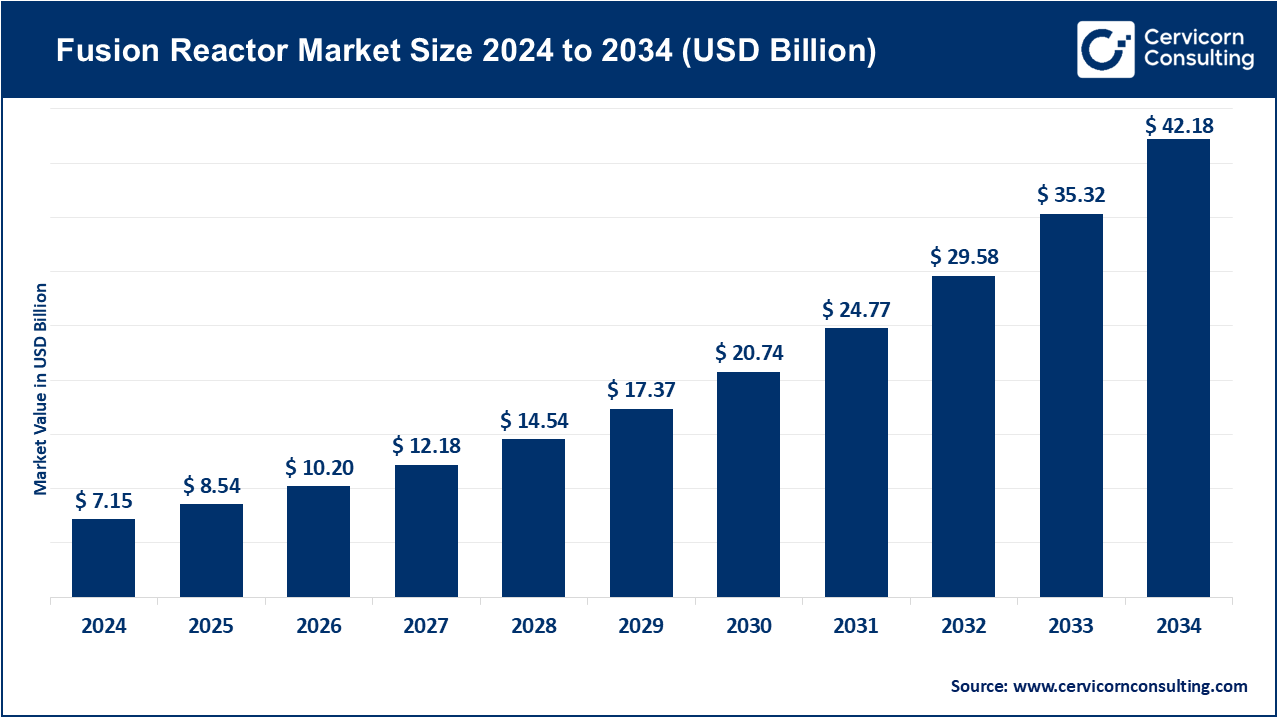

The global fusion reactor market size was valued at USD 7.15 billion in 2024 and is expected to hit around USD 42.18 billion by 2034, expanding at a compound annual growth rate (CAGR) of 19.42% over the forecast period from 2025 to 2034. The fusion reactor market is expected to grow significantly owing to rising global demand for clean, limitless energy and increasing investments in next-generation nuclear technologies. Advances in superconducting magnets, plasma containment, and public-private partnerships like ITER and Helion are accelerating commercialization timelines, positioning fusion as a key solution for future energy security.

The current global search for safe, clean and clean energy sources is pushing the fusion reactor market which drew billions in research from both the private sector and governments. With rapid advancement in technology, it is becoming essential for more countries to increase their dependence on clean energy sources rather than using fossil fuels, to combat climate change more effectively. Unlike traditional fission reactors, fusion reactors do not emit greenhouse gases, have fuel reserves that far exceed traditional fossil fuels, and are far safer, offering unprecedented advantages. ITER, SPARC, and even private companies like Helion and TAE Technologies have been shifting commercialization timetables forward. The fusion sector is poised to reshape global energy generation as breakthroughs in superconducting magnets, laser confinement, and plasma stability occur.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 8.54 Billion |

| Expected Market Size in 2034 | USD 42.18 Billion |

| Projected CAGR 2025 to 2034 | 19.42% |

| Prime Region | North America |

| Leading Growth Region | Asia-Pacific |

| Key Segments | Reactor Type, Technology, Component, Cooling System, End Use, Region |

| Key Companies | General Fusion, Tokamak Energy, Commonwealth Fusion Systems (CFS), TAE Technologies, Helion Energy, ITER Organization, First Light Fusion, Zap Energy, Fusion Fuel Green PLC, LPPFusion, Marvel Fusion, HB11 Energy, EX-Fusion Inc., Lockheed Martin (Skunk Works CFR Program), Princeton Stellarators Inc. |

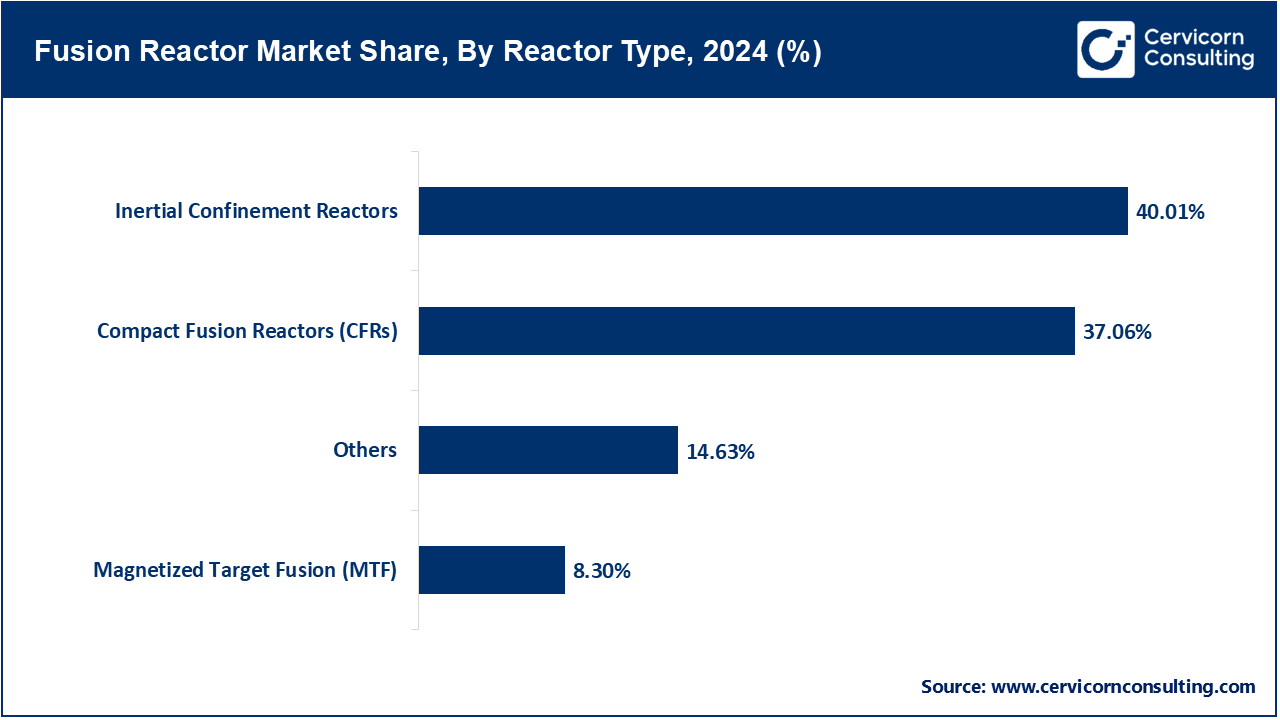

Inertial Confinement Reactors: The inertial confinement reactors segment has generated highest revenue share. These types of reactors utilize the most powerful laser or ion beams to compress and heat fuel pellets considering that in fusion fuel volume, the pressure must be very significant, thus, pyrotechnically via inertia. Other than burning magnetic systems, these reactors release energy in bursts, short, explosive and violent. As of December 2022, the National Ignition Facility in the US achieved a milestone net energy gain in controlled fusion using this method. This shift of focus towards inertial confinement led to an increase of investment into ion-laser and other fusion techniques in United States and abroad.

Compact Fusion Reactors (CFRs): These are small, modular off-grid reactors that can be easily deployed and inexpensive, tailored to remote locations. Their engineering focuses on faster construction as well as easier marketing and engineering. The SMART spherical tokamak reached first plasma in January 2025, proving that the compact design can be implemented for actual energy needs. In addition to being tailored for military bases and remote population centers, CFRs have been deemed appealing for industrial clusters that need a stable, carbon-economical energy source.

Magnetized Target Fusion (MTF): MTF integrates magnetic pre-confinement of plasma with rapid mechanical or magnetic compression to achieve fusion conditions. It seeks to provide a middle ground between the ease of implementation of inertial confinement and the stability provided by magnetic systems. A private firm announced in June 2024 the successful testing of a pulsed plasma liner which compressed magnetized fuel, thus marking a technical milestone in MTF. This hybrid model is attractive to start up companies, as well as to researchers, because it has a lower infrastructure requirement as compared to traditional tokamaks.

Magnetic Confinement Fusion (MCF): The magnetic confinement fusion segment has captured highest revenue share. With Magnetic Confinement, superheated plasma is contained and held using magnetic fields, and fusion is allowed to occur via tokamaks or stellarators. This technique leads the industry by both being the most researched and implemented in large projects. Japan’s JT-60SA advanced AI control permits implementation magnetic stabilization to control plasma during prolonged operation in March 2025. This merger of intelligent control and magnetic limit proves to be a leap in the direction towards industry scalability which secures MCF Technologies position as the leader in development in the Fusion industry.

Hybrid Confinement Fusion: Such attempts focus on achieving an equilibrium between energy extraction, the sophistication of processes involved, return on investment, and overall costs. Between 2023 and 2025, strides were made toward realizing magnetically confined pulsed compression fusion. Hybrid confinement fusion represents a refinement fusion between inertial and magnetic fusion. It chiefly relies on pre-plasma constraining which is magnetically-initiated with rapid compression during the ignition phase. While still nascent, these efforts aim at developing smaller, cheaper, and more efficient systems as opposed to traditional fusion methods.

Fusion Reactor Market Revenue Share, By Technology, 2024 (%)

| Technology | Revenue Share, 2024 (%) |

| Magnetic Confinement Fusion (MCF) | 56.30% |

| Hybrid Confinement Fusion | 28.50% |

| AI-Integrated Fusion Systems | 15.20% |

AI-Integrated Fusion Systems: AI-Integrated Fusion Systems categorize the regulation of plasma as well as other maintenance tasks powered by a fusion reactor. These functions leverage artificial intelligence and machine learning for enhanced productivity. Safety or disruptive risks incurable by real-time AI-powered changes can assuredly be avoided. In March 2025, QST and NTT of Japan incorporated an AI on the JT-60SA tokamak which enhanced dynamic magnetic control, substantially mitigating previously excessive plasma fluctuation problems. This achievement significantly advances self-regulating fusion reactors and illustrates how crucial AI is in achieving dependable and commercially viable fusion technology.

Power Generation Utilities: The power generation utilities segment accounted for a highest revenue share. This subsection relates to fusion power systems that are intended to interface with national or regional power utilities at the grid level. Their purpose is to serve as an alternative to fossil fuel-based power plants by providing clean and reliable baseload power. In May of 2023, the U.S. Department of Energy announced funding for pilot integrated utility fusion power plants. These initiatives seek to validate the capability of fusion power to either provide supplemental generation or replace conventional generation during peak load periods of high demand and during efforts to decarbonize electricity grids.

Defense & Aerospace: These industries segments are attracted to the portable and compact energy solutions offered by fusion. These systems may supply power to remote military bases and future spaceships, eliminating the need for extensive fuel supply chains. In June of 2024, a fusion startup sponsored by defense agencies began developing a portable reactor design toward energy self-sufficiency for military operations. The advantages of fusion energy for military and aerospace applications stem from its use in next generation systems because of ‘total power production’, energy density, and dependable efficiency, even in harsh circumstances.

Industrial Manufacturing: Gives the capability to augment an industrial fusor to accomplish high energy tasks like steel, ammonia, and cement production. This part centers on the use of fusion to carbon footprint industrial emissions. An industrial consortium partnered with a fusion company to sponsor a prototype reactor designed to deliver continuous process heat on April 2025. This collaboration suggests an emerging readiness to harness fusion energy beyond electricity generation as industrial shift their focus toward steam for thermal energy operational constancy in production energy dense industrial contexts.

Vacuum Vessel & Blanket Systems: The vacuum vessel and blanket systems segment emerged as the dominant force in the market. Plasma is contained within the vacuum vessel which maintains high vacuum levels. The blanket system also captures neutrons and has the capability of breeding tritium which may be used as fuel. The components are crucial to sustain fusion and fuel cyclic sustainability. As of June 2025, researchers had finished testing a modular breeding blanket which has been able to capture both neutrons and breed tritium. Achieving self sustaining fusion fuel cycles is vital in increasing reactor longevity, supporting engineering readiness for commercial fusion reactors, and closed loop operation within the plasma chamber.

Fusion Reactor Market Revenue Share, By Component, 2024 (%)

| Component | Revenue Share, 2024 (%) |

| Vacuum Vessel & Blanket Systems | 41.01% |

| Helium Gas Cooling | 25.60% |

| Fuel & Breeding Systems | 19.40% |

| Others | 13.99% |

Helium Gas Cooling: Propellant-grade helium's lack of chemotropic activity allows for the transfer of thermal energy; thus, helium may also be used for inertial conveyance of thermal energy from the fusion core to the heat exchangers. Furthermore, these properties enable the use of helium in high-temperature and high-pressure environments where safety concerns are present in radioactive contexts. From 2023 to 2025, prototype tokamak models featuring helium cooled loop systems were tested under extreme thermal cycling in severe fusion energy environments. The purpose of these tests was to evaluate system performance in various configuration drives, between the fusion energy system components, fuel cycle subsystems, and helium working fluid during the sustained operation.

Fuel and breeding systems: This part deals with the collection, administration, and synthesis of elements used in fusion such as deuterium and tritium. It also includes breeding blankets that generate tritium during reactor operation. Oak Ridge National Laboratory is one of the institutions testing tritiumbreeding modules with lithium and achieving results as of 2024. These prototypes demonstrated great promise towards overcoming one of the major obstacles in commercial scalability-autonomous fusion fuel cycle sustainment. Effective regenerative systems are crucial for long-term operation of reactors and reduced reliance on external radioactive materials.

Water-Based Cooling Systems: The water cooling systems accounted for the largest market share. As a simpler and more efficient method of cooling, water-based systems are being utilized in fusion reactors as they are in traditional nuclear reactors. As with traditional reactors, water is circulated to remove heat from the core and plasma-facing components. From 2022 to 2025, various research labs focused on creating water-based cooling systems that were resistant to corrosion from neutron bombardment. Current efforts are focused on achieving fusion-compatible cooling while still integrating existing fusion coolant infrastructure. This makes water cooling systems transitional methods for near-term fusion prototypes.

Fusion Reactor Market Revenue Share, By Cooling System, 2024 (%)

| Cooling System | Revenue Share, 2024 (%) |

| Water Cooling | 43.50% |

| Liquid Metal Cooling (e.g., Lithium, Lead) | 25.80% |

| Cryogenic Cooling | 30.70% |

Liquid Metal Cooling (e.g., Lithium, Lead): This system uses lithium or lead and can rotate both metals with high efficiency. Lithium is especially useful since it also aids in tritium breeding which is advantageous. A fusion startup conducted high-temperature simulations and was able to validate the lithium-lead alloy's thermal load management as well as its ability to foster tritium production. Such systems will significantly improve the neutronic performance of high neutron flux reactors by improving harsh environment performance, dependability, and increasing the operational lifespan of commercial fusion systems.

Cryogenic Cooling: The superconducting magnets and ultra-sensitive components within reactors operational down to cryogenic temperatures; therefore, they require cryogenic cooling. These systems facilitate the magnetic confinement of plasmas with a reduction in resistive energy loss. Magnetically confined plasmas suffer from energy loss due to resistive processes. In February 2025, a South Korean laboratory commissioned a novel cryogenic helium cooling spiral to the upgraded KSTAR Tokamak magnets. This system is capable of maintaining -260 °C, which allows stable plasma confinement. For fusion reactors that aspire HTS (high temperature superconducting) technologies which provide intense magnetic fields, cryogenics will be crucial.

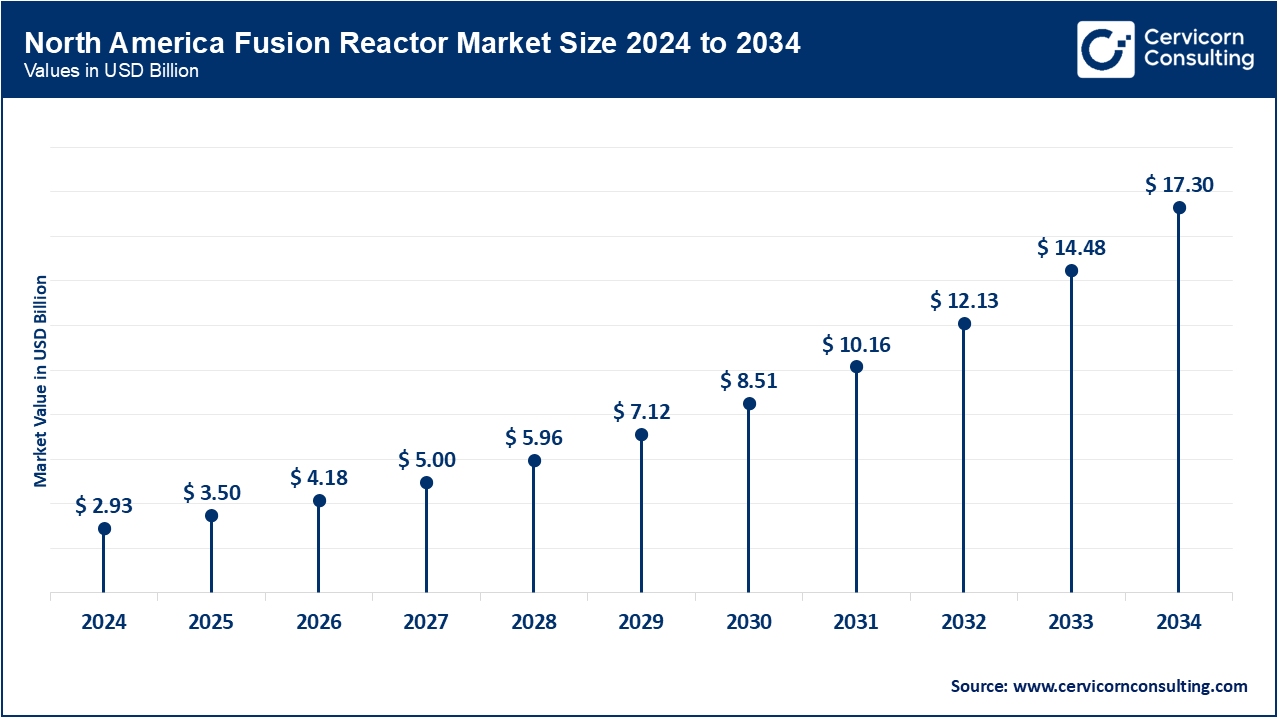

The fusion reactor market is segmented into several key regions: North America, Europe, Asia-Pacific, and LAMEA (Latin America, Middle East, and Africa). Here’s an in-depth look at each region.

Federal grants, private contractor projects, and joint initiatives have all contributed to Canada and the U.S. global leadership position in North America. The United States assumes primary responsibility through large undertakings like SPARC and other national lab projects. Canada has emphasized supply role by providing the tritium and assuming more collaborative roles. As of December 2022, the region received another milestone in fusion progress when the Department of Energy announced the National Ignition Facility (NIF) achieved net energy gain.

Home to ITER located in France and supporting technologies envisioned in the UK, Germany and further afield places Europe at the center of global fusion activity. The European Union remains committed to implementing long-term fusion programs which have climate objectives as their drivers. In October 2023, the UK Atomic Energy Authority entered into a major contract with General Fusion to construct a demonstration plant in Oxfordshire. This furthered Europe’s growing enthusiasm towards both public and private fusion projects moving beyond ITER towards national commercialization.

The Asia-Pacific region has become a new hub for competition in fusion, with China, Japan, South Korea, and India working on flagship projects. These countries are targeting both experimental and commercial reactors as a long-term solution to their energy needs. China's EAST reactor set a world record in November 2023 for maintaining plasma at 158 million degrees Fahrenheit for 1,056 seconds. This affirmation reinforced China's technological prowess in experimental fusion and demonstrated the region's awakening potential in fusion power innovation.

Fusion Reactor Market Revenue Share, By Region, 2024 (%)

| Region | Revenue Share, 2024 (%) |

| North America | 41.01% |

| Europe | 28.08% |

| Asia-Pacific | 23.40% |

| LAMEA | 7.51% |

LAMEA’s infrastructure for energy fusion research is still at an embryonic stage, with some research activities and policy interest, but more focus is needed. Collaboration with other countries could speed up research and infrastructure development due to the region’s high demand for clean energy. Pioneering fusion research policies are being advanced in the Middle East by South Korean and UAE institutions, as evidenced by the UAE's June 2024 strategic collaboration with South Korean institutions to explore fusion-based programs. Latin America and Africa remain largely in the research phase.

The fusion reactor sector is driven by pioneering companies like General Fusion, Tokamak Energy, Commonwealth Fusion Systems (CFS), and TAE Technologies, who are accelerating efforts in compact, next-gen reactor designs for clean, baseload energy. In April 2023, CFS completed testing of its high-temperature superconducting magnets, vital for SPARC’s performance. TAE Technologies, in October 2024, secured $250 million to advance its aneutronic reactor platform. Tokamak Energy launched a new HTS-based modular reactor prototype in January 2025. General Fusion began construction of its demonstration plant in June 2024. Also, Helion Energy signed a commercial energy delivery agreement in November 2023, becoming the first fusion firm to ink a utility-scale contract. These advancements reflect growing investor and government confidence in scalable, carbon-free fusion energy solutions.

Market Segmentation

By Reactor Type

By Technology Type

By End Use Industry

By Component

By Cooling System

By Region