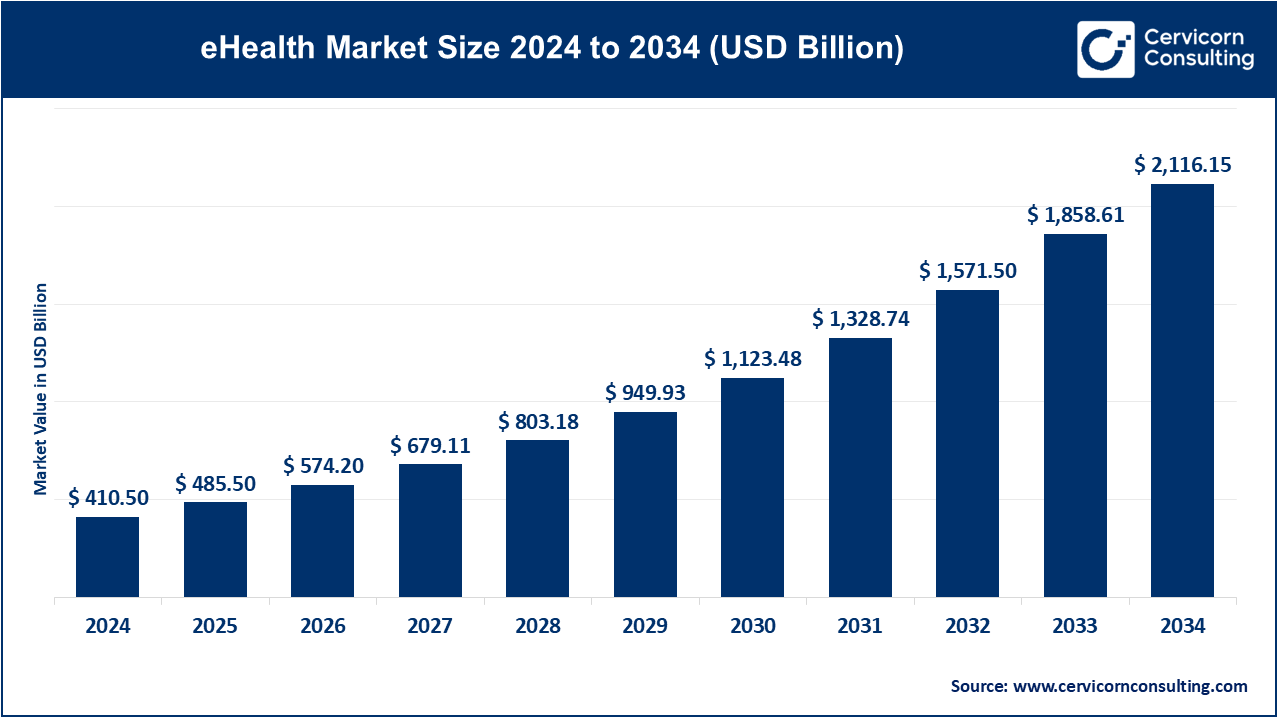

The global eHealth market size was valued at USD 485.50 billion in 2025 and is expected to be worth around USD 2,116.15 billion by 2034. It is growing at a compound annual growth rate (CAGR) of 18.27% from 2025 to 2034.

The global eHealth market has been growing rapidly in recent years. This growth is driven by the increasing adoption of smartphones, the rise in chronic diseases, and the need for better access to healthcare services. Factors like the increased focus on patient-centered care, government investments in digital health infrastructure, and the rise of personalized medicine are also fueling this growth. Additionally, the pandemic accelerated the adoption of eHealth solutions, particularly in telemedicine and remote patient monitoring. Virtual consultations became mainstream, and healthcare providers quickly embraced digital platforms to continue providing services amid lockdowns. The market's growth is expected to continue as healthcare systems around the world further integrate digital solutions for diagnosis, treatment, and ongoing patient management. In June 2024, Andreessen Horowitz (a16z) led a USD 130 million funding round for Talkiatry, a telehealth startup specializing in mental health services. This investment aims to support Talkiatry's growth and preparation for an initial public offering.

eHealth refers to the use of digital technologies to improve and manage health and healthcare services. It includes a wide range of tools such as online health records, telemedicine, health apps, wearable devices, and electronic prescriptions, all aimed at enhancing patient care, improving access to healthcare services, and reducing healthcare costs. eHealth enables patients to access healthcare remotely, connect with doctors online, and track their health using devices that monitor vital signs, physical activity, or sleep patterns. It supports healthcare providers in making data-driven decisions through efficient, real-time information sharing. eHealth makes healthcare to be accessible, especially to those living in the countryside and those who are underserved areas, by using these tools in a telemedicine format allowing remote consultations.

Moreover, it opens opportunities for the better way of treating the chronic disease using real-time monitoring and personalized health interventions. To a maximum extent, electronic health is also an irreplaceable aspect in the process of data gathering and analysis which may be a tool for creating more productive public health policies and improving global health. As the digital world gradually evolves, eHealth is anticipated to be the major factor that will reshape the whole healthcare delivery and patient experience in the whole world.

The eHealth sector is on the fast track to unprecedented growth due to the rise of information technology and the newfound appetite for telemedicine services. This sector is very large and it includes aspects like telemedicine, electronic medical records (EMR), mobile health platforms, and health analytics to name a few. To a great extent, the ever-increasing prevalence of long-term health issues, the growth of the geriatric population, and the necessity of efficient healthcare models have been the chief drivers of the market expansion.

Moreover, the global outbreak of the virus has pushed the eHealth technical infrastructure to progress, as patients and healthcare services providers were in search of safe alternatives to in-person appointments. This is seen with the healthcare industry, as through eHealth, they become more and more techno-friendly hence, thus, leading technology integration to enhance patient experience, improved healthcare outcomes, and effective operation. The future of eHealth is exciting, with the prospect of breakthroughs in artificial intelligence, wearable devices, and data analytics, which will no doubt turn the world around in terms of healthcare provision.

Report Scope

| Area of Focus | Details |

| Market Size in 2025 | USD 485.50 Billion |

| Projected Market Size (2034) | USD 2,116.15 Billion |

| Growth Rate (2025 to 2034) | 18.27% |

| Leading Region | North America |

| Fastest Growing Region | Asia-Pacific |

| Key Segments | Type, Deployment, End User, Region |

| Key Companies | LiftLabs, Doximity, Inc., IBM, Set Point Medical, Medisafe, Telecare Corporation, Epocrates, Medtronic, Koninklijke Philips N.V, Veradigm LLC, UNITEDHEALTH GROUP, iCliniq, Teladoc Health, Inc., CVS Health, American Well |

Patient Preferences: The eHealth market is heavily dictated by patient choices due to the fact that more and more people are nowadays looking for healthcare services that conform with their interests and the way they live their lives. The current patients give the highest priority to comfort and personalization in their healthcare experiences. So, the popularity of these digital health services has increased, and a patient who wants traditional therapy now has the monitoring option. To the increased number of smartphones and wearable technology is due the fact that the patients now want to consult their healthcare providers over telemedicine, mobile health applications, and online portals that make appointment scheduling, prescription refilling.

Cost-Effectiveness: Cost-effectiveness is the main factor boosting the eHealth sector because, in fact, doctors and their patients need therapies that not only stay within the money limit but also do their homework. Digital health technologies, like telemedicine and remote monitoring, enable healthcare systems to improve effectiveness, cut extra hospital visits and administrative costs, and even reduce costs for running online sessions. When it comes to patients, eHealth products can offer substantial economies by doing away with travel expenses, missing work days, and henceforth the protective costs of, for example, curing mild disease by answering more efficient health programs.

Healthcare Provider Adoption: The low level of healthcare provider adoption to digital tools is anticipated to be one of the factors hampering the e-health market. Health professionals are often challenged in the process of implementing digital health technologies in their daily practices. The state of resistance to change, awareness of safety and reliability risks in electronic systems, and the fear of technology complexity that does not even exist are the obstacles for the inclusion of eHealth solutions. Expenses (for the initial installation of infrastructure, training, and maintenance) are another big reason why small medical practices do not want to embrace digital health.

Workforce Shortages: The shortage of healthcare workers in the healthcare sectors can hamper the growth of the eHealth market as the limited availability of qualified specialists' can prevent the effective implementation. As the demand for the healthcare services is increasing, the existing workforce in areas like telehealth and remote patient monitoring may unwillingly embrace technologies or may not be able to meet the new patient volume efficiently. Moreover, the lack of personnel who have undergone training can lead to the increased rate of work-related exhaustion among the existing medical staff, thereby making them less likely to fully implement changes that eHealth calls for.

Technological Advancements: The eHealth market is expected to achieve significant development with the help of the latest technologies. This is facilitated by the continuous innovations in the healthcare sector, which are transforming how healthcare is done and experienced. AI, machine learning, and data analytics are some of the major recent advancements, which have resulted in the provision of more accurate diagnostics, custom personal prescription designing, and time-saving patient management systems. Besides that, the rise of mobile and wearable devices has facilitated real-time health monitoring, prompting patients to take the lead in their health and in the provision of ongoing care.

Integration with Traditional Healthcare: Integration with traditional healthcare systems could be an extremely good proposition for the development of the eHealth market, since it creates a seamless continuum of care that in its turn enhances patient satisfaction and outcomes. Consistently, traditional healthcare concepts and digital health technologies may be unblemished through collaboration between healthcare providers with the aim of rendering wider and more productive services from both aspects. Consider, for example, linking telehealth platforms with electronic health records (EHRs), and the result will be that real-time data sharing will take place, thus letting health workers.

Patient Concerns: Patient concerns are the main problem and with the inclusion of violations of privacy, security, and the way care quality is perceived, the Electronic Health market is challenged, as many patients may leave behind digital health solutions. However, patients who are anxious about their health data confidentiality, i.e. in the light of the intensifying cyber-attacks and data breaches to health systems, are the main point of concern. This disbelief in the system pushes the patients to be more intransigent and to avoid the new digital sharing channels.

Regulatory Barriers: Regulatory barriers can hold back the growth of the eHealth market since different laws and guidelines around regions can make it difficult to implement and adopt the digital health solutions. The gap between the development of digital practices in healthcare and the lag of regulations that usually come subsequently generates a rather Sisyphus-like development where innovators and providers can hardly see tips on how to include eHealth services. The main problems include telehealth providers' licensing terms, privacy rules for data, and no standardized protocols that allow for interoperation among different eHealth systems.

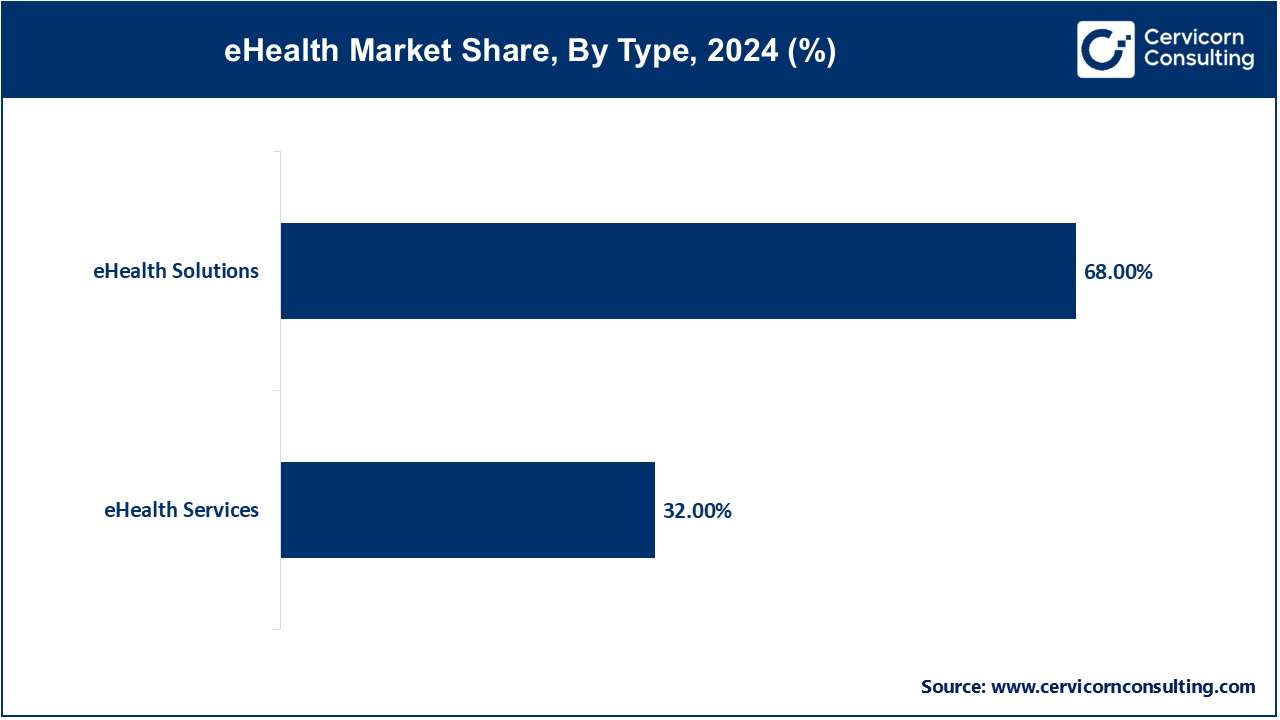

The eHealth market is segmented into type, deployment, end user and region. Based on type, the market is classified into eHealth services, and eHealth solutions. Based on deployment, the market is classified into cloud-based, and on-premise. Based on end user, the market is classified into pharmacies, healthcare consumers, payers, and healthcare providers.

eHealth Solutions

The eHealth solutions segment has captured highest revenue share of around 68% in 2024. eHealth solutions cover a wide range of digital technologies and services which are, in turn, placed into healthcare, patients’ outcomes better, and health management. These solutions include telemedicine platforms to make virtual consultations that make it possible for people to remotely receive healthcare as well as mobile health applications that individuals use for monitoring personal health metrics, managing long term conditions, and obtaining personalized health information among others. Electronic Health Records (EHRs) is a key factor in the process of patients’ care by managing patient data in a well-organized way, improving collaboration between healthcare providers, and accelerating administrative processes.

eHealth Services

The eHealth services segment has accounted revenue share of 32% in 2024. eHealth services are systems that aid in the delivery, procurement, and quality of health by the means of technology. These are the likes of telemedicine where patients can have their meetings with a healthcare worker using digital gadgets like webcams or skype calls, thus making medication easier to cope with and more accessible to people who are in far away and less well served areas. Mobile apps for health are an easy way for users to keep track of their health markers, manage their medications, and get the information and guidance that they need. Users will be able to monitor their progress through the provided information and to control themselves.

On-Premise

On-premise deployment in the eHealth sector represents the execution and supervision of digital health services and software in the health organization's system, as opposed to involving cloud-based solutions. This approach to deployment enables healthcare institutions to stick to a higher level of control over their data, meaning compliance with the very difficult privacy and security rules that protect patients' information. Such on-premise infrastructures can be further individualized to meet the particular demands of an organization, which provides for the unique design of its workflows and the inclusion of functions in alignment with the existing operation.

Cloud-Based Deployment

Cloud-based deployment in the eHealth market simply means the use of internet-based platforms, which are web-based software and services that one uses through the Internet browser, to provide digital health solutions. Cloud computing allows healthcare organizations to have access to, store, and manage patient data remotely. One of the great merits of this technology is its scalability, which means that it can be easily adjusted, as well as its flexibility and cost-effectiveness, as healthcare providers can easily scale their services according to demand without the need for extensive hardware investments.

Healthcare Provider

The healthcare providers segment is leading controbutor in 2024, accounted revenue share of 61.40%. The healthcare providers are an important end-users and they have the ability to take the digital health solutions further by improving patient care, administrative procedures, and the quality of the clinical outcomes. These are the ones that include hospitals, clinics, telehealth platforms, and the individual practitioners who use eHealth tools such as electronic health records (EHRs), telemedicine, etc. Furthermore, the emergence of the eHealth technology has led the healthcare professionals to combine the eHealth tools of the electronic health record (HERs), telehealth, and remote monitoring systems into the process of a healthcare that is both quicker and more convenient.

Payers

The palers segment has garnered revenue share of 13.80% in 2024. The eHealth industry sees payers bringing the technological and digital health solutions that enable themselves to perform their functions in a more streamlined manner and to give improved care to their members. This group covers the insurance companies, the government healthcare programs, and their likes that are the ones responsible for the financing of the healthcare services. Digital health solutions brought about by eHealth by the payers can manage the reimbursement policies efficiently, cut the costs, and boil the data analytical devices to the most useful levels that will make them uncover the better choices. Nonetheless, there is to clean up a little bit the language and the grammar has to be perfect.

Healthcare Consumers

The healthcare consumers segment has generated revenue share of 7.60% in 2024. The healthcare consumers are a very important end-use section, they are now looking for e-health solutions that allow them to control their health and wellness better with the use of digital information technology. This group includes patients, caregivers, and individuals interested in proactive health management who utilize various eHealth services. The group gets their services from Telemedicine, mobile health applications, wearables among other techniques. This is possible through telehealth platforms where patients can call their doctors for consultations, therefore, eliminating the factors of location and time and also getting treatment on time.

Pharmacies

The pharmacies segment has accounted 17.20% of the total revenue share in 2024. Pharmacies employ eHealth technologies like electronic prescription systems, the tele pharmacy services, and the medication management applications to modernize the activities and enhance the patient’s overall experience. An e-prescription is a highly safe and effective way of transmitting medication orders and thus reducing the risk of errors and timely access to necessary medication. Tele pharmacy enables pharmacists to deliver remote consultations, register patients in medication therapy management program, and give them adherence support, especially to those in rural or underserved areas with limited access to pharmacy services.

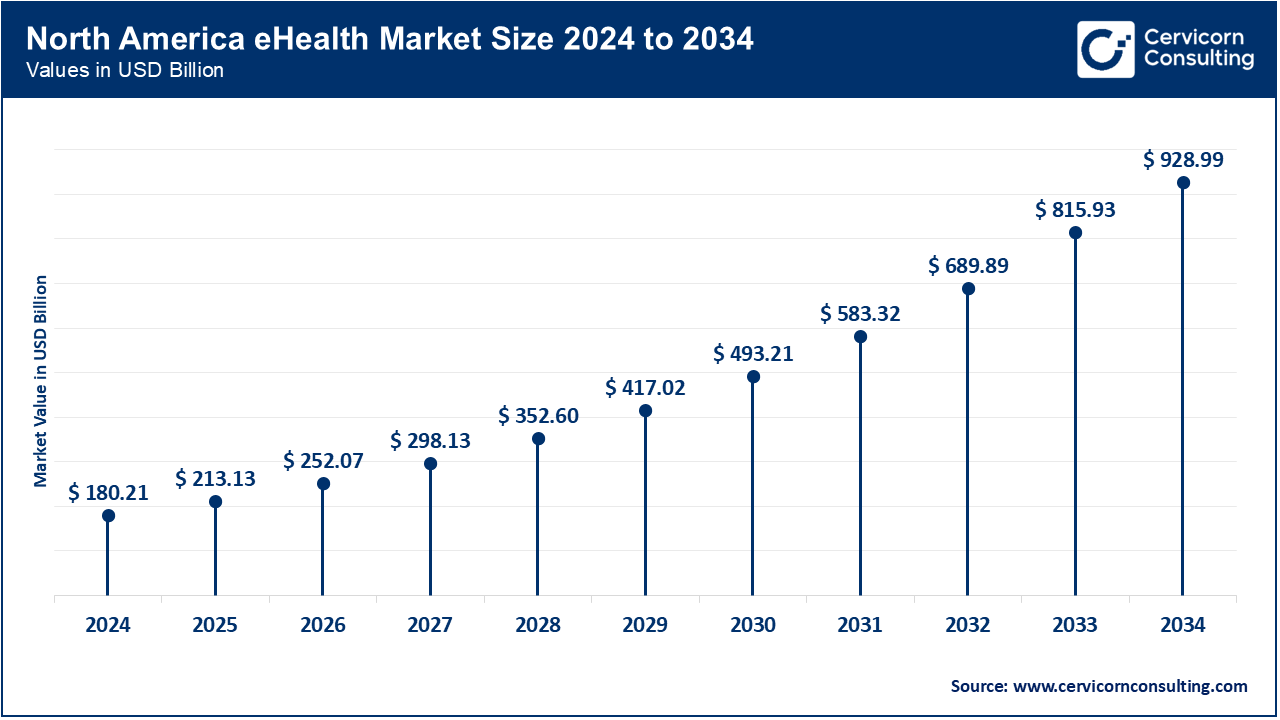

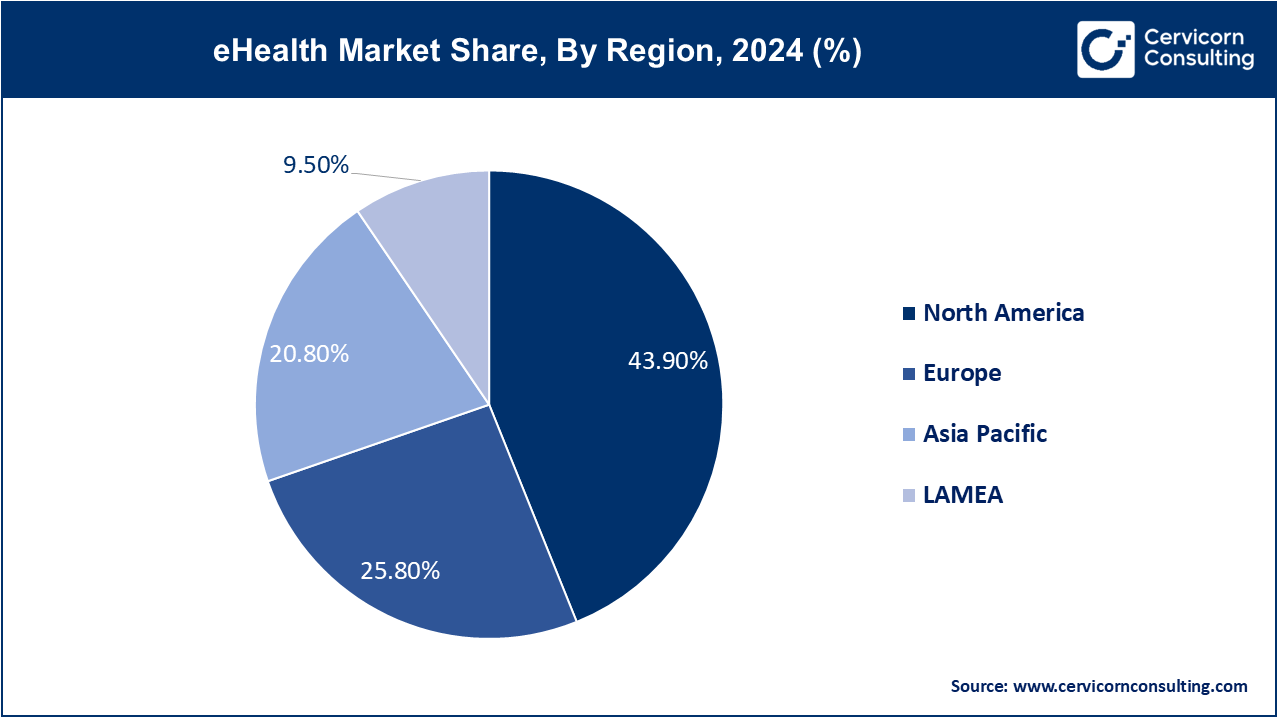

The North America eHealth market size was estimated at USD 180.21 billion in 2024 and is expected to reach around USD 628.99 billion by 2034, growing at a CAGR of 18.10% from 2025 to 2034. The North America eHealth market accounts for the majority of the share of the eHealth market owing to the mass penetration of digital health technologies, sound health care infrastructure as well as supportive governmental policies. The USA and Canada dominate this market owing to high investments in telehealth, EHRs, mobile health and wearable devices.

Rising health care costs, growth in the geriatric population and increasing incidences of chronic disease have also contributed in spurring the need for effective eHealth approaches. In the US, Policies like the Health Information Technology for Economic and Clinical Health (HITECH) Act have served in one way or the other to spur the use of EHR systems. In addition, legislative changes to telemedicine practices have widened the scope of virtual medical care.

The Europe eHealth market size was reported at USD 105.91 billion in 2024 and is predicted to surpass around USD 545.97 billion by 2034, rising with a CAGR of 17.30% from 2025 to 2034. Europe eHealth market is witnessing sustainable growth, driven by government policies, an aging population, along with developments in digital health technology. European countries such as the United Kingdom, Germany, France, and the Nordic countries are developing eHealth projects, which range from wearable health monitoring devices to telemedicine, in order to be able to diagnose, monitor, and provide treatments for the patients.

The EU has also been a key player in the adoption of eHealth by creating the necessary regulations and programs that would not only contribute to the modernization of the healthcare system by the improvements in digital infrastructure and interoperability of healthcare information across different member states in the EU. The rise in the telemedicine, electronic health records (EHRs), and mobile health applications segment played a vital role in the exponential development of the eHealth market in Europe.

The Asia-Pacific eHealth market size was estimated at USD 85.38 billion in 2024 and is projected to hit around USD 440.16 billion by 2034, expanding at a CAGR of 19.60% from 2025 to 2034. Asia-Pacific market is expected to witness significant growth owing to rising health care requirements, increasing digitalization and government programs to improve accessibility and quality of healthcare. China, India, Japan, South Korea, and Australia are countries that are taking the lead in the adoption of eHealth solutions. One of the major factors behind this development is the gradual expansion of the Internet, unprecedented smartphone usage, and the burden of chronic illnesses in the population. The integration of tele-health, m-health apps, and patient monitoring systems from remote access has impacted healthcare positively by making it more accessible to not only the urban but also to the rural and other underserved areas.

The LAMEA eHealth market was valued at USD 39 billion in 2024 and is anticipated to reach around USD 201.03 billion by 2034. The LAMEA market is expanding, owing to the rising healthcare requirements, expansive internet accessibility, and governmental actions toward the renovation of the healthcare systems. In Latin America, countries such as Brazil, Mexico, and Argentina are experiencing substantial telemedicine, mobile health apps, and electronic health records (EHRs) growth.

The large population in the region alongside challenges like access to healthcare and the high prevalence of chronic illnesses, leads to the preference for digital health solutions which bring about the improvement of patients’ care as well as lowering healthcare costs. The governments are actively involved in the support of the eHealth, with the Brazil government having a huge investment in telehealth platforms to be able to offer services to underserved communities.

The eHealth market is characterized by the presence of several key players that dominate the global landscape. Leading companies like Medtronic, Koninklijke Philips N.V., Veradigm LLC, iCliniq, Teladoc Health, Inc., Abbott Laboratories and CVS Health are among the major producers, with extensive manufacturing facilities and distribution networks. Medtronic and Abbott Laboratories are two of the players that are moving the market's most in the remote patient monitoring field, having wearable and connected health wearables that check the health metrics of the patients, thus helping to monitor their medical care in advance. As has been noted, IBM Watson Health and Google Health are the leaders in the utilization of artificial intelligence (AI) and big data analytics to facilitate early diagnostics, personalized treatment plans and population health management.

CEO Statements

Alexander Komarov, CEO, Kyivstar said "By signing the agreement with Helsi we see great potential to take a leadership in the role eHealth industry. Kyivstar is planning to expand its business and invest in the next three years in the development of digital eco-systems for the health of Ukrainians, developing new products, enhancing critical infrastructure and creating new jobs."

Strategic partnerships and Launches highlight the rapid advancements and collaborative efforts in the eHealth market. Industry players are involved in various aspects of eHealth, including production, storage technologies, and fuel cells, and play a significant role in advancing the market. Some notable examples of key developments in the eHealth Market include:

These developments underscore significant strides in advancing Industrial infrastructure and technology, reflecting growing collaborations and strategic investments aimed at expanding the global Market.

Market Segmentation

By Type

By Deployment

By End User

By Region