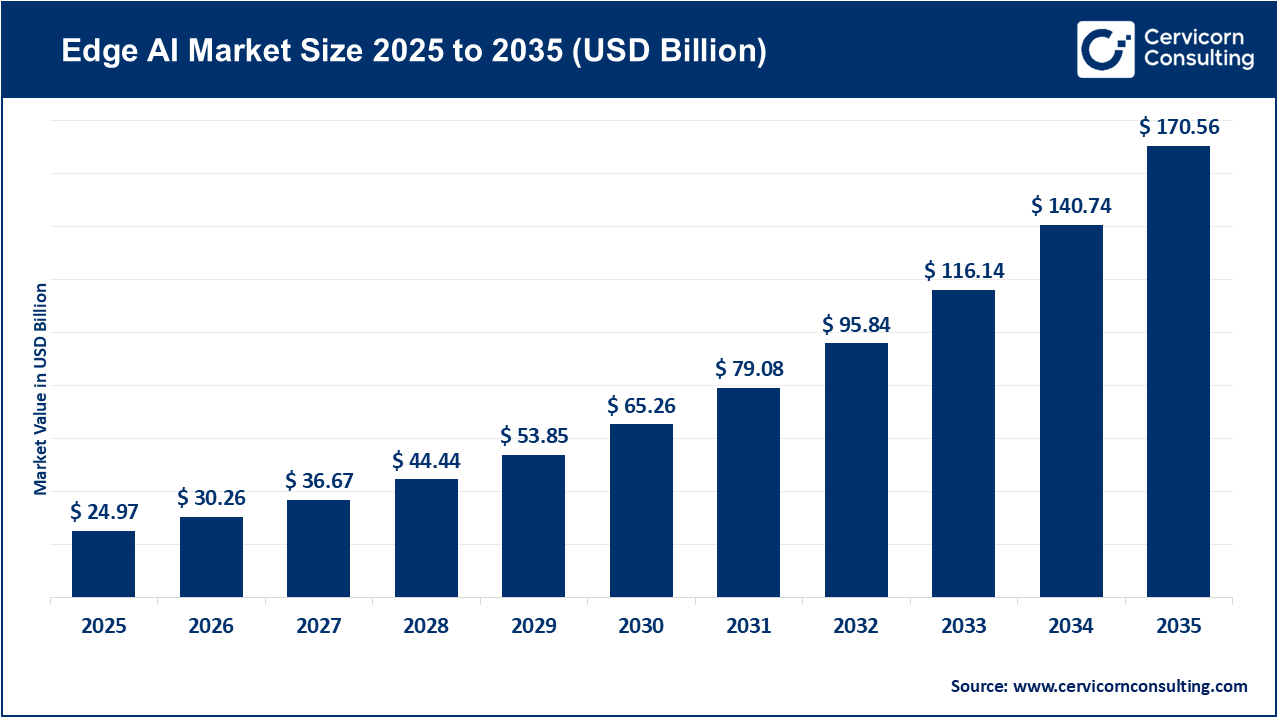

The global edge AI market size was valued at USD 24.97 billion in 2025 and is forecasted to surpass around USD 170.56 billion by 2035, expanding at a notable compound annual growth rate (CAGR) of 21.2% over the forecast period from 2026 to 2035. The edge AI sector is experiencing rapid growth due to a surge of new customers from many different sectors. These customers are looking for the most effective options for real-time data processing and low-latency applications. Many organizations want to be able to make decisions and take action on their own devices without communicating back to the cloud for processing. This helps reduce delay and bandwidth requirements associated with sending data to the cloud. The growth of edge AI is also driven by increased use of IoT devices, smart manufacturing, healthcare remote monitoring, and autonomous vehicles. As privacy concerns mount, most consumers prefer to keep their personal data secure by limiting the amount of data sent to other locations for processing. In addition, the introduction of 5G networks and advances in AI hardware such as efficient chips will also support much faster and more reliable computation at the edge. This is as opposed to just on central servers.

Recent developments indicate that there is considerable interest and investment from countries and companies around the world embracing AI solutions. For instance, silicon manufacturers are focusing on design of enhanced edge-AI silicon chipsets targeted at the surveillance and automation markets to address issues of dependence upon the cloud, as well as reduce latency. In addition, there are many companies working together internationally in India to co-develop edge AI chip designs, which will enhance the capabilities of local semiconductor manufacturers. These initiatives demonstrate that demand for faster and secure data processing, as well as the ability to innovate through hardware, software, and regional tech initiatives that promote the adoption and production of intelligent edge systems, is fueling the growth of edge AI.

Growing Investment in AI Technology Driving the edge AI market

Global investment is growing in artificial intelligence technology, which is driving the edge AI market. Organizations are investing in AI startups, developing an infrastructure to support processing data efficiently on the user's device. They are also investing in new edge AI technologies. This is to create more intelligent and quick systems that do not rely as heavily on the cloud. Due to the influx of capital into AI and an increase in R&D, new components such as edge computing chips, real time sensing and analysis, and AI enabled devices will become less expensive and of improved quality. Due to the availability of low-cost and advanced technology, sectors from manufacturing to medical are adopting edge AI systems increasing demand for edge AI solutions. In addition, the increase in funding allows for greater innovation in the hardware and software sectors. This increases deployment speed and contributes to the success of the edge AI market.

Increasing amounts of funding into the AI space by some of the largest technology companies in the world. This is coupled with the amounts being invested by venture capital firms globally demonstrate a higher level of investor confidence in AI technology for the future. Large investment rounds and acquisitions are occurring worldwide, demonstrating the belief that AI technology will have significant opportunities in the future. Capital investing in the AI space provides startups with the means to develop advanced edge AI products. They can increase processing power and scale their businesses for real-world applications. The increase in capital flowing into this space will provide an opportunity to generate a short-term growth surge as well as build out the backbone of the long-term opportunity to develop the edge AI market.

Recent Investments in AI & Edge-Focused Technologies

| Company | Investment | Purpose | Key Details |

| OpenAI | USD 41 Bn raised in 2025 | Frontier AI development | OpenAI secured one of the largest funding rounds of the year, helping scale compute, R&D, and foundation model work. This large capital base fuels AI infrastructure and tools that can eventually support edge integration. |

| Anthropic | USD 13 Bn Series F + other rounds | Advanced AI models & safety | Anthropic raised massive funding across multiple rounds in 2025, strengthening its position in generative AI and safety-first model design, which supports enterprise and edge usage scenarios. |

| Accenture (CLIKA) | Strategic investment | Edge AI & model compression | Accenture invested in CLIKA to expand intelligent edge AI capabilities. CLIKA’s tech improves model deployment on edge devices like IoT endpoints and autonomous systems. |

| Armada AI (Infrastructure) | USD 131 Mn funding | Modular AI data centers / edge | Armada raised capital to scale modular AI data centers designed for distributed compute, which supports edge AI workloads and reduces cloud dependency. |

| NetFoundry | USD 12 Mn funding | Secure networking for AI | Investment to develop AI-era secure networking, relevant for edge environments needing robust connectivity. |

| NexGen Cloud | USD 45 Mn Series A | Sovereign AI infrastructure | Focused on regional/data sovereignty infrastructure, which can support local (edge) AI deployment across enterprises. |

| Ori (backed by Saudi Aramco Wa’ed Ventures) | Undisclosed strategic funding | Edge AI expansion Middle East | Investment aimed at expanding edge AI deployment in the Middle East via local partners. |

| Lambda | USD 480 Mn Series D | GPU cloud scaling | Capital raised to expand GPU cloud infrastructure — foundational for AI training and inference that complements edge AI systems. |

| SoftBank / DigitalBridge Acquisition | USD 2.9-4 Bn acquisition | AI data & infrastructure | SoftBank acquired DigitalBridge to build out digital infrastructure including data centers, which supports AI growth (critical for edge-to-cloud workflows). |

1. Qualcomm & e& Strategic Collaboration in the UAE

Qualcomm has collaborated with e&, an established telecommunications company in the UAE, to create an innovative ecosystem using 5G technology. This ecosystem will provide businesses, governments and industries with solutions. They will develop 5G-enabled Edge AI Gateways, Smart Mobility Technologies, and AI-enabled devices that process data at the source rather than sending it over long distances to be processed elsewhere. A new ecosystem of 5G with localised AI processing capabilities will facilitate faster deployments of real-time intelligent systems, since latency will be reduced, as well as better infrastructure for establishing Edge solutions at a larger scale.

2. TCS & Qualcomm Co-innovation Lab for Edge AI in India

Tata Consultancy Services (TCS) and Qualcomm have developed a new Edge AI Co-Innovation Lab in Bengaluru. With this lab, TCS will utilize advanced Qualcomm platforms along with private 5G networks to prototype and implement real-time AI capabilities across various industries, including smart infrastructure, industrial manufacturing, and healthcare. Aside from fostering local development, the lab will create AI ecosystems tailored specifically to regional enterprises' needs and build a foundation for their adoption of AI.

3. California State AI Education & Workforce Partnership

The California government has partnered with Google, Adobe, IBM, and Microsoft to develop a large-scale AI education and training program for schools and universities. Increasing student and professional training is critical to meeting future demands for edge AI products and services. This initiative will help to bolster the talent pool for developing new innovations by increasing the number of engineers and developers trained in AI. This will enable the widespread use of AI products and services.

4. Indian Fabless Startups Target Edge-AI Silicon Development

Several Indian fabless semiconductor companies developed edge AI silicon chips for video surveillance and automation applications. They are building a strong domestic ecosystem for semiconductor hardware that supports on-device intelligence, so companies are less reliant on foreign cloud infrastructure for their AI initiatives, as well as encouraging innovation at home. This milestone represents a huge step toward the development of a silicon chip ecosystem for edge AI. Thus, it encourages the wider implementation of edge AI technology across industries that require rapid, efficient real-time performance from AI platforms.

The edge AI market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of each region:

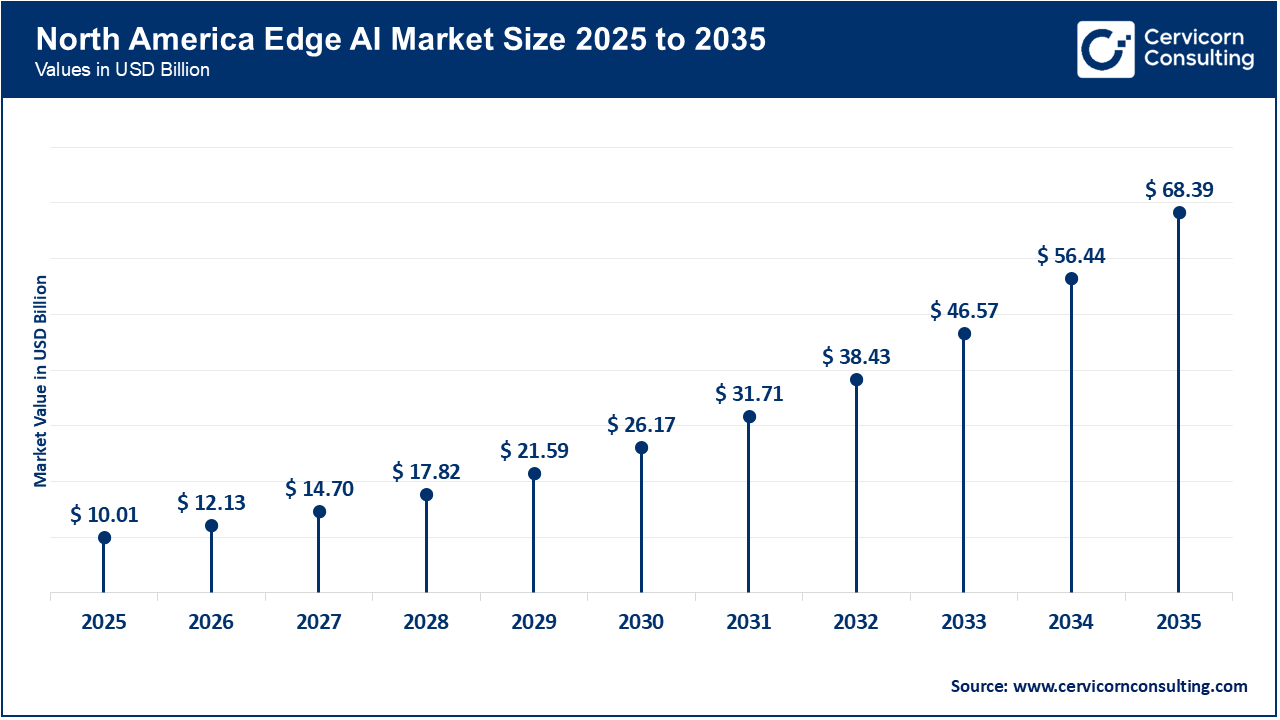

The North America edge AI market size was valued at USD 10.01 billion in 2025 and is forecasted to attain around USD 68.39 billion by 2035. North America remains the largest regional market for edge AI, powered by strong digital infrastructure, widespread early adoption of 5G, and significant investments from leading technology companies and cloud providers. The presence of major tech giants, advanced research ecosystems, and demand for real-time analytics in sectors like healthcare, automotive, and manufacturing continue to fuel growth. With businesses seeking reduced latency, improved data privacy, and intelligent edge solutions, North America’s edge AI ecosystem thrives on substantial R&D spending and enterprise deployment.

Recent Developments:

The Asia-Pacific edge AI market size was estimated at USD 6.14 billion in 2025 and is projected to hit around USD 41.96 billion by 2035. Asia-Pacific is the fastest-growing region, supported by rapid adoption of 5G, strong government backing for AI and IoT initiatives, and large manufacturing and consumer electronics sectors. Countries like China, India, Japan, and South Korea are aggressively deploying AI chips and edge solutions, expanding smart city projects and industrial automation. Tech giants and startups alike are innovating in edge AI hardware and software, making the region a key growth hub globally.

Recent Developments:

The Europe edge AI market size was reached at USD 6.24 billion in 2025 and is expected to hit around USD 42.64 billion by 2035. Europe is growing steadily as industries adopt digital transformation strategies and automation solutions to enhance productivity and competitiveness. Countries like Germany, the U.K., and France are deploying edge AI across smart manufacturing, automotive systems, and smart cities to boost efficiency and sustainability. Supportive policies around data sovereignty and investments in IoT and edge technologies further propel adoption, while focus on regulatory compliance shapes secure deployment across sectors.

Recent Developments:

Edge AI Market Share, By Region, 2025 (%)

| Region | Revenue Share, 2025 (%) |

| North America | 40.1% |

| Europe | 25.0% |

| Asia-Pacific | 24.6% |

| LAMEA | 10.3% |

The LAMEA edge AI market was valued at USD 2.57 billion in 2025 and is anticipated to reach around USD 17.57 billion by 2035. The LAMEA region is emerging as a promising market for edge AI as digital infrastructure expands, IoT adoption increases, and governments invest in smart services. Rising demand for real-time processing in telecommunications, public safety, and smart city pilot projects drives interest in edge solutions across Latin America, the Middle East, and Africa. While adoption rates vary, strategic partnerships and localized technology investments are creating momentum, especially in countries seeking to modernize industries and improve service delivery.

Recent Developments:

The edge AI market is segmented into components, end-user industry, and region.

Hardware continues to dominate the edge AI market because edge intelligence fundamentally depends on physical computing components deployed near data sources. AI-enabled processors, sensors, cameras, gateways, and embedded devices are essential for executing machine learning models locally with low latency. Industries such as manufacturing, automotive, and smart surveillance invest heavily in specialized chips like GPUs, NPUs, and ASICs to ensure reliable real-time performance. The high cost and volume of hardware deployments contribute significantly to overall market revenue, reinforcing hardware’s dominant position.

Edge AI Market Share, By Component, 2025 (%)

| Component | Revenue Share, 2025 (%) |

| Hardware | 52.5% |

| Software | 23.4% |

| Edge Cloud Infrastructure | 11.8% |

| Services | 12.3% |

Software is the fastest-growing segment in the edge AI market as enterprises increasingly focus on flexibility, scalability, and lifecycle management of AI models. Edge AI software platforms enable model training, deployment, orchestration, monitoring, and optimization across distributed environments. Growing adoption of containerization, edge analytics, AI inference engines, and model-compression tools supports rapid growth. As organizations seek vendor-agnostic and upgradeable solutions, software investment rises faster than hardware spending.

Manufacturing remains the leading end-user industry in the edge AI market due to strong adoption of automation and Industry 4.0 initiatives. Edge AI supports real-time quality inspection, predictive maintenance, robotics control, and production optimization directly on factory floors. Local AI processing reduces downtime, improves yield, and minimizes reliance on cloud connectivity in harsh industrial environments. The clear operational and financial benefits drive sustained investment, maintaining manufacturing’s dominant market share.

Edge AI Market Share, By End-User Industry, 2025 (%)

| End-User Industry | Revenue Share, 2025 (%) |

| IT & Telecom | 20.3% |

| Manufacturing | 20.8% |

| Automotive | 12.8% |

| Consumer Electronics | 12.0% |

| Healthcare | 9.1% |

| Smart Cities | 8.3% |

| Government | 7.0% |

| Energy | 5.9% |

| Retail | 3.4% |

| Others | 0.4% |

Automotive is the fastest-growing segment as vehicles become increasingly connected, autonomous, and software-defined. Edge AI enables instant decision-making for advanced driver-assistance systems, in-vehicle vision systems, and vehicle-to-everything communication. Safety-critical applications require ultra-low latency, making on-device AI essential. Rising investments in electric vehicles, autonomous driving technologies, and smart mobility infrastructure continue to accelerate growth in this segment.

By Component

By End-user Industry

By Region