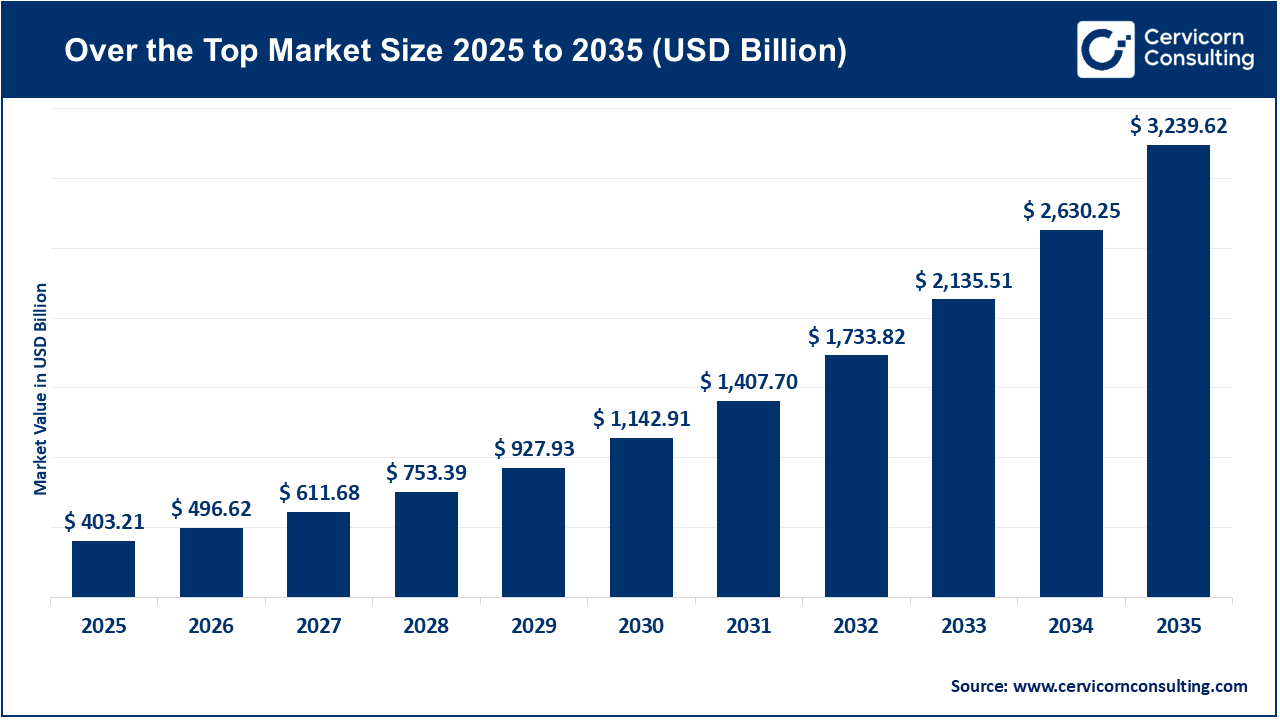

The global over the top (OTT) market size was valued at USD 403.21 billion in 2025 and is expected to be worth around USD 3,239.62 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 23.2% over the forecast period from 2026 to 2035. The growth of the OTT market is primarily driven by the rapid expansion of high-speed internet infrastructure, including widespread 4G and accelerating 5G deployment, which has significantly improved streaming quality and accessibility. Increasing smartphone penetration and smart TV adoption have further enabled consumers to access OTT platforms anytime and across multiple devices. In addition, changing consumer preferences toward on-demand, personalized, and ad-free content experiences have accelerated the shift away from traditional cable and satellite television. The rise of original and exclusive content, especially regional and language-specific programming, has strengthened platform differentiation and increased user engagement and subscription uptake globally.

Strategic Shift to Hybrid Monetization and Ad-Supported Tiers driving the OTT market

One major trend in the recent history of the OTT market is the collective pivot to hybrid monetization. For years, premium streaming services was synonymous with ad-free, subscription-based access, until economic pressures and market saturation in developed markets compelled OTT to reevaluate this approach. Research findings indicate that Netflix and Disney+ scaled their ad-supported tiers during 2024 and 2025, achieving critical mass subscriber numbers while increasing overall ARPU, a clear strategy of lower entry pricing and high-value advertising inventory.

This "Ad-Lite" strategy satisfies two specific goals: first, the ad-supported tier provides a low-price entry point for consumers in new and emerging markets, and second, these models have provided resilient revenue streams that are less dependent on ongoing subscriber acquisition. In addition, the development of password-sharing crackdowns has pushed "freeloaders" into these ad-supported tiers which made "non-paying" viewers monetizable. This factor is likely the blurring of a line between traditional television and OTT platforms, as they both now adopt the advertising-based revenue models of the medium they originally sought to displace.

Global OTT Market – User & Consumption Statistics

| Metric | Statistical Data |

| Global OTT Users | 3.6 billion users worldwide |

| Annual User Growth Rate | 8–10% |

| Average Daily Watch Time | 95–120 minutes per user |

| Monthly Active Users (Top Platforms) | 200–260 million per leading platform |

| Percentage of Mobile OTT Users | 65% |

| Percentage of Households Using OTT | 72% globally |

| Average Subscriptions per Household | 2.8 platforms |

1. Adoption of Generative Artificial Intelligence for Content Personalization

Generative Artificial Intelligence (Gen-AI) has shifted from issuing experimental use cases to an operational necessity for OTT platforms. By late 2024, over-the-top (OTT) players like Amazon Prime Video began to develop Gen-AI tools for enhanced user discovery and engagement. For example, Gen-AI now generates AI-driven "X-Ray" summaries and user-specific personalized trailers based on individual viewing history, which has virtually cleared "choice fatigue".

Beyond user experience, Gen-AI technologies are also revolutionizing content production and localization. Automated dubbing and subtitling technologies have allowed OTT platforms to take localized content and disseminate globally virtually instantaneously versus the previous exhaustive and expensive localization processes. This leap in technology is important for OTT players pursuing a "glocal" strategy, where local productions must find an international audience to justify the high production costs.

2. Government Initiatives to Support Digital Infrastructure and Broadband Expansion

The growth of the OTT market is highly dependent on digital infrastructure availability. Government-led initiatives have been a significant factor in expanding the addressable market, particularly in rural and underserved locations. In the US, the Broadband Equity, Access, and Deployment (BEAD) program has reached maximum implementation in 2025 with the goal of providing high-speed internet access to every household.

In the context of the Asia-Pacific region, India's rapid rollout of 5G connection has introduced millions of first-time "mobile-only" viewers into the OTT ecosystem. Investments in digital infrastructure have yielded results that are not just increasing the user base of OTT, but giving users higher quality-of-service (QoS) standards, such as 4K and 8K streaming which require high bandwidth standards. Government-mandated local content quotas in both Europe and Canada have also forced global OTT players to invest significantly in local production hubs, further stimulating regional market growth.

3. Expansion of Live Sports Streaming and Exclusive Sports Rights

Live sports have proven to be the "ultimate churn killer" in the OTT-flooded landscape. As scripted content is competing with more and more production platforms while production costs are increasing, live events provide the "appointment viewing" experience that keeps subscribers engaged, over and over again. One key turning point in this trend was when Netflix secured exclusive streaming rights for WWE Raw and select NFL games in 2024 and 2025, marking an unequivocal commitment to live sports.

Exclusive sports rights are an effective engagement driving mechanism and provide premium inventory to advertisers, as sports fans are more inclined to engage with live sports content and watch the entire contest. Not to mention, this has been an active cannibalization of the last stronghold of linear cable television. Additionally, niche sports, such as Major League Soccer (MLS) on Apple TV+, have been met with success in connection with migrating dedicated fan bases to OTT platforms through exclusive, comprehensive, global rights deals.

Global Smartphone Proliferation and 5G Connectivity

The main driver of the OTT market is the global proliferation of smartphones and 5G connectivity. In many parts of the world, especially in APAC and LAMEA, the smartphone is the primary, and in some cases the only, device for accessing the internet and consuming content. The decline in the cost of data and affordable high-speed handsets has made OTT services available to a wider demographic than ever before.

5G technology is a force multiplier against this trend because it offers low latency and high bandwidth, which together drive seamless streaming on the go, particularly for data-heavy use cases like live sports and cloud gaming. The always-on nature of the mobile device means that content is available 24/7. This increase in the total number of consumption hours in tandem with more touchpoints for monetization through subscriptions and advertising, ultimately leads to a larger OTT market.

Content Piracy and Complicated Local Licensing Regulations

Even with the advancement of technology, content piracy keeps rearing its ugly head as a continuing restraint in the market. Sophisticated piracy networks (websites that stream illegally and illegal “IPTV” boxes) continue to siphon revenue to legitimate OTT services or hurt the potential revenue to a legitimate OTT service. This is even more dire in parts of the world that have weak enforcement of traditional IP laws (everywhere that multiple subscriptions add up to more than minimum wage).

Additionally, dealing with complicated local licensing regulations and country regulations adds another operational challenge. Each country has its own data privacy laws (GDPR in Europe and the DPDP Act in India), censorship, and requirements for local investment. The cost of entry and start-up expense goes up by manoeuvring the local labyrinth for every country where they distribute content, and all the red tape slows up global content deployment which is now forced to accommodate region by region, or just for that specific country.

Cloud Gaming and Interactive Content

More importantly, cloud gaming stands out as one of the most significant opportunities for OTT. A platform can offer high quality AAA (triple-A) gaming experiences and not require expensive hardware, simply leveraging its existing streaming infrastructure. The convergence of gaming and video streaming together allows platforms to capitalize an even larger share of the entertainment wallet. Additionally, with greater stickiness and likely improvement to average session lengths and time spent within a platform.

Interactive-type content, where viewers influence the narrative or participate, has perils for even newer engagement avenues. Some early research indicates that younger folks leverage interactive and snackable content formats instead of long-form videos. Lastly, there are rich opportunities in deep-vertical OTT content services that would ideally fit niches like fitness, education (Edtech), and hyper-local language content that can co-exist comfortably alongside the major general interest platforms.

Significant Content Production Costs and Subscriber Churn

The OTT industry faces a key challenge in runaway content production costs. Many analysts warn that the arms race for prestige television has gone too far, forcing platforms to focus on being more selective with which shows to greenlight. Many platforms are shifting to cheaper unscripted or reality type shows, which often have much more high profitability margins with much less per episode production costs.

Subscriber churn, or managing to put it plainly churn, is another ongoing challenge. Consumers are exhibiting “churn and return” behavior more frequently, subscribing to a service to binge a series then canceling the subscription immediately after the season’s release. This behavior is certainly causing volatility in revenue forecasting, which then leads to more intense investment in retention science “using AI and Data Analytics to predict when a user is likely to cancel a subscription and provide targeted offers to stay.

The over-the-top market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

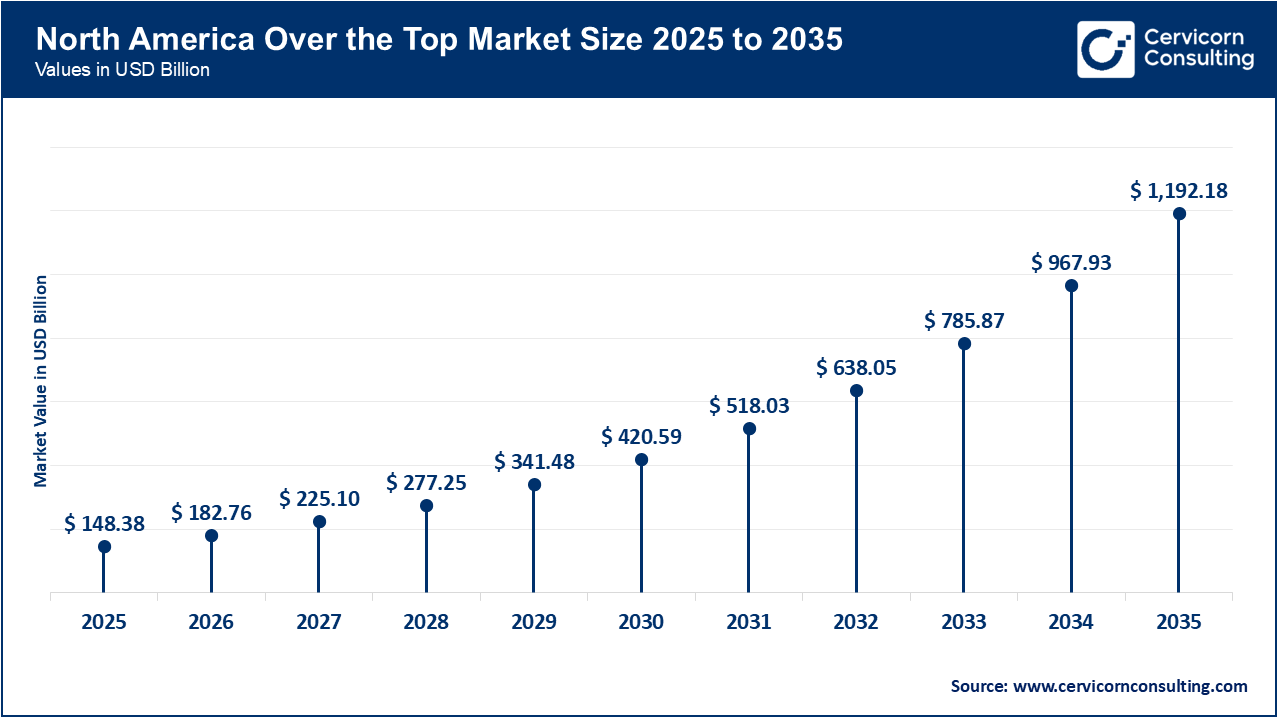

The North America over the top (OTT) market size was valued at USD 148.38 billion in 2025 and is predicted to reach around USD 1,192.18 billion by 2035. North America is the most mature and first to develop technological innovation in the world in OTT, which is evidenced by the household penetration as well as a well-educated consumer base. Research suggests that North America has moved beyond the "Streaming Wars" phase into a period of consolidation and focus on Average Revenue Per User (ARPU). As most of the OTT market has reached saturation, the major players objectives have shifted from acquiring new subscribers to maximizing their revenue streams by employing multiple monetization strategies.

Technological innovation has dominated the North American OTT market, particularly with high bitrate streaming and ad-tech. The North American market is the leader in 4K, 8K, and other premium quality content delivery based upon a well-developed broadband infrastructure and high Smart TV penetration. Ad-tech (the use of technology to deliver ads) has become hyper-targeted advertising, which yields high profit for networks providing ad-supported tiered content. Major technology hubs also allow the initial adoption of Generative AI that will help with content discovery and personalized user interface experiences, ensuring North American platforms remain on the leading edge of the global OTT industry.

Recent Developments:

The Asia-Pacific over the top (OTT) market size was estimated at USD 135.08 billion in 2025 and is forecasted to hit around USD 1,085.27 billion by 2035. The Asia-Pacific (APAC) is the fastest home of OTT growth, fueled by rapid digital transformation and a market with billions of mobile-first consumers. Unlike North America, many consumers in the APAC region are first-time digital adopters, particularly in countries like India, Indonesia, and Vietnam. The rollout of 5G has fueled high-quality video streaming on mobile devices in markets where fixed-line broadband has not been adopted yet.

For example, in India, cheap 5G plans have democratized access to premium content and OTT subscriptions, which have led to additional "mobile-only" OTT subscriptions. As a result, global players have adapted their pricing structure to provide low-cost mobile-specific OTT tiers that account for local economic conditions. The APAC region is also known to produce a great deal of local content. As a new or existing player in the fragmented APAC market, having a "hyper-local" strategy will be a requirement as OTT platforms will need to invest heavily in the local language and narrative to stand apart from existing domestic players.

China, a unique and dominant market in the APAC region, is largely a closed ecosystem supported by domestic platforms, which have advanced social media, e-commerce, and streaming integration to build all-in-one digital lifestyle platforms and have informed the "Super-App" trend elsewhere. Meanwhile, Southeast Asia is becoming a global and regional streaming service battleground, with regional growth opportunities driven by growing youth populations, socio-economic factors and growing smart phone penetration although regulatory environments and levels of payment infrastructure diversity are barriers.

Recent Developments:

The Europe over the top (OTT) market size was reached at USD 86.29 billion in 2025 and is projected to surpass around USD 693.28 billion by 2035. The European OTT market is characterized by cultural diversity and regulation that promotes consumer privacy and local content. Research shows that despite substantial share occupied by global platforms, there is an increasing demand for localized and multi-language content that reflects the continent's diversified linguistic genealogy. A "Glocal" approach emerged; in partnership with local production houses, international streaming services produce 'original' content that can travel across markets while satisfying local tastes.

Regulatory frameworks, such as the General Data Protection Regulation (GDPR) and the Digital Services Act, impose significant requirements on OTT providers in European markets and impact market conditions and operations. These regulations require adherence to strict requirements around data management and advertising standards, forcing OTT providers to innovate how to deliver personalized experiences without compromising the privacy of user data. Many European countries also have implemented quotas on content, which means streaming services must have some minimum percentage of their catalogue be of European origin, spurring the local creative economy while imposing additional costs to global players.

Recent Developments:

OTT Market Share, By Region, 2025 (%)

| Region | Revenue Share, 2025 (%) |

| North America | 36.8% |

| APAC | 33.5% |

| Europe | 21.4% |

| LAMEA | 8.3% |

The LAMEA over the top (OTT) market was valued at USD 33.47 billion in 2025 and is anticipated to reach around USD 268.89 billion by 2035. The LAMEA (Latin America, Middle East, Africa) region represents both a "blue ocean" of opportunity for the OTT industry with significant structural barriers, but growth in the region is practically married to the pace of infrastructure development, especially in 4K-capable mobile networks and the number of undersea fiber-optic cables. By improving connectivity, economies are unlocking millions of low and middle-income consumers who are accessing digital entertainment for the first time, thus representing the beginning of a massive consumer base.

In Latin America, markets like Brazil and Mexico are at the front of the pack, with robust demand for telenovelas and live sports driving subscriber growth. This region has emerged as the likely primary area of focus for global OTT platforms looking for growth to counteract slowing growth in North America, resulting in very active competition and a surge in local content investments. The Middle East is also undergoing a transformation based on government-led initiatives to diversify economies and invest in digital infrastructure. The high average revenue per user (ARPU) in Gulf Cooperation Council (GCC) market makes this a very appealing sub-region, especially for premium and exclusive content.

Recent Developments:

The over the top (OTT) market is segmented into component, type, streaming devices, deployment type, monetization model, content type, and region.

The OTT market consists of both solutions and services, with the solution segment leading the market. Solutions contain the complete software stack needed to deliver content, including Content Management Systems (CMS), Digital Rights Management (DRM), billing engines, and User Interface (UI) frameworks. As these platforms quickly come to support millions of concurrent viewers, the need for robust, secure, and scalable solutions is at an all-time high.

Over the Top Market Share, By Component, 2025 (%)

| Component | Revenue Share, 2025 (%) |

| Solution | 67.9% |

| Services | 32.1% |

The services segment includes consulting, system integration, and managed services. This is a growth area for OTT, in part because OTT is getting more complex. For example, when providers must layer on multiple third-party tools for advertising, analytics, and content delivery. There is a clear trend toward longer-term managed services as now the platform looks to outsource the technical heavy lifting so that they can focus on their core competency: curating and acquiring content.

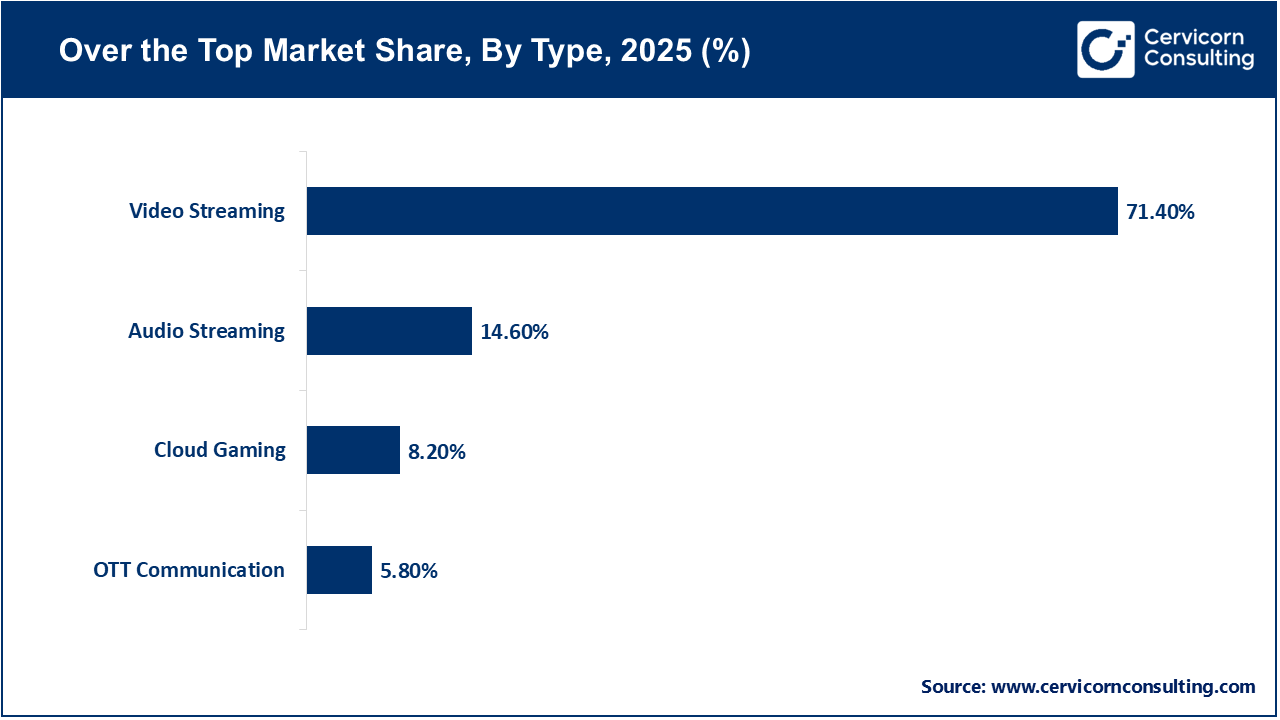

Video is still the largest segment by revenue, but the OTT market is expanding into audio, cloud gaming, and communication. Video continues to be the leading driver of data traffic, but the audio segment has been made highly relevant to people's digital lifestyles, especially driven by podcasts and music streaming that have widespread global popularity. Communication, including Voice over IP (VoIP), messaging apps, etc., is an established but important segment of the OTT ecosystem.

Cloud gaming is the fastest growing segment by type. Driven by the technical maturation of streaming protocols and the rollout of 5G, this segment allows games to be processed on remote servers and streamed to devices in real-time. Such a model democratizes access to high-end gaming that required expensive consoles or computer systems, and makes it highly compelling for consumers in emerging markets.

The landscape of devices is dominated by smartphones, which provide the primary screen for most of the world's OTT consumers. In places like APAC and LAMEA, these mobile devices are the portals to the Internet and OTT access, so providers have responded by offering mobile-only subscription plans at lower price points. The portability and always-on characteristics of smartphones easily positions them as the device of choice to consume snackable content and video integrated with social media.

OTT Market Share, By Streaming Devices, 2025 (%)

| Streaming Devices | Revenue Share, 2025 (%) |

| Smartphones | 41.8% |

| Smart TVs | 27.3% |

| Laptops, Desktops & Tablets | 15.6% |

| Gaming Consoles | 6.2% |

| Set-Top Boxes | 5.4% |

| Others | 3.7% |

However, the Big Screen experience is still an absolutely critical part of the market, with Smart TVs and connected devices (e.g., Roku, Amazon Fire Stick, Apple TV, etc.) increasing adoption in more mature markets. Smart TVs are coming into their own as the hub of the digital living room, delivering 4k and 8k quality content. The direct integration of OTT apps into the operating system of the TV has further simplified the experience for users and contributed to the demise of the traditional set-top box supplied to subscribers by the cable companies.

Cloud-based deployment is the clear leader in the OTT market, and it makes sense with all the benefits that come from cloud deployment, which have scalability, flexibility, and cost advantages. From a cloud perspective, once a provider begins to spin up clouds and resources to handle sudden spikes in traffic (e.g., during a significant live sports event), they only pay for capacity required to support the event. This flexibility to scale up/down as needed and the "pay-as-you-go" model is attractive to smaller players and startups with limited capital and access to market with a high capital expense.

OTT Market Share, By Deployment Type, 2025 (%)

| Deployment Type | Revenue Share, 2025 (%) |

| Cloud-Based | 78.5% |

| On-Premise | 9.6% |

| Hybrid | 11.9% |

While the use of on-premise deployment is all but gone, hybrid models are making their way back for use cases where they are needed. Hybrid Deployment - combining local edge compute and centralized cloud computing resources are proving useful to achieve reduced latency in high-priority cases such as cloud gaming and live sports betting. Hybrid models are being used to address latency issues experienced in cloud computing environments that cannot guarantee minimal latency to ensure responsiveness, which is critical for user retention in interactive formats.

The Subscription Video on Demand model (SVOD) is still the largest share of the market, because the global players have enormous user bases. The hybrid model that combines SVOD and Advertising based Video on Demand (AVOD) is the fastest growing monetization strategy. This should not come as a surprise, as simply adding an advertising revenue stream is a natural decision to capture a larger swath of consumer budgets and expand revenue opportunities in an ultra-competitive environment.

OTT Market Share, By Monetization Model, 2025 (%)

| Monetization Model | Revenue Share, 2025 (%) |

| Subscription (SVOD) | 55.7% |

| Advertising (AVOD) | 24.9% |

| Transactional / PPV (TVOD) | 9.8% |

| Freemium | 5.1% |

| Hybrid (SVOD + AVOD) | 4.5% |

Transactional Video on Demand (TVOD) is still relevant, although smaller and primarily used for first-run movies. However, another development in the advertising space is the use of a Free Ad-supported Streaming TV (FAST) channels. FAST channels provide a linear-like experience without subscription fees and are attractive to viewers who appreciate "lean-back" viewing, which demonstrates how streaming has expanded access to traditional television's reach.

Though general entertainment content (movies and scripted TV shows) remains the dominant type, there has been a significant diversification into various specialized verticals. In terms of rights valuation and strategic value, live sports rights are the fastest growing segment. Educational content (or EdTech streaming) has also experienced a boom in demand, especially since the pandemic brought about distance learning.

OTT Market Share, By Content Type, 2025 (%)

| Content Type | Revenue Share, 2025 (%) |

| Movies & TV Shows | 46.3% |

| Sports | 18.9% |

| News | 7.4% |

| Music | 9.6% |

| Gaming | 6.2% |

| Education | 4.3% |

| Fitness | 3.1% |

| Kids Content | 4.2% |

Children's content is still quite resilient, valuable and provides long-term household subscriptions, and significant cross-platform merchandising opportunities. Disney+ majorly capitalized on its extensive libraries of content and has built a hefty market presence. Overall, this content diversification indicates that OTT has evolved outside of just a replacement for cinema or cable television, but encompasses all types of digital information and entertainment formats.

1. Netflix: Strategic Shift Towards Gaming and Ad-Tier Revenue Growth

Netflix's lead position has persisted as it continues to navigate the transition to a more mature business model. A key branch of its more recent strategy has been its expansion into cloud gaming and is leveraging its existing infrastructure to provide interactive entertainment without the need for end-user hardware. By integrating gaming into its standard subscription, Netflix aims to increase engagement and reduce churn, making the shift from a pure video service to the entertainer that encompasses digital entertainment.

The ad-supported tier and subsequent ramp-up mark critical strategic developments. Research shows the ad-tier attracted new price-sensitive subscribers and has become a key revenue component due to quality advertising inventory . This has been complemented by Netflix's global password-sharing crackdown, which converted millions of "borrowers" into paying subscribers, increasing ARPU tremendously.

2. Disney+: Content Consolidation, and Strategic Ecosystem Bunding

The Walt Disney Company has focused its OTT strategy on content consolidation and ecosystem integration to maximize profitability for Disney+. A big milestone in 2024-2025 included integrating Hulu content fully into the main Disney+ app in the United States, essentially creating a "one-app" experience that strengthens discovery for users. This consolidation is designed to increase the time spent on the platform while providing a broadened range of content offerings with family-friendly animation, all the way to adult dramas and documentaries.

Disney+ has also aggressively rolled out its ad-supported tier in international markets with the same success as North America. This strategy enables the platform to remain competitive in price sensitive markets, while also developing a viable advertising business. To boost subscriber retention, Disney has doubled down on "strategic bundling" through discounted packages that also include Disney+, Hulu, and ESPN+. This increases total consumer value proposition and creates a more stable revenue source by making the service less dispensable from household budgets.

3. Amazon Prime Video: Investment in Localized Content and Sports Rights

Amazon Prime Video funds a unique strategy based on its place in the larger Amazon e-commerce ecosystem. To further this strategy, in 2024, the platform introduced default advertising on all of its subscribers, with optional ad-fee subscriptions. This change quickly created one of the largest potential ad-supported streaming audiences in the world, alongside a massive new revenue source, and high-value audience data to scale its retail advertising business.

Amazon's investment in live sport has provided a pivotal component of its strategy to promote Prime memberships. The conclusions regarding the successful entry of "Thursday Night Football" content in the U.S. has encouraged global market entry, having secured rights to large sporting events in Europe and Asia. Live sport monetization also allows Amazon to interject retail services within the watching experience with not only shippable ads, but can embed real-time buys for particular merchandise link within programming.

By Component

By Type

By Streaming Devices

By Deployment Type

By Monetization Model

By Content Type

By Region