT is the fastest-growing end-user segment, fueled by 5G deployment, data consumption growth, and cloud-native applications. Telecom operators and IT service providers are expanding network data centers and edge facilities, significantly increasing demand for scalable and energy-efficient cooling solutions.

Major India-Headquartered Companies in the Data Center Cooling Sector:

By Cooling Type

By Component

By Data Center Type

By Cooling Technology

By End User