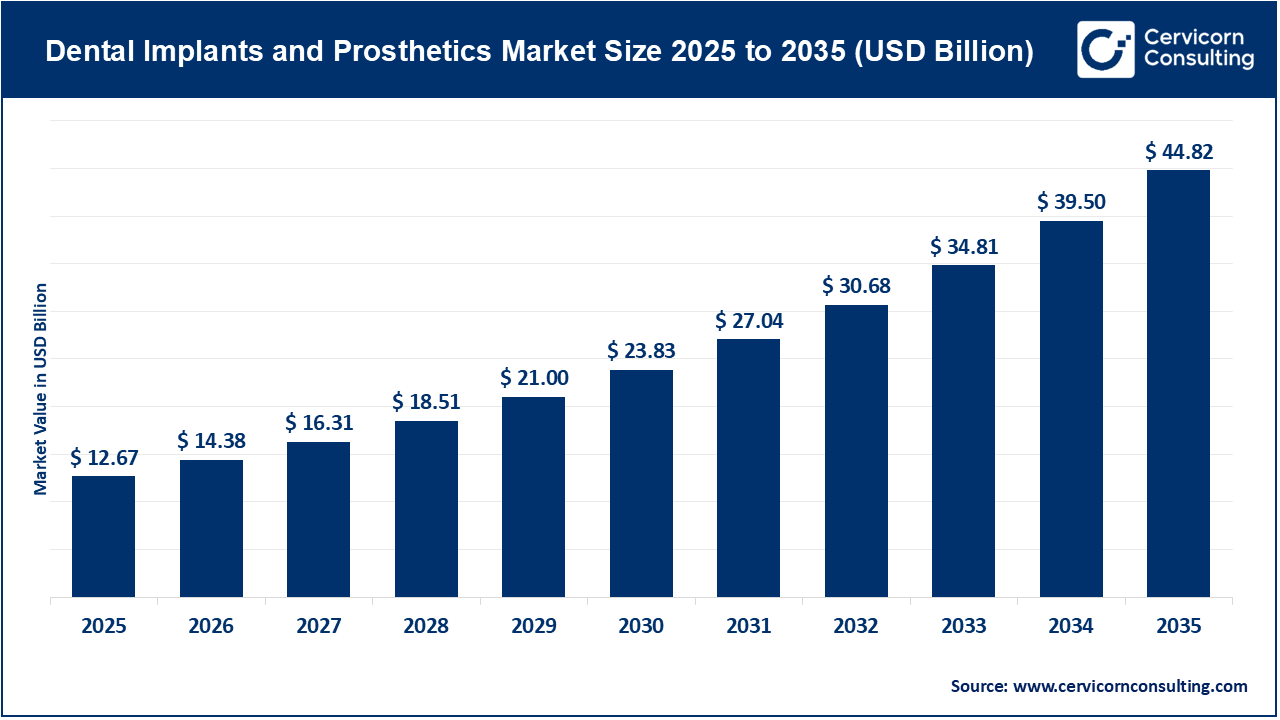

The global dental implants and prosthetics market size was valued at USD 12.67 billion in 2025 and is projected to reach around USD 44.82 billion by 2035, growing at a compound annual growth rate (CAGR) of 13.5% from 2026 to 2035. The market’s growth is poise due to the overall expansion of digital dentistry and advancements in biomaterials for dental treatments.

The dental implant and prosthetic market includes creating, making, selling and using artificial teeth or roots from both a manufacturing and clinical applications standpoint for both end users (patients) and dentists alike. The products that are sold in this market include the three different types of dental implants (endosteal, zygomatic and sub-periosteal) along with the many restorative devices that attach to them (crowns, bridges, dentures, etc.) for both aesthetic and functional uses.

The dental implants serve as a permanent anchoring point surgically inserted into the patient's jawbone to support the implanted prosthetic tooth, while the dental prosthetic is a visible restorative device that replaces the missing or damaged natural tooth. In conjunction with each other, they provide solutions for patients suffering from partial or complete loss of teeth due to a variety of causes (i.e., dental caries, periodontal disease, trauma, congenital defects and age). Additionally, this market is a key component of the overall dental devices marketplace, providing support for a trend toward long-term, minimally invasive, and patient-centered dental restoration solutions.

Increasing prevalence of edentulism and the trend towards the use of permanent restorative solutions

An increase in the prevalence of tooth loss, periodontal disease will be the primary driver of the dental mplants & prosthetics market. Approximately one-quarter of adults in the world experience some level of ipartial or complete loss of teeth, particularly among people over 60 years old, resulting in continued demand for restorative procedures for patients of all ages. Patients and clinicians are also transitioning between traditional removable dentures and implant-based/fixed prosthetic devices due to the enhanced stability, aesthetics, and longer-term functionality of implant prostheses over traditional prostheses. New implant designs, surface treatment technologies, and new biomaterials such as titanium and zirconium will continue to result in enhanced implant success rates and thus more widespread use of implants as a treatment modality.

High Treatment Prices and Little Reimbursement Coverage

The combination of strong demand fundamentals and the high price of dental implant procedures and prosthetic materials are major factors preventing market growth. Because implant placement requires multiple clinical stages, special imaging, surgical ability, and premium biocompatible materials; total costs for implant treatment are high. Many implant patients pay for their procedures' total costs outof-pocket due to the limited number of public health insurance programs that reimburse for dental implants or prosthetics.

Thus, they are forced to seek the coverage through their own finances. Therefore, for many low- and middle-income people and people living in rural areas; being unable to afford the high price of implants restricts the adoption of these technologies; as there are not many options for access to them. The shortage of trained implantologists in some areas is another constraint to their ability to do the procedures.

The rapid expansion of digital technologies in dentistry

The use of digital technologies, which include CAD/CAM systems, 3d printing, CBCT, and computer-guided implant surgery, is providing better accuracy in treatment, shortened chair time for patients, and the ability to do same-day restorations. All of which are helping to improve efficiencies of the actual implant and prosthetic procedures while increasing predictability and acceptance of the procedures among both providers and patients alike. In addition, many of the emerging economies within the Asia Pacific, Latin America and Middle East regions are seeing increases in the amount of healthcare-related funds available, increases in the size of the middle classes population, as well as growth of the increase in number of private dental chains in these markets which all represent prime opportunity for market entry into the dental implant and prosthetic industry.

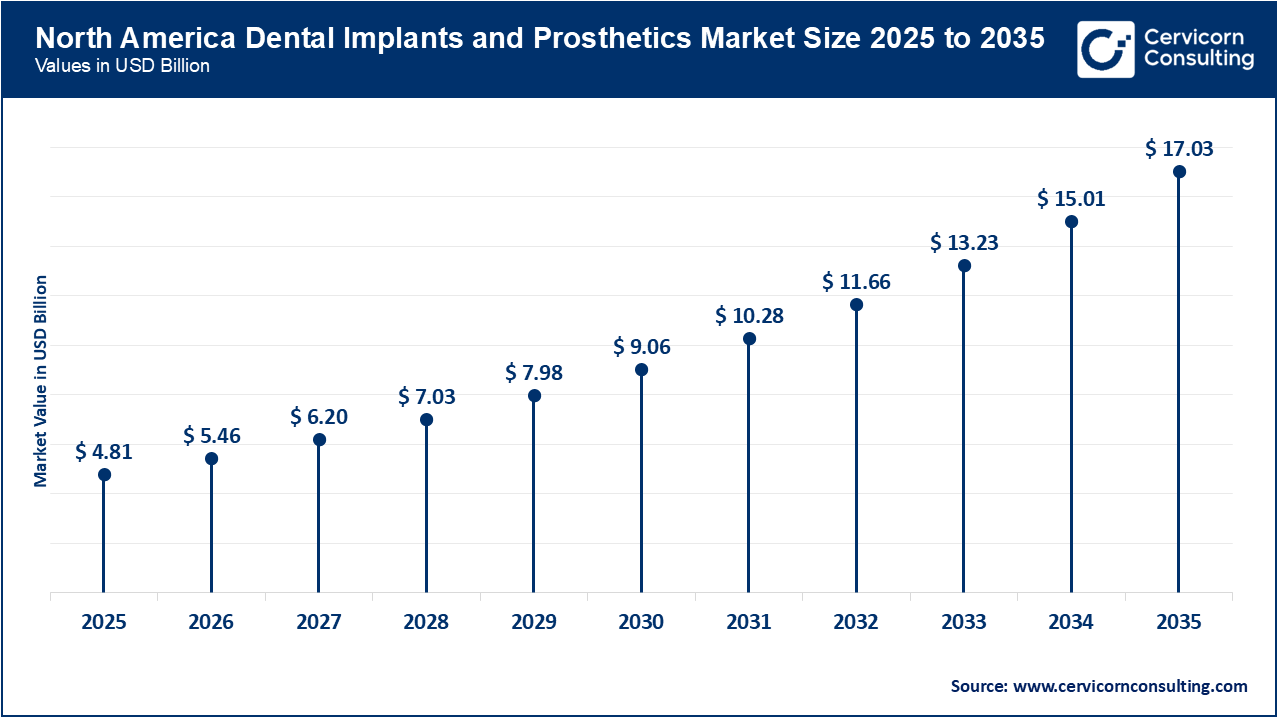

The North America dental implants and prosthetics market size was reached at USD 4.81 billion in 2025 and is anticipated to surpass around USD 17.03 billion by 2035. North America dominated the market in 2025, region’s strong positioning in adopting advanced dental procedures and patients’ requirements for minimally invasive procedures create a potential factor for its sustained corner in the market. Factors such as widespread use of cutting-edge platforms enhances both clinical confidence and patient acceptance of implant procedures, support higher procedure volumes and faster market growth in North American region.

The U.S. and Canada have a high prevalence of edentulism and dental disorders among adults, directly fuelling demand for implants and prosthetics. For example, reports indicate that approximately 40 million adults in the U.S. are missing all their teeth, and millions more require tooth replacement solutions.

While the United States carries the largest share of the market, several major dental implant and prosthetics manufacturers are headquartered here including; DENTSPLY Sirona, Henry Schein Inc., Zimmer Biomet and BioHorizons. Leading players are investing heavily in integrated digital implant platforms and FDA-regulated materials that raise quality and performance standards.

According to the research experts, approximately 93% of dental implant procedures in the United States utilize titanium implants, owing to titanium’s superior mechanical strength, high biocompatibility, and non-allergenic properties, which minimize the risk of immune system reactions.

The Asia-Pacific dental implants and prosthetics market size was estimated at USD 2.79 billion in 2025 and is forecasted to surpass around USD 9.86 billion by 2035. Asia Pacific is observing the fastest rate of growth in market during the forecast period. Multiple Asian countries are considering significant advancements in the field of dentistry. By replacing conventional techniques such as bridges and dentures, the industry in Asian countries has started focus on functional and cosmetic aspects of implants and prosthetics. According to our intelligence, approximately 70% of Indian patients from urban population, in 2024 chose aesthetic dental procedures.

Considering major countries in the market in Asia, India is developing expertise and building up production capabilities through their Dental Technology Innovation Hub to decrease the need for imports of dental tools; materials; and implants. In addition, dental technology is improving the delivery of quality dental care to patients, especially those in rural locations that may not have regular access, through Malaysia having converted to digital technology with tele-dentistry services that allow for remote diagnostics and monitoring without requiring a patient to go see a doctor multiple times.

5 Major Government or Private-sector Initiatives and Investments in Asian Countries

| Country | Initiative/Investment | Sector | Key Highlights |

| Japan | Adoption of Aging Focused Care | Private & Public Health | With over 28 % of the population aged 65+, government emphasis on quality dental care and advanced restorative solutions increases demand for implant and prosthetic services. |

| South Korea | Digital Dental Tech Integration | Private Health Sector | The focus on high-precision restoration and digital workflows enhances prosthetics production efficiency and service quality. |

| India | Dental Technology Innovation Hub | Government Health Sector | The Hub focuses on indigenous dental device development, reducing dependence on imported dental implants and related technologies, promoting R&D. |

| Thailand | Innovation of BDMS | Private Health Sector | BDMS Wellness Clinic Thailand focuses on advancing aesthetic implant technology and reinforcing Thailand’s strategy to become a regional dental and wellness hub. |

| Malaysia | Digital Dentistry Adoption & Tele-dentistry Integration | Private Health Sector | Malaysia is embracing digital dental technologies, including tele-dentistry, laser dentistry, and smart dental devices, enabling improved access to care, efficient treatment outcomes, and expanded service reach. |

“Dental Prosthetics Led the Market in 2025; Implants to Grow Rapidly by 2035”

In the year 2025, the dental prosthetics segment made up the largest share of share out of all product categories, making it the largest source of revenue within the entire global market for dental prosthetics. As noted, the prosthetic dental industry includes dentures, crowns, bridges, veneers, abutments, and inlays/other restoration devices utilized to replace missing or damaged teeth by restoring functionality-adjacent-to-aesthetic-value. Within this dental prosthetics segment, crowns and dentures are by far the most common types of prosthetic solution used for helping patients replace their chewing function. Also, both crowns and dentures deliver a restoration to a patient’s respective speech and aesthetics of their personality.

Dental Implants and Prosthetics Market Share, By Type, 2025 (%)

| Type | Revenue Share, 2025 (%) |

| Dental Implants | 61% |

| Dental Prosthetics | 39% |

Although dental implants is projected to grow at the highest rate across the dental prosthetics segment during this forecasted period, dental implant solutions are anticipated as the most preferred method for permanently replacing missing natural teeth. Based on the success-rate of each type, it appears as though endosteal implants will continue as the most successful (based upon total occurrences) type of dental implant.

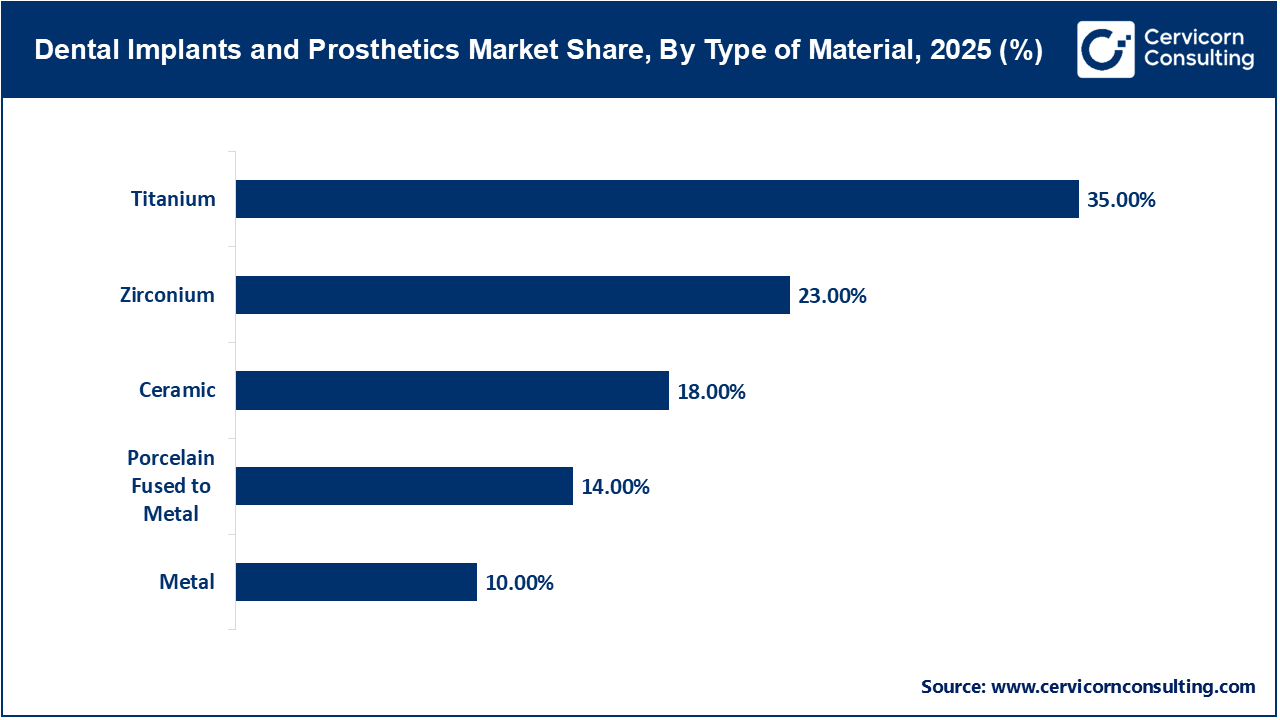

“Titanium Segment Dominated the Market Globally; Zirconium to Grow at the Fastest Rate”

The Titanium segment, which dominated the market in 2025, remains the material of choice for dental implants due to its exceptional biocompatibility, high mechanical strength, and long-term stability within the jawbone. Titanium implants integrate seamlessly with the bone through osseointegration, making them highly reliable for long-term dental restoration. Its dominance is also reinforced by the widespread familiarity of dental surgeons with titanium-based procedures and the availability of a wide range of titanium implant products globally.

On the other hand, zirconium is emerging as the fastest-growing material segment. This growth is primarily driven by increasing patient preference for metal-free dental solutions that provide superior aesthetics. Zirconium implants and prosthetics offer a tooth-like natural appearance, excellent resistance to wear and corrosion, and high durability, making them particularly appealing for anterior (front tooth) restorations where appearance is critical.

“Root-form Dental Implants Segment Dominated the Market in 2025”

Root-form dental implants, dominated the market in 2025, accounting for the majority of procedures performed globally. These implants are inserted directly into the jawbone, offering a secure foundation for prosthetic attachments and ensuring long-term functionality and stability. Their widespread adoption is attributed to the high success rate, adaptability for single or multiple teeth replacement, and compatibility with advanced prosthetic designs.

Dental Implants and Prosthetics Market Share, By Procedure, 2025 (%)

| Procedure | Revenue Share, 2025 (%) |

| Root-form Dental Implants | 57% |

| Plate-form Dental Implants | 22% |

| Sub-periosteal Dental Implants | 13% |

| Transosteal Dental Implants | 8% |

Sub-periosteal dental implants is expected to witness notable growth during the forecast period, particularly among patients with insufficient bone height or density. These implants are placed on top of the jawbone but beneath the gum tissue, providing an alternative to traditional bone grafting. The increasing demand for minimally invasive procedures and quicker recovery times is fueling the adoption of sub-periosteal implants, making them an important emerging segment in the procedural landscape.

“Dental Hospitals and Clinics Held the Largest Share in 2025; Research Centers to Gain Momentum”

The dental hospitals and clinics segment dominated the market in 2025, reflecting their central role in providing both routine and advanced dental restoration services. The dominance of this segment is supported by the increasing number of dental clinics worldwide, rising patient awareness about oral health, and the availability of advanced diagnostic and surgical equipment that enhances treatment outcomes. Additionally, hospitals and clinics serve as primary access points for the majority of patients seeking dental prosthetics and implant procedures, making them the largest revenue-generating end-user category.

Dental Implants and Prosthetics Market Share, By End-user, 2025 (%)

| End-user | Revenue Share, 2025 (%) |

| Dental Hospitals and Clinics | 82% |

| Dental Research Centers | 18% |

The dental research centers is expected to witness steady growth during the forecast period, as research initiatives continue to focus on the development of innovative implant designs, new biomaterials, and digital dentistry solutions. These centers contribute significantly to clinical advancements and the adoption of state-of-the-art procedures, ensuring the long-term evolution of the dental implants and prosthetics market. By exploring new techniques, materials, and surgical innovations, research centers help expand the possibilities of dental restoration treatments, indirectly influencing market growth across hospitals and clinics globally.

By Type

By Type of Material

By Procedure

By End-user

By Region