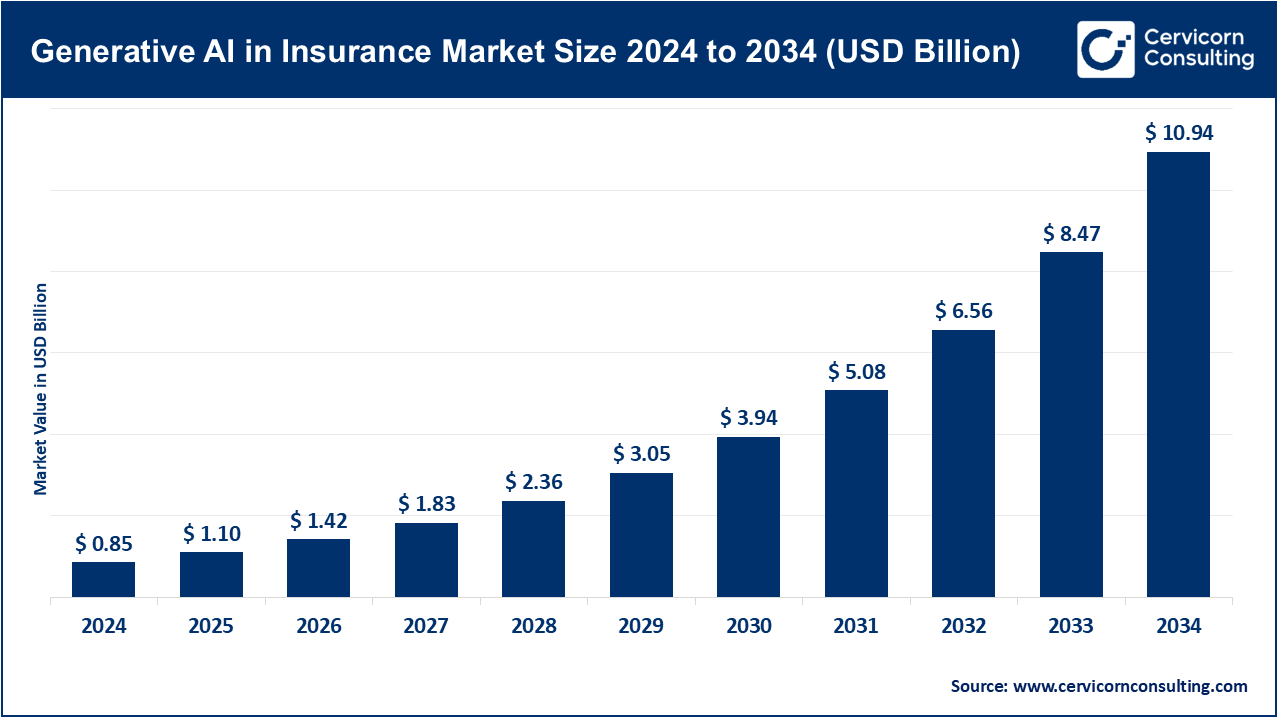

The global generative AI in insurance market size is calculated at USD 1.10 billion in 2025 and is anticipated to reach around USD 10.94 billion by 2034, expanding at a strong compound annual growth rate (CAGR) of 29.11% over the forecast period 2025 to 2034. The generative AI in insurance market is gaining momentum with insurers under pressure to modernize their operations, improve customer experience, and mitigate risks as the risk environment evolves. As claims get more complex, the regulations become stricter and customers seek individualized policies, Generative AI provides a transformative solution. Automating claims processing with the use of synthetic data models to scenario simulation to enhance fraud detection, among other processes, insurers are undergoing the implementation of AI-driven systems to enhance efficiency and accuracy. The technology as well enables the insurers to develop dynamic pricing models, custom coverage, and simplify underwriting, which will ultimately result in a quicker, customer-centric service.

One of the main facilitators of such growth is the transition of the industry to predictive and preventive insurance, where Generative AI has become an important factor in predicting risks in terms of which losses can be minimized at an early stage. Be it health, auto, life, or property insurance, Generative AI can assist carriers to create sophisticated risk models, simulate catastrophes, and deliver highly personalized customer experiences. In addition, insurers are using AI-powered markets to drive resiliency into portfolios by better evaluating climate-related risks and putting sustainability targets in place. It makes Generative AI anything more than a tool to drive operational efficiency but also a key to innovation and future competitiveness in the international insurance market.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 1.10 Billion |

| Estimated Market Size in 2034 | USD 10.94 Billion |

| Projected CAGR 2025 to 2034 | 29.11% |

| Leading Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Key Segments | Component, Deployment Mode, Enterprise Size, Application, End-User, Region |

| Key Companies | Microsoft Corporation, Amazon Web Services Inc., IBM Corporation, Avaamo Inc, Cape Analytics LLC, MetLife, Prudential Financial, Wipro Limited, ZhongAn, Acko General Insurance |

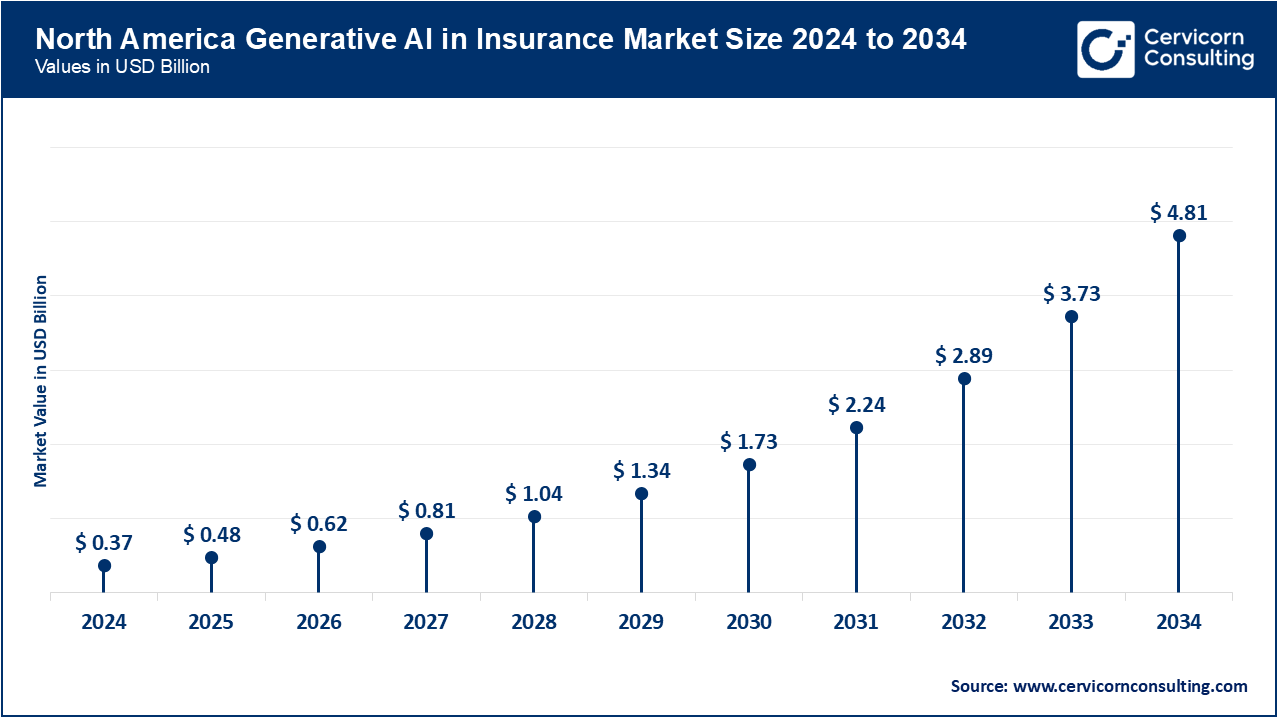

The generative AI in insurance Market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region.

The use of generative AI in insurance, especially in the fields of claims and fraud protection, is most advanced in the North American region. In June 2024, Lemonade has further scaled its artificial intelligence-based claims platform, where claims are processed in minutes. This innovation is an indication of how seriously the region approaches elements of efficiency and customer-based services. American carriers are using AI to create customized risk analysis, predictive pricing and intelligent fraud detection. Similar development is also being witnessed when it comes to customer engagement solutions in Canada.

Europe pursues generative AI with a laudable degree of caution; innovation on the one hand but need a high level of compliance regulation on the other. In May 2024, Allianz SE in Germany has introduced a generative AI tool to provide a user with personalized policy recommendations, and it fully complies with the changes to AI Act the EU currently proposed. This indicates how Europe is determined to adopt the concept of responsible AI in regulated sectors. Insurers in France, the UK and Spain are evaluating the use of AI in underwriting and claims at the same time being transparent and explainable. There are regulatory sandboxes that promote limited innovation in the sector.

Generative AI in Insurance Market Share, By Region, 2024 (%)

| Region | Revenue Share, 2024 (%) |

| North America | 44% |

| Europe | 24% |

| Asia-Pacific | 27% |

| LAMEA | 5% |

Asia-Pacific is fastest growing, owing to the large client bases and digital-first markets. In August 2024, the Chinese insurance conglomerate Ping An applied its AI-based underwriting technology to more policyholders to ramp up the pace of health risk profiles across its base of millions of policyholders. Insurers in India, Japan, and South Korea are also integrating generative AI to customer support, fraud, and dynamic price models. The competitive insurance arena in the region is spurring blistering innovation in AI.

The Middle East & Africa is a slow-mover, with initiatives in this sector such as the Oman Insurance AI chatbot, which was launched in Dubai in March 2024 to facilitate claims and inquiries. In the UAE and South Africa, regulators are welcoming pilot projects in regulatory sandboxes, and insurers are attracting newer customers (those with young families) interested in more customized products. Just as the case in Asia and Pacific, Latin America is also leading in the application of AI, where Porto Seguro in Brazil has implemented the generative AI to its platform in July 2024 to support multilingual services.

Solutions: General AI in insurance Insurtech Solutions like workflow automation, policy generation, claims settlement, and fraud detection automation are examples. These systems powered with AI minimize time taken in processing and enhance satisfaction of the customer. In March 2024, Lemonade Insurance expanded its AI-enabled claims system and was able to settle simple claims instantly. This illustrated how solutions can lead to direct increase in efficiency The implementation of solutions is an indication of insurers expecting economies and quick responsiveness to their services.

Generative AI in Insurance Market Share, By Component, 2024 (%)

| Component | Revenue Share, 2024 (%) |

| Solutions | 65.70% |

| Services | 34.30% |

Services (Consulting, Integration, Training & Support): Services promote seamless implementation of AI, including integration, training and post-implantation support. Consulting can enable insurers to determine the avenues of AI-driven optimization. Accenture, in conjunction with various insurers, has since integrated AI-supports underwriting support tools in July of 2023. The collaborations also involved training of employees. This indicates the vitality of services to make AI implementation successful.

Claims Processing: Generative AI can replace time-consuming manual work and automate documentation, and it enables predicting fraudulent claims. It assists insurers in clip-clopping down cases with more accuracy over a shorter time frame. In January 2024, Allstate introduced its automated claims adjusters with AI-assisted claims processing, which reduced their average time taken to be handled by quite some bit. This was evidence of the potential that AI will have on simplifying operations. Improved speeds create more customer confidence, as well as cost efficiency.

Underwriting & Risk Assessment: Involves using AI models to crunch through medical, financial and behavioral data to evaluate risks correctly. It also aids insurers to make policies more individual and minimize underwriting errors. In November 2023, Swiss Re has applied generative AI to underwriting life insurance to make faster decisions. This shows the essence of AI in high risk risky observation intensive decisions. A more intelligent underwriting may result in competitive advantage in the market.

Fraud Detection & Prevention: AI models will be able to identify anomalies in claims data, detecting fraudulent behavior with greater speed than man versus machine checks. Generative AI creates risk scenarios to test the fraud detection. In May 2024, AXA started using AI to detect fabricated injury claims, thus saving it millions of potential losses. This demonstrated the capability of AI to reduce fraud related costs. Fraud detection is another of the most powerful ROI opportunities that insurers have using AI.

Customer Support & Virtual Assistants: Customer Support – Customer Support policies, payments, claims information transacted by the use of generative AI via virtual assistants. They enhance engagement and workloads in call centres. In August 2023, Progressive Insurance implemented a chatbot powered by the conversational AI to be used by customers with questions. There were time savings as customers got real-time explanation of policies. This highlighted the position that AI has to play in enhancing customer experience.

Policy Generation & Personalization: AI can generate custom policies based on the behaviour of a user, demographics and their wealth. This customization improves customer loyalty/retention. In February 2024, Prudential launched Personalized health insurance plans through an AI. Such adaptive policies were in the spotlight due to relevance and flexibility. Artificial intelligence assists in personalization of the insurers to cover a variety of market segments successfully.

On-Premise: On-premise deployment focuses on installing the AI system in the vicinity of the insurer in order to have greater control over it and to ensure data security. This applies well to companies with stern compliance requirements. MetLife implemented on-premise AI to create risk-related models in October 2023 to work in accordance with local data regulations. This also gave sensitive financial data a way to remain in-house. On-premise is important to insurers that deal with sensitive data.

Generative AI in Insurance Market Share, By Deployment Mode, 2024 (%)

| Deployment Mode | Revenue Share, 2024 (%) |

| On-Premise | 26.50% |

| Cloud | 73.50% |

Cloud deployment: Cloud deployment enables softer scalable insurance to access AI powered tools. It lowers infrastructure expenses as in real-time updates are guaranteed. Liberty Mutual transitioned some of its claims processing AI over to cloud resources in June 2024 in order to scale more rapidly. The move enabled the smooth international operations in the world. The use of AI solutions in the Cloud reflects the increased need of insurers to be agile and cost-effective in the implementation of solutions.

Life Insurance: Life insurance AI can assess the risks in the long-term, automate personalization of the policy, and validate claims. In September 2023, John Hancock introduced an artificially intelligent system that is intended to automate the application process of life insurance. This greatly minimised the approval time of applications Generative AI also aids the insurance companies in delivering faster and more precise life insurance covers.

Health Insurance: AI assists health insurance companies process claims, detect potential frauds and design personal health plans. In April 2024, Cigna used AI to automate and customize claims and wellness benefits. Customers had a smoother reimbursement process with responses on regular progress. This showed the increasing importance of AI in regards to healthcare-oriented insurance.

Auto Insurance: Generative AI helps to deal with accident assessment, fraud detection, and automated claims in auto insurance. In December 2023, GEICO has been experimenting with AI-enhanced accident damage inspection through image analysis. This minimization of disputes and settlement times. Using AI, insurers of auto have also managed to eliminate delays and enhance customer confidence.

Property and Casualty Insurance: In property and casualty insurance, AI helps predict risk caused by natural disasters and automates the policy processing. In July 2024, Farmers Insurance used AI to determine wildfire risks in California. This resulted in more rapid changes in policy, and more accurate coverage. AI will make insurers manage risks better.

Travel Insurance: Diligence to travel insurance using predictive processing and real-time customer support. In January 2024, the Allianz company launched an AI-powered chatbot that handles the delayed flight claims in a few minutes. The customers were refunded faster with minimum documentation. This indicates that AI is a contributor to dynamic and short-term insurance products.

Large Enterprises: Large insurance companies using generative AI to process massive amounts of claims, customer enquiries and frauds. They make enterprise level customization and integration their priority. In August 2023, AIA Group deployed AI in various regional offices underwriting and claims. This kept consistency and also minimized errors It is desirable to scale AI at a global level by large enterprises.

Generative AI in Insurance Market Share, By Enterprise Size, 2024 (%)

| Enterprise Size | Revenue Share, 2024 (%) |

| Large Enterprises | 69.20% |

| Small & Medium-Sized Enterprises (SMEs) | 30.80% |

Small & Medium: Sized Enterprises (SMEs) SMEs make use of generative AI to achieve cost-effectiveness and efficiency in insurance management. Their AI tools enable them to compete with other large players without incurring high infrastructures cost. In March 2024, a small insurer, based in the U.S. incorporated the technology of AI chatbots with customers who were to process a few of their claims. This assisted the SMEs to provide 24/7 service similar to those of bigger insurers. AI helps SMEs in gaining a much-needed competitive advantage.

Market Segmentation

By Component

By Deployment Mode

By Enterprise Size

By Application

By End-User / Insurance Type

By Region